Curious about Nubank's latest financial trends? Follow us on Twitter for real-time insights and updates..

Introduction

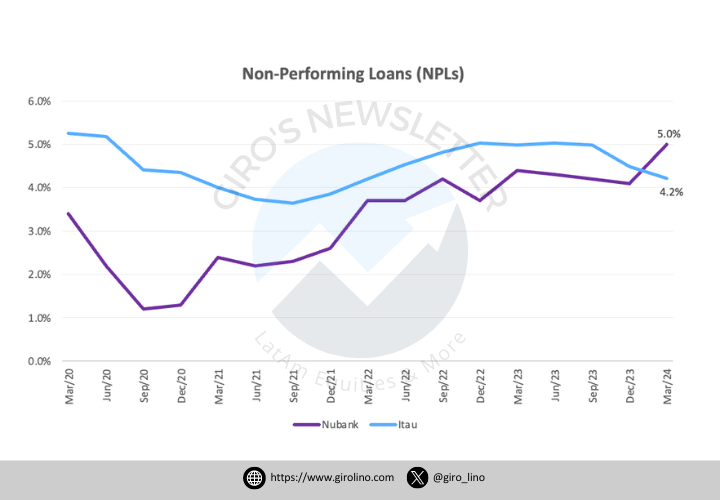

In the first quarter of 2024, Nubank saw a 90 basis point rise in its 15-90 day non-performing loan (NPL) ratio, reaching 5.0%. This increase aligned with market trends and historical seasonality. The 90+ NPL ratio also climbed to 6.3%, reflecting typical early delinquency patterns. This post explores the reasons behind this rise and examines whether it signals broader macroeconomic issues, considering the overall healthy state of the Brazilian economy.

While Nubank has experienced a rise in NPLs, traditional banks like Itaú Unibanco have shown improving trends. Itaú Unibanco, for example, reported a decrease in its NPL ratio to 3.5% in Q1 2024. This contrast highlights different risk management approaches and market positions between digital and traditional banks.

Nubank's management attributes the NPL increase to several factors, primarily its rapid expansion into broader and riskier credit segments. This strategic move aims to diversify its loan portfolio and maintain attractive returns. However, it also inherently carries higher risks, contributing to the rise in NPL ratios.

Seasonal trends also play a role, with early delinquency ratios typically rising by 80-90 basis points in the first quarter. Additionally, the 90+ NPL ratio reflects the lagging impact of broader economic conditions. Despite these increases, the overall economic environment in Brazil remains stable, suggesting that Nubank's specific expansion strategy and seasonal factors are more significant contributors to the NPL rise.

Importantly, when focusing on interest-earning balances excluding credit, Nubank's NPL ratios have been significantly lower in both the 15-90 and 90+ metrics, indicating strong overall credit quality.

Nubank's credit strategy leverages technological agility, large-scale data analysis, and customized risk management. They adopt a "low and grow" approach, starting customers with low credit limits that increase with positive payment behavior.

Despite the rise in NPLs, when focusing on interest-earning balances excluding credit, Nubank's NPL ratios are significantly lower, indicating strong overall credit quality. Nubank's approach leverages technological agility, large-scale data analysis, and customized risk management, which contribute to its resilience through economic cycles.

Ultimately, while Nubank's NPL ratios are higher than a year ago, they remain below the industry average. With a robust capital position and a CET1 ratio of 18.5% as of Q1 2024, Nubank is well-buffered against potential credit losses.

In summary, while Nubank's non-performing loan ratios have increased, this trend is consistent with the company's strategic expansion into broader credit segments and seasonal patterns. The Brazilian economy's stability further supports that Nubank's specific strategies are the primary drivers of these changes. We will continue to monitor these developments and their implications for Nubank's financial health and the broader market.

This post explores why Nubank's NPL worsened in the first quarter of 2024 and whether a macroeconomic issue is at play, given that the Brazilian economy is performing well.

In the next editions, we'll delve into the factors influencing Nubank's NPL ratios, compare them with other banks, and analyze the broader economic context to understand the underlying dynamics. This will provide a comprehensive perspective on Nubank's financial health and the market trends affecting it.

