ASML Holding NV, a cornerstone of the semiconductor industry, has unveiled its financial results for the second quarter of 2024, demonstrating resilience and robust performance in a challenging macro environment. As we dissect ASML's Q2 2024 report, we'll explore the company's achievements, future outlook, and its crucial role in driving technological advancements that shape our digital world.

Financial Highlights: Steady Performance Amidst Industry Fluctuations

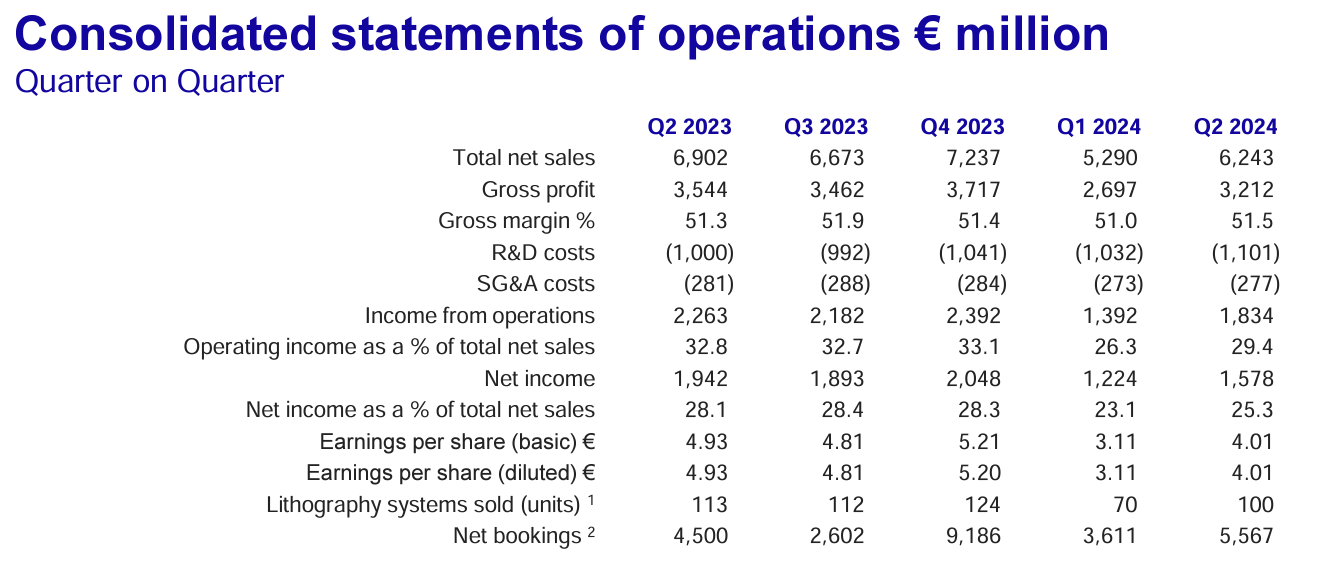

ASML reported net sales of €6.2 billion for the second quarter, showcasing the company's ability to maintain strong performance even as the semiconductor industry navigates through a transition year. This figure of €6.2 billion in net sales reflects the ongoing demand for ASML's cutting-edge lithography systems, despite overall semiconductor inventory levels continuing to impact the market.

The company's net income for Q2 2024 stood at €1.58 billion, highlighting ASML's profitability even in a complex market landscape. This net income figure is particularly impressive given the current state of the semiconductor industry, where many players are grappling with inventory challenges and market uncertainties.

"Our Q2 2024 results, with net sales of €6.2 billion and a net income of €1.58 billion, demonstrate ASML's resilience and strategic importance in the global semiconductor ecosystem," stated Roger Dassen, ASML's Chief Financial Officer.

ASML's gross margin for the quarter came in at a robust 51.5%, primarily driven by increased sales of higher-margin immersion systems. The strong gross margin performance underscores ASML's pricing power and operational efficiency, particularly noteworthy given the challenging market conditions. More immersion systems sales contributed significantly to this margin improvement, highlighting the continued demand for ASML's advanced lithography solutions.

