Intuit's recent Investor Day showcased the company's remarkable journey from a tax and accounting software provider to an AI-driven platform powerhouse. The event highlighted Intuit's strategic evolution and its positioning for future growth across multiple segments.

Sasan Goodarzi, Intuit's CEO, set the stage by emphasizing the company's transformation:

We're going to talk about the next 5 years, which is how we will win as a platform company and really deliver undisputed benefits for our customers and accelerate the company's growth.

This statement encapsulates Intuit's ambitious vision and its commitment to leveraging its platform capabilities to drive long-term success.

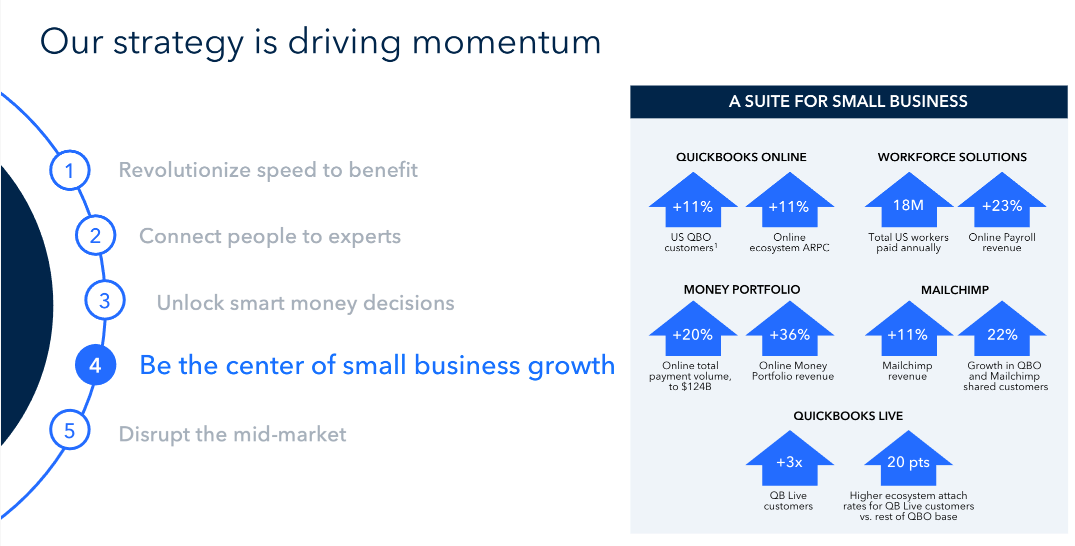

The Five Big Bets

Intuit's strategy revolves around five "big bets" that form the foundation of its growth plans:

- Revolutionizing Speed to Benefit

- Connecting People to Experts

- Unlocking Smart Money Decisions

- Becoming the Center of Small Business Growth

- Disrupting the Mid-Market

Let's explore each of these bets and their implications for Intuit's future.

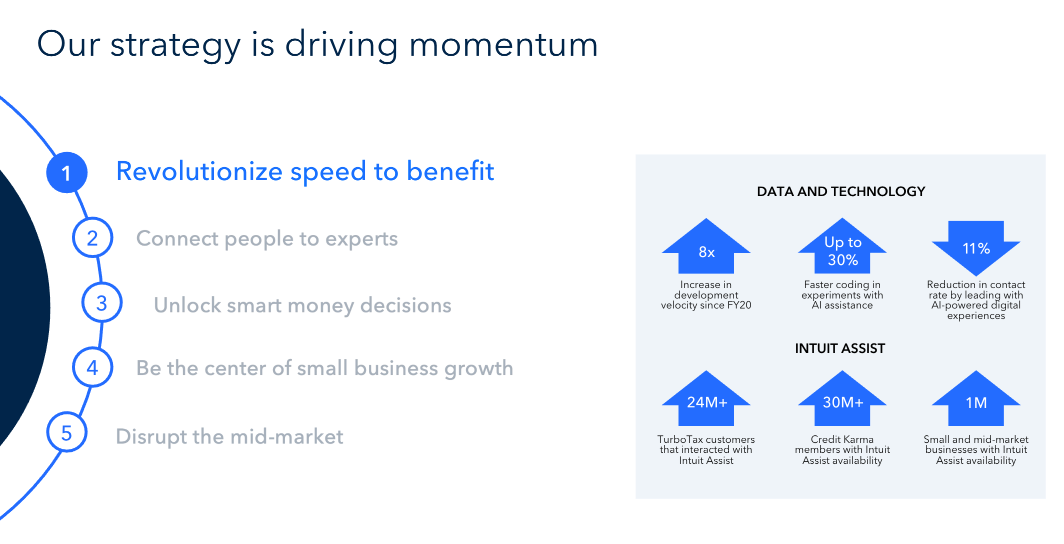

1. Revolutionizing Speed to Benefit

At the core of Intuit's transformation is its focus on leveraging AI to create "done for you" experiences. Goodarzi explained:

This bet has been about creating done for you experiences. And it's a significant shift from building workflows where customers do the work to delivering experiences where we do the work for our customers with them always in control.

