In the complex world of financial markets, understanding how companies recognize income is crucial for making informed investment decisions. This comprehensive guide will walk you through the principles of income recognition, helping you navigate financial statements with confidence and gain deeper insights into a company's true financial health.

Understanding the Basics of Income Recognition

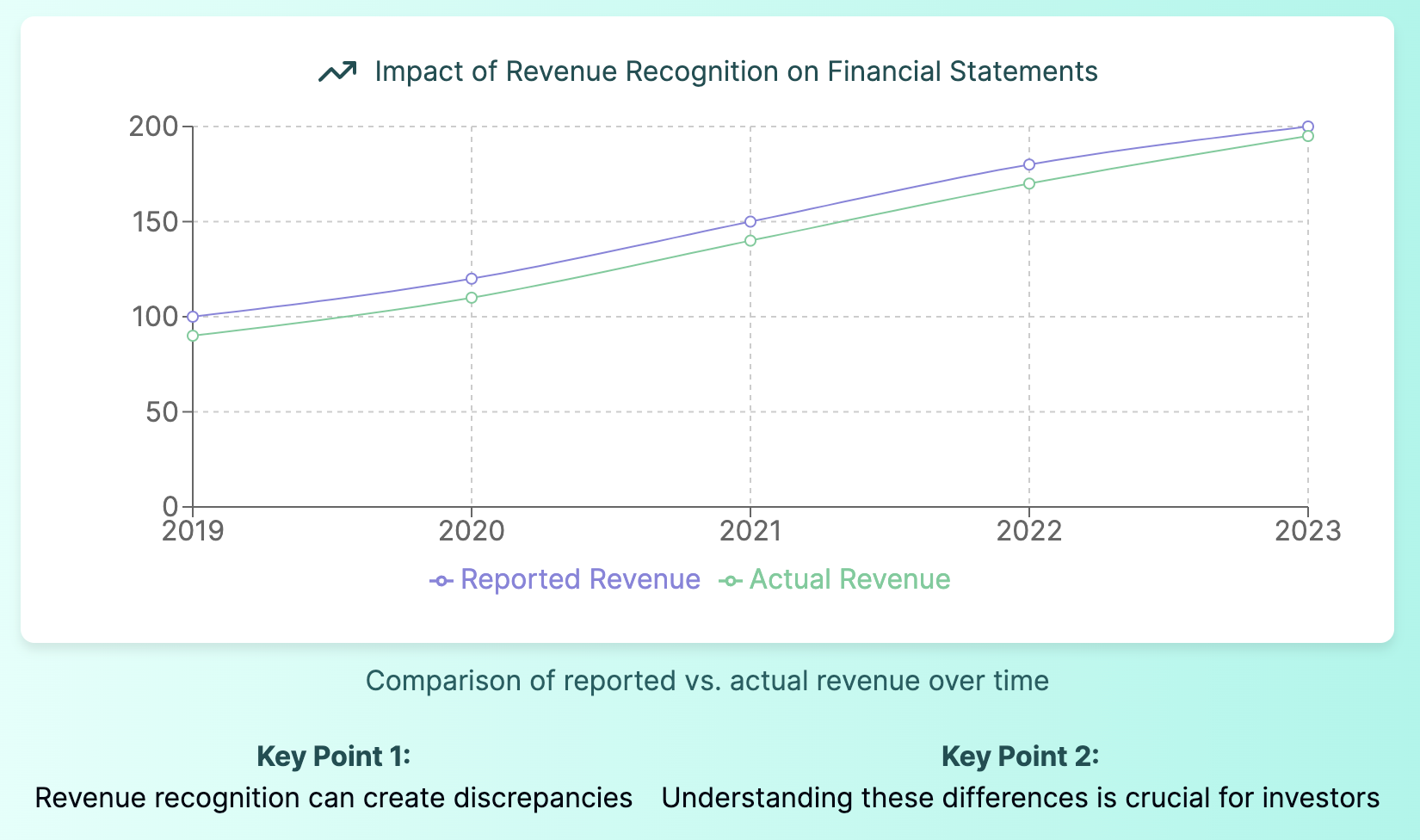

Income recognition, also known as revenue recognition, is a fundamental concept in accounting that determines when and how a company reports its earnings. For investors, grasping this concept is essential as it directly impacts a company's reported financial performance and, consequently, its stock price.

