Intel Corporation (NASDAQ: INTC), a leading player in the semiconductor industry, recently released its second-quarter 2024 earnings report. This comprehensive review delves into Intel's financial performance, key business segments, and strategic initiatives, providing investors and tech enthusiasts with a detailed analysis of the company's position in the evolving semiconductor landscape.

Intel Corporation: Company Overview

Intel Corporation, headquartered in Santa Clara, CA, is a global technology company that designs and manufactures computer products and technologies. The firm operates across several segments, delivering computer, networking, data storage, and communications platforms designed for the cloud, enterprise, and PC markets.

Q2 2024 Financial Results: A Closer Look

Intel's second-quarter 2024 financial results reveal a company facing significant challenges. CEO Pat Gelsinger acknowledged the disappointing performance, stating, "Q2 profitability was disappointing despite continued progress on product and process road maps."

| Metric | Q2 2024 Result | Year-over-Year Change |

|---|---|---|

| Revenue | $12.83 billion | -0.9% decrease |

| Net Income | $(1.61 billion) | vs. $1.48 billion profit in Q2 2023 |

| Adjusted EPS | $0.02 | vs. $0.10 expected |

| GAAP EPS | $(0.38) | vs. $0.35 in Q2 2023 |

He further explained the company's response:

"With our new operating model firmly in place, we are accelerating actions to improve profitability and capital efficiency by more than $10 billion in 2025, which I will discuss shortly."

CFO David Zinsner provided additional context on the factors impacting profitability:

"Weaker-than-expected gross margin was due to 3 main drivers. The largest impact was caused by an accelerated ramp of our AIPC product. In addition to exceeding expectations on Q2 Core Ultra shipments, we made the decision to accelerate transition of Intel 4 and 3 wafers from our development fab in Oregon to our high-volume facility in Ireland, where wafer costs are higher in the near term."

The company's performance fell short of analysts' expectations, with revenue declining by 0.9% year-over-year. The significant net income loss of $1.61 billion stands in stark contrast to the $1.48 billion profit recorded in the same period last year.

Dividend and Stock Performance

- Current dividend yield: 1.7%

- Intel expects to suspend dividend payments starting in Q4 2024

- INTC shares traded at $29.05 as of the earnings release date

Segment Performance Analysis

Intel's business is structured into the following segments:

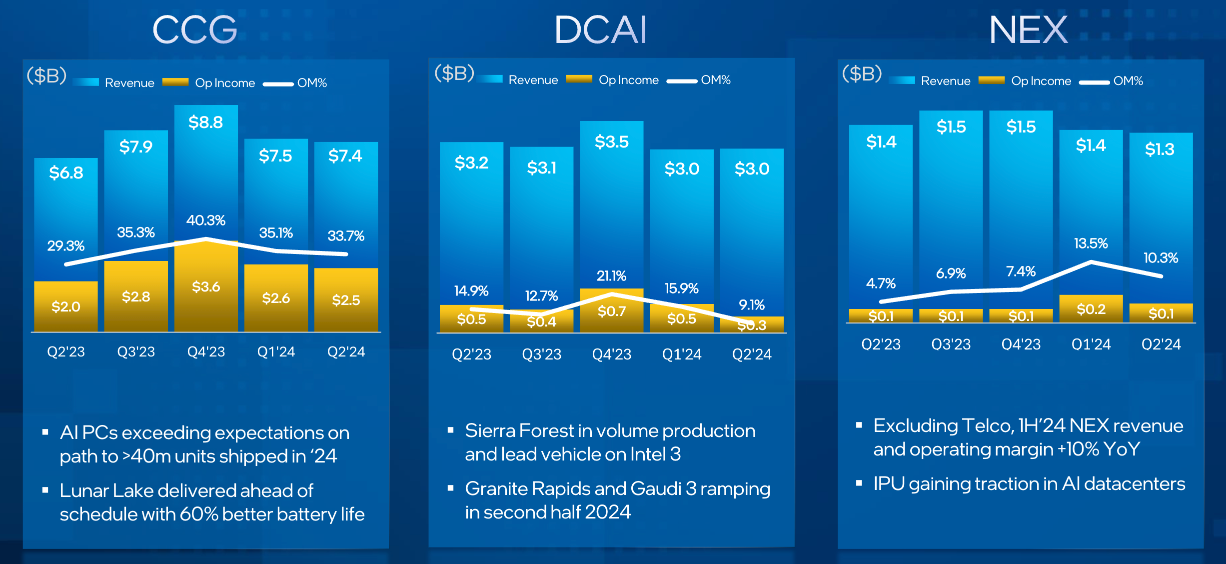

Client Computing Group (CCG)

- Revenue: $7.41 billion

- Year-over-Year Change: +9%

- The CCG segment consists of platforms designed for end-user form factors, focusing on higher growth segments of 2-in-1, thin-and-light, commercial and gaming, and growing adjacent products such as modems, Bluetooth, and WiFi.

