Giro's Recap

ASML Reports its 2Q24 earnings

ASML's Q2 2024 results demonstrate the company's continued dominance in the semiconductor equipment market, with €6.2 billion in sales and €4.5 billion in new bookings. Despite challenges, ASML maintains its technological leadership in EUV and High-NA lithography, crucial for advancing chip manufacturing. The company's strong performance, driven by AI-related demand and ongoing digital transformation across industries, positions ASML at the forefront of enabling future technological innovations. With a robust financial position and clear long-term strategy, ASML is well-equipped to shape the future of the semiconductor industry and the broader technology landscape.

ASML's cutting-edge lithography technology enables the production of increasingly advanced semiconductor chips, powering the future of digital innovation.

NFLX Reports its 2Q24 earnings

Netflix's Q2 2024 earnings report reveals exceptional performance across all metrics. The company added 8.05 million new subscribers, bringing its global total to 277.65 million. Financial results were equally impressive, with revenue up 17% year-over-year to $9.56 billion. The success of the ad-supported tier, accounting for 45% of new sign-ups, and strategic moves into live programming highlight Netflix's adaptability. With raised full-year guidance and continued investment in content and technology, Netflix demonstrates its ability to innovate and maintain leadership in the competitive streaming landscape, despite potential economic challenges ahead.

Netflix's Q2 2024: Skyrocketing growth, diverse content, global reach, and ad-tier success fuel streaming dominance

Major IT Outage Hits the World

In July 2024, a faulty software update from cybersecurity leader CrowdStrike triggered a widespread IT outage, affecting businesses, airlines, and healthcare systems worldwide. This incident exposed the vulnerabilities in our interconnected digital infrastructure and highlighted the potential risks of relying heavily on single security providers. The event caused significant disruptions across multiple sectors, including major airlines, healthcare systems, and even Microsoft services. While CrowdStrike responded swiftly, the incident serves as a wake-up call for organizations to develop more robust incident response plans and adopt multi-layered security approaches. This post explores the causes, consequences, and lessons learned from this unprecedented cybersecurity event.

CrowdStrike's 2024 global outage exposes cybersecurity vulnerabilities across industries

Value Investing: Timeless Strategy for Wealth Creation

This comprehensive post explores value investing, a time-tested strategy for long-term wealth creation. From its origins with Benjamin Graham and David Dodd to its evolution under Warren Buffett and Charlie Munger, we delve into the core principles that have made value investing a powerful tool for generations of investors. The post examines why value investing remains relevant in today's fast-paced markets, discussing its adaptability to various market conditions, its role in risk management, and its alignment with sustainable investing practices. Whether you're a seasoned investor or just starting out, this exploration of value investing offers insights into a disciplined, analytical approach that can help navigate market volatility and potentially achieve superior long-term returns.

The Evolution of Online Shopping: How Mercado Libre is Transforming eCommerce and Online Sales in Latin America

Disclaimer: As of 2024/07/21, I hold MELI shares in my personal account.

In the dynamic world of eCommerce, businesses selling online in Latin America, particularly Brazil, continue to evolve rapidly. Our 2022 analysis highlighted the competition between Mercado Libre (Meli) and Sea Limited's Shopee, alongside other major players in the Brazilian online shopping space. Now, in 2024, we revisit this landscape to see how the market for online sales has shifted.

Our previous examination showcased strong performances from both Mercado Libre and Shopee, with the latter carving out its niche in Brazil's digital marketplace. We anticipated that the following years would focus on execution, with numerous opportunities for savvy operators to capture market share across various categories.

Two years on, Brazil's eCommerce market has matured significantly. This updated analysis explores how our 1Q22 predictions have played out, examining current eCommerce penetration, market share shifts among top players, and diving deep into the performance metrics of industry leader Mercado Libre. We'll see how consistent growth, strategic execution, and profitability have shaped the competitive landscape for online stores and compare the trajectories of key players like Sea Limited to our earlier expectations.

