In the ever-evolving stock market landscape, specific sectors occasionally outshine others, drawing significant attention from investors. Recently, the "Magnificent 7" (Mag7) tech stocks have delivered exceptional returns, capturing the spotlight with their impressive performance. As we navigate these dynamic times, it becomes increasingly important to consider diversification and the strategic inclusion of defensive sectors in our portfolios.

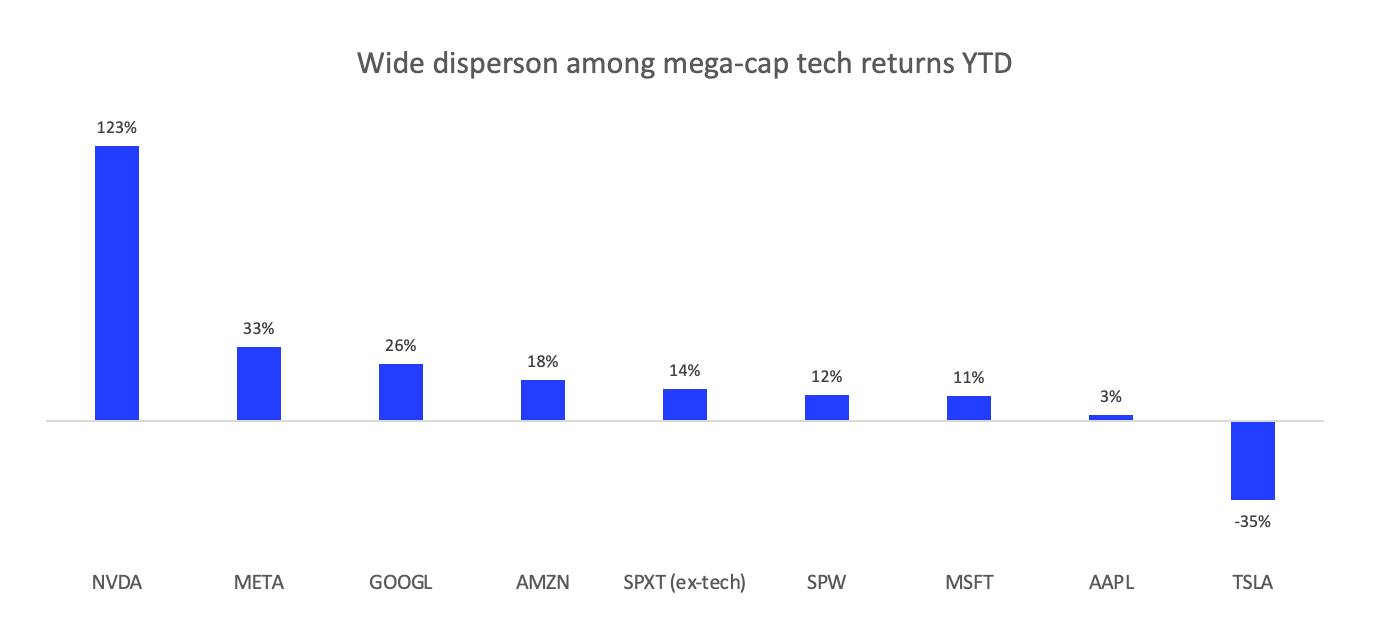

The Mag7 tech stocks—NVIDIA (NVDA), Meta (META), Alphabet (GOOGL), Amazon (AMZN), Microsoft (MSFT), Apple (AAPL), and Tesla (TSLA)—have been the standout performers this year. These giants have shown remarkable growth, driven by technological advancements and increasing demand for AI and cloud computing solutions. NVIDIA, in particular, has surged due to its leadership in AI technology, underscoring the growing importance of AI across various sectors. Below is a chart illustrating the year-to-date performance of these tech stocks:

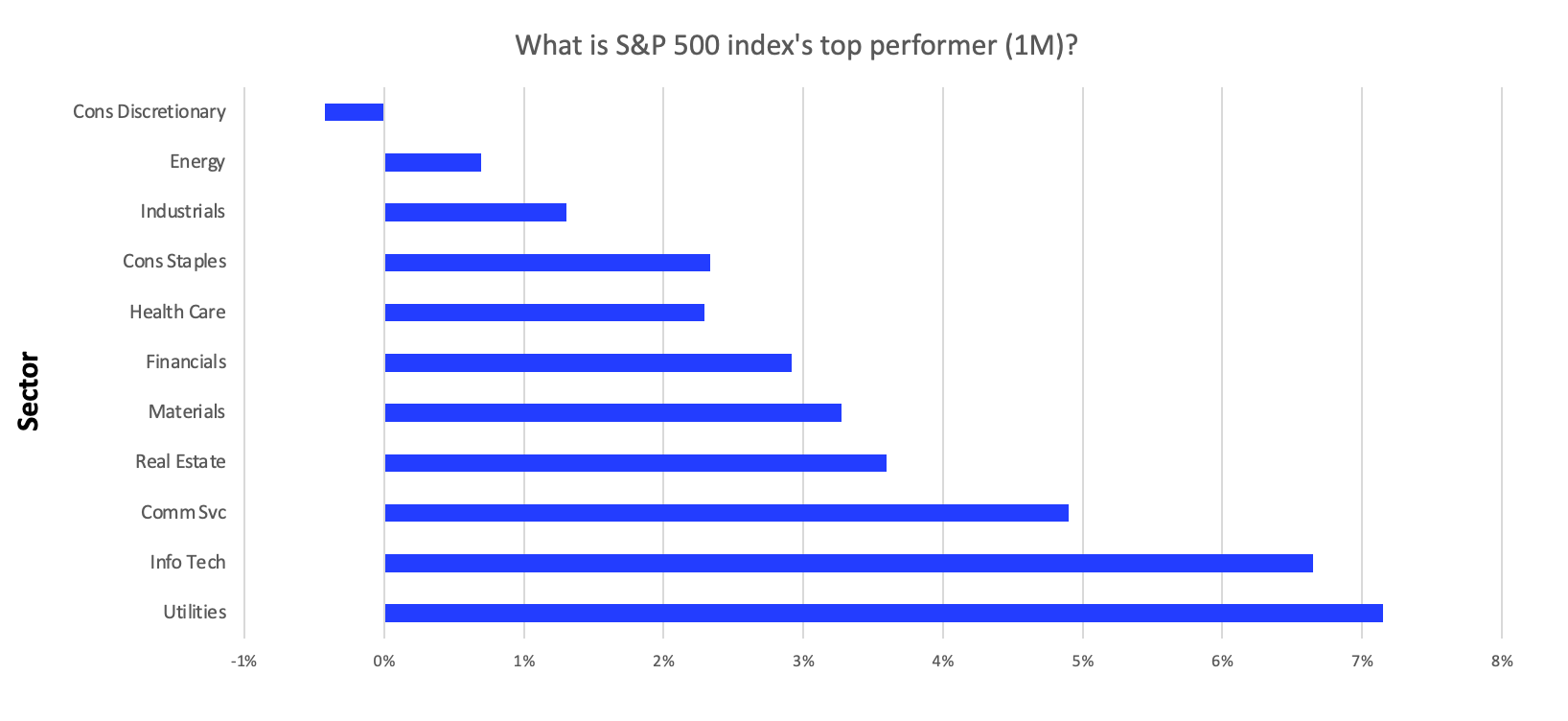

The tech sector's resilience is further highlighted by its strong performance over the past month, as shown in the chart below. This trend underscores the market's confidence in technology-driven growth:

However, while the Mag7 stocks have driven significant market gains, this exceptional performance raises questions about valuations and potential overvaluation risks. For a deeper dive into the AI revolution and its impact on the tech sector, read our previous post: Navigating the AI Revolution.

