The Outline

- Revenue Streams

- Market Share

- Forecasts and Valuation

- Deal Breaker

Revenue Streams

While DLO 0.00%↑ does not provide detailed disclosure on its revenue, we did our research to understand how the company makes money.

DLO 0.00%↑ earns its revenue from fees charged to merchants in connection with payment processing for cross-borders and local payment transactions.

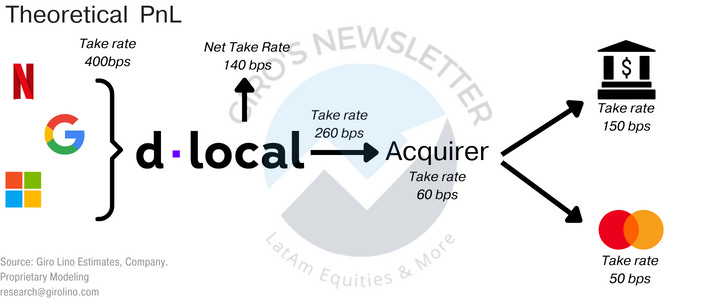

These fees are primarily generated per approved transaction basis, in most cases a fixed percentage per transaction, but it also can be a fixed fee per transaction. Since most transactions are through cards, we did our own theoretical PnL:

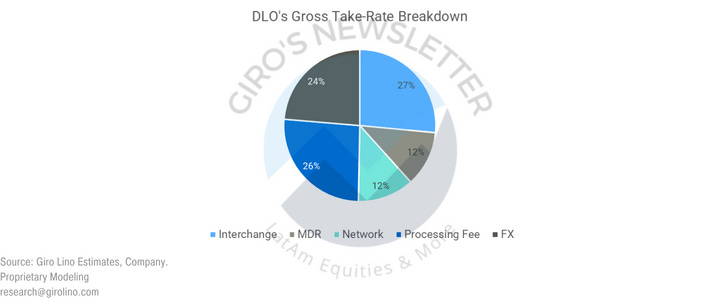

(1) The company charges a gross take-rate in each transaction, which depends on the transacted volume. The gross take rate is recognized as revenue for the company, while the paid take rate to the acquirer is a cost.

Even though DLO 0.00%↑ does not open its spread, we believe there is increasing pressure on processing fees, especially in countries with a mature payment system, such as Brazil.

(2) FX spread fee earned on payments involving conversion and expatriation of funds to and from various currencies (USD, EUR,…). We believe that FX spread is a relevant component of DLO’s profitability.

The FX spread for non-exporting contracts in Brazil has been around 100-150bps, according to the Brazilian Central Bank (Portuguese-only).

On one side, for mainly operating in emerging countries, DLO 0.00%↑ attains a considerable improvement in its profitability spreading the merchant in the FX pricing.

However, we see a significant risk in this source of revenue. Even though the spread has been constant in the past decade, it’s impossible to ignore that cheaper services are emerging nowadays.

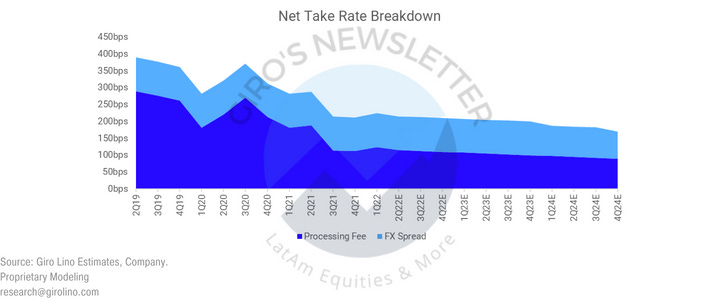

Once again, in our modeling, we were contrarian to the market consensus. The consensus assumes that the processing fee and the FX spread will remain constant.

These assumptions sound aggressive. Gross take-rates have started to drop in recent years, with competition intensifying in the region.

Through industry channel checks, we see no easing in competitive pressure. On the contrary, actually. Companies are seeking new clients by offering more aggressive pricing.

In our model, we consider that (i) processing fee will converge to a similar remuneration that acquirers and scheme companies yield, and (ii) FX spreads will reduce from 100bps to 50bps.

Market Share

We estimate that dLocal has been significantly increasing its share of wallet among its top ten clients. Regrettably, DLO 0.00%↑ has not disclosed its top 10 merchants.

However, our channel checks suggest that GOOG 0.00%↑ , META 0.00%↑ , NFLX 0.00%↑ , AMZN 0.00%↑ , and UBER 0.00%↑ are included in the list. We know that the top 10 merchants combined represented 56% of total revenues in 2021.

Considering only LatAm and the mature share of the wallet, it’s unlike that DLO 0.00%↑ yields a market share much superior to 13%, which is the mature share of the wallet we expect for the business.

However, we highlight that our model does not consider any global expansion. Even though there is a significant upside risk, that will take time for the company to establish its local relationship, acquire clients, and generate revenue streams.

Also, we do not know how much Capex the company will need to deploy its expansion strategy, the potential share of wallet in new regions, and the pricing.

For instance, DLO 0.00%↑ could charge a superior take rate after entering a new region. Still, if the company fails to charge its FX spread, profitability will be inferior in the long term.

In Brazil, the FX regulation is mature, players have been operating for decades, and we understand why the 100-150bps represents a risk to the company’s profitability.

Considering that we do not know how each of those new markets works, we prefer to be overly conservative and respect our limitations.

Forecasts and Valuation

eCommerce penetration and adoption of electronic payment methods, credit and debit card penetration in emerging markets continue low relative to developed markets peers.

According to a study by Morgan Stanley, the average card penetration of emerging countries is around 25% of PCE, almost 3x lower than the average for developed markets peers.

