Last week, we delved into Mercado Libre's powerful marketplace operation in Brazil, examining its impressive market share, profitability, and growth prospects. This week, we turn our attention to its most significant threat in the Brazilian market: Amazon.

In this post, we'll explore Amazon's journey in Brazil, from its humble beginnings to its current position as a major e-commerce player. We'll examine the company's history, substantial investments, and current market standing.

Many of you expressed interest in understanding Amazon's role in this competitive landscape, and rightfully so. As the global e-commerce giant, Amazon's moves in any market are worth watching closely. However, after thorough analysis, I've come to a clear conclusion: Despite Amazon's significant resources and global experience, Mercado Libre maintains a superior competitive position in Brazil.

This superiority stems from Mercado Libre's deeply integrated ecosystem, its unparalleled understanding of local market dynamics, and its tailor-made solutions for Brazilian consumers and sellers. As we'll see, these advantages have allowed Mercado Libre to not just compete with Amazon, but to maintain a commanding lead in one of Latin America's most crucial markets.

Join us as we unpack the high-stakes battle for Brazil's e-commerce crown and what it means for investors watching this space. By the end of this post, you'll understand why Mercado Libre's position in Brazil remains strong, even in the face of competition from one of the world's most formidable tech giants.

Amazon's Latin American Expansion: Investments in E-commerce and Fintech

Amazon entered the Latin American market in 2012, initially focusing on selling books. Over the years, it has expanded its product offerings and made substantial investments to enhance its market presence. Key milestones include the launch of Amazon Prime in 2019 and the establishment of multiple fulfillment centers to streamline logistics and delivery services.

Since 2011, Amazon has invested BRL 33 billion (approximately USD 6.2 billion) in Latin America, contributing BRL 25 billion to the region's GDP and creating over 18,000 jobs. This investment has significantly impacted Amazon's ability to compete with local and global e-commerce players, as well as financial services companies.

Table 1: Amazon's Key Investments in Brazil

| Year | Investment Type | Impact on Market |

|---|---|---|

| 2012 | Entry (Books) | Initial market presence |

| 2019 | Launch of Amazon Prime | Increased customer loyalty |

| 2020 | Fulfillment Centers | Enhanced delivery speed and reliability |

Amazon's logistical infrastructure has experienced remarkable growth:

Table 2: Amazon - Infrastructure investments in Brazil

| Infrastructure Type | 2019 | 2023 |

|---|---|---|

| Distribution Centers | 1 | 10 |

| Delivery Stations | 14 | 64 |

| States with operations | 1 | 7 |

The expansion of fulfillment centers across key regions has enabled Amazon to reduce delivery times and offer a broader range of products. This expansion aims to improve delivery speed and offer benefits like free shipping, which Daniel Mazini, Amazon's president in Brazil, considers crucial for customer loyalty and competing with traditional financial institutions.

One of the pivotal moments in Amazon's Brazilian expansion was the introduction of Amazon Prime. This service has not only attracted a significant number of subscribers but also boosted customer loyalty and spending. To acquire customers, Amazon offered Amazon Prime for an initial price of R$9.90 per month (approximately US$2.40) or R$89 per year (about US$22). This subscription includes not only unlimited free shipping on hundreds of thousands of items but also access to Prime Video, Prime Music, Prime Reading, and Prime Gaming.

Table 3: Amazon Prime Subscriber Growth in Brazil

| Year | Subscribers (Million) |

|---|---|

| 2019 | 2 |

| 2020 | 5 |

| 2021 | 8 |

| 2022 | 12 |

While specific future investment plans are not disclosed, Amazon continues to evaluate expansion opportunities, including potential growth of existing distribution centers and new locations across Latin America. The company is also expanding its Fulfillment By Amazon (FBA) program to all sellers in the region, necessitating further investments in infrastructure and technology.

As Amazon continues to expand its services and capabilities, it's clear that the company is eyeing opportunities beyond traditional retail. The integration of financial technology into its existing ecosystem could transform Amazon into a one-stop-shop for both commerce and financial services, challenging established banks and fintech startups alike.

Amazon's Evolution in Latin America: GMV Growth and Market Share

While Amazon doesn't publicly disclose specific Gross Merchandise Value (GMV) data for its Latin America operations, estimates and trends provide insights into the company's performance and its potential impact on the financial technology sector:

Table 4: Amazon - GMV Estimate for the Operation in Brazil

| Year | Information |

|---|---|

| 2021 | Estimated GMV of BRL 11.4 billion (~USD 2.2 billion) |

| 2022 | Estimated growth of 32% compared to 2021 |

| 2023 | Market share of 16.3% in Brazilian e-commerce |

For 2022, market analysts projected a significant growth of about 32% in Amazon's GMV compared to the previous year. This substantial increase reflects Amazon's ongoing investments in logistics infrastructure, marketplace expansion, and potential forays into financial technology services in the region.

By 2023, Amazon had achieved a market share of 16.3% in Latin American e-commerce. Although this doesn't directly translate to a GMV value, it indicates continued growth and an increasingly strong position in the market. This growing market share also suggests that Amazon is well-positioned to introduce financial services and compete with traditional banking institutions in the region.

