In the dynamic world of finance and investment, understanding industry multiple valuation and enterprise value calculation is crucial for making informed decisions. This comprehensive guide will delve into the intricacies of valuation multiples, explore their applications across various industries, and provide a practical framework for calculating enterprise value. Whether you're a seasoned investor, a financial analyst, or a business owner looking to understand your company's worth, this guide will equip you with the knowledge and tools to navigate the complex landscape of business valuation.

Understanding Enterprise Value

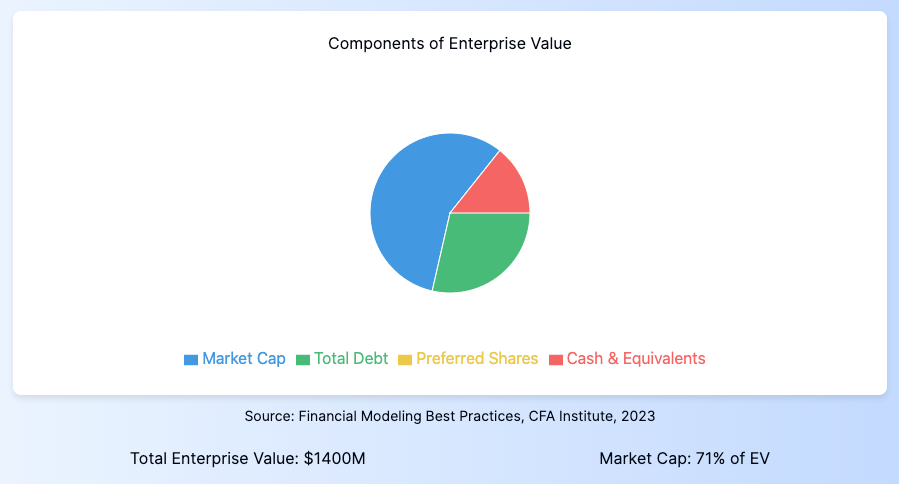

Enterprise value (EV) is a comprehensive measure of a company's total value, encompassing both its equity and debt. It provides a more holistic view of a company's worth compared to market capitalization alone. Enterprise value is particularly important when conducting industry multiple valuation, as it allows for a more accurate comparison between companies with different capital structures.

Calculating Enterprise Value

To calculate enterprise value, follow these steps:

- Start with the company's market capitalization

- Add the company's total debt

- Add preferred shares

- Subtract cash and cash equivalents

The formula for enterprise value is:

EV = Market Cap + Total Debt + Preferred Shares - Cash and Cash Equivalents

This calculation gives us a more accurate picture of a company's total value, considering its capital structure and liquid assets. Let's break down each component:

- Market Capitalization: The total value of a company's outstanding shares

- Total Debt: Both short-term and long-term debt obligations

- Preferred Shares: A class of ownership that has a higher claim on assets and earnings than common stock

- Cash and Cash Equivalents: Highly liquid assets that can be used to pay off debt

Why Enterprise Value Matters

Enterprise value is particularly useful when dealing with valuation multiples. It provides a more accurate basis for comparison between companies with different capital structures. For instance, comparing the price-to-earnings (P/E) ratios of two companies might not tell the whole story if one company is highly leveraged while the other isn't. Using enterprise value in our multiples can help level the playing field.

Consider two companies in the same industry:

- Company A: Market Cap $1 billion, Debt $500 million, Cash $100 million EV = $1 billion + $500 million - $100 million = $1.4 billion

- Company B: Market Cap $1.2 billion, Debt $100 million, Cash $300 million EV = $1.2 billion + $100 million - $300 million = $1 billion

While Company B has a higher market cap, Company A actually has a higher enterprise value. This difference becomes crucial when comparing valuation multiples and assessing the true value of these companies.

Valuation Multiples: A Comprehensive Overview

Valuation multiples are essential tools in financial analysis, allowing us to evaluate one financial metric as a ratio of another. They provide a standardized way to compare companies of different sizes or within different subsectors of an industry. Valuation multiples are the cornerstone of industry multiple valuation techniques.

Types of Valuation Multiples

There are two main types of valuation multiples:

- Comparable Company Valuation Multiples

- Enterprise Value Multiples

Each type serves a specific purpose and can provide valuable insights when used correctly. Let's explore each in detail.

