Comprehensive Guide to Net Tangible Assets: Calculation, Importance, and Applications

In the complex world of financial analysis, understanding a company's true value goes beyond just looking at its stock price or revenue figures. One crucial metric that savvy investors use to gauge a company's financial health is Net Tangible Assets (NTA). This comprehensive guide will delve into the intricacies of net tangible assets, exploring their calculation, significance, and real-world applications.

What Are Net Tangible Assets?

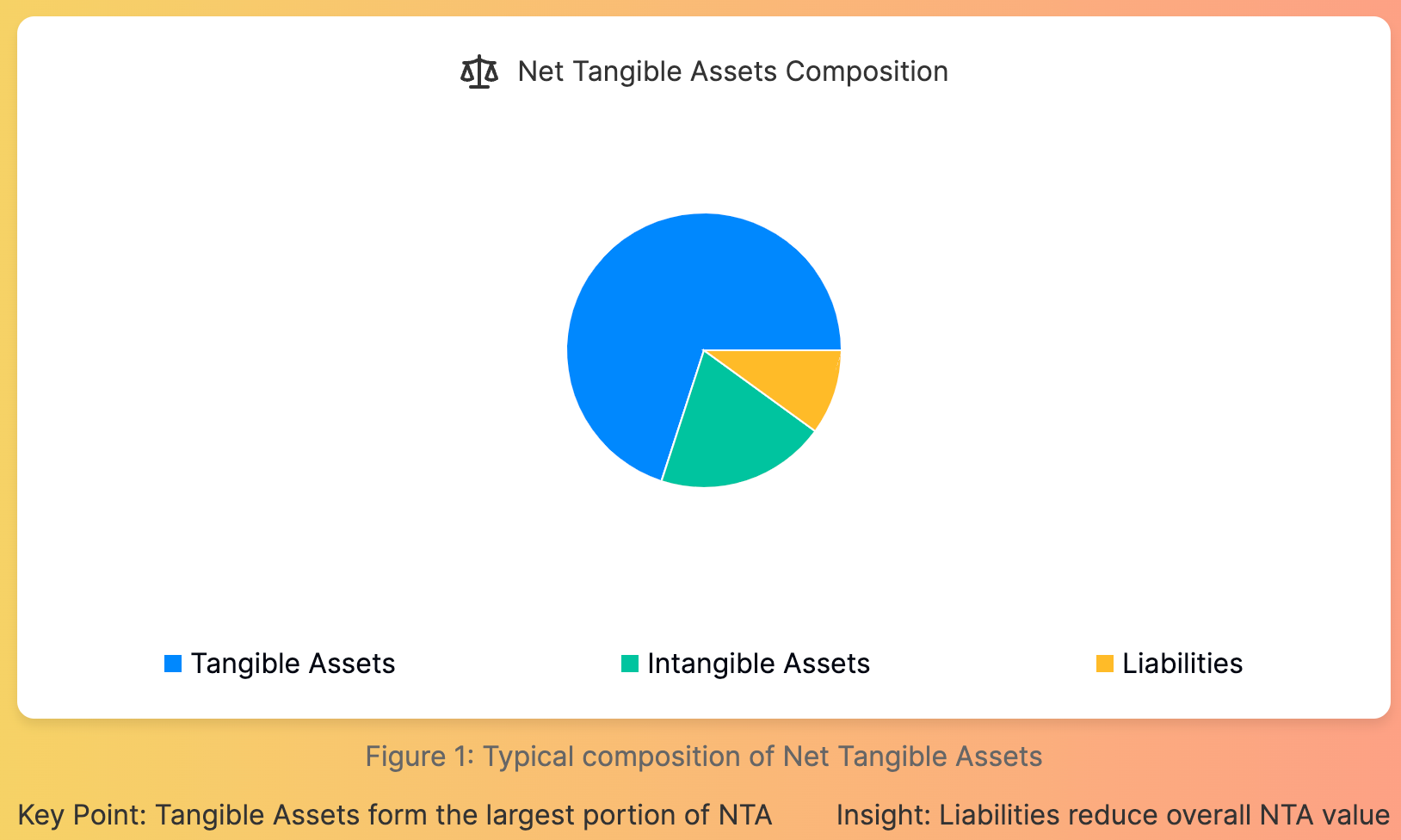

Net tangible assets represent the physical assets of a company minus its intangible assets and total liabilities. This figure gives investors a clearer picture of what a company actually owns in terms of concrete, measurable assets. For investors in listed companies and general investors alike, mastering the calculation and interpretation of NTA can provide valuable insights into a company's financial stability and potential for growth.

