Hi 👋

Pretty busy week. A pleasant one, though. I thought about breaking down this post into one for Meta and another for Vale.

The initial thought was that Meta is a tech company and Vale a mining company, so my readers would prefer to read each one apart.

However, I was reminded of a book I read — about philosophy, I guess —that connected with the quality of our decisions and how important it is to be a multidisciplinary person.

That will not take much time, but I’ll share my personal notes.

We genuinely believe that the quality of our thinking is proportional to the models in our heads and their usefulness in the situation at hand.

The more models you have—the bigger your toolbox—the more likely you will have suitable models to see reality. It turns out that when it comes to improving your ability to make decisions, various matters.

Most of us, however, are specialists. Instead of a latticework of mental models, we have a few from our discipline. Each specialist sees something different.

By default, a typical Engineer will think in systems. A psychologist will think in terms of incentives. A biologist will think in terms of evolution.

By putting these disciplines together in our heads, we can walk around a problem in a three-dimensional way. If we’re only looking at the issue one way, we’ve got a blind spot. And blind spots can kill you.

Sharing knowledge, or learning the basics of the other disciplines, would lead to a more well-rounded understanding that would allow for better initial decisions about managing systems.

FB: Back to the Game

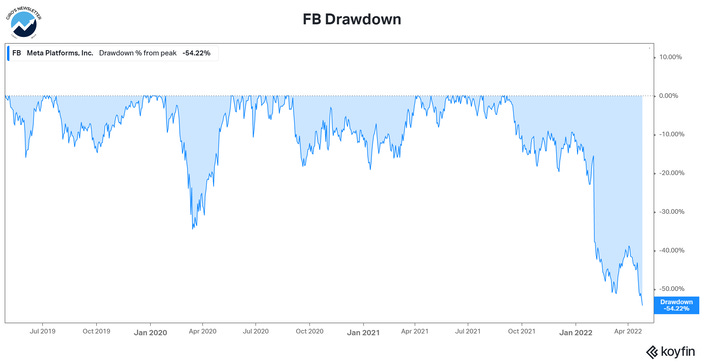

After a past three months of 41% stock underperformance since its last earnings report, we expect FB to have a positive stock price reaction after its 1Q22 Earnings Release.

Actuals vs. Estimates: Meta reported Q1 total revenues of $27.91bn (Street $28.28bn), or +7% YoY, including Family of Apps revenues of $27.21bn (+6% YoY) and Reality Labs revenues of $695mm (+30% YoY).

For us, the positive highlight was the total DAUs at 1,960mm (Street 1,952mm). But, again, it helps to put into context the discussion about the long-term sustainability of the business.

Also, 1Q22 operating income was $8.52bn (Street $8.55bn) for a 31% consolidated operating income margin. Finally, the EPS for 1Q was $2.72, compared to Street’s $2.56.

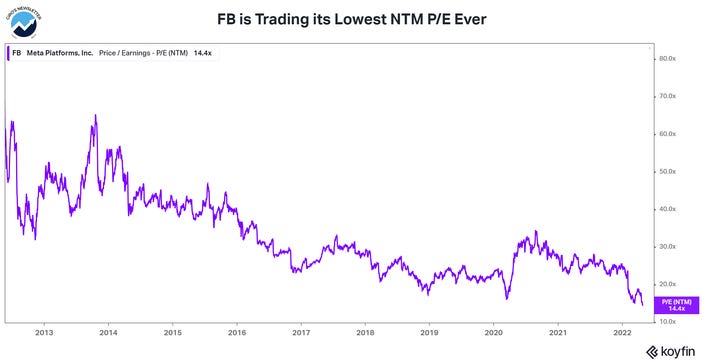

The last earnings call resulted in debates on revenue growth, broad product competition dynamics, and momentum, even though FB is trading at a discounted valuation (vs. historical).

This set of results (with FB exceeding fears on both Q1 revs performance and Q2 revs guide) puts some of those concerns in context.

In addition, the company refining its Opex range (slightly lower) and purchasing ~$9.4b of stock in Q1 should help frame the medium-term narrative around the company’s earnings power (especially for long-term margins).

We believe investors should be looking for greater granularity on revenue headwinds/tailwinds, how to think about investments in Apps and Reality Labs, and any progress on industry measurement post-Apples iOS changes to frame the potential for revenue re-acceleration in 2H22.

We expect Meta mgmt to remain squarely focused on a series of long-tailed investment opportunities shifts in the video, commerce, payments, messaging & augmented reality of continually evolving the platform in terms of its utility to consumers and advertisers.

Zuck and Mental Models

We wrote the previous topic before reading Meta’s transcript. But, seriously, someone should give a raise to the IR team for training Zuck so well.

Species tend to adapt to their surroundings to survive, given internal and external factors – an always-unavoidable combination.

Populations of species adapt through evolution by natural selection, as the most-fit examples of the species replicate at an above-average rate.

In that sense, Zuck has taught us a valuable lesson today: even someone who achieved so much as he did, has to learn new tricks to please the “inferior” wall street dudes. Amazing.

He even used “macroeconomics,” “revenue headwinds,” and others. After last Q’s conf call, probably he learned a lesson and applied it fast. Bull message for Meta.

VALE: Not Worth the Risk

Vale reported 1Q22 adjusted EBITDA of US$6.4bn, declining -26% YoY, and slightly below Street’s US$6.6bn estimates.

We assess it’s been a challenging start, with shipments negatively impacted by much weaker volumes (heavy rainfall in Minas Gerais).

Despite the recurring operational challenges, we expect management to sustain its ongoing focus on achieving operational stability/reliability.

At this point, the best-case scenario for the company is achieving the low-end of its iron ore output guidance of 320-335Mt.

Our takes

- The EBITDA breakeven (for fines) landed in China is now at US$49/t, vs. 50.4/t in the 4Q, and 37.1/t in 1Q21, though iron ore breakeven costs to China corrected to US$44/t from US$46/t, with lower freight costs partially offset by higher C1 mining costs (lower fixed cost dilution, BRL strength). Nevertheless, we see a headwind for freight cost due to seasonal effect and IMO carbon regulation.

- Vale generated US$1.2bn of FCF in the Q for a 6% (annualized) yield, which comes in well below recent showings. We believe a chunk of the miss came from higher Capex, +16% YoY, driven by rising one-off investments into energy (solar capacity) and by a seasonally higher tax payment of -US$2.6bn.

- The positive highlight was the buyback announced. Management approved a buyback of up to 500m shares (~10% of shares outstanding) over the next 18 months. We welcome the initiative of buying back its own shares instead of distributing more dividends — especially at the current valuation.

- The net debt target was changed once more from US$15bn to a US$10-20bn range (vs. US$19bn currently), although we recognize that Vale would benefit from greater flexibility in its balance sheet — for opportunistic buybacks, for instance.

Even though we appreciate that Vale is doing a good job optimizing capital allocation. However, we understand that the recent sell-off created a rare opportunity to invest in great businesses at reasonable prices.

Therefore, we’ll keep focusing our time on studying and learning more about those businesses.