Hi 👋

In the past three weeks, all editions were monothematic. I wrote about Brazilian Equities, my opinion about Oil, and, finally, about China.

However, if you joined us recently, there is a second layout of writing I deeply enjoy, which is going through different topics in the same post, connecting the dots along the way.

The idea behind this newsletter is to share a multidisciplinary mindset with my dear readers. It’s just like my reading routine.

I don’t like to read one book— maybe I will read 3 or 6 books at any given point in time, and when I finish them, I’ll pick up another 2 or 3 books to read.

One reason is that you get bored reading the same thing, the same subject. And based on what Charlie Munger says, you should have a multidisciplinary mindset.

So it’s good to have different books and topics from other disciplines and read them. And then one of the fantastic things that I discovered is that you then associate one thought with another one. And that really is helpful to me.

Once the book is over, I go back to the cloud and take out what I had underlined in that particular book, notes, and annotations. I put them in a different document, letting that be.

Food for Thought is about looking at a problem from multiple perspectives. That’s, I think, the correct way of doing it.

When you are trying to evaluate something, you ask, ‘why?’. Why did this happen? And when you reflect upon it, you find that the answer sometimes comes from multiple disciplines, and you get down to that and try to figure it out.

It is delightful to do it in that way. The process for me has always been to ask the question ‘why?’ and wait. Because the mind will tend to jump to a particular answer, and that’s not the only answer.

So the way I think about it is wherever there is a complex question I am trying to answer, I always start with the words ‘part of the reason is this’ - which means there must be other parts too.

I’d like to think about what those parts might be. There don’t have to be twenty of them - even if there are three or four, that’s better than one. So it helps me to ask the question ‘why?’ and then look for answers.

Honestly, I’ve never worked so much as I’ve been since January. Also, I’ve never enjoyed so much working. Sharing my thoughts is my favorite everyday routine.

💙Thank you for reading.💙

Giro’s Newsletter is reader-supported. we would appreciate it if you could help me share the content so I keep sharing my thoughts.💙

Today’s outline

- FOMC is Approaching

- Uninspiring Earnings Season

- Technical Doesn’t Help

- Neither Does Amazon

- Last Hope

- Meanwhile in China

- Politburo Highlights

- Reiterating the View

FOMC is Approaching

While it’s clear that this economy doesn’t need a stimulative monetary policy, what is less clear is the speed at which this stimulus should be removed and the reasons for choosing that speed.

Almost all FOMC policymakers who spoke since the last meeting indicated varying degrees of comfort with hiking by 50bps at next week’s meeting.

President Bullard suggested 75bps might be more appropriate (and more “expeditious” than 50bps), though this seemed to receive little buy-in among other Fed officials.

The near-unanimity of this view suggests that perhaps this option has already been tacitly agreed upon.

The Powell Fed has displayed a strong preference to telegraph its intentions ahead of the meeting day, and for that reason, we think 50bps is very likely next week.

As for our view, as we head into next week’s FOMC meeting, forwards are priced to 50bps hikes at each of the next 4 meetings, which we view as fair given that we expect the Fed to stick to a cadence of 50bps hikes.

Uninspiring Earnings Season

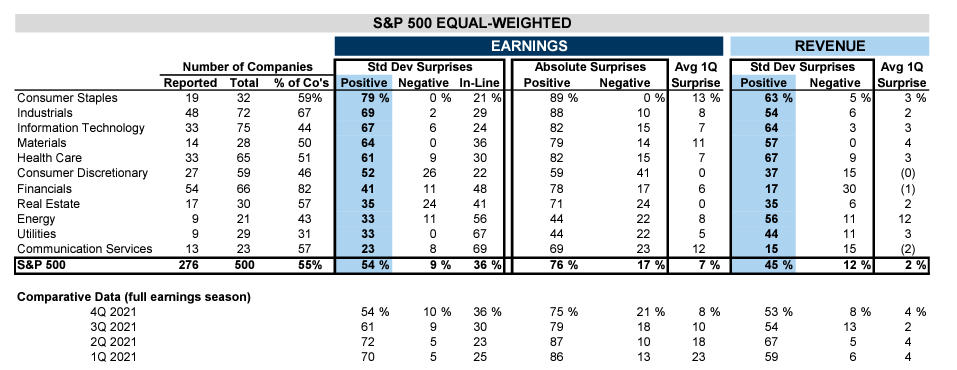

- Based on 55% of S&P 500 companies reported so far, 75% are beating 1Q earnings, and 45% exceed revenue estimates.

