The Walt Disney Company (NYSE: DIS) recently released its third-quarter 2024 earnings report, revealing a mixed bag of results that exceeded analyst expectations in some areas while facing challenges in others. This comprehensive review delves into the key aspects of Disney's performance, analyzing various segments and offering insights into what these results mean for Disney stock and the company's future.

Streaming Services Achieve Profitability Milestone

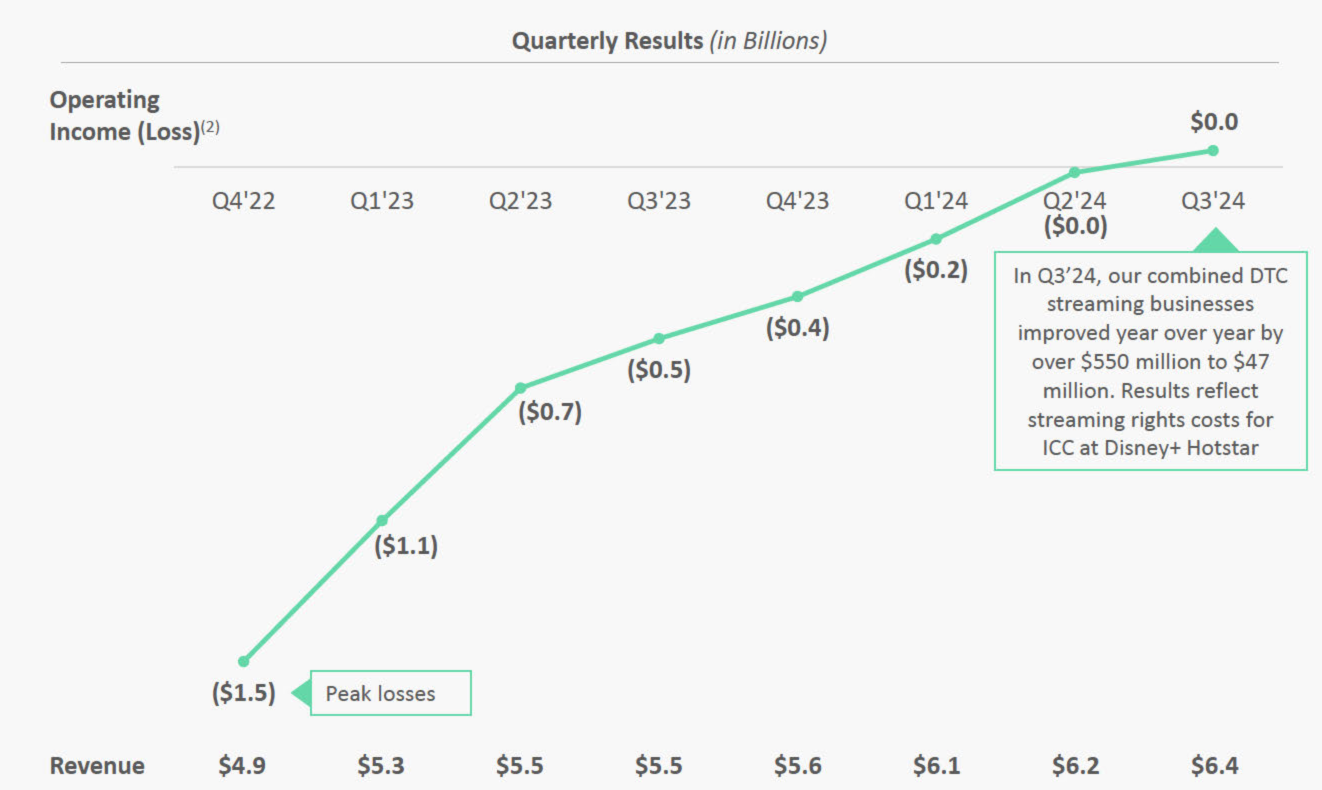

One of the most significant highlights of Walt Disney's Q3 2024 earnings was the profitability of its streaming services for the first time. This achievement marks a crucial turning point for the company's direct-to-consumer (DTC) strategy and streaming business.

"We've had only modest churn from that, nothing that we would consider significant. We believe that as we add these new features, like the channels that we're going to be adding later this year, that – and the success of our movie slate, and I'll get into that a little bit more, that the pricing leverage that we have has actually increased," commented Disney CEO Bob Iger during the earnings call.

