Alphabet Q2 2024 Earnings: Solid Quarter, Despite Surge in Capex

Alphabet, the parent company of Google, delivered a solid performance in the second quarter of 2024, showcasing the strength of its core businesses and the growing impact of artificial intelligence across its product suite. Let's dive into the key highlights and what they mean for the tech giant's future.

Key Highlights:

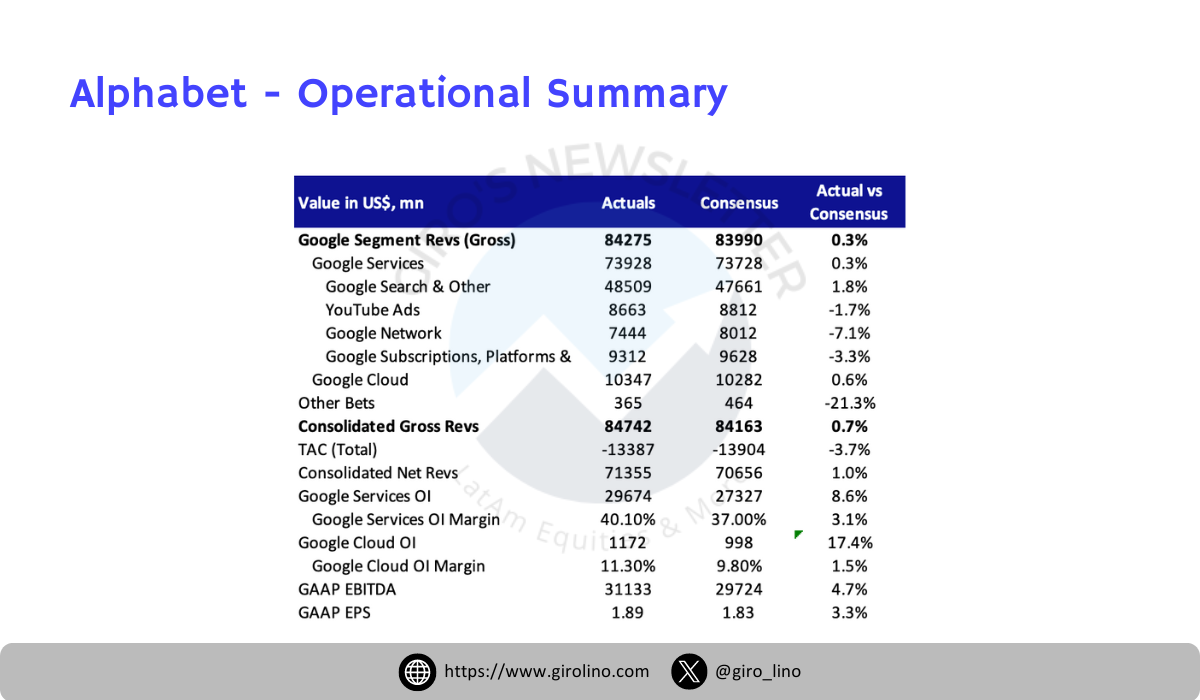

- Revenue Beats Expectations: Alphabet reported Q2 consolidated gross revenues of $84.74 billion, up 14% year-over-year and surpassing analyst estimates.

- Search Remains Strong: Google Search & Other revenue grew 14% YoY to $48.51 billion, demonstrating the resilience of Alphabet's core business.

- Cloud Momentum Continues: Google Cloud revenue increased by an impressive 29% YoY to $10.35 billion, with AI-related revenues reaching "billions of dollars" year-to-date.

- YouTube Mixed Results: YouTube Ads revenue grew 13% YoY to $8.66 billion, slightly below expectations but showing continued growth.

- Margin Improvement: Operating margins for both Google Services and Cloud segments exceeded estimates, reflecting ongoing cost-efficiency efforts.

Solid Earnings

Alphabet's Q2 results paint a picture of a company successfully navigating the evolving tech landscape while capitalizing on the AI revolution. The strong performance in Search dispels concerns about potential disruption, while the accelerating growth in Cloud showcases Alphabet's ability to compete in the enterprise market.

