Costco Wholesale recently released its fiscal fourth-quarter earnings report, revealing a mixed bag of results that warrant a closer look. As we unpack the numbers and management's insights, we'll explore what these results mean for the company's future and the broader retail landscape.

The Numbers at a Glance

Costco's Q4 results showed some positives, but also a few areas of concern:

- Earnings per share: $5.29, surpassing Wall Street estimates

- Revenue: $79.7 billion, slightly missing projections

- Net income: $2.35 billion, up 9% year-over-year

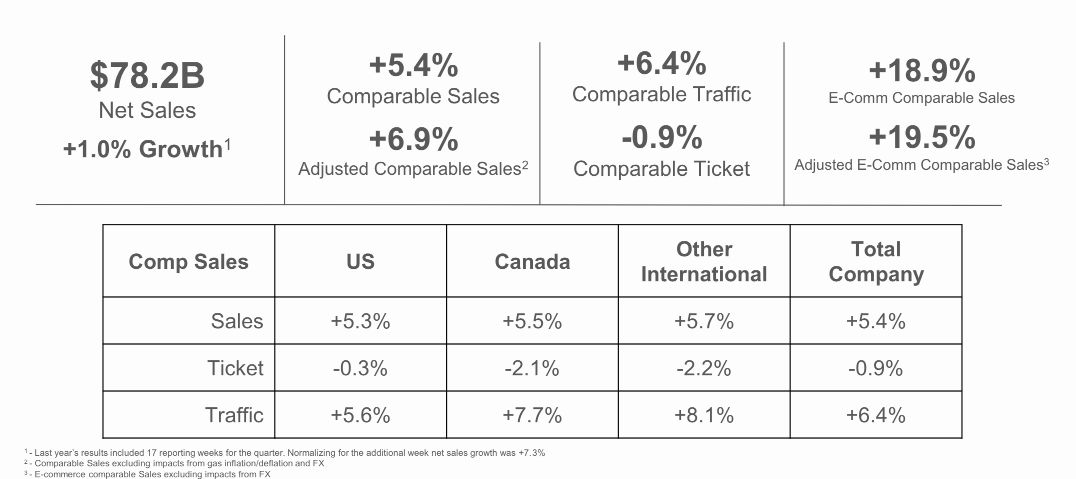

- Comparable sales: Up 5.4% overall (6.9% excluding gas and forex impacts)

- E-commerce sales: Up 19.5% year-over-year

These figures paint a picture of a company that's still growing, but perhaps not quite as rapidly as some had hoped. Let's dig deeper into what's driving these results and what they might mean for the future.

Membership: The Backbone of Costco's Business Model

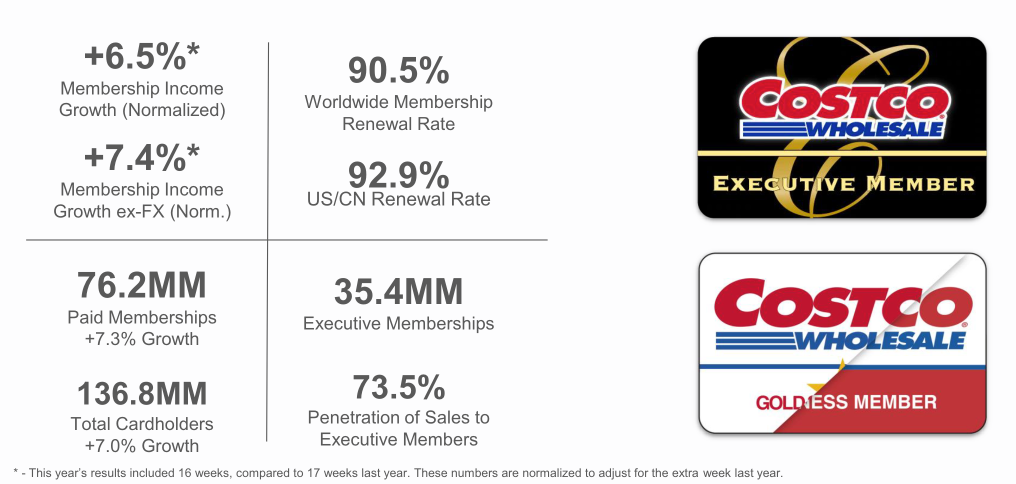

Costco's membership model is a crucial part of its business strategy, providing a steady revenue stream and fostering customer loyalty. The company reported some interesting membership statistics:

"We ended Q4 with 76.2 million paid household members, up 7.3% versus last year and 136.8 million cardholders, up 7% year-over-year. About half of new member sign-ups in fiscal year 2024 were under 40 years of age."