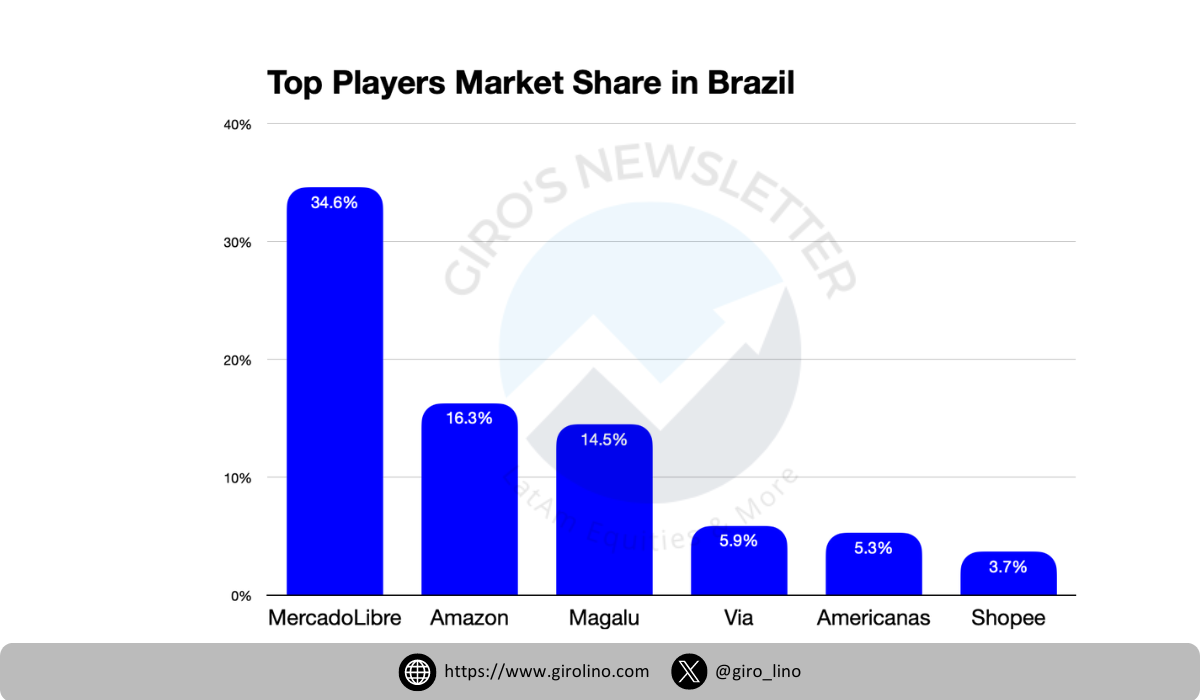

It's important to note that Amazon faces strong competition in Latin America, particularly from Mercado Libre (MELI), which held a market share of 34.6% in 2021.

Table 6: Mercado Libre - GMV and Market Share in Brazil

The growth trajectory from 2021 to 2023 suggests that Amazon is making significant strides in the Latin American market, steadily increasing its market share and GMV. However, the company still has considerable room for growth compared to the market leader, Mercado Libre. This competition could drive innovation in financial technology as both companies seek to offer more comprehensive services to their users.

Factors Driving Amazon's GMV Growth in Latin America

Marketplace Expansion: In 2023, the number of sellers on Amazon's platform in the region grew by 53%, reaching 78,000. Notably, 99% of these sellers are small and medium-sized businesses, indicating Amazon's success in attracting local entrepreneurs to its platform.

Increased Product Variety: Amazon now offers over 18.4 million products in its catalog for the Latin American market. This vast expansion of product offerings provides consumers with a wide range of choices, likely contributing to increased sales and GMV growth.

Logistics Investments: As discussed earlier, Amazon has significantly expanded its logistics infrastructure in Latin America. This expansion has improved delivery speeds and overall customer satisfaction, potentially leading to increased sales and repeat customers.

Customer-Centric Approach: Amazon has invested heavily in enhancing the customer experience, focusing on faster deliveries and value-added services like the Prime program.

Consistent Investment: Over 13 years of operation in Latin America, Amazon has invested over BRL 30 billion (approximately USD 6 billion) in the region. This sustained investment demonstrates Amazon's long-term commitment to the Latin American market and has likely fueled its growth.

While exact current GMV figures are not publicly disclosed, Amazon's growth trajectory in Latin America has been consistent. The company's market share reached 16.3% in 2023, indicating significant progress. However, it's worth noting that Amazon still trails behind the market leader, Mercado Libre, which holds a 34.6% market share.

Despite this gap, Amazon's pace of expansion and continued investments suggest that the company is determined to increase its presence and, consequently, its GMV in the Latin American e-commerce market.

Future Expansion Plans: Amazon's Strategy for E-commerce and Financial Technology Integration

Amazon has ambitious plans to further expand its operations in Latin America, focusing on several strategic areas that could pave the way for a stronger presence in both e-commerce and financial technology sectors:

Table 5: Amazon - Expansion Strategy in Brazil

| Expansion Area | Details |

|---|---|

| Distribution Centers | Planning to open more DCs in the future |

| Delivery Stations | Continued expansion beyond the current 64 |

| FBA Program | Expansion to all Brazilian sellers |

| Imports | Increase of imported products on the platform |

| Renewable Energy | Transition to 100% renewable energy by 2025 |

Key aspects of Amazon's expansion strategy include:

- Distribution Centers: Amazon plans to continue expanding its network of Distribution Centers (DCs) in Latin America. While specific details aren't disclosed, Daniel Mazini, Amazon's president in Brazil, indicates that new DCs will be opened to bring the company closer to customers.

- Delivery Stations: The rapid expansion of delivery stations, from 14 to 64 in just two years, is set to continue, improving delivery speed and customer satisfaction.

- Fulfillment By Amazon (FBA) Program: A significant plan is the expansion of the FBA program to all Latin American sellers. This will allow more partners to use Amazon's logistics infrastructure, improving efficiency and offering benefits such as the Prime badge to customers.

- Product Offering Improvement: Amazon plans to increase the offer of imported products on its Latin American platform. The recent regulation of international purchases up to BRL 50 is seen as an opportunity for greater investments in imports.

- Seller Base Expansion: While the number of sellers grew 53% in 2023, reaching 78,000, Amazon seeks not only to increase this number but also to ensure the success of these sellers on the platform.

- Regional Expansion: Amazon is considering expanding existing DCs, such as the distribution hub in Recife, to accommodate growing regional demand.

