dLocal (NASDAQ: DLO), the emerging markets payment processor, has released its financial results for the second quarter of 2024. Let's dive into the company's performance, key metrics, and future outlook to understand how dLocal is navigating the complex landscape of global fintech.

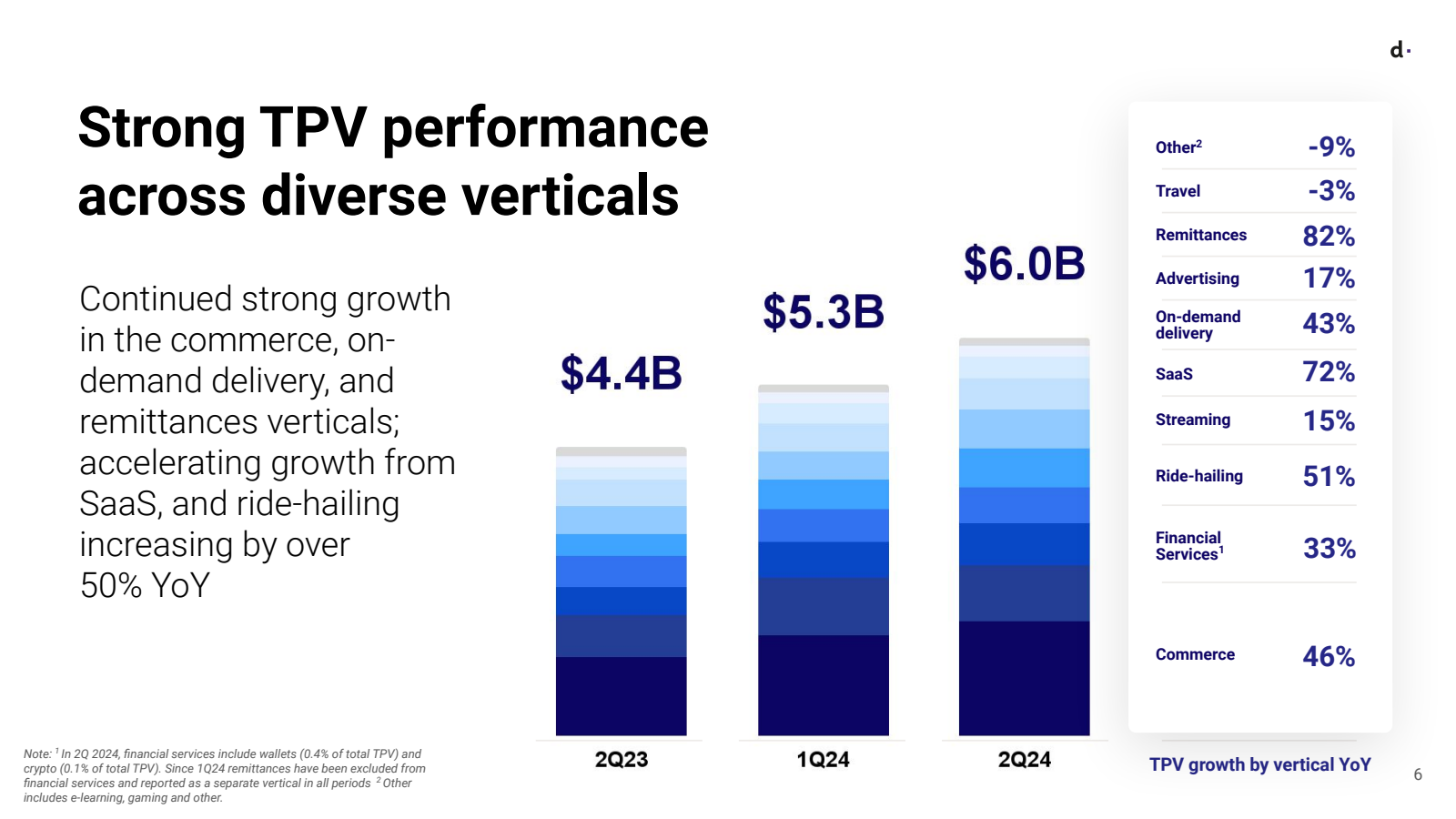

Record-Breaking Total Payment Volume (TPV)

dLocal achieved a milestone this quarter, with Total Payment Volume (TPV) reaching $6.0 billion, marking a 38% year-over-year growth and a 14% quarter-over-quarter increase.

