Today’s outline

- Tale of Two Realities

- Lost Decade

- Secret Sauce Recipe

- Reality Check

- In case you missed it (Pix, Rates, Google)

- Closed Ideas

This week Posts

- Trade Book Changes

- Mastercard faces complaints

- Why Value Investing?

- PIX vs. Debit Card

- Brazil March Wrap-up

- Pix Handbook - Part I ⭐

Tale of Two Realities

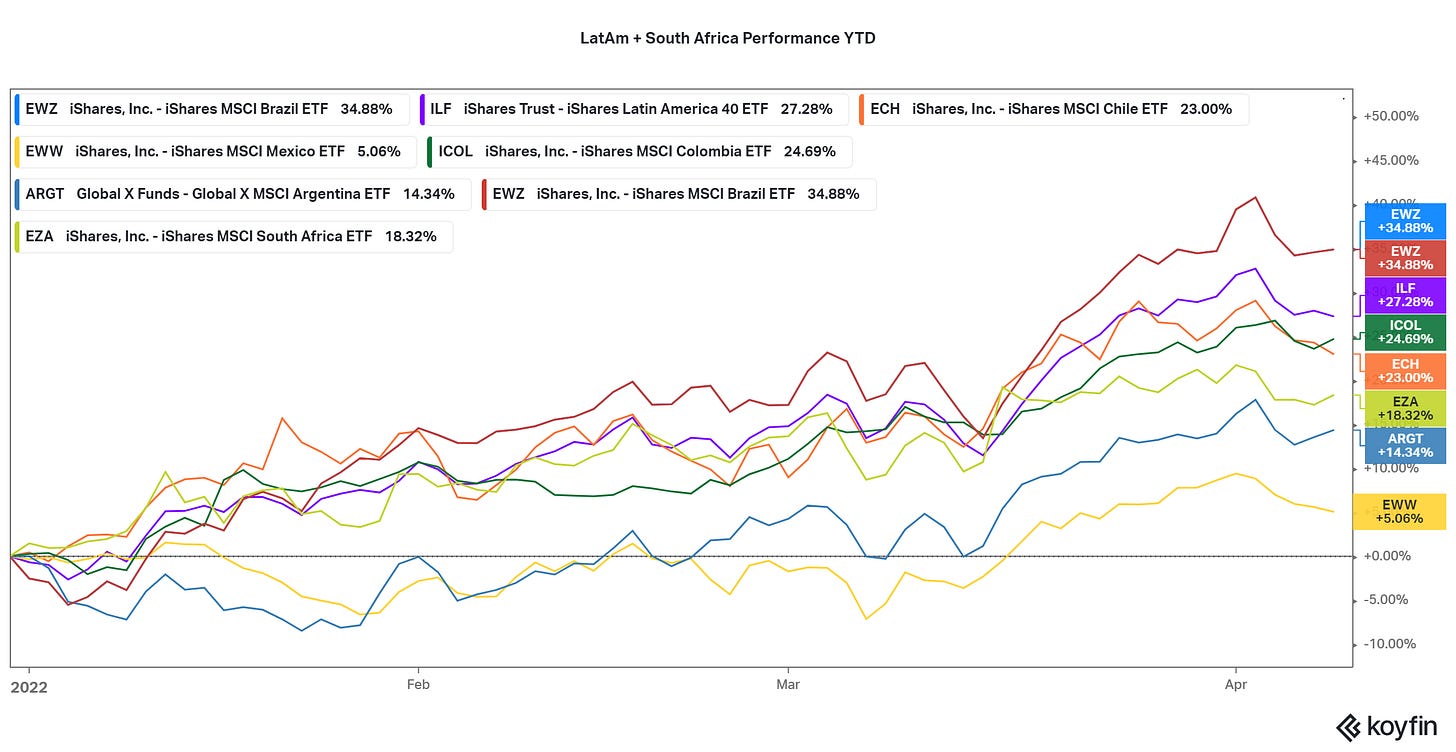

Some individual markets have posted substantial gains despite headline performance disappointment for Emerging Markets thus far in 2022 (MSCI EM -7%).

