The weight loss industry has a new sheriff in town, and it's making Big Pharma break out in a cold sweat. Hims & Hers Health, a scrappy direct-to-consumer startup, has just lobbed a grenade into the pharmaceutical world. Their bold move? Offering compounded GLP-1 weight loss drugs at a price that makes Wegovy look like liquid gold.

The Numbers Game: Dollars, Pounds, and Cents

Let's cut to the chase: Hims & Hers isn't just entering the market; they're crashing through the wall like the Kool-Aid Man on a sugar high.

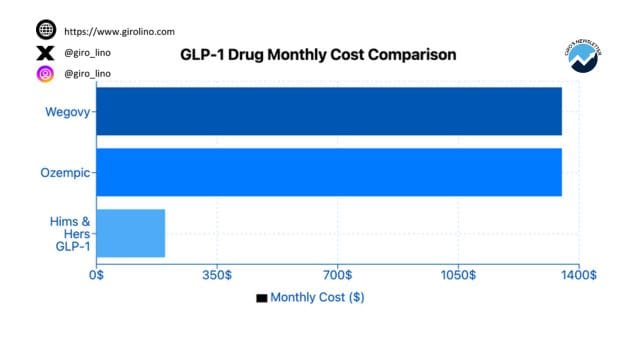

Caption: The stark price difference between brand-name GLP-1 drugs and Hims & Hers' copycat version is reshaping the weight loss medication landscape.

At $199 per month, their copycat GLP-1 drugs make Wegovy's $1,350 price tag look like it belongs in a luxury car showroom, not a pharmacy. It's the kind of price difference that has consumers doing a double-take and Big Pharma executives reaching for their calculators.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

Wall Street, always quick to sniff out a potential goldmine, reacted with unbridled enthusiasm. Hims & Hers' stock skyrocketed by over 30% in a single day following the announcement. That's not just a good day on the market; that's the kind of jump that makes other startups wonder if they're in the wrong business.

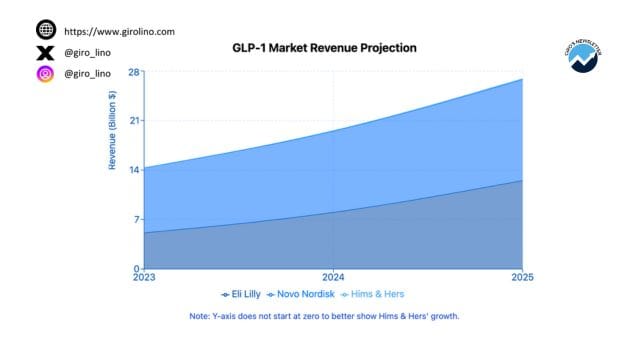

But here's where it gets really interesting: Hims & Hers is projecting over $100 million in revenue from their weight-loss program by 2025. In the grand scheme of the pharmaceutical industry, that might sound like pocket change. But for a newcomer in a market dominated by giants, it's a clear signal that they're not here to play small ball.

Caption: The GLP-1 market is set for explosive growth, with newcomers like Hims & Hers aiming to capture a slice of the expanding pie.

The Obesity Epidemic: A Weighty Issue

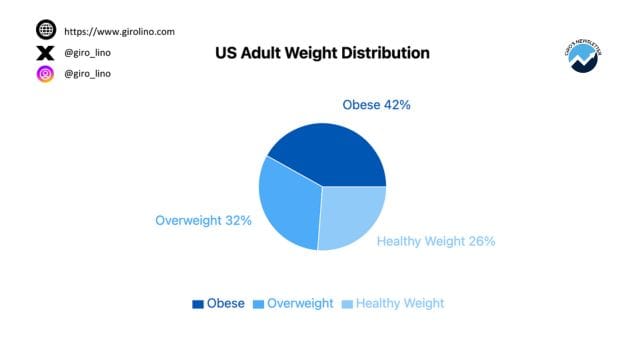

To understand why this matters, we need to zoom out and look at the bigger picture. Obesity isn't just a personal health issue; it's a global epidemic. In the United States alone, more than 40% of adults are classified as obese. That's not just a statistic; it's a health crisis with far-reaching implications for healthcare systems, economies, and individual lives.

Caption: The US adult weight distribution underscores the urgent need for effective weight management solutions, fueling demand for GLP-1 medications.

Enter GLP-1 drugs. Originally developed for diabetes management, these medications have shown remarkable efficacy in weight loss. They work by mimicking a hormone that targets areas of the brain involved in appetite regulation. The result? People feel fuller faster and stay satisfied longer.

When Wegovy (semaglutide) hit the market, it was hailed as a game-changer. Clinical trials showed participants losing an average of 15% of their body weight. In the world of weight loss medications, that's not just impressive; it's revolutionary.

