Financial Performance Overview: A Slice of Success

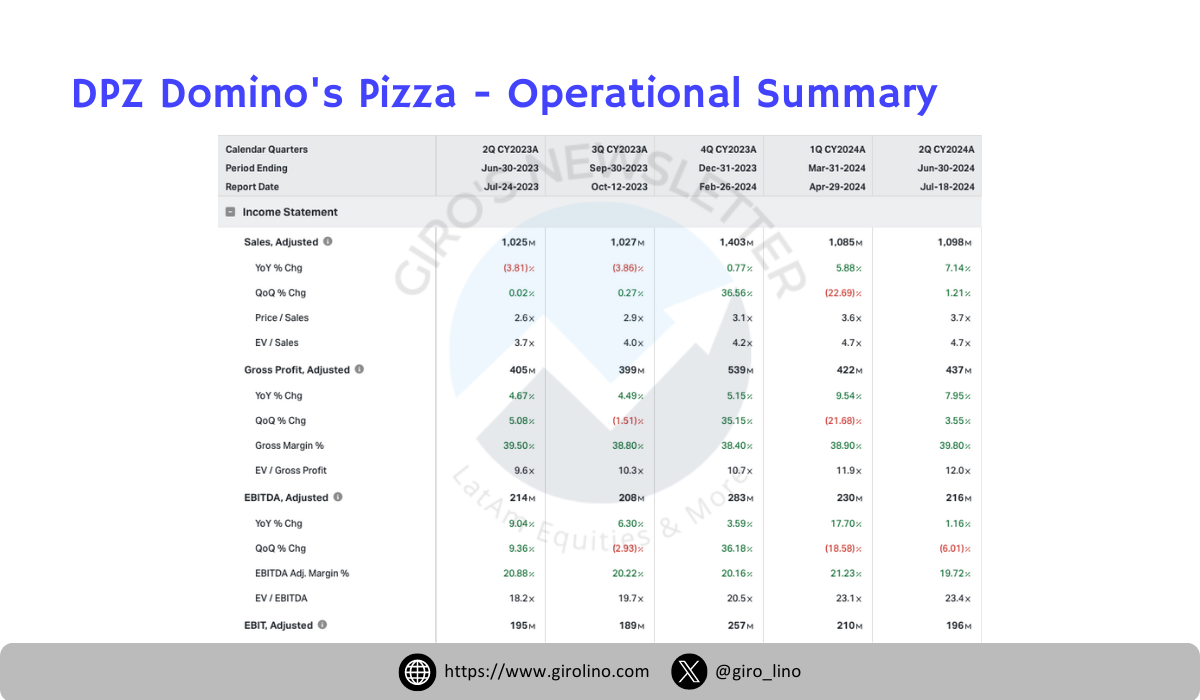

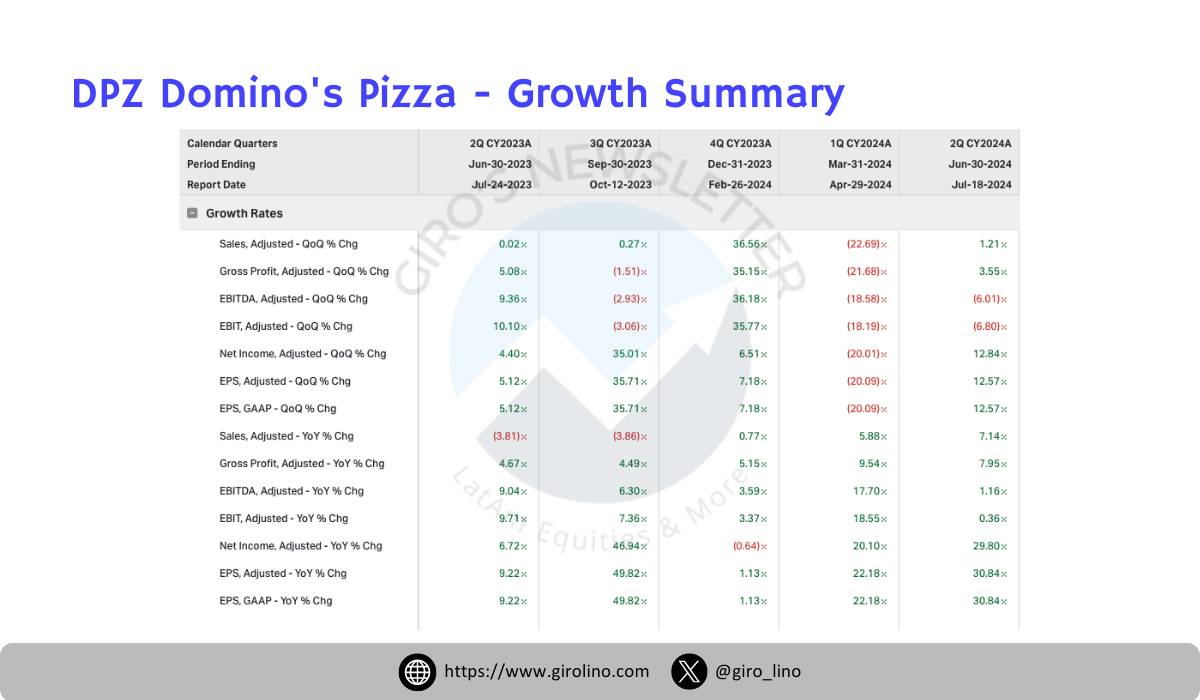

Domino's Q2 2024 financial results tell a story of a company that continues to rise to the challenge in a competitive market. The pizza giant reported a 7.1% year-over-year increase in revenue, reaching an impressive $1.09 billion for the quarter. This growth wasn't just a slice of good fortune; it was driven by increased supply chain revenues, higher U.S. franchise advertising revenues, and growth in U.S. franchise royalties and fees.

But the real meat of the financial story lies in the bottom line. Domino's saw its net income surge by a mouth-watering 29.8% to $142 million, while diluted earnings per share (EPS) rose by 30.8% to $4.03. This significant boost was largely attributed to a $26.4 million change in pre-tax unrealized gains and losses associated with the remeasurement of the company's investment in DPC Dash.