Data Center and AI Group (DCAI)

- Revenue: $3.05 billion

- Year-over-Year Change: -3%

- The DCAI segment offers platforms designed for data center, enterprise, network, embedded, cloud, and communications market segments.

Network and Edge Group (NEX)

- Revenue: $1.3 billion

- Year-over-Year Change: -1%

- NEX focuses on networking, edge computing, and wired connectivity products.

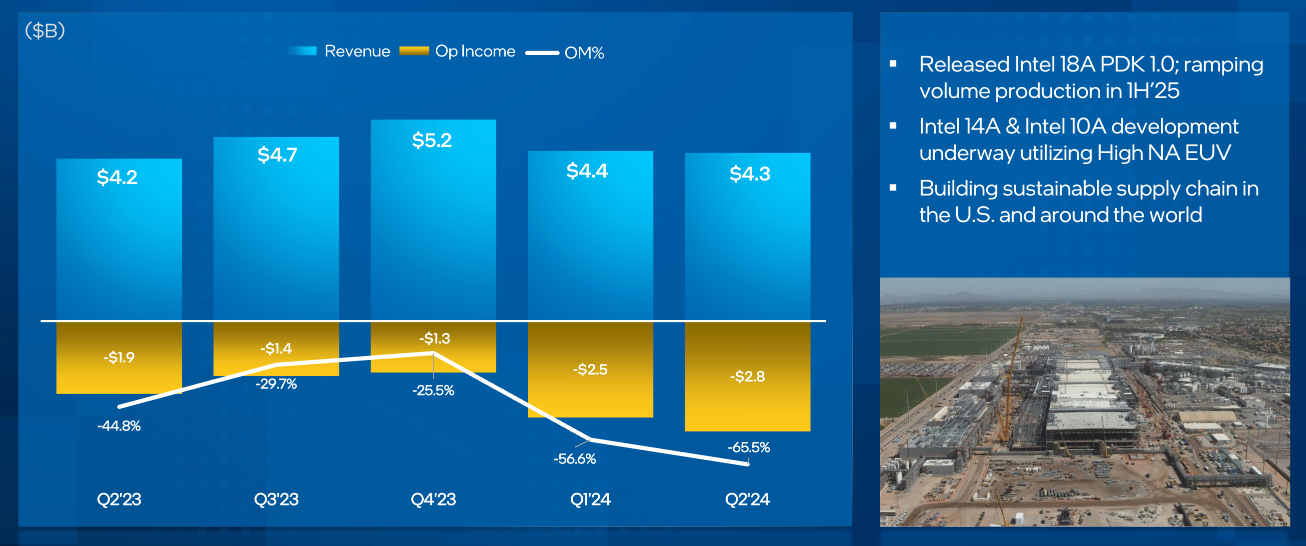

Intel Foundry Services (IFS)

- Result: Loss of $2.8 billion

- Intel Foundry Services provides manufacturing, design, and packaging services.