Key streaming metrics include:

- Combined streaming services operating profit: $47 million

- Disney+ and Hulu combined operating loss: $19 million

- Disney+ subscriber growth: 1% increase to 118.3 million subscribers

This profitability milestone is particularly noteworthy considering that just two years ago, the streaming businesses reported an operating loss of $1.06 billion. The turnaround can be attributed to price increases, disciplined content spending, successful bundling strategies, and strong performance of key franchises and content.

While ESPN+ saw a slight decline in subscribers (2% decrease to 24.8 million), the traditional ESPN TV network remains a strong performer within Disney's conventional television sector.

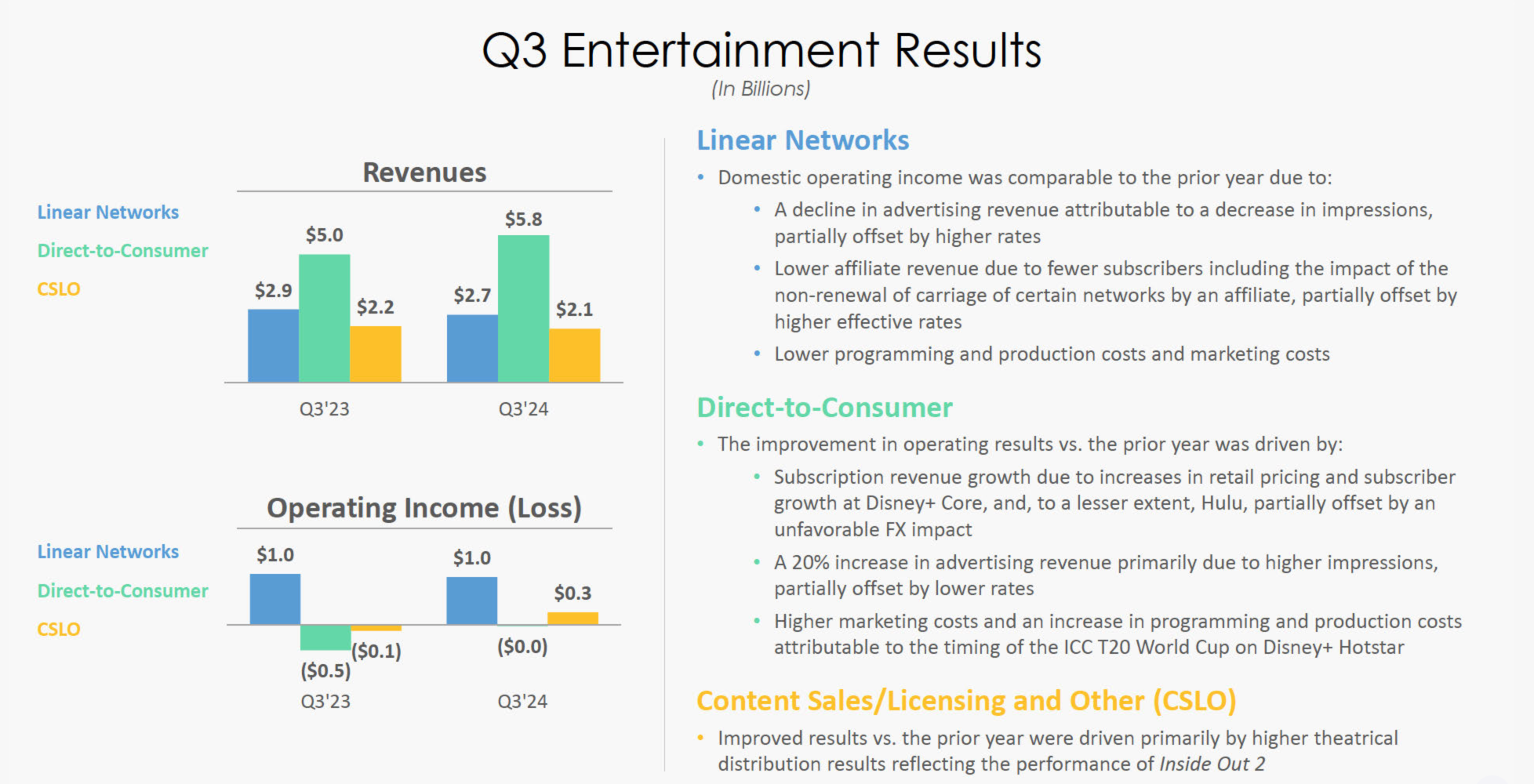

Entertainment Segment Success and Theme Park Headwinds

The Walt Disney Company's Entertainment segment experienced substantial success in Q3 2024, contributing significantly to the company's overall performance. Notable film performances include "Inside Out 2" becoming the highest-grossing animated film ever, and "Deadpool & Wolverine" breaking the record for the largest R-rated global opening.