In terms of order intake, ASML reported net bookings of €5.6 billion for the quarter. These net bookings provide a glimpse into the future demand for ASML's products and services, indicating continued investments from customers across various market segments. The strong net bookings suggest that despite current market challenges, semiconductor manufacturers are still committed to long-term capacity expansion and technological advancement.

Market Dynamics and Industry Recovery

The semiconductor industry has been experiencing a period of adjustment, with overall semiconductor inventory levels continuing to impact market dynamics. However, ASML's performance suggests that the company is well-positioned to navigate these challenges and capitalize on the expected industry recovery.

ASML expects the second half of the year to show further improvement, with strong developments anticipated in both logic and memory segments. The company's optimism is backed by improving litho tool utilization levels and continued investments from key customers, particularly memory customers who are beginning to ramp up their capacity.

Christophe Fouquet, ASML's Executive Vice President, commented on the market outlook:

"We're seeing signs of recovery across various market segments. While the macro environment remains challenging, the fundamentals driving long-term demand for advanced semiconductor technology remain strong. Our customers are continuing to invest in cutting-edge capabilities, recognizing the critical role of semiconductors in enabling the digital transformation."

The semiconductor industry's recovery is closely tied to broader technological trends, including the proliferation of artificial intelligence, 5G networks, and high-performance computing applications. These advanced technologies require increasingly sophisticated chips, driving demand for ASML's most advanced lithography systems, particularly in the extreme ultraviolet (EUV) category.

CEO Statement: Navigating Through a Transition Year

Peter Wennink, ASML President and CEO, provided insights into the company's performance and future outlook in his CEO statement:

"The second quarter results demonstrate ASML's resilience in what we consider a transition year for the semiconductor industry. While we continue to see inventory corrections in some market segments, we also observe strong developments in others, particularly in leading-edge nodes driven by artificial intelligence applications. Our ability to deliver solid results in this environment underscores the critical nature of our technology in enabling the semiconductor industry's advancement."

Wennink further elaborated on the company's expectations for the remainder of the year:

"We expect a strong second half of 2024, with growing demand for our extreme ultraviolet (EUV) systems and continued strength in our deep ultraviolet (DUV) business. This growth is primarily driven by the ongoing digital transformation across industries and the increasing adoption of artificial intelligence technologies. As we look ahead, we remain confident in the semiconductor industry's long-term growth prospects and ASML's pivotal role in enabling that growth."

The CEO's statements reflect ASML's strategic positioning at the forefront of semiconductor manufacturing technology. By enabling the production of more advanced and efficient chips, ASML plays a crucial role in driving innovation across the entire technology sector.

Future Outlook: Growth and Innovation

Looking ahead, ASML expects strong growth in the second half of the year, with net sales projected to be significantly higher compared to the first half. The company anticipates full-year 2024 net sales to grow by a low double-digit percentage compared to 2023. This positive outlook is based on several factors, including the expected industry recovery, increasing demand for advanced nodes, and ASML's strong market position.

ASML's future plans include:

- Capacity Ramp: The company is focused on ramping up its production capacity to meet the growing demand for its advanced lithography systems, particularly in the high-end EUV segment. This capacity expansion is crucial to support the semiconductor industry's growth and ensure timely delivery of critical manufacturing equipment.

- Technology Advancements: ASML continues to invest heavily in research and development to push the boundaries of semiconductor manufacturing technology. The company is making significant progress in its next-generation High-NA EUV systems, which will enable even more advanced chip designs. These technological advancements are essential for maintaining Moore's Law and driving the semiconductor industry forward.

- Market Expansion: While maintaining its strong position in logic and foundry segments, ASML is also targeting growth in memory and other market segments. The company sees opportunities in emerging applications such as automotive semiconductors, power electronics, and sensors for Internet of Things (IoT) devices.

- Sustainability Initiatives: ASML is committed to improving the energy efficiency of its systems and reducing the environmental impact of semiconductor manufacturing. The company is investing in technologies that enable more efficient chip production, reducing energy consumption and waste in the manufacturing process.

- Talent Development: Recognizing the importance of human capital in driving innovation, ASML is investing in talent acquisition and development programs. The company aims to attract and retain top engineering talent to support its ambitious research and development goals.

