In the rapidly evolving landscape of digital payments, a fascinating battle is unfolding between two titans: Visa and the Automated Clearing House (ACH) network. As someone who's been closely watching this space, I'm excited to dive into how Visa is positioning itself to compete against ACH, particularly in the massive $200 trillion B2B payments market.

The Changing Face of B2B Payments

The business-to-business (B2B) payments sector is undergoing a significant transformation. Traditionally dominated by checks and ACH transfers, this space is now ripe for disruption as businesses increasingly demand faster, more efficient payment solutions. Visa, a global leader in digital payments, has set its sights on capturing a substantial portion of this market.

The ACH Stronghold

Before we delve into Visa's strategy, it's crucial to understand the current landscape. ACH has long been the go-to choice for many businesses, especially for high-value transactions. Its low fees and reliability have made it a staple in corporate finance departments across the country.

However, ACH isn't without its limitations. Transactions typically take 2-4 business days to process, which can be problematic in today's fast-paced business environment. Additionally, ACH is primarily a domestic U.S. system, which poses challenges for companies engaged in international trade.

Visa's Vision

Visa sees these limitations as an opportunity. With its vast network and technological prowess, the company is positioning itself as a formidable competitor to ACH in the B2B space. But how exactly does Visa plan to take on this entrenched player?

Visa's Arsenal: Tools and Strategies

Visa is employing a multi-faceted approach to compete against ACH and gain market share in the B2B payments space. Let's break down the key components of their strategy:

1. Leveraging Visa Direct

At the heart of Visa's B2B strategy is Visa Direct, the company's real-time push payment platform. This technology allows for near-instantaneous fund transfers, with money typically available within 30 minutes, even on nights and weekends.

The speed advantage of Visa Direct is particularly appealing for time-sensitive B2B transactions. Imagine a scenario where a company needs to make an urgent payment to a supplier to secure a critical shipment. In such cases, the ability to transfer funds instantly could be a game-changer.

Ryan McInerney, President of Visa, highlighted the potential of Visa Direct in a recent earnings call:

"Visa Direct transactions grew 20% year-over-year to 1.8 billion in the fiscal third quarter. We're seeing strong growth across use cases, including B2B payments, where businesses are increasingly turning to Visa Direct for its speed and reliability."

Application Example: A software company could use Visa's solutions to accept card payments from their business customers, potentially accelerating their cash flow compared to traditional invoicing methods. This could be particularly beneficial for SaaS companies dealing with recurring payments from multiple clients.

2. Cross-Border Capabilities

One of Visa's significant advantages over domestic ACH is its ability to handle cross-border payments efficiently. In an increasingly globalized business world, this capability is becoming more crucial than ever.

Visa B2B Connect, the company's multilateral B2B cross-border payments network, is a key part of this strategy. In fiscal year 2023, Visa increased the number of banks signed onto Visa B2B Connect by over 70%. This expansion enhances Visa's ability to facilitate seamless international B2B payments, addressing a pain point that ACH struggles to solve.

Application Example: A mid-market manufacturing company in the U.S. that sources materials from suppliers in Asia could use Visa B2B Connect to make faster, more transparent payments to those suppliers. This would help improve their supplier relationships and potentially negotiate better terms due to quicker payments.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

3. Targeting Specific Verticals

Visa is strategically focusing on industries where account-to-account payments are increasingly used. These "stubborn categories" often involve larger, less frequent payments where Visa believes it can offer superior solutions to ACH. Some of these verticals include:

- Loan payments

- Rent payments

- Life insurance premiums

- Healthcare payments

- Education fees

By tailoring its solutions to the specific needs of these industries, Visa aims to demonstrate clear value over traditional ACH transfers.

Application Example: A healthcare services provider could benefit from the enhanced data capabilities of Visa's B2B solutions, making it easier to reconcile payments and manage accounts receivable more efficiently. This could be particularly valuable in managing complex billing scenarios often encountered in healthcare.

4. Enhancing Security and Reliability

Security is paramount in B2B payments, and Visa is leveraging its longstanding reputation in this area. The company is integrating its robust security measures into new B2B payment services, providing businesses with a simple yet secure digital experience.