This shift represents a fundamental change in how Intuit approaches product development. By automating complex tasks and leveraging AI to streamline processes, Intuit aims to deliver more value to its customers while reducing friction.

The company has made significant strides in this area, with Goodarzi noting:

Developer velocity deploying code is 8x faster today than it was several years ago. The second is our developers now are having access to AI assistance to do the work. And for those that have access to AI assistance, they're 30% more productive.

These improvements in internal efficiency translate directly to faster innovation and better experiences for Intuit's customers.

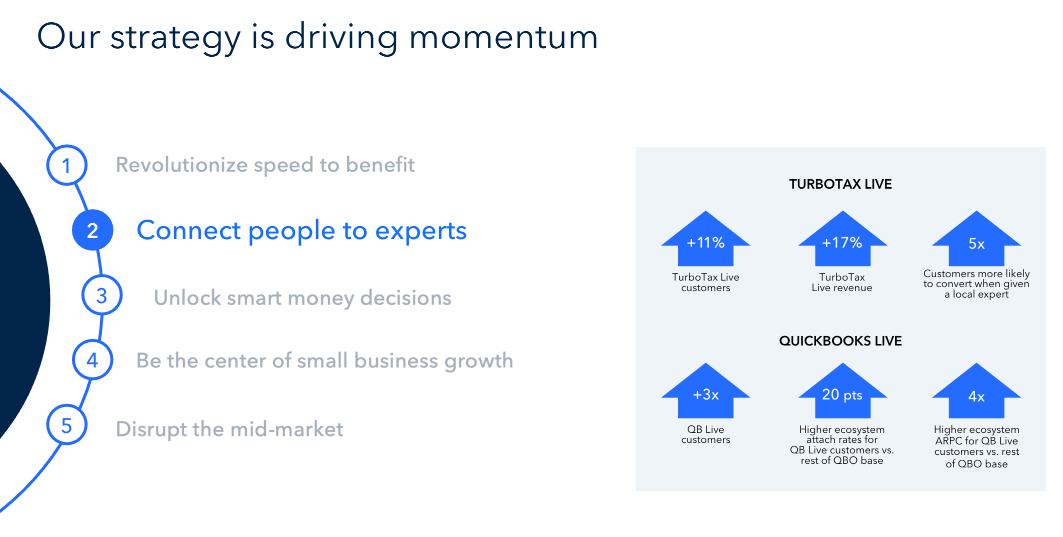

2. Connecting People to Experts

Intuit recognizes that while AI can handle many tasks, there's still a need for human expertise in complex scenarios. The company's second bet focuses on seamlessly connecting customers with experts when needed.

Goodarzi highlighted the success of this approach:

TurboTax Live grew 11% this year. Revenue grew 17%, and we've seen incredible green shoots at scale of things like when we show up in local search, there's 11 million folks that churn every year in the assisted segment. And one of the places they go is they search for a [pro near me]. When we show up, our conversion has been 5x better than when we don't show up.

This strategy not only improves customer satisfaction but also opens up new revenue streams for Intuit. By bridging the gap between DIY software and full-service professional assistance, Intuit is tapping into a massive market opportunity.