For example, the equities and fixed income markets in Brazil, South Africa, Chile, Peru, and Colombia have risen by double digits. Moreover, between April 1st and 5th, they all hit their respective high YTD.

Nevertheless, there are two tales for this story. In these cases, on one side, commodities companies are enjoying a significant tailwind and performing well.

Meanwhile, higher inflation and tightening financial conditions struggle for most businesses that rely on economic performance to perform well.

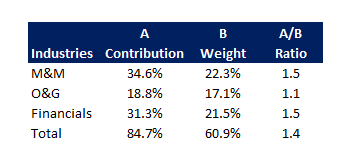

In Brazil, for instance, Oil & Gas, Metals & Mining, and Financials accounted for almost 85% of the index performance in 2022, although they represent ~60% of the index market cap.

Lost Decade

If you’ve been investing in LatAm for a while, you probably notice how messy things could be. So, when markets start to move positively, investors raise an eyebrow.

For instance:

- Annualized inflation in Argentina runs above 50%;

- Chile just elected President Boric, who thinks that printing money is a good solution to poverty, leading the country into the fiscal abyss; Venezuela becoming uninvestable;

- Brazil has been under the corrupt populist shadow for more than a decade.

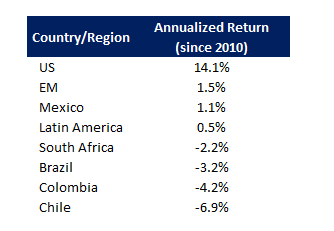

As a starting point, Latin American equity markets (and South Africa) have posted weak long-term returns since the Global Financial Crisis.

Brazil, Colombia, Chile, and South Africa all have negative returns over the period, with Mexico and general EM all returning 1-2% annually. This compared to ~14% annually for the S&P 500.