Alfred F. Kelly Jr., Chairman and CEO of Visa, emphasized this focus on security in a recent statement:

"Our unparalleled security capabilities are a key differentiator in the B2B space. We're not just offering speed; we're offering peace of mind."

Application Example: A financial services company could utilize the tokenization technology in Visa Commercial Pay to reduce the risk of fraud in their B2B transactions. This could be particularly valuable for companies dealing with high-value transactions or sensitive financial data.

5. Developing Pay-by-Bank Services

In a move that shows Visa's willingness to compete directly in ACH's territory, the company is preparing to launch pay-by-bank services in the U.S. This service will allow customers to make payments directly from their bank accounts, similar to ACH transfers but with the added benefits of Visa's network.

This strategic move demonstrates Visa's commitment to offering a comprehensive suite of payment solutions, catering to various business needs and preferences.

Application Example: A growing e-commerce company could use Visa's virtual card solutions to extend their payment terms with suppliers while still paying them on time. This allows the company to better manage their cash flow and use the freed-up capital for growth initiatives.

6. Strategic Partnerships and Acquisitions

Visa is not going it alone in its quest to dominate the B2B payments space. The company has been forming strategic partnerships and making key acquisitions to enhance its capabilities.

For example, Visa's acquisition of Earthport expanded its ability to execute payments in countries where it previously couldn't. This move significantly bolstered Visa's cross-border payment capabilities, a crucial factor in competing against ACH on a global scale.

Application Example: A growing retail chain looking to expand into new markets could use Visa B2B Connect to simplify payments to international vendors and partners, reducing the complexity of managing multiple banking relationships across countries.

7. Value-Added Services

To differentiate itself from basic ACH transfers, Visa is bundling additional services with its B2B payment solutions. These include:

- Enhanced data capabilities

- Reconciliation tools

- Working capital management features

By offering these value-added services, Visa aims to provide a more comprehensive solution that goes beyond simple fund transfers, potentially justifying higher fees compared to ACH.

Application Example: A mid-sized food distribution company could leverage Visa's B2B payment solutions to offer early payment discounts to their suppliers, helping to strengthen their supply chain relationships while also potentially reducing costs. The enhanced data capabilities could also help in tracking and optimizing these early payment programs.

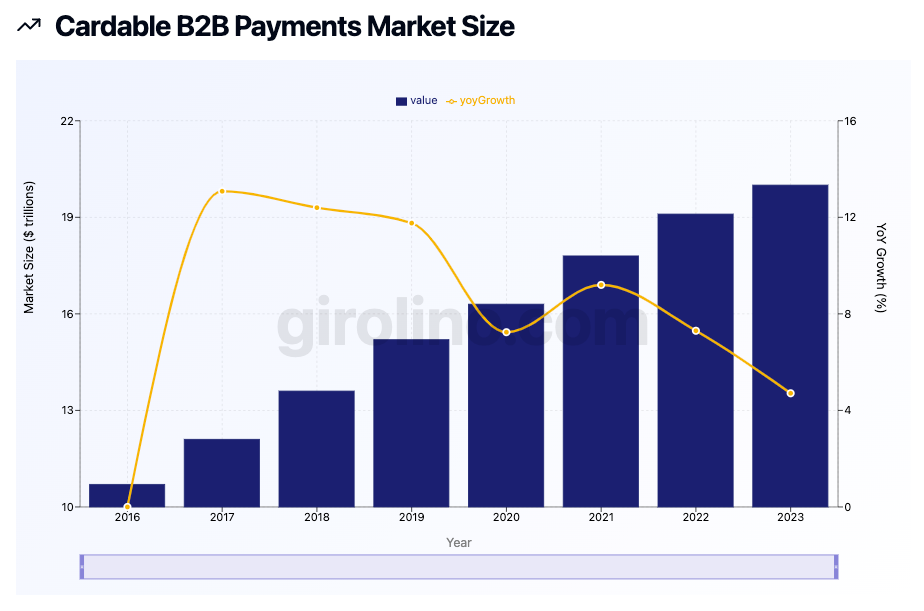

The Battlefield: Key Market Segments

As we dive deeper into Visa's strategy, it's essential to understand the various segments of the B2B payments market where this battle is playing out. Each segment presents unique challenges and opportunities for Visa as it seeks to compete against ACH.