The integration of AI across Alphabet's product portfolio appears to be paying dividends, particularly in Cloud and Search. Management's disclosure that AI-related revenues have reached billions of dollars underscores the tangible impact of these investments.

YouTube's performance, while solid, faces challenges from increasing competition in the short-form video space. However, the company's focus on diversifying YouTube's revenue streams through subscriptions and direct response advertising provides potential for future growth.

Alphabet's commitment to balancing investments in long-term opportunities with cost discipline is evident in the improved operating margins. This approach should help the company maintain its competitive edge while delivering value to shareholders.

AI-Driven Capex Surge

A notable aspect of Alphabet's Q2 results was the significant increase in capital expenditures, primarily driven by AI-related investments. The company reported capex of $13.2 billion for the quarter, exceeding analyst expectations and growing sequentially from Q1.

Key points:

- AI Infrastructure: The elevated capex reflects Alphabet's aggressive investment in AI infrastructure, including data centers, specialized hardware (like TPUs), and network capacity to support AI workloads.

- Long-term Strategy: This increased spending underscores Alphabet's commitment to maintaining its competitive edge in AI technology, viewing it as crucial for future growth across its product portfolio.

- Near-term Pressure on Margins: While these investments may put some pressure on margins in the short term, they are essential for Alphabet's long-term AI strategy and ability to compete in areas like cloud computing and advanced search capabilities.

- Balancing Act: Management faces the challenge of balancing these necessary AI investments with maintaining financial discipline and delivering shareholder value.

- Investor Focus: The elevated capex levels are likely to remain a key focus for investors, who will be closely monitoring the return on these investments in terms of revenue growth and market share gains in AI-driven markets.

This increased AI-related capex demonstrates Alphabet's conviction in the transformative potential of AI technology. While it may impact near-term profitability, it positions the company to capitalize on the growing demand for AI-powered solutions across its business segments. Investors will be keenly watching how these investments translate into tangible business outcomes in the coming quarters.

Looking Ahead

As Alphabet continues to invest heavily in AI and cloud infrastructure, investors will be watching closely to see how these investments translate into revenue growth and market share gains. The company's ability to monetize AI advancements across its product suite, particularly in Search and Cloud, will be crucial in driving future performance.

With a strong balance sheet and ongoing share repurchase program, Alphabet remains well-positioned to weather potential economic headwinds while investing in strategic growth areas.

In conclusion, Alphabet's Q2 2024 results demonstrate the company's resilience and adaptability in a rapidly changing tech landscape. As AI continues to reshape the industry, Alphabet's early investments and strong market position put it in a favorable position to capitalize on emerging opportunities.

Spotify Delivers Stellar Q2 2024 Results: Record Profitability and Continued Growth

Spotify (NYSE: SPOT) reported its second quarter 2024 results on July 23, showcasing a remarkable combination of robust growth and record-breaking profitability. The streaming giant's performance exceeded expectations on multiple fronts, signaling a potential inflection point in its business model.

Key Highlights:

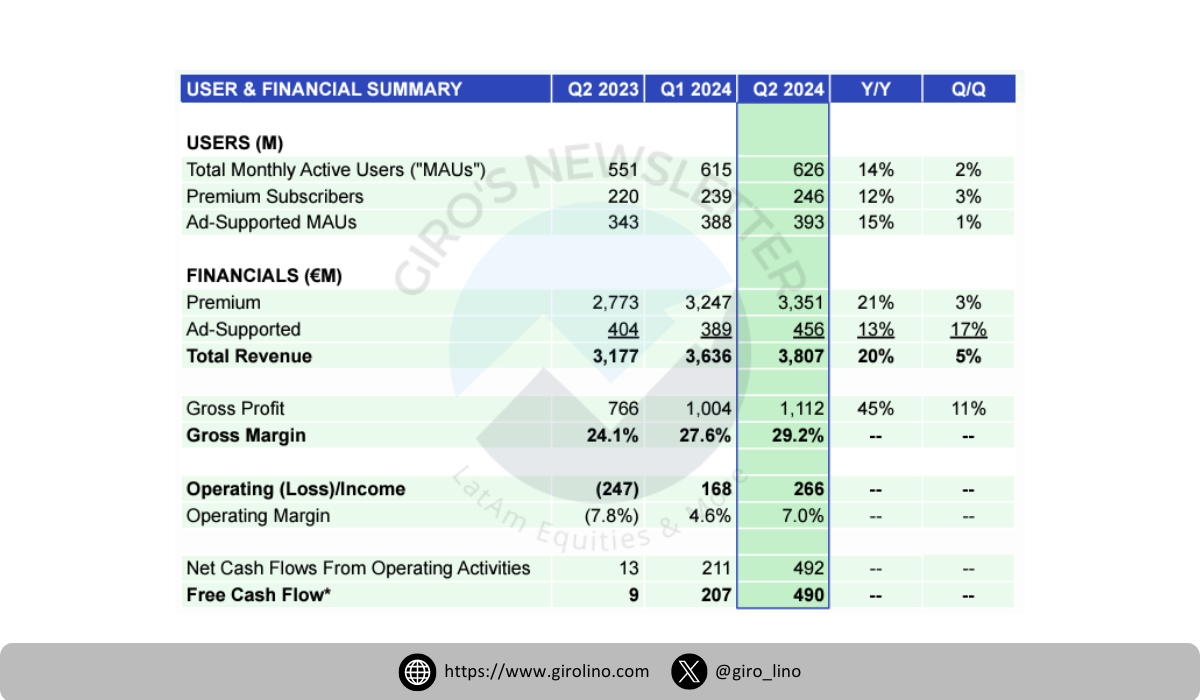

- Monthly Active Users (MAUs): 626 million, up 14% YoY (vs. consensus 631 million)

- Premium Subscribers: 246 million, up 12% YoY (vs. consensus 245 million)

- Revenue: €3.81 billion, up 20% YoY (21% in constant currency) (vs. consensus €3.82 billion)

- Gross Margin: 29.2%, a record high and 110 basis points above guidance (vs. consensus 28.2%)

- Operating Income: €266 million (vs. consensus €238 million)

- Free Cash Flow: €490 million, a new quarterly record (vs. consensus €336 million)

User Growth and Engagement

While MAU growth slightly missed consensus estimates, Spotify reported healthy engagement trends across its user base. The company attributed the slight slowdown in MAU growth to volatility in developing markets. However, Premium Subscriber growth remained solid, driven by strong conversions, increased engagement, and faster acquisition within developed markets.

Spotify's evolving product offerings, including its expanded audiobook access and podcast innovations, continue to drive user engagement. The company reported that audiobook engagement is incremental to overall platform usage, suggesting that these new content types are expanding listening time rather than cannibalizing music consumption.

Financial Performance Deep Dive

Revenue growth of 20% YoY (21% in constant currency) was primarily driven by Premium segment performance. Premium revenue grew 22% YoY in constant currency, supported by both subscriber growth and ARPU increases. The recent price increases in key markets like the US, UK, and Australia have been well-received, with churn rates lower than anticipated.

The Ad-Supported segment grew more modestly at 12% YoY in constant currency. While this represents a deceleration from Q1, Spotify emphasized its ongoing efforts to enhance its advertising technology stack, particularly in programmatic and automated buying capabilities.

Profitability Breakthroughs

The standout aspect of Spotify's Q2 results was its dramatic improvement in profitability metrics:

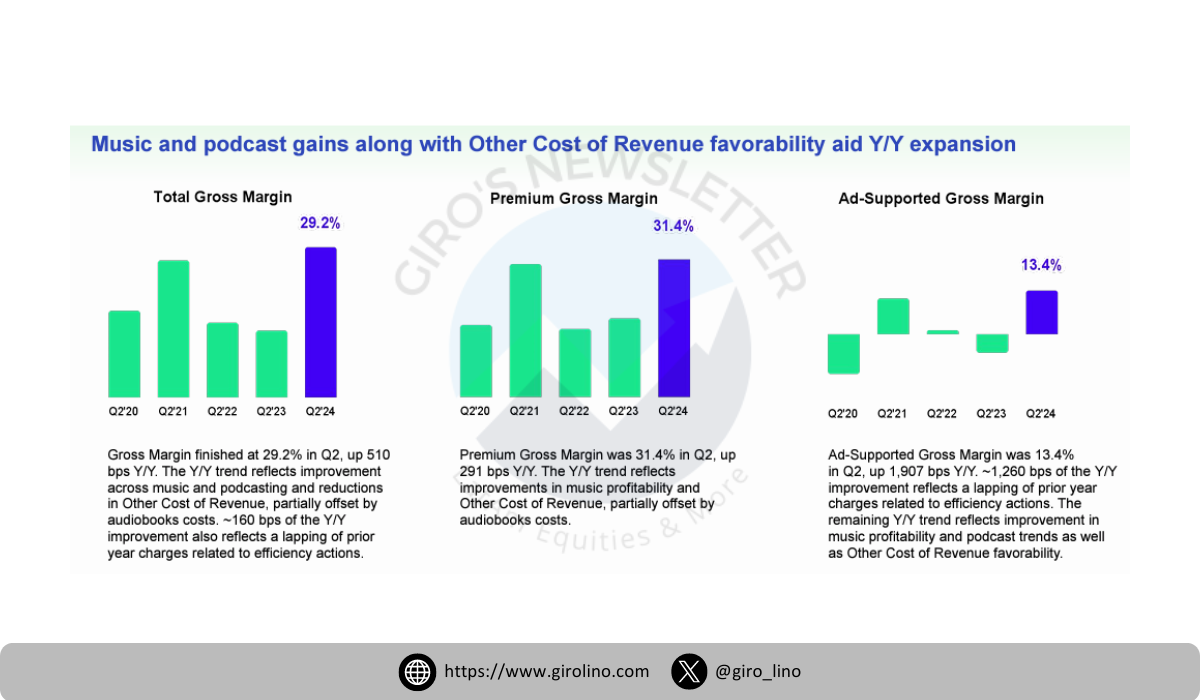

- Gross Margin: At 29.2%, this represents a significant step towards Spotify's medium-term target of 30-40%. The expansion was driven by improvements across Music, Podcasts, and Other Cost of Revenue.

- Operating Income: At €266 million, this far exceeded both guidance and consensus estimates, demonstrating Spotify's increasing operating leverage.

- Free Cash Flow: The record €490 million in FCF underscores Spotify's improving cash generation capabilities, opening up possibilities for strategic investments or capital returns in the future.

These profitability improvements stem from multiple factors, including more favorable content costs, growth in the high-margin Marketplace business, and overall operational efficiencies. Notably, Spotify's podcast business is approaching breakeven, with management reiterating expectations for positive podcast gross margins in 2024.

Q3 2024 Outlook and Long-Term Vision

Spotify's Q3 guidance touches the low end of its medium-term financial targets, suggesting that the company's journey towards sustainable profitability is well underway. The projected gross margin of 30.2% and operating income of €405 million for Q3 indicate that Q2's strong performance was not an anomaly but part of a broader trend.

Looking further ahead, Spotify reaffirmed its confidence in reaching 1 billion users by 2030. The company plans to drive growth through improved marketing efficiency, enhanced product features, and continued geographic expansion.

Market Reaction and Analyst Perspectives

Spotify's shares surged following the earnings release, with many analysts upgrading their outlook on the stock. The combination of continued growth and dramatically improved profitability has led to a reassessment of Spotify's long-term value proposition.

JP Morgan analyst Doug Anmuth raised his price target from $375 to $425, citing "Spotify's faster revenue growth and improving profit profile" compared to subscription-based peers.

Share Repurchase Potential

Spotify's record-breaking free cash flow generation in Q2 2024 has opened up discussions about potential capital return to shareholders, particularly through share buybacks. While the company has not officially announced a new buyback program, analysts are increasingly speculating about this possibility.

In 2021, Spotify's board authorized a $1 billion share repurchase program. As of Q2 2024, approximately €91 million of this authorization has been utilized, leaving a substantial amount still available. Given the company's improving cash position, there's potential for Spotify to accelerate its buyback activity or even announce an expansion of the program.