CEO Pedro Arnt highlighted the significance of this achievement:

"We continue to see strong growth in our business, achieving another quarterly record of $6 billion of TPV during Q2 '24. The evolution of this key metric demonstrates our continued ability to grow as we gain share of wallet from our global merchant base, add new merchants to the mix as well."

The company saw robust growth across various verticals:

- Commerce: 33% YoY

- On-demand delivery: 46% YoY

- Remittances: 82% YoY

- SaaS: 72% YoY

- Ride-hailing: 51% YoY

This diversified growth underscores dLocal's adaptability and its strong position in multiple market segments.

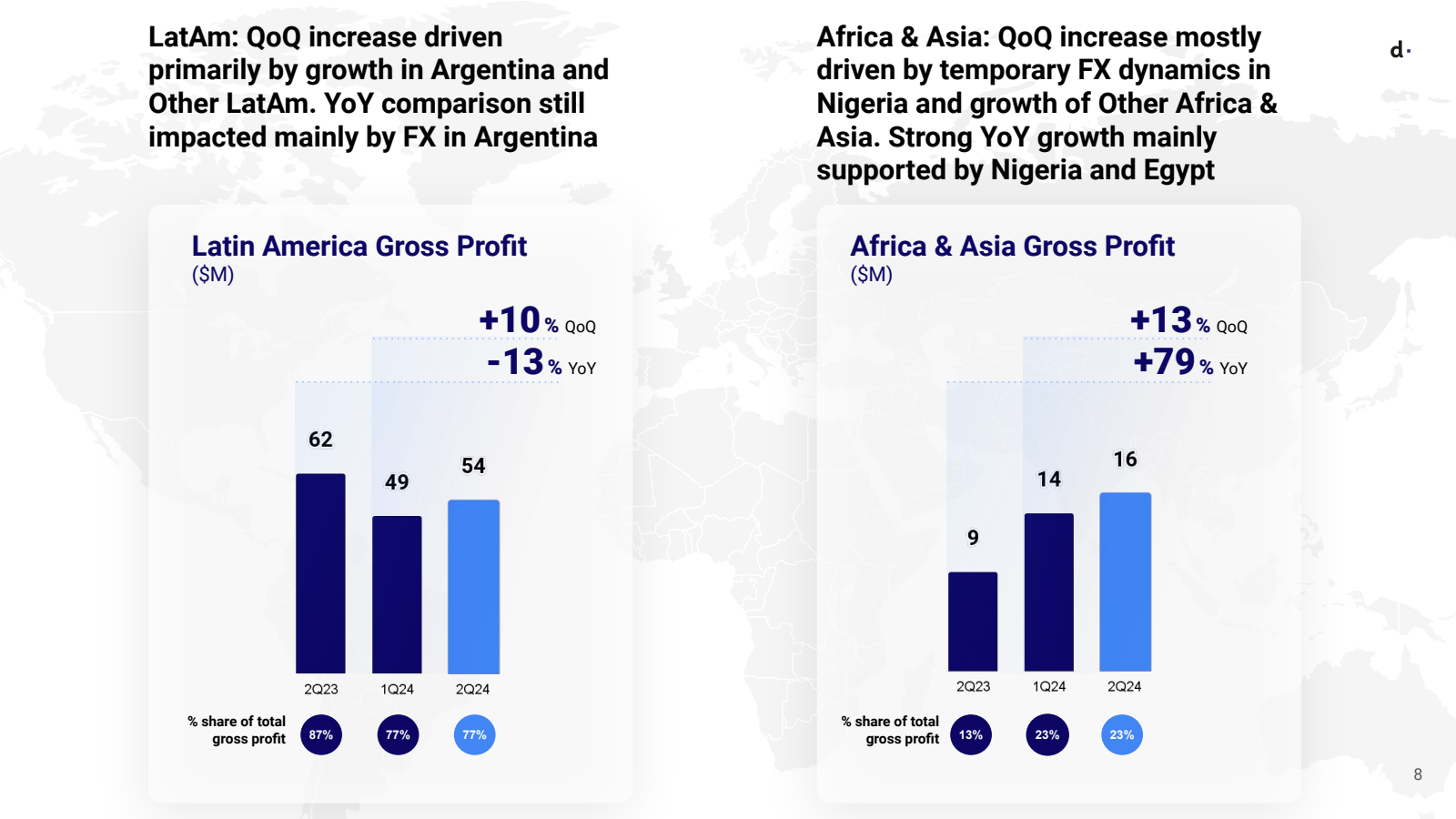

Revenue Performance: A Tale of Two Regions

dLocal reported revenue of $171 million for Q2 2024, a 6% year-over-year increase but a 7% quarter-over-quarter decline. The regional breakdown reveals a nuanced picture:

- Latin America: $138.7 million (81% of total revenue)

- Africa & Asia: $32.6 million (19% of total revenue)

Maria Oldham, SVP of Corporate Development, Strategic Finance & IR, explained the regional dynamics:

"LatAm gross profit increased by 10% quarter-over-quarter. The main drivers were the growth in Argentina and other LatAm markets, mainly Colombia and Costa Rica and Brazil with lower processing costs following our renegotiation with processors, coupled with change in payment mix."

The Africa & Asia segment faced headwinds due to currency devaluations, particularly in Egypt and Nigeria, leading to a 45% quarter-over-quarter decrease in revenue.

