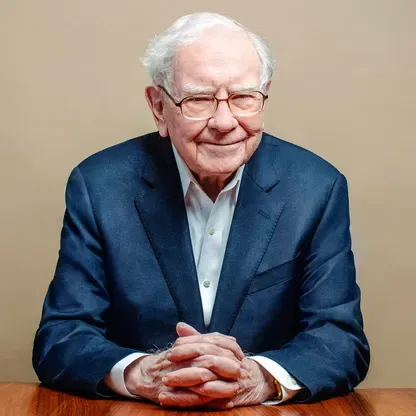

In a surprising turn of events that has sent shockwaves through the investment world, Warren Buffett's Berkshire Hathaway has significantly reduced its stake in Apple Inc. by nearly 50% during the second quarter of 2024. This dramatic move by the "Oracle of Omaha" has raised questions about the tech giant's future prospects and Buffett's investment strategy. Let's delve into the details of this major portfolio shift and explore its implications for investors.

The Scale of the Sell-Off

To fully grasp the magnitude of Buffett's decision, it's crucial to understand the numbers behind the move:

| Aspect | Details |

|---|---|

| Reduction Percentage | Nearly 50% |

| Time Period | Second quarter of 2024 |

| Previous Stake Value | $135.4 billion (end of Q1 2024) |

| New Stake Value | $84.2 billion (end of Q2 2024) |

| Estimated Shares Held | Approximately 400 million |

| Apple's Position in Portfolio | Remains largest holding |

This substantial reduction represents a significant shift in Berkshire's investment strategy. The sale follows a pattern of gradual selling that began in late 2023, with Berkshire having already trimmed its Apple holdings by 13% in the first quarter of 2024. However, this latest sale marks a much more dramatic reduction.

Warren Buffett's relationship with Apple has been a fascinating chapter in his storied investment career. Berkshire Hathaway first invested in Apple in 2016, when the stock traded at a price-to-earnings ratio of about 10. At the time, this move surprised many, as Buffett had historically shied away from technology stocks, claiming they were outside his "circle of competence."

Over the years, Buffett's enthusiasm for Apple grew, and he frequently praised the company and its CEO, Tim Cook. He often highlighted the strong consumer loyalty to iPhones and Apple's robust ecosystem as key factors in his investment thesis. By 2022, Apple had become Berkshire's largest holding, accounting for over 40% of its equity portfolio.

Learn more about Warren Buffett's investment philosophy and strategy

Reasons Behind the Reduction

While Buffett hasn't provided explicit reasons for the significant reduction in Berkshire's Apple stake, several factors likely contributed to this decision:

Valuation Concerns: Apple's stock price has seen substantial growth since Berkshire's initial investment. With the stock reaching an all-time high during the summer of 2024 and its price-to-earnings ratio expanding to around 30, Buffett may have felt that the valuation had become stretched, potentially limiting future returns.

Portfolio Rebalancing: Given Apple's outsized position in Berkshire's portfolio, the reduction could be seen as a move to mitigate concentration risk. Even after the sale, Apple remains Berkshire's largest holding, indicating that Buffett hasn't lost faith in the company entirely.

Economic Uncertainty: The decision to reduce the Apple stake and increase cash reserves may reflect concerns about broader economic conditions. With Berkshire's cash pile growing to a record $277 billion, Buffett could be preparing for potential market downturns or seeking new investment opportunities.

Changing Tech Landscape: The rapidly evolving technology sector and increasing competition in the smartphone market may have influenced Buffett's decision. As new players enter the field and consumer preferences shift, Apple's dominant position could face challenges in the future.

Market Reaction and Impact

The market's response to Berkshire's significant reduction in its Apple stake was swift and notable:

| Aspect | Market Reaction |

|---|---|

| Apple Stock Price | Fell about 4% to $210.91 following the announcement |

| Broader Tech Sector | Experienced increased volatility and selling pressure |

| Investor Sentiment | Raised concerns about potential overvaluation in tech stocks |

| Analyst Perspectives | Mixed, with some maintaining optimism despite the sell-off |

The immediate impact on Apple's stock price was significant, with shares dropping approximately 4% in response to Berkshire's divestment. This reaction highlights the influence that major investors like Buffett can have on market sentiment, even for a company as large as Apple.

The sell-off in Apple stock had ripple effects across the broader technology sector, leading to increased volatility as investors reassessed their positions in other tech giants. This reaction was compounded by recent weak tech earnings reports and economic uncertainty, causing some analysts to express concern about the sector's overall valuation.

