How Much is Too Much?

The current investment landscape is characterized by rising interest rates and a deceleration in economic growth, prompting investors to move away from long-duration and cyclical assets. In contrast, mega-cap companies have thrived thanks to their robust liquidity, sustainable growth trajectories, and strong pricing power. This has resulted in an unprecedented concentration in the stock market, driven primarily by a handful of stocks. This trend reflects global central banks' policies shift from zero-interest-rate (ZIRP) to a "higher for longer" stance to tackle persistent inflation.

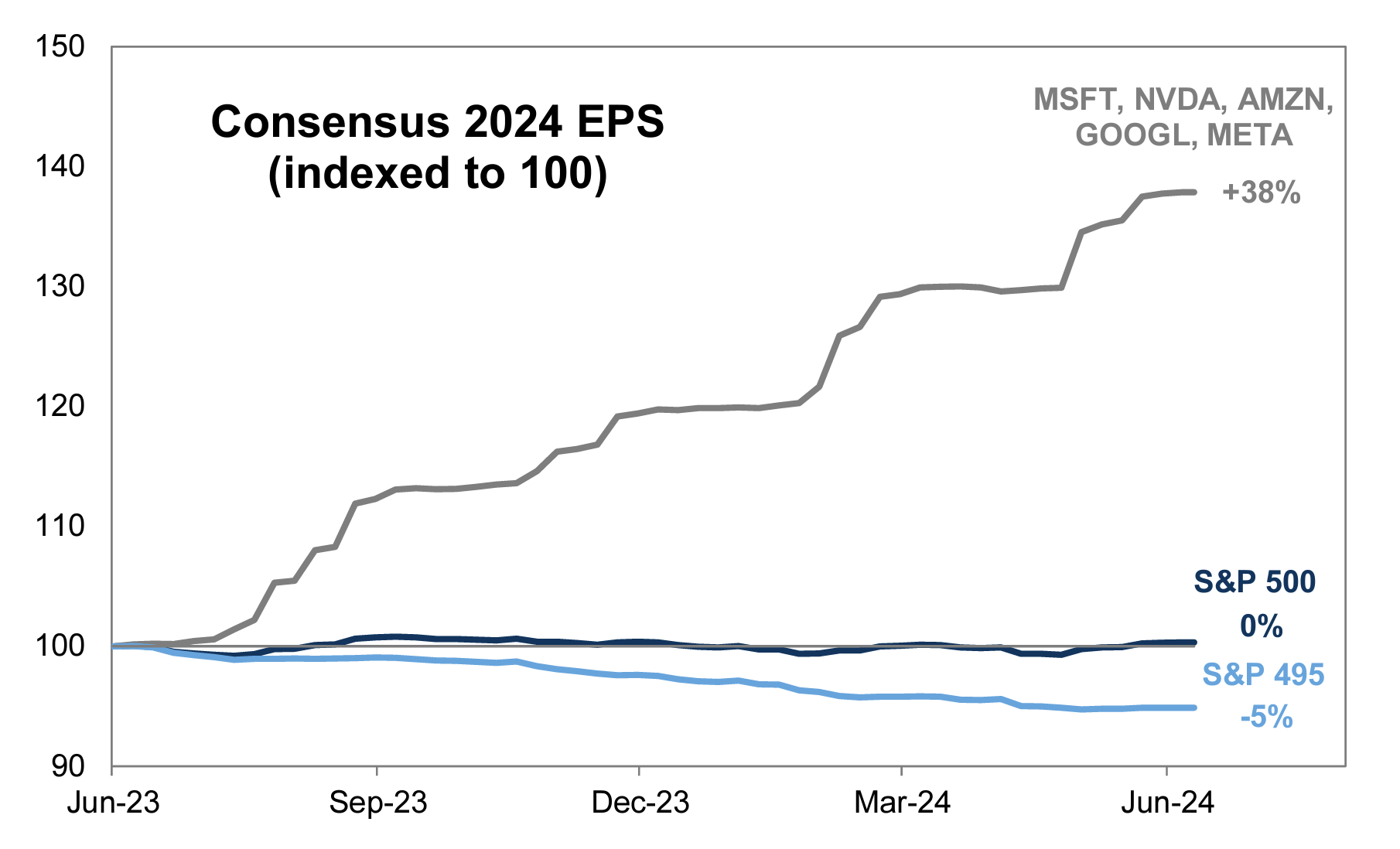

A recent analysis highlights the remarkable performance of mega-cap companies such as Microsoft, Nvidia, Amazon, Google, and Meta. Their earnings per share (EPS) expectations significantly surpass those of the broader S&P 500 index, underscoring the concentrated nature of market returns. This trend underscores these tech giants' critical role in shaping the financial landscape.

The intersection of finance and technology is transforming, with Nvidia at the forefront. Recently, Nvidia's stock faced a notable 10% sell-off over a few days, underscoring the current market's volatility and concentration. This movement is significant, as Nvidia has been a primary driver of market returns, with its stock surging by an impressive 239% in 2023 alone.

Market concentration in a select few key stocks, particularly within the tech sector, has reached unprecedented heights. The "Magnificent Seven" companies (Apple, Microsoft, Amazon, Google, Nvidia, Tesla, and Meta) now account for nearly 65% of the S&P 500 Index's year-to-date returns. This concentration level is nearing historical peaks, with the top 10 U.S. stocks by market cap comprising approximately 29.4% of the overall equities market.

The S&P 500's resilience is noteworthy, having avoided a single-day drop more significant than 2% since December 2022. However, this resilience is set against significant economic challenges, including rising interest rates, persistent inflation concerns, and escalating geopolitical tensions.

Nvidia's market position stands out remarkably. Nvidia's stock recently traded at approximately 100% above its 200-day moving average, placing it in a league of its own. Such extreme valuation draws comparisons to companies like Cisco and Intel during the dot-com bubble era.