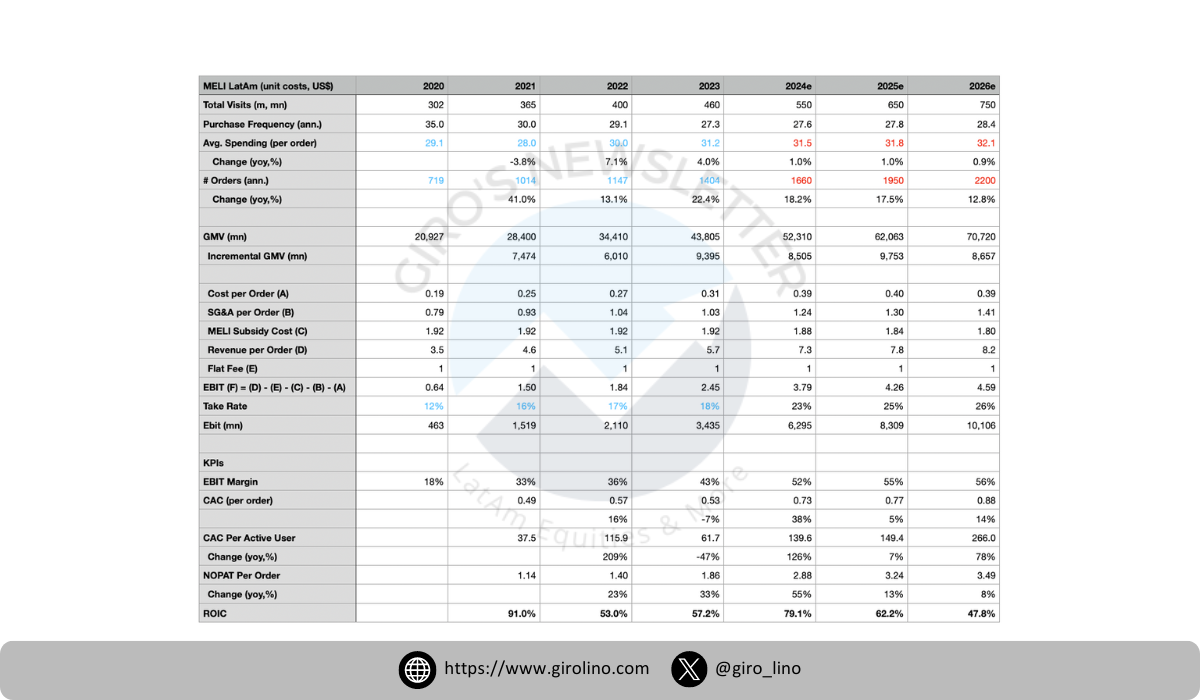

To truly understand the value proposition of these eCommerce giants, we've employed sophisticated valuation techniques. We calculated Mercado Libre's unit economics using the Earnings Power Value (EPV) methodology, a cornerstone of value investing. This approach involved meticulously analyzing MELI's income statement, studying its history, and assessing the business's true return.

This deep-dive valuation is crucial for investors navigating the complex world of high-growth tech companies. For those intrigued by this methodology and eager to learn more about applying value investing principles to modern markets, our eBook on Value Investing offers invaluable insights to help you identify true value in today's dynamic digital commerce landscape.

Join us as we explore the latest trends, dissect the numbers, and provide insights into the future of eCommerce in Brazil. Whether you're an investor, industry professional, or simply interested in online purchases and digital commerce dynamics, this analysis offers valuable perspectives on one of the most important eCommerce markets in Latin America.

The Rapid Evolution of Online Shopping in Brazil: MercadoLibre's Dominance in a Market in Overdrive

When we last examined the Brazilian eCommerce landscape in early 2022, we witnessed a market undergoing dramatic transformation. Fast forward to 2024, and the online shopping scene has evolved in unexpected ways, with stark contrasts between the sector's leader and other businesses selling online.

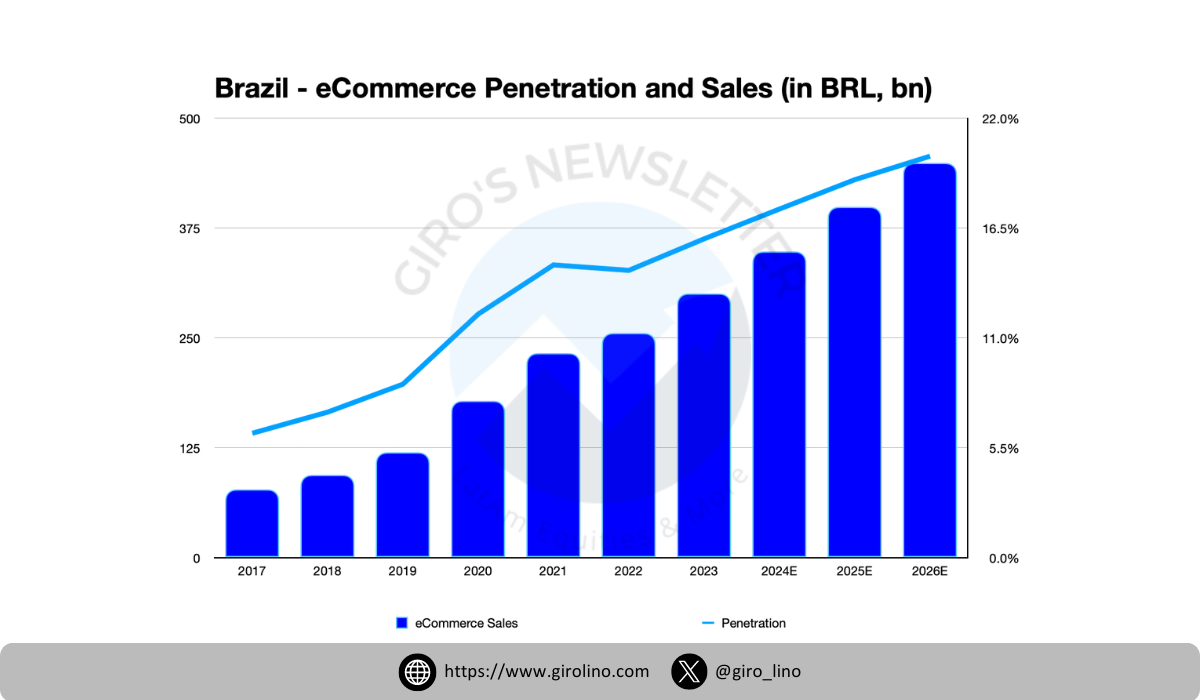

The numbers tell a compelling yet complex story. eCommerce penetration in Brazil has reached 16%, a figure that seemed overly optimistic just two years ago. However, this growth in online sales has not benefited all players equally. While the overall market for online purchases has expanded, the past two years have been challenging for most companies in the sector, with one notable exception: Mercado Libre.

The sheer volume of eCommerce sales has indeed grown, reaching R$300 billion (~US$55 billion) in the past year. But this growth has been largely captured by a single player, while other online stores have struggled to maintain their positions or even survive.

What's driving this divergence? While improved logistics, widespread smartphone adoption, and innovative payment options have contributed to the sector's overall growth, not all companies have been able to capitalize on these trends equally. Mercado Libre's integrated ecosystem of marketplace, payment platform, and logistics has proven to be a winning formula for online shopping, while others have faltered.

