Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money.

Today’s outline

- Peace

- Temporary Shock

- Implication for Metals

- Keep an eye on it

- In case you missed it ($MELI, $STNE, $RRRP3)

- Weapon to protect the portfolio I (PRO)

- Weapon to protect the portfolio II (PRO)

- Portfolio (PRO)

- Research Schedule (PRO)

- Watchlist (PRO)

Links to Interactive Models (PRO)

- Stone ($STNE), Petrobras ($PBR), 3R (BVMF: RRRP3), Sinqia (BVMF:SQIA3), Vale ($VALE).

Peace

Throughout the week, the world witnessed Russian forces moving by air and land to attack Kyiv, hitting defenses across Ukraine that U.S. and British defense officials said were unexpectedly strong.

Yet, at the same time, Moscow signaled openness to hold talks with the Ukrainian government. Though Russians are reasoning the situation, one cannot tease with war.

The Western seems speechless, with few sanctions or harsher actions targeting Russia. Though it rages me, the situation requires patience.

Autocrats win in the short term; systems win in the long run. There is a substantial military advantage for an autocrat with centralized resolutions against a system with decentralized institutions. Often, autocracies are run by individuals, not collegiates.

Also, after invading Ukraine, Russian authorities ordered Meta to stop the independent fact-checking and labeling content posted on Facebook by four state-owned Russian media organizations, a movement intended to silence the critics.

However, things change with succession, as the autocrat is not a system. And he has no successors. Even his immediate staff are afraid of him. So there is no structure in Russia tackling Ukranian people, just Mr. Putin.

Temporary shock

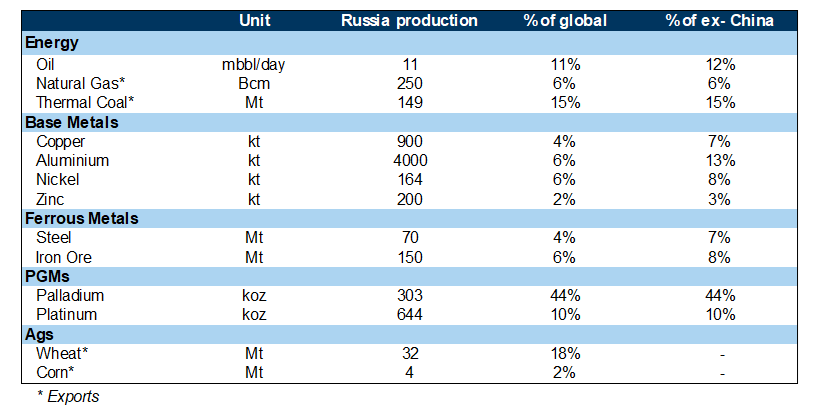

As discussed in the previous weeks, a prolonged commodity supply shortage is unlikely. Yet, uncertainty around sanctions creates a narrative around a possible supply shock.

Uncertainty leaves an upside risk for commodities in case of further escalation in conflicts, especially prices for European natural gas, wheat, corn, and oil higher from already-elevated levels.

If broad sanctions are imposed, exposure to Russian material can create legal costs, as physical aluminum traders learned during the 2018 Russian sanctions.

Although the shock looks temporary, it changes a few dynamics, such as any prospective Iran deal, in which higher oil prices give some flexibility to the country.

Also, since there was no physical shock to Russia's supply, the odds for OPEC+ to accelerate ramp-up in the following months sound unlikely, leaving space for a rally in oil prices while sanctions persist.

Implication for Metals

The most susceptible markets to a phase of impacted Russia supply within the base metals would be aluminum, copper, and nickel.

Although given inventory levels in all three of these base metals, markets are at lows given significant ongoing deficit conditions, prices will be more sensitive to any volume loss.

Also, the risk for a stoppage in metals production is unlike. Instead, a more probable scenario is a remapping of metal flows, exporting to markets that accept buying products from countries under sanctions.

The most likely scenario is Russia redirecting its volume to China, as Iran does with its oil. However, this adjustment would be significantly more straightforward in the copper and nickel markets. China already accounts for 60% of Russia's refined copper exports and a third of their refined nickel exports.

Keep an eye on it

Throughout the week, there were a bunch of movements looking like a breakout, though we saw a strong rebound on Thursday and Friday.

Investors should be looking forward to next's week performance in the tech universe. In the past two days of the week, there was a significant rebound in mid-cap technology companies.

Two-day performance has low significance, but the chart above is second evidence that tech companies might be facing support for the next leg-down or a rebound.

From a different angle, inflation expectation is in a box looking for the next breakout, as shown above. So we’re talking about a 20 years breakout.