ASML's Earning Forecast and Expected Growth

ASML's earning forecast for the coming quarters remains positive, with the company expecting a strong second half of 2024. While specific revenue figures for future quarters haven't been disclosed, ASML anticipates significant growth compared to previous quarters. The company's confidence is based on several factors, including the ongoing recovery in the semiconductor industry, increasing demand for advanced nodes, and ASML's strong order book.

The expected growth of ASML is underpinned by several key drivers:

- Increasing demand for advanced semiconductor technology driven by AI, 5G, and high-performance computing applications. These cutting-edge technologies require the most sophisticated chips, which can only be manufactured using ASML's advanced lithography systems.

- The ongoing digital transformation across industries, fueling the need for more powerful and efficient chips. As businesses and consumers alike embrace digital technologies, the demand for semiconductors continues to grow, driving long-term demand for ASML's products.

- The recovery in the memory market, with memory customers showing renewed interest in capacity expansion. After a period of inventory correction, memory manufacturers are beginning to invest in new capacity, which is expected to boost demand for ASML's systems.

- ASML's technological leadership, particularly in EUV lithography, which is crucial for manufacturing the most advanced semiconductor nodes. As the complexity of chip designs increases, ASML's EUV technology becomes increasingly critical for enabling continued progress in semiconductor manufacturing.

- Expansion into new markets and applications, such as automotive semiconductors and power electronics. These emerging segments present new growth opportunities for ASML, diversifying its customer base and revenue streams.

While ASML expects industry recovery to continue, the company remains cautious about potential challenges in the macro environment. Factors such as geopolitical tensions, supply chain disruptions, and economic uncertainties could impact the pace of recovery. However, the long-term growth prospects for ASML remain strong, driven by the increasing importance of semiconductor technology in various aspects of our digital lives.

Innovation and R&D: Driving the Future of Semiconductor Technology

At the heart of ASML's success and future growth prospects is its unwavering commitment to innovation and research and development (R&D). In Q2 2024, the company invested €1.1 billion in R&D, representing a significant 17.6% of its quarterly revenue. This substantial investment underscores ASML's dedication to pushing the boundaries of lithography technology and ensuring its products remain at the cutting edge of semiconductor manufacturing capabilities.

"Our R&D investments are the lifeblood of our company," emphasized Martin van den Brink, ASML's President and Chief Technology Officer. "They ensure that we remain at the forefront of lithography technology, enabling the semiconductor industry to continue its path of innovation and miniaturization. Our focus on developing next-generation technologies like High-NA EUV is critical for addressing the future needs of our customers and the broader technology ecosystem."

ASML's R&D efforts span a wide range of areas, including:

- High-NA EUV Technology: The next generation of EUV lithography, High-NA (High Numerical Aperture) systems, promises to extend the capabilities of EUV technology even further. These systems will enable the production of even smaller and more complex chip designs, pushing the boundaries of what's possible in semiconductor manufacturing.

- Computational Lithography: As chip designs become more intricate, advanced software tools are needed to optimize the lithography process and maximize yields. ASML is investing heavily in computational lithography solutions that integrate hardware and software for optimal performance.

- Metrology and Inspection: Ensuring the quality and consistency of chip manufacturing processes is crucial as designs become more complex. ASML is developing advanced metrology and inspection tools to support the production of cutting-edge semiconductors.

- Sustainability in Chip Manufacturing: Recognizing the growing importance of environmental considerations, ASML is investing in technologies that improve the energy efficiency of its systems and reduce the overall environmental impact of semiconductor manufacturing.

- New Applications: ASML is exploring potential applications of its technologies in adjacent markets, such as the manufacturing of advanced displays or the production of photonic chips. These initiatives could open up new avenues for growth and diversification in the future.

ASML's innovation strategy is not limited to internal efforts. The company maintains strong partnerships with academic institutions, research organizations, customers, and suppliers. These collaborative efforts help accelerate innovation and address industry-wide challenges, ensuring that ASML's R&D investments translate into practical solutions that drive the entire semiconductor ecosystem forward.