Comparable Company Valuation Multiples

Comparable company valuation multiples, also known as equity multiples, are based on the principle that similar companies should be valued similarly. This approach involves identifying a set of public companies that are similar to the one being valued and using their financial ratios as a benchmark.

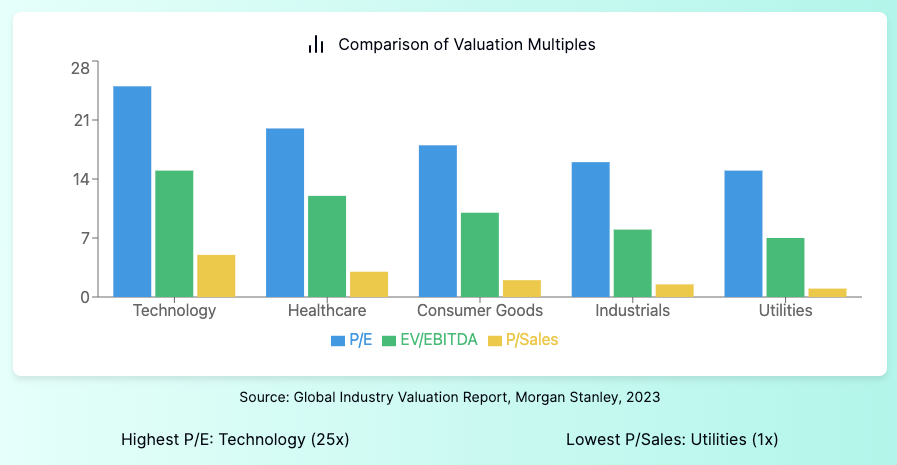

Common comparable company multiples include:

- Price-to-Earnings (P/E) Ratio: Compares a company's share price to its earnings per share

- Price-to-Book (P/B) Ratio: Compares a company's market value to its book value

- Price-to-Sales (P/S) Ratio: Compares a company's market capitalization to its revenue

These multiples are particularly useful when comparing companies within the same industry that have similar business models and growth rates. However, they can be influenced by differences in capital structure, making enterprise value multiples sometimes more appropriate for comparison.

Enterprise Value Multiples

Enterprise value multiples use enterprise value as the basis for comparison, providing a more comprehensive picture of a company's true value. These multiples are particularly useful when comparing companies with different capital structures or tax situations.

Common enterprise value multiples include:

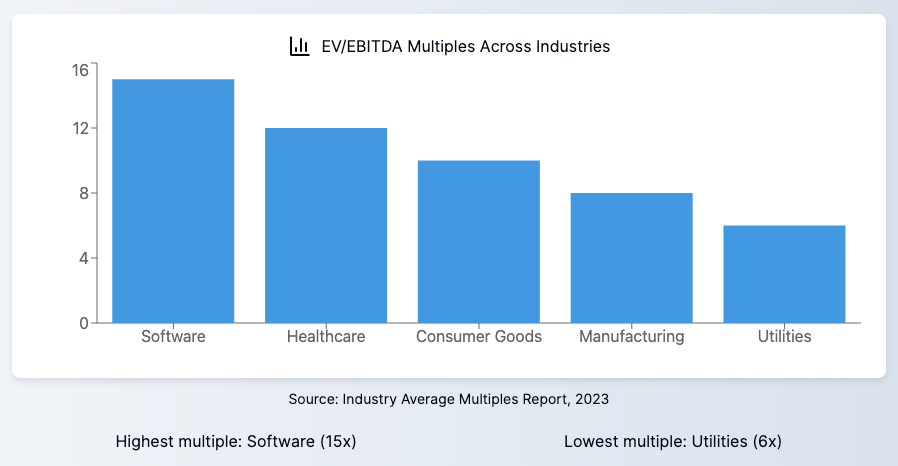

- EV/EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): A popular multiple that provides insight into a company's operating performance without the effects of capital structure, taxes, or accounting practices

- EV/Sales: Useful for comparing companies with different levels of profitability

- EV/EBIT (Earnings Before Interest and Taxes): Similar to EV/EBITDA but includes the effects of depreciation and amortization

Enterprise value multiples are often preferred in industry multiple valuation because they account for differences in capital structure between companies. This makes them particularly useful in industries where companies may have varying levels of debt or in comparing companies across different countries with different tax regimes.

