AMD has made a bold move in the data center artificial intelligence (AI) market with its acquisition of ZT Systems, a leading provider of AI infrastructure for hyperscale computing. This $4.9 billion deal, set to close by 2025, represents AMD's ambitious strategy to compete more effectively with industry giants like Nvidia in the lucrative data center AI sector.

AMD's CEO, Dr. Lisa Su, didn't mince words when discussing the acquisition. In her own words:

"This acquisition builds on our investments to accelerate our AI hardware and software roadmaps. We've invested over $1 billion in the past 12 months to expand our AI ecosystem and strengthen our AI software capabilities."

It's clear that AMD is not just dipping its toes in the AI waters – it's diving in headfirst.

Market Opportunity and AMD's Current Position

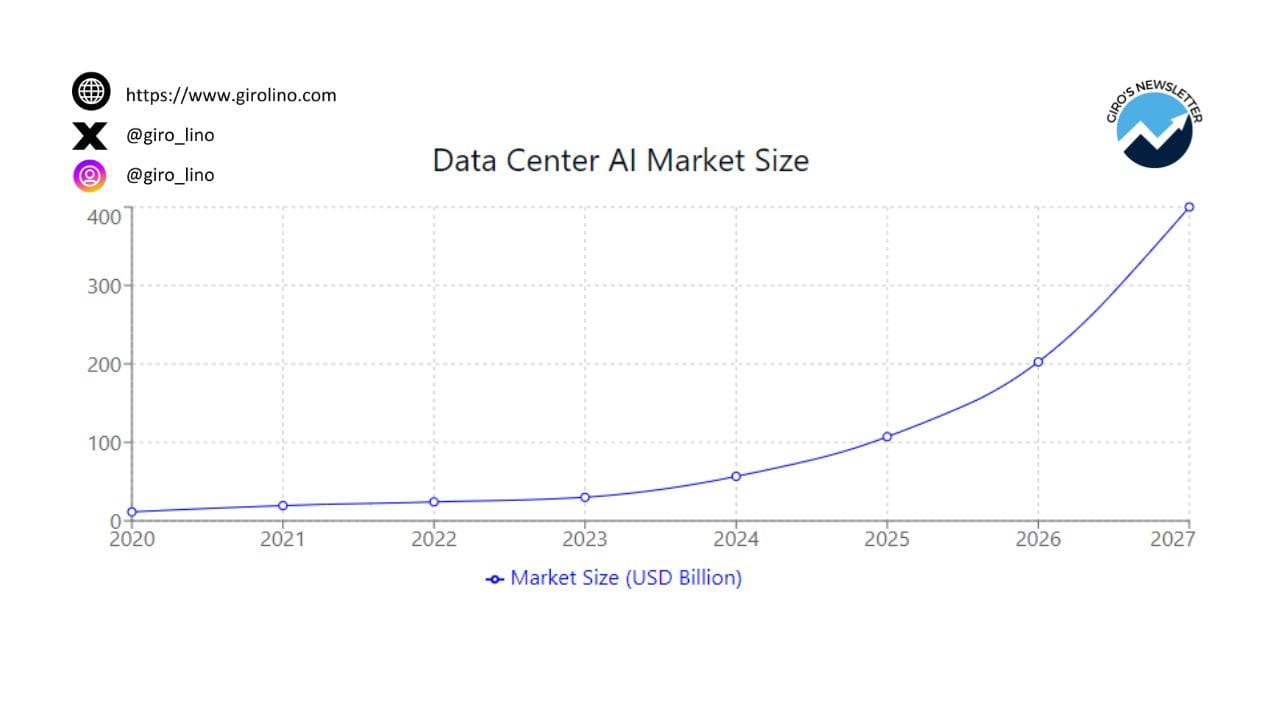

Now, let's talk numbers. The data center AI market isn't just growing – it's exploding.

Take a look at this chart. It's not just a line graph; it's a rocket trajectory. The Data Center AI Market Size is expected to skyrocket from around $30 billion in 2023 to a mind-boggling $400 billion by 2027. That's not just growth; that's a market transformation happening before our eyes.

Before you dive into our comprehensive analysis of Nu Holdings' risk management strategies, we have a quick favor to ask:

If you find value in this content, please consider sharing it!

Why? Your shares help us reach more readers, allowing us to keep producing high-quality, in-depth analyses like this one—completely free, with no paywalls or subscriptions.

As one industry analyst put it:

"The data center AI market is experiencing unprecedented growth. We're seeing a perfect storm of increased AI adoption, the need for more powerful computing resources, and the emergence of new AI-driven applications. It's a gold rush, and companies like AMD are positioning themselves to be the primary suppliers of the picks and shovels."