The Importance of Tangible Assets

Tangible assets are physical items that a company owns and can be seen, touched, or measured. These assets play a vital role in the day-to-day operations of a business and often contribute directly to revenue generation. Understanding the composition of a company's tangible assets is crucial for accurately assessing its financial position.

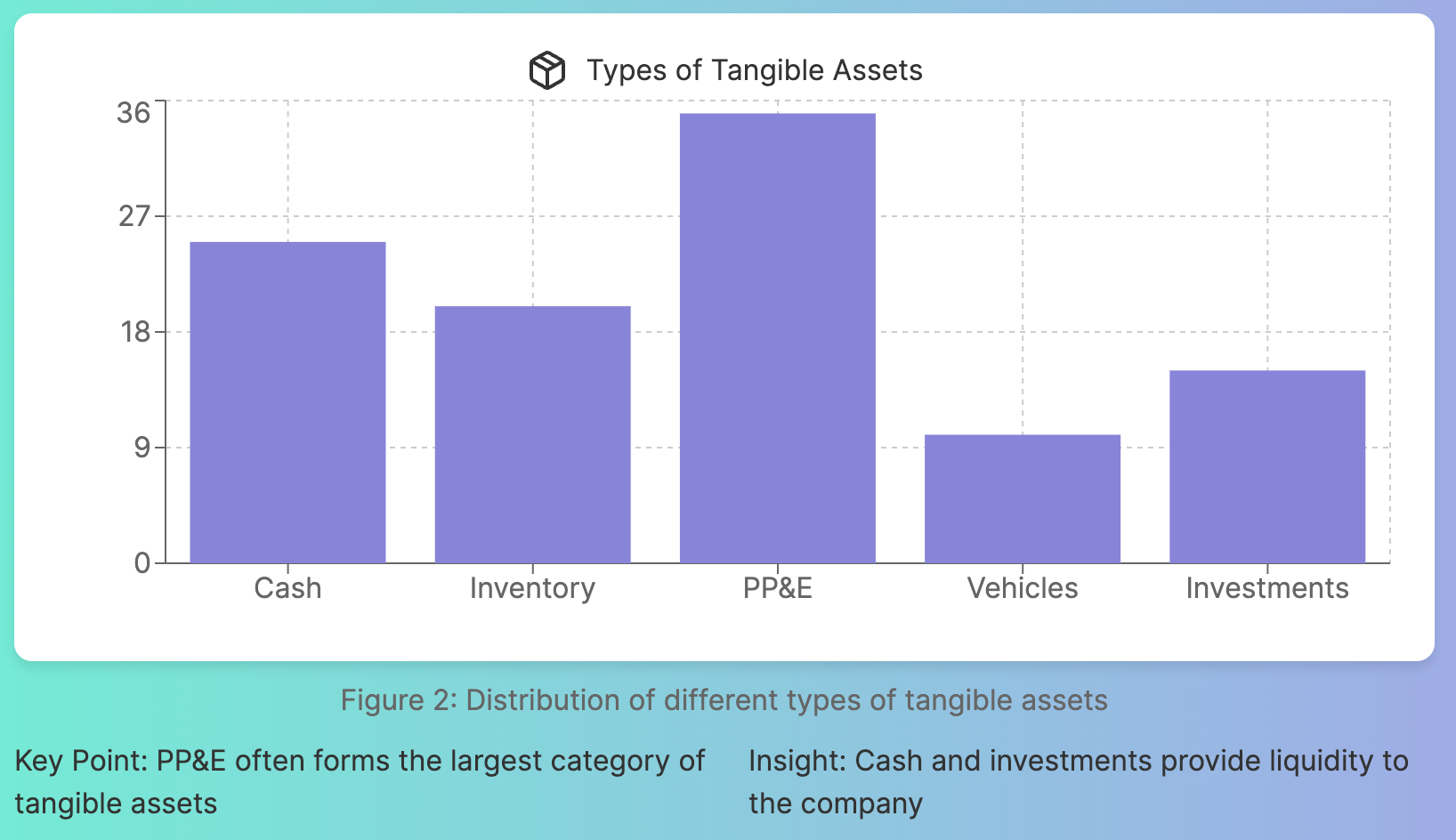

Examples of tangible assets include:

- Cash and cash equivalents

- Inventory

- Property, plant, and equipment (PP&E)

- Vehicles

- Investments in securities

Intangible Assets: The Invisible Value Creators

In contrast to tangible assets, intangible assets lack physical substance but can still provide significant value to a company. These assets often represent intellectual property or other non-physical resources that contribute to a company's competitive advantage.

Common intangible assets include:

- Goodwill

- Patents

- Trademarks

- Brand recognition

- Copyrights

While intangible assets can be valuable, they are excluded from the net tangible assets calculation, focusing instead on the physical assets that can be more readily valued and liquidated if necessary.

The Net Tangible Asset Formula: A Step-by-Step Breakdown

To accurately calculate net tangible assets, we use the following formula:

Net Tangible Assets = Total Assets - Intangible Assets - Total Liabilities

Let's break down each component of this formula to ensure a thorough understanding.

Step 1: Determine Total Assets

The first step in our calculation is to identify the company's total assets. This figure includes all resources owned by the company, both tangible and intangible. You can typically find this information on the company's balance sheet.

Step 2: Identify and Subtract Intangible Assets