The starkest examples of this struggle are Via and Americanas. Via has filed for prepackaged Chapter 11 due to weaker-than-expected performance and has undergone senior management changes. Even more dramatically, Americanas filed for Chapter 11 following the revelation of a fraud scheme led by its C-level executives and major shareholders. These developments underscore the challenging environment facing even established players in the Brazilian eCommerce industry.

An out-of-court workout involves a financially distressed company negotiating directly with its creditors to restructure its debt without the formalities of court proceedings. This method is typically faster and less expensive than going through bankruptcy court. A prepackaged Chapter 11 Bankruptcy, on the other hand, is a hybrid approach where the company negotiates a reorganization plan with its creditors before filing for bankruptcy. The pre-negotiated plan is then quickly confirmed by the bankruptcy court, combining the benefits of out-of-court negotiations with the legal protections of a formal bankruptcy filing.

The year-over-year growth rate of 17% for the sector might seem encouraging, but it masks the widening gap between the market leader and other businesses selling online. This is not a slowdown; it's a consolidation of power in the hands of the most efficient and adaptable player.

As we look to the future, it's clear that we're witnessing a reshaping of the Brazilian eCommerce landscape. The question isn't just how the market for online sales will grow, but how this growth will be distributed among the remaining players.

Will any company be able to challenge Mercado Libre's dominance in Latin America? Can the traditional sellers recover from their setbacks, or will they be relegated to niche status? And how will the struggles of major players like Via and Americanas impact the overall market dynamics?

One thing's certain: the Brazilian eCommerce market of 2024 is radically different from what we observed in 2022. It's bigger and more integral to the Brazilian economy than ever before, but also more concentrated and challenging for most companies. For retailers, investors, and consumers alike, the message is clear: the future of Brazilian commerce is digital, but success in this future is far from guaranteed for all but the strongest players.

As we delve deeper into the data and trends shaping this market, one question looms large: in this new era of Brazilian eCommerce, can anyone catch up to Mercado Libre, or will we see further consolidation of its market leadership in online shopping?

Learn more about MercadoLibre

Online Shopping Trends: MercadoLibre's Dominance in Brazilian eCommerce Market Share