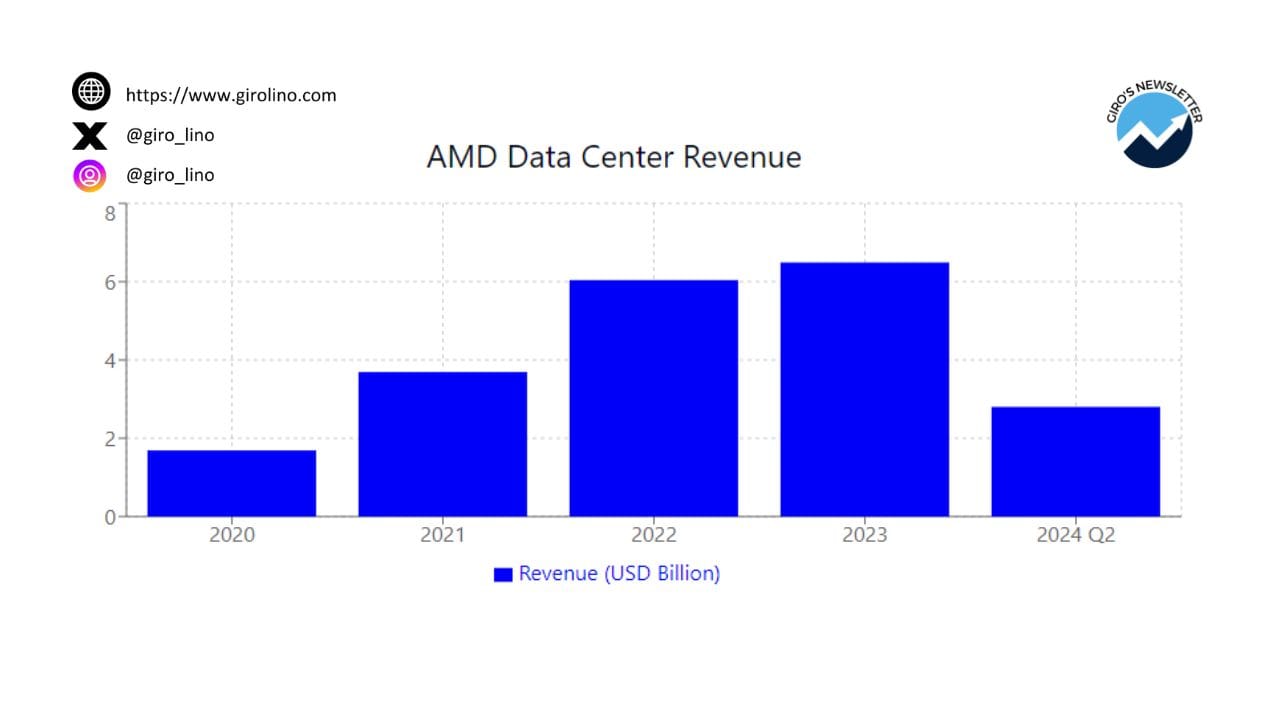

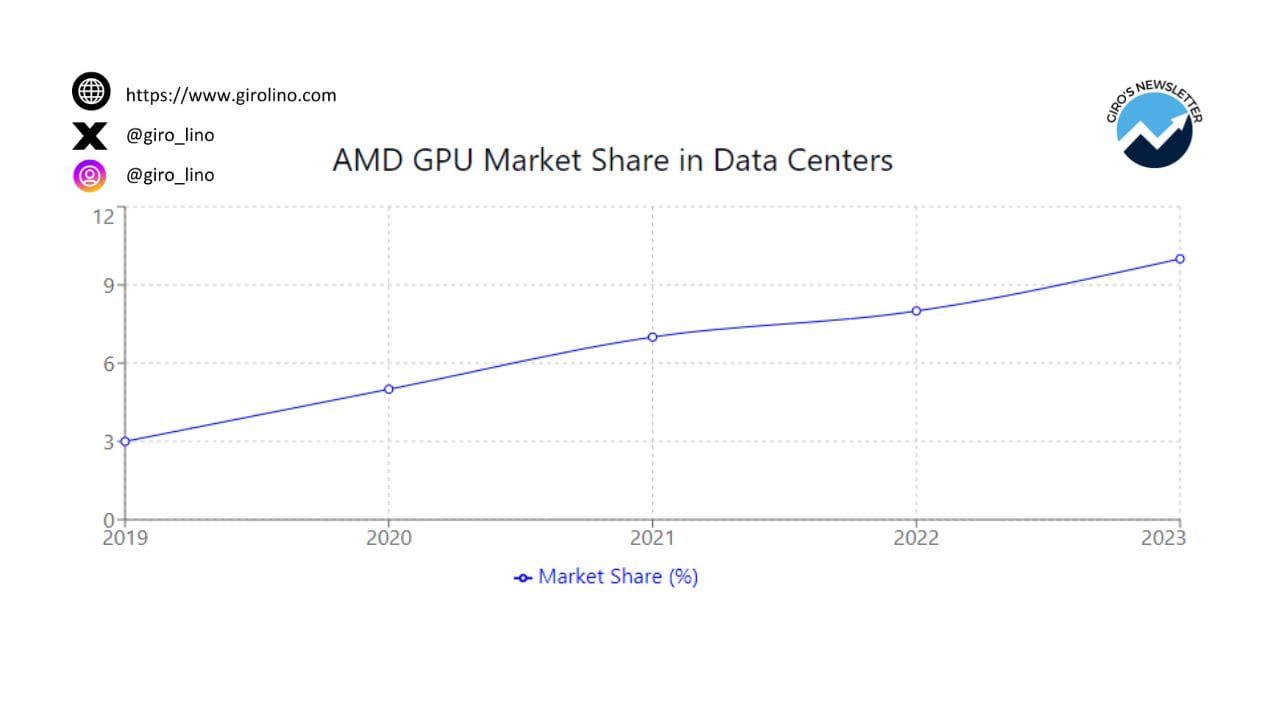

But here's where it gets interesting. AMD isn't starting from scratch in this market. They've been steadily building their presence in the data center space.

This chart tells a story of consistent growth. AMD's Data Center Revenue has been on an upward trend, climbing from $1.69 billion in 2020 to $6.6 billion