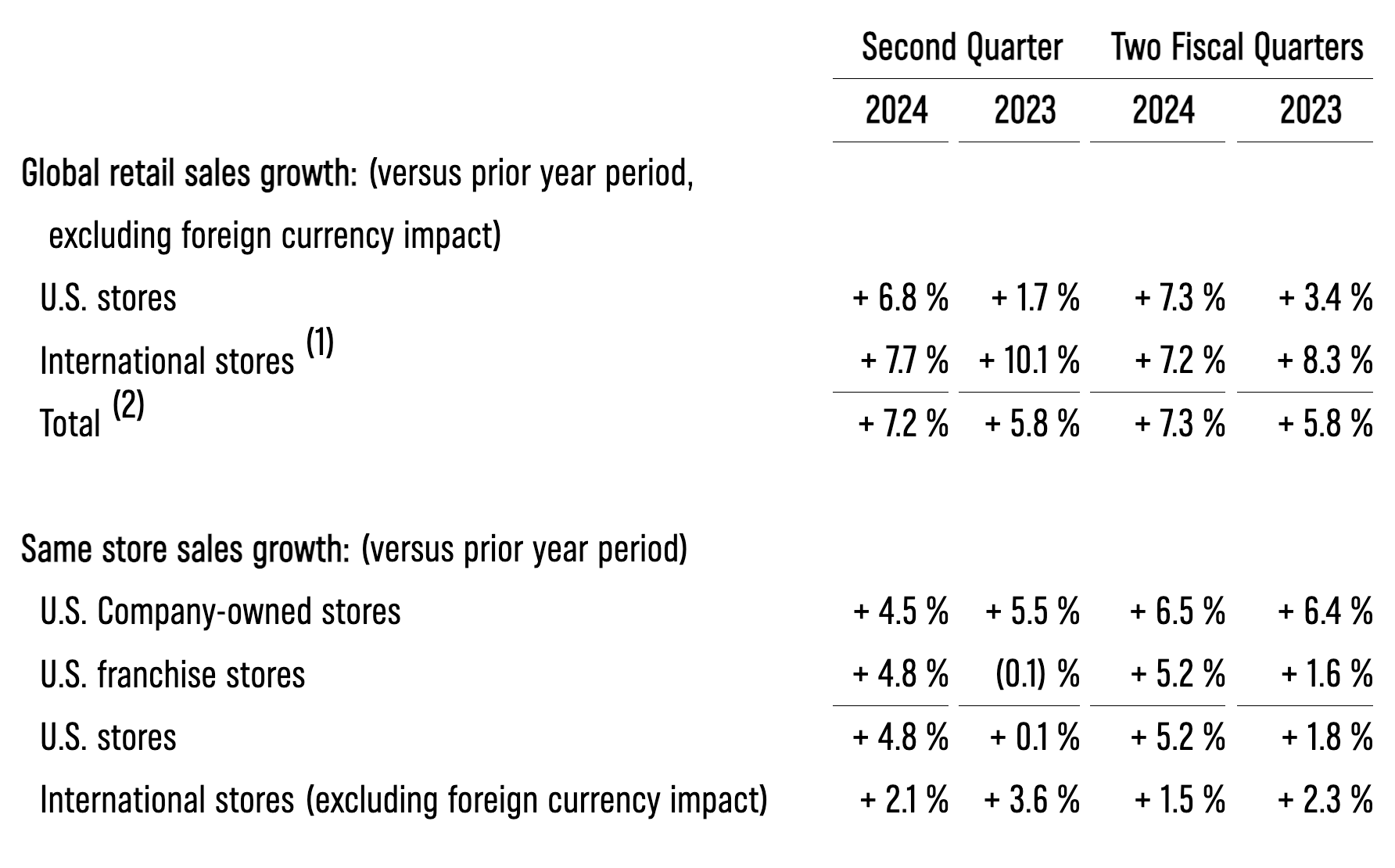

The company's performance wasn't just confined to its home turf. Domino's demonstrated strong growth both domestically and internationally. U.S. same-store sales grew by a robust 4.8%, while international same-store sales, excluding foreign currency impact, increased by 2.1%. This global success story was further underscored by a 7.2% increase in global retail sales, excluding the impact of foreign currency.

However, like any well-balanced meal, Domino's financial performance had its sides of challenges. While the company's supply chain gross margin improved by 0.4 percentage points, driven by procurement productivity, U.S. company-owned store gross margin decreased by 1.0 percentage point. This dip was primarily due to higher insurance and labor costs, highlighting the ongoing challenges in the restaurant industry.

"Our Q2 results demonstrate the power of Domino's model when we're focused on driving profitable transaction growth," said Sandeep Reddy, Domino's CFO, during the earnings call.

These financial results, while generally positive, set the stage for a complex market reaction that left many observers puzzled. As we'll explore later, sometimes even a delicious earnings report can leave investors with financial indigestion.

Cooking Up Success

Domino's Q2 2024 earnings report revealed a company actively working to enhance its recipe for success while navigating significant challenges. The global expansion strategy continued with a net store growth of 175 outlets during the quarter. However, this expansion faced headwinds, leading to the suspension of the company's guidance metric of achieving over 1,100 global net stores annually.

On the home front, Domino's U.S. market performance was piping hot. The 4.8% increase in same-store sales was accompanied by positive order counts in both delivery and carryout businesses across all income cohorts. The carryout segment, in particular, showed strong growth, indicating Domino's success in capturing a larger slice of the takeaway market.

A key ingredient in Domino's recent success has been its revamped loyalty program. The new Domino's Rewards emerged as a significant driver of growth, attracting new, lapsed, and light customers. This digital-first approach aligns with the company's ongoing investments in consumer and store technology, aimed at driving long-term operational efficiencies and enhancing customer engagement.

"Our 'Hungry for MORE' strategy is delivering results for the second straight quarter," stated Russell Weiner, Domino's CEO, highlighting the company's focus on sustainable order count growth.