Secret Sauce Recipe

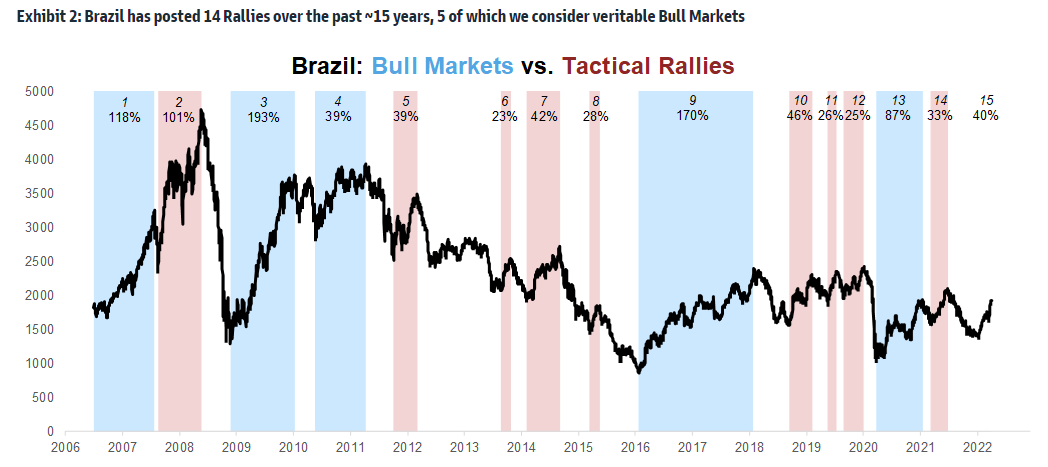

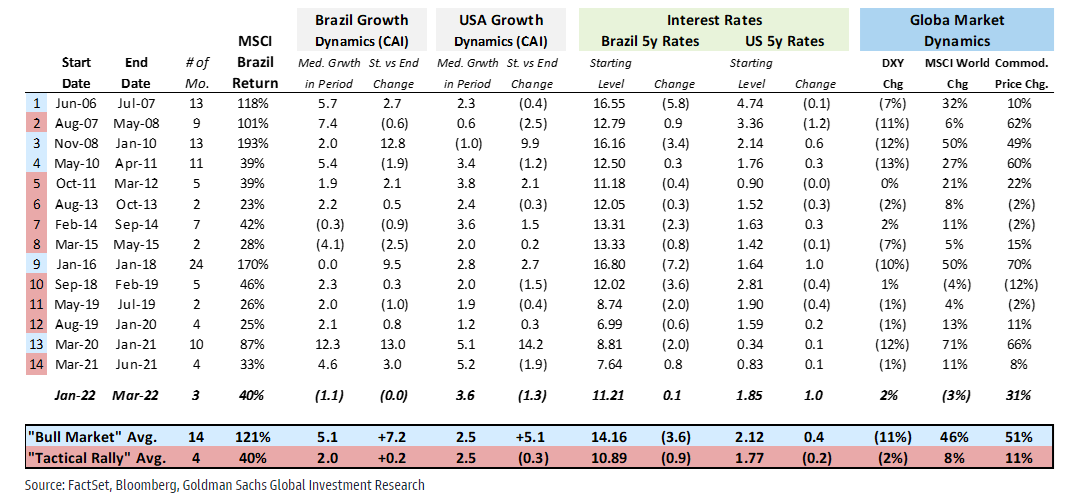

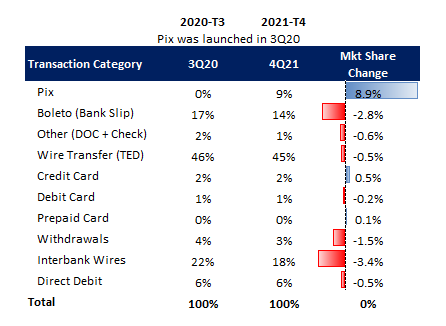

Goldman Sachs has often debated the bull market and tactical rally moves in different assets. Recently, they did a very simple, though interesting, study about the past 20 years of Brazilian equity performance.

“To help identify the “key ingredients” of a bull market, we analyze the past twenty years of Brazilian markets and fundamentals and distinguish between “tactical rallies” that last less than 10 months and typically return ~40% in USD terms from “Bull markets” that persist for longer and have typically returned 120%. This results in 15 episodes since 2006, and we highlight the relevant growth, interest rate, and global market dynamics during each of these periods below.”

The table above shows consistent patterns for every inevitable bull market that has ever happened in Brazil: i) falling local interest rates, ii) accelerating growth rates (Brazil’s CAI), and iii) stable global markets.

EM equities and local bond yields are typically negatively correlated (especially for high-yielding EMs), so unsurprisingly, Brazilian interest rates rally during equity bull markets.

Personally, EM equities are so unique that most sentences request a quantitative perspective. So, for instance, between 2016 and 2018, Brazilian equities had a 170% positive return in the period.

The starting level for the Brazil 5y rates was 16.8%, and it had a negative 7.8% change in the period to a 9% yield at the end of the period.

This interest rate level is so monstrous that the Equity Risk Premium (Equity Yield - Bond Yield) is negative, meaning that index investing is not worth the risk.

Just considering the negative 7.8% impact on rates would be translated into a ~90% increase in equity value, partially explaining the 170% bull market rally.