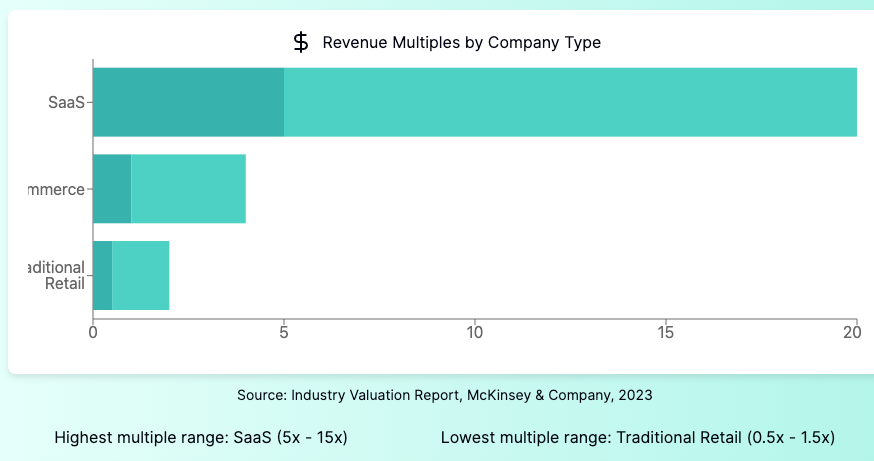

Revenue Multiples: A Key Valuation Metric

Revenue multiples, based on a company's gross revenue, can be particularly insightful, especially when dealing with high-growth or early-stage companies. These multiples provide valuable information even when a company isn't yet profitable, making them crucial in many industries where traditional earnings-based multiples may not be applicable.

Types of Revenue Multiples

The most common revenue multiples are:

- Price-to-Sales (P/S) ratio for equity valuation

- EV/Sales ratio for enterprise value

These ratios tell us how much we're paying for each dollar of revenue a company generates. For instance, if a company has an EV/Sales ratio of 2, it means that for every dollar of sales, the company is valued at $2.

Industry Variations in Revenue Multiples

It's important to note that revenue multiples can vary significantly across industries. For example, software companies often trade at much higher revenue multiples than retail companies due to their higher growth potential and scalability. This is why it's crucial to compare companies within the same industry or sector when using these multiples.

Here's a simplified example of how revenue multiples might vary across industries:

- Software as a Service (SaaS) companies: 5x - 15x revenue

- E-commerce companies: 1x - 3x revenue

- Traditional retail companies: 0.5x - 1.5x revenue

These ranges are illustrative and can vary based on factors such as growth rate, profit margins, and market conditions. Always consider the specific circumstances of the company and industry when interpreting revenue multiples.

Choosing the Right Valuation Multiple

Selecting the appropriate valuation multiple depends on various factors, including the company's industry, growth stage, and financial situation. Here are some guidelines to help you choose the right multiple:

- For mature, stable companies with consistent earnings, consider earnings-based multiples like P/E or EV/EBITDA. These multiples are particularly useful in industries such as utilities, consumer staples, or established manufacturing companies.

- For high-growth companies or those in industries with high profit margins, such as technology or healthcare, revenue-based multiples might be more appropriate. These industries often have companies that are reinvesting heavily in growth, making earnings-based multiples less reliable.

- For companies with significant depreciation or amortization expenses, EV/EBITDA can be more informative than P/E ratios. This is often the case in capital-intensive industries like telecommunications or energy.

- In industries where assets play a crucial role, such as banking or real estate, consider using asset-based multiples like Price-to-Book value.

- For cyclical industries, it might be beneficial to use average earnings over a full business cycle rather than a single year's earnings to smooth out the effects of economic fluctuations.

Always consider the specific characteristics of the company and industry when choosing a multiple. It's often beneficial to use multiple valuation metrics to get a more comprehensive view of a company's value.

Common Valuation Multiple Analysis Pitfalls

While valuation multiples are powerful tools, they can be misused or misinterpreted. Here are some common pitfalls to avoid when conducting industry multiple valuation:

- Comparing apples to oranges: Ensure you're comparing companies within the same industry and with similar growth characteristics. For example, comparing a high-growth tech startup to a mature manufacturing company using the same multiples would likely lead to misleading conclusions.

- Ignoring capital structure: Consider a company's debt and equity structure when calculating valuation multiples. This is why enterprise value multiples are often preferred, as they account for differences in capital structure.