However, Nvidia's current business fundamentals appear stronger than its historical counterparts. For instance, Nvidia's net profit margin in 2023 was 48.9%, compared to Intel's 31.2% at its dot-com peak. Nvidia's market valuation of over $3 trillion is significantly larger than Intel's inflation-adjusted $510 billion in 2000 .

As we move forward, investors seem divided into two camps: those nervously waiting for a market downturn that hasn't materialized and a growing group that senses underlying issues despite the market's apparent strength. The disconnect between the market's performance and various economic challenges suggests that caution may be warranted, even as the market continues to reach new highs.

While Nvidia and other tech giants continue to propel market returns, the extreme concentration and elevated valuation levels raise questions about the trend's sustainability. As is often the case with finance, past performance does not guarantee future results. Investors should remain vigilant and adaptable in this dynamic and evolving market landscape.

Bleeding LBOs

Vista Equity Partners' recent write-down of Pluralsight's equity value to zero is a stark reminder of the challenges that leveraged buyouts (LBOs) face from 2020-2021. Vista acquired Pluralsight for $3.5 billion in 2021, with the purchase price representing a 25% premium to its 30-day trading average. The acquisition was partly funded by $1.3 billion in debt, which has become more expensive due to rising interest rates. Despite Pluralsight's 26% EBITDA growth in 2023, the company has struggled to service its debt, and its future is further threatened by AI-driven automation of developer skills.

This situation is not unique to Pluralsight. The European high-yield debt market faces significant refinancing needs, with €43 billion due in 2025 and €82 billion in 2026. Rising interest rates and tighter financial conditions could lead to increased defaults or higher borrowing costs for many companies. This "maturity wall" poses a substantial risk to firms that relied on cheap debt during the low-interest-rate environment of the past decade.

The broader economic context also reflects growing financial stress. In the U.S., 275 companies declared bankruptcy through May 2024, the highest number since 2010. May alone saw 62 bankruptcies, with a notable concentration in the consumer discretionary sector, indicating slowing consumer spending. The Citi Economic Surprise Index has been weakening for the last ten months, approaching 2022 levels, suggesting that economic conditions are deteriorating. Additionally, U.S. unemployment has risen from 3.4% to 4% since April 2023, surpassing its 36-month average for the first time in four years.