Large Enterprise Payments

This segment involves high-value transactions between major corporations. Traditionally, ACH has dominated here due to its low fees for large transfers. However, Visa is targeting specific use cases where speed is critical.

For instance, just-in-time inventory payments or urgent supplier transactions could benefit significantly from Visa Direct's near real-time processing. While ACH might still be preferred for scheduled, high-value transfers, Visa is carving out a niche for time-sensitive, mission-critical payments.

Small and Medium-sized Business (SMB) Payments

The SMB market is a key battleground in the competition between Visa and ACH. These businesses often require more flexible payment options and faster cash flow, making them an ideal target for Visa's offerings.

The potential here is substantial. B2B payments among SMBs are expected to reach $2,146.70 billion by 2030, growing at a CAGR of 10.1%. Visa Direct's speed and ease of use make it particularly attractive for this segment, where cash flow management is often a critical concern.

A Visa executive recently commented on the importance of this market:

"SMBs are the backbone of the global economy, and we're committed to providing them with payment solutions that can help them grow and thrive. Visa Direct's speed and flexibility are perfectly suited to meet the needs of these dynamic businesses."

Cross-Border Payments

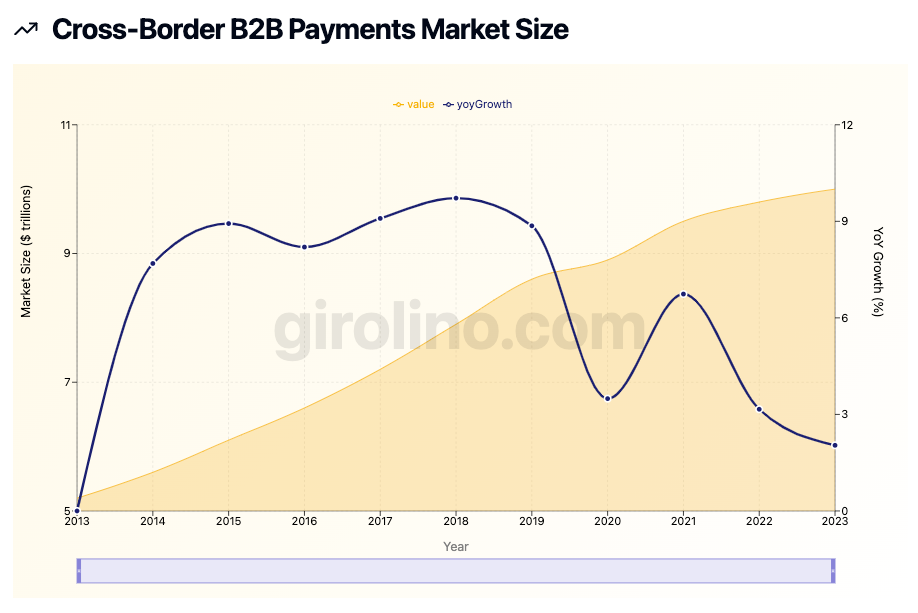

This is perhaps the arena where Visa has the most significant advantage over domestic ACH. The cross-border B2B payment market is estimated at $10 trillion, and it's a space ripe for disruption.

Visa B2B Connect, which enables businesses to make cross-border payments directly from bank to bank, is a key weapon in Visa's arsenal here. The 70% increase in participating banks in fiscal year 2023 is a testament to the growing demand for efficient cross-border payment solutions.

Gig Economy and Freelancer Payments

The rapid growth of the gig economy has created a need for fast, flexible payment solutions. Visa Direct's ability to process payments quickly, even on nights and weekends, makes it well-suited for paying freelancers and gig workers.

This is a space where ACH's limitations become particularly apparent. Gig workers often rely on frequent, smaller payments, and the ability to access funds quickly can be crucial for their financial well-being.

Supply Chain Financing

Visa is also targeting the space between accounts payable and accounts receivable, offering solutions that can help optimize working capital for both buyers and suppliers. This is an area where the combination of Visa's payment speed and value-added services could provide a compelling alternative to traditional ACH-based supply chain financing solutions.

