Hi!

Folks, I couldn’t thank you enough for subscribing to my Substack. When I was planning the content, many friends argued that launching a Substack charging since day one was suicide, though we’re proving they’re wrong.

What most people don’t get this is a life’s project. I’m not looking for a job on Wall Street. So, performing “free deep dive” posts for greater visibility carries no value for me.

The value proposition will not change over time: offer evidence-based, actionable ideas and share my thoughts on portfolio management and markets.

This is an appealing value proposition for those who believe that it is possible to perform superior long-term returns based on collaborative partnerships.

A few achievements in these first ten weeks:

- Partnership with W-Equil. Joe & Team share most of my personal values, and we started a few mutual collaboration projects that will impact the quality of my research.

- Partnership with Stream. The value proposition Stream offers to customers is unique. I expect to enrich the platform and improve the qualitative content published in my Substack.

Also, I’d like the announce the ✨Partnership subscription✨

It’s a unique value proposition. Patron members can make special requests and will be granted WhatsApp access. If you, or your company, are looking for a thoughtful and experienced partner, consider it.

According to recent data, 80% of my paid customers are analysts or portfolio managers located in different regions.

The objective of the new product is to bring a more detailed view of local equities. I’ll be sharing my conversations with companies and executives (respecting their integrity and identity) regulatory changes, products, competitors, and so on.

If you have any questions about the ✨Partnership✨ you can also mail me at [email protected].

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Today’s outline

- This week posts

- Reality Check

- Next Chapter

- What charts are telling us?

- In case you missed it (PIX, Rates in Brazil)

- Closed Ideas

This week Posts

Reality Check

I always hated reading a newsletter. The dude talks about something (“I’m bull XYZ”) and never notes it again if he’s wrong until the next bull call on the same stock.

As mentioned earlier, this is a life project. Also, I’ve got my personal capital in those ideas, so I should identify my mistakes and learn from them.

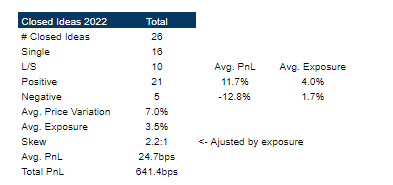

Eventually, it’s important to go through a reality check process, listing all ideas you actually put money on throughout a period and how they played out.

The most important factor is not being correct but being able to evaluate the process — especially if the idea was profitable, though the process was flawed.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