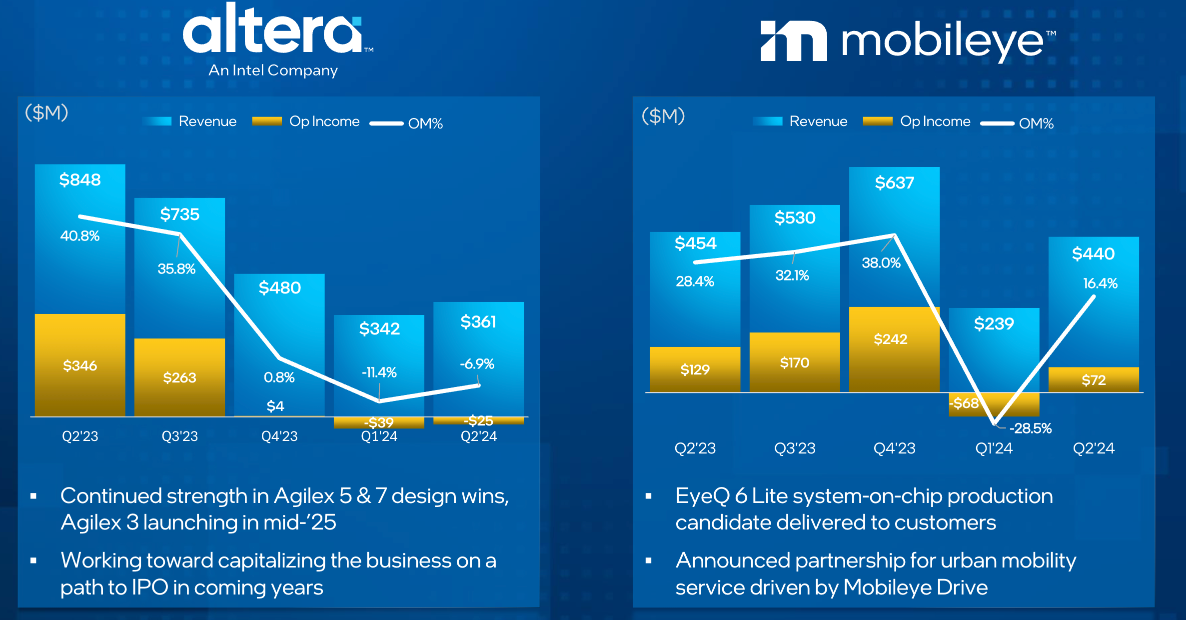

Mobileye and Other Segments

- Revenue: $968 million

- Year-over-Year Change: -32%

- Includes results from Mobileye, non-volatile memory solutions, and other corporate-related charges.

Strategic Initiatives and Cost-Cutting Measures

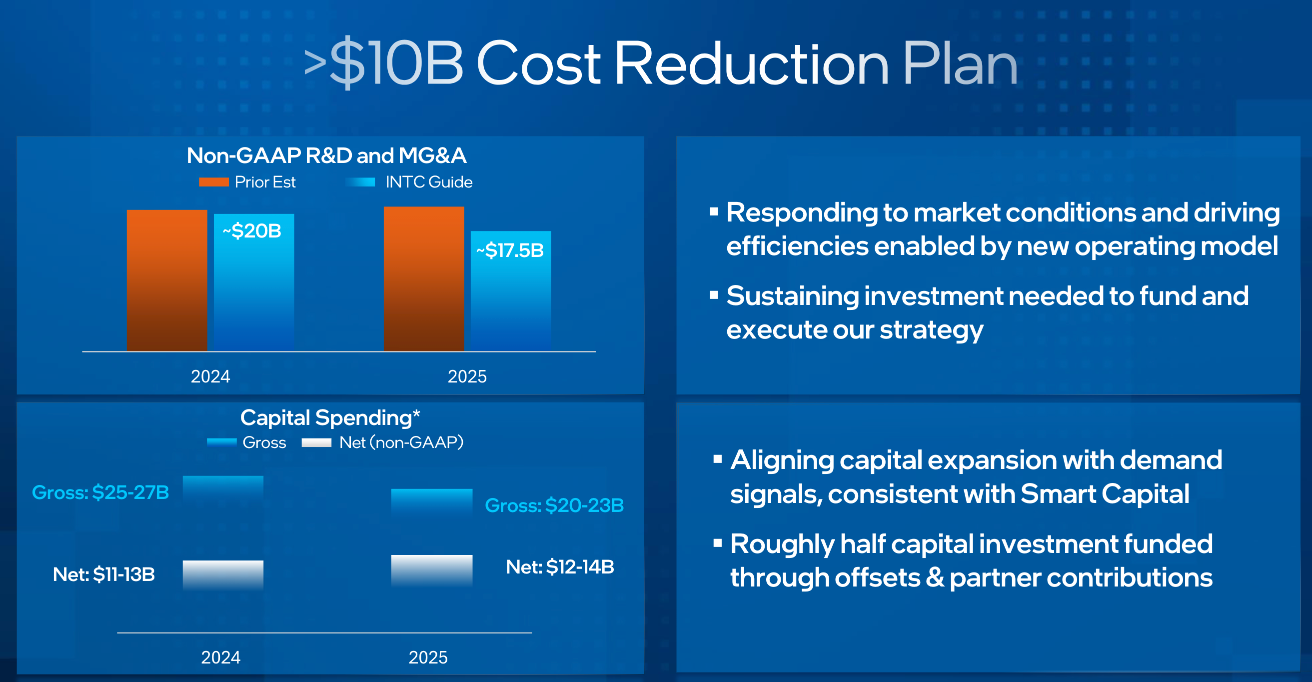

In response to the challenging financial results, Intel announced a comprehensive $10 billion cost reduction plan. Pat Gelsinger outlined the key components of this plan:

- Workforce Reduction: "We are targeting a head count reduction of greater than 15% by the end of 2025 with the majority of this action completed by the end of this year. We do not take this lightly and we have carefully considered the impact this will have on the Intel family. These are hard but necessary decisions."