Market Trends and Economic Context

As discussed in last week's post, our view on Brazil's macroeconomic environment underscores both challenges and opportunities. In 2024, Brazil's economic landscape showcases a blend of positive trends and ongoing hurdles, particularly in the areas of credit and delinquency.

Positive Trends

- Declining Default Rates: Following the interest rate easing cycle initiated by the Brazilian Central Bank in August 2023, default levels in some of the country’s largest financial institutions have stabilized or are on a downward trend. This indicates a potential recovery in the credit market.

- Economic Growth: Brazil's GDP growth reached 2.9% in 2023, supported by a resilient job market and falling inflation. The unemployment rate dropped to 8%, nearing full employment levels, bolstering consumer spending and economic activity.

- Inflation Control: Inflation fell to 4.6% in 2023, within the target band set by the Central Bank. This allowed for a gradual easing of monetary policy, which has helped improve financial conditions and support economic growth.

- Trade Surplus: Brazil achieved a record trade surplus of $100 billion in 2023, driven by strong exports in various sectors. This surplus has contributed positively to the country's economic stability.

Challenges

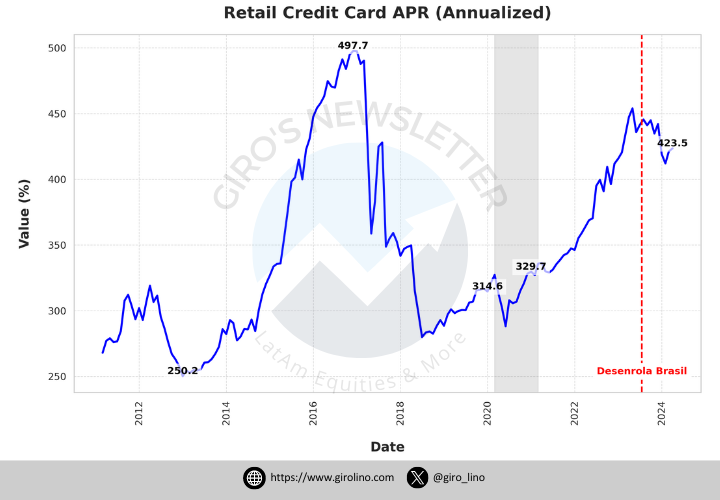

Brazil is currently grappling with high interest rates on consumer credit despite a recent easing cycle. The average Annual Percentage Rate (APR) on consumer credit cards is an astonishing 423.5%, with some rates peaking at 497.7%. These high rates significantly burden consumers, making it harder for them to manage their finances effectively.

In addition to high interest rates, Brazil's fiscal health has deteriorated. The general government primary deficit rose to 2.3% of GDP in 2023, up from a surplus of 1.2% in 2022. Debt levels also increased, reaching 74.3% of GDP compared to 71.7% the previous year. Addressing these fiscal challenges is a priority for policymakers who must manage and reduce the deficit and debt levels to ensure economic stability.

The country faces ongoing structural challenges that complicate its economic landscape. These include a complex tax system, a cumbersome business environment, low savings and infrastructure investments, and limited integration into global markets. These issues hinder productivity, innovation, and competitiveness, making sustainable economic growth difficult to achieve.

Moreover, Brazil's aging population presents additional challenges, particularly in healthcare and pensions. These aging-related issues are expected to put increasing pressure on public finances in the long term, necessitating comprehensive policy responses to address the needs of an older population while maintaining fiscal health.

Government Initiatives: Desenrola Brasil

To address the financial distress faced by millions of Brazilians and support economic recovery, the government launched the Desenrola Brasil program in 2023. This initiative aims to help individuals renegotiate their debts and regain access to credit, fostering financial inclusion and economic participation. "Desenrola Brasil" translates to "Unroll Brazil" in English, symbolizing the easing of financial burdens and the untangling of debt issues for citizens.

Key Features of Desenrola Brasil

- Debt Renegotiation: The program provides a centralized platform for individuals to renegotiate their debts, including those with banks, utilities, and other creditors.

- Significant Discounts: Desenrola Brasil offers substantial discounts on outstanding debts, ranging from 83% to 96%, depending on the creditor and the individual's financial situation.