- The earnings season comparative data shows that positive surprises have lost momentum compared to prior seasons.

- The table shows the sectors facing headwinds. We highlight the real estate industry ($XHB), our least favorite.

- Over the next 5 days, ~ 20% of the S&P 500 market cap will report earnings.

- We estimate roughly 50% of S&P 500 companies are currently in earnings blackout.

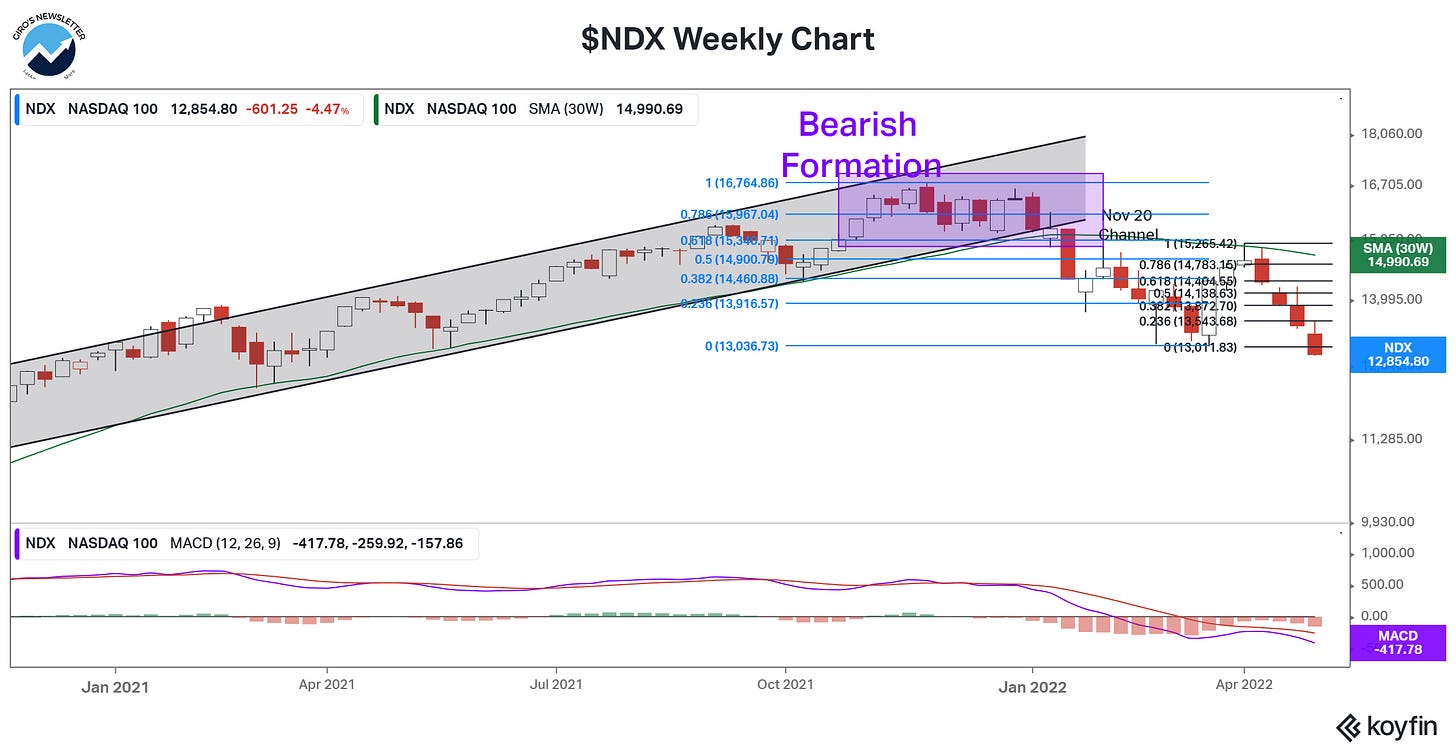

Technical Doesn’t Help

Commented on Commonstock, we are skeptical about Nasdaq price action since the index is trading in a delicate range.

The Nasdaq index weekly chart is trading below the short moving average from the MACD (circled in the illustration below). Investors should raise a yellow flag. The market may be leading to another leg down.