What is Income Recognition?

Income recognition refers to the specific conditions under which a company can record income as revenue in its financial statements. It's not just about when money changes hands; it's about when a company has truly earned that income according to accounting standards.

Why is Revenue Recognition Important for Investors?

For investors, understanding revenue recognition is crucial for several reasons:

- Accurate Financial Analysis: It helps you interpret financial statements correctly, giving you a clearer picture of a company's actual performance.

- Comparing Companies: Consistent revenue recognition practices allow for fair comparisons between different companies and industries.

- Detecting Red Flags: Knowledge of proper revenue recognition can help you spot potential accounting irregularities or aggressive revenue reporting practices.

Real-World Example: Enron Scandal

The importance of proper revenue recognition was starkly illustrated by the Enron scandal in 2001. Enron, once a darling of Wall Street, used aggressive and ultimately fraudulent accounting practices to recognize revenue prematurely. This included booking projected future profits from long-term energy contracts as current revenue. When the truth came to light, it led to one of the largest corporate bankruptcies in U.S. history and significant losses for investors.

Key Principles of Revenue Recognition

To ensure consistency and transparency in financial reporting, accountants and companies follow specific principles when recognizing revenue. These principles are guided by Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS) globally.

The Matching Principle

The matching principle is a cornerstone of accrual accounting. It states that expenses should be recognized in the same accounting period as the revenues they helped generate. This ensures that the income statement accurately reflects the relationship between a company's revenues and the costs incurred to generate those revenues.

The Realization Principle

The realization principle dictates that revenue should only be recognized when it has been earned. This typically occurs when goods or services have been delivered to the customer, and there is reasonable assurance that payment will be received.