This growth in membership, particularly among younger consumers, is a positive sign for Costco's future. It suggests that the company is successfully attracting a new generation of shoppers, which could help drive long-term growth.

The company also noted strong renewal rates:

"The worldwide rate came in at 90.5%, the same as Q3, with improvement internationally offsetting the slight negative in the U.S."

These high renewal rates indicate strong customer satisfaction and loyalty, which are key drivers of Costco's business model.

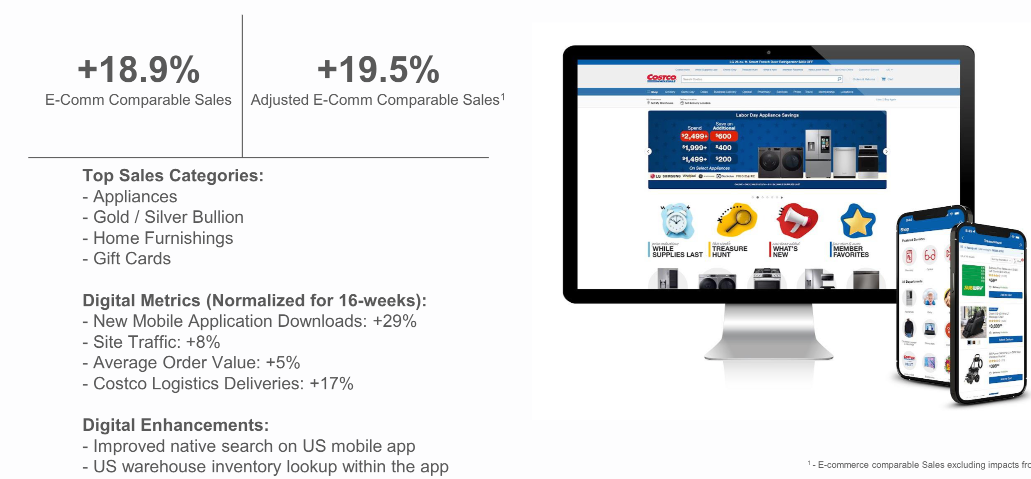

E-commerce: A Bright Spot in the Report

One of the standout areas in Costco's report was its e-commerce performance. The company reported a 19.5% year-over-year increase in e-commerce sales, significantly outpacing overall sales growth. This suggests that Costco is successfully adapting to changing consumer preferences and competing effectively in the online retail space.

Gary Millerchip, Costco's CFO, provided some color on the e-commerce growth:

"E-commerce traffic, conversion rates and average order value were all up year-over-year, helping to drive another strong quarter of comparable sales growth. While continued strength in bullion was a meaningful tailwind to e-commerce comps, appliances, health and beauty aids, tires, toys, gift cards, hardware, housewares, home furnishings, optical and pharmacy all grew double digits year-over-year."

This diverse growth across multiple categories indicates that Costco's e-commerce success isn't limited to a single product line, but is broad-based across its offerings.

Kirkland Signature: A Key Differentiator

Costco's private label brand, Kirkland Signature, continues to be a significant driver of growth and differentiation for the company. Ron Vachris, Costco's CEO, highlighted the importance of Kirkland Signature:

"We continue to see the penetration grow. And it's in the high 20s now as it continues to grow as our penetration across the board goes. We are not only seeing investment in price in Kirkland Signature. But with Claudine and her team, they have a commitment that if we're going to expect that of our suppliers, we're going to start setting that example and showing the benefits of investing in price and driving unit volume."

This focus on driving value through Kirkland Signature while maintaining quality appears to be resonating with customers. The brand's growing penetration suggests that it's becoming an increasingly important part of Costco's overall strategy.

