In a week of notable business developments, AMD's bold acquisition stands out among recent retail earnings reports. Let's break down the big moves and quarterly results shaping the tech and retail landscapes.

🚨 Breaking News: AMD's $4.9 Billion AI Gambit

AMD has made a big move. They're acquiring ZT Systems for $4.9 billion. This is a significant step into the AI market.

Why does this matter? AMD is positioning itself to compete more effectively in the AI chip sector. They're adding about 1,000 engineers to their team with this acquisition.

Here's an interesting twist: AMD plans to sell off ZT's manufacturing business. They're after the design expertise, not the production capacity. It's a strategic play that could reshape their position in the market.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

🏗️ Lowe's Q2 Results: Pro Growth Offsets DIY Challenges

Lowe's Q2 results show some challenges. Overall sales are down 5.1%. But there's more to the story.

The Pro segment is growing well. It's seeing mid-single-digit growth. On the flip side, DIY projects are slowing down. This split in performance highlights the changing dynamics in home improvement.

Lowe's is responding actively. They're adjusting inventory and launching targeted promotions. The goal? To balance the needs of both Pro and DIY customers in a shifting market.

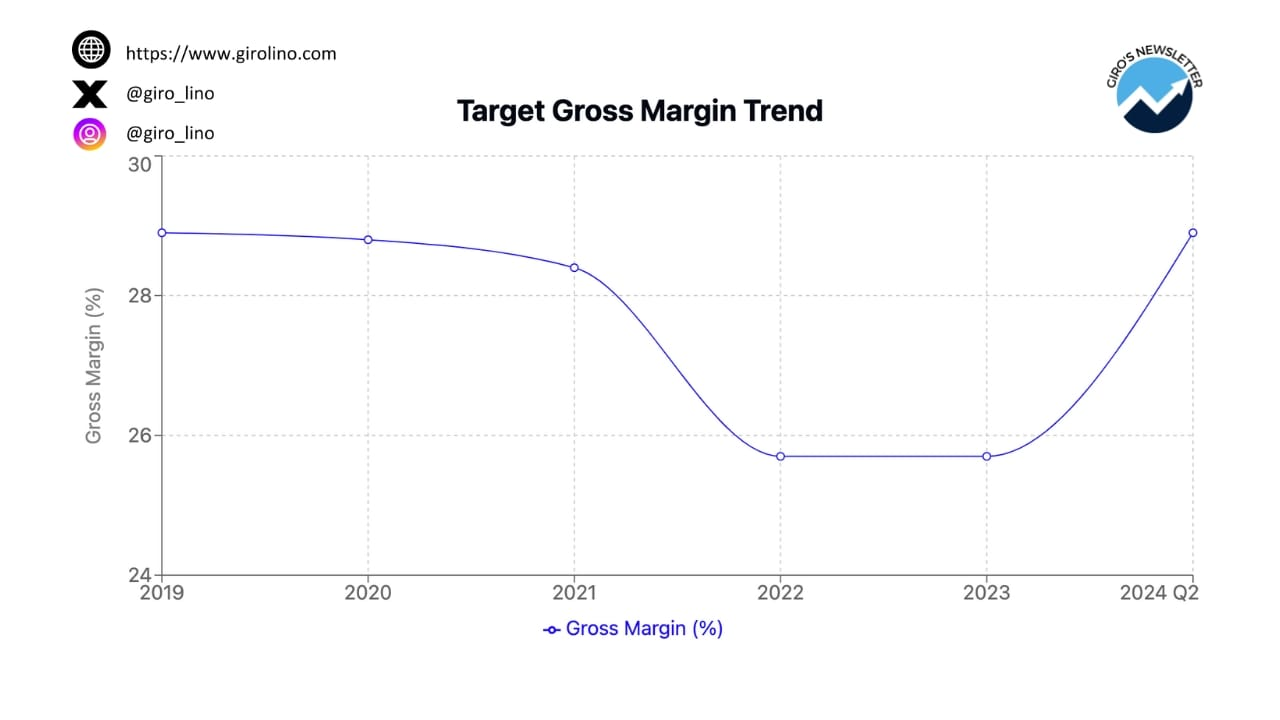

🎯 Target Exceeds Expectations in Q2

Target has delivered strong Q2 results. Revenue is up 2.7%, and earnings per share have increased by 42.8%. These numbers are beating market expectations.

What's driving this success? Efficiency improvements are key. Target has managed to increase margins while keeping costs in check.