The ASC 606 Framework

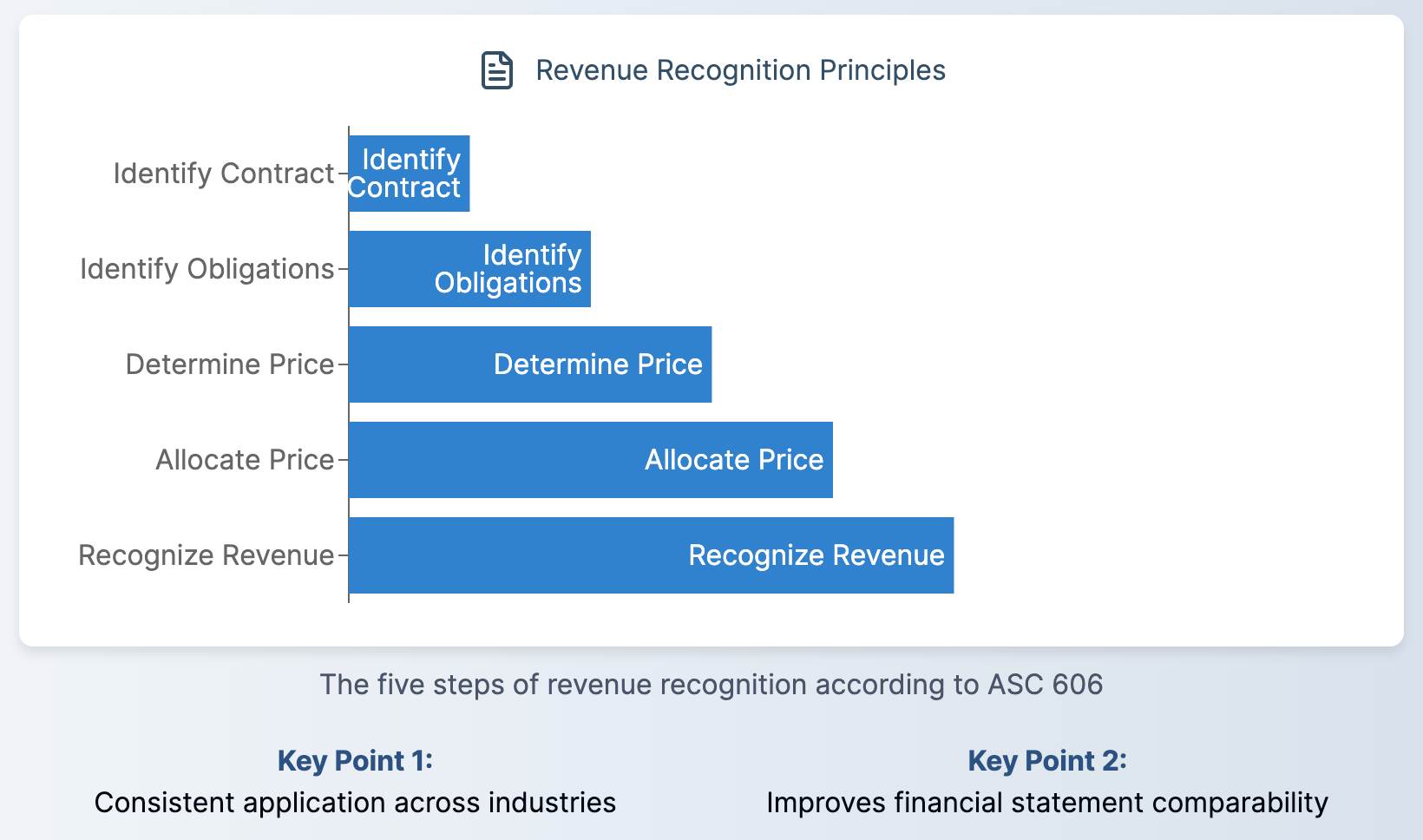

In recent years, the Financial Accounting Standards Board (FASB) introduced Accounting Standards Codification (ASC) 606, which provides a comprehensive framework for revenue recognition. This revenue recognition standard aims to create consistency across industries and improve comparability of financial statements.

The Five-Step Revenue Recognition Process

ASC 606 outlines a five-step model that companies must follow to determine when and how much revenue to recognize. Understanding this model can help investors better interpret a company's revenue recognition practices.

Step 1: Identify the Contract with a Customer

The first step in the revenue recognition process is to identify the existence of a contract with a customer. A contract can be written, verbal, or implied, but it must create enforceable rights and obligations between the parties involved.

Step 2: Identify Performance Obligations in the Contract

Companies must identify the distinct goods or services promised in the contract. Each distinct promise is considered a separate performance obligation. Understanding these performance obligations is crucial for accurate revenue recognition.

Step 3: Determine the Transaction Price

The transaction price is the amount of consideration the company expects to receive in exchange for transferring goods or services to the customer. This can include fixed amounts, variable consideration, and non-cash considerations.

Step 4: Allocate the Transaction Price to Performance Obligations

If a contract contains multiple performance obligations, the company must allocate the transaction price to each obligation based on their relative standalone selling prices. This step ensures that revenue is recognized appropriately for each distinct component of the contract.

Step 5: Recognize Revenue When (or as) Performance Obligations are Satisfied

Revenue is recognized when (or as) the company satisfies each performance obligation by transferring control of the promised goods or services to the customer. This step is crucial in determining when revenue is recognized in the company's financial statements.

Real-World Example: Apple's iPhone Sales

Apple's iPhone sales provide an excellent illustration of these revenue recognition principles in action. When Apple sells an iPhone, it doesn't just recognize revenue for the hardware. The company identifies multiple performance obligations within the sale:

- The iPhone hardware

- Software updates (iOS) for a specified period

- Online services (iCloud, Apple Music trial, etc.)

Apple allocates the transaction price across these obligations and recognizes revenue for each component as it fulfills its obligations. This is why Apple's revenue recognition for iPhone sales is more complex than simply recording the full sale price at the point of purchase.

Industry-Specific Revenue Recognition Challenges

While the ASC 606 framework provides general guidance, certain industries face unique challenges in revenue recognition due to the nature of their business models.