Inflation and Pricing Strategies

In the current economic environment, Costco's approach to inflation and pricing is particularly noteworthy. Gary Millerchip provided some insights into the company's current inflation outlook:

"We shared for the quarter overall inflation was essentially flat. We saw a little bit of inflation in fresh. That was mainly driven by produce right now. That was sort of the key category there that drove -- but again, very low inflation, nothing meaningful to talk about. We're still seeing it very quiet in terms of the inflationary impact on prices and on the business."

This relatively benign inflation environment could be good news for Costco, potentially allowing the company to maintain its focus on providing value to customers without significant pressure on margins.

International Expansion and Growth Opportunities

Costco continues to see international markets as a key avenue for growth. Ron Vachris discussed the company's international expansion plans:

"We've got 12 next year that will be outside of the U.S. And we've got some -- you could imagine in some countries, it takes us a few more years to get a building opened up. So it really is about the cadence of them opening. But we continue to look forward that we feel pretty good, balanced growth."

This balanced approach to growth, with a mix of domestic and international expansion, could help Costco continue to drive top-line growth in the coming years.

Technology and Innovation

Costco is also investing in technology to improve the customer experience and drive operational efficiencies. One notable innovation is the introduction of membership card scanners at warehouse entrances. Ron Vachris explained the benefits:

"It gives our operators real-time traffic counts throughout the day. So we're able to adjust front-end lines that we need to open and close lines based on the fluctuations of business. We can monitor our fresh foods a little better because we know what the traffic counts look like and so forth. And it has also taken the friction of membership verification away from the front-end registers and move that to the front door, where we're able to look at people's membership status."

These technological improvements could help Costco enhance its operational efficiency and improve the shopping experience for members.

Challenges and Potential Headwinds

While Costco's overall results were generally positive, there are some potential challenges on the horizon. The company faces ongoing supply chain issues, particularly related to potential port strikes. Ron Vachris addressed this concern:

"The port strike is something we've been watching very closely for some time. We knew about the timing of this as well. When you think about the impact to our business, we import primarily nonfoods and some limited food and sundries come in, but nonfoods is less -- about 25% of our total business and only a subset of that is imported."

While Costco has taken steps to mitigate these risks, supply chain disruptions could potentially impact the company's ability to maintain inventory levels and meet customer demand.

Another potential challenge is the recent membership fee increase. While the company reported minimal impact so far, it will be important to monitor how this affects membership renewals and new sign-ups in the coming quarters.

Looking Ahead: Costco's Future Prospects

Despite these challenges, Costco's management team seems confident in the company's future prospects. Gary Millerchip summed up the company's outlook:

"Overall, we feel very good about our momentum ending fiscal year '24. And as we head into the new fiscal year, we feel very good about the opportunity ahead of us. As always, we've set ourselves high internal expectations for how we expect to grow the top line and to do so profitably. And we'll be doing that by continuing to invest in member value and employees while driving efficiencies and leverage."

This focus on balancing growth with profitability, while continuing to invest in both customers and employees, has been a hallmark of Costco's strategy for years. The company's ability to execute on this strategy in the face of changing market conditions will be key to its future success.

Conclusion: A Solid Foundation with Room for Growth

Costco's mixed earnings report reveals a company that's continuing to grow and adapt in a challenging retail environment. While there are certainly areas for improvement, the company's strong membership base, growing e-commerce presence, and strategic focus on value through Kirkland Signature provide a solid foundation for future growth.

The company's ability to attract younger members, expand internationally, and leverage technology for operational improvements are all positive signs for its long-term prospects. However, potential headwinds from supply chain issues and the impact of the membership fee increase will need to be closely monitored.

As we look ahead, Costco's commitment to its core business model of providing value to members while investing in its employees seems likely to continue driving its success. The company's ability to navigate the evolving retail landscape while staying true to its core principles will be crucial in determining its future performance.

For those watching the retail sector, Costco's performance and strategies offer valuable insights into broader industry trends. As always, it will be important to keep a close eye on future earnings reports and management commentary to gauge how well the company is executing on its plans and adapting to market conditions.