As we move further into the year, it’s crucial to watch broader market trends and economic forecasts that could influence investment decisions. The recent strong performance of tech stocks is part of a larger market narrative influenced by various macroeconomic factors. For more insights into navigating market turbulence, check out our post: Navigating Market Turbulence.

Utilities and AI Exposure

While tech stocks have captured the spotlight with their impressive gains, it's essential to consider the role of defensive sectors in a balanced investment strategy. Traditionally viewed as a defensive play, the Utilities sector has shown robust performance recently, providing a counterbalance to the high volatility often associated with tech stocks.

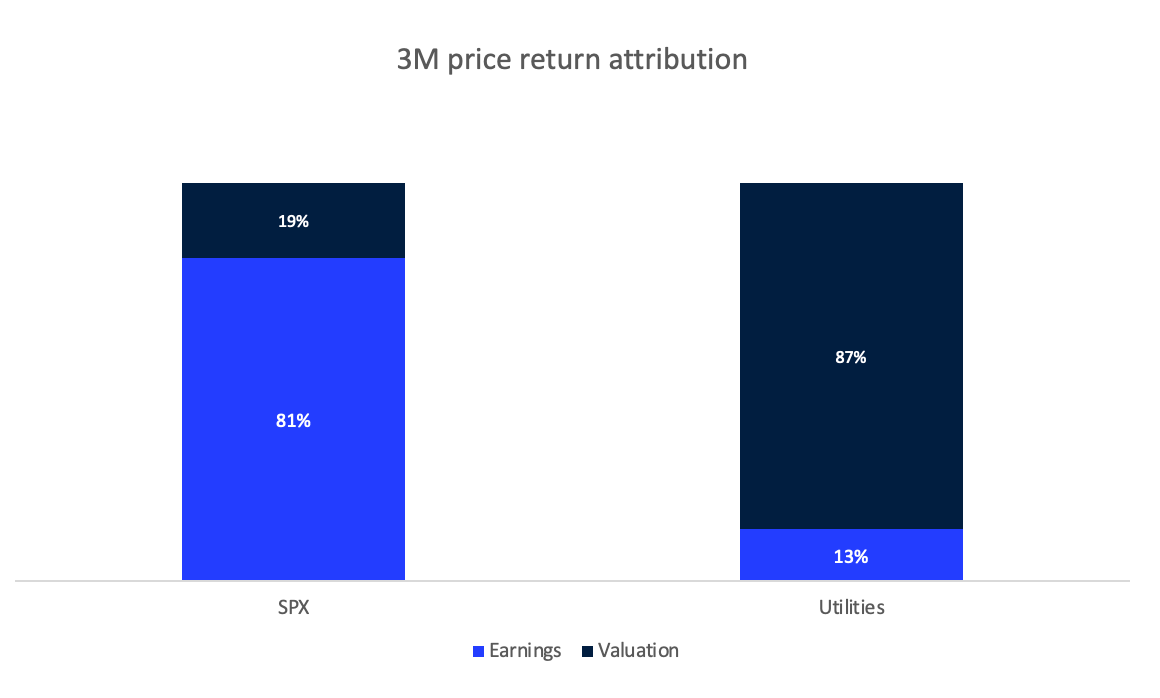

Over the past three months, the Utilities sector has been the best-performing sector in the S&P 500, delivering a remarkable 16% return. This performance is driven primarily by valuation expansion rather than improved near-term earnings expectations. The sector's P/E multiple has increased from 15x to 17x, contributing significantly to the price return. Despite this strong performance, Utilities remain reasonably valued relative to their historical averages. The sector’s forward P/E ratio of 17.2x aligns with its 10-year average and well below peak valuations. This suggests that while Utilities have rallied, they are not excessively overvalued compared to historical standards.