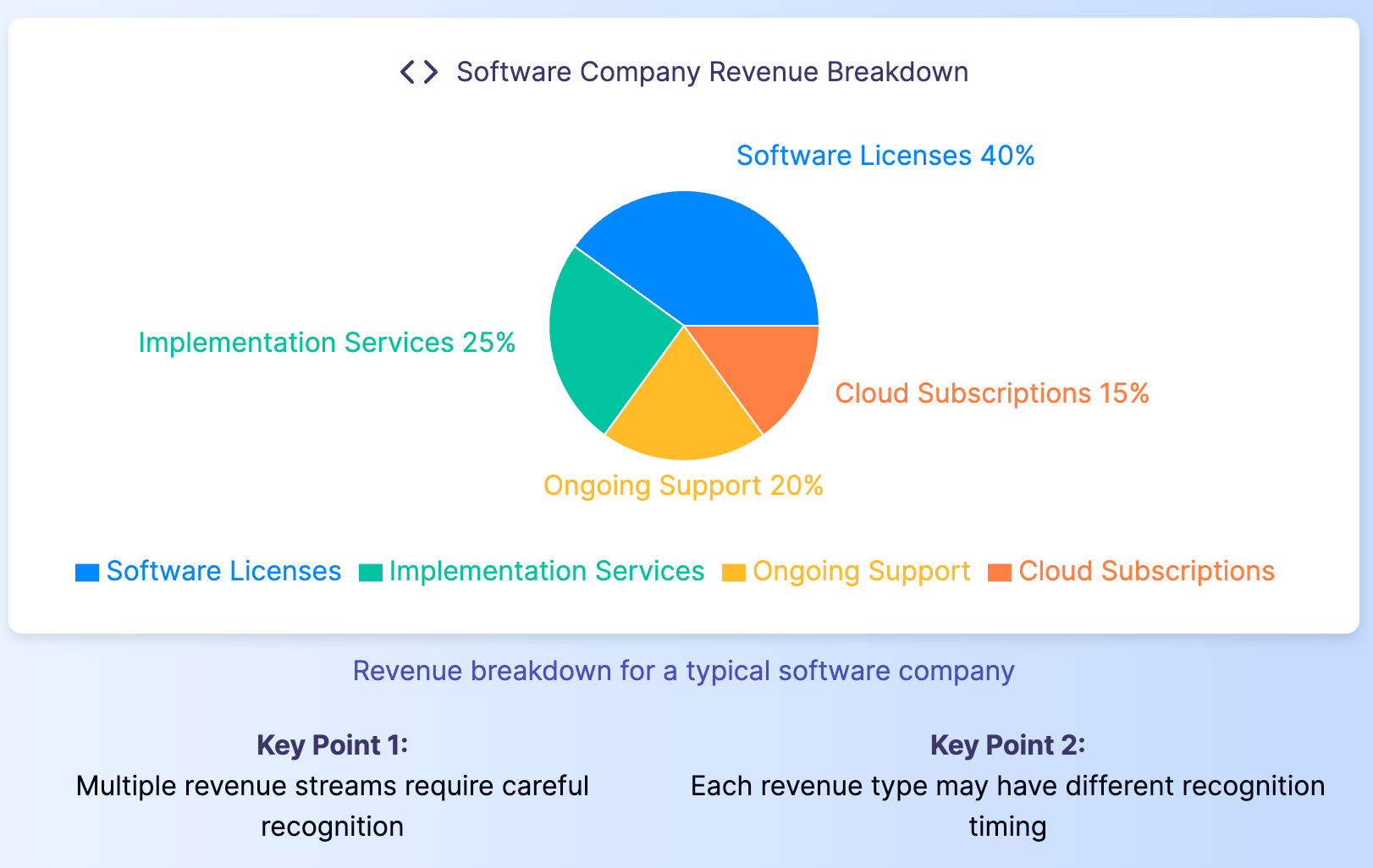

Software and Technology Companies

Software companies often deal with complex arrangements involving multiple elements such as software licenses, implementation services, and ongoing support. The challenge lies in determining how to allocate revenue across these different components and over what period to recognize it.

Example: Salesforce.com

Salesforce.com, a leading customer relationship management (CRM) platform, offers subscription-based access to its software. The company recognizes revenue from these subscriptions ratably over the contract term, typically one to three years. This reflects the continuous nature of the service provided and aligns revenue recognition with the period over which customers receive and consume the benefits.