ASML's Role in the Global Semiconductor Supply Chain

ASML's critical role in the global semiconductor supply chain cannot be overstated. As the world's leading manufacturer of lithography systems, ASML is an essential enabler of semiconductor production, sitting at the heart of a complex and interconnected industry.

"ASML's technology is fundamental to the entire semiconductor ecosystem," notes Dan Hutcheson, Vice Chairman of TechInsights. "Their lithography systems are the linchpin in the production of the most advanced chips, making ASML a key player in driving technological progress across multiple industries."

The company's importance is magnified by its virtual monopoly in EUV lithography, a technology that is crucial for manufacturing the most advanced semiconductor nodes. This position makes ASML a strategic asset not just for the semiconductor industry, but for the broader technology sector and even national economies.

ASML's role in the supply chain extends beyond just providing manufacturing equipment. The company works closely with its customers, often years in advance, to develop the technologies that will enable future chip designs. This collaborative approach ensures that ASML's innovations are aligned with the needs of the semiconductor industry and can be quickly adopted into production processes.

The geopolitical importance of ASML's technology has also come into focus in recent years, with various countries recognizing the strategic value of having domestic access to advanced semiconductor manufacturing capabilities. This has led to increased government interest and investment in the semiconductor industry, potentially opening up new opportunities for ASML while also presenting challenges in navigating complex international relations.

As the semiconductor industry continues to evolve, ASML's position in the supply chain is likely to become even more critical. The company's ability to deliver increasingly sophisticated lithography systems will be a key factor in determining the pace of advancement in semiconductor technology, influencing everything from smartphone performance to the capabilities of artificial intelligence systems.

Challenges and Opportunities Ahead

While ASML's outlook remains positive, the company faces several challenges and opportunities that will shape its future:

- Geopolitical Tensions: The ongoing technology rivalry between major global powers has put the semiconductor industry, and ASML in particular, in the spotlight. Navigating export controls and ensuring compliance with various national regulations while maintaining global operations is a significant challenge.

- Supply Chain Resilience: The COVID-19 pandemic highlighted the importance of robust and flexible supply chains. ASML continues to work on diversifying its supplier base and improving its supply chain resilience to mitigate potential disruptions.

- Talent Acquisition and Retention: As the complexity of semiconductor technology increases, attracting and retaining top engineering talent becomes crucial. ASML faces competition not just from other semiconductor companies, but from the broader tech industry in its quest for skilled professionals.

- Sustainability Pressures: With increasing focus on environmental sustainability, ASML faces the challenge of improving the energy efficiency of its systems and reducing the overall environmental impact of chip manufacturing.

- Emerging Technologies: The rise of new computing paradigms, such as quantum computing and neuromorphic computing, presents both challenges and opportunities for ASML. The company needs to stay ahead of these trends and potentially adapt its technologies to support new forms of chip design and manufacturing.

- Market Cyclicality: The semiconductor industry is known for its cyclical nature. While ASML has demonstrated resilience, managing through industry downturns and capitalizing on upswings remains an ongoing challenge.

Despite these challenges, ASML is well-positioned to capitalize on several significant opportunities:

- Artificial Intelligence Boom: The explosive growth in AI applications is driving demand for the most advanced semiconductor nodes, where ASML's EUV technology is critical.

- 5G and Edge Computing: The rollout of 5G networks and the growth of edge computing are creating new demand for a wide range of semiconductor products, potentially expanding ASML's market.

- Automotive Electrification: The shift towards electric vehicles is increasing the semiconductor content in cars, opening up new opportunities for ASML in the automotive sector.

- Industry 4.0: The ongoing digital transformation of manufacturing and other industries is driving demand for sensors, microcontrollers, and other semiconductor components, potentially broadening ASML's customer base.

- Government Investments: Increased government focus on domestic semiconductor manufacturing capabilities could lead to new fab investments, driving demand for ASML's products.

Conclusion: ASML's Pivotal Role in Shaping the Future

As we look beyond ASML's Q2 2024 results, it's clear that the company is poised to play a crucial role in shaping the future of the semiconductor industry and, by extension, the broader technology landscape. With its cutting-edge lithography technology, strong financial performance, and strategic focus on innovation, ASML is well-positioned to capitalize on the growing demand for advanced semiconductor solutions.

