Followed by my first post on Amazon, the discussion about Amazon extended from the eCommerce to the cloud business.

It was personally shocking to see people mocking AWS on Twitter. After years of following companies and talking to industries expert, AWS is one of the very few genuinely admired in the industry.

Regardless of the stock price, the business performance it’s admirable, especially considering how large the company already is.

So, I decided to write this post to explain why I believe that AWS enjoys a long-term sustainable competitive advantage versus its primary peer, Azure.

A fundamental characteristic is its architecture, making AWS a unique player in the PaaS industry. I hope you enjoy the reading.

AWS, Azure, GCP?

When it comes to selecting which cloud service provider your company will hire, you’ll probably go for all of them.

Most companies and enterprises are multicloud, to begin with. Definitely two, and actually, quite a number of them are using all the big three: AWS, Azure, and Google.

However, there is a misconception about how the client switch between platforms. It doesn’t happen like this: “wow, today I’m going for Azure because we used AWS yesterday.” Usually, when your workflow is in the cloud, it stays there.

The companies' decision depends on the workflow they have to deal with. So, going forward, we’ll avoid mentioning GCP.

Some customers decide to go to GCP for their marketing analytics because GCP tends to have more developed, mature solutions for analyzing data from a marketing perspective.

Of course, they got the whole Google Ads and all those services. Some customers are already leveraging that. So, therefore, they'll move their entire marketing workload to Google.

Therefore, we see GCP as a way of strengthening Google’s dominant position in the Ads market, not necessarily competing against Azure or AWS.

Both Microsoft and Amazon have their own Ads manager platform. Even though they’re inferior to Google in many senses, processing the campaign data in a different cloud provider could jeopardize the company’s dominance.

Clash of Titans

Except if the company is processing analytics related to marketing when they first make that move to the cloud, that's when they decide whether it's AWS or Azure.

Then, in our opinion, we have to sort of clients: enterprise, others. So let’s go over an enterprise in this topic. In some cases, they have complex SAP, then they'll look at which cloud provider provides that exact specification for their SAP environment in terms of actual memory configuration.

That would be a good fit for them and at a reasonable price point. They'll take AWS over Azure or vice versa, depending on what they have on-premise and the workflow they’ll allocate on each.

We frequently heard that the cloud is about pricing, though I’ve never heard it from anyone who used it. Indeed, price is a huge factor, but it’s more complicated than pricing.

Several variables influence which service provider you’ll go for. For instance, who the customer is, who are their clients, and their size as an enterprise?

Size is an underestimated factor. If the client uses an SAP, it is usually very sticky with various workloads. In the majority of our interviews, the interviewee laughed when we asked about how hard it was to move to a different cloud service provider after you’re settled.

So, yeah… Sticky to clients. Of course, if AWS or Azure is willing to give a substantial discount, the CTO will have a considerable challenge ahead.

Also, we noticed a parallel in enterprise clients with existing Microsoft .NET shops. It may sound like a legacy (and it is), but many enterprises are using it. Check out this link if you’re curious.

If you’re from Azure’s sales team and had access to that info — which you certainly did —it’s time to book a new client. Follow us…

If you’re running a .NET shop, your enterprise has a big chance to have a huge Windows 2008 installed somewhere there, even though you should have migrated a decade ago.

If you’re Microsoft, is there a better way of squeezing the client by telling him that you’re cutting his Windows 2008 support unless he picks up Azure?

Even though AWS may win the whole process, the enterprise will have some commitment to Azure and share the spending.

So, instead of going all-in AWS, let’s spend an amount on Azure and then move to AWS. This makes Microsoft a beast selling to enterprise clients and differentiating itself from AWS.

So, Why AWS?

As we mentioned previously, considering its applications, Azure is focused on enterprise, and also because of its sales effort.

There are two general uses of clouds. One is what's it's called infrastructure as a service (“IaaS”), which Microsoft is an exceptional player.

That's more where the focus is on basically setting up VMs in the cloud-like storage. There are a few types of VMs, such as compute-focused, network-focus, and memory-focus.

So, if the solution is IaaS-based, it's more along those lines of typical storage, computing, and networking. That was more significant earlier on.

Nowadays, the trend is to leverage PaaS, a platform as a service. This makes the environment more cloud-native and cost-effective if they take advantage of the cloud provider's PaaS services.

That’s the winner model. You could have microservices functions in the case of Azure and Kubernetes. Then, you have the whole container movement where they want to break down an application to various components.