These trends highlight the tension between Total Value to Paid-In (TVPI) and Distributed to Paid-In (DPI) metrics in private equity. Firms face pressure to return cash to limited partners (LPs) while dealing with potential discrepancies between asset valuations and realizable sale prices. The narrowing spreads in the market indicate ongoing challenges in achieving favorable exits for investments made during the low-interest-rate period.

High leverage, rising interest rates, potential economic slowdown, and technological disruption create a complex and potentially volatile environment. The accumulation of these pressures suggests that careful monitoring and risk management will be crucial in the coming months and years. As the author aptly puts it, "something has to give," reflecting the need for strategic adjustments in response to these evolving challenges.

Visionary Path to Market Dominance

Under CEO Jensen Huang's leadership, Nvidia has firmly established itself as a dominant force in the GPU and AI markets. Huang's leadership style, characterized by high expectations, intellectual honesty, and a relentless pursuit of perfection, has driven Nvidia to achieve an 88% market share in the GPU industry as of Q1 2024, up from 80% in the previous quarter. This success is due mainly to Nvidia's technological innovations, strategic foresight, and consistent investment in future technologies.

Huang's leadership is demanding and intense. He focuses on continuous improvement and learning from mistakes. By maintaining a flat organizational structure with around 60 direct reports, Huang stays closely involved in various aspects of the business, ensuring Nvidia remains agile and responsive to market changes. His ability to simplify complex concepts and extensive knowledge base has driven Nvidia's success.

Nvidia's investment strategy is multifaceted, centering on strategic collaborations, venture capital investments, and startup support through initiatives like Nvidia Inception. These investments help Nvidia stay ahead of competitors and foster innovation in the AI ecosystem. For instance, Nvidia has invested in companies such as Ayar Labs, Hugging Face, and CoreWeave, advancing AI and accelerated computing technologies.

Despite its market dominance, Nvidia faces challenges from competitors like AMD and Intel and hyperscalers like Google and Amazon, which are developing their own AI chips. Nvidia's CUDA software and ecosystem have been key to its success, but the emergence of alternative solutions could threaten its position. The AI chip market is expected to reach $400 billion in annual sales by 2027, and Nvidia's ability to maintain its lead will depend on continued innovation and strategic investments.

Huang's leadership is also marked by a focus on empathy and inclusivity, which has facilitated a culture of collaboration and innovation at Nvidia. His leadership principles include continuous learning, direct communication, and building from first principles. These principles have helped Nvidia navigate the fast-paced tech landscape and anticipate industry shifts.

Nvidia's success results from Jensen Huang's visionary leadership, strategic investments, and relentless focus on innovation. While challenges remain, Nvidia's dominant market position and commitment to advancing AI and computing technologies position it well for continued growth in the future.

Commoditization of AI

The commoditization of AI presents a compelling counter-consensus theory suggesting that foundational models are among the fastest depreciating assets on earth. Building these models requires extraordinary engineering talents and substantial funding. For instance, training costs for models like OpenAI's GPT-4 and Google's Gemini Ultra have soared to $78 million and $191 million, respectively. Despite these investments, success is not solely guaranteed by the amount of money spent.

Moreover, it is argued that crucial talent in building large language models (LLMs) may shift to a layer above the LLMs, where much of the monetization potential lies. This shift could be driven by the realization that foundational models, while essential, may not be the primary revenue source. Instead, applications and services built on these models could offer more lucrative opportunities. AI-related investment is expected to reach $200 billion globally by 2025, with significant portions directed towards developing software and infrastructure to run AI applications.

The dual nature of AI as both a transformative technology and a potential "gold rush" with significant capital burn is reminiscent of past technological booms. During the COVID-19 pandemic, the explosion of food delivery unicorns led to some scale winners and many casualties. Similarly, the AI industry will likely see a few dominant players emerge while others may fail to capitalize on their investments. This pattern is evident in the uneven adoption of AI across industries, with only 55% of organizations reporting AI adoption in at least one business function as of 2023.