Also, the UST10 is close to another major breakout. All inflations since 1973 have been oil-related. If this bull market in crude oil continues higher—as price action indicates—then there will be no relief from inflation.

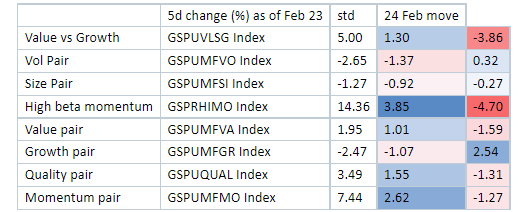

Finally, the table above tells you an exciting story about momentum in the past few days. Between 17th and 23rd, the 12-month GS momentum pair basket (BBG: GSPRHIMO Index) saw a 14% move higher, a 3.8 std move (ranked 99.5% in history).

Momentum has quietly outperformed 25% since late December. The momentum trade is long energy/fins/cyclical and short secular growth and healthcare.

The momentum basket pair is correlated to rates and oil and increasingly value vs. growth. So although I've carried a very optimistic view on Value factor stocks, it's essential to keep an eye out for potential crowding dynamics.

The significant momentum move of late has exacerbated growth stock underperformance as the growth stock peak was almost exactly a year ago.

Momentum had a violent reversal intraday (~8%), closing down 4.7% despite oil higher and rates rebounding from depressed levels. Nevertheless, for now, I'm doing nothing with my value positions.

In case you missed it ($MELI, $STNE, $NU)

$MELI earnings

Giro Lino @giro_lino1/n $MELI posted outstanding quarterly earnings, especially the fintech business, with the off TPV expanding >70% and credit portfolio reaching $1,7b (+50% QoQ), entirely above my $1,4b estimates, while NPLs are improving (as expected).

February 23rd 202215 Retweets102 Likes

$NU earnings

Giro Lino @giro_lino1/n It took me a little longer to digest $NU's earnings. I'm still getting used to the release and locating the footnotes, but numbers were worth the delay. Let's do it. 👇🧵

February 23rd 202214 Likes

About my new experiment

Giro Lino @giro_linoYeah… ok, Round 1 is definitely to $MELI. Yet, I wasn’t able to checkout my $PAGS POS. I’ll perform over 1000 transactions in each POS hiring the ERP system for the respective company to evaluate the service.

February 23rd 20222 Retweets44 Likes

B3 will launch its operation in the registrar business

Giro Lino @giro_lino1/n What a coincidence... B3 ($BOLSY) announced this morning they're stepping in the receivable business, extending its registrar solution to payment companies (especially acquirers).

February 23rd 20227 Likes

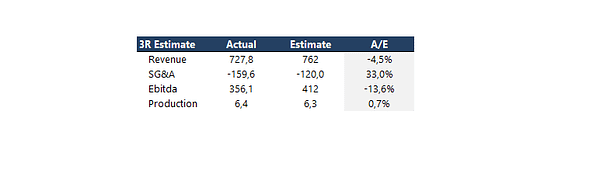

BVMF: #RRRP3 earnings

Giro Lino @giro_lino1/n Hi. As promised, I'll comment on BVMF: #RRRP3 and will start working on $PBR ( : With all O&G posting solid earnings, I wasn't expecting a negative surprise this quarter. Nevertheless, 3R reported polluted earnings, with surprises in the top line and SG&A. Let's do it. 🧵

February 24th 20221 Retweet16 Likes

PRO Content

Closed Ideas in 2022

Weapon to protect the portfolio I

Unfortunately, my role evolves to think of the worst outcomes and companies that may thrive for this turbulent period.

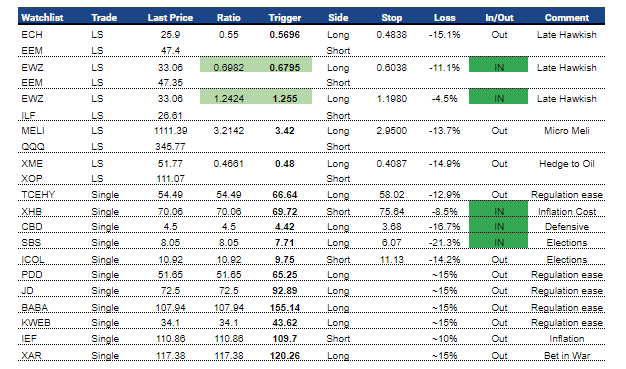

I added it to the Watchlist, but I’m looking to get a position in $XAR after being stopped in my $XP position.

Not much to discuss. Both support on moving average and 20 years trend line and just waiting for the breakout, if it comes.

Weapon to protect the portfolio II

In a scenario where inflation persists, shorting bonds is obvious, though simple, trade to jump in. So the idea was added to my Watchlist.