However, Disney's theme parks faced challenges. Disney CFO Hugh Johnston noted, "We expect to see a flattish revenue number in Q4 coming out of the parks. And as we mentioned in – earlier in the letter, really just a few quarters. So I don't think I'd refer to it as protracted, but just a couple of quarters of likely similar results."

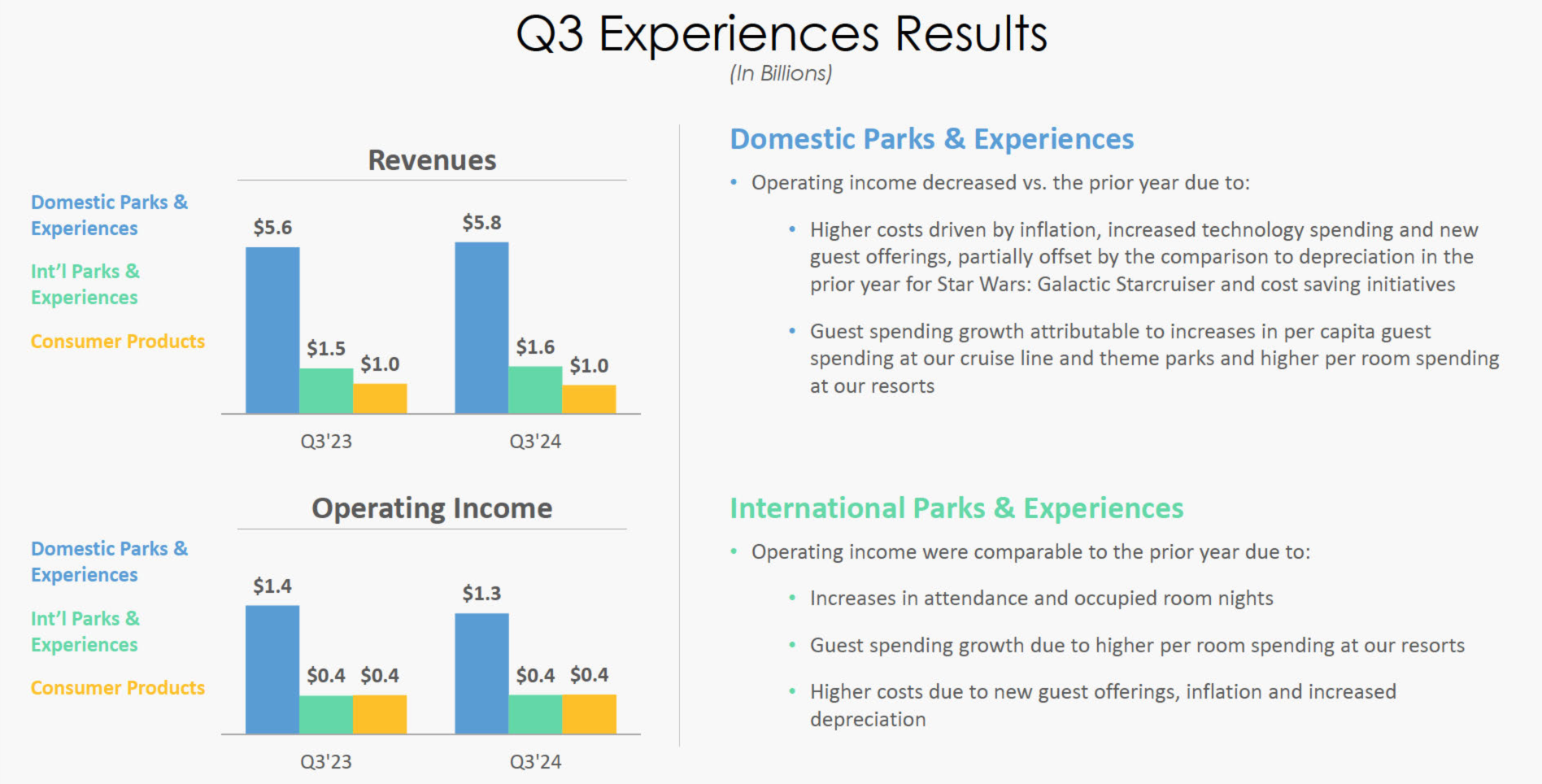

The Experiences segment showed signs of moderation, with operating income at $2.2 billion (3% decrease year-over-year). The company anticipates further challenges in the fourth quarter, projecting a mid-single digit year-over-year decrease in operating income for the Experiences segment.

Theme Parks Face Headwinds

While Disney's theme parks have traditionally been strong performers for the company, the Experiences segment showed signs of moderation in Q3 2024 compared to previous quarters.

Disney CFO Hugh Johnston noted, "We expect to see a flattish revenue number in Q4 coming out of the parks. And as we mentioned in – earlier in the letter, really just a few quarters. So I don't think I'd refer to it as protracted, but just a couple of quarters of likely similar results."

Experiences Segment Performance:

- Operating income: $2.2 billion (3% decrease year-over-year)

- Fourth quarter outlook: Mid-single digit decline in operating income expected

- Domestic parks: Reduced consumer demand

- International parks, including Disneyland Paris: Lower attendance expected due to Olympics

The company anticipates further challenges in the fourth quarter, projecting a mid-single digit year-over-year decrease in operating income for the Experiences segment. This decline is primarily driven by reduced consumer demand at domestic parks and lower attendance at international parks, including Disneyland Paris, due to the Olympics.