In a significant shift, Domino's has embraced third-party delivery partnerships. The company's collaboration with Uber Eats, launched in Q1 2024, accounted for 1.4% of sales in that quarter, with aims to increase this to 3% by year-end. This move demonstrates Domino's ability to adapt to changing consumer preferences.

On the operational front, Domino's introduced the "MORE Delicious Operations" program, focusing on enhancing product quality through intensive training across its U.S. stores. The company has also revamped its marketing approach, moving away from a purely price-focused strategy to campaigns that "break cultural tensions."

Internationally, despite challenges, Domino's remains committed to global expansion, particularly in China and India, with a long-term goal of reaching 40,000 stores globally. However, this ambition faces significant hurdles. The company now expects to fall 175 to 275 stores below its 2024 goal of 925+ net stores internationally, underscoring the complexities of managing a global franchise network.

Economic headwinds continue to buffet the company, particularly in international markets. The modest 2.1% growth in international same-store sales (excluding foreign currency impact) compared to 4.8% growth in the U.S. reflects these pressures. Labor costs remain a pressing issue, especially in areas with minimum wage increases. The broader economic environment, with signs of slowing consumer spending, poses another challenge.

Competitive pressures in the fast-food and delivery spaces continue to intensify. With the rise of ghost kitchens, an increasing number of restaurants offering delivery, and the continued growth of food delivery apps, Domino's faces competition from a wide array of dining options.

"We're not just selling pizzas; we're building a global brand that resonates with customers across cultures and continents," a sentiment echoed in Domino's strategic initiatives.

"In this environment, every pizza sold, every customer retained, is a victory. We're competing not just with other pizzerias, but with the entire spectrum of food options available to consumers," as one industry analyst noted.

These strategic moves and challenges paint a picture of a company proactively shaping its future while navigating a complex and competitive landscape. Domino's ability to execute its growth strategies while addressing these headwinds will be crucial in determining its future success and market performance.