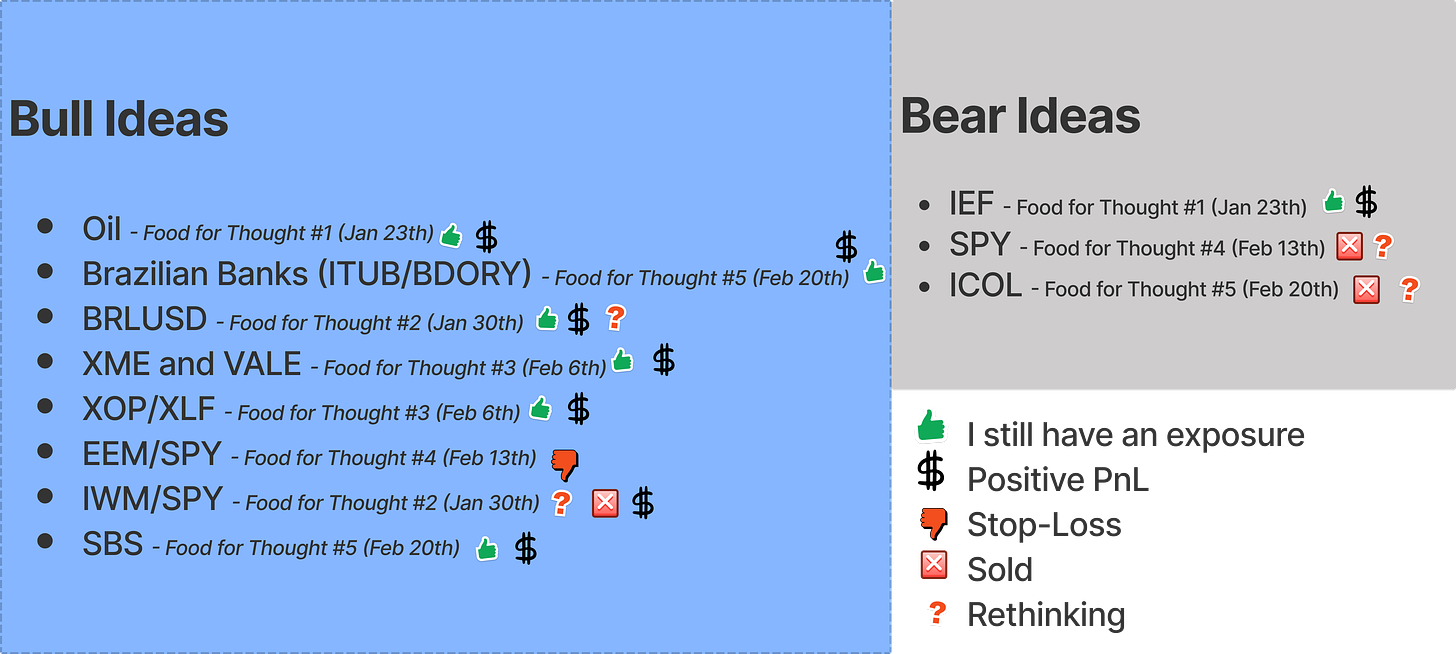

The biggest mistake committed in the past 10 weeks was the call favoring EEM over SPY. Sure, all the Russia and Ukraine situation came, and no one could have predicted that, but I actually wrote that doing this could be bad. 🤦♂️

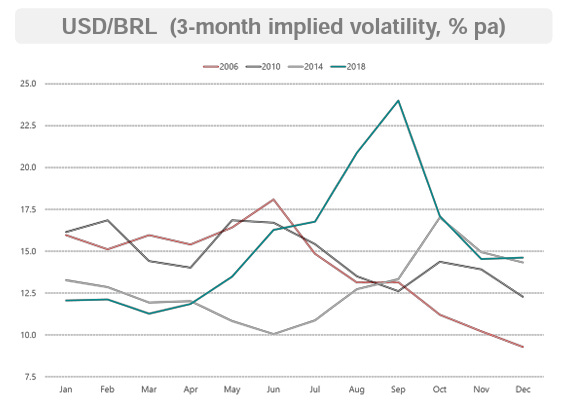

About the BRLUSD, I’ve been carrying almost a 15% exposure in the currency given its carry (real rates above 6% p.a.). The currency gained ~20% against the USD, being the top contributor to the portfolio performance in 2022.

Nevertheless, in the past 20 years, BRL trades with higher volatility during elections years. So far, the carry has been supportive, but it’s not a cheap valuation anymore — considering fiscal risk in the country. I should leave in any sign of weakness.

Finally, I’ve made two mistakes in the IWM/SPY trade. First, though the trade was profitable, I should have waited for better momentum and lower exposure.

The ratio between the pair has an incredibly high correlation to the US ISM, and it was overshot by any possible measure. So that was my buy signal.

Nevertheless, it doesn’t matter how cheap a stock look. It always can get cheaper. So I should have waited for price action to improve.

Second, the sizing was improper, a 20% exposure. You’ve probably noticed that most of my trade positions have a 2% exposure if you’re paid subscriber.

This isn’t a random number. Based on my trading history, the exposure that would have maximized my performance (Sharpe ratio) is between 1,6% and 2% — considering volatility, hit ratio, skew, and trading cost.

My trading exposure oscillates around the asset volatility, using 2% as a base rate. For the pair IWM/SPY, my exposure should have been between 8% and 10%. That was greedy and could have cost me a lot of money.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Next chapter

The Fed was hawkish. The Fed hiked 25bp as expected. Chair Powell pledged that the Fed would be nimble given risks from Russia-Ukraine, but cited solid growth and a tight labor market and continued pressure on inflation upward.