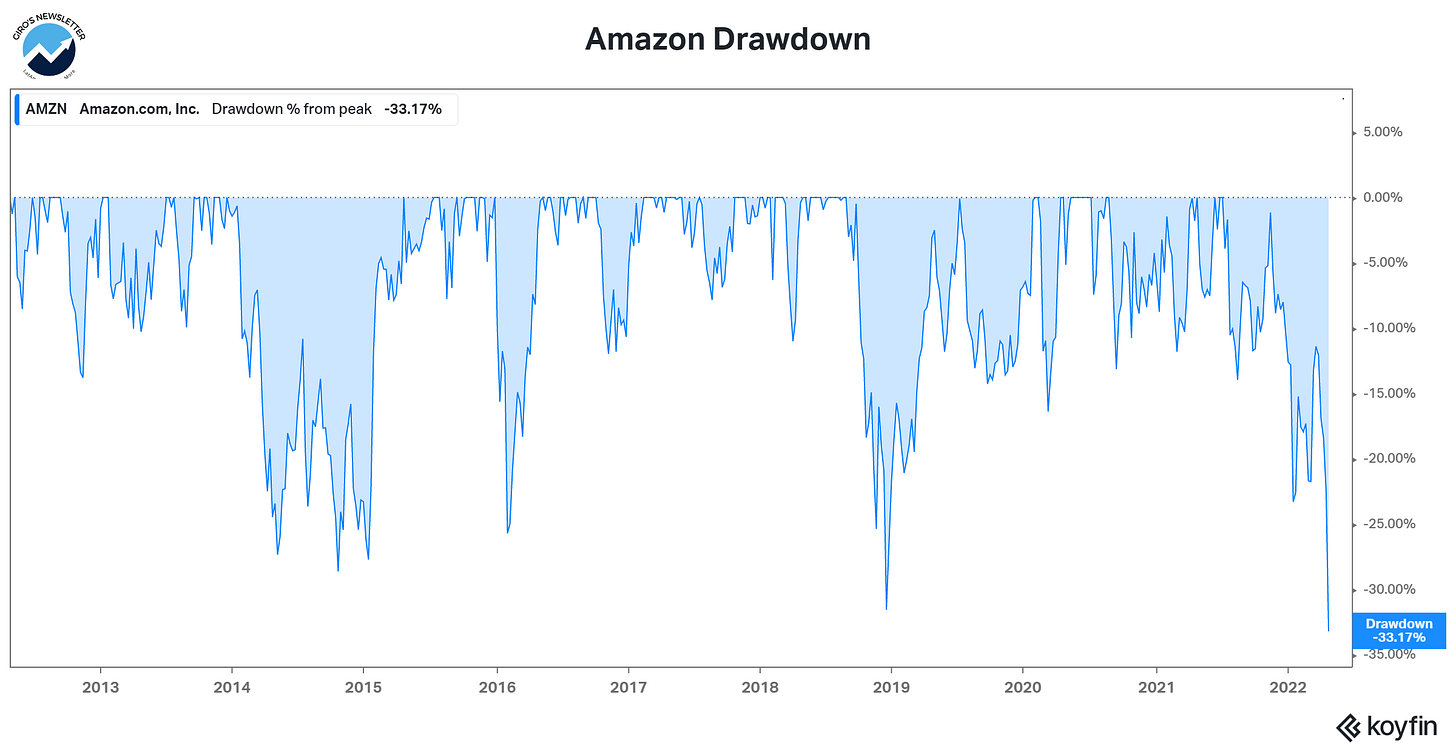

Neither Does Amazon

Amazon (“AMZN”) reported disappointing earnings that triggered a substantial sell-off in the stock. Adding to our comment throughout the week, we believe retail headwinds will perdure for longer:

- We estimate these costs will represent ~$2bn/$1.8bn incremental profit headwinds in 2Q/3Q, with heading easing to ~$1bn in the 4Q22;

- In 2021, we constantly heard comments about AMZN being understaffed due to Covid, but now it looks otherwise. The company aggressively hired and has a reduction in productivity. We expect that Price Day will generate a $1bn relieve, though it will not be enough;

- Headwinds dilute fixed costs after expanding its logistics footprint. For example, in the past couple of years, AMZN added double the fulfillment network built over the last 25 years to meet consumer demand. We tried to estimate when the headwind may cease, but we’re not comfortable with our numbers, though it sounds obvious that we can expect the headwinds to perdure in 2022.