Financial Highlights and Future Outlook

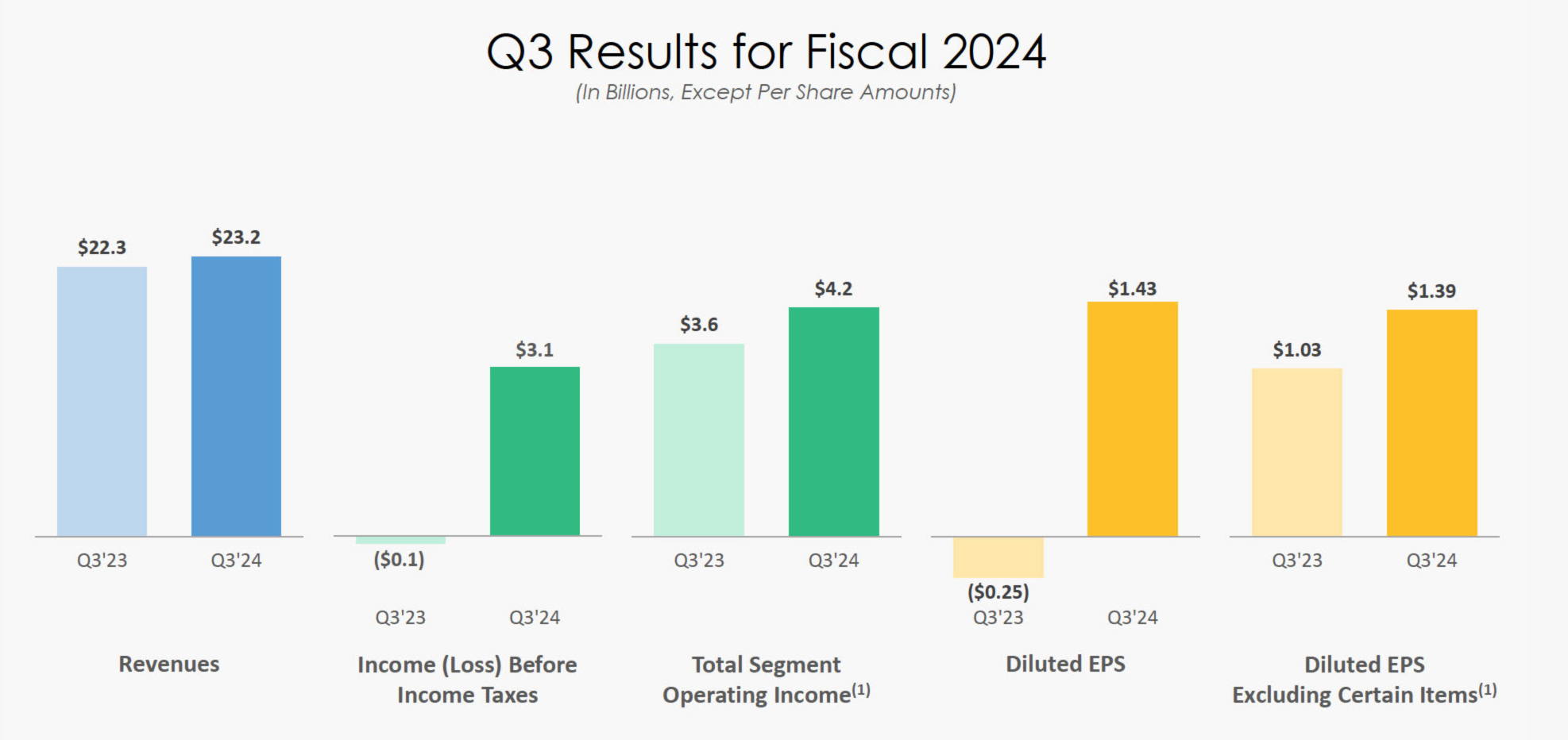

Despite the challenges in some areas, Disney's overall financial performance in Q3 2024 was strong:

- Revenue: $23.2 billion (beating estimates)

- Earnings per share: $1.39 (surpassing expectations)

- Full-year EPS growth target: Raised to 30% (from 25% previously)

Disney CEO Bob Iger and CFO Hugh Johnston remain focused on leveraging the company's diverse portfolio to drive growth and long-term value. Key strategic initiatives include enhancing streaming services, expanding theme park investments, and capitalizing on the strong performance of the entertainment segment.

Bob Iger emphasized the company's future outlook, stating, "When you think about not only the potential of those in box office, but the potential of those to drive global streaming value, I think there's a reason to be bullish about where we're headed."

The company expects its streaming business to grow nicely in fiscal 2025, implementing strategies such as password sharing initiatives and pricing adjustments.

Regarding password sharing, Iger mentioned, "We started our password-sharing initiative in June. That kicks in, in earnest in September. By the way, we've had no backlash at all to the notifications that have gone out and to the work that we've already been doing."

Implications for Disney Stock (DIS)

The mixed results from Walt Disney's Q3 2024 earnings report have implications for DIS stock. While the achievement of streaming profitability and strong performance in the entertainment segment are positive factors, the challenges faced by the theme parks segment may cause some investor concern.

As the company moves forward, investors and industry observers will be closely watching how Disney navigates the evolving media landscape, leverages its strong IP portfolio, and addresses the challenges in its Experiences segment. With its diverse business model and strong brand, Disney remains well-positioned to capitalize on opportunities across its various segments in the coming quarters.