GS analyst Eric Sheridan provided an interesting analysis of Spotify's buyback potential in his post-earnings report:

- Base Case Scenario: Anmuth projects that if Spotify completes the majority of its existing $1 billion repurchase authorization by 2026, it could result in a 0.3% accretion to 2026 GAAP EPS compared to a scenario with no buybacks. This would represent Spotify repurchasing about 1% of its current market capitalization.

- Upside Case Scenario: In a more aggressive scenario where Spotify uses 100% of its prior-year free cash flow for buybacks each year through 2029, Anmuth estimates:

- 3.5% accretion to 2026 GAAP EPS and 5.5% to 2029 GAAP EPS versus no buybacks

- Spotify could repurchase approximately 25% of its current market capitalization by 2029

These projections highlight the significant potential for value creation through share repurchases, given Spotify's improving free cash flow generation.

Management's Stance

During the earnings call, Spotify's management didn't provide specific guidance on buybacks but emphasized their focus on balanced capital allocation.

"Our priority remains investing in growth opportunities for the business, but as our profitability and cash flow generation improve, we have increasing flexibility in how we think about capital returns.", CEO Daniel Ek stated.

Implications for Investors

The potential for increased share repurchases adds another compelling element to the Spotify investment thesis. Not only is the company delivering on growth and profitability metrics, but it may soon be in a position to return significant capital to shareholders. This could provide additional support for the stock price and signal management's confidence in the company's long-term prospects.

However, investors should note that any large-scale buyback program would need to be balanced against Spotify's needs for continued investment in content, technology, and potential strategic acquisitions. The company's approach to capital allocation in the coming quarters will be a key area for investors to watch.

Conclusion

Spotify's Q2 2024 results mark a potential turning point for the company. By delivering both growth and profitability at scale, Spotify is demonstrating the strength of its business model and its ability to monetize its massive user base effectively. As the company continues to innovate in content offerings, improve its advertising capabilities, and expand globally, it appears well-positioned to maintain its leadership in the audio streaming market while delivering increasing value to shareholders.

The coming quarters will be crucial in determining whether this performance represents a new baseline for Spotify or if there are still fluctuations to be expected. However, one thing is clear: Spotify's Q2 2024 results have set a new standard for what's possible in the streaming audio industry.

Visa Q3 2024 Earnings: Resilient Growth Amid Mixed Economic Signals

Visa, the global payments technology leader, reported its fiscal third-quarter 2024 results, demonstrating resilience in the face of a complex macroeconomic environment. Here's a breakdown of the key highlights and what they mean for the company's outlook.

Key Highlights:

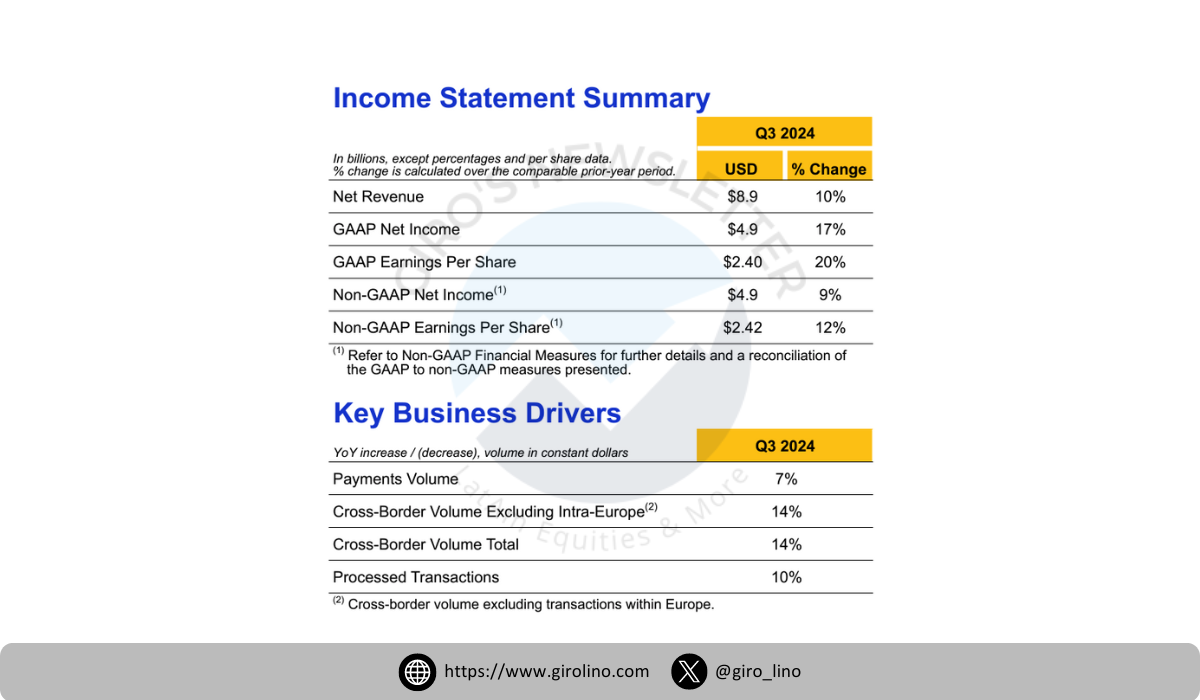

- Revenue Growth: Net revenue grew 9.6% year-over-year to $8.9 billion, slightly below consensus estimates but in line with the company's guidance of high single-digit growth.

- Earnings Per Share: Adjusted EPS came in at $2.42, up 11.8% year-over-year and slightly ahead of analyst expectations.

- Payment Volume: Total payment volume grew 7% year-over-year on a constant currency basis, showing a slight deceleration from previous quarters.

- Cross-Border Volume: Cross-border volume (excluding intra-Europe) grew 14% year-over-year, lower than expected but still robust.

- Processed Transactions: Grew 10% year-over-year, in line with expectations.

- Value-Added Services and New Flows: Value-added services revenue grew 23% year-over-year, while new flows revenue accelerated to 18% growth.

Still a Solid Business

Visa's Q3 results paint a picture of a company navigating a challenging economic landscape with relative success. While some metrics showed signs of slowing growth, the overall performance remained solid.

The slight deceleration in payment volume growth, particularly in the U.S. and Asia, reflects broader economic concerns. Management noted some softness among lower-end consumers and macro pressures in mainland China. However, the company's diversified revenue streams, particularly in value-added services and new flows, helped offset these headwinds.

The strong performance in value-added services (23% growth) and accelerating new flows revenue (18% growth) underscore Visa's strategy of expanding beyond traditional transaction processing. The company's investments in areas like Visa Direct, which saw transaction growth of 41%, are paying off and providing new avenues for growth.

Cross-border volume growth, while lower than expected, remains a bright spot at 14% year-over-year growth. This suggests that international travel and e-commerce continue to recover, albeit at a more moderate pace.

Outlook

Visa reiterated its full-year 2024 outlook, projecting low double-digit revenue growth on a constant currency basis and low-teens EPS growth. For Q4, the company expects slightly faster revenue growth than in Q3, which should provide some reassurance to investors concerned about economic headwinds.

Management's commentary on improving average U.S. transaction sizes in the coming quarters could be a positive catalyst if it materializes. However, the company remains cautious about the macroeconomic environment, particularly in Asia and among lower-income U.S. consumers.

Conclusion

Visa's Q3 2024 results demonstrate the company's ability to deliver growth even in a challenging economic environment. While there are signs of slowing in some areas, the diversification of Visa's business and its strong position in the global payments ecosystem continue to provide resilience. As the company navigates economic uncertainties, its investments in value-added services and new payment flows should help support growth in the quarters ahead.

Investors will likely focus on how Visa balances its growth initiatives with cost management, as well as its ability to capitalize on the ongoing shift to digital payments globally. The company's performance in the coming quarters will be crucial in determining whether it can maintain its growth trajectory in the face of economic headwinds.

Your Opinion Matters!

We're constantly striving to improve our content. Could you spare 2 minutes to let us know what you think? Your feedback is invaluable in helping us deliver the financial insights you need.