Profitability: Navigating Challenges

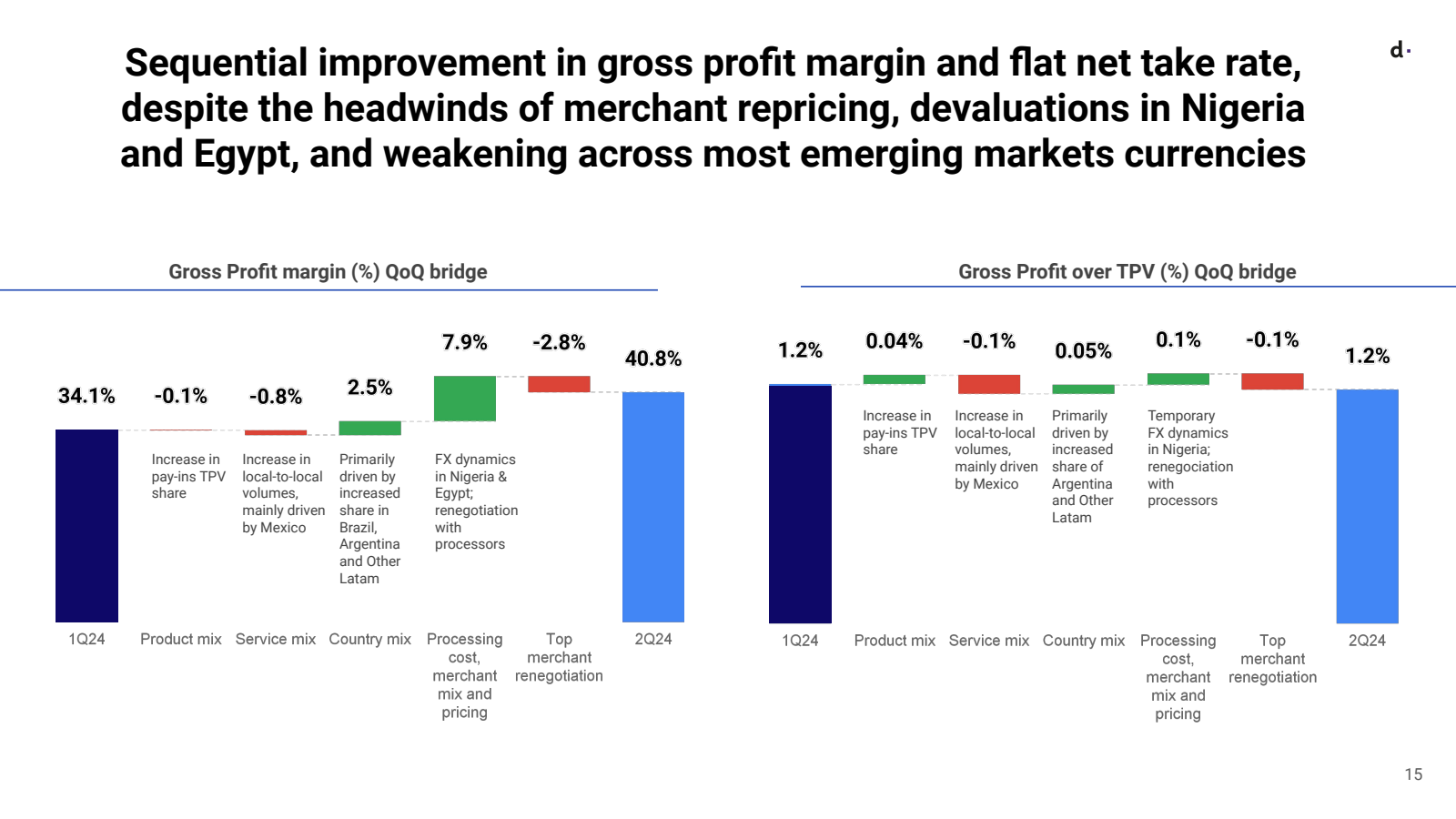

dLocal's gross profit for Q2 2024 was $69.8 million, showing a slight 1% year-over-year decrease but an 11% quarter-over-quarter increase. The gross profit margin stood at 40.8%, up 662 basis points quarter-over-quarter but down 313 basis points year-over-year.

CFO Mark Ortiz outlined the company's approach to balancing growth and profitability:

"We remain committed to maintaining a balanced approach to expense management, balancing short-term and long-term opportunity. As a result, we delivered operating profit of $30 million for the quarter, up 12% quarter-over-quarter and adjusted EBITDA of $43 million, up 16% quarter-over-quarter, representing an adjusted EBITDA margin of 25%."