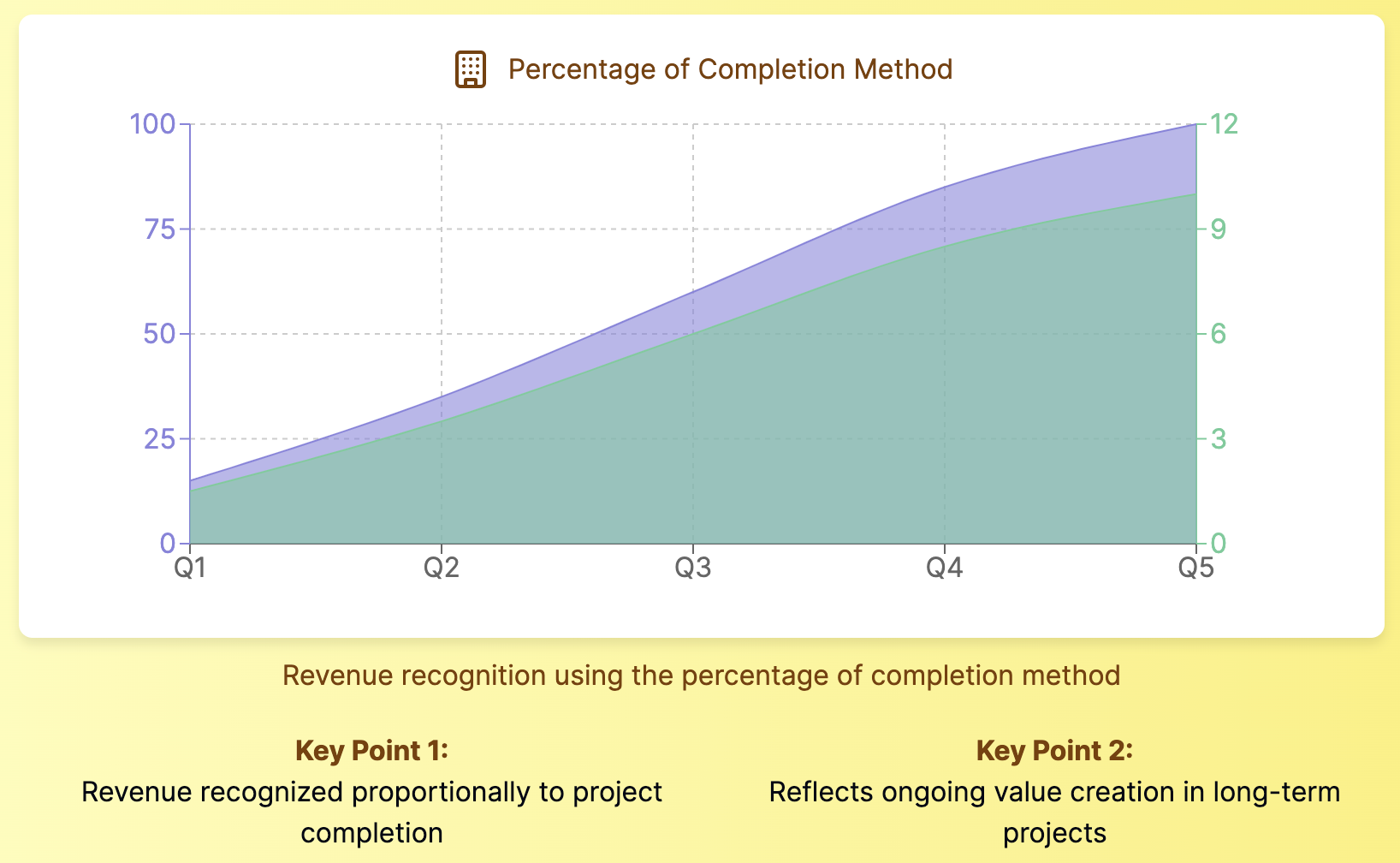

Construction and Long-Term Contracts

Construction companies and others involved in long-term projects face the challenge of recognizing revenue for work that may span multiple annual reporting periods.

Example: Fluor Corporation

Fluor Corporation, a global engineering and construction firm, uses the percentage-of-completion method for many of its long-term contracts. This method allows Fluor to recognize revenue incrementally as it makes progress on a project, rather than waiting until the entire revenue recognition process is complete. Investors analyzing Fluor's financials need to understand this method to accurately interpret the company's reported revenues and profitability.

Retail and E-commerce

Retail companies, especially those with significant online operations, must navigate issues such as customer returns, gift cards, and loyalty programs when recognizing revenue.