Next, we need to subtract the value of intangible assets from the total assets figure. This step is crucial in isolating the tangible, physical assets of the company.

Step 3: Subtract Total Liabilities

The final step in our calculation is to subtract the company's total liabilities. This figure includes all of the company's financial obligations, such as short-term debt, long-term debt, accounts payable, and accrued expenses.

Practical Example: Calculating Net Tangible Assets

Let's walk through a practical example to illustrate the process of calculating net tangible assets. We'll use hypothetical financial data for a company called "TechInnovate Inc."

TechInnovate Inc.'s balance sheet shows the following:

- Total Assets: $500 million

- Intangible Assets (including goodwill): $100 million

- Total Liabilities: $200 million

Applying our net tangible asset formula:

Net Tangible Assets = Total Assets - Intangible Assets - Total Liabilities Net Tangible Assets = $500 million - $100 million - $200 million Net Tangible Assets = $200 million

This calculation shows that TechInnovate Inc.'s net tangible assets are $200 million, representing the value of all the physical assets owned by the company after accounting for intangible assets and liabilities.

Interpreting Net Tangible Assets: What Does It Tell Investors?

Now that we've calculated the net tangible assets, what does this figure actually tell us about a company? Let's explore the significance of NTA for investors and how it can be used in financial analysis.

1. Assessing Financial Stability

A high net tangible assets value generally indicates that a company has a strong asset base relative to its liabilities. This can be seen as a sign of financial stability, as the company has substantial tangible resources to cover its obligations.