Last Hope

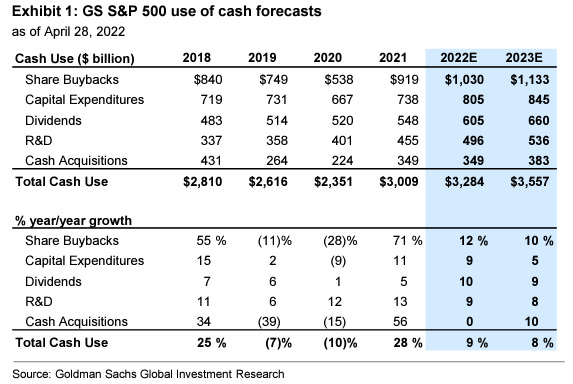

Equity volatility has also coincided with the buyback blackout window. Ahead of earnings reports, companies are restricted from discretionary share repurchases.

By next week, most firms will have exited their blackout windows. As a result, the market expects that S&P 500 buybacks will grow by ~10% YoY in 2022 and remain the largest source of demand for US equities.

Solid earnings growth (+5%) and large cash balances among S&P 500 firms will support continued buyback growth. In addition, management has indicated a desire to return excess cash to shareholders in the form of repurchases.

Buyback authorizations, a signal for subsequent executions, totaled $1.2 trillion in 2021 and have surpassed $400 billion YTD, 22% above the record pace last year.

For instance, AAPL and GOOGL authorized $90 billion and $70 billion in buybacks. Tech and CommServices accounted for 43% of S&P 500 repurchases in 2021 and will probably account for +50% in 2022.

Meanwhile in China

On Friday, Beijing held a symposium on the heels of the Politburo meeting, sending a clear message the clampdown is over since everybody keeps following the rules.

The country’s major Big Tech players, including Alibaba, Tencent, Meituan, and TikTok owner ByteDance, were present.

A joint regulatory meeting is also set to take place this weekend to put all regulators on the same page regarding Beijing’s new decision to ease aggressive actions.

In the last 18 months, regulatory hostility has been one of China's tech stocks' most significant investment risks, wiping out trillions of dollars in market value across New York and Hong Kong while deterring venture funding for Chinese tech start-ups.

Last Friday, the Politburo statement was issued in the early afternoon, breaking Beijing’s tradition of releasing reports outside market hours.

As a result, Alibaba rose 15.7%, Tencent gained 11.1%, while Meituan advanced 15.5% during the trading session.

Since January, we’ve been calling investors’ attention to the regulatory developments in China. Particularly last week, we wrote extensively about it.