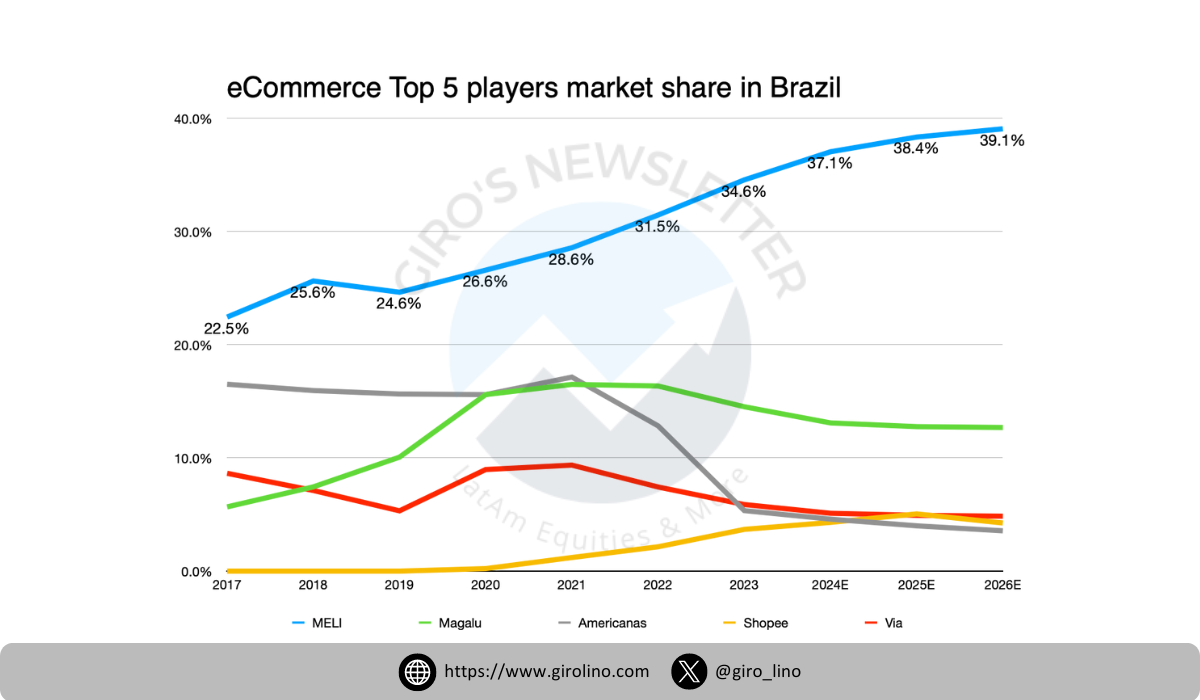

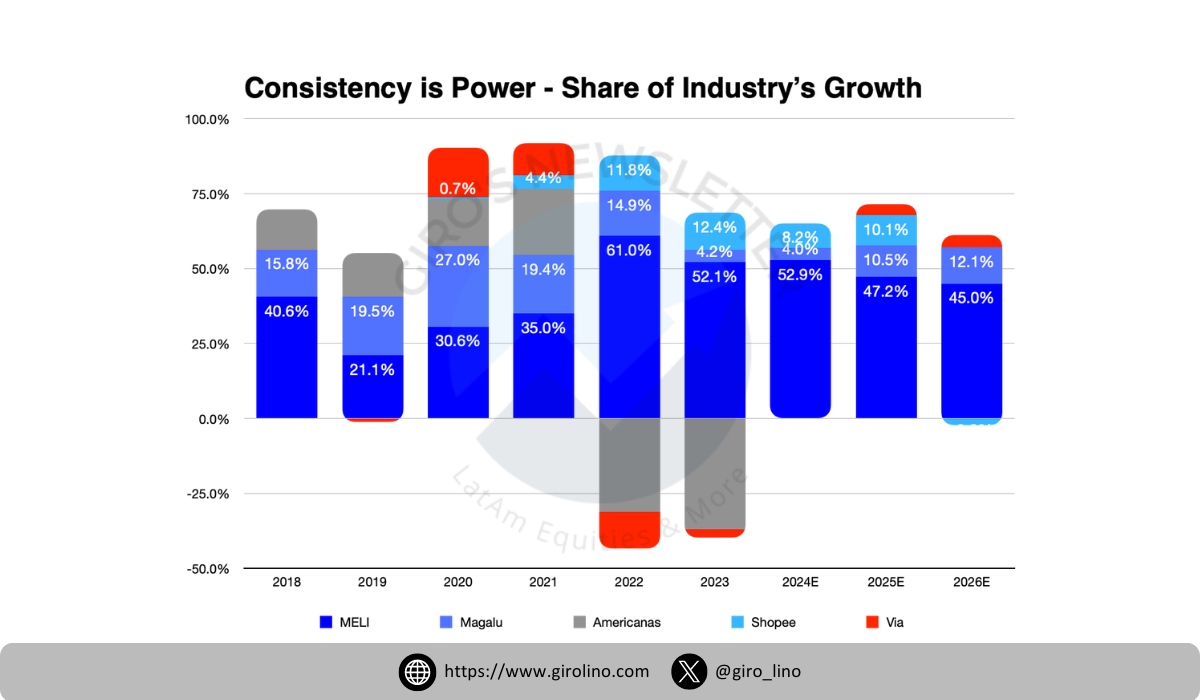

The Brazilian eCommerce market has undergone a dramatic transformation since our last deep dive in Q1 2022. What we once thought would be an intriguing battle for market share has instead become a story of Mercado Libre's overwhelming dominance in online sales and the struggle of other businesses selling online to remain relevant.

Mercado Libre, affectionately known as Meli, has not just maintained its crown but has solidified its reign in the world of online shopping. Our latest data shows Meli commanding an impressive 34.6% of the market in 2023, up from 31.5% in 2022, with projections reaching 37.1% market share in 2024. This growth isn't just a number – it's a testament to Meli's relentless execution and strategic foresight. They've managed to expand their moat, leveraging their marketplace, payment platform, and logistics network to create an ecosystem that's proving insurmountable for competitors.

The traditional players – Magalu, Americanas, and Via – have faced even greater challenges in selling online. Our prediction of their losing aggregate share has played out dramatically, with these once-dominant retailers now holding just 14.5%, 5.4%, and 5.9% of the market, respectively. The industry's unforgiving nature has been starkly illustrated by recent events: Via filed for prepackaged Chapter 11 due to weak performance, while Americanas faced a similar fate following a major fraud scandal.

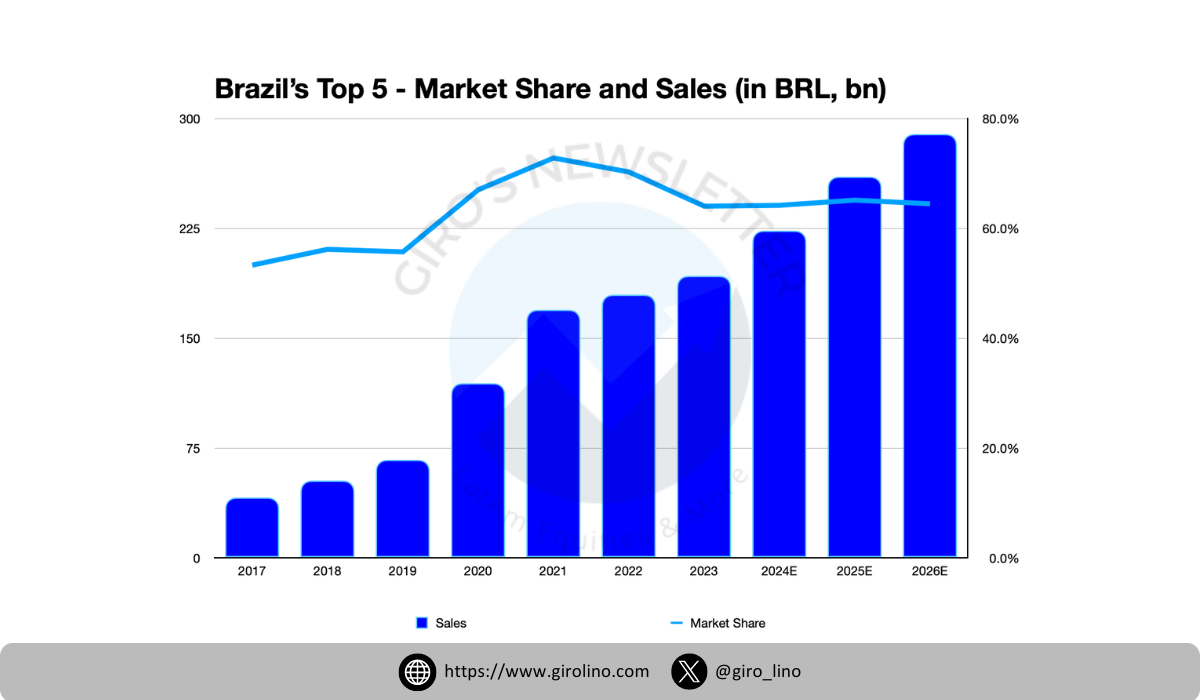

This consolidation has led to a more concentrated market, with the top 5 players now accounting for 64% of all eCommerce sales in Brazil. However, this figure is actually down from 70.3% in 2022, primarily due to the struggles of Via and Americanas. The landscape has become increasingly inhospitable for new entrants or comebacks, with the cost of acquiring new unique buyers for online purchases spiking to US$61.7 per user in 2023 from US$37.5 in 2021.