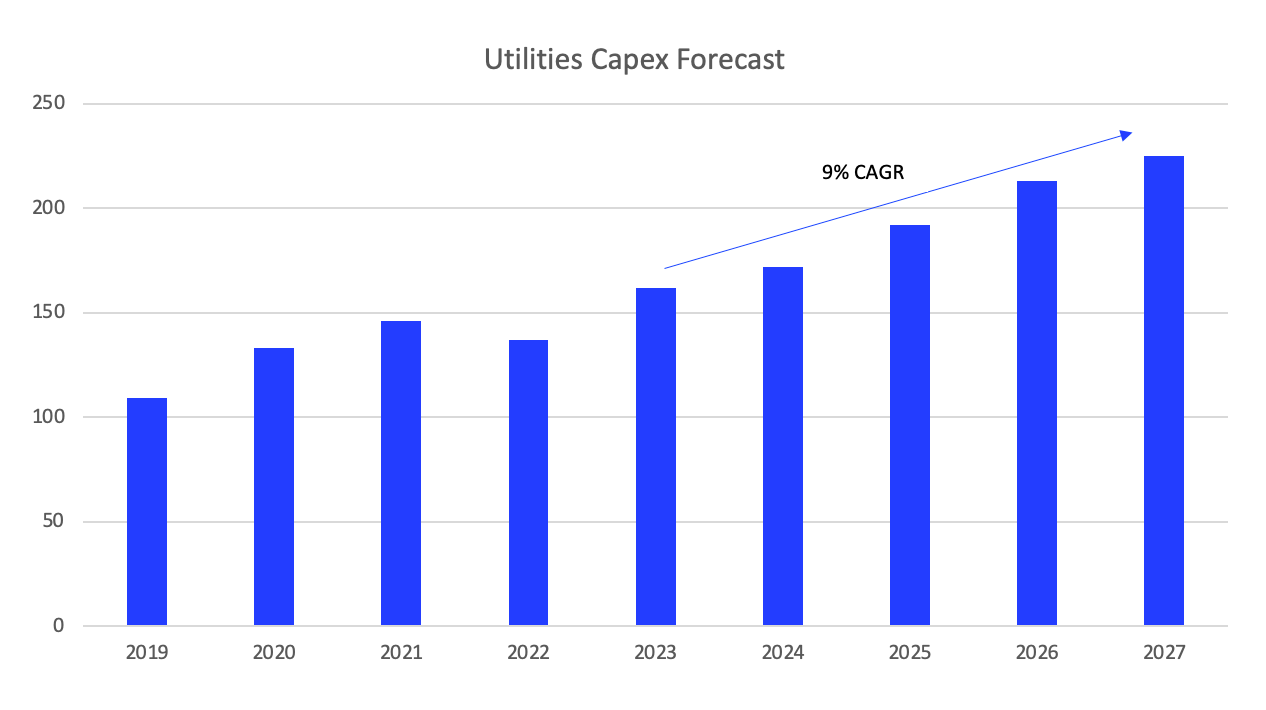

The AI revolution is transforming technology companies and creating ripple effects across various sectors, including Utilities. As data centers and AI applications demand more power, Utilities are poised to benefit significantly. This indirect exposure to the AI boom makes Utilities an attractive option for investors seeking stability and growth potential. Our equity analysts forecast that capex in the Utilities sector will increase by approximately 36% from 2024 to 2027 compared to the previous four years, driven by AI demand and a slowdown in energy efficiency gains.

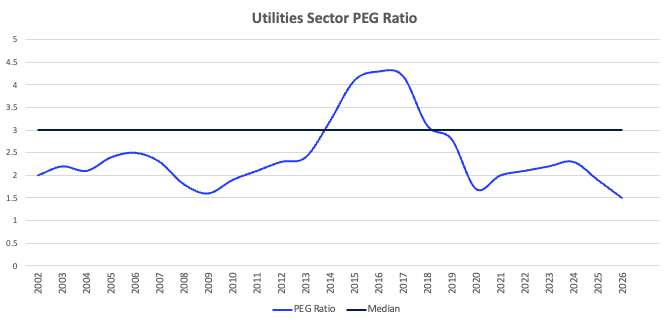

Moreover, consensus long-term EPS growth expectations for the Utilities sector have risen to 8%, similar to expected FY3 EPS growth. This increase in growth expectations is typically associated with higher valuations. However, when adjusting valuations to improve long-term EPS growth, the Utilities sector’s PEG ratio remains below historical averages, indicating reasonable valuations despite the recent rally.