Digital growth is another bright spot. Online sales are up, and same-day services are seeing double-digit growth. Target is effectively blending online and in-store strategies.

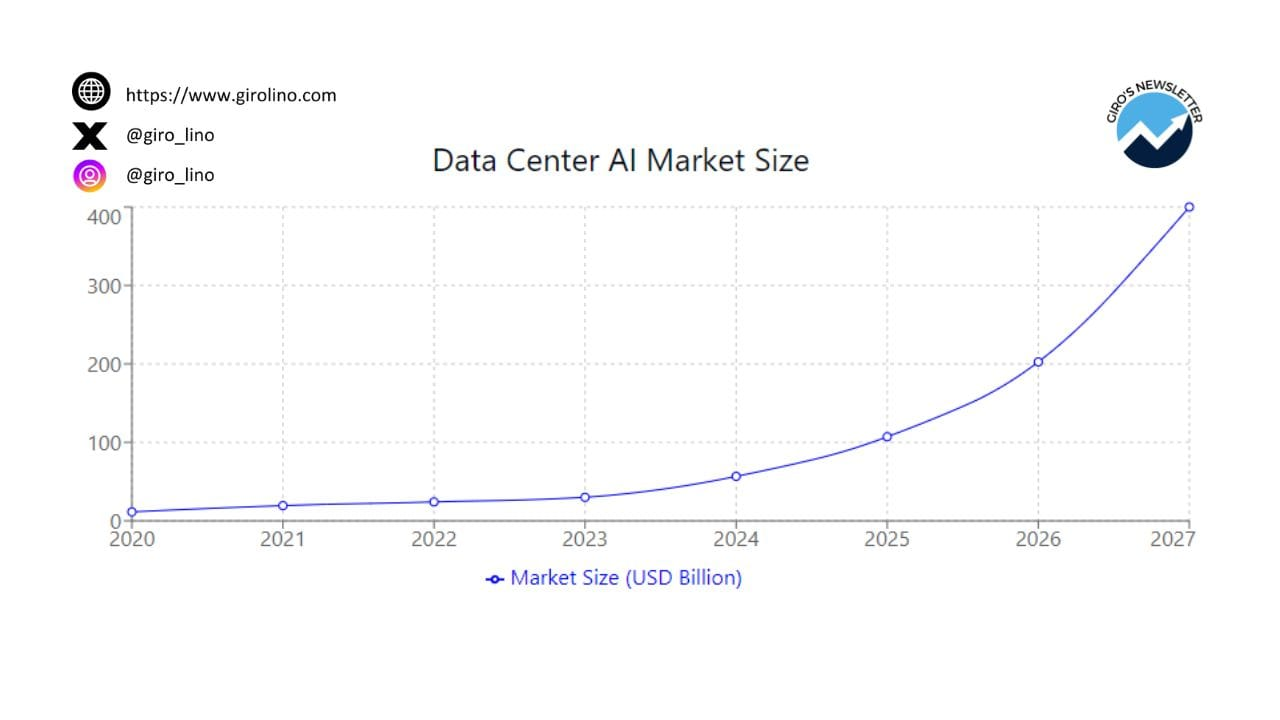

🧠 The AI Gold Rush Continues...

The data center AI market is expanding rapidly. Projections suggest it could reach $400 billion by 2027. This growth is attracting major players and driving strategic decisions.

AMD's acquisition is part of this trend. They're aiming to challenge Nvidia's strong position in this market. It's setting the stage for increased competition in AI chip development.

💼 Impact on the Workforce

These changes are affecting job markets. There's growing demand for AI engineers and data scientists. This trend is likely to continue as companies invest more in AI technologies.

Retail workers are also seeing changes. As companies like Lowe's and Target invest more in digital capabilities, job roles are evolving. Adaptability is becoming increasingly important in the retail sector.

🔮 Looking Ahead

The AI chip sector is becoming more competitive. AMD's move signals their intent to be a major player. We can expect to see more developments in this space.

In retail, the focus is on balancing online and offline strategies. Companies that can effectively combine these approaches are likely to perform well. The ability to meet diverse customer needs will be crucial.

💡 Key Takeaway

While major companies make headlines, there are opportunities throughout the supply chain. Companies providing AI infrastructure, specialized software, and support services could see significant growth.

In both tech and retail, adaptability is key. Today's market leaders need to innovate continuously to maintain their positions. Keep an eye on how companies respond to changing market conditions.

That wraps up today's business news. Stay informed, stay curious, and we'll see you next time!