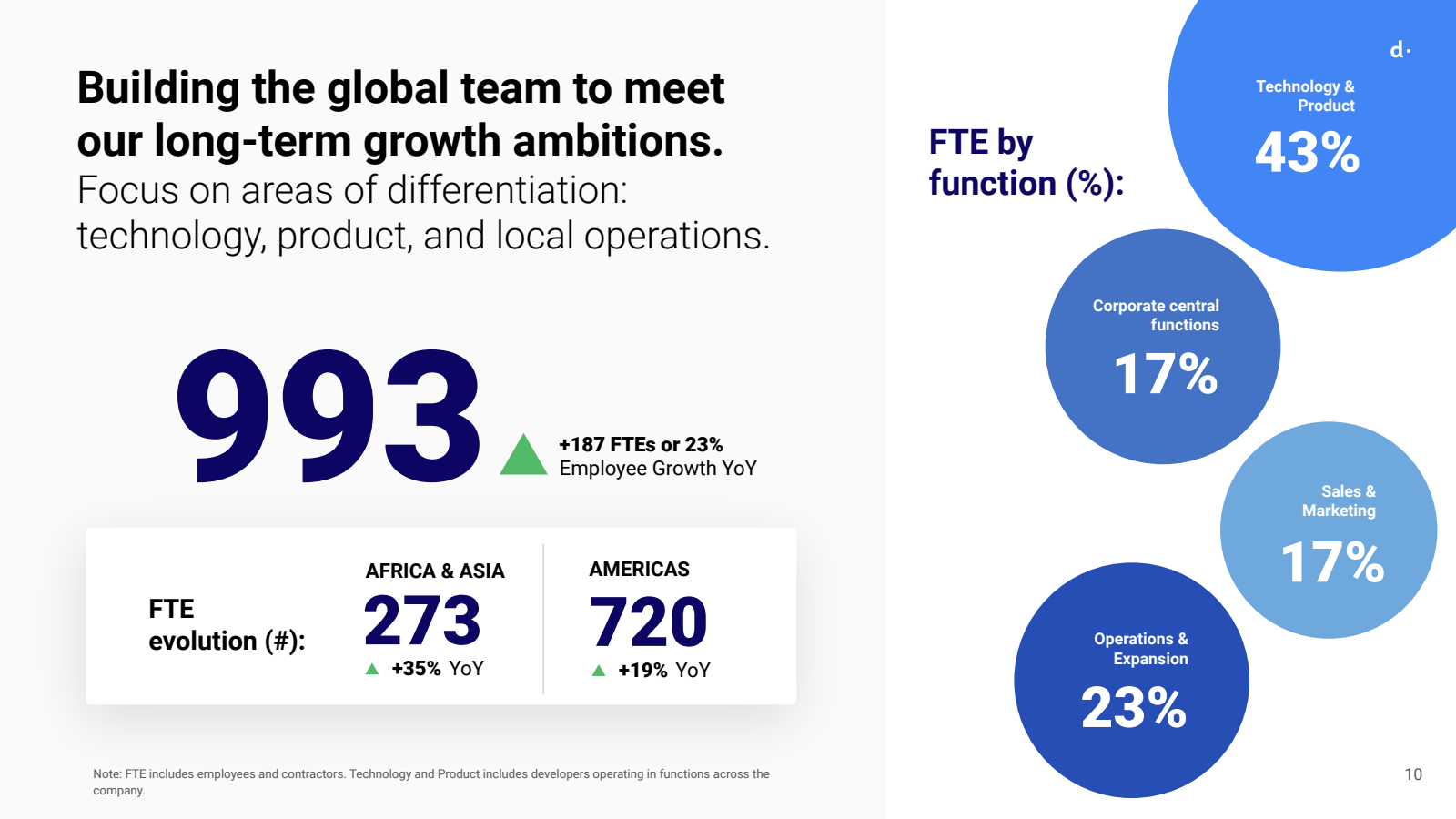

Strategic Investments for Future Growth

Despite short-term profitability challenges, dLocal continues to invest in key areas:

- Technology and product development

- Expansion of local operations

- Strengthening of back-office capabilities

CEO Pedro Arnt emphasized the importance of these investments:

"We need to continue hiring more IT and product talent, strengthening our internal controls for the ever more complex businesses we manage and investing in control functions that protect our merchants' business and reputations across the Global South."