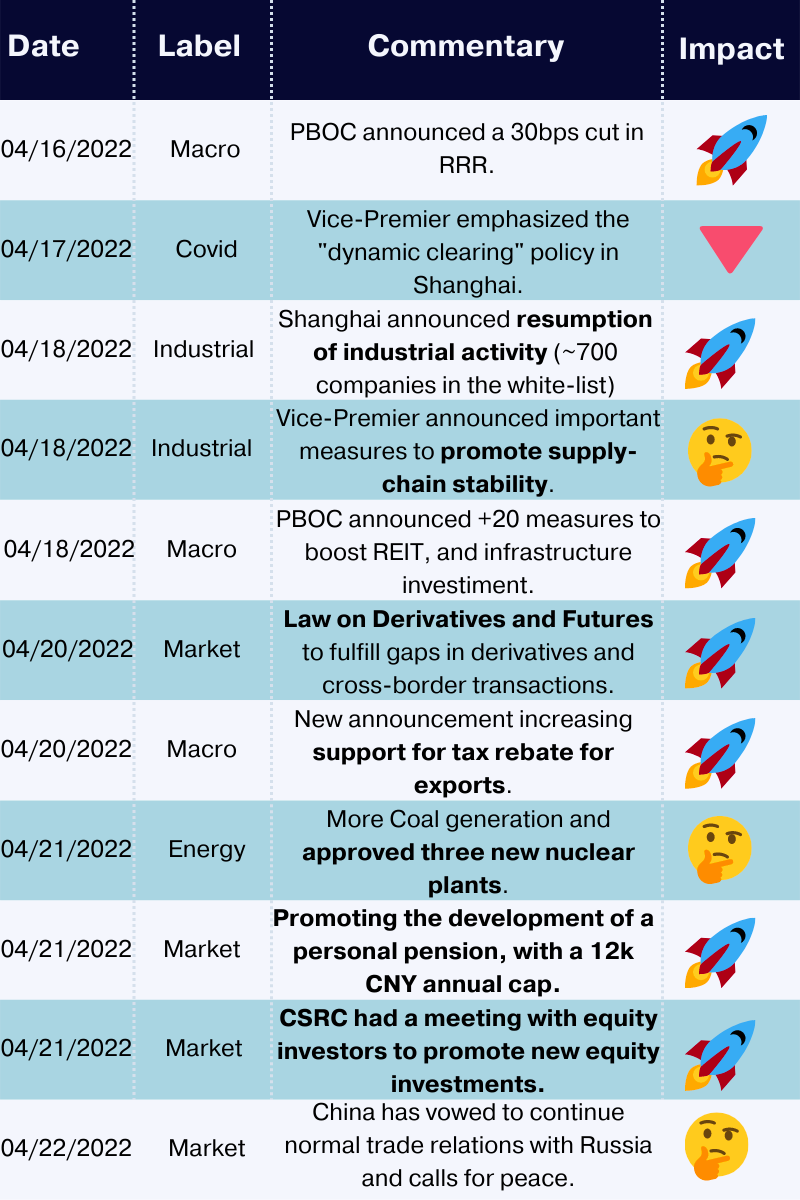

Politburo Highlights

➡️ Economic Growth

Policymakers highlighted "increased uncertainties due to Covid outbreak and Russia-Ukraine conflict." However, they reiterated they would "step up policy support, work hard to achieve economic growth and maintain growth within a reasonable range."

They also highlighted the need to "accelerate the implementation of supportive measures already announced, prepare additional easing measures, and properly handle policy intensity and relative magnitude under the guidance of economic targets."

You could read it like: “Dude, QE is coming.”

➡️ Investment and consumption

They noted expanding domestic demand and pushing for "comprehensive acceleration of infrastructure investment."

Policymakers would roll out a relief program for SMEs and industries hit by Covid and facilitate consumption growth. In addition, the statement mentioned "stabilize and expand employment" and "ensure normal operation of supply chains for key industries."

➡️ Platform companies

As mentioned before, the Politburo meetings sent positive signals by stating to complete targeted inspections of these companies and even to roll out measures to support the healthy development of these companies, as long as they play accordingly. Policymakers understand that platforms support the common good by boosting local economies.

➡️ Property market

The broad statement follows recent communications. "Housing is for living not for speculation" was reiterated.

➡️Zero Covid policy

No signs of policy fine-tuning on this front. Like President Xi emphasized in late March, policymakers continued to emphasize "people first, lives first," stick with "dynamic zero-Covid" while minimizing the economic costs of anti-pandemic measures.