Also, according to Rapyd, over 98% of Brazilians already use online banking and bank apps. Most (83%) are willing to migrate to fully digital banks, driven by their lower costs, 24-hour operations, and faster speed.

Consequently, credit card growth will be driven by product substitution due to higher product penetration and competition increasing in the past years.

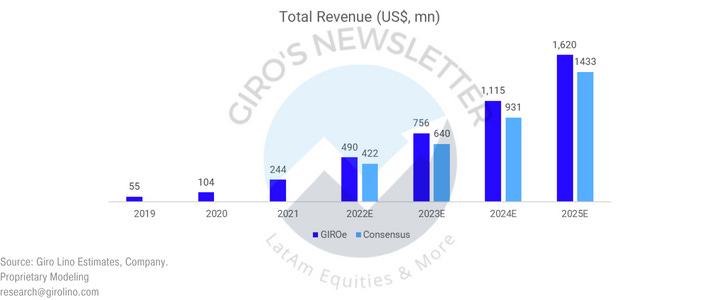

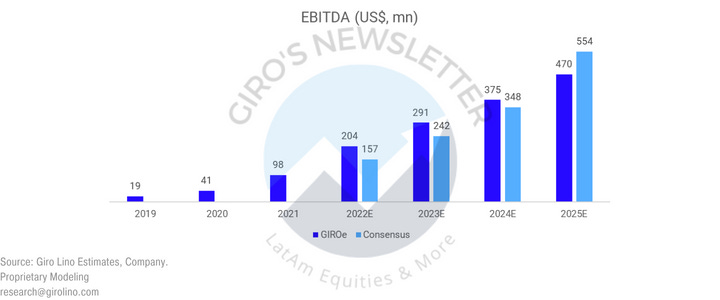

Our modeling suggests a strong than expected credit card penetration in LatAm, presenting an upside risk for revenue throughout the following years, explaining higher sales than consensus.

Also, as previously commented, we disagree with the market consensus regarding the company’s margin, mainly due to lower than expected FX spread.

Consequently, we do not believe that DLO 0.00%↑ will keep its profitability throughout the following years. We had a lot of difficulties estimating a running margin different from an acquirer firm.

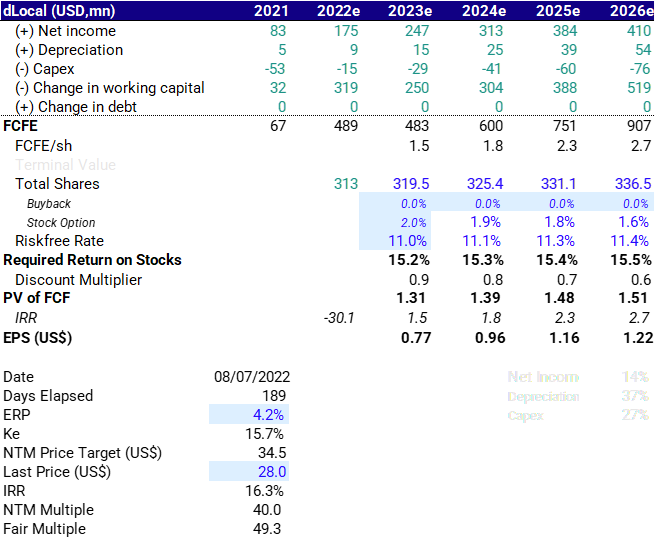

Finally, there is no secret in the company valuation. One business, not much catch, except for the cost composition.

Dlo Client 2022 07 08725KB ∙ XLSX fileDownloadDownload

Deal Breaker

Unfortunately, although we wrote almost 25 pages about DLO 0.00%↑ , it was a non-go after less than an hour of researching the firm.

As you probably noticed, every time we start writing about a new company, we spend a great deal of time explaining the company’s history.

However, dLocal’s F-1 had absolutely nothing about its history. Nothing. It only says the company was founded in 2016, then repeats the entire overview section.

That raised 50 yellow flags at the same time. Indeed, it’s tough to find anything about it, and the little information we found is a deal-breaker.

dLocal is a carve-out from a company called AstroPay, also owned by dLocal’s shareholders. While DLO 0.00%↑ is focused on cross-border B2B, AstroPay focuses on processing domestic transactions, also for B2B.

If you have two businesses complementary to each other, why carve out one of them?

Not only this, another company called Datanomik has an awkward context. The company was founded by Sergio Fogel (dLocal major shareholder) and Gonzalo Strauss, a former AstroPay product manager.

According to them, it was an internal project within AstroPay. Still, after developing the idea, Strauss approached Fogel, his manager at the time, and pitched him on launching the project as a standalone company.

AstroPay has the entire open banking product bundle (wallet, digital card,…), dLocal outstanding cross-border processing with top-notch clients, and Datanomik the open finance capability.

They’re all complementary businesses that could become massively successful companies operating in all industry segments. Only AstroPay would have these capabilities in the entire market.

Also, dLocal could be a private company forever and still fund Datanomik, which received US$6mn for seed money.

Since its IPO, we estimate that DLO 0.00%↑ has spent US$42mn in expansion Capex. In the same period, we estimate a US$142mn FCFF, and a US$440mn for 2022e. The recent expansion initiatives should expand its annual maintenance Capex from US$4.5mn to US$10mn.

Why turn public only dLocal, leaving AstraPay and Datanomik as private firms?

The only information we only have is that from the US$620mn from the IPO, almost 80% was a secondary tranche, with the controlling shareholder selling.

There is a wide range of possibilities for a manager to make this decision. But unfortunately, most are bad for minority shareholders.

Given the lack of transparency, we don’t care about the DCF and business perspectives. We see too much risk in governance for pursuing any investment in the firm.