Amazon (NASDAQ: AMZN) delivered a strong performance in Q2 2024, surpassing analyst expectations and demonstrating resilience across its diverse business segments. However, beneath the surface of impressive headline numbers, there are both opportunities and challenges that warrant closer examination.

Beating Expectations, But By How Much?

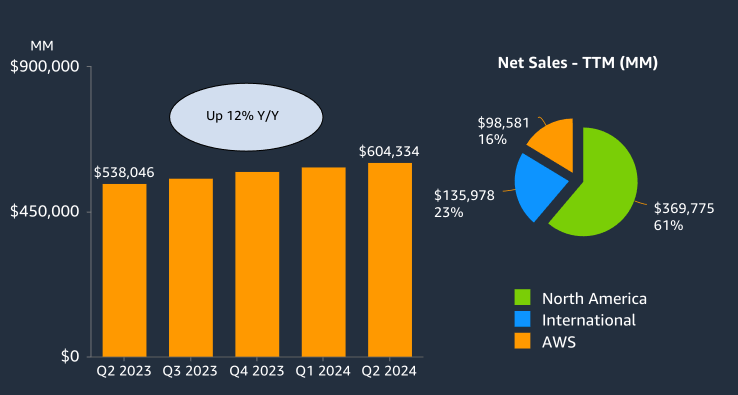

Amazon reported Q2 2024 revenue of $148.0 billion, up 10% year-over-year and slightly above the consensus estimate of $147.6 billion. Earnings per share came in at $1.26, significantly beating the expected $0.95. While these numbers are undoubtedly positive, it's worth noting that the beat on revenue was relatively modest, suggesting that top-line growth, while solid, may be facing some headwinds.

| Metric | Actual | Expected | Beat |

|---|---|---|---|

| Revenue | $148.0B | $147.6B | +0.3% |

| EPS | $1.26 | $0.95 | +32.6% |

The substantial earnings beat, coupled with a modest revenue surprise, indicates that Amazon's profitability improvements are outpacing its top-line growth. This trend raises questions about the sustainability of such margin expansion and whether it comes at the cost of future growth investments.

CFO Brian Olsavsky provided some context on this during the earnings call:

"We remain focused on managing costs in a way that allows us to continue innovating and investing in areas that we think can move the needle for our customers."

AWS: Reacceleration or Temporary Boost?

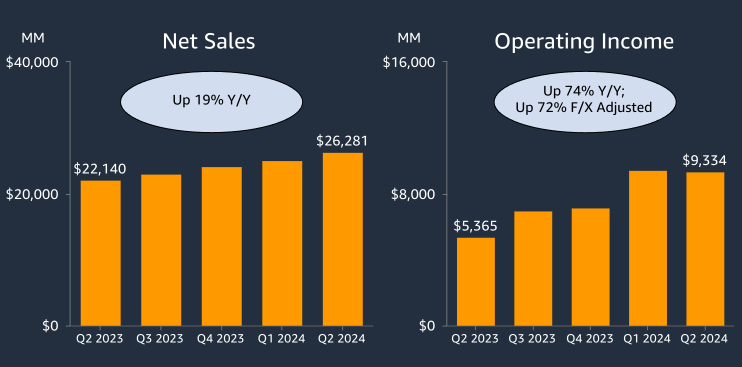

Amazon Web Services (AWS) posted an impressive 19% year-over-year growth, accelerating from 17.2% in Q1 2024. CEO Andy Jassy attributed this to three factors:

- Completion of customer cost optimization efforts

- Renewed focus on cloud migration

- Growing excitement around AI

Jassy elaborated on these trends during the call:

"Companies have completed the significant majority of their cost optimization efforts and are focused again on new efforts. Companies are spending their energy again on modernizing their infrastructure and moving from on-premises infrastructure to the cloud. Builders and companies of all sizes are excited about leveraging AI."

While these factors seem plausible, investors should consider whether this reacceleration is sustainable or a temporary phenomenon. The cloud computing market remains highly competitive, with Microsoft Azure and Google Cloud continuing to gain market share. Amazon's lead in this space, while still substantial, has been gradually eroding over the past few years.

Moreover, the emphasis on AI as a growth driver for AWS is a double-edged sword. While it presents significant opportunities, it also requires substantial investments in infrastructure and R&D. Amazon's custom silicon efforts with Trainium and Inferentia chips are promising but put the company in direct competition with established players like NVIDIA in a highly specialized field.

Jassy highlighted the company's AI efforts:

"We have a deep partnership with NVIDIA and the broader selection of NVIDIA instances available, but we've heard loud and clear from customers that they relish better price performance. It's why we've invested in our own custom silicon in Trainium for training and Inferentia for inference."

Retail: Profitability Gains, But at What Cost?

The North America segment's operating income increased to $5.1 billion, up from $3.2 billion in Q2 2023. This significant improvement in profitability is commendable, but it's essential to examine the underlying factors:

- Efficiency gains through network optimization and automation

- Shift towards higher-margin products and services

- Potential pullback on growth investments

While these strategies have boosted short-term profitability, they may impact Amazon's long-term competitive position in e-commerce. The company's focus on "everyday essentials" and faster delivery is a defensive move against competitors like Walmart and Target, who have been gaining ground in online retail.