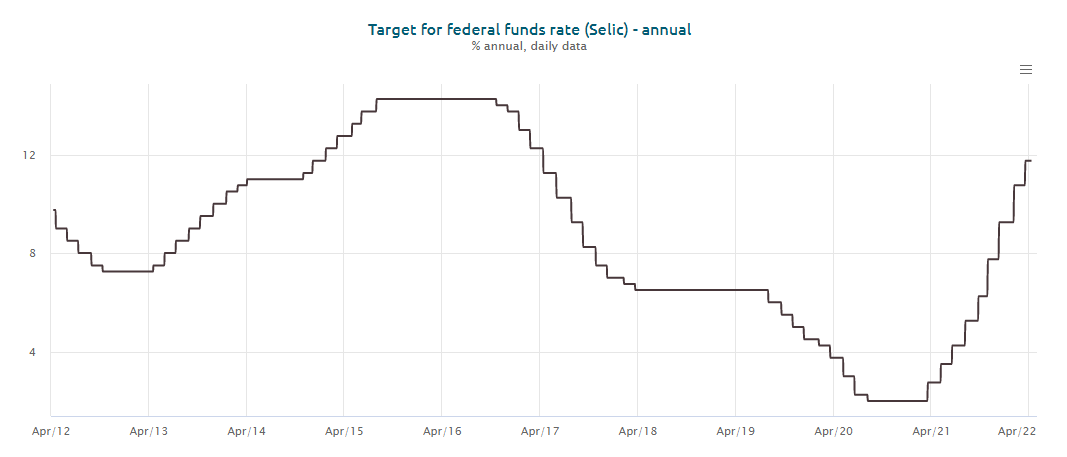

Considering that Brazilian Federal Funds (“Selic”) increased from 2% to 11.75%, it’s hard to imagine equities overperforming bonds in the following twelve months.

Brazilian equities can post a bull market somewhat independently of US rate moves. However, there is a clear pattern that long-lived rallies coincide with significant US Dollar downside and large rises in global equity and commodity prices.

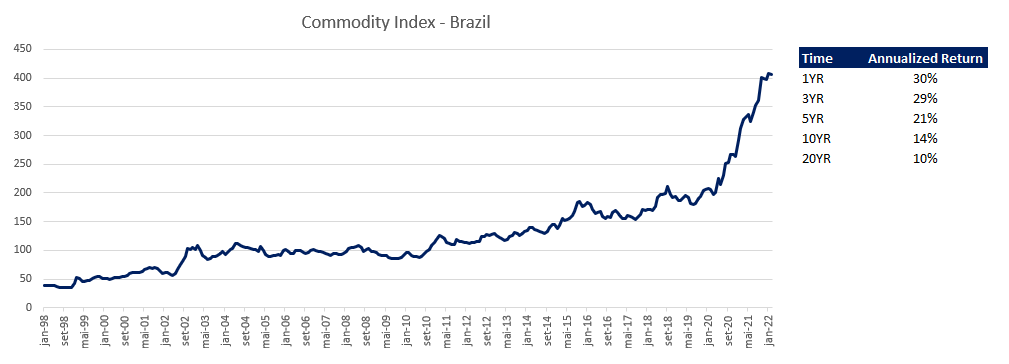

Currently, ~50% of Brazil’s Stock Exchange comprises companies that benefit from the higher global inflationary period, highlighting metals and mining and oil and gas industries.

However, it’s important to highlight that commodity prices without a supportive interest rate are not enough to trigger a bull market or sustain the market for long.

The image below illustrates the total and annualized returns for the Brazilian Commodity Index. Of course, that would be great to have Brazil’s equities return only to commodities, though it is not.