- Flexible Repayment Terms: Participants can choose to pay their renegotiated debts in full or opt for installment plans of up to 60 months, with interest rates capped at 1.99% per month.

- Automatic Debt Clearance: The program automatically clears negative credit records for debts up to R$100 (approximately US$20), providing immediate relief to millions of Brazilians.

- Eligibility Criteria:

- Faixa 1: Targets individuals earning up to two minimum wages or those registered in the CadÚnico social program, with debts up to R$20,000 (approximately US$5,000).

- Faixa 2: Focuses on individuals earning between two minimum wages and R$20,000 per month, and having debts from banks and financial institutions.

According to the Ministry of Finance, Desenrola Brasil has benefited more than 15 million Brazilians, with over R$52 billion in debts renegotiated. The program's success led to an extension of the deadline, initially set for March 20, 2024, to May 20, 2024, allowing more individuals to take advantage of the debt renegotiation opportunities.

Desenrola Brasil aims to alleviate individuals' financial burdens, reduce default rates, and promote economic recovery by enabling access to credit and fostering financial inclusion. By addressing indebtedness, the government seeks to support the overall economic well-being of Brazilian households and stimulate consumer spending, which could contribute to sustained economic growth.

Analysis of Credit for Individuals in Brazil

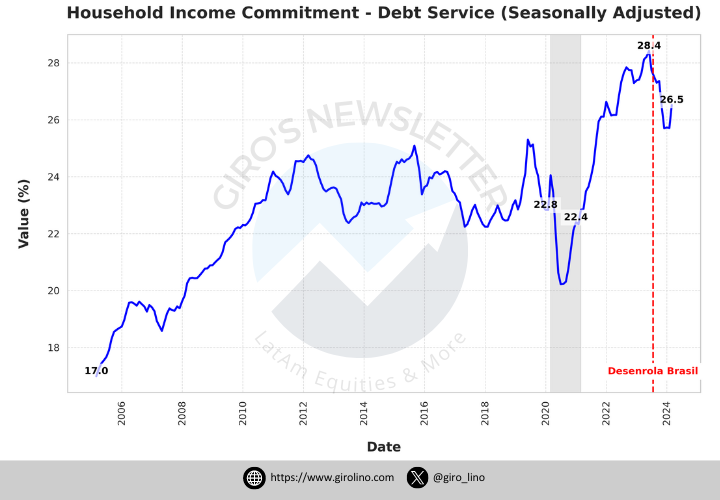

Household Income Commitment to Debt Service

Brazil's economic landscape is a complex mix of challenges and opportunities. In recent years, the percentage of household income committed to debt service has fluctuated significantly. This figure peaked at 28.4% in 2022 before easing to 26.5% in 2024. Such high levels of debt commitment mean a large portion of household income goes towards paying off debt, leaving less for other expenses and savings.

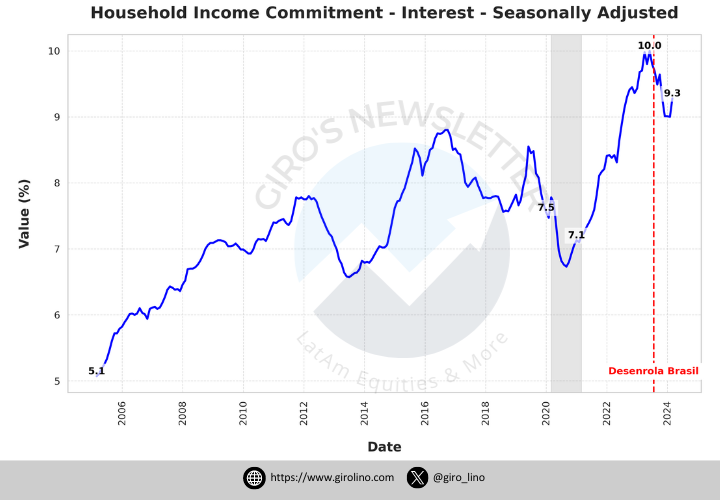

Similarly, the percentage of income committed to interest payments peaked at 10% in 2022 but improved to 9.3% in 2024. These high interest payments indicate significant financial pressure on households, making budgeting a tough task for many families.