- Relying too heavily on projected earnings: Be cautious about using projected earnings in your calculations. Projections can be overly optimistic or fail to account for potential challenges. It's often more reliable to use actual earnings or a combination of historical and projected earnings.

- Overlooking quality of earnings: Consider whether earnings are sustainable and driven by core operations. One-time gains or accounting adjustments can distort earnings-based multiples. Always review the company's financial statements carefully to understand the source and quality of earnings.

- Failing to consider growth rates: Always consider a company's growth rate in context with its valuation multiples. A company with a high P/E ratio might actually be undervalued if it has exceptional growth prospects, while a low P/E ratio might be justified for a company with stagnant or declining earnings.

- Neglecting industry-specific factors: Different industries may have unique characteristics that affect how companies should be valued. For example, the importance of R&D spending in pharmaceuticals or the impact of regulatory changes in financial services can significantly influence appropriate valuation multiples.

- Overreliance on a single multiple: Using only one valuation multiple can provide a misleading picture. It's best to use a combination of multiples to get a more comprehensive view of a company's value.

- Ignoring the business cycle: Valuation multiples can vary significantly depending on where we are in the business cycle. During economic booms, multiples tend to expand, while they often contract during downturns. Consider this context when interpreting valuation multiples, especially for cyclical industries.

Practical Applications of Valuation Multiples

Valuation multiples have numerous practical applications in the real world of finance and investment. Here are some key areas where they prove invaluable:

Company Valuation

The most straightforward application of valuation multiples is in company valuation. They help determine whether a company is overvalued or undervalued relative to its peers and historical averages. For example, if the average EV/EBITDA multiple for the software industry is 15x, and a particular software company is trading at 10x, it might indicate that the company is undervalued (assuming all other factors are equal).

Mergers and Acquisitions Analysis

Valuation multiples play a crucial role in M&A analysis, providing a quick sense of whether a proposed deal price is reasonable compared to recent transactions in the sector. For instance, if recent acquisitions in the industry have occurred at EV/Sales multiples of 3-4x, and a proposed deal is at 6x sales, it might suggest that the acquirer is paying a premium. This could be justified by synergies or strategic value, but it warrants closer examination.

Identifying Investment Opportunities

Multiples can be excellent screening tools for identifying potential investment opportunities, serving as a starting point in the investment research process. An investor might screen for companies trading at below-average P/E ratios in their industry, then conduct further research to understand why these companies are valued lower and whether this represents a buying opportunity.

Monitoring Financial Performance

By tracking how a company's multiples evolve over time, investors can gain insights into how the market's perception of the company is changing. For example, if a company's P/E ratio is expanding while its growth rate remains constant, it might indicate that the stock is becoming overvalued.

Benchmarking

Valuation multiples provide a useful benchmark for comparing a company's performance and valuation against its peers, helping to understand a company's competitive position within its industry. This can be particularly useful for company management in setting performance targets or for investors in assessing management effectiveness.

Scenario Analysis

Multiples can be used in scenario analysis to estimate potential returns or losses under different circumstances, helping investors understand the potential upside and downside of an investment. For instance, an analyst might model how a company's EV/EBITDA multiple could expand during an economic upswing and contract during a downturn to create a range of potential future valuations.

Best Practices for Using Valuation Multiples

To get the most out of valuation multiples while avoiding common pitfalls, follow these best practices:

- Use a range of multiples for a comprehensive view: Don't rely on a single multiple. Different multiples can provide different insights, and using a range of them gives a more comprehensive view of a company's valuation.

- Compare like with like: When using comparable company analysis, be careful to select companies that are truly comparable. Consider factors like size, growth rate, business model, and geographic focus.

- Consider the business cycle: Valuation multiples can vary significantly depending on where we are in the business cycle. For cyclical industries, it can be useful to look at multiples over a full business cycle.

- Adjust for non-recurring items: When calculating valuation multiples, make sure to adjust for non-recurring items that might distort the picture. This could include one-time gains or losses, restructuring costs, or other unusual events.

- Consider qualitative factors: While valuation multiples are powerful quantitative tools, don't forget to consider qualitative factors as well. Things like management quality, brand strength, competitive position, and growth prospects can all influence a company's appropriate valuation multiple.

- Use forward-looking metrics cautiously: While it can be tempting to rely on forward-looking metrics, use these cautiously. Analyst projections can be overly optimistic or fail to account for potential challenges.