When Good News Turns Sour

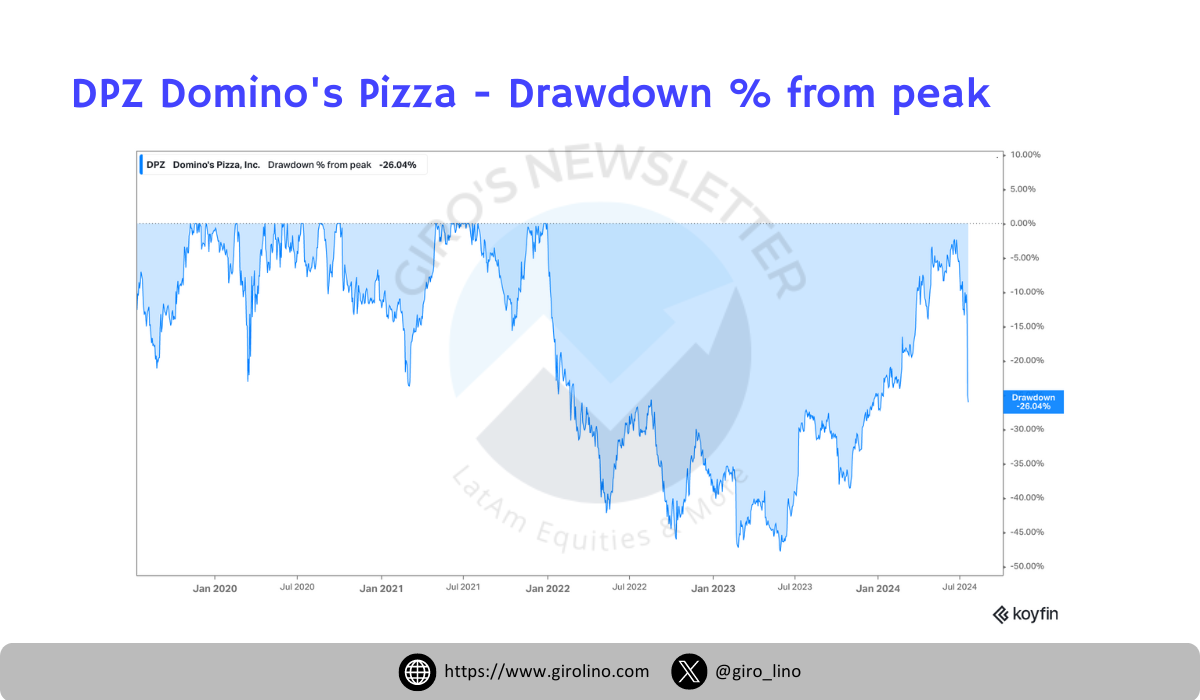

Despite Domino's seemingly strong Q2 2024 performance, the market reaction was far from what many expected. On the day of the earnings release, Domino's stock price took a surprising tumble, leaving many investors and analysts puzzled. This paradoxical response to what appeared to be positive news highlights the complex interplay of factors that influence stock prices.

The stock decline was significant, with Domino's shares falling by approximately 26% from its peak. This drop erased billions in market capitalization and left many wondering: why did good news translate into bad news for Domino's stock?

Several factors likely contributed to this unexpected market response:

- Missed "Whisper Numbers": While Domino's officially beat analyst estimates, it's possible that unofficial "whisper numbers" circulating among investors were even higher. If the company failed to meet these elevated expectations, it could trigger selling despite the ostensibly positive results.