As we look ahead, the question is no longer about who will challenge Mercado Libre in the Latin America eCommerce space, but rather if anyone can. The disparity in sales volumes between Meli and its competitors is stark and widening. For the traditional players and even for Shopee, the path forward in online shopping looks increasingly challenging. Can they find a way to remain relevant in a market now dominated by a single, highly efficient player? Or will they be relegated to niche status in a sector they once led?

In our next section, we'll explore how Mercado Libre's consistent performance has shaped its current market position, and examine the strategies that have driven its unparalleled success in the most dynamic digital commerce market in Latin America.

Consistent Online Sales Growth: MercadoLibre's Domination in Brazilian eCommerce

When we last examined the Brazilian eCommerce scene, we anticipated a competitive race among businesses selling online. Fast forward to 2024, and it's clear that this digital frontier has been decisively conquered by one player: Mercado Libre. Their story isn't just about growth; it's about consistent, relentless expansion in online sales that has left competitors in the dust.

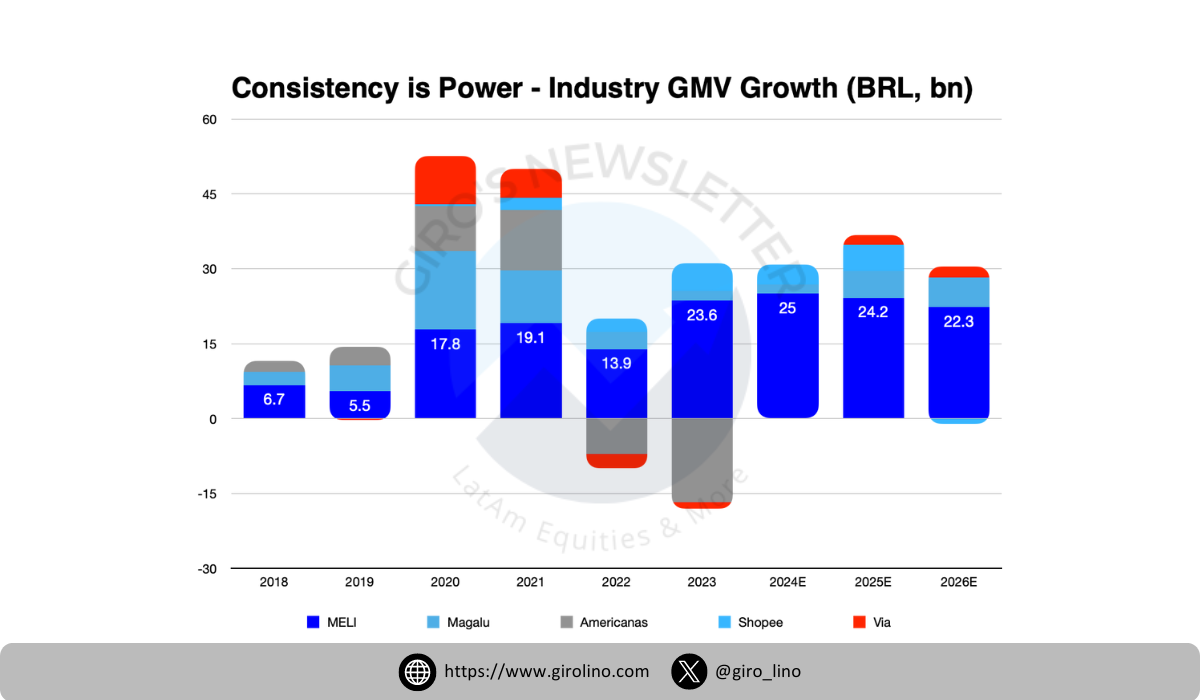

Our latest data paints a stark picture of absolute GMV growth among the top players in online shopping. Mercado Libre continues to be the standout performer, adding an impressive 23.6 billion reais (US$4.3 billion) to its GMV over the past year. This isn't just growth; it's a masterclass in scaling. Meli has managed to maintain its momentum even as its base size has expanded, a feat that's proven impossible for other online stores.

Shopee, our ambitious challenger from 2022, has shown growth in online purchases, but it pales in comparison to Mercado Libre's. They've added 5.6 billion reais (US$1 billion) to their GMV, a figure that would have seemed extraordinarily bearish for them back in 2022. This performance suggests that Shopee's strategy of capturing high-frequency, lower-ticket sales is not paying off as hoped in the world of eCommerce.

The story becomes even more compelling when we look at each player's share of the industry's overall growth. Mercado Libre accounts for a staggering 51.7% of all new GMV generated in the Brazilian eCommerce market over the past year. This isn't just impressive – it's a seismic shift in the competitive landscape the online retail sector in Latin America.

Meanwhile, the traditional players – Magalu, Americanas, and Via – have seen their contributions to industry growth shrink dramatically. Via and Americanas, in particular, have struggled to keep pace, with a negative contribution of 43.4% to the sector's expansion. It's a stark reminder of how quickly fortunes can change in the digital economy, and how consistency in execution is paramount for businesses selling online.