- Renewable Energy: Amazon aims to transition to 100% renewable energy by 2025, demonstrating a commitment to sustainability in its operations.

These expansion plans demonstrate Amazon's long-term commitment to the Latin American market and its strategy to strengthen its position in the region's e-commerce sector. However, they also hint at a broader vision that could see Amazon evolving into a significant player in the financial technology space.

As Amazon continues to invest in its infrastructure and services, the company's ambitions could extend beyond traditional retail. The integration of financial technology into its existing ecosystem could transform Amazon into a one-stop-shop for both commerce and financial services, potentially reshaping the landscape of digital commerce in Latin America.

Amazon vs. Mercado Libre: The Battle for E-commerce and Fintech Leadership

Despite Amazon's significant investments and rapid growth in Latin America, Mercado Libre (MELI) continues to hold a dominant position in the region's e-commerce market. This section explores why Mercado Libre remains the leader and how its integrated ecosystem provides a formidable competitive advantage, particularly in the realm of financial technology.

Here is a comparison of their market positions:

Table 6: Market Share Summary

| Metric | Mercado Libre | Amazon Brazil |

|---|---|---|

| Market Share | 34.6% | 16.3% |

| Share of Search | 28% | 13.5% |

| Position in Marketplace Ranking | 1st place | 2nd place |

| Monthly Traffic (June 2023) | 322 million visits | 178 million visits |

Mercado Libre's Competitive Advantages

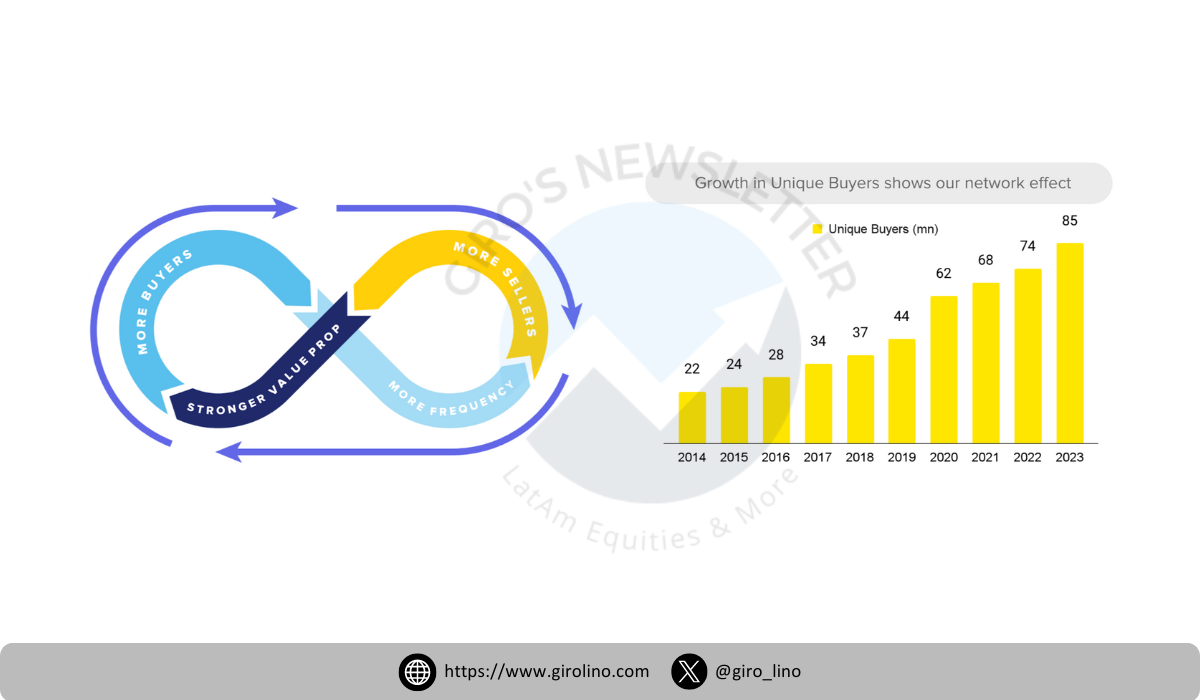

Mercado Libre's stronghold in Latin America is evident from its impressive 34.6% market share and a vast seller base of 12 million. This extensive presence is reflected in their high share of search at 28% and monthly traffic of 322 million visits as of June 2023. Mercado Libre's strategy has been to cultivate a diverse and vibrant seller ecosystem, which includes over 574,000 micro and small businesses across Latin America, with 85 million unique buyers in 2023.

This ecosystem supports a wide range of business sizes and types, with 25% of these sellers generating over half of their revenue from the platform. The inclusion of 3,000+ official brand stores further cements Mercado Libre's market appeal and broadens its reach across various consumer segments.