Powell also strongly hinted at balance sheet reduction beginning in May and flagged that additional information on runoff would be revealed in the upcoming minutes on April 6th.

Nevertheless, throughout this week, after Fed policymakers have doubled down on the message that policy tightening will be front-loaded, the market is moving to an even steeper path for policy tightening in the near term. Many talking about QT and 50bps both in May.

Though everyone comes up with a theory with a bright outcome, personally, it’s improbable that anyone knows the outcome for the current situation.

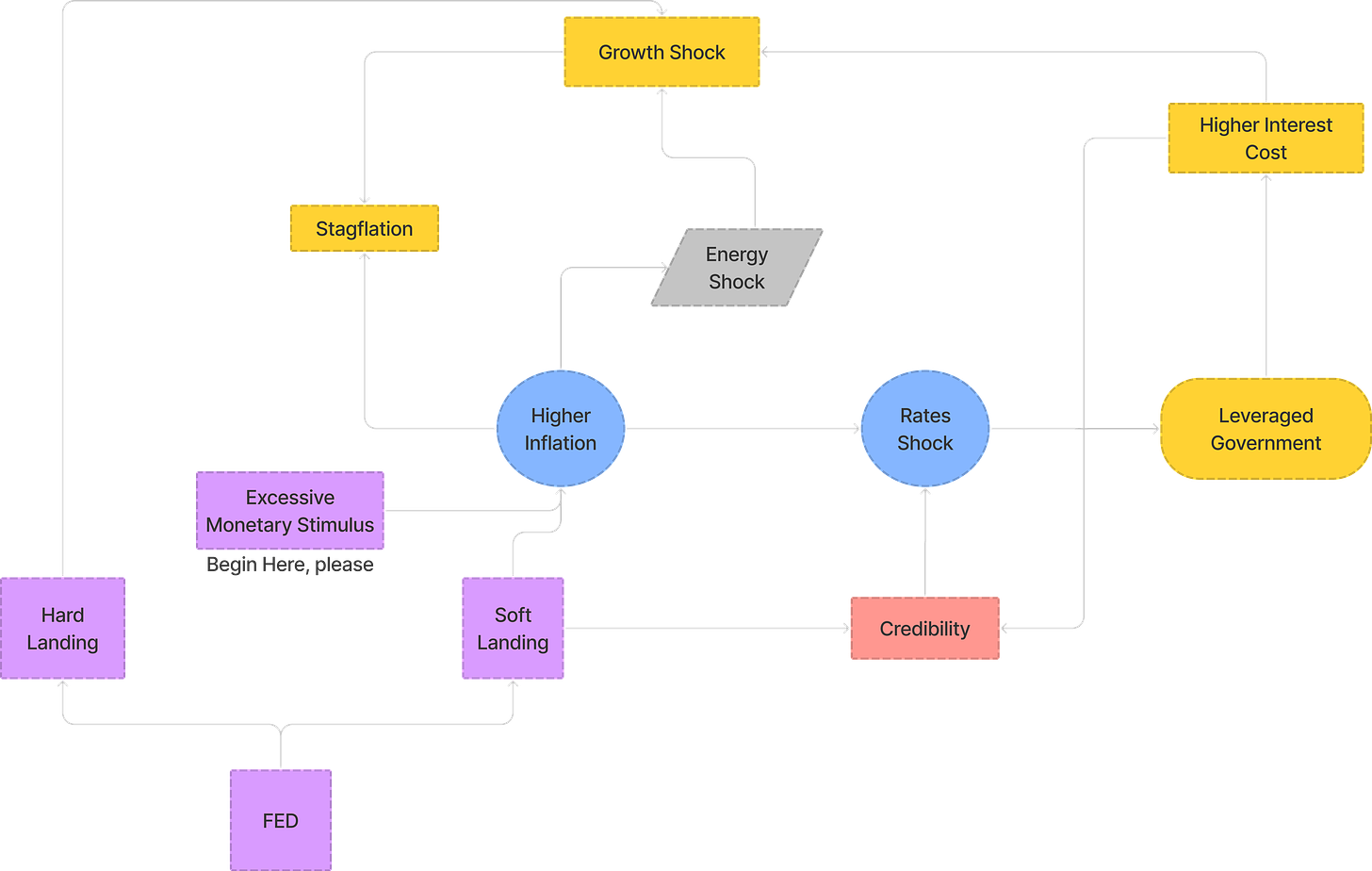

The Federal Reserve faces a classic problem of tightening the monetary policy just enough without hitting the GDP growth. Though it’s a bit complex, the image below illustrates the situation.