What's driving this consistency in growth for Mercado Libre? It's all about ecosystem power. Their ability to cross-sell services, from marketplace listings to payment platform solutions, has created a flywheel effect that's proven impossible to match. Each new service strengthens the others, driving both customer retention and acquisition in the online shopping space.

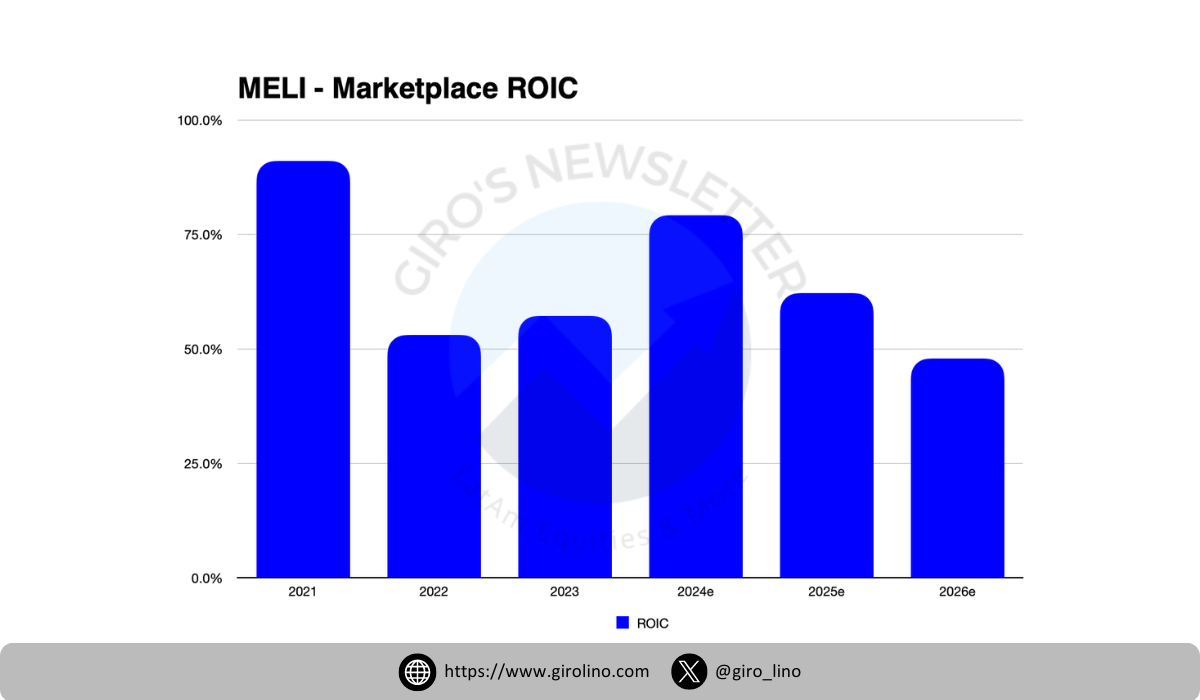

But consistency isn't just about top-line growth. It's about predictability in performance, something that investors and partners value highly. Mercado Libre's steady ROIC (Return on Invested Capital) in its marketplace business speaks volumes about its operational efficiency and strategic focus in eCommerce.

Looking ahead, the question isn't who will grow, but whether anyone can challenge Mercado Libre's dominance in online sales. The Brazilian eCommerce market is maturing, and with maturity comes new challenges. Can Mercado Libre continue to outpace the market at such a dramatic rate? Will we see any resurgence from the traditional players, or perhaps the emergence of a new disruptor in the world of online shopping?

One thing's for certain: in the high-stakes world of Brazilian eCommerce, Mercado Libre's consistency isn't just impressive – it's become the benchmark against which all other businesses selling online are measured. As we continue to monitor these trends, it's clear that the ability to deliver steady, predictable growth will separate the leader from the pack in the years to come in the digital commerce landscape in Latin America.

MercadoLibre: Dominating Online Sales and Revolutionizing eCommerce in Brazil leveraging on businesses selling online

