Eli Lilly's Q2 2024 Earnings Shatter Expectations, Boosting LLY Stock

Eli Lilly and Company (NYSE: LLY), the renowned medicine company turning science into life-changing treatments, delivered a knockout performance in its second quarter of 2024. The pharmaceutical giant, headquartered in Indianapolis, Indiana, significantly surpassed analyst expectations and showcased the strength of its innovative pharmaceutical products portfolio. This exceptional performance has led to a surge in Eli Lilly stock price, cementing its position as one of the top pharmaceutical companies in the world.

Financial Highlights: Eli Lilly's Quarter of Remarkable Growth

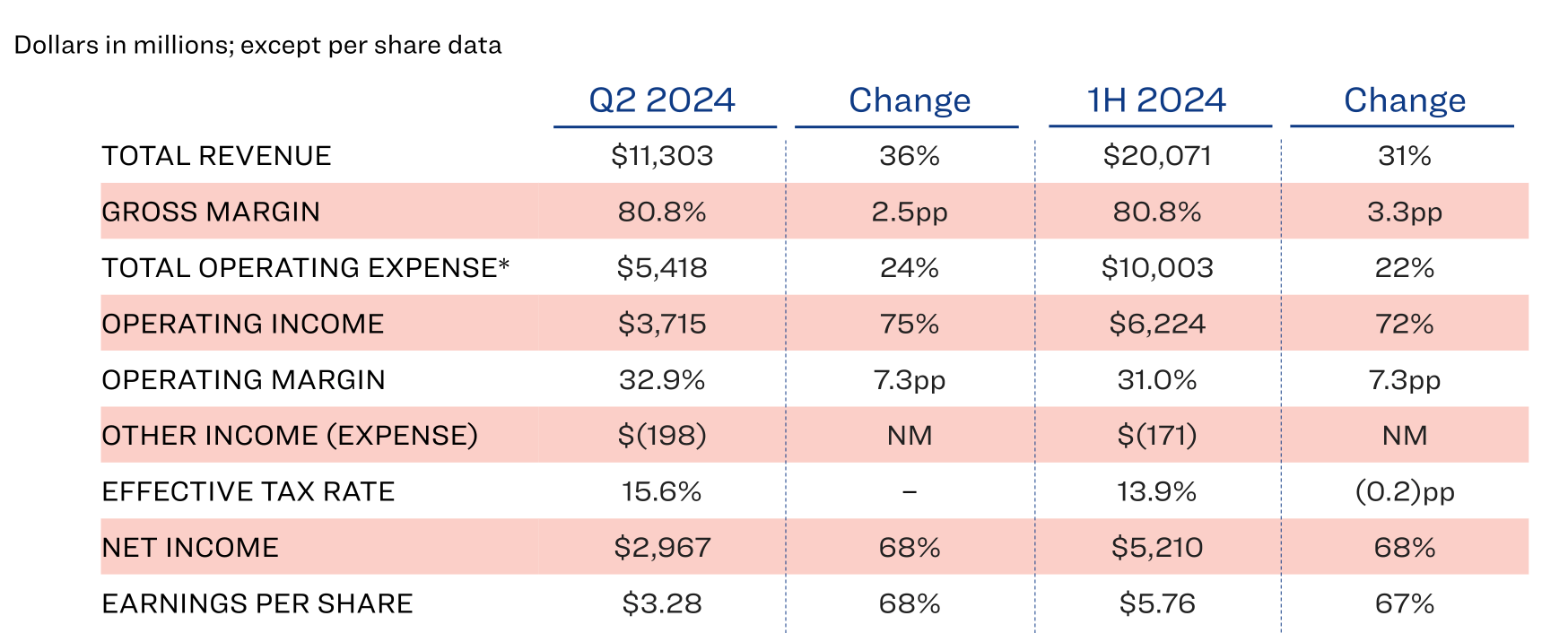

Eli Lilly reported total revenue of $11.3 billion for Q2 2024, representing a staggering 36% increase compared to the same period last year. This figure significantly exceeded market expectations, demonstrating the company's ability to capitalize on growing demand for its key pharmaceutical products.