in 2023. And if you look at the latest data for Q2 2024, you'll see a revenue of $2.8 billion. That's not just maintaining momentum; that's acceleration.

The Competitive Landscape: David vs. Goliath?

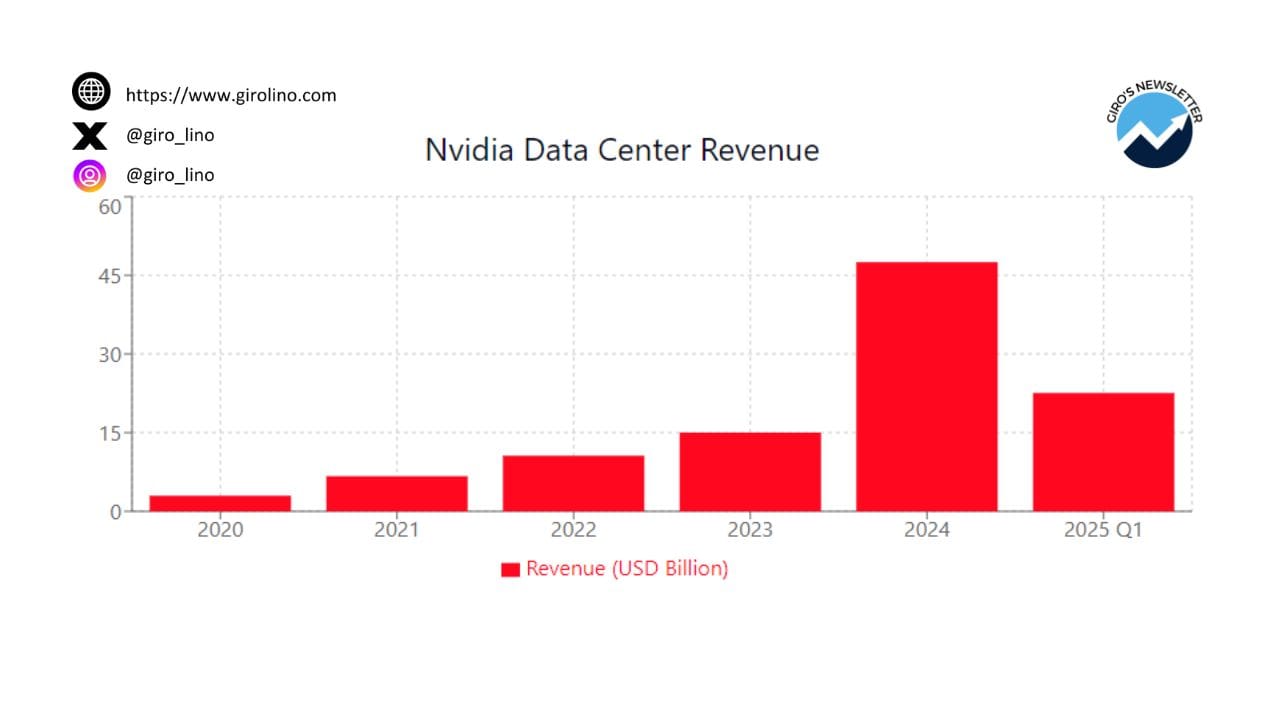

No discussion of the data center AI market would be complete without mentioning the elephant – or should we say, the green giant – in the room: Nvidia.