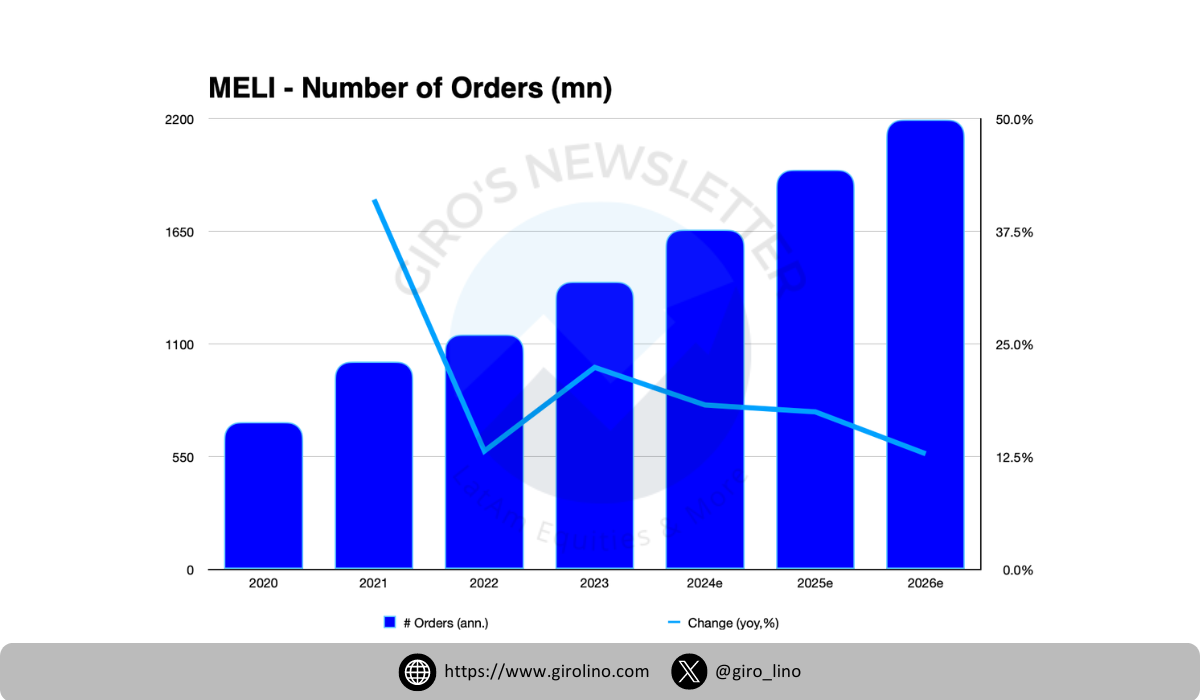

When we last examined Mercado Libre's performance in 2022, we were impressed by its robust growth in purchases online and strategic execution. Fast forward to 2024, and it's clear that Meli hasn't just maintained its momentum – it's accelerated it to a level that has left other businesses selling online in awe. Let's dive into the numbers and strategies that have solidified Mercado Libre's position as the undisputed leader in Brazilian eCommerce.

First, let's talk about profitability. Our latest data on Meli's marketplace ROIC (Return on Invested Capital) tells a compelling story. The company has managed to consistently improve its ROIC, reaching an impressive 50%+ in the most recent year. This isn't just a number – it's a testament to Meli's operational efficiency and its ability to extract value from every real invested in the business. In a sector where many online stores struggle to balance growth and profitability, Mercado Libre stands out as a beacon of financial health and strategic insight.

But profitability without growth is a recipe for stagnation, and Meli has shown no signs of slowing down in the world of online shopping. The number of orders processed by Mercado Libre's marketplace has seen a staggering increase. In our last analysis, we were looking at quarterly order volumes in the hundreds of millions. Now, Meli is consistently processing over 400 million online purchases per quarter. This exponential growth in transaction volume speaks to the company's ability to not just attract new customers, but to keep them coming back time and time again.

What's particularly intriguing is the marketplace's unit economics. Stripping away investments in growth to look at the standalone business, we see a picture of robust profitability. The revenue per order has increased to 5.7 reais (US$1), while operating profit per order has been optimized to 2.45 reais (US$0.50). These numbers underscore Mercado Libre's ability to scale efficiently, improving margins even as it expands its reach in Latin America.

So, what's driving this exceptional performance? Several factors come into play:

- Ecosystem Synergy: Meli's diverse offerings, from its marketplace to Mercado Pago (payment platform) and Mercado Envios (logistics), create a self-reinforcing ecosystem. Each service strengthens the others, increasing user engagement and loyalty.

- Technological Innovation: Continuous investments in AI, machine learning, and user experience have kept the platform at the cutting edge, enhancing everything from product recommendations to fraud prevention for purchases online.

- Logistics Mastery: The expansion of Mercado Envios has given Meli unprecedented control over its supply chain, improving delivery times and reliability – crucial factors in eCommerce success.

- Fintech Integration: Mercado Pago's growth has not only opened new revenue streams but also reduced friction in the buying process, driving higher conversion rates and repeat purchases.

- Focus on Seller Success: By providing tools and services that help sellers thrive, Meli has cultivated a vibrant marketplace with a wide array of products and competitive pricing for online shoppers.

Looking ahead, the question isn't whether Mercado Libre will continue to lead the Brazilian eCommerce market, but rather how far it can extend its advantage. With its robust financials, growing ecosystem, and proven ability to execute, Meli is well-positioned to capitalize on the continued digitalization of retail in Brazil and Latin America.

As we observe Mercado Libre's journey, it's clear that the company has not just lived up to the potential we saw in 2022 – it has exceeded it by leaps and bounds. In a market where many players are still figuring out the path to profitability, Mercado Libre stands as a model of how to build a sustainable, profitable, and rapidly growing eCommerce powerhouse.

The challenge for competitors is no longer just catching up to where Meli was – it's trying to anticipate where this eCommerce juggernaut is headed next. And for investors and industry watchers, Mercado Libre's performance sets a new benchmark for what's possible in the dynamic world of Latin America eCommerce and online shopping.

Future of Online Shopping: Trends Revolutionizing Brazilian eCommerce and MercadoLibre's Dominance

As we've journeyed through the evolving landscape of Brazilian eCommerce, from Mercado Libre's overwhelming dominance in purchases online to the struggles of traditional businesses selling online and new entrants, it's clear that this market has reached a pivotal point. Let's explore the trends and challenges that are likely to shape the future of digital commerce in Latin America's largest economy, with Mercado Libre at its center.

- The Maturation Paradox: Brazil's eCommerce market is simultaneously mature and nascent. While we've seen exponential growth in online shopping and the emergence of a dominant player in Mercado Libre, there's still significant room for expansion. Our data shows eCommerce penetration at 16%, suggesting ample opportunity for growth. The question is: can anyone but Mercado Libre capitalize on this potential?

- The Battle for the Last Mile: Logistics remain a critical differentiator in Brazilian eCommerce. Mercado Libre's investments in Mercado Envios have paid off handsomely, creating a moat that competitors struggle to cross. The challenge for other online stores will be finding innovative ways to compete in this space without the scale and resources of the market leader.