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Former Fed Chairman Bernanke’s paper on the monetary policy and effects of oil shocks covering the second half of the previous century concluded that on every occasion, it was Fed’s policy rather than the oil price shock that caused the most economic damage.

A week ago, former IMF chief economist Blanchard’s paper where the author finds that past soft landings are not comparable today and happened with much lower inflation. His analysis is that a hard landing looms.

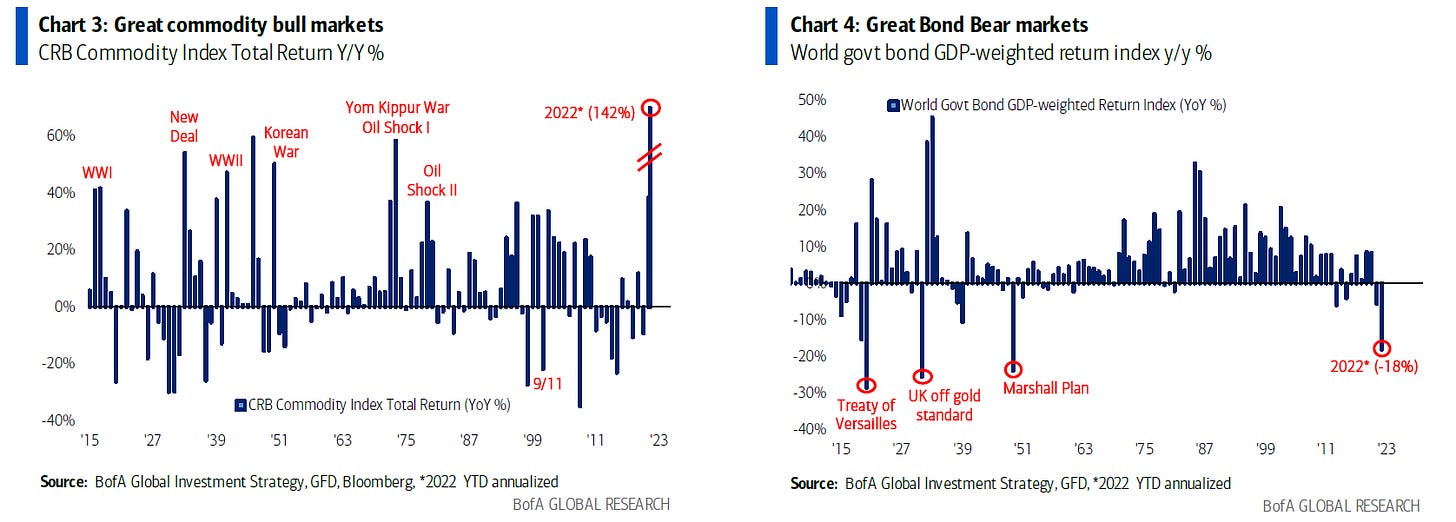

With that in mind, there is sufficient fundamental evidence supporting my short on Bonds and long Commodities (especially Energy).

Commodity prices are on course for the best year since 1915, while government bonds are on track for the worst since 1949.

Finally, in China, I continue to be bullish, given the broad policy pivot. Perhaps initially encouraged by Fed hawkishness, China’s pivot was made possible by the fiscal carry-over from 2021, enabling front-loaded stimulus in 2022.

Although policy-makers pledge to solve growth slowdown and investors sentiment over regulatory changes, nobody should just jump in Chinese stocks. Go easy.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

What charts are telling us?

The rise of the 10-year note yield extends despite several oversold positions, sentiment, and momentum indicator readings. The market is now approaching the 2.60% and secular trend line support that extends back into the 1980s.

Although the bear market can potentially violate that channel support, expect some response to it over the short to medium-term period. For me, this is the most important chart to follow.

Also, the 10-year TIPS breakevens widening trend looks to extend again this week despite recent signs of deceleration near the 297bp cycle wide, hitting its all-time high(!) since 2003. It seems the market is charging the FED upfront.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Finally, despite oil volatility, the XOP/XLF ratio is widening trend looks to keep extending gain this week. Although banks are labeled as “value stocks,” there is an implicit risk for raising rates in asset quality and liquidity for capital markets.

We should follow credit deterioration momentum, a leading indicator for banking outperformance versus the S&P 500. There’s been an incremental flow in corporate and household bonds in the past couple of weeks. I’m watching this.

In case you missed it (PIX, Rates in Brazil)

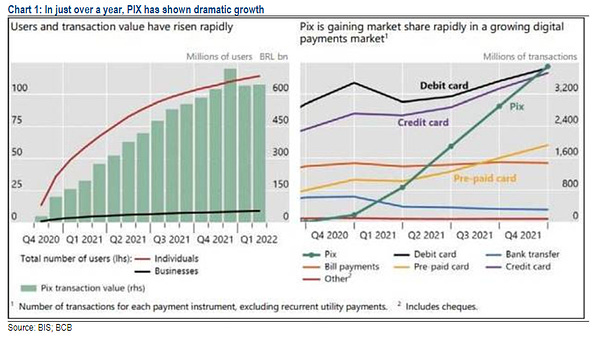

PIX

Giro Lino @giro_linoIt's impressive how a public payment infrastructure built by central banks can play an important role in the system by promoting competition and interoperability between platforms. Subscribe for free to receive the post I'm writing about it (link in Bio) 😀

March 25th 20221 Retweet8 Likes

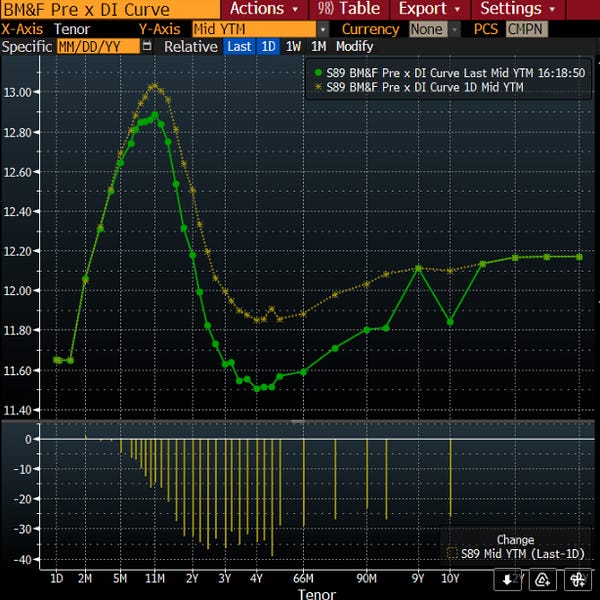

Rates in Brazil

Giro Lino @giro_linoYesterday, BCB president Roberto Campos gave market a dovish view for BZ rates past May meeting (guided for 100bps hike). Campos signaled BCB may end the tightening cycle at the next meeting. Market was pricing in another 75bps hike (175bps total). This is bizarre 🤦♂️

March 25th 20229 Likes

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Closed Ideas

If you’re paid subscriber, don’t worry. I created a new section (“Trade Ideas”) to improve our communication. You can expect to receive all PRO content in your mailbox.

Also, all posts/ideas will be saved in this new section, so you can find any topic much more quickly from now on. : )

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.