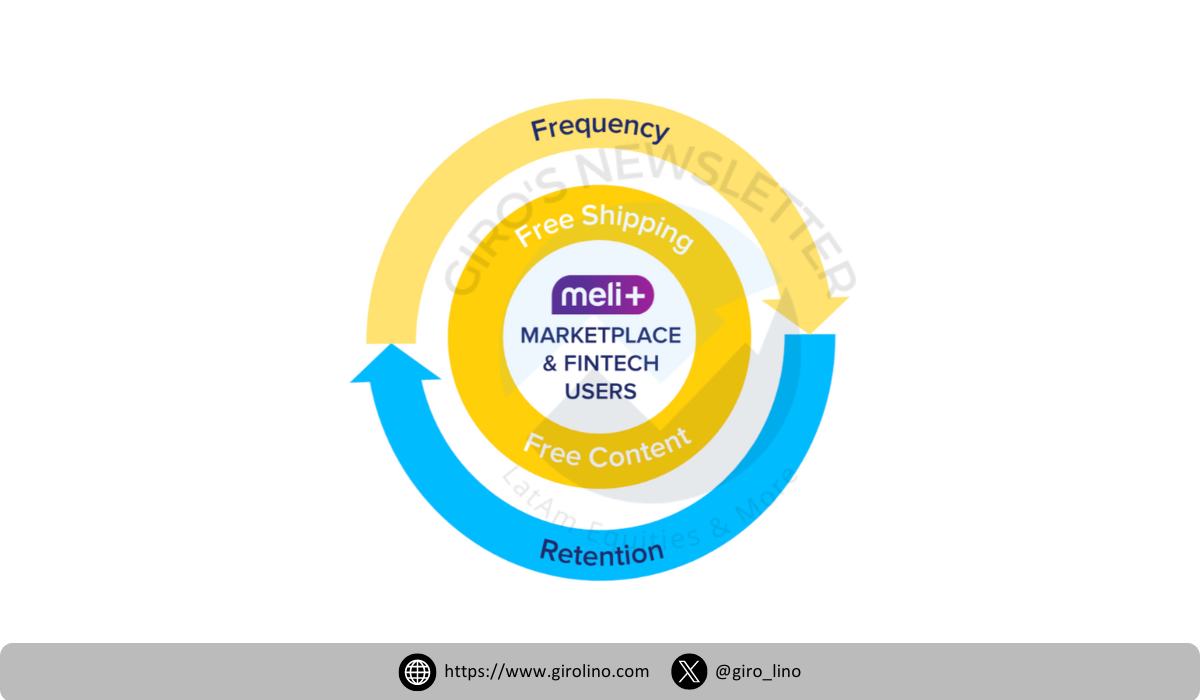

Integrated Ecosystem: Mercado Libre's trump card is its deeply integrated ecosystem, which encompasses e-commerce (Mercado Libre), fintech (Mercado Pago), and logistics (Mercado Envios). This ecosystem creates a seamless experience for both buyers and sellers, fostering loyalty and increasing switching costs.

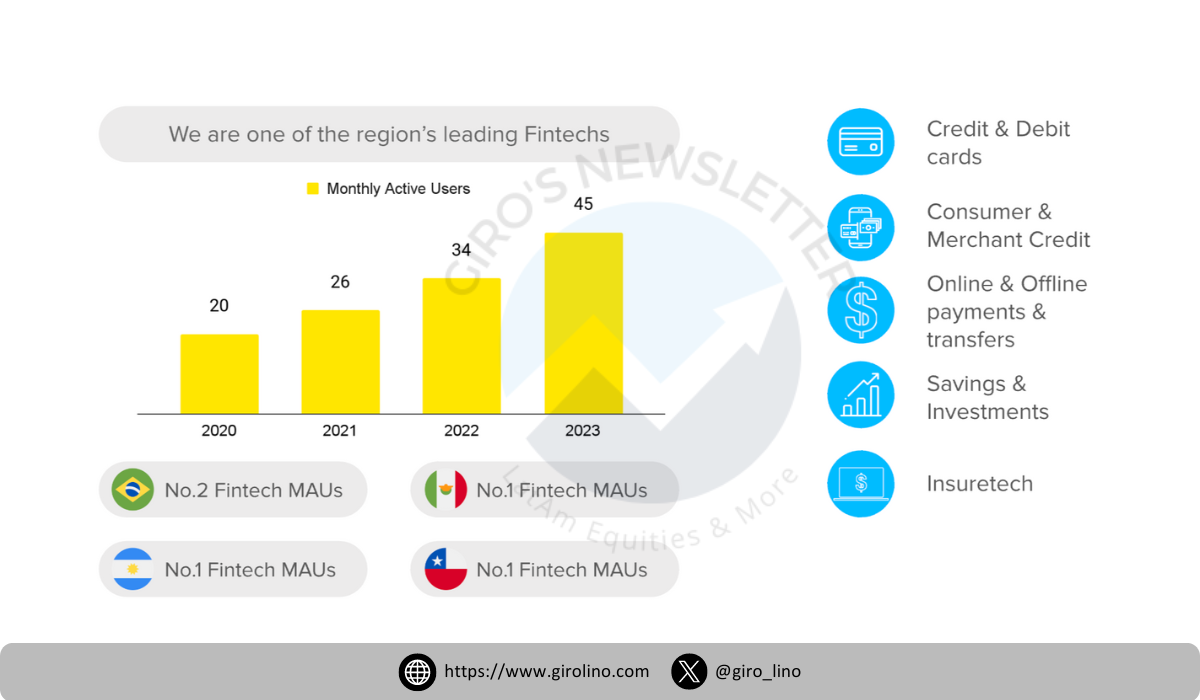

Financial Services: Mercado Pago has become a cornerstone of Mercado Libre's value proposition. With 45 million monthly active users and generating US$3 billion in revenue in Latin America in 2023, it offers a comprehensive suite of financial services including payments, credit, investments, and insurance. Its credit accessibility, particularly for SMEs, is a game-changer in the Latin American market, challenging traditional financial institutions.