- The Fintech Factor: The lines between eCommerce and fintech are blurring, and Mercado Libre's success with Mercado Pago has shown the power of integrating payment platforms with eCommerce. Competitors will need to find ways to offer comparable financial solutions or risk falling further behind in purchases online.

- The Social Commerce Challenge: While social commerce is growing in importance, its impact has been less dramatic than anticipated. Shopee's relative underperformance suggests that social features alone are not enough to challenge Mercado Libre's ecosystem advantage in the world of online purchases.

- AI and Personalization at Scale: Artificial Intelligence is moving from a nice-to-have to a must-have in eCommerce. Mercado Libre's ability to leverage AI for personalization and operational efficiency sets a high bar for competitors in the online shopping space.

- Sustainability as a Differentiator: As sustainability becomes more important to Brazilian consumers, Mercado Libre's scale gives it an advantage in implementing and communicating sustainable practices effectively across its eCommerce operations.

- The Omnichannel Imperative: The distinction between online and offline retail is fading. Mercado Libre's dominant online position gives it a strong foundation to explore physical touchpoints, potentially further challenging traditional retailers in Latin America.

- Regulatory Challenges and Opportunities: As the eCommerce sector grows, so does regulatory scrutiny. Mercado Libre's market position may attract additional attention, but its resources also position it well to navigate regulatory challenges in the online sales landscape.

- The Next Wave of Consolidation: With the market maturing and smaller players struggling, we may see further consolidation. Mercado Libre could potentially acquire smaller competitors or complementary businesses to strengthen its position further in the eCommerce industry.

- The Wild Card: Global Economic Factors: Global economic trends will continue to impact the sector. Mercado Libre's strong financial position makes it better equipped to weather economic uncertainties compared to its competitors in the online shopping market.

As we look to the future, it's clear that the Brazilian eCommerce market is entering a new phase of evolution, with Mercado Libre firmly at the helm. The explosive growth we've seen in online sales may moderate, but opportunities for innovation and expansion remain abundant. The key question is whether any player can find a way to meaningfully challenge Mercado Libre's dominance, or if the market will continue to consolidate around this central player.

For investors, entrepreneurs, and industry watchers, Brazil's eCommerce sector continues to be one of the most exciting spaces to watch in the global digital economy. As the market matures, the strategies that drove success in past online sales may not be sufficient for the future. Agility, innovation, and a deep understanding of the unique characteristics of the Brazilian market will be key to thriving in this dynamic landscape – or even just surviving in Mercado Libre's shadow.

The story of Brazilian eCommerce is increasingly becoming the story of Mercado Libre. As we move forward, all eyes will be on this eCommerce giant, watching to see how it leverages its dominant position to shape the future of digital commerce in Brazil and beyond.

Discover why MercadoLibre is our top pick in Latin America

Mercado Libre's Triumph: Revolutionizing Online Shopping in Brazil's Evolving eCommerce Landscape

As we conclude our deep dive into the Brazilian eCommerce landscape of 2024, one story towers above all others: the absolute dominance of Mercado Libre in online sales. Our analysis from 2022 wasn't just accurate – it was conservative in predicting Meli's meteoric rise in the world of businesses selling online.

Reflecting on our projections from 2021, we're in awe of Mercado Libre's performance. The company's Gross Merchandise Value (GMV) for 2023 and 2024 has surpassed our initial forecasts by an impressive 8%. This isn't just beating expectations; it's shattering them. Mercado Libre hasn't just maintained its leadership position – it has expanded its moat in the online shopping space to a degree that seemed almost unimaginable two years ago.

Our foresight in recognizing Mercado Libre's potential has been vindicated emphatically. The company's ability to consistently improve Return on Invested Capital (ROIC) while driving explosive growth in online purchases is nothing short of remarkable. Their strategic investments in logistics, payment platforms, and user experience have created an ecosystem that competitors in Latin America can only dream of replicating.

While we anticipated strong performance from Mercado Libre, the struggles of its competitors have been more pronounced than expected. Shopee's growth has stagnated far below our initial projections, and traditional players like Via and Americanas have faced existential challenges in selling online. This contrast only serves to highlight the extraordinary nature of Mercado Libre's success in the eCommerce industry.

The broader trends we identified – from the increasing importance of last-mile logistics to the rise of fintech integration – have played out largely as expected, with Mercado Libre capitalizing on each of these opportunities more effectively than any other online store in the market.

For investors who recognized Mercado Libre's potential early on, the rewards have been substantial. As a happy shareholder myself, I can attest to the satisfaction of watching this eCommerce juggernaut exceed even the most optimistic projections. Mercado Libre isn't just a successful company; it's a force of nature in the Latin American digital commerce landscape.

Looking ahead, the question is no longer whether Mercado Libre will maintain its leadership in online sales – that seems all but certain. Instead, we must ask: how much further can this absolute monster of a company extend its dominance? Can any player, existing or new, mount a significant challenge to Meli's reign? Or will we see the Brazilian eCommerce market become synonymous with Mercado Libre?

As we conclude this analysis, we're reminded that in the world of Brazilian eCommerce, Mercado Libre isn't just writing the story – it is the story. For those of us observing and participating in this dynamic sector, the coming years promise to be nothing short of exhilarating as we watch Mercado Libre continue to redefine what's possible in digital commerce and online shopping.

To my fellow Mercado Libre shareholders: our faith in this company has been richly rewarded, and the future looks brighter than ever. The Brazilian eCommerce saga continues, and Mercado Libre is holding the pen, shaping the future of how businesses sell online in Latin America.

Your Opinion Matters!

We're constantly striving to improve our content. Could you spare 2 minutes to let us know what you think? Your feedback is invaluable in helping us deliver the financial insights you need.