For those interested in staying updated on Walt Disney Company's performance, the next earnings date is expected to be in early November 2024. Creating a free account on financial websites can provide access to real-time data and analysis to help make informed decisions about Disney stock and other investments in the entertainment and media markets.

Frequently Asked Questions

Q: What were the key highlights of Disney's Q3 2024 earnings report? A: The main highlights were the achievement of profitability in Disney's streaming services for the first time, strong performance in the Entertainment segment, and challenges faced by the Theme Parks division.

Q: How did Disney's streaming services perform in Q3 2024? A: Disney's combined streaming services reported an operating profit of $47 million, with Disney+ subscriber growth of 1% to 118.3 million subscribers. This marks a significant turnaround from previous losses.

Q: What challenges is Disney facing in its Theme Parks division? A: Disney is experiencing reduced consumer demand at domestic parks and expects lower attendance at international parks, including Disneyland Paris, due to the Olympics. The company projects a mid-single digit decline in operating income for the Experiences segment in the fourth quarter.

Q: How is Disney addressing password sharing on its streaming platforms? A: Disney initiated a password-sharing prevention program in June 2024, which will be fully implemented in September. According to CEO Bob Iger, the company has not experienced any significant backlash to these efforts so far.

Q: What is Disney's outlook for its streaming business in the coming year? A: Disney expects its streaming business to grow nicely in fiscal 2025. The company plans to implement pricing strategies, content expansion, and address account sharing to boost subscription revenue and engagement.