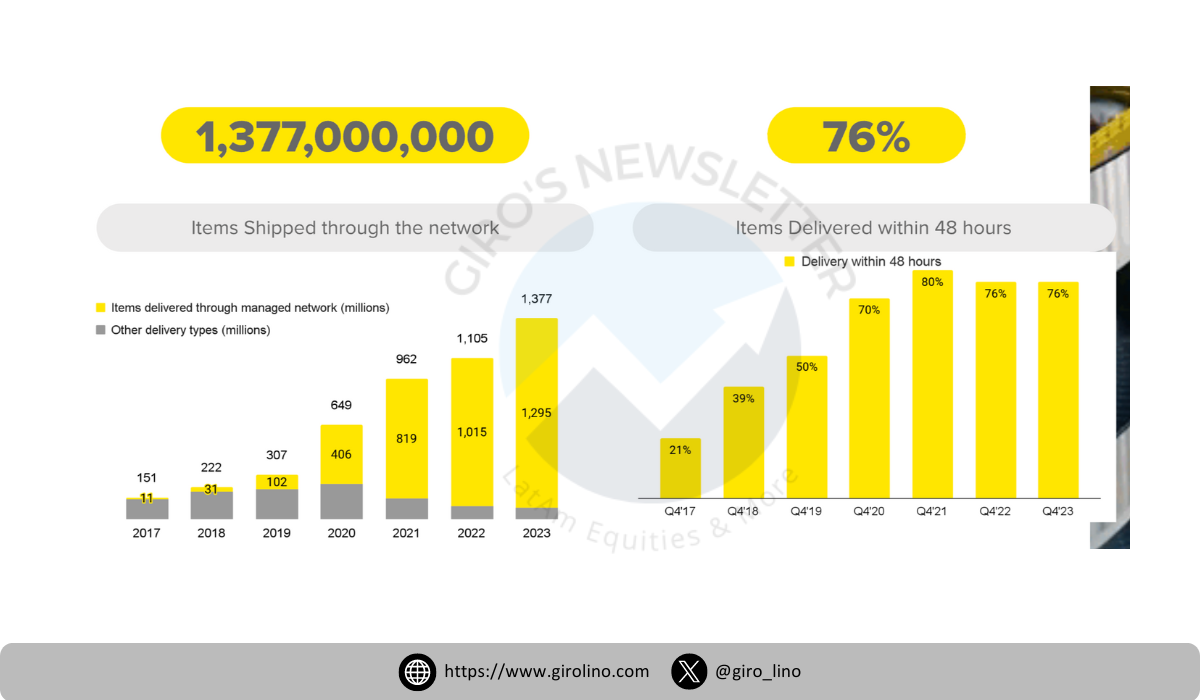

Logistics Network: Mercado Envios handles an impressive 94% of all shipments on the platform, with 76% of deliveries completed in less than 48 hours. This efficient logistics network, which includes over 10 fulfillment centers in Latin America, provides Mercado Libre with a significant advantage in terms of delivery speed and reliability.

Local Market Expertise: As a Latin American company, Mercado Libre has a deep understanding of local market dynamics and consumer preferences. This knowledge allows them to tailor their services and marketing strategies more effectively to the Latin American audience.

Brand Recognition and Trust: Mercado Libre has been operating in Latin America since 1999, giving it a significant head start in building brand recognition and trust among Latin American consumers and sellers, building an incredible value flywheel connecting buyers and sellers.

While Amazon's growth in Latin America is impressive, Mercado Libre's integrated ecosystem, local market expertise, and established brand presence continue to give it a significant edge. The synergy between Mercado Libre, Mercado Pago, and Mercado Envios creates a powerful value proposition that Amazon has yet to fully match in the Latin American context.

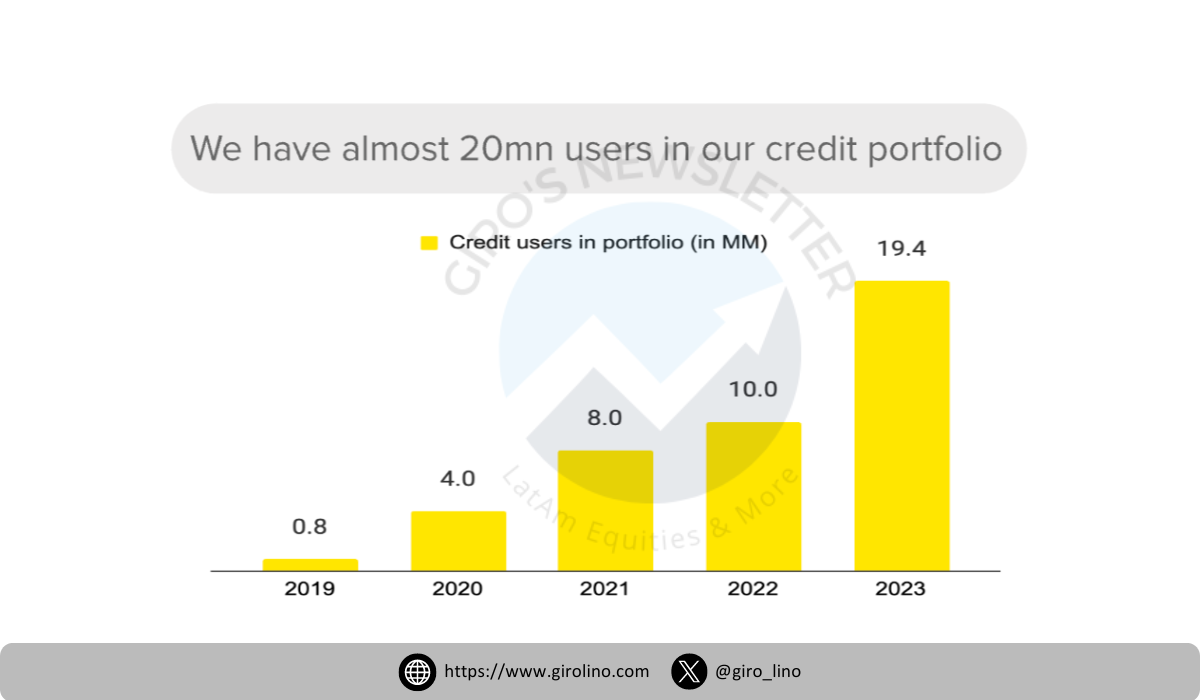

Mercado Pago: The Financial Powerhouse Fueling MELI's Dominance

Mercado Pago, Mercado Libre's fintech arm, has emerged as a crucial component of the company's value proposition in Latin America. This comprehensive financial services platform offers a wide range of tools, including payments, credit, investments, and insurance, positioning Mercado Libre as a major player in the Latin American fintech space and a formidable competitor to traditional financial institutions.