- Guidance Concerns: The suspension of Domino's international store growth guidance likely spooked some investors. The acknowledgment of challenges in international expansion may have raised concerns about the company's long-term growth prospects.

- Margin Pressures: Despite revenue growth, the decrease in U.S. company-owned store gross margins due to higher labor and insurance costs may have worried investors about the company's ability to maintain profitability in the face of rising costs.

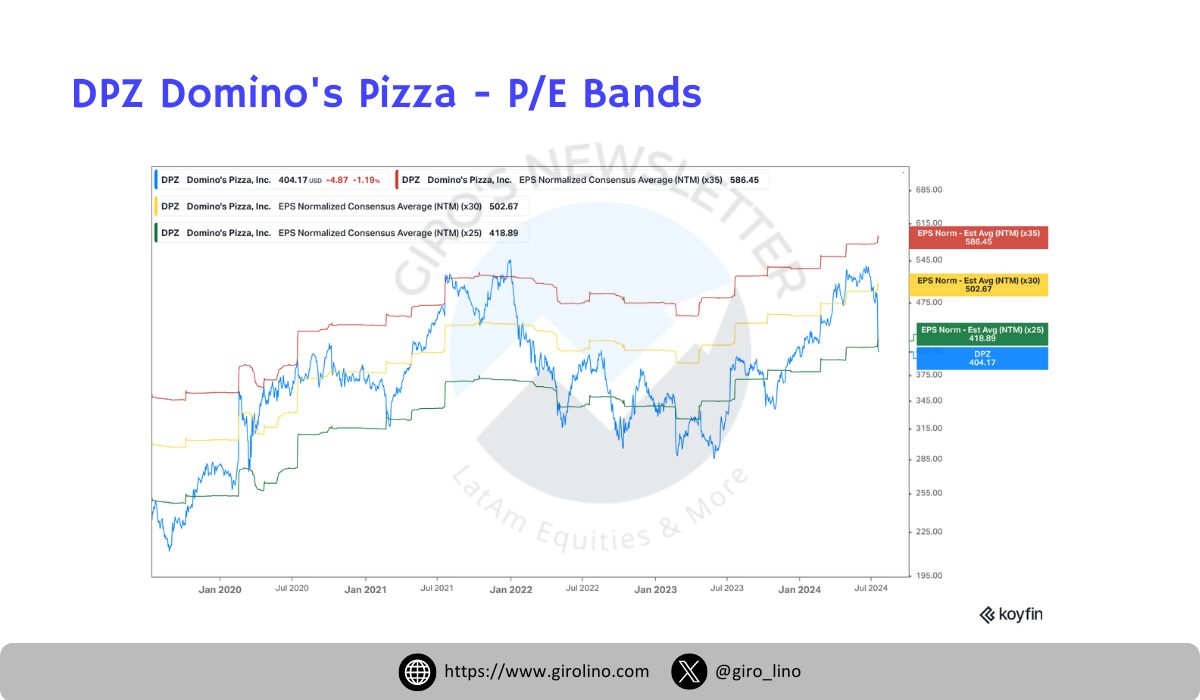

- Valuation Concerns: Prior to the earnings release, Domino's stock had been trading at relatively high multiples. Some investors may have viewed the earnings report as an opportunity to take profits, believing the stock to be fully valued or overvalued.