Jassy's comment about North American unit growth outpacing sales growth suggests a trend towards lower average selling prices (ASPs). This could indicate pressure on margins in the future, especially if inflationary pressures persist.

Jassy provided insight into these trends:

"While consumers are being careful on price, our North American unit growth is meaningfully outpacing our sales growth, as our continued work on selection, low prices and delivery is resonating."

Advertising: A Bright Spot with Potential Pitfalls

Amazon's advertising business continues to show strong growth, with over $50 billion in trailing twelve-month revenue. The introduction of ads on Prime Video presents a significant opportunity but also risks alienating subscribers who are accustomed to an ad-free experience.

Jassy highlighted the potential of this new initiative:

"With ads and Prime Video, the exciting opportunity for brands is the ability to directly connect advertising that's traditionally been focused on driving awareness, as is the case for TV, to a business outcome like product sales or subscription sign-ups."

The convergence of e-commerce and advertising positions Amazon well against competitors like Google and Facebook. However, it also exposes the company to potential regulatory scrutiny over its dual role as a marketplace operator and advertiser.

Strategic Investments: Balancing Act

Amazon's increased capital expenditures, particularly in AWS infrastructure and AI capabilities, demonstrate the company's commitment to maintaining its competitive edge. However, these investments come at a time when many tech companies are cutting back on spending due to economic uncertainties.

Olsavsky provided more details on the company's investment strategy:

"For the first half of the year, CapEx was $30.5 billion. Looking ahead to the rest of 2024, we expect capital investments to be higher in the second half of the year. The majority of the spend will be to support the growing need for AWS infrastructure as we continue to see strong demand in both generative AI and our non-generative AI workloads."

The company's venture into satellite internet with Project Kuiper is ambitious but faces stiff competition from established players like SpaceX's Starlink. While diversification is generally positive, investors should closely monitor the return on these significant investments.

Jassy expressed optimism about Project Kuiper:

"We expect to start shipping production satellites late this year and continue to believe this could be a very large business for us."

Challenges and Risks

- Macroeconomic Headwinds: Consumer behavior remains cautious, with a trend towards lower-priced items and deal-seeking. This could pressure margins in the retail segment.

- Regulatory Scrutiny: Amazon's dominance in e-commerce and cloud computing continues to attract attention from regulators worldwide. Any adverse rulings could impact the company's business model.

- Intensifying Competition: While Amazon leads in many areas, competitors are catching up. Microsoft and Google in cloud computing, Walmart and Target in e-commerce, and specialized players in areas like streaming and advertising all pose threats to Amazon's market position.

- Balancing Growth and Profitability: As Amazon matures, finding the right balance between investing for future growth and delivering consistent profitability becomes increasingly challenging.

Olsavsky acknowledged these ongoing challenges:

"We're seeing a lot of the same consumer trends that we have been talking about for the last year. Consumers being careful with their spend, trading down, looking for lower ASP products, looking for deals."

Outlook: Cautious Optimism

Amazon's Q2 2024 results demonstrate the company's ability to execute across its diverse business lines. The reacceleration of AWS and improved profitability in retail operations are positive signs. However, the company faces significant challenges in maintaining its growth trajectory while navigating economic uncertainties and competitive pressures.

Investors should watch for:

- Sustainability of AWS growth rates

- Continued profitability improvements in retail without sacrificing market share

- Success of new initiatives like Prime Video advertising and Project Kuiper

- Ability to maintain innovation leadership, particularly in AI and cloud services

While Amazon's Q2 performance is undoubtedly strong, the company's future success will depend on its ability to address these challenges while capitalizing on its strengths in e-commerce, cloud computing, and digital advertising.

Jassy concluded the call with an optimistic outlook:

"There's a lot to feel optimistic about over the next several years, and the team collectively remains focused on continuing to invent and deliver for our customers in the business."

FAQ

Q: Is Amazon's focus on profitability sustainable? A: While Amazon has shown impressive profit growth, sustaining this trend may be challenging without impacting long-term competitiveness. The company needs to balance efficiency gains with necessary investments in future growth areas.

Q: How significant is the threat from cloud competitors to AWS? A: The threat is substantial and growing. While AWS remains the market leader, Microsoft Azure and Google Cloud are gaining market share. Amazon's investments in AI and custom silicon aim to maintain its competitive edge, but the outcome remains uncertain.

Q: What impact might Prime Video ads have on Amazon's business? A: Prime Video ads present a significant revenue opportunity but risk subscriber backlash. Success will depend on Amazon's ability to implement ads in a way that doesn't significantly detract from the viewing experience while providing value to advertisers.

Q: How exposed is Amazon to potential economic downturns? A: Amazon has diverse revenue streams, which provide some insulation. However, its retail business could be impacted by reduced consumer spending, while AWS might see slower growth if businesses cut back on cloud investments during a downturn.