The Numbers Game: Visa Direct vs. ACH

When it comes to choosing between Visa Direct and ACH, businesses must consider various factors, with cost being a primary concern. Let's break down the pricing structures and potential market capture for each option.

Pricing Structures

ACH transfers typically have a flat fee structure, with costs ranging from $0.20 to $1.50 per transaction. The median cost is around $0.40. This pricing model makes ACH particularly attractive for high-value transactions. For example, a $10,000 ACH transfer might only incur a $0.40 fee, representing just 0.004% of the transaction value.

Visa Direct, on the other hand, uses a percentage-based fee structure. While rates can vary, Visa Direct transactions generally incur an interchange rate of 0.25% with a cap of $0.043 per transaction. This pricing model makes Visa Direct more competitive for smaller transactions.

The Crossover Point

Based on these pricing structures, we can calculate a crossover point where Visa Direct becomes more cost-effective than ACH. This occurs at around $172, assuming the median ACH fee of $0.40 and Visa Direct's 0.25% rate.

- For transactions below $172, Visa Direct is typically cheaper.

- For transactions above $172, ACH becomes more economical.

However, it's crucial to note that this calculation doesn't account for the potential value of Visa Direct's speed and additional features, which could justify its use even for larger transactions in time-sensitive scenarios.

Potential Market Capture and Revenue Impact

As Visa positions itself to compete against ACH in the vast B2B payments landscape, it's crucial to understand both the potential market capture and revenue impact across various segments. Our analysis, based on projected data over a 10-year period, reveals a significant opportunity for Visa to capture substantial market share and generate considerable revenue growth.

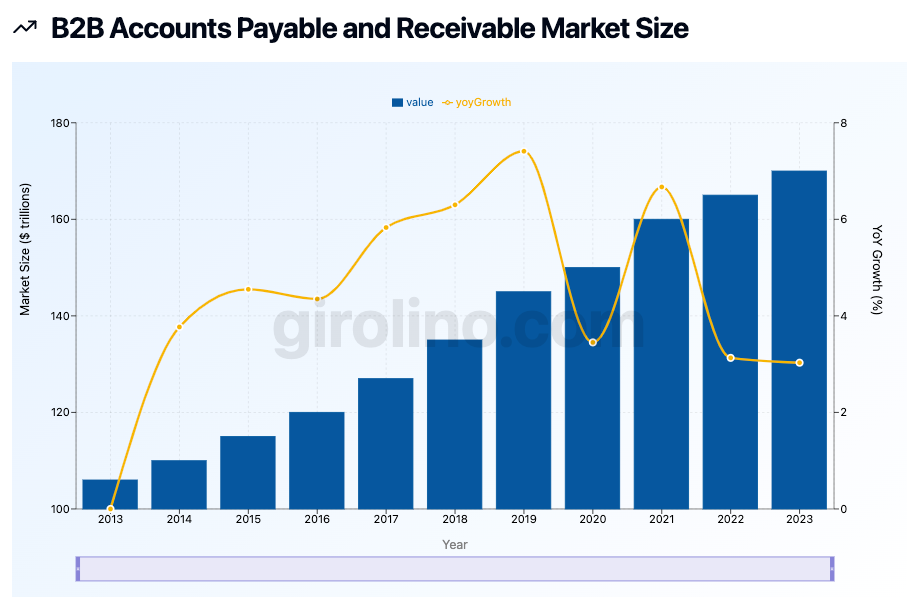

B2B Payments: The $160 Trillion Core Opportunity

The B2B payments market, valued at a staggering $160 trillion globally, represents Visa's largest opportunity. We estimate that Visa Direct could potentially service $15-20 trillion of this market, or 10-15% of the Total Addressable Market (TAM). However, considering strong competition from established players and new entrants, a more realistic market capture estimate might be 2-5% of the TAM, or $4-10 trillion.

This estimate is based on several key factors:

- Time-sensitive transactions: A PYMNTS study found that 93% of businesses consider faster payments important, with 32% rating them as "very" or "extremely" important. Visa Direct's near real-time processing gives it an edge in this segment.