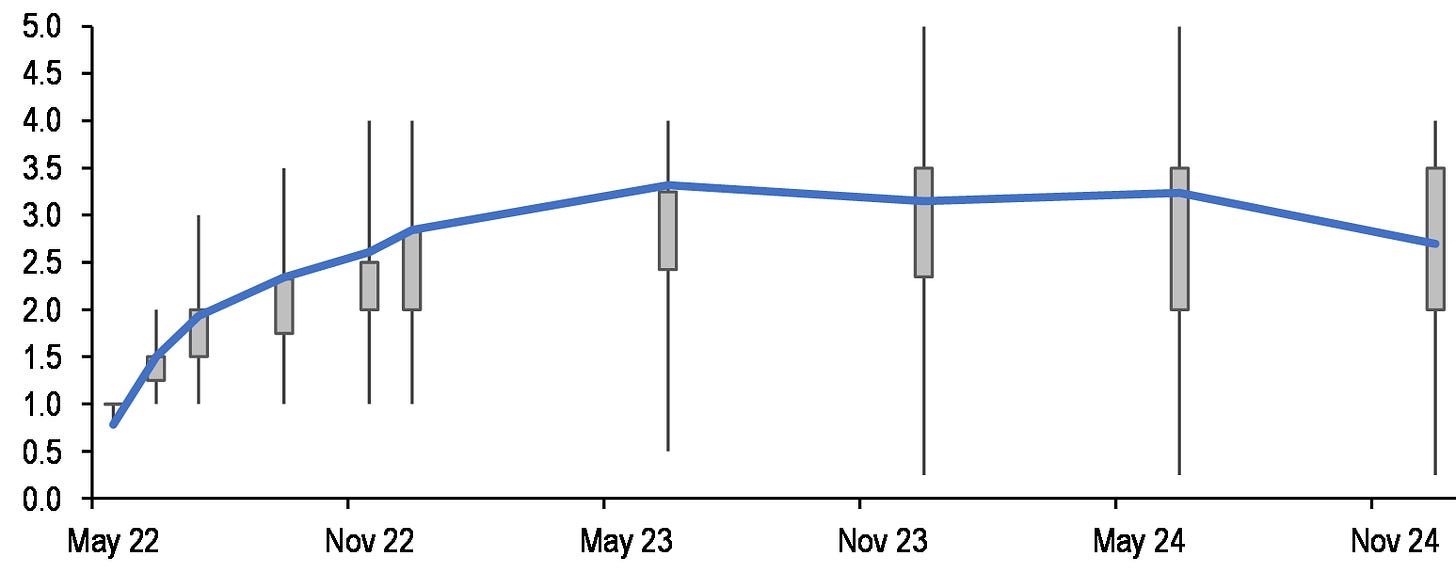

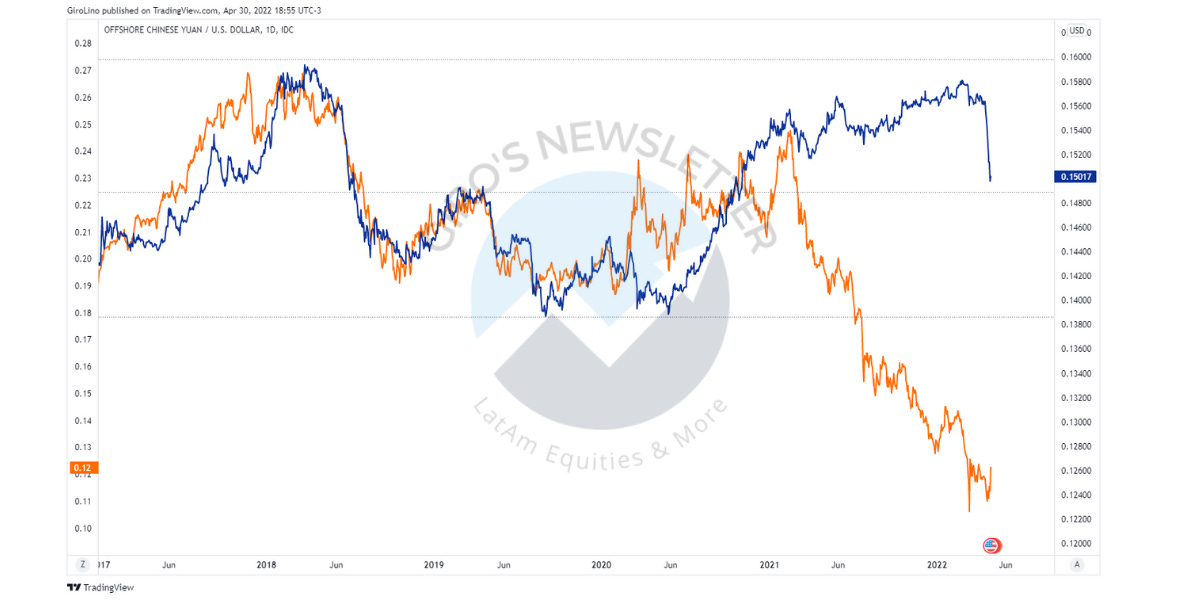

Reiterating the View

For as long as it takes, we’ll reiterate the Chinese stocks hit bottom on March 16th, when the policymaker hit its circuit breaker.

On March 16th, Vice Premier Liu He chaired the Financial Stability and Development Committee meeting. He responded to key market concerns on a macro policy stance, property risks, ADR, and platform company regulation.

Over the past several weeks, the policymaker understood the rapidly worsening Covid-19 situation and weak credit indicators.

They don’t only need firm policy easing measures but also support from platforms that are supplying the lockdown population and supporting local communities. So a month later, they started a series of supportive measures.