For a deeper understanding of current market trends and economic forecasts, which also affect the Utilities sector, read our previous post, The S&P 500: A Nuanced Valuation Perspective.

Investing in Utilities provides a way to gain exposure to the AI thematic without the high volatility associated with tech stocks. It offers a more stable and defensive approach while still participating in the growth driven by technological advancements.

Investment Thesis

In today's dynamic market environment, striking the right balance between high-growth tech stocks and defensive sectors is crucial for maintaining a resilient portfolio. The recent performance of the Mag7 tech stocks—NVIDIA (NVDA), Meta (META), Alphabet (GOOGL), Amazon (AMZN), Microsoft (MSFT), Apple (AAPL), and Tesla (TSLA)—has undoubtedly been impressive. However, the volatility and potential overvaluation risks associated with these stocks cannot be ignored. On the other hand, the Utilities sector offers a more stable and defensive investment, with the added benefit of indirect exposure to the AI thematic.

Diversification is critical to mitigating risk and ensuring long-term growth. By balancing investments in high-growth tech stocks with more stable sectors like Utilities, investors can protect their portfolios against market downturns while still participating in significant upside potential. For instance, an investor might consider holding shares in leading tech companies alongside major utility firms.

Regarding tactical allocation, strategically investing in the Mag7 tech stocks allows you to capitalize on their growth potential driven by advancements in AI and technology. At the same time, allocating a portion of your portfolio to the Utilities sector provides steady returns and benefits from increased power demand due to AI. This approach leverages the high-growth prospects of tech while maintaining stability through utilities.

Let's explore some utility companies that are well-positioned to benefit from the AI-driven demand for power:

NextEra Energy (NEE) is aggressively expanding its renewable energy capacity to meet the surging demand from AI data centers. The company plans to build more than 3 gigawatts of clean power generation for data centers. They have developed a system to identify new data center locations based on solar and wind resources, aiming to leverage their renewable energy portfolio to support AI-driven power demand. NextEra's CEO, John Ketchum, highlighted that the electricity demand growth rate is expected to increase by 81% over the next five years, driven by AI, electrification, cloud capacity, and chip factories. The company sees a 15% compound annual growth rate (CAGR) for data center demand through the end of the decade.

Duke Energy (DUK) invests heavily in new natural gas generation to meet the unprecedented demand from AI-powered data centers. The company plans to build more than 2 gigawatts of new natural gas generation in the Carolinas, with construction starting in 2026. Duke Energy is also collaborating with tech giants like Microsoft, Amazon, and Google to develop cost-effective clean energy solutions and to tap into generators installed at data centers to add electricity to the grid during high-demand periods. These strategic partnerships reflect Duke Energy's commitment to meeting the rising electricity demand from AI data centers.

Southern Company (SO) is exploring the use of AI to manage the transition to increased electric vehicle (EV) adoption and to optimize grid operations. They are working with WeaveGrid to manage EV charging and to collect data on EV charging habits to make load growth predictions. Southern Company expects data centers to significantly boost its electricity sales growth, projecting a 6% annual growth rate from 2025 to 2028, up from the previous estimate of 1-2%. Additionally, Southern Company invests in renewable energy projects and energy storage solutions to support the growing power demand from AI data centers and other sectors.

Entergy Corporation (ETR) is focusing on grid upgrades and expanding its renewable energy capacity to meet the increasing electricity demand from AI data centers. The company is well-positioned in the Southeast U.S., a region experiencing significant growth in data center development. Entergy's investments in clean energy and infrastructure improvements are aimed at capitalizing on the AI-driven surge in electricity demand, particularly in its service areas.