Initially, Microsoft decided to launch Azure Cloud, then came to infrastructure later. They went with the many services, and then they changed the infrastructure much later.

Microsoft focused on creating powerful VMs, alongside storage services for its products, then the microservice functions in Azure, which led to several changes in the infrastructure.

So, even though Microsoft has all the technology, the scalability and the architecture of the AWS platform are excellent.

In our opinion, that’s why AWS is superior. Microsoft did it backward! That’s why they have some challenges around scalability and reliability.

We’re not saying that Azure is not a good solution. We’ve never heard it. However, it is a usual complaint with certain limitations and restrictions in the service, resulting in some trust issues for a few clients.

AWS, on the other hand, every start-up uses its service. So the answer is always easy to use, scalable, and reliable.

The company started with the end goal of becoming a PaaS business, not just an infrastructure provider. Believe this is a brilliant and unique perspective that just a company like Amazon could possibly have.

Let’s remember that AWS was born to support the marketplace, creating microservices to improve Amazon’s business.

So, from ground zero, AWS was built as a microservice platform to solve the issues that a business such as Amazon had – this is possibly the best sandbox ever.

In our opinion, this advantage cannot be replicated. For instance, once Microsoft has spent over $60bn creating and allocating its clients in Azure, they cannot simply create a new one and plug their clients there.

So, we see AWS positioned in a privileged position in the competitive landscape, and considering the industry size, it’ll generate a high yield of durable returns for decades.

Competition Isn’t a Problem, Yet

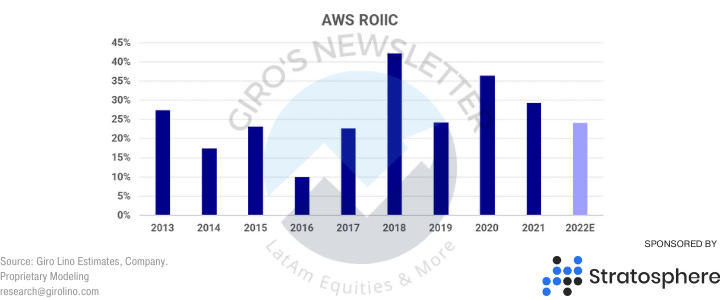

We bet there are thousands of ways to analyze the competition in a specific market. But, in our opinion, one of the most simple though effective ways is through a ROIIC analysis.

You can notice there is an incremental “I” in this ROIC. It’s right. The Return on Incremental Invested Capital is calculated by the Nopat generated by a specific growth Capex.

We define Capex as the properties expensed the depreciation plus the net working capital for the operation.

So, AWS is yielding an incremental 25% return on all the capital reinvested in operation, ranking as one of the few companies at that size capable of doing so.

This is a strong indication that AWS enjoys one, or more, relevant competitive advantages, agreeing with the fundamental points we disclosed before.

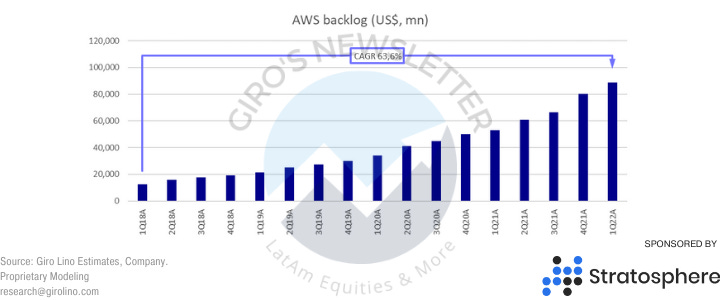

Also, many investors are focused on reported sales and missing the big picture on AWS. Look at the sales backlog. There is an overestimated mismatch between backlog and actual sales that doesn’t matter for a business such as AWS.

Backlogs show information on goods that have been sold but cannot be invoiced yet, and, therefore, is an excellent leading indicator for sales.

The industry has barely entered a competitive mode. Seriously, barely. Most companies are presenting growth Capex inferior to depreciation, yielding high ROIIC, which is a sign of no/low, competitive pressure or business exhaustion.

However, we believe that companies are being overly cautious, making all the fine-tuning needed before a higher Capex cycle. In our view, Amazon will debut the next leg up in the cloud industry.

Finally, even though we recognize and critique the company ourselves, we must distinguish what noise and information. AWS is an outstanding business with unique competitive advantages.

Going forward 10 years, we have serious difficulties imagining a scenario where AWS will not be thriving.

I’m a value-oriented and diligent investor, so putting all this information together and developing an analysis over it takes several hours.