- Lower-value transactions: Visa Direct's percentage-based pricing model (0.25% with a cap of $0.043 per transaction) makes it more economical for transactions under $172 compared to the median ACH fee of $0.40.

- Small and Medium-sized Business (SMB) market: The SMB B2B payments market is projected to reach $2,146.70 billion by 2030, growing at a CAGR of 10.1%. Visa Direct's speed and ease of use make it particularly attractive for this rapidly growing segment.

- Industry-specific verticals: Visa is targeting "stubborn categories" like loan payments, rent payments, life insurance, healthcare, and education. These sectors represent a significant portion of B2B transactions.

In terms of revenue impact, our projections show B2B payments as Visa's core opportunity. Revenue is expected to grow from a negligible amount in Year 1 to approximately $23 billion by Year 10, following a classic S-curve adoption pattern:

- Slow initial adoption (Years 1-3) as Visa establishes its presence and overcomes market inertia.

- Rapid growth phase (Years 4-7) as the solution gains traction and network effects take hold.

- Gradual slowdown (Years 8-10) as the market matures and penetration reaches higher levels.

This projection suggests that Visa's B2B payment solution could become a significant revenue driver, potentially rivaling some of its current core businesses.

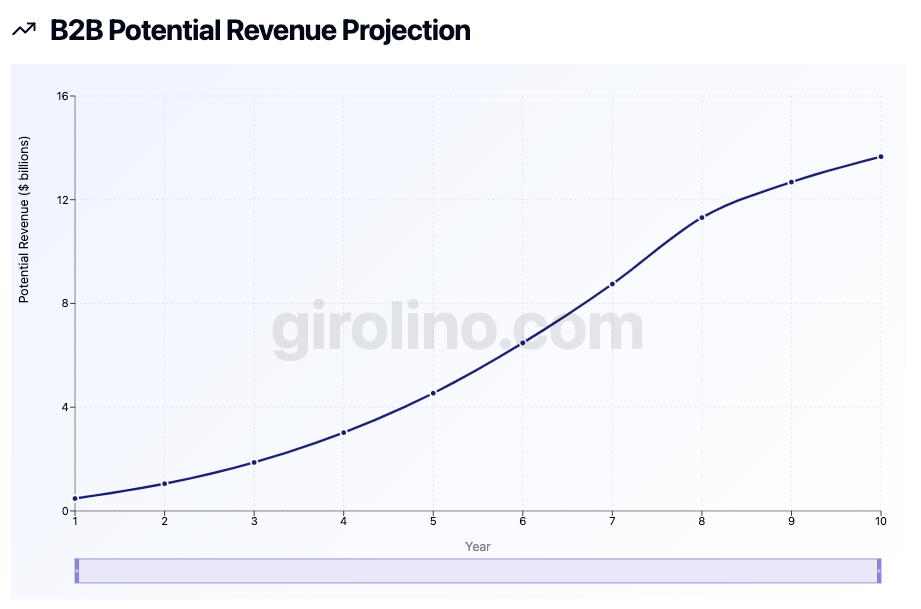

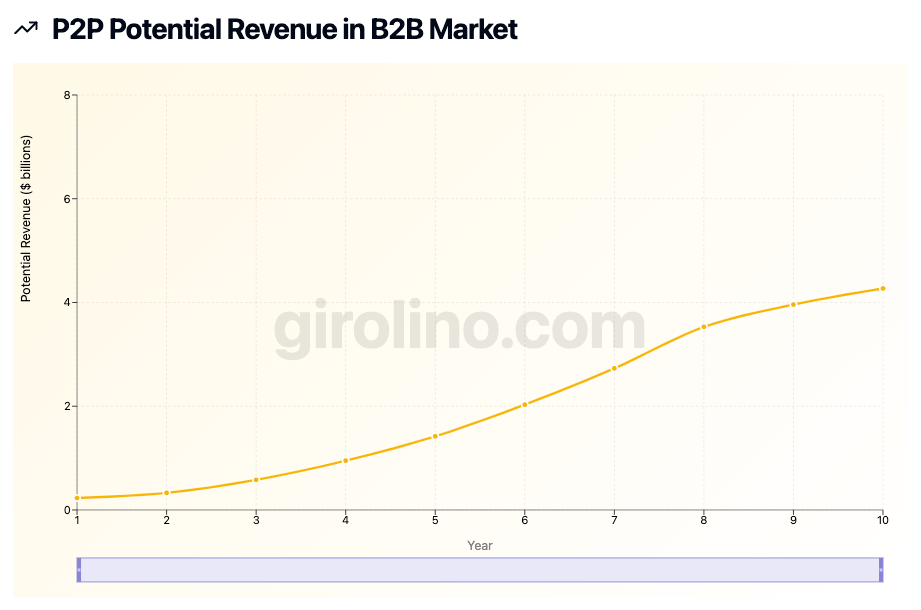

P2P Transfers: Capturing the Digital Shift