Take a moment to absorb this chart. Nvidia's data center revenue growth isn't just impressive; it's almost vertical. From about $15 billion in 2023 to nearly $48 billion in 2024, with Q1 2025 already showing revenue of over $22 billion. It's the kind of growth that makes other tech companies green with envy.

A senior tech analyst commented on this dynamic:

"Nvidia has been the undisputed king of AI chips for years. Their first-mover advantage and robust software ecosystem have given them a significant lead. But in tech, today's leader can quickly become tomorrow's follower. AMD's acquisition of ZT Systems is a clear signal that they're not content to play second fiddle."

This is the Goliath that AMD is gearing up to challenge. But remember, in the world of tech, today's underdog can be tomorrow's leader. AMD's acquisition of ZT Systems isn't just about catching up; it's about leapfrogging the competition.

AMD's Strategy for Growth: More Than Just Chips

So, how does AMD plan to take on this challenge? It's not just about making faster chips or more efficient GPUs. The acquisition of ZT Systems signals a more holistic approach.

Dr. Su elaborated on this strategy:

"By combining ZT Systems' deep experience in AI infrastructure for hyperscale with AMD's high-performance CPUs, GPUs, and adaptive computing engines, we're positioning AMD to define AI-optimized data center infrastructure and deliver rapidly deployable AI solutions at scale."

This strategy is crucial in a market where time-to-deployment can make or break a product's success. By offering more comprehensive, ready-to-deploy solutions, AMD is positioning itself to capture a larger slice of that rapidly expanding data center AI pie.

Financial Implications and Operational Considerations

Let's talk money. The $4.9 billion price tag for ZT Systems isn't pocket change, even for a company of AMD's size. But in the high-stakes game of data center AI, it could be a bargain if it pays off.

A financial analyst specializing in tech acquisitions shared this insight:

"While $4.9 billion is a significant investment, it's important to view this in the context of the potential market opportunity. If AMD can leverage ZT Systems' expertise to capture even a small additional percentage of the projected $400 billion market, this acquisition could pay for itself many times over."

AMD expects the acquisition to be accretive on a non-GAAP basis by the end of 2025. In layman's terms, they're betting that this deal will boost their earnings per share within about 18 months of closing. That's a pretty optimistic timeline, but it speaks to the confidence AMD has in this strategic move.

Impact on the Data Center AI Ecosystem: Ripples Becoming Waves

The implications of this acquisition extend far beyond AMD and ZT Systems. This move has the potential to reshape the competitive landscape of the data center AI market in several ways.

A data center infrastructure expert weighed in:

"This acquisition isn't just about AMD gaining market share. It's about potentially reshaping how AI infrastructure is designed and deployed. If AMD can successfully integrate ZT Systems' expertise with their own chip technology, we could see a new paradigm in data center AI solutions."

The potential impacts include increased competition, a shift in the AI software ecosystem, more choice for customers, and potentially accelerated AI adoption across industries.

The Road Ahead

While the acquisition of ZT Systems positions AMD for growth in the data center AI market, the road ahead is far from easy. To succeed in this highly competitive landscape, AMD will need to execute flawlessly on several fronts.

As one industry veteran put it:

"The real test for AMD will be in the execution. Acquisitions of this scale are never easy, and the data center AI market moves at breakneck speed. AMD will need to not only integrate ZT Systems effectively but also continue to innovate at a rapid pace to keep up with or surpass competitors."

Key challenges include leveraging ZT Systems' expertise effectively, accelerating product development cycles, developing the software ecosystem, building partnerships, and navigating potential regulatory scrutiny.

In conclusion, AMD's acquisition of ZT Systems is more than just a business transaction; it's a statement of intent. It signals AMD's ambition to be a major player in shaping the future of AI infrastructure. Whether this bet pays off remains to be seen, but one thing is certain: the data center AI market just got a lot more interesting.

As Dr. Su confidently stated:

"This acquisition advances our AI strategy and deepens our partnerships with hyperscale customers. We're excited about the opportunities ahead and our ability to accelerate the deployment of AMD-powered AI infrastructure at scale."

The tech world will be watching closely as this story unfolds. Buckle up, folks – the AI chip race is heating up, and AMD just hit the nitro boost.