Table 7: Mercado Libre - Mercado Pago Summary

| Metric | Value |

|---|---|

| Monthly Active Users | 49 million |

| Revenue (2023) | US$3 billion |

| Credit Portfolio (Q1 2024) | US$4.4 billion |

| Year-over-Year Growth in Credit Portfolio | 46% |

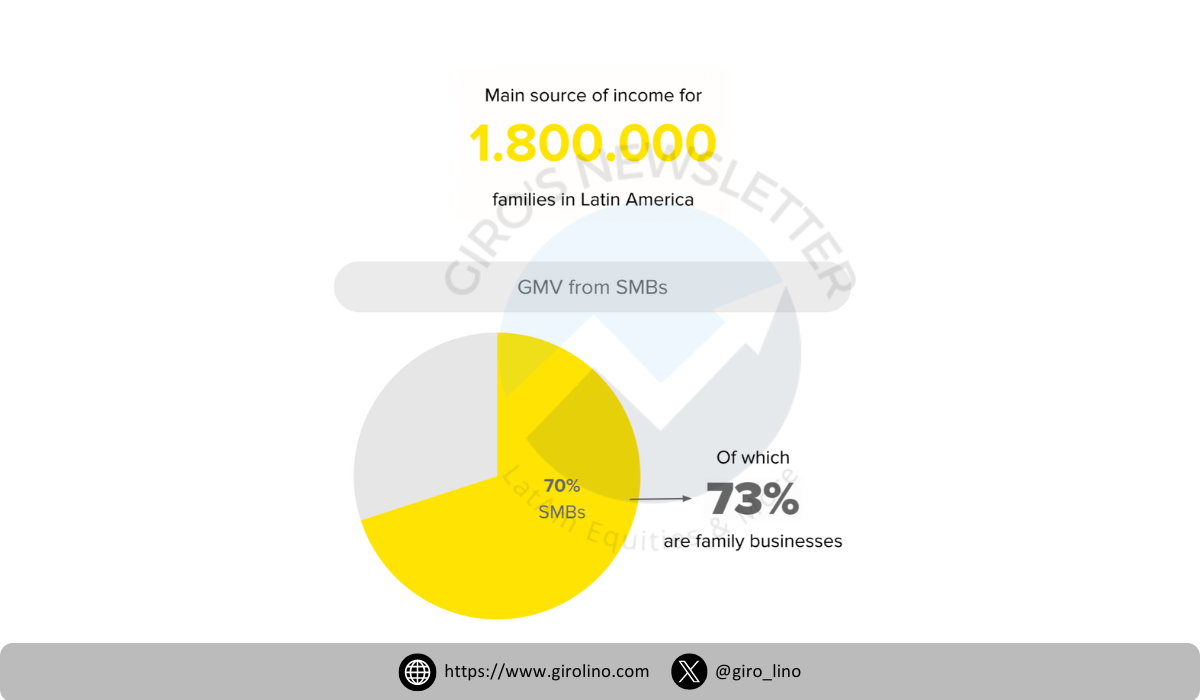

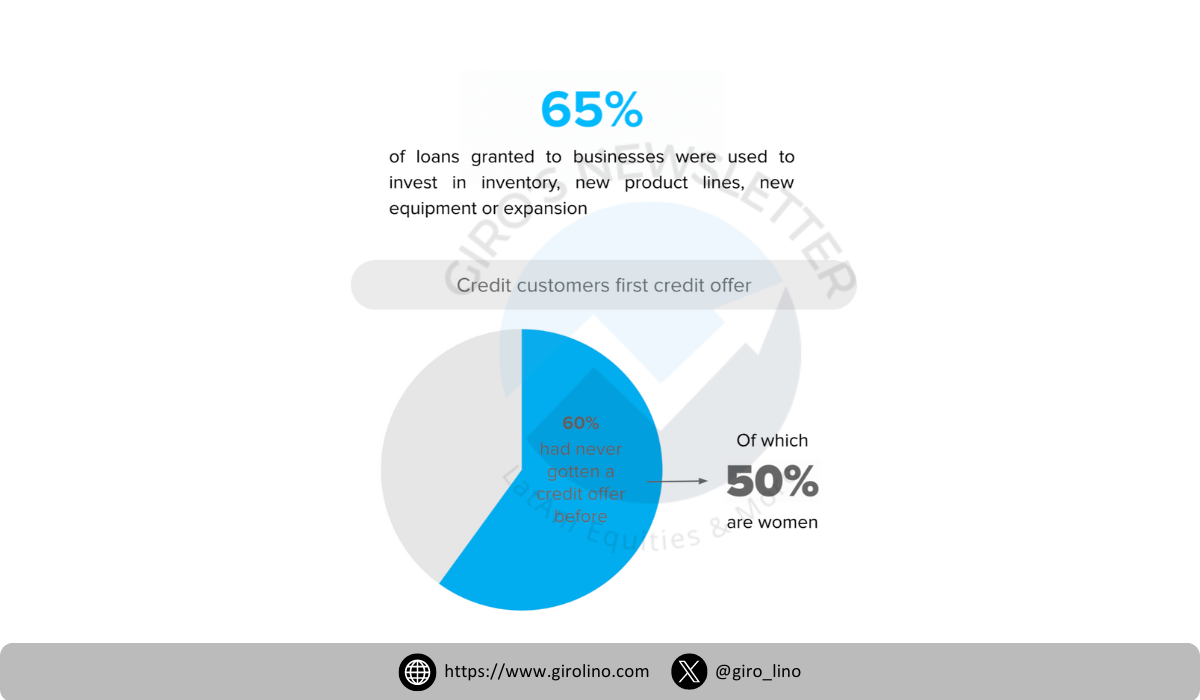

Mercado Pago's credit accessibility is a significant advantage for sellers, particularly small and medium-sized enterprises (SMEs). The platform has become a vital source of financing, with 60% of SMEs receiving their first credit offer through Mercado Pago. This access to credit enables sellers to invest in inventory, expand operations, and improve cash flow, fostering growth and innovation in Latin America's e-commerce market.