The P2P (peer-to-peer) transfers market is estimated at $20 trillion. We project that Visa Direct could potentially service $5-7 trillion of this market, or 25-35% of the TAM. Given the competitive landscape with established players like PayPal, and Zelle, a more realistic market capture for Visa might be 10-15% of the TAM, or $2-3 trillion.

Key advantages for Visa in this space include:

- Real-time processing: Visa Direct's near-instant availability of funds is particularly attractive for P2P transfers.

- Global reach: With the ability to send money to over 3 billion cards and accounts worldwide, Visa Direct has a significant advantage in the increasingly global P2P transfer market.

- Integration with popular platforms: Visa Direct powers real-time transfers for services like Venmo and Square Cash.

- Cross-border capabilities: Unlike domestic ACH, Visa Direct supports international remittances, a significant portion of P2P transfers.

In the B2B context, P2P solutions are projected to grow from near zero to about $4.3 billion in revenue by Year 10. While smaller than the core B2B segment, it represents a notable additional revenue stream, potentially addressing niche B2B payment needs or serving as a gateway product for smaller businesses.

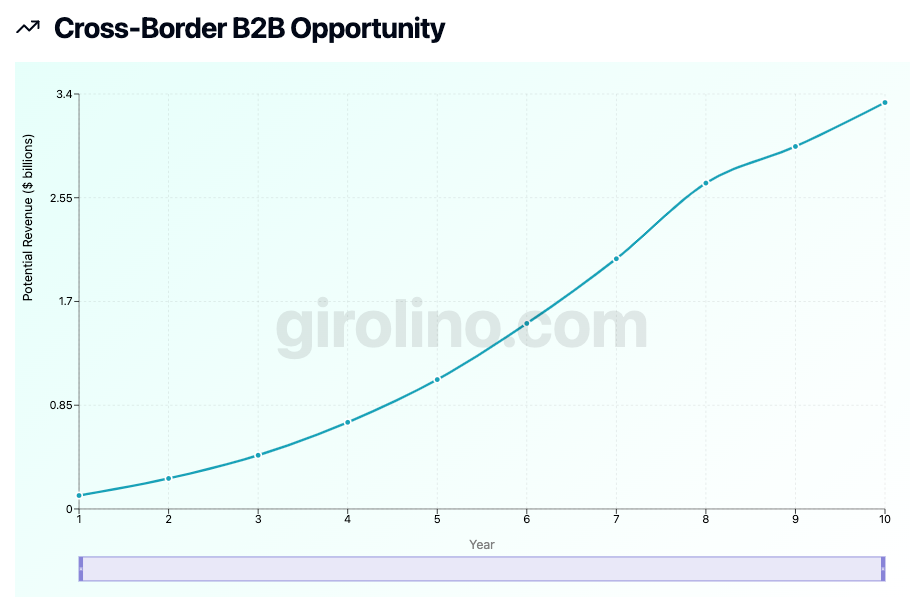

Cross-Border Payments: Breaking Down Barriers

The cross-border payments market is estimated at $10 trillion. We estimate that Visa Direct could potentially service $4-5 trillion of this market, or 40-50% of the TAM. Given Visa's strengths in this area, a realistic market capture might be 20-25% of the TAM, or $2-2.5 trillion.