- Operational Efficiency: "Our actions will reduce OpEx to approximately $20 billion in 2024 and we see a bigger impact next year with 2025 OpEx target at $17.5 billion, more than 20% below prior estimates. We expect further benefits in 2026 with OpEx to decline in absolute dollars yet again."

- Capital Expenditure Reduction: "We now expect gross CapEx in 2024 to be between $25 billion and $27 billion. That is a reduction of over 20% from our plan entering the year and additionally reflects expectations for softer second half demand."

- Dividend Suspension: "We are taking the avid step of suspending the dividend at the beginning of the fourth quarter, recognizing the importance of prioritizing liquidity to support the investments needed to execute our strategy."

Technological Advancements and Future Outlook

Despite financial challenges, Intel remains committed to its long-term strategy. Pat Gelsinger highlighted several key technological milestones and future initiatives:

- Process Node Advancements: "We are well into the ramp of Intel 4, Intel 3 and Intel 28A is being ready for production next quarter. And Intel 18A, we released the 1.0 PDK last month and are on track to be manufacturing-ready by the end of this year with production wafer start volumes in the first half of '25."

- AI PC Market: "The AIPC category is transforming every aspect of the compute experience and Intel is at the forefront of this category creating moment. Intel Core Ultra volume more than doubled sequentially in Q2 and is already powering AI capabilities across more than 300 applications and 500 AI models."

- Data Center Strategy: "We have a strong foundation on which to build, including the more than 130 million Xeon's powering data centers around the world today. And our road map is designed to build upon this fast installed base to deliver greater performance and efficiency, enable AI solutions that are open, flexible and scalable and reduce total cost of ownership for customers."

Moore's Law and Manufacturing Innovation

Intel continues to push the boundaries of semiconductor manufacturing, adhering to the principles of Moore's Law. The company's focus on advanced process nodes aims to maintain its competitive edge in the industry.

Competitive Landscape and Market Challenges

Intel faces several significant challenges in the current semiconductor market:

- Market Share Pressure: Potential loss of share in Server CPUs to competitors like AMD.

- AI Compute Competition: Intense rivalry with NVIDIA and AMD in high-performance and AI compute spaces.

- Gross Margin Compression: Q2 2024 non-GAAP gross margin of 38.7%, below company guidance.

- Global Economic Factors: Weakening consumer and commercial spending, particularly in China.

Investment Considerations and Future Prospects

For investors considering INTC stock, the Q2 2024 earnings report presents a mixed picture:

- Short-term Challenges: Cost-cutting measures and dividend suspension may impact short-term returns.

- Long-term Potential: Focus on AI PCs, process node advancements, and Foundry business development could drive future growth.

- Execution Risk: Success depends on Intel's ability to navigate a highly competitive semiconductor market.

- Market Reaction: Analysts remain cautious about Intel's recovery prospects in the near term.

Conclusion: Navigating the Future of Computing

Intel's Q2 2024 earnings review reveals a company at a critical juncture, facing significant challenges but also pursuing ambitious strategies for future growth. Pat Gelsinger summarized the company's position and outlook:

"We remain confident that we have and will continue to make the investments needed to drive long-term shareholder value and we view cost discipline as the compass that drives effective execution, helping teams stay on track to both prioritize and achieve measurable results. The operational and capital improvements we are driving will be especially important as we manage the business through the near term."

As Intel continues to invest in AI capabilities, advanced process nodes, and Foundry services, it aims to regain its competitive edge in the semiconductor industry. The coming quarters will be crucial in determining whether Intel can successfully execute its plans and emerge as a stronger player in the evolving tech landscape.

FAQs

What were Intel's key financial results for Q2 2024? Intel reported revenue of $12.83 billion, a 0.9% year-over-year decrease, and a net income loss of $1.61 billion.

How is Intel addressing its financial challenges? Intel announced a $10 billion cost reduction plan, including workforce reduction, dividend suspension, and capital expenditure cuts.

What is Intel's strategy for AI and data center markets? Intel is focusing on AI PC development and anticipates data center revenue growth in the latter half of the fiscal year.

How is Intel progressing with its process node advancements? Intel reports that its "5 nodes in 4 years" initiative is nearing completion, with several advanced nodes in or approaching production.

What are the main challenges Intel faces in the current semiconductor market? Key challenges include market share pressure, intense competition in AI compute, gross margin compression, and global economic headwinds.