In perspective:

- In the United States, the trend of household income committed to interest payments has been generally upward. Starting around 5.1% in 2006, it reached a peak of approximately 9.3% in 2022. While similar to Brazil's peak, higher household incomes in the U.S. help to cushion the impact of these interest payments.

- According to the OECD Better Life Index, Brazil's average household net adjusted disposable income per capita is significantly lower than the OECD average of USD 30,490. This disparity means that even similar percentages of income committed to debt service and interest payments have a more substantial impact on Brazilian households compared to those in wealthier countries.

- The debt-to-income ratio of Brazilian households has risen dramatically, from 16.5% in 2005 to 49.0% in 2022. This growth indicates a significant increase in household indebtedness, posing challenges for managing debt levels effectively compared to other emerging markets.

- In high-income countries like Denmark, Norway, and Switzerland, household debt-to-income ratios are much higher. For instance, Denmark's ratio stands at 252.18%, Norway's at 246.79%, and Switzerland's at 227.41%. These countries can manage higher debt levels due to robust financial systems and higher household incomes, which absorb the impact more effectively.

- Conversely, countries with lower household incomes, such as Mexico and Chile, have much lower debt-to-income ratios. Mexico's ratio is 25.62%, while Chile's is 67.40%. These lower ratios reflect limited access to credit and lower levels of household indebtedness.

Brazil's household debt levels and the proportion of income committed to servicing these debts are high, especially when compared to other countries. This significant debt burden strains household budgets, limiting disposable income for other expenses and savings. High-income countries can better manage higher debt levels due to their financial systems and higher incomes, while low-income countries typically have lower debt levels due to limited credit access.

Understanding these dynamics is crucial for Brazilian policymakers and financial institutions as they strive to enhance financial stability and support sustainable economic growth. Programs like Desenrola Brasil, which translates to "Unroll Brazil" in English, are essential. This initiative aims to help households manage their debt obligations and reduce financial stress, thereby supporting economic well-being and stimulating consumer spending. However, evaluating how effectively people access these benefits and whether they are utilizing them properly is crucial. Otherwise, the government could worsen its fiscal conditions by offering this benefit without ensuring less leverage in the financial system.

Brazil in a Nutshell

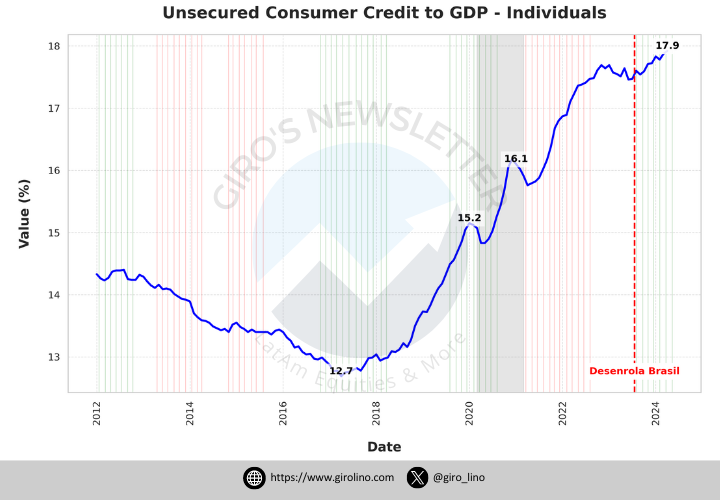

The launch of the Desenrola Brasil program appears to have influenced consumer behavior, leading to an increase in unsecured consumer credit relative to GDP. As seen in the accompanying chart, the percentage of unsecured consumer credit to GDP has risen significantly since the program's inception.

From 2014 to 2017, Brazilian families faced worsening financial conditions, forcing them to deleverage and reduce their debt levels. This period saw a significant contraction in unsecured consumer credit as households struggled with economic hardship.

In 2018, the trend began to reverse as interest rates started to fall due to structural fiscal changes. This decline in rates continued and accelerated sharply in 2020, driven by extraordinarily low rates aimed at stimulating the economy. The lower interest rates made borrowing more attractive, leading to a rise in unsecured consumer credit.