The rapid growth of Mercado Pago is evident in its financial performance. In Q1 2024, its credit portfolio grew by 46% year-over-year, reaching US$4.4 billion, reaching almost 20 million users in 2023. This growth, driven by robust performance in its credit card business, underscores Mercado Pago's strategic importance to Mercado Libre and its potential to disrupt traditional banking services in the region.

By integrating a comprehensive suite of financial services, Mercado Pago enhances the overall ecosystem of Mercado Libre's platform, benefiting both sellers and buyers. This integrated approach creates a more robust and versatile marketplace, setting Mercado Libre apart from competitors in the Latin American market and positioning it as a significant player in the fintech landscape.

As Mercado Pago continues to expand its services and grow its user base, it remains a critical component of Mercado Libre's strategy to maintain its leadership position in Latin America's e-commerce sector. This financial services advantage is a key factor in Mercado Libre's ability to compete effectively against global giants like Amazon, providing a unique value proposition that is deeply integrated with the local market needs and challenges traditional financial institutions.

Mercado Envios: Logistics Solutions Challenging Traditional Banking Services

Mercado Envios, the logistics arm of Mercado Libre, plays a crucial role in the company's success and serves as a significant attraction for sellers. This efficient logistics solution is essential for maintaining high customer satisfaction and encouraging repeat purchases, while also providing a platform for potential financial technology integration.

Table 8: Mercado Libre - Mercado Envios Summary

| Metric | Value |

|---|---|

| Shipment Handling | 94% of all Mercado Libre shipments |

| Delivery Speed | 74% of deliveries in less than 48 hours |

Handling an impressive 94% of all shipments on the Mercado Libre platform, Mercado Envios ensures efficient logistics, with 74% of deliveries completed in less than 48 hours. This logistical efficiency is crucial for maintaining high customer satisfaction and encouraging repeat purchases, while also providing opportunities for integrated financial services.

Here is a comparison of Mercado Envios with Amazon's Fulfillment by Amazon (FBA) service:

Table 9: Amazon - FBA

| Feature | Mercado Envios | Amazon FBA |

|---|---|---|

| Coverage | Primarily Latin America | Global |

| Fulfillment Centers | Over 10 in Brazil | Not disclosed for Brazil |

| Same-day Delivery | Available in select cities | Available through Prime |

| Seller Eligibility | Open to all Mercado Libre sellers | Requires approval process |

| Storage Fees | No long-term storage fees | Charges long-term storage fees |

| Returns Management | Included | Included |

| Multichannel Fulfillment | Not available | Available |

Mercado Envios offers several key advantages for sellers:

- No Long-term Storage Fees: Unlike Amazon FBA, Mercado Envios does not charge long-term storage fees, making it more cost-effective for sellers with slower-moving inventory. This feature could potentially be integrated with financial services to offer inventory financing solutions.

- Open Eligibility: Mercado Envios is open to all Mercado Libre sellers without an approval process, lowering the barrier to entry for new and smaller sellers. This inclusivity aligns with Mercado Libre's strategy of supporting small businesses and could be leveraged to offer tailored financial products to these sellers.

- Efficient Delivery: With 74% of deliveries completed in under 48 hours, Mercado Envios helps sellers meet customer expectations for fast shipping, crucial for satisfaction and loyalty. This efficiency could be paired with financial technology solutions such as instant payouts or working capital loans based on sales velocity.

These features make Mercado Envios particularly attractive for small and medium-sized businesses that may lack resources to manage their own logistics or meet Amazon FBA's requirements. By providing a reliable and efficient logistics solution, Mercado Envios allows sellers to focus on their core business while ensuring quick and efficient product delivery. This creates opportunities for Mercado Libre to offer additional financial services tailored to the needs of these businesses, potentially competing with traditional banking services.

Mercado Envios continues to expand its infrastructure to improve logistics capabilities further. This ongoing investment is part of Mercado Libre's strategy to maintain its competitive edge in the Latin American e-commerce market. By enhancing its logistics network, Mercado Envios aims to offer even faster delivery times and handle larger shipment volumes, supporting Mercado Libre's growth ambitions in the region and providing a robust foundation for integrated financial technology solutions.

Competitive Advantages: Why Sellers Choose Mercado Libre

Mercado Libre's integrated ecosystem offers several competitive advantages that make it the preferred choice for many sellers in Latin America. These advantages stem from the synergy between Mercado Libre's e-commerce platform, Mercado Pago's financial services, and Mercado Envios' logistics solutions.

Table 10: Mercado Libre - Key Advantages for Sellers

| Feature | Description |

|---|---|

| Market Reach and Visibility |

- 34.6% market share in Latin America - 144.7 million active users - High visibility for small sellers - Significant product exposure |

| Financial Services (Mercado Pago) |

- Crucial support for SMEs - Credit offerings for business growth - 40% of SMEs received first credit offer through Mercado Pago - Financial inclusion for overlooked businesses |

| Logistics Efficiency (Mercado Envios) |

- Extensive network and fast delivery - 74% of deliveries completed in less than 48 hours - Enhanced customer satisfaction and loyalty - Opportunities for integrated financial services |

| Lower Barriers to Entry |

- Accessible for new and small sellers - Attractive for individual entrepreneurs - User-friendly interface - Supportive seller policies |

| Integrated Services |

- Comprehensive ecosystem (e-commerce, payments, logistics) - Simplified operations for sellers - All-in-one platform - Streamlined business operations |

| Local Market Understanding |

- Deep understanding of local dynamics - Tailored features for Latin American market - Relevant and effective services - Localized financial products |

| High Switching Costs |

- Integrated services create dependency - Challenging to move to other platforms - Retains sellers within Mercado Libre ecosystem |

By offering a suite of services that spans e-commerce, logistics, and financial technology, Mercado Libre is creating a new paradigm for business support in Latin America, challenging conventional models of both online retail and financial services.