However, not all market observers viewed Buffett's move negatively. Wedbush tech analyst Dan Ives remained optimistic, stating, "Buffett is a core believer in Apple, and we do not view this as a signal of bad news ahead." This perspective suggests that some analysts interpret Berkshire's sale as portfolio rebalancing rather than a fundamental shift in outlook on Apple's business prospects.

Buffett's Strategy Shift

Warren Buffett's decision to significantly reduce Berkshire Hathaway's stake in Apple marks a notable shift in his investment strategy. This move is part of a broader trend of reducing Berkshire's exposure to stocks and accumulating cash at an unprecedented level.

Key aspects of Buffett's strategy shift include reduced concentration in a single stock, increased cash reserves for future opportunities, potential reassessment of the tech sector's growth prospects, and demonstration of flexibility in investment approach.

This strategic shift underscores the importance of remaining adaptable in investment strategies, even for long-term investors like Buffett. It serves as a reminder that market conditions, company valuations, and economic outlooks can change, necessitating periodic reassessment and adjustment of investment portfolios.

Explore more about portfolio management strategies for long-term investors

Implications for Investors

Warren Buffett's decision to significantly reduce Berkshire Hathaway's stake in Apple offers several important lessons for individual investors:

Portfolio Rebalancing

Regularly reassess and adjust portfolio allocations to manage risk and maintain desired asset balance. Buffett's move demonstrates the importance of not becoming overly concentrated in a single position, even if it's a high-performing stock like Apple.

Valuation Matters

Even great companies can become overvalued. Consider price-to-earnings ratios, growth prospects, and other valuation metrics when making investment decisions. Buffett's willingness to sell a significant portion of a winning investment underscores the importance of valuation in long-term investing.

Cash Management

Maintaining a cash reserve provides flexibility and opportunities during market downturns. Berkshire's growing cash pile, which reached a record $277 billion, highlights the value of liquidity in uncertain economic times.

By applying these lessons, individual investors can improve their portfolio management strategies and potentially enhance their long-term returns. It's crucial to remain vigilant and adaptable, willing to adjust strategies based on changing market conditions and company-specific factors.

The Challenge of Large-Scale Investments

Berkshire Hathaway's massive cash reserves of $277 billion as of mid-2024 present both opportunities and challenges for the company's investment strategy. Given this substantial cash position, only a limited number of companies offer sufficient liquidity for Berkshire to make meaningful investments without significantly impacting stock prices.

| Factor | Impact on Berkshire's Investment Options |

|---|---|

| Market Capitalization | Only large-cap and mega-cap stocks provide enough liquidity |

| Daily Trading Volume | Higher average daily trading volumes allow for larger positions |

| Ownership Structure | Companies with more publicly traded shares offer greater liquidity |

| Regulatory Constraints | SEC regulations limit the size of positions Berkshire can take |

This limitation explains why Berkshire has increasingly focused on a small number of large positions in recent years, such as Apple, Bank of America, and Coca-Cola. It also clarifies why the company has shown interest in major oil companies like Chevron and Occidental Petroleum, which have the scale to absorb multi-billion dollar investments.

The scarcity of suitable investment targets also helps explain Berkshire's growing cash pile. As Warren Buffett has often stated, he prefers to hold cash rather than make investments he considers overvalued or too small to impact Berkshire's overall performance.

Looking Ahead: Buffett's Next Move

With Berkshire Hathaway's reduced stake in Apple and its record cash reserves, investors and analysts are speculating about Buffett's next move. Several possibilities have been suggested:

- Increasing stakes in existing large holdings

- Pursuing full acquisitions of large private companies

- Expanding investments in foreign markets, particularly Japan

- Considering more aggressive share buybacks of Berkshire's own stock

Whatever Buffett's next move may be, it's clear that his decision to reduce Berkshire's Apple stake has significant implications for the investment world. As always, investors will be watching closely to see how the "Oracle of Omaha" navigates the ever-changing landscape of global markets.

Warren Buffett's decision to halve Berkshire Hathaway's stake in Apple represents a significant shift in his investment strategy and has far-reaching implications for investors worldwide. While Apple remains Berkshire's largest holding, this move raises questions about the tech giant's future prospects and the broader market conditions.

For individual investors, Buffett's actions serve as a reminder of the importance of portfolio rebalancing, valuation considerations, and maintaining flexibility in investment strategies. As the market continues to evolve, staying informed and adaptable will be crucial for long-term investment success.

As we look to the future, all eyes will be on Buffett and Berkshire Hathaway, waiting to see how they will deploy their massive cash reserves and navigate the challenges of large-scale investments in an increasingly complex global economy.