- Incorporate industry-specific metrics: Different industries often have specific metrics that are particularly relevant. For example, in the retail industry, metrics like sales per square foot are important. For software companies, annual recurring revenue (ARR) is a key metric.

- Understand the limitations: Remember that valuation multiples, while useful, have their limitations. They're a starting point for analysis, not the end point. Always combine multiple analysis with thorough fundamental research.

Conclusion

Industry multiple valuation and enterprise value calculations are powerful tools in the investment arsenal. They provide a framework for assessing company worth, comparing businesses across an industry, and making informed investment decisions. By mastering these concepts and applying them thoughtfully, investors can enhance their ability to identify promising opportunities and avoid potential pitfalls.

Remember, valuation is as much an art as it is a science. While multiples and calculations provide valuable quantitative insights, they should always be balanced with qualitative factors and a deep understanding of the business and industry dynamics. Continue to practice applying these concepts, stay curious, and keep learning to navigate the complexities of the financial markets with greater confidence.

As you continue your investment journey, remember that the world of finance is constantly evolving. New industries emerge, business models change, and economic conditions shift. Stay adaptable in your approach to valuation, always considering the unique aspects of each company and industry you analyze. By combining a solid understanding of valuation multiples with continuous learning and adaptability, you'll be well-equipped to make sound investment decisions in any market condition.

FAQ

How do you calculate industry multiples?

To calculate industry multiples, follow these steps:

- Identify a group of comparable public companies in the same industry.

- Gather financial data for these companies, including metrics like revenue, EBITDA, and net income.

- Calculate the relevant multiples (e.g., EV/EBITDA, P/E) for each company.

- Take the average or median of these multiples to get the industry multiple.

What is the industry multiplier for business valuation?

The industry multiplier varies depending on the specific industry and the metric being used. Common industry multipliers include:

- EV/EBITDA: Typically ranges from 4x to 15x, depending on the industry.

- P/E Ratio: Can range from 10x to 30x or more, depending on growth prospects and industry.

- EV/Revenue: Can vary widely, from less than 1x for low-margin industries to 10x or more for high-growth tech companies.

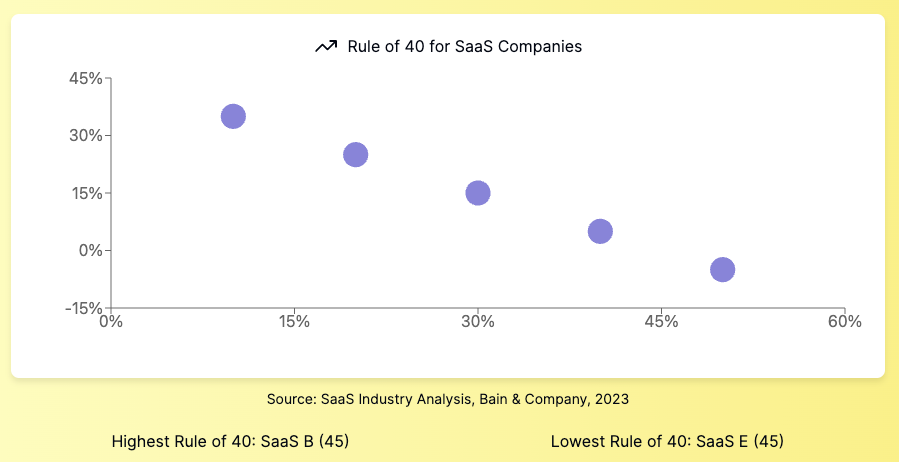

What is the rule of 40 valuation multiple?

The Rule of 40 is a principle used primarily in the software as a service (SaaS) industry. It states that a healthy software company's combined growth rate and profit margin should exceed 40%. While not a traditional valuation multiple, it's often used alongside multiples to assess SaaS companies. Companies achieving the Rule of 40 often command higher valuation multiples.

What is the average multiple for a business valuation?

The average multiple for business valuation varies significantly based on the industry, company size, growth rate, and economic conditions. However, here are some general guidelines:

- Small businesses: Often valued at 2-3x EBITDA

- Mid-size companies: Typically 4-8x EBITDA

- Large corporations: Can range from 8-15x EBITDA or higher

Remember, these are broad generalizations, and actual multiples can vary widely based on specific company and industry factors. Always conduct thorough research and analysis when valuing a business.