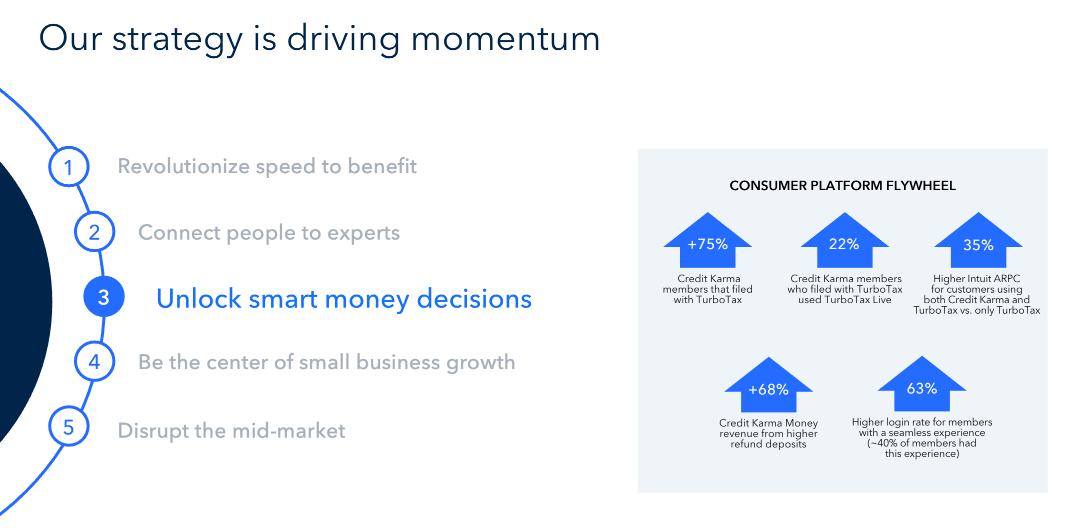

3. Unlocking Smart Money Decisions

Intuit's acquisition of Credit Karma plays a crucial role in its third big bet. By combining Credit Karma's personal finance platform with TurboTax, Intuit aims to create a comprehensive financial ecosystem for consumers.

Goodarzi shared some impressive metrics:

We're seeing the growth of the number of filers through Credit Karma up over 75%. For the combined ARPC and Credit Karma and TurboTax customers versus TurboTax only, it's up 35%.

This integration allows Intuit to engage with customers year-round, not just during tax season. It also provides opportunities for cross-selling and upselling services across the platform.

4. Becoming the Center of Small Business Growth

Intuit's QuickBooks ecosystem forms the foundation of its fourth bet. By integrating various services like payments, payroll, and marketing automation (through Mailchimp), Intuit aims to become an indispensable platform for small businesses.

Goodarzi outlined the success of this strategy:

U.S. QBO grew over 11% and our ARPC overall grew 11%. Workforce Solutions grew over 23%. Our overall money portfolio grew at 36%. You can see a huge indication of the integration of Mailchimp and QuickBooks, where our combined customers grew 22%.

These numbers demonstrate the power of Intuit's platform approach, as businesses adopt multiple services and increase their overall spend with the company.

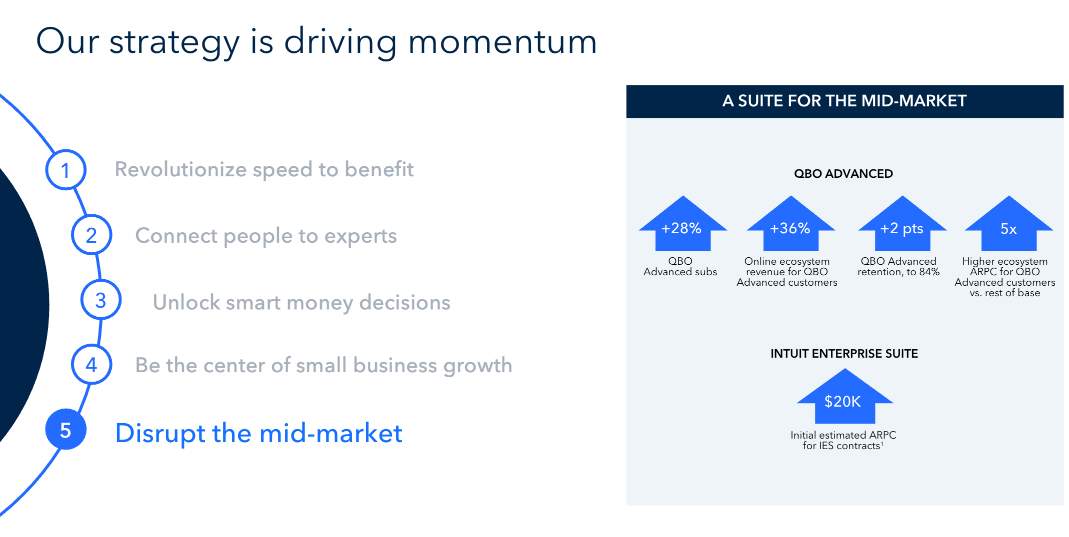

5. Disrupting the Mid-Market

Perhaps the most ambitious of Intuit's bets is its push into the mid-market segment. With the launch of Intuit Enterprise Suite (IES), the company is targeting larger businesses with more complex needs.

Laurent Sellier, SVP of Product for mid-market, explained the opportunity:

We've sold many their needs with QuickBooks Online Advanced, our offering from mid-market businesses. We've continued to expand the offering by adding Bill Pay, expanding beyond payroll into human capital management and improving features like advanced role-based permissions. In fiscal year '24, QuickBooks Advanced subscribers grew 28% and penetration of services such as payroll and payments is 12 and 9 points higher, respectively, than for our core QBO customers.

This expansion into the mid-market represents a significant growth opportunity for Intuit, with a potential to dramatically increase average revenue per customer (ARPC).

The