However, as interest rates began to rise again, starting in the early 2020s, the financial strain on families increased. The Desenrola Brasil program was introduced to offer relief to those excluded from the financial system, providing an opportunity to renegotiate debts and regain financial stability. Despite this intention, many individuals used the program as an opportunity to increase their leverage, anticipating that they could renegotiate with banks later.

Consumer Credit Behavior Post-Program Launch

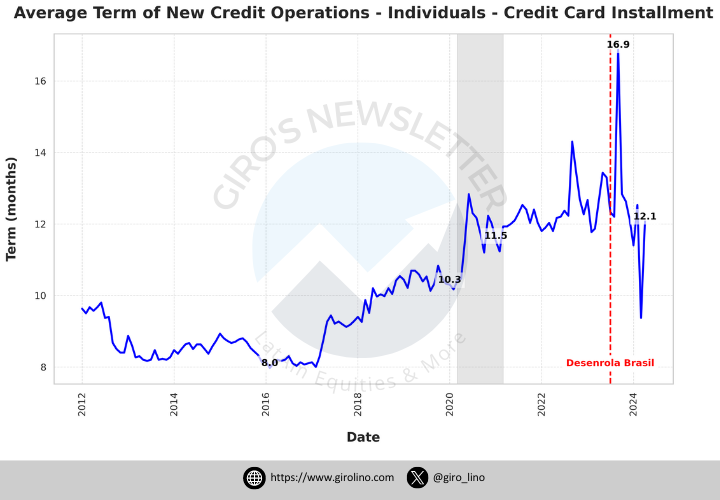

The average term of new credit card installment operations for individuals has shown significant fluctuations over the years. Notably, the graph reveals a peak of 16.9 months in August of 2023, which then declined to 12.1 months in the following months, suggesting that the Desenrola Brasil program, introduced in 2023, influenced credit behavior.

After the program's launch, individuals appeared to take on more credit with longer terms, possibly to facilitate easier renegotiation of existing debts. Financial institutions likely adapted their credit offerings in response, providing extended repayment periods to help borrowers manage their debt more effectively. This change aligns with the program’s goal of alleviating financial distress among individuals, enabling better cash flow management, and reducing immediate financial pressure.

The Desenrola Brasil program, despite its intentions, ultimately failed to reduce household leverage. Instead, it appears that individuals leveraged the program to increase their borrowing, anticipating future renegotiations with banks. This outcome highlights the need for careful monitoring and effective implementation of financial relief programs to ensure they achieve their intended goals without exacerbating fiscal conditions. Policymakers must evaluate how these benefits are accessed and utilized to avoid worsening the financial system's leverage and placing additional strain on the economy.

Conclusion

Nubank's early NPLs (Non-Performing Loans) rose while traditional banks experienced a contraction, highlighting a significant divergence in credit risk management. This increase in Nubank's NPLs likely stems from expectations of future losses, exacerbated by worsening credit conditions and increased household leverage. Programs like Desenrola Brasil, although well-intentioned, may have inadvertently encouraged more borrowing, increasing the risk of defaults rather than providing the intended financial relief.

Traditional banks, on the other hand, managed to reduce their NPLs through better risk mitigation and possibly stricter credit assessment practices, as well as later provisioning practices. This contrast underscores the complexities of managing credit risk in a volatile economic environment and the need for careful implementation of financial relief programs. Effective measures must balance providing relief with encouraging responsible borrowing to maintain fiscal health.

Understanding these dynamics is crucial for Brazilian policymakers and financial institutions as they strive to enhance financial stability and support sustainable economic growth. The key lies in monitoring the accessibility and utilization of relief programs to prevent exacerbating leverage issues within the financial system.

Stay tuned for next week's post, where we'll delve deeper into why Nubank's NPLs increased despite traditional banks reducing theirs. We'll explore the factors driving this divergence and what it means for the future of credit management in Brazil.

Thanks for reading!

Join the conversation! We value your thoughts on Nubank’s strategies and Brazil’s economic landscape. Share your insights with us on Twitter.