This estimate is based on several strengths:

- Global Network Reach: Visa Direct leverages Visa's network spanning over 200 countries and territories.

- Real-Time Processing: Near real-time processing for cross-border payments is a significant improvement over traditional international wire transfers.

- Currency Support: Visa Direct supports transactions in over 160 currencies, simplifying international payments.

- B2B Connect Growth: Visa B2B Connect saw a 70% increase in participating banks in fiscal year 2023, indicating strong market demand.

In the B2B context, cross-border transactions are projected to generate about $3.3 billion in revenue by Year 10. While smaller than other segments, it represents a critical component of Visa's comprehensive B2B strategy.

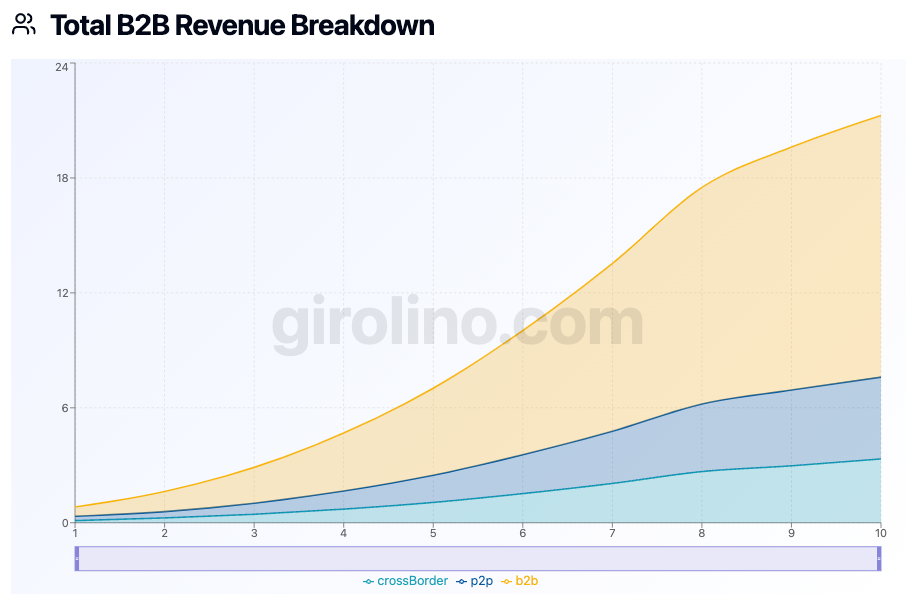

Total B2B Revenue: A Comprehensive View

The comprehensive view of Visa's B2B revenue streams paints a picture of significant growth potential:

- Total revenue across all B2B-related segments is projected to reach around $38 billion by Year 10.

- Core B2B payments form the largest portion of revenue, followed by B2C disbursements, P2P, and cross-border transactions.

- The stacked nature of the growth indicates that all segments contribute to overall revenue growth, providing diversification and multiple avenues for expansion.