- Broader Market Sentiment: The stock's decline may have been exacerbated by overall market conditions or sector-specific concerns in the restaurant industry.

This market reaction serves as a reminder that stock prices are influenced by more than just headline numbers. Investor expectations, future guidance, and broader market sentiment all play crucial roles in determining how the market responds to earnings reports.

Reading Between the Slices

As Domino's navigates the complex landscape of global fast-food and delivery markets, its Q2 2024 earnings report and the subsequent market reaction highlight both the challenges and opportunities that lie ahead. The company's strong domestic performance, innovative approach to customer engagement, and long-term growth strategies suggest resilience and adaptability.

However, challenges in international expansion, margin pressures, and an ever-evolving competitive landscape will require continued strategic focus and operational excellence. The coming quarters will be crucial in determining whether Domino's can overcome current hurdles and deliver on its long-term growth promises.

Despite the challenges and the market's initial negative reaction, Domino's Pizza Enterprises (DMP) future outlook appears remarkably promising, with current valuations suggesting an exciting opportunity for investors.

Based on the closing price of A$33.12 per share, DMP is trading at attractive valuation multiples relative to its projected earnings growth. The key metrics paint an intriguing picture:

- FY25 estimated Price-to-Earnings (P/E) ratio: 20x

- FY26 estimated P/E ratio: 17x

- FY24-26 estimated Earnings Per Share (EPS) Compound Annual Growth Rate (CAGR): 21%

- Price/Earnings to Growth (PEG) ratio: ~1.0x

These figures suggest that DMP's stock may be undervalued compared to its growth prospects. The forward P/E ratios of 20x for FY25 and 17x for FY26 are relatively modest for a company with strong growth potential in the quick-service restaurant industry. More importantly, the projected 21% CAGR for EPS from FY24 to FY26 indicates robust earnings growth over the next few years.

Perhaps most exciting is the PEG ratio of approximately 1.0x. This suggests that the stock's P/E ratio is perfectly in line with its expected earnings growth rate, potentially indicating an undervalued stock when considering its growth prospects.

Domino's strategic shifts are particularly encouraging. The company's focus on improving unit economics, including the closure of underperforming stores in Japan and France, is expected to enhance profitability and set a stronger foundation for future growth. Additionally, Domino's digital initiatives, including the successful relaunch of its loyalty program and partnerships with food delivery aggregators, are driving customer engagement and sales growth.

While challenges in some international markets persist, Domino's maintains strong long-term growth targets, including 7% or more annual global retail sales growth and 8% or more annual income from operations growth. These ambitious goals, coupled with the current attractive valuation, make DMP an exciting prospect for investors.

It's important to note that while these valuation metrics suggest an attractive investment opportunity, they should be considered alongside other factors such as market conditions, competitive landscape, and potential risks. The company's ability to execute its strategic plans, particularly in improving international performance and capitalizing on digital opportunities, will be crucial in realizing the projected earnings growth.

Given the substantial stock price decline, the company's strong fundamentals, and these promising valuation metrics, we are deepening our analysis of Domino's as an investment thesis. The combination of robust U.S. performance, innovative strategies, and the current valuation makes Domino's an intriguing and potentially undervalued prospect in the fast-food sector.

As we look to the future, the path forward for Domino's appears bright. If the company can successfully navigate its current challenges and capitalize on its strengths, it may offer significant value to investors at its current price point. The coming quarters will be crucial in determining whether Domino's can deliver on its promises and justify the excitement surrounding its potential.

Your Opinion Matters!

We're constantly striving to improve our content. Could you spare 2 minutes to let us know what you think? Your feedback is invaluable in helping us deliver the financial insights you need.