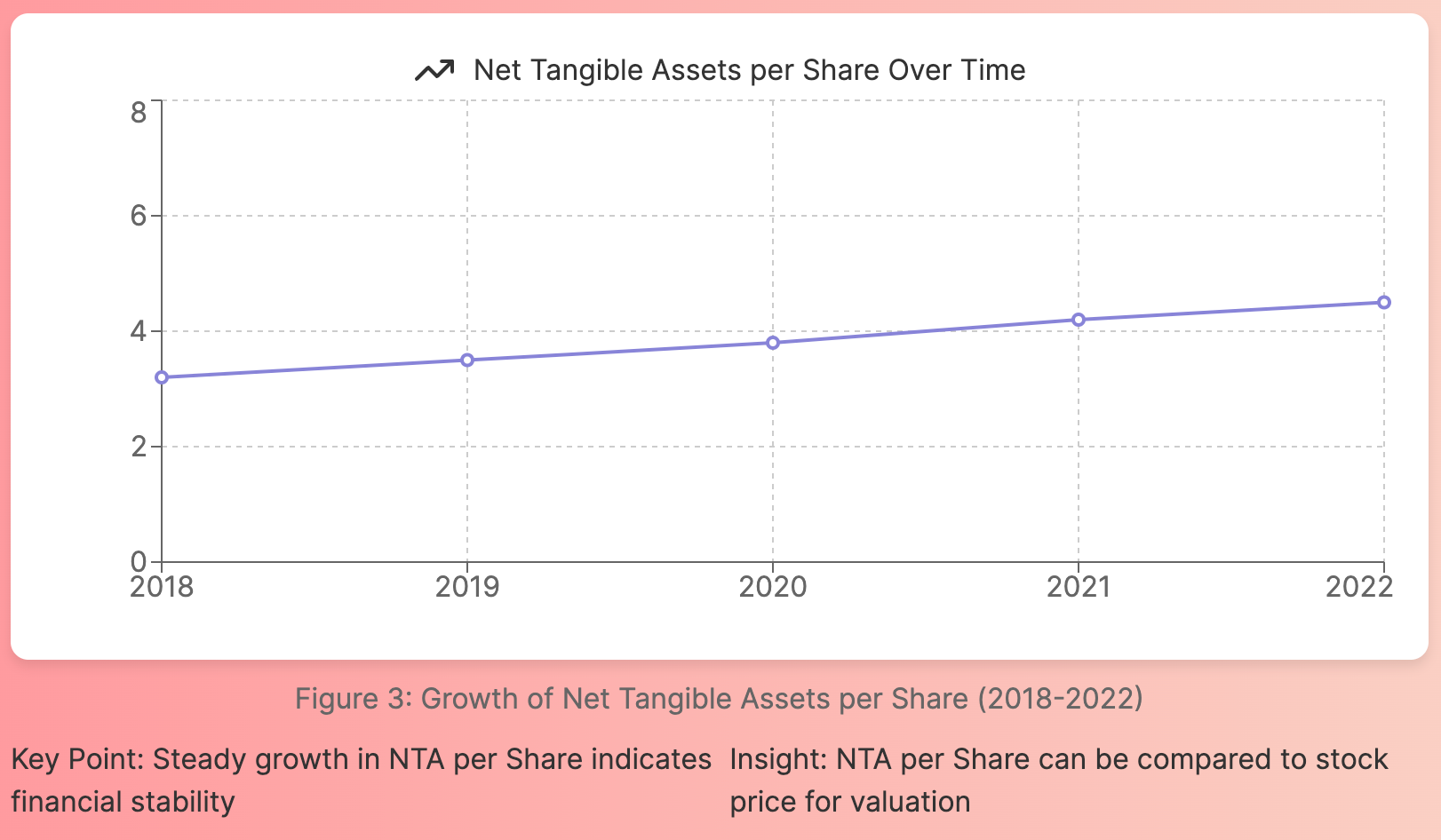

2. Comparing Companies Within an Industry

Net tangible assets can be particularly useful when comparing companies within the same industry. It allows investors to assess the relative strength of companies' tangible asset positions, which can be especially important in asset-intensive industries.

3. Identifying Potential Risks

A low or negative NTA value might indicate that a company is heavily reliant on intangible assets or has a high level of liabilities relative to its tangible assets. While this isn't necessarily a red flag (especially for companies in industries that typically have high intangible asset values), it can signal potential risks that investors should investigate further.