But there was a catch. At $1,350 per month without insurance, Wegovy was priced out of reach for many who needed it most. It's a familiar story in the pharmaceutical world: breakthrough drug meets prohibitive pricing.

The Regulatory Roulette: FDA's Wild Card

This regulatory gray area is where the plot thickens. The FDA has already raised concerns, reporting adverse events from patients using compounded semaglutide medications. It's not just a footnote; it's a flashing warning sign that this wild west of weight loss drugs might be heading for a showdown.

For Hims & Hers, this regulatory uncertainty is both a risk and an opportunity. On one hand, it allows them to bring a product to market quickly and at a lower cost. On the other, it exposes them to potential regulatory backlash if things go south.

The FDA isn't known for its love of regulatory loopholes. If compounded GLP-1 drugs gain significant market share, it's not hard to imagine the agency stepping in to tighten regulations. It's a delicate balance between innovation and oversight, and Hims & Hers is walking a tightrope.

The Big Pharma Counterattack: Goliath's Not Going Down Without a Fight

Don't for a second think that the pharmaceutical giants are going to take this lying down. Novo Nordisk and Eli Lilly, the heavyweights behind Wegovy and Mounjaro, didn't spend billions on R&D just to watch a startup eat their lunch.

These companies have deep pockets, extensive legal teams, and decades of experience navigating the complex world of pharmaceutical regulations. They're likely already strategizing their counterattack.

What might that look like? A few possibilities come to mind:

- Legal challenges: Big Pharma could argue that compounded versions of their drugs infringe on patents or violate regulatory standards.

- Pricing adjustments: They might decide to lower prices on their brand-name drugs to compete more directly with the copycat versions.

- New formulations: Developing new, patent-protected formulations of GLP-1 drugs could help them stay ahead of the copycats.

- Lobbying: Pushing for stricter regulations on compounded drugs could make it harder for companies like Hims & Hers to operate in this space.

- Marketing blitz: Emphasizing the safety and efficacy of FDA-approved drugs could sway both consumers and healthcare providers.

The Healthcare Provider Dilemma: To Prescribe or Not to Prescribe?

In the middle of this pharmaceutical fracas are healthcare providers. They're the ones who ultimately decide whether to prescribe these medications, and they're facing a complex set of considerations.

On one side, there's the allure of a more affordable option that could help more patients access effective weight loss treatment. On the other, there are concerns about safety, efficacy, and liability when prescribing compounded medications.

For many providers, it's not just a medical decision; it's an ethical one. Is it better to prescribe a more affordable but less rigorously tested medication, or stick with the expensive but FDA-approved option?

The Consumer Conundrum: Cheap Thrills or Expensive Peace of Mind?

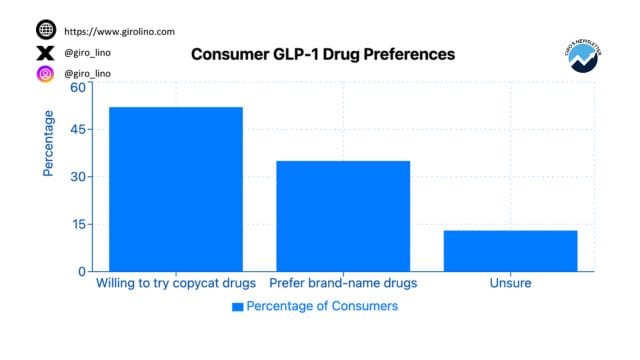

And what about the consumers in all this? For many, the decision between a $199 per month copycat drug and a $1,350 per month brand-name medication isn't just about money; it's about weighing risks and benefits.

The promise of significant weight loss at a fraction of the cost is undeniably appealing. But that appeal is tempered by concerns about safety, efficacy, and the long-term implications of using a compounded medication.

It's a classic consumer dilemma: Is the lower price worth the potential risks? Or is peace of mind worth the premium price tag?

The Bottom Line: Adapt or Die

For CMOs and brand managers in the pharmaceutical industry, the message is clear: the landscape is changing, and fast. The weight loss market is no longer a predictable, controlled environment. It's a dynamic, rapidly evolving ecosystem where new players can upend established norms overnight.

The winners in this new world will be those who can adapt quickly, balancing innovation with safety, affordability with quality. They'll need to be nimble, responsive to consumer demands, and adept at navigating an increasingly complex regulatory environment.

The losers? They'll be the ones clinging to outdated business models, watching their market share evaporate as more agile competitors race ahead.

As the dust settles on this latest disruption, one thing is clear: the weight loss drug market will never be the same. Whether that's a good thing or not remains to be seen. But one thing's for sure – it's going to be one hell of a ride.

The copycat drug clock is ticking. Time to face the music - and maybe rethink everything you thought you knew about the pharmaceutical industry.