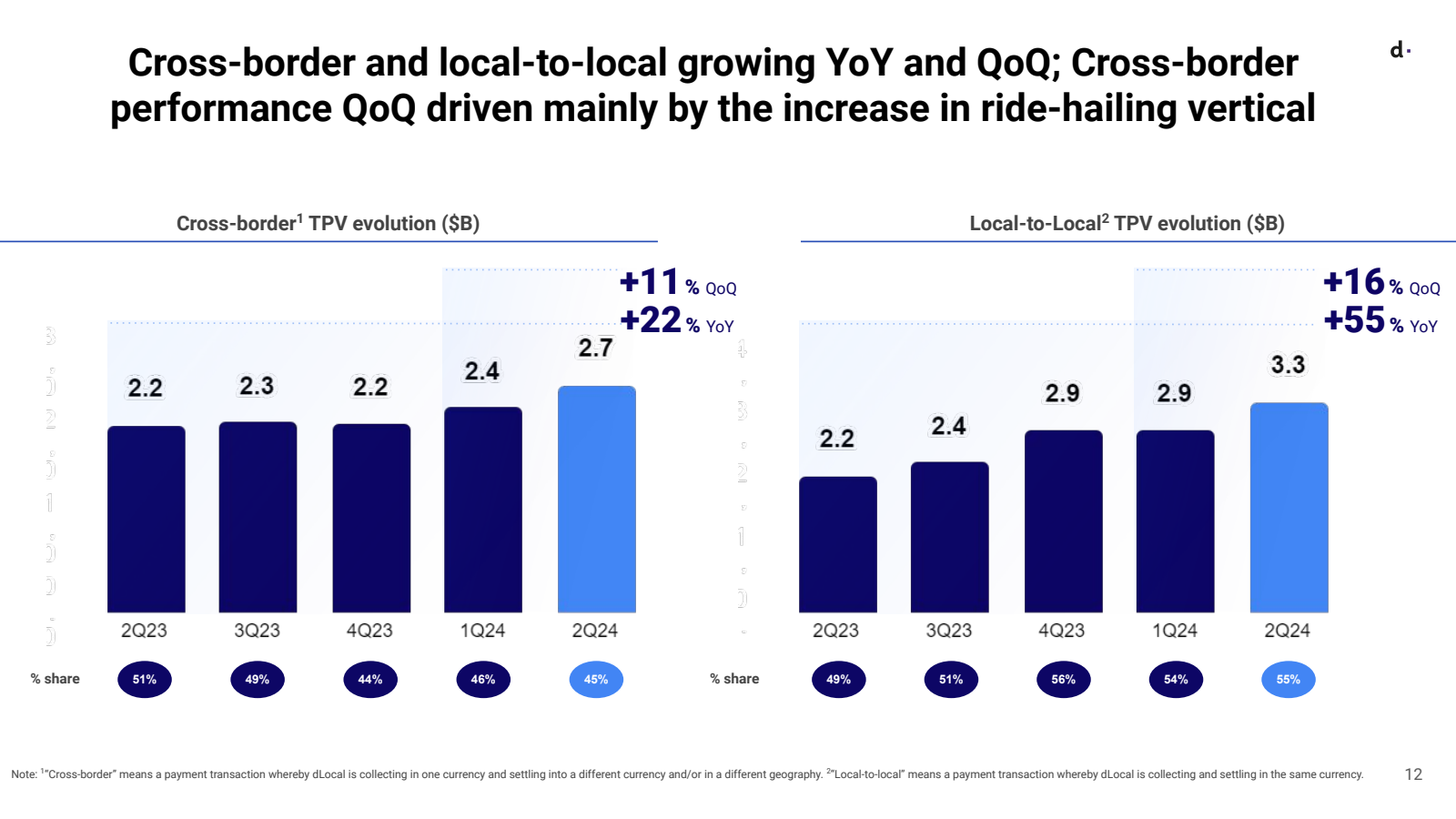

Cross-Border and Local-to-Local Payment Dynamics

dLocal's business model encompasses both cross-border and local-to-local payment flows:

- Cross-Border Payments: $2.7 billion TPV (22% YoY growth, 11% QoQ growth)

- Local-to-Local Payments: $3.3 billion TPV (55% YoY growth, 16% QoQ growth)

Maria Oldham provided insights on these dynamics:

"Cross-border business core to our value proposition grew 11% quarter-over-quarter and 22% year-over-year, reaching a new record of $2.7 billion in TPV. The quarterly growth is driven especially by the ride-hailing vertical."