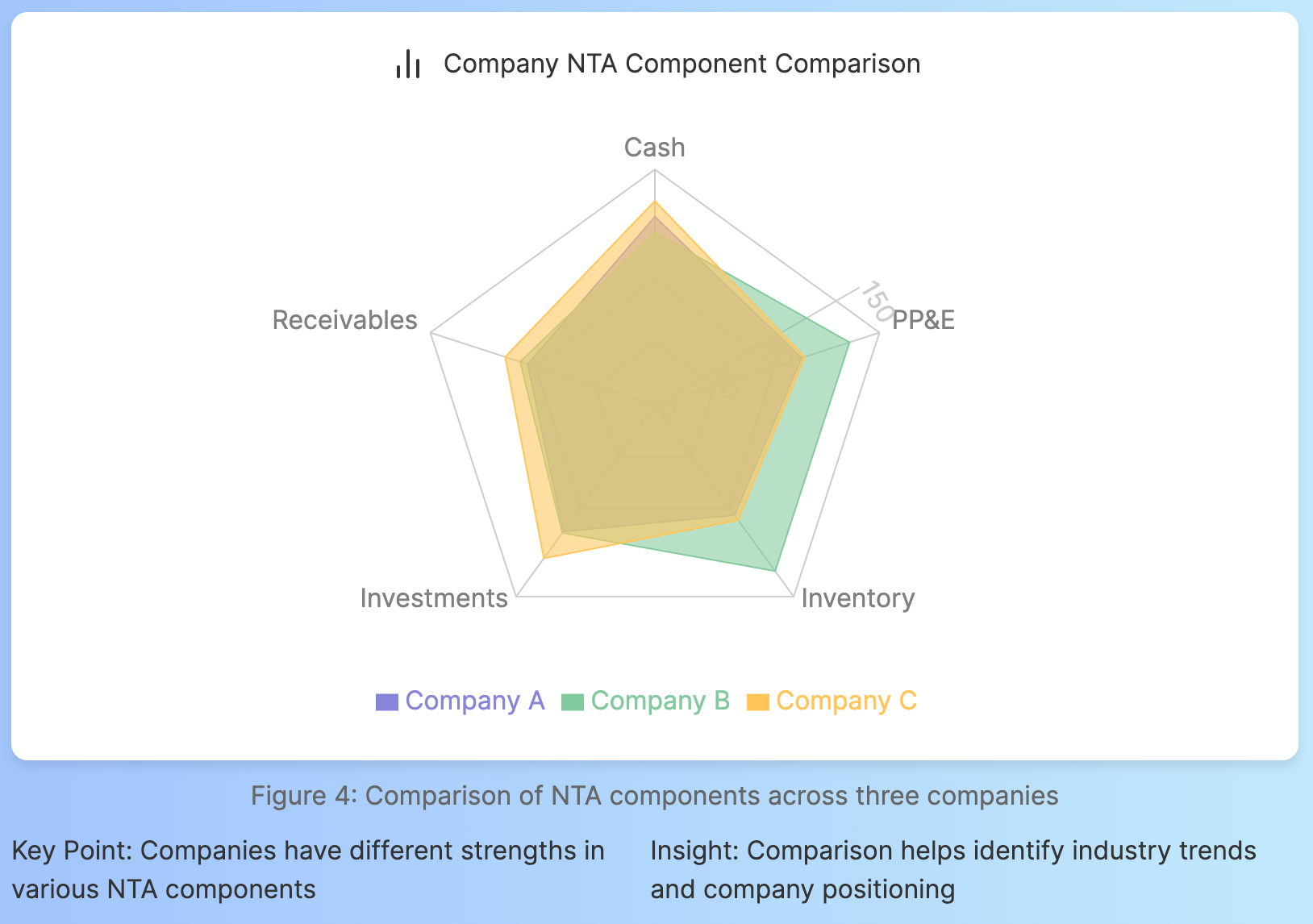

4. Calculating Net Tangible Assets per Share

To make NTA more comparable across companies of different sizes, investors often calculate the Net Tangible Assets per Share. This is done by dividing the NTA by the number of outstanding shares.