Xcel Energy (XEL) is investing in renewable energy and infrastructure to support the growing electricity needs of AI data centers. The company is recognized for its strong regulatory environment and strategic initiatives to meet the rising power demand. We highlight Xcel Energy as a top pick due to its data center growth exposure and proactive approach to integrating renewable energy solutions.

ETFs and sector-specific funds offer a convenient way to gain exposure to both high-growth and defensive sectors. For example, investing in an ETF like the Invesco QQQ Trust (QQQ) can provide broad exposure to the tech sector, including the Mag7 stocks. Similarly, the Utilities Select Sector SPDR Fund (XLU) offers a diversified and stable investment in the Utilities sector.

Regularly rebalancing your portfolio ensures you maintain your desired allocation and risk level. This can involve selling some of your high-performing tech stocks to lock in gains and reinvesting in undervalued defensive sectors like Utilities. By strategically balancing high-growth tech stocks with defensive Utilities, investors can build a resilient portfolio that leverages technology's growth potential while maintaining stability through more predictable sectors.

For more insights on navigating market turbulence and making strategic investment decisions, check out our post: Navigating Market Turbulence.

Navigating Market Uncertainties

While the strategies of balancing high-growth tech stocks with defensive sectors like Utilities can provide a robust investment approach, it's crucial to be aware of the inherent risks and uncertainties in the market. Understanding these risks can help investors make informed decisions and better navigate potential challenges.

Overvaluation Concerns:

Many analysts consider the S&P 500, driven in part by the stellar performance of the Mag7 tech stocks, overvalued. High valuations can lead to increased market volatility and potential corrections, especially if earnings growth fails to meet market expectations or if macroeconomic conditions deteriorate.

Interest Rates:

Higher interest rates present a significant risk to the market, particularly for sectors like Utilities that are often seen as bond proxies. Rising interest rates increase borrowing costs, impacting corporate profits and investor sentiment. Unexpected changes in monetary policy could adversely affect market performance.

Economic Slowdown:

An economic slowdown or recession can impact earnings across all sectors, including high-growth tech stocks and defensive Utilities. While Utilities may offer more stability during downturns, they are not entirely immune to broader economic challenges, potentially leading to earnings revisions and slower growth.

Regulatory Changes:

The Utilities sector is heavily regulated, and shifts in regulations or policies can significantly affect profitability. New environmental regulations or changes in energy policies, for instance, could increase utility companies' operational costs.

Market Sentiment and Volatility:

Market sentiment can change rapidly, leading to increased volatility. High-growth tech stocks, in particular, may experience sharp price swings due to sentiment, news, or earnings reports changes. Although Utilities might buffer against volatility, they are not entirely shielded from market-wide shocks.

For a more detailed analysis of market valuation concerns, see our previous post, The S&P 500: A Nuanced Valuation Perspective.

By being aware of these risks, investors can better navigate the market's uncertainties and make more informed investment decisions.

Embrace Strategic Diversification

As we navigate these dynamic times, the need for a balanced investment approach becomes ever more critical. The Mag7 tech stocks have shown remarkable performance, driven by technological advancements and the AI revolution. At the same time, the Utilities sector offers a stable, defensive investment with the added benefit of indirect exposure to AI-driven power demand.

Investors can create a resilient portfolio that captures the best of both worlds by strategically balancing investments in high-growth tech stocks and defensive sectors like Utilities. Stay informed about market trends and economic forecasts, and regularly review your portfolio to ensure it aligns with your investment goals.

For further insights and a deeper understanding of market trends, economic forecasts, and strategic investment decisions, explore our previous posts:

- Navigating the AI Revolution

- Navigating Market Turbulence

- The S&P 500: A Nuanced Valuation Perspective

Stay tuned for more market insights and strategies to help you navigate the complexities of investing in today's market.