Key financial metrics for Eli Lilly and Company's quarter include:

- Net Income: $3.0 billion, up 68% year-over-year

- Earnings Per Share (Reported): $3.28, a 68% increase

- Earnings Per Share (Adjusted): $3.92, surging 86%

- Gross Margin: 80.8%, improving by 4.3 percentage points

Eli Lilly's performance in the U.S. market was particularly strong, with revenue growing by 42% to reach $7.84 billion. This growth was driven by a 27% increase in volume and a 15% boost from higher realized prices, with Mounjaro, Zepbound, and Verzenio leading as the company's primary revenue drivers.

"Revenue grew 36% in Q2 with our new products growing nearly $3.5 billion compared to the same period last year. U.S. demand for Mounjaro and Zepbound is strong and growing as access and supply continue to expand," said David Ricks, Chairman, CEO & President of Eli Lilly.

Mounjaro and Zepbound: Eli Lilly's Twin Engines of Growth

The standout stars of Eli Lilly's Q2 performance were undoubtedly Mounjaro (tirzepatide) and Zepbound (tirzepatide), both developed through rigorous clinical trials:

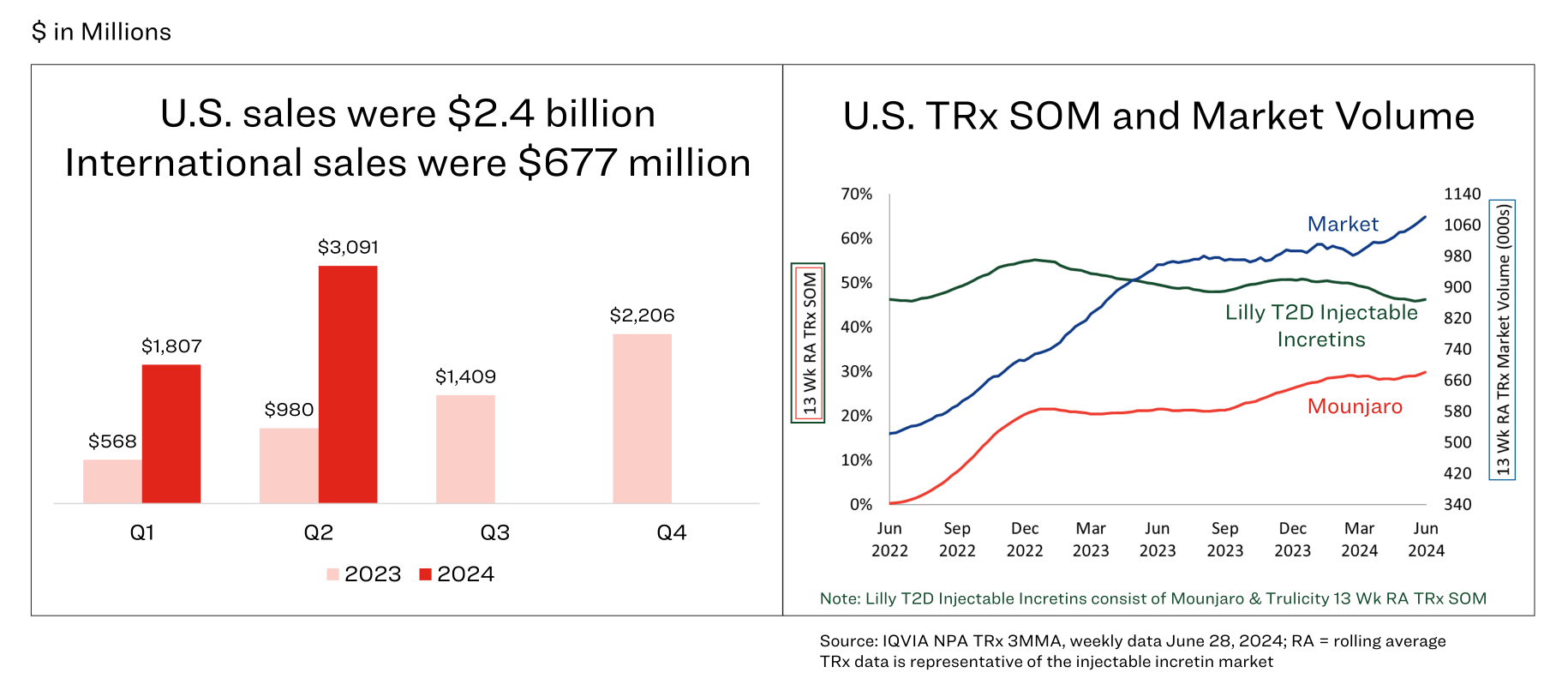

Mounjaro: Sales skyrocketed to $3.09 billion, representing an astounding 215% increase from Q2 2023. The diabetes medication's success has been a key factor in Lilly's overall revenue growth and improved financial outlook.

Zepbound: In its first full quarter on the market, the weight loss treatment generated an impressive $1.24 billion in revenue. This rapid uptake indicates strong market acceptance and positions Zepbound as a potential blockbuster drug for the company.

The combined sales of these two treatments reached $4.33 billion, accounting for a significant portion of Eli Lilly's total revenue and highlighting the company's strong position in the rapidly growing markets for diabetes and obesity treatments.

Dan Skovronsky, Chief Scientific Officer and President of Lilly Immunology, commented on the success of these treatments: "We're really excited about the opportunity to help patients suffering from diabetes and obesity. I think the data that we shared in Phase II for tirzepatide is really quite profound in terms of the size of effect we can have."

Other Key Product Performances in Eli Lilly's Portfolio

While Mounjaro and Zepbound were the headliners, other products in Eli Lilly's portfolio also contributed to the strong quarter:

- Verzenio: The cancer treatment saw revenue increase by 44% to $1.33 billion, supported by heightened demand and expanded indications.

- Taltz: Sales grew by 8% to $825 million, outperforming expectations.

- Jardiance: Revenue remained stable at $770 million.

It's worth noting that Trulicity, another of Lilly's diabetes medications, experienced a decline in sales to $1.25 billion. This was partly due to competitive pressures and supply constraints. However, the strong performance of Mounjaro and Zepbound more than offset this decline, showcasing the strength of Eli Lilly's diverse product lineup.

Raised Guidance: A Bright Outlook for Eli Lilly in 2024

Based on the exceptional Q2 results and increased confidence in its production capabilities, Eli Lilly significantly raised its full-year 2024 guidance:

- Revenue: Now expected to be between $45.4 billion and $46.6 billion, up $3 billion from previous estimates

- Earnings Per Share (non-GAAP): Projected range of $16.10 to $16.60, a substantial increase from prior guidance

This upward revision reflects improved clarity on production expansions and international launches, signaling Lilly's confidence in its ability to meet the growing demand for its key products. The raised guidance has contributed to the positive sentiment surrounding LLY stock among investors and analysts.

Manufacturing and Supply Chain Developments at Eli Lilly

Eli Lilly has been making significant strides in expanding its manufacturing capabilities to meet the surging demand for its products, particularly Mounjaro and Zepbound. The company has committed over $18 billion since 2020 to build, upgrade, or acquire facilities in the U.S. and Europe, solidifying its position as one of the first pharmaceutical companies to make such a substantial investment in manufacturing.

David Ricks emphasized the company's commitment to manufacturing expansion: "Our top priority remains executing on our ambitious manufacturing expansion agenda. In May, we announced plans to invest an additional $5.3 billion in our Lebanon, Indiana manufacturing site, bringing our total investment there to $9 billion. We believe this is the largest single investment in synthetic medicine active pharmaceutical ingredient manufacturing in the history of the United States."

Key developments include:

- Progress at the Research Triangle Park facility in North Carolina, which is expected to initiate production by the end of 2024.

- Advancements at the Concord, North Carolina site, with product availability anticipated in 2025.

- The introduction of multidose KwikPen in multiple markets outside the U.S.

- Plans to launch vials of Zepbound in the U.S. market in the coming weeks.

These investments and initiatives are crucial for Eli Lilly to maintain its growth trajectory and meet the increasing global demand for its innovative treatments. The company's focus on expanding production capacity sets it apart from other pharmaceutical manufacturers and positions it well for future growth.

Pipeline Progress and Strategic Developments at Eli Lilly

Eli Lilly continues to advance its robust pipeline, with several notable developments in Q2 2024:

- FDA approval of Kisunla (donanemab) for the treatment of Alzheimer's disease, marking a significant milestone in addressing this challenging condition.

- Submission of tirzepatide for the treatment of moderate to severe obstructive sleep apnea and obesity to the FDA and EMA.

- Positive results from the Phase III SUMMIT trial, evaluating tirzepatide for heart failure with preserved ejection fraction and obesity.

- Initiation of new clinical trials for next-generation incretin molecules and cancer treatments.

The company also announced plans to acquire Morphic Holding, aiming to bolster its immunology pipeline with innovative oral therapies for chronic diseases. This strategic move further demonstrates Eli Lilly's commitment to expanding its portfolio of new medicines and maintaining its position as a leader in clinical development.

"We are, of course, very excited about the FDA approval of Kisunla for treatment of Alzheimer's disease," stated Dan Skovronsky. "We were pleased by the discussion of the FDA advisers, particularly with regard to our data supporting stopping of Kisunla therapy when amyloid plaques are removed to minimal levels."

Market Response and Future Outlook for Eli Lilly Stock

The market response to Eli Lilly's Q2 results and revised guidance has been overwhelmingly positive. The company's stock, which had already seen significant growth over the past year, responded favorably to the news. LLY stock price has increased by more than 49% over the past 12 months, outperforming many of its peers in the pharmaceutical sector and other stocks in the broader market.

Gordon Brooks, Interim CFO, commented on the company's financial outlook: "We've been speaking for a long time about operating margins and getting to the mid- to high 30% range. As we've seen this year, Mounjaro and Zepbound are taking an inflection point upwards and so we're seeing ourselves at the top end of that range."

Analysts remain bullish on Lilly's prospects, with many maintaining a strong buy rating on LLY stock. The company's strong pipeline, including promising treatments for Alzheimer's disease and other chronic conditions, along with its strategic acquisitions, has bolstered investor confidence in its long-term growth prospects.

Challenges and Opportunities Ahead for Eli Lilly

While Eli Lilly's Q2 performance was exceptional, the company still faces some challenges:

- Increased competition in the diabetes and weight loss markets

- Potential pricing pressures in key markets

- The need to continuously innovate and bring new medicines to market

However, Lilly's strong R&D investments, robust pipeline, and strategic focus on high-growth areas like obesity and Alzheimer's disease position the company well to navigate these challenges and capitalize on future opportunities. The company's history of innovation, dating back to its founding in Indianapolis in 1876, continues to drive its success in the modern pharmaceutical marketplace.

Patrik Jonsson, President of Lilly Cardiometabolic Health and Lilly USA, addressed future opportunities: "When we look at the marketplace, about two are very important barriers. We have been extremely successful in gaining access across both Mounjaro and Zepbound. The second piece is the amount of outcome indications. We are investing heavily in both Mounjaro and Zepbound, and similarly for the Phase III assets of orforglipron and retatrutide."

Frequently Asked Questions

Q: What were the main drivers of Eli Lilly's strong Q2 2024 performance? A: The primary drivers were the exceptional sales of Mounjaro for diabetes and Zepbound for weight loss, which combined for over $4.3 billion in revenue. Strong performances from other products like Verzenio also contributed to the results.

Q: How much did Eli Lilly raise its full-year guidance? A: Lilly raised its full-year revenue guidance by $3 billion to a range of $45.4 billion to $46.6 billion. The company also significantly increased its earnings per share guidance to a range of $16.10 to $16.60.

Q: What progress is Eli Lilly making on manufacturing capacity? A: Lilly has committed over $18 billion since 2020 to expand manufacturing capabilities. Key developments include progress at facilities in Research Triangle Park and Concord, North Carolina, as well as plans to introduce new product formats like vials for Zepbound.

Q: What are some key pipeline developments for Eli Lilly? A: Recent highlights include FDA approval of Kisunla for Alzheimer's disease, submission of tirzepatide for sleep apnea and obesity, and positive Phase III results for tirzepatide in heart failure with obesity. The company also continues to advance next-generation incretin molecules and cancer treatments.

Q: How has the market responded to Eli Lilly's Q2 results? A: The market response has been very positive, with LLY stock price showing strong growth. Analysts generally maintain a bullish outlook on the company's prospects, citing its strong product portfolio and pipeline.

As Eli Lilly continues to innovate and expand its reach in key therapeutic areas, the company appears well-positioned for sustained growth in the coming years. Investors and industry observers will be watching closely to see if Lilly can maintain this impressive momentum in future quarters, potentially solidifying its status as a top entry-level employer and a leader in the pharmaceutical industry.