For example, if TechInnovate Inc. has 50 million shares outstanding:

Net Tangible Assets per Share = $200 million / 50 million shares Net Tangible Assets per Share = $4 per share

This figure can be compared to the company's stock price to assess whether the stock might be overvalued or undervalued based on its tangible asset backing.

Real-World Applications: How Investors Use Net Tangible Assets

Understanding the theory behind net tangible assets is important, but how do investors actually use this metric in practice? Let's explore some real-world applications:

1. Value Investing

Value investors often use NTA as one of several metrics to identify potentially undervalued companies. If a company's stock price is trading below its net tangible assets per share, it might be considered undervalued, as investors are essentially getting the company's intangible assets for free.

2. Merger and Acquisition Analysis

In M&A scenarios, net tangible assets can play a crucial role in determining a company's value. Acquirers often pay close attention to the target company's NTA as it represents the "hard assets" they'll be acquiring. Understanding a company's net tangible assets is crucial for determining the tangible value being acquired versus the premium being paid for intangible assets and future growth potential.

3. Assessing Bankruptcy Risk

Investors and creditors often use NTA to assess a company's ability to cover its debts in a worst-case scenario. A company with high net tangible assets relative to its liabilities may be seen as having a lower bankruptcy risk, as it has more tangible assets that could potentially be liquidated to pay off debts.

4. Industry Benchmarking

Net tangible assets can be used to benchmark companies within the same industry. For example, in the manufacturing sector, where physical assets play a crucial role, investors might compare the NTA of different companies to assess their relative financial strength.

Common Pitfalls in Calculating Net Tangible Assets

While the concept of net tangible assets is straightforward, there are several common mistakes that investors should be aware of when performing this calculation:

- Overlooking hidden intangible assets

- Ignoring the quality of tangible assets

- Failing to consider industry context

- Neglecting to adjust for fair market value

- Overlooking off-balance-sheet liabilities

By being aware of these potential pitfalls, investors can make more accurate and meaningful NTA calculations.

Frequently Asked Questions About Net Tangible Assets

Q1: How do you calculate tangible assets?

To calculate tangible assets, start with the company's total assets from the balance sheet. Then, subtract all intangible assets such as goodwill, patents, and trademarks. The resulting figure represents the company's tangible assets.

Q2: What are examples of tangible assets?

Tangible assets are physical assets that have a monetary value and can be seen or touched. Examples include:

- Cash and cash equivalents

- Inventory

- Property, plant, and equipment (PP&E)

- Vehicles

- Office furniture and supplies

- Land and buildings

Q3: Where can I find net tangible assets?

Net tangible assets are not typically listed as a single line item on a company's financial statements. To find net tangible assets, you'll need to calculate them using information from the company's balance sheet. Start with total assets, subtract intangible assets, and then subtract total liabilities.

Q4: What are net intangible assets?

Net intangible assets represent the value of a company's intangible assets minus any associated liabilities or amortization. While this metric is not as commonly used as net tangible assets, it can be calculated by subtracting tangible assets and liabilities from a company's total market value.

Conclusion: Leveraging Net Tangible Assets in Your Investment Strategy

As we've explored throughout this guide, calculating and interpreting net tangible assets can provide valuable insights for investors. By understanding a company's tangible asset base relative to its liabilities and intangible assets, investors can gain a clearer picture of a company's financial health and potential risks.

However, it's important to remember that NTA is just one piece of the puzzle. A comprehensive investment analysis should consider multiple factors, including industry context, growth potential, management quality, competitive positioning, and overall market conditions.

By combining NTA analysis with other financial metrics and qualitative factors, investors can make more informed decisions and potentially identify overlooked investment opportunities. As you continue to develop your investment strategy, we encourage you to incorporate net tangible assets into your analysis toolkit.

Remember to stay vigilant about the potential pitfalls we discussed, and always consider NTA in the broader context of a company's overall financial picture. With this knowledge, you'll be better equipped to navigate the complex world of financial analysis and make more informed investment decisions.