Reality Check

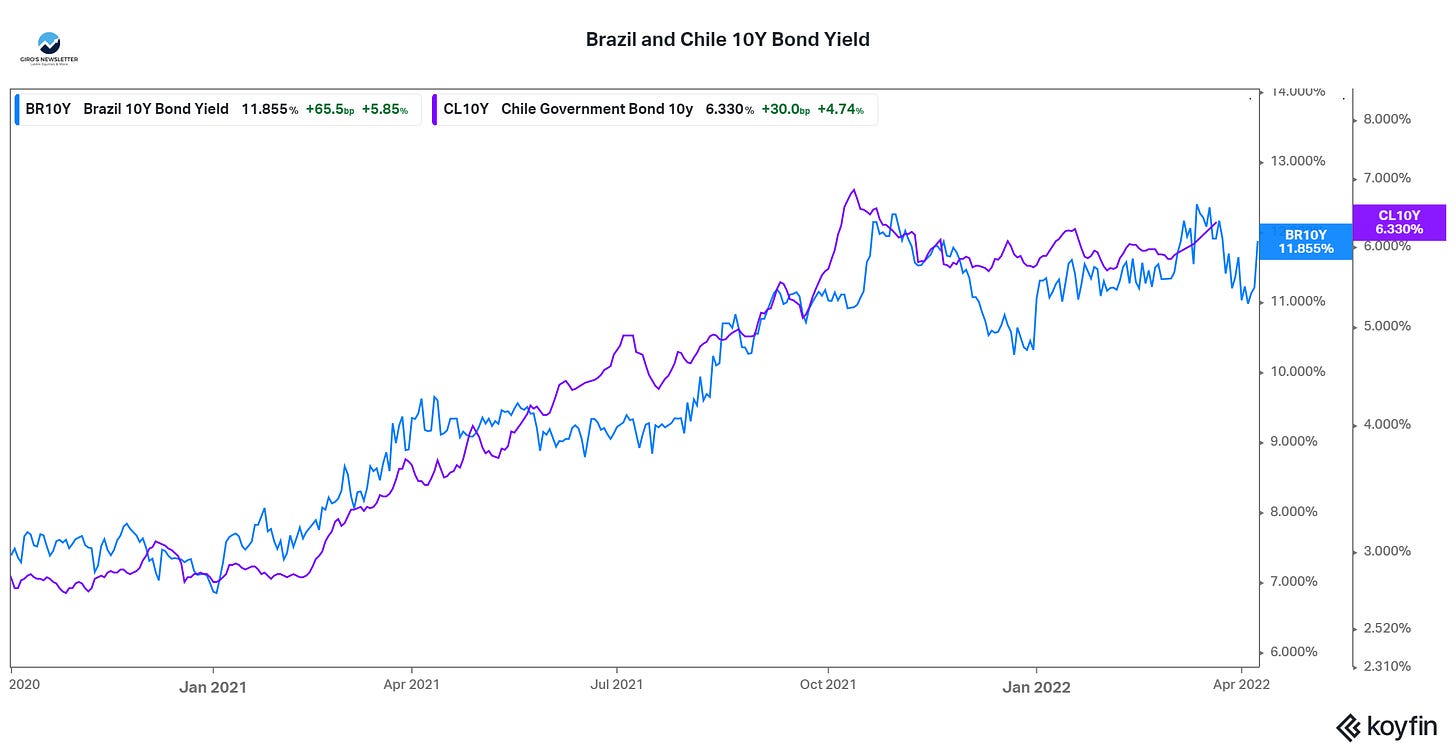

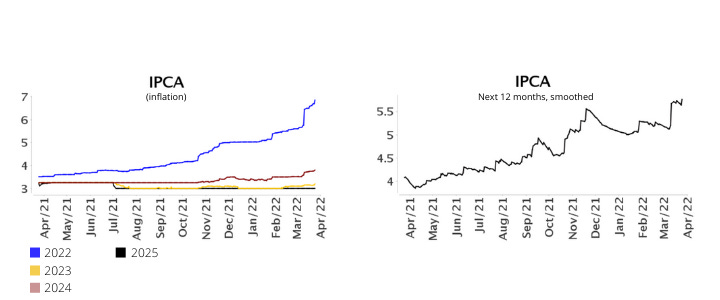

From a global perspective, we see the potential for interest rates to rise further (US 10-year to 2.7% by year-end). However, Brazilian rates have been deranged to global dynamics and operating on domestic factors.

For example, Brazilian 5-year rates have rallied by 140bp since their local highs of October 2020. In contrast, US 5-year yields have climbed 135bp since then, bringing other EM high-yielders such as South Africa and Mexico an average 50bp higher as well.

Nevertheless, this is a dynamic found in a few countries in Latin America, such as Chile, which is going through a period with higher populist measures that affect bonds prices.

Therefore, local bonds in Brazil have been driven by local factors, such as inflationary pressure and the arisen of new populist governments.

So, Brazil’s local rates may stay defensive against further rises in US Yields, but it’s unlike considering that yields are elevated given inflationary pressure.

Looking out into 2023, inflationary pressures should ease, and central banks begin cutting rates, suggesting that fixed income markets may discount these outcomes in the coming months.

However, the market started lifting expectations for 2023 and 2024 inflation, which could generate additional pressure on BCB policy on rates. So, there is a huge question mark com local rates.