The company's ability to navigate through a transition year while maintaining strong sales and profitability demonstrates its resilience and strategic importance in the global technology ecosystem. As the semiconductor industry continues to evolve and recover, ASML's technologies will remain at the heart of the innovations that drive our increasingly digital world.

"ASML's role in the semiconductor industry is more critical than ever," concludes Peter Wennink. "As we look to the future, we see tremendous opportunities to drive technological progress, enable new applications, and contribute to solving some of the world's most pressing challenges through the power of advanced semiconductor technology."

Investors, industry observers, and technology enthusiasts alike will be watching ASML closely in the coming quarters. The company's performance and technological advancements will have far-reaching implications not just for the semiconductor industry, but for the broader technology sector and the global economy as a whole. As we move further into the age of artificial intelligence, quantum computing, and other transformative technologies, ASML's innovations will continue to be a driving force behind the devices and systems that are reshaping our world.

Frequently Asked Questions

What are the future plans of ASML?

ASML's future plans focus on several key areas:

- Capacity Expansion: ASML is ramping up its production capacity to meet growing demand, particularly for advanced EUV systems.

- Technological Innovation: The company is investing heavily in R&D, with a focus on next-generation High-NA EUV technology and computational lithography.

- Market Diversification: While maintaining its strong position in logic and foundry segments, ASML is targeting growth in memory and emerging market segments like automotive semiconductors.

- Sustainability: ASML is committed to improving the energy efficiency of its systems and reducing the environmental impact of semiconductor manufacturing.

- Talent Development: The company is investing in programs to attract and retain top engineering talent to support its ambitious R&D goals.

What is ASML's earning forecast?

While ASML doesn't provide specific earning forecasts for future quarters, the company has shared some guidance for the near future:

- Strong Second Half: ASML expects a strong second half of 2024, with net sales projected to be significantly higher compared to the first half.

- Full-Year Growth: The company anticipates full-year 2024 net sales to grow by a low double-digit percentage compared to 2023.

- Margin Expectations: ASML expects its gross margin to remain robust, supported by a favorable product mix and operational efficiencies.

It's important to note that these projections are subject to market conditions and other factors that may impact the semiconductor industry.

What are the future earnings for ASML?

While specific future earnings figures aren't provided, ASML's future earnings are expected to be driven by several factors:

- Increasing Demand: Growing demand for advanced semiconductor technology, particularly in AI, 5G, and high-performance computing applications, is likely to boost ASML's sales and earnings.

- Product Mix: A higher proportion of sales from advanced systems, particularly EUV lithography tools, could positively impact earnings due to their higher margins.

- Operational Efficiency: Ongoing efforts to improve operational efficiency and manage costs could contribute to earnings growth.

- Market Recovery: As the semiconductor industry continues to recover and grow, ASML's earnings are expected to benefit from increased customer investments in capacity and technology.

What is the expected growth of ASML?

ASML's expected growth is underpinned by several key drivers:

- Semiconductor Industry Growth: ASML expects to benefit from the overall growth of the semiconductor industry, which is projected to reach $1 trillion by 2030.

- EUV Adoption: Increasing adoption of EUV technology in both logic and memory chip production is expected to drive ASML's growth.

- Technological Advancements: The introduction of High-NA EUV systems in the coming years is anticipated to open up new growth opportunities.

- Market Expansion: Growth in emerging segments such as automotive semiconductors and power electronics could provide additional avenues for expansion.

- Long-term Trends: The ongoing digital transformation across industries and the increasing importance of semiconductors in various applications are expected to support ASML's long-term growth.

"We remain confident in the semiconductor industry's long-term growth prospects and ASML's pivotal role in enabling that growth," reiterates Peter Wennink, ASML's President and CEO. "Our technology roadmap, aligned with the needs of our customers and the broader industry, positions us well to capitalize on the opportunities ahead."

It's worth noting that while ASML's growth outlook is positive, the semiconductor industry is cyclical, and short-term fluctuations can occur. However, the company's strong market position, technological leadership, and the increasing importance of semiconductors in the global economy support a positive long-term growth trajectory.