This comprehensive support system, extensive market reach, and understanding of local needs provide a strong foundation for seller success, positioning Mercado Libre ahead of Amazon in the Latin American e-commerce landscape and as a formidable competitor to traditional financial institutions.

Local Market Expertise: MELI's Home Field Advantage in Financial Technology

As a Latin American company, Mercado Libre has a deep understanding of the local market dynamics and consumer preferences in the region. This local insight is reflected in the platform's design, features, and services, making it more attuned to the needs of Latin American consumers and sellers. Mercado Libre's ability to tailor its offerings to the local market gives it a significant edge over global competitors like Amazon and traditional financial institutions.

Key Advantages of Mercado Libre's Local Expertise

Cultural Relevance: Mercado Libre's marketing campaigns, user interface, and customer support are all designed with Latin American cultural nuances in mind. This cultural alignment resonates more deeply with local consumers compared to Amazon's more standardized global approach or traditional banks' often rigid services. For instance, Mercado Libre's platform incorporates local holidays and shopping events, creating a more personalized experience for users.

Language Proficiency: While both Mercado Libre and Amazon offer services in Spanish and Portuguese, Mercado Libre's native understanding of regional language variations allows for more nuanced and effective communication with users. This proficiency extends to customer service, product descriptions, and financial technology interfaces, making the platform more accessible and user-friendly for local consumers.

Payment Methods: Mercado Libre, through Mercado Pago, offers a wider range of local payment options that are popular in Latin America, including local credit cards, cash payments, and installment plans. These options are deeply ingrained in Latin American consumer behavior and not as readily available on Amazon or through traditional banking services. For example, Mercado Pago supports "boleto bancário" in Brazil, a popular payment method that allows consumers to pay for online purchases with cash at various locations.

Seller Support: Mercado Libre provides localized support and training for sellers, helping them navigate the specific challenges of the Latin American market. This includes guidance on local regulations, tax laws, and consumer protection policies. The company also offers tailored financial services through Mercado Pago, such as working capital loans and payment processing, which are designed to address the unique needs of Latin American businesses.

Seasonal Promotions: Mercado Libre is adept at leveraging local shopping events and holidays for promotions, such as "El Buen Fin" in Mexico or "Cyber Monday" in Argentina, with campaigns that resonate with Latin American shoppers. These promotions are often integrated with special financing options through Mercado Pago, creating a seamless shopping and payment experience.

Localized Product Categories: The platform's product categories and search algorithms are optimized for Latin American shopping habits and preferences, making it easier for local consumers to find what they're looking for. This localization extends to financial products as well, with Mercado Pago offering services tailored to local needs, such as microloans for small businesses or consumer credit for specific product categories.

Adaptation to Local Logistics Challenges: Mercado Envios, Mercado Libre's logistics arm, is designed to navigate the complexities of Latin America's diverse geography, including remote areas that global players and traditional financial institutions often struggle to serve efficiently. This expertise allows Mercado Libre to offer more reliable delivery services and integrate financial solutions that account for regional logistics challenges.

Local Market Expertise: MELI's Home Field Advantage

As a Latin American company, Mercado Libre has a deep understanding of the local market dynamics and consumer preferences in the region. This local insight gives it a significant edge over global competitors like Amazon and traditional financial institutions.

Key Advantages of Mercado Libre's Local Expertise

Cultural Relevance: Marketing campaigns, user interface, and customer support are designed with Latin American cultural nuances in mind.

Language Proficiency: Native understanding of regional language variations allows for more nuanced and effective communication with users.

Payment Methods: Mercado Pago offers a wider range of local payment options popular in Latin America, including local credit cards, cash payments, and installment plans.

Seller Support: Localized support and training for sellers, helping them navigate specific challenges of the Latin American market.

Seasonal Promotions: Adept at leveraging local shopping events and holidays for promotions that resonate with Latin American shoppers.

- Localized Product Categories: Product categories and search algorithms are optimized for Latin American shopping habits and preferences.

- Adaptation to Local Logistics Challenges: Mercado Envios is designed to navigate the complexities of Latin America's diverse geography.

Deep Roots in the Local Market

Mercado Libre's long-standing presence in Latin America since 1999 has allowed it to build trust and credibility with local consumers over time. This established reputation gives Mercado Libre an advantage over newer entrants like Amazon, particularly in attracting and retaining customers in a market where trust plays a significant role in online shopping and financial decisions.

The company's local market understanding gives it a significant competitive advantage in several key areas:

Financial Inclusion: Developed financial products that cater to the large unbanked population in Latin America.

Credit Assessment: Uses vast seller data to assess creditworthiness more effectively than traditional financial institutions.

Consumer Financing: Offers "Buy Now, Pay Later" options tailored to local consumer preferences for installment payments.

SME Support: Provides a suite of services designed to help small and medium-sized enterprises grow, including easy-to-use online storefronts, targeted advertising options, and working capital loans.

Mobile-First Approach: Prioritized mobile app development and optimization, ensuring a seamless experience for the large number of mobile-only users in the region.

This deep-rooted local market understanding allows Mercado Libre to create a shopping and financial services experience that feels more familiar and tailored to Latin American consumers and businesses. It fosters loyalty, drives continued growth in the market, and positions Mercado Libre as not just an e-commerce leader, but as a comprehensive digital ecosystem that challenges both global tech giants and traditional financial institutions.