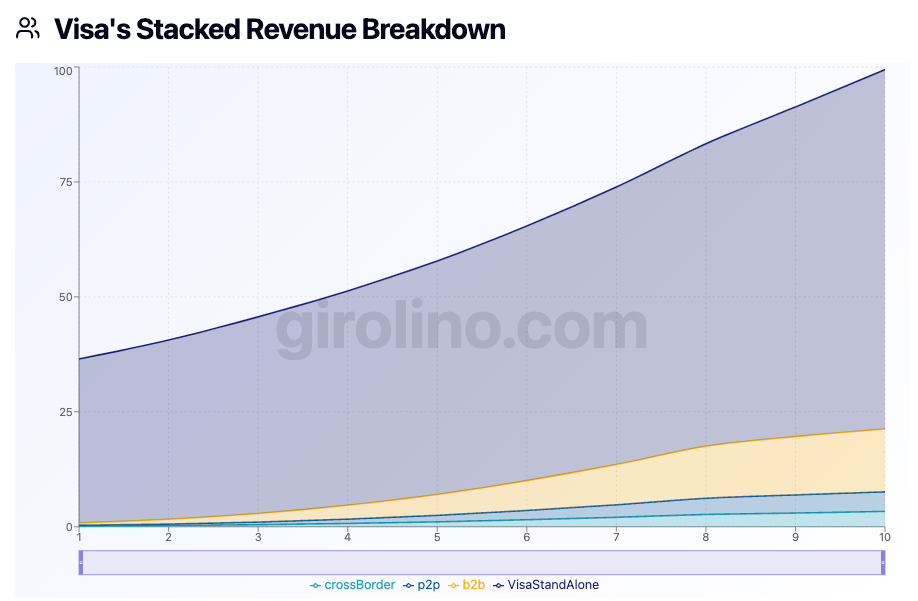

Strategic Implications

- Dominant Visa Stand-Alone Focus: The chart clearly shows that Visa's stand-alone products are expected to be the primary driver of revenue growth, representing the largest portion of the stacked area. This indicates that Visa is likely to focus most of its resources and innovation efforts on enhancing and expanding its core payment processing capabilities.

- Significant B2B Growth: While not the largest segment, the B2B segment (shown in yellow) demonstrates substantial growth over the 10-year period. This suggests that Visa sees B2B payments as a key area for expansion and is likely to invest heavily in developing solutions tailored to business needs.

- Diversified Revenue Streams: The stacked nature of the chart illustrates Visa's strategy to address multiple segments (cross-border, P2P, B2B, and stand-alone products). This diversified approach positions Visa to capture a wide range of payment flows, potentially insulating itself from segment-specific risks.

- Gradual Adoption Curves: All segments show gradual, steady growth rather than dramatic jumps. This pattern suggests that Visa anticipates a measured, long-term approach to capturing market share across all its offerings, likely accounting for factors such as competition, regulatory challenges, and the time needed for adoption of new payment systems.

- Cross-Border Opportunity: While the smallest segment, cross-border payments (shown in teal) demonstrate consistent growth. This aligns with Visa's global strengths and suggests a focus on leveraging its international network to expand in the B2B space.

- Integrated Ecosystem Strategy: The presence of multiple segments growing in tandem suggests Visa is building an integrated payment ecosystem. This could lead to significant cross-selling opportunities, allowing Visa to offer comprehensive solutions that span various payment needs for both businesses and consumers.

- Long-Term Revenue Transformation: The chart shows that by year 10, the new segments (B2B, P2P, cross-border) combined contribute a significant portion of total revenue. This indicates that Visa's strategy could substantially transform its revenue composition over time, reducing reliance on traditional stand-alone products.

The stacked revenue breakdown demonstrates Visa's comprehensive approach to growth, with a strong foundation in its core business and strategic expansions into B2B, P2P, and cross-border payments. This multi-faceted strategy positions Visa to not only compete effectively against traditional players like ACH but also to adapt to emerging trends in the payment industry. If successful, this approach could significantly enhance Visa's competitive position and create new avenues for long-term growth, potentially reshaping its business model in the process.

Final Consideration

As we look to the future, it's clear that the B2B payments landscape is set for significant transformation. Visa's aggressive push into this space, leveraging its technological prowess and global network, poses a serious challenge to the long-standing dominance of ACH in certain segments of the market.

However, this isn't a winner-take-all scenario. The most likely outcome is a diversified ecosystem where businesses use a combination of payment methods, choosing the most appropriate option based on the specific requirements of each transaction.

Visa's success in this arena will largely depend on its ability to clearly demonstrate the value of its solutions, particularly in scenarios where speed, cross-border capabilities, and additional data services can justify potentially higher costs compared to ACH transfers.

For those watching this space, the key metrics to monitor will be:

- The growth rate of Visa Direct transactions, particularly in B2B use cases.

- The expansion of Visa B2B Connect, both in terms of participating banks and transaction volumes.

- Visa's market share in key verticals like healthcare, education, and commercial real estate.

- The adoption rate of Visa's upcoming pay-by-bank services in the U.S.

As this competition unfolds, we're likely to see continued innovation in the B2B payments space, ultimately benefiting businesses with more efficient, secure, and feature-rich payment options. The battle between Visa and ACH is just beginning, and it promises to be a fascinating one to watch in the coming years.