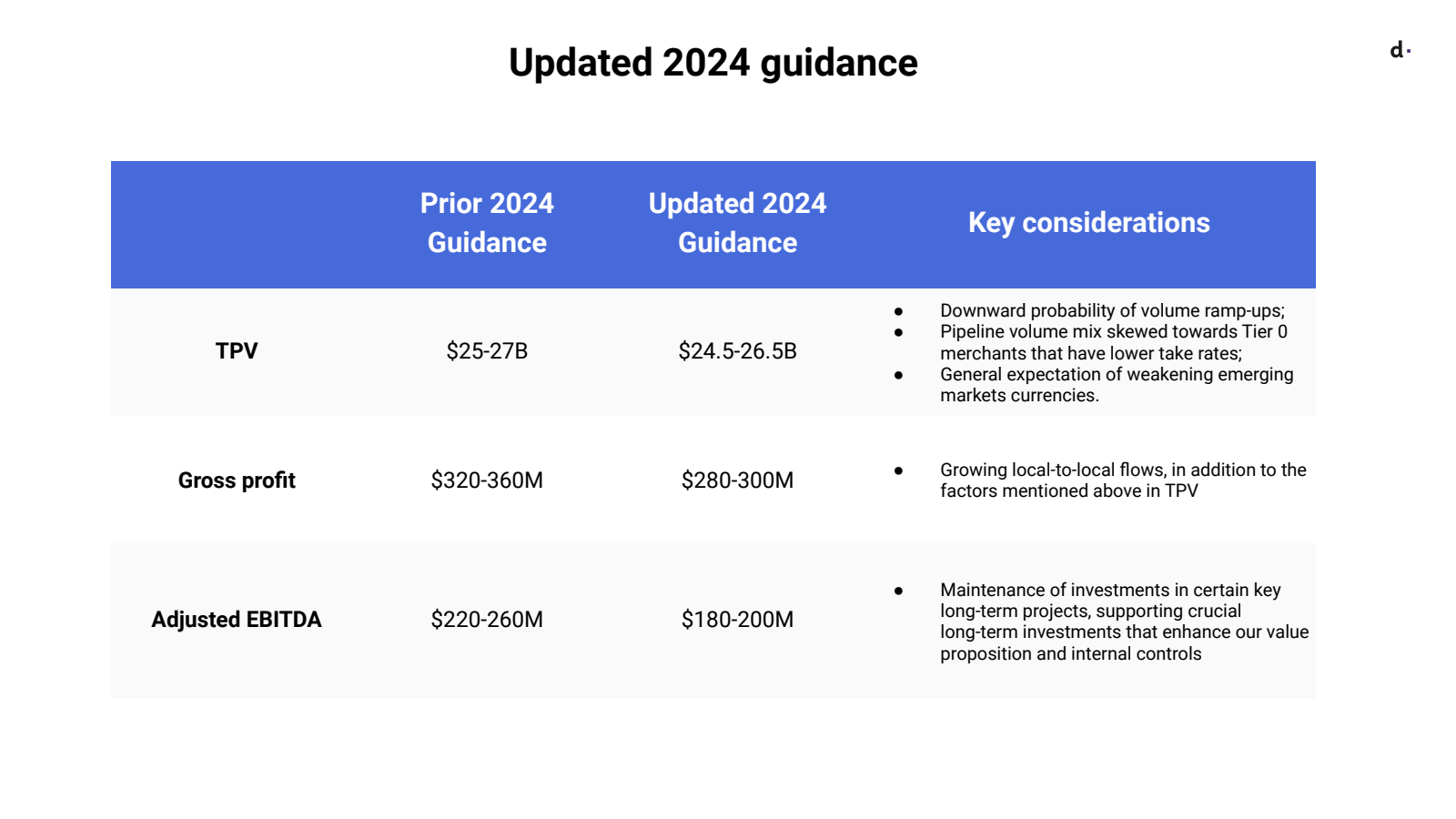

Updated 2024 Guidance: Adapting to Market Realities

In light of Q2 results and ongoing market challenges, dLocal has updated its 2024 guidance:

- TPV: $24.5 - $26.5 billion (previously $25 - $27 billion)

- Gross Profit: $280 - $300 million (previously $320 - $360 million)

- Adjusted EBITDA: $180 - $200 million (previously $220 - $260 million)

CEO Pedro Arnt explained the rationale behind the revised guidance:

"Our new TPV expectation is explained by lower probability of volume ramp-ups on certain merchants, pipeline development that is skewed even more towards Tier 0 merchants with lower take rates and weaker emerging market currency expectations, going forward."

Looking Ahead: Opportunities Amid Volatility

Despite the challenges, dLocal remains optimistic about its long-term prospects in emerging markets. CEO Pedro Arnt concluded:

"We continue to thrive across emerging markets, despite their complexities, which we embrace as we deliver simple, effective solutions to our merchants. Our focus remains on execution and long-term growth and our commitment to our merchants and our expertise in the regions where we operate enable us to consistently win business from these global players."

As dLocal navigates the volatile landscape of emerging markets fintech, investors and industry observers will be watching closely to see how the company balances growth ambitions with profitability goals in the quarters to come.