Research Schedule

I’ve been working hard on offering the best research to my readers. I genuinely believe that is possible, but I need your help.

Giving feedback is the best way to help me organize my schedule. So, please help me by answering this form.

Since I’m not collecting any personal information in this form, please, feel free to contact me at [email protected].

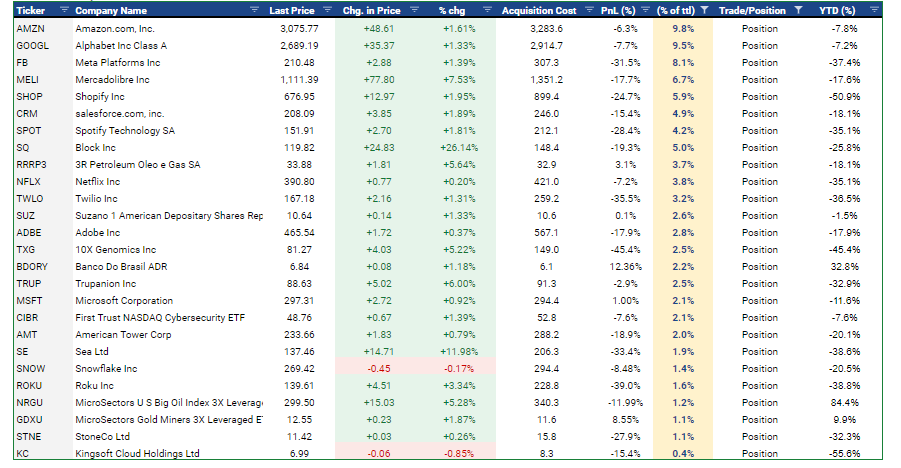

Portfolio

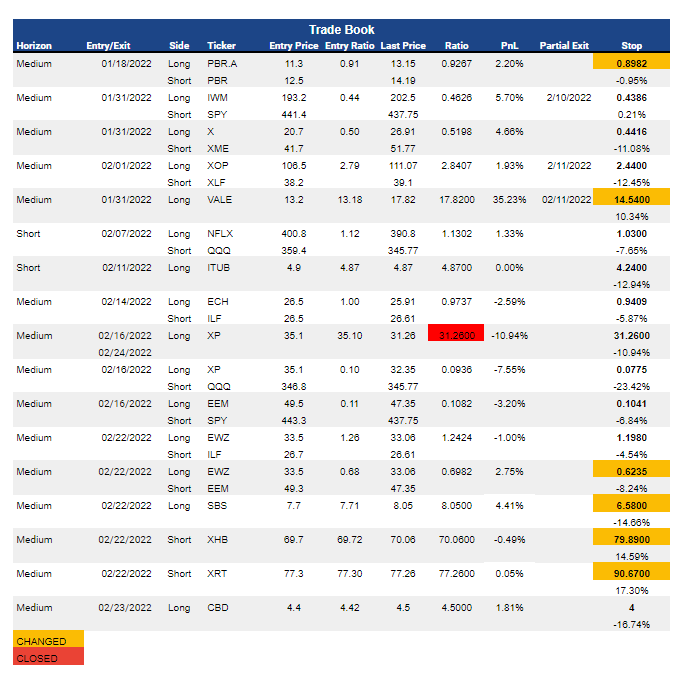

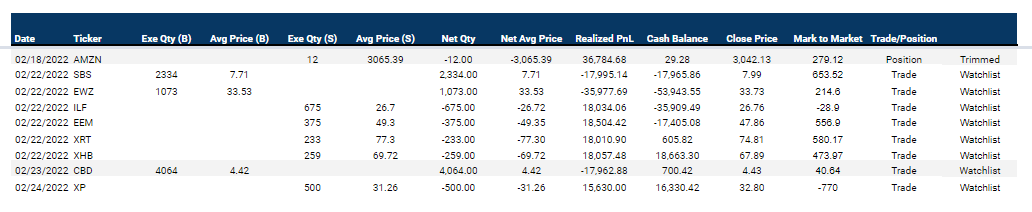

Trade Log

Position

New: None

Add: None

Trimmed: None

Sold: None

Trades

New: i) $SBS, ii) $EWZ/$ILF, $EWZ/EEM, iii) $XRT, iv) $XHB, v)$CBD

Out: $XP

Watchlist

Links to Interactive Models

Stone ($STNE)

Password: STNE2022#

Sinqia (BVMF: SQIA3)

Password: SQIA2022#2

3R Petroleum (BVMF: RRRP3)

Password: RRRP2022#

Petrobras ($PBR)

Password: PBR2022#

Vale ($VALE)