Example: Amazon.com

Amazon.com offers a Prime membership program that includes benefits like free shipping and access to streaming content. Amazon recognizes revenue from Prime membership fees over the course of the membership period, reflecting the ongoing nature of the services provided. Additionally, Amazon must consider issues like estimated returns when recognizing revenue from product sales.

Best Practices for Investors in Analyzing Revenue Recognition

As an investor, understanding a company's revenue recognition practices is crucial for accurate financial analysis. Here are some best practices to follow:

1. Scrutinize the Revenue Recognition Policy

Always read the revenue recognition policy in a company's financial statements. This is typically found in the "Significant Accounting Policies" section of the annual report. Look for any changes in policy from previous years, as these can significantly impact reported revenues.

2. Compare with Industry Peers

Compare a company's revenue recognition practices with those of its industry peers. Significant differences could indicate either innovative business models or potentially aggressive accounting practices.

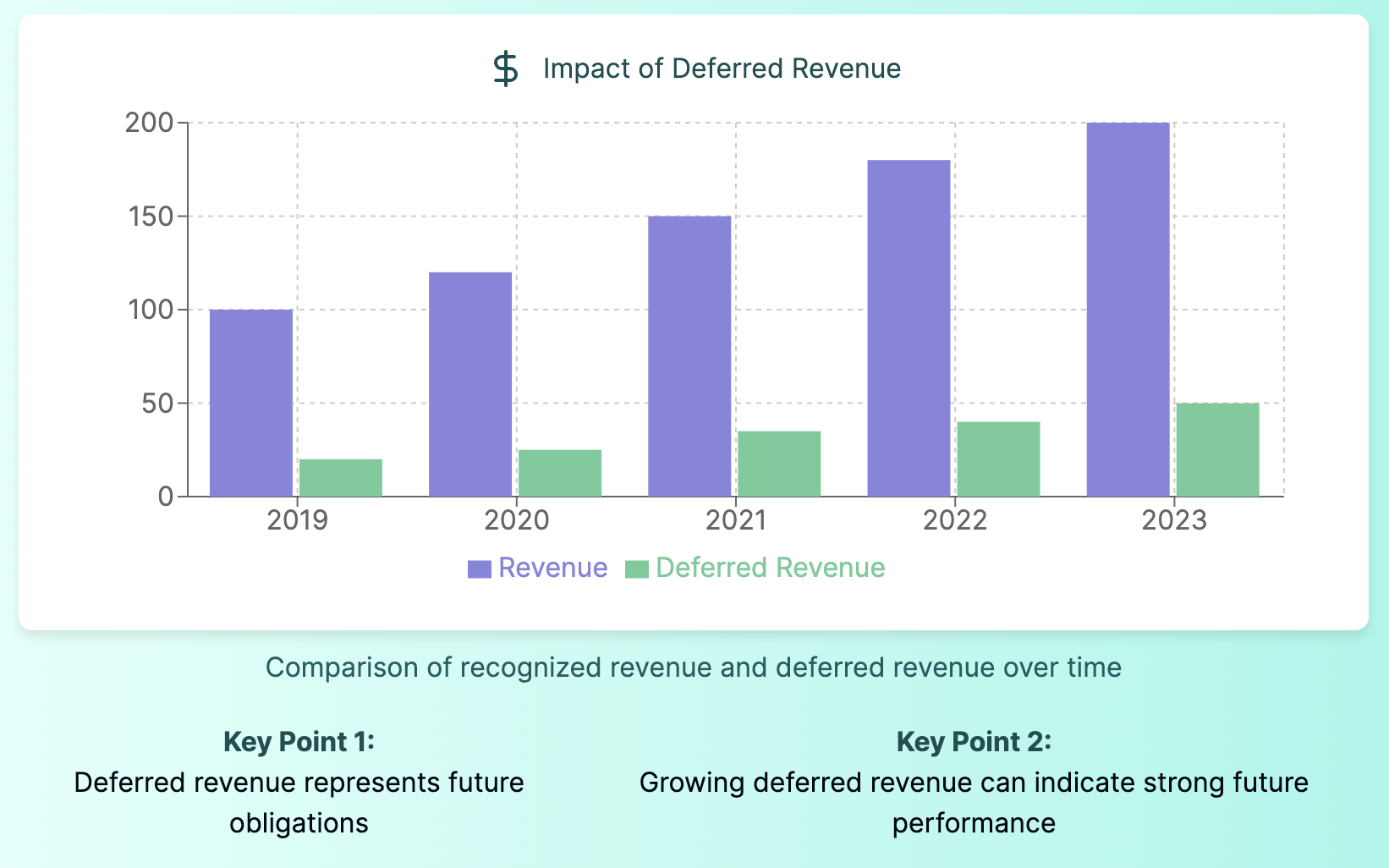

3. Analyze Deferred Revenue

Pay attention to changes in deferred revenue, which represents cash received for goods or services not yet delivered. A growing deferred revenue balance can be a positive sign, indicating future revenue streams, but a rapidly declining balance could signal slowing sales.

4. Consider Non-GAAP Metrics Carefully

Many companies present non-GAAP metrics like "bookings" or "billings" alongside traditional revenue figures. While these can provide additional insights, be cautious and understand how these metrics are calculated and why they might differ from GAAP revenue recognition principles.

5. Watch for Red Flags

Be alert to potential red flags in revenue recognition, such as:

- Significant increases in accounts receivable outpacing revenue growth

- Frequent changes in revenue recognition policies

- Large fourth-quarter revenue spikes that reverse in the following first quarter

- Vague or overly complex explanations of revenue recognition practices

The Future of Revenue Recognition

As business models continue to evolve, particularly in the digital economy, revenue recognition practices are likely to face new challenges and adaptations.

Subscription-Based Models

The rise of subscription-based business models across various industries, from software to consumer goods, is changing how companies think about and report revenue. Investors will need to become adept at analyzing metrics specific to these models, such as Monthly Recurring Revenue (MRR) and Customer Lifetime Value (CLV).

Blockchain and Cryptocurrencies

The increasing adoption of blockchain technology and cryptocurrencies presents new challenges for revenue recognition. How should companies recognize revenue from crypto transactions? When is income from mining activities recognized? These are questions that accounting standard-setters and companies are grappling with.

Artificial Intelligence and Predictive Analytics

