Hi.

When I first thought of writing about dLocal (“DLO” or “dLocal”), the impression was that it was possible to do it in one post.

However, after careful consideration, I split the report into Part I and Part II. Even though the company hasn’t many complexities, the sector is demanding.

There is a few misunderstanding about the industry gear I wish to clarify in the post. Also, as promised previously, the idea is to avoid gigantic posts.

So, this first post will give a very (very) short overview of dLocal, and a profound analysis of the industry size, tailwinds, growth, and so on.

Next week, I’ll break down the entire value chain in dLocal’s take-rate and understand its future prospects, presenting my estimates, valuation, and why I don’t hold any stock.

The valuation (Xls) and the presentation (pdf) will be attached in the next week’s post. In my opinion, that would not make sense to break it down as well.

As a solo writer self-funding the entire research, any support is invaluable for maintaining the operations. To support my work, consider becoming a free or paid subscriber.

The Outline

- Company Overview

- Industry Overview

- Cross-Border Pay

- Tailwinds

- Estimating Addressable Market

- Going Deep

Company Overview

dLocal is a payment company focused on making the complex simple, redefining the online payments experience in emerging markets (ex-China).

The company enables global enterprise merchants to get paid (pay-in) and make payments (pay-out) online safely and efficiently through one direct API, one technology platform, and one contract.

Merchants on the platform consistently benefit from improving acceptance and conversion rates, reduced friction, and improved fraud prevention, leading to enhanced potential interaction with nearly 2 billion combined internet users in the countries we serve (excluding China).

dLocal’s proprietary, fully cloud-based platform can power cross-border and local-to-local transactions in 30+, mainly LatAm.

The solutions are built to be both payment method-agnostic and user-friendly, enabling global merchants to connect with over 600 local payment methods for emerging countries.

Industry Overview

In the past decade, probably one of the industries that went through the most significant changes was payments.

Payments companies are using tech to digitize manual workflows and automate tasks to respond to customer demand, reduce expenses, and streamline legacy payment systems.

This includes deploying solutions that automate accounting processes and move money more quickly and efficiently, saving costs and proving profitability.

Cross-border payments & money transfer tech companies help businesses send funds to other businesses, often internationally.

Some technologies, like white-label digital wallets, help non-financial institutions customize their digital wallets to improve the customer experience.

Other tech solutions help financial institutions connect to real-time payments networks for faster payment processing.

According to multiple channel checks, we observed three key themes: customers are increasing their exposure to automated accounting, faster payment processing, and product personalization.

Companies in this space provide comprehensive payment processing solutions that allow businesses to accept payments through online, mobile, or in-store channels.

These platforms offer data integration across payments, marketing, and sales channels so that customers can shop and transact the same way online and offline, giving businesses a single view of the customer journey.

In the long-term, omnichannel payments startups help merchants integrate datasets to build personalized shopping experiences and drive customer value.

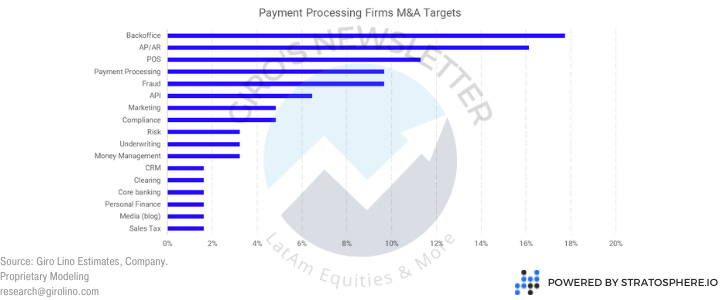

To understand the market trend, we selected leading payment processing firms, incumbents, and challengers and mapped all M&As they did.

For incumbents, it’s important to highlight they’re responsible for almost every payment processing firm acquisition.

Incumbents are global players. There are few incentives for them to expand and create a commercial relationship in smaller countries, so M&A is the cheapest alternative.

For challengers, though, except for one company, there is no acquisition of payment processing firms. Most challengers are born local, with their respective commercial relationships, so M&A between challengers' payment processing firms looks unlike.

If you’re interested in the exception, it was Valitor’s acquisition by Rapyd in 2021. Nevertheless, Arion Bank, Valitor’s previous owner, was actively looking for a buyer and leaving the business, so it was not Rapyd actively looking for new processing companies.

Nevertheless, challenger payment processing firms have been investing heavily in backoffice capabilities to support scalability, AP/AR, and POS to increase customer stickiness, as the payment processing is perceived as a commodity business.

We agree with them. Companies such as Stripe and Adyen, who transit from a payment processing firm to a Payment API & Infrastructure company, are likely to charge higher take rates with substantial stickiness to their clients.

Cross-Border Pay

Dealing with cross-border payments, we could split them up between B2B and B2C product bundles. In this post, we’ll focus exclusively on B2B, though B2C presents an exciting opportunity.

Today, establishing a commercial relationship with local partners is costly. For companies such as Google, Microsoft, Netflix, and so on that operates globally, hiring cross-border companies is advantageous.

Even though take-rates are still high, global players have little interest in investing heavily in creating their own commercial network in regions with little importance to them.

For instance, if Google didn’t hire any partner, it’d have to build 800+ commercial agreements with local partners to facilitate its receivables.

Even though we believe open banking will solve most of the puzzle, facilitating this connection will take years. Perhaps, decades.

In summary, cross-border companies make money transfer cheaper and faster by building various tech solutions:

- Cross-border payments infrastructure that doesn’t run on traditional bank networks;

- Platforms that allow clients to access legacy bank rails more easily;

- Crypto-based payment solutions that run on blockchain technology.

The following years will be interesting for the sectors. In 2021, many companies emerged, backed by huge VCs. Take-rates will go down.

B2B money transfer tech is moving further into crypto & blockchain-based payments as emerging fintechs provide platforms, products, and services that leverage the blockchain network to transfer funds.

Bank incumbents still dominate the global money transfer market, although fintechs are gaining market share with SMB customers that tend to move smaller amounts of money across borders.

So, most cross-border players are focused on enterprise customers. We believe that it will take years for penetration in SMBs to increase, as the complexity is also greater.

Tailwinds

Credit Card Penetration

eCommerce penetration, and adoption of electronic payment methods, credit and debit card penetration in emerging markets continues low relative to developed markets peers.

According to a study conducted by Morgan Stanley, the average card penetration of emerging countries is around 25% of PCE, almost 3x lower than the average for developed markets peers.

Lower penetration in a context of faster digitalization poses an attractive multiyear high growth opportunity for electronic payments in EM.