The rapid increase in AI-related publications, growing by over 300% in the last decade, underscores the intense focus and competition in the field. However, the concentration of AI development in a few leading companies, such as Google, OpenAI, and Nvidia, which have released the most foundational models, highlights the high barriers to entry and the potential for market consolidation.

While AI promises to transform various sectors, the path to widespread adoption and profitability is fraught with challenges. The high costs of developing foundational models, the need for unique talent, and the potential for rapid obsolescence suggest that AI could simultaneously be a groundbreaking technology and a speculative bubble. As with previous technological revolutions, the AI industry will likely experience significant turbulence, with a few major players emerging as leaders and many others falling by the wayside.

Changing Everything

The potential for AI to revolutionize every aspect of our lives and economy is immense, with far-reaching implications for how we live, consume, operate, and even run businesses and nations. This transformative technology could create a stark divide between AI-enabled and non-AI-enabled entities, potentially becoming the key differentiating factor in global competitiveness.

While the short-term impacts of AI may be overestimated, its long-term effects are likely underestimated. According to PwC, AI could potentially add $15.7 trillion to the global economy by 2030, boosting global GDP by about 1.2% annually. This economic boost is expected primarily from increased productivity and innovation in products and services.

The development of AI is progressing rapidly, with a focus shifting from foundational models to more specialized applications. As AI models train on specific datasets, questions arise about whether this data will be open-source or restricted and how this will impact societies, states, and businesses regarding health, productivity, and efficiency. The barriers to entry in AI development are significant, with high costs for data accessibility and computing power.

AI's impact on various industries is already evident. In the financial sector, AI adoption is expected to reach $9.48 billion by 2032, growing at a CAGR of 28.1% from 2022. The retail industry has seen 40% of companies adopt AI to enhance in-person experiences and implement real-time pricing. In healthcare, the AI market was valued at $15.4 billion in 2022 and is projected to grow at a CAGR of 37.5% from 2023 to 2030.

The adoption of AI technologies is becoming widespread across industries. IBM's Global AI Adoption Index 2023 reports that 42% of enterprise-scale organizations have AI in use, with 59% already working with AI planning to accelerate and increase their investments. This trend is solid in certain regions, with India (59%), the UAE (58%), and Singapore (53%) leading in active AI use.

AI's potential to disrupt traditional business models and labor markets cannot be ignored. It could trigger a shift from software to hardware dominance, potentially unwinding the "software eating the world" thesis and disrupting the horizontal SaaS market. In the labor market, AI could automate work activities that currently absorb 60-70% of employees' time, potentially leading to significant workforce restructuring and the need for extensive reskilling efforts.

Despite these challenges, AI's potential benefits are substantial. It could enhance productivity across various sectors, from manufacturing to services, mirroring the productivity surge seen in the 1990s due to computer and communications investments. Some studies suggest that AI could improve productivity by 10-20%, particularly in cognitive work.

As we navigate this AI revolution, we must consider both the opportunities and the potential risks. While AI promises to drive innovation and economic growth, it raises important questions about data privacy, job displacement, and ethical considerations. The key to harnessing AI's potential while mitigating its risks lies in thoughtful policy-making, strategic investments in AI development and adoption, and focusing on building AI systems that complement and enhance human capabilities rather than replace them entirely.

We work hard to provide valuable insights on AI commoditization and its impact, all at no cost to you. If you find this article helpful, please consider sharing it on Twitter. Your support helps us deliver quality content and reach more readers like you.

Staying in the Game

The concept of "staying in the game" and playing the long game in business is powerfully illustrated by several high-profile acquisitions in the tech industry. One striking example is Masayoshi Son's decision to sell SoftBank's stake in Nvidia. In 2019, SoftBank's Vision Fund sold its entire 4.9% stake in Nvidia for $3.3 billion, a move that initially seemed profitable as they had acquired the shares for approximately $700 million. However, this decision has proven to be a missed opportunity of colossal proportions. Had SoftBank retained its stake, it would now be worth an estimated $160 billion, given Nvidia's current market value of around $2.9 trillion.

This scenario echoes other famous missed opportunities in tech history. Perhaps the most notorious is Blockbuster's rejection of Netflix's offer to sell for $50 million in 2000. At the time, Netflix was a struggling startup mailing DVDs to customers. Blockbuster's CEO, John Antioco, reportedly struggled not to laugh at the proposition. Today, Netflix's market cap is over $150 billion, while Blockbuster has been reduced to a single store.

Similarly, seemingly overpriced acquisitions at the time have proven to be incredibly savvy investments. Google's purchase of YouTube for $1.65 billion in 2006 was considered a hefty price for a company with no revenue. However, by 2020, YouTube was generating almost $20 billion in annual revenue, accounting for nearly 11% of Alphabet's overall revenue. Even more impressively, as of 2023, YouTube generates $1.65 billion in revenue approximately every 16 days.

Facebook's acquisition of Instagram for $1 billion in 2012 provides another example of long-term vision paying off. At the time of purchase, Instagram had only 13 employees and zero revenue. By 2016, Instagram was estimated to contribute $3.2 billion to Facebook's revenue. Today, Instagram is valued at roughly $100 billion.

These cases underscore the importance of long-term thinking and the potential for transformative technologies to create enormous value over time. They also highlight the challenges of accurately valuing disruptive technologies and the power of network effects in the tech industry. As Masayoshi Son reflected on his Nvidia decision, "It's frustrating to remember the ones that I missed," reminding us that in the fast-paced world of tech, timing is everything.

The Rise of the 'Geeks'

The rise of "geeks" in business leadership positions is a notable trend reshaping the corporate landscape. This shift is particularly evident in technology-driven sectors like AI, SaaS, cybersecurity, and semiconductors, where deep technical expertise is increasingly valued at the highest levels of management.

A 2019 study by Korn Ferry found that 83% of tech executives believe tech leaders are becoming more prevalent in the C-suite across all sectors, not just in technology companies. This trend is further supported by a 2019 analysis from Crist Kolder Associates, which revealed that 40% of CEOs in S&P 500 and Fortune 500 companies had engineering or science degrees, up from 34% in 2014.

The importance of academic research and innovation in business success is exemplified by companies like Moderna and Novo Nordisk in the biotechnology sector. This trend extends beyond tech, highlighting the growing overlap between scientific research and business innovation. The UK government's 2021 R&D Roadmap emphasized that collaborations between universities and businesses increased by 3% annually between 2013 and 2018.

London's growing status as a tech center exemplifies the potential for innovation hubs. According to Tech Nation's 2021 report, London attracted $10.5 billion in tech investment in 2020, more than any other European city. This aligns with the LocalGlobe argument about London's potential as an innovation hub, comparable to Palo Alto, due to its concentration of top universities and engineering talent.

European innovation in AI is gaining traction, as evidenced by the success of companies like Mistral AI. CB Insights reported that Europe was home to 1,600 AI companies as of 2021, with the UK leading with 479 companies, followed by France with 217 and Germany with 196.

Quantitative strategies are becoming more prominent in the financial sector. A 2020 report by Coalition Greenwich found that 60% of institutional investors planned to increase their allocation to quantitative strategies over the next three years.

The shift from sales-driven to expertise-driven leadership is reflected in changing C-suite demographics. A Korn Ferry study found that the average age for a C-suite member is 56, with CEOs being the oldest at an average age of 59. Interestingly, CIOs are the youngest on average at 51, reflecting the growing importance of technology leadership.

Education statistics further support this trend towards technical expertise in leadership roles. The National Center for Education Statistics reports that the number of U.S. STEM graduates increased by 43% between 2009 and 2019, indicating a growing pool of technically skilled professionals entering the workforce.

In conclusion, the rise of "geeks" in business leadership reflects a broader shift towards valuing deep technical knowledge and innovation capabilities in driving business success. This trend will likely continue shaping corporate leadership's future across various industries.

Thanks for reading,

Giro.