As companies increasingly use AI and predictive analytics in their operations, questions arise about how to recognize revenue from these technologies. For instance, how should a company recognize revenue from an AI system that continuously provides value to customers?

Conclusion

Understanding revenue recognition is essential for any serious investor. It provides crucial insights into a company's financial health, business model, and potential risks. By mastering the principles and best practices outlined in this guide, you'll be better equipped to analyze financial statements, compare companies, and make informed investment decisions.

Remember, while revenue recognition can be complex, it's fundamentally about matching a company's reported revenues with the actual delivery of goods or services to customers. By keeping this principle in mind and staying alert to industry-specific nuances and potential red flags, you can gain a significant edge in your investment analysis.

As you continue your investment journey, make it a habit to scrutinize how companies recognize their revenue. This knowledge will serve you well in navigating the complex world of financial markets and building a robust, informed investment strategy.

Frequently Asked Questions

What is an example of income recognition?

An example of income recognition is a software company selling a one-year subscription service. The company would recognize revenue evenly over the 12-month period as the service is delivered, rather than recognizing the entire amount upfront when the customer pays. This aligns with the principle that revenue is recognized when earned, which in this case is over the service period.

What are the conditions to recognize income?

The conditions to recognize income, according to GAAP revenue recognition principles, are:

- Identification of a contract with a customer

- Identification of performance obligations in the contract

- Determination of the transaction price

- Allocation of the transaction price to the performance obligations

- Recognition of revenue when (or as) the entity satisfies a performance obligation

These conditions ensure that revenue is recognized when it is earned and realizable.

What is meant by the income recognition principle?

The income recognition principle, also known as the revenue recognition principle, is a fundamental concept in accrual accounting. It states that revenue should be recognized when it is earned, regardless of when cash is received. This principle ensures that financial statements accurately reflect a company's economic activities in the appropriate accounting period.

What are the 5 criteria for revenue recognition?

The 5 criteria for revenue recognition, as outlined in ASC 606, are:

- Identify the contract(s) with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price to the performance obligations in the contract

- Recognize revenue when (or as) the entity satisfies a performance obligation

These criteria form the core of the revenue recognition process and help ensure consistent and accurate financial reporting across different industries and business models.