Even though commodities enjoy good fundamentals to outperform markets in the following months, restrictive interest rate levels and supply chain disruption lead to growth estimates revisions downwards.

Nevertheless, the data calculated over market expectations collected by the BCB still don’t indicate a contagious for 2023 growth, although they usually happen in the subsequent months.

Finally, don’t forget that Brazil, Colombia, Chile, and South Africa have had negative returns over the past 12 years. My dear reader, this means that for every 120% upward, Brazilian equities had a subsequent 50%-55% move down.

Since 2000, every calendar has witnessed a minimum 17% drawdown in Brazilian equities, even in years with positive performance.

Assuming the average investor was a passive investor, yielding ~+35% performance YTD, why not make another +10% performance until YE22 “without” risk? For a year, it’s a substantial performance that the S&P 500 performs poorly.

However, don’t forget: if you’re a stock picker, be worried about the company’s underlying fundamentals and the business cycle.

In case you missed it (PIX, Rates in Brazil)

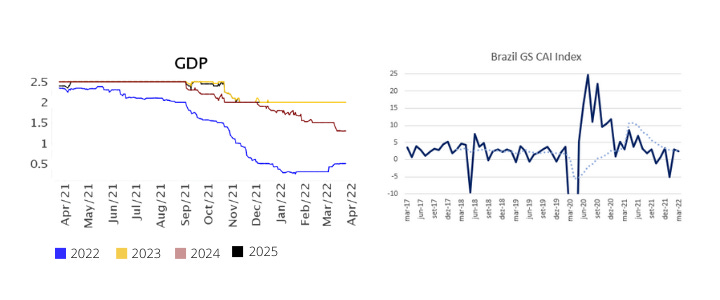

Pix

Giro Lino @giro_linoThis is true for P2P. Pix has gained a share mainly over bank slips, cash, and wire transfers. However, there is evidence suggesting a significant change in P2B transactions. I'm writing about it for my Substack 🙂 $STNE $PAGS $MELI @_ram_

Jerry Capital @JerryCap"National Payment schemes drive digital payments, but mostly disrupt P2P" https://t.co/9greK5bwxc

April 8th 20222 Retweets7 Likes

Rates

Giro Lino @giro_linoIn Brazil, real rates are currently at +7.3%, which is incredibly high from any possible angle. Except for a further deterioration in the current scenario, the market will start looking for quality domestic names that leverage during easing cycles in a few months.

April 8th 20221 Retweet27 Likes

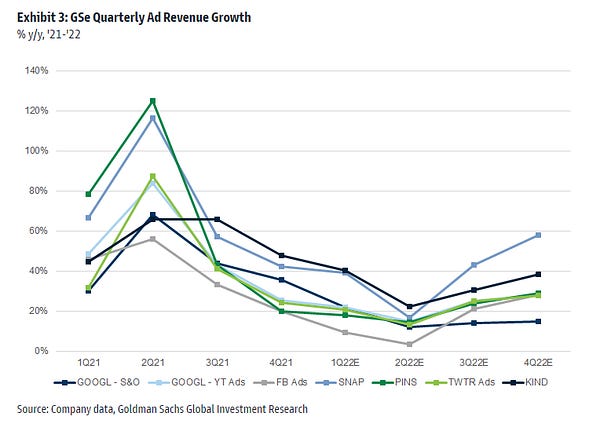

GOOG

Giro Lino @giro_linoGoing through a crisis, bet on pricing power. $GOOG, $GOOGL, is a beast. Probably one of the best businesses ever.

April 7th 20221 Retweet14 Likes

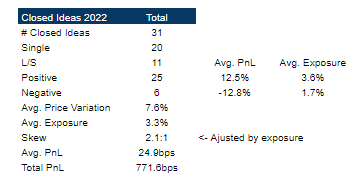

Closed Ideas

If you're a subscriber, don’t worry. I created a new section (“Trade Ideas”) to improve our communication. You can expect to receive all PRO content in your mailbox.

Also, all posts/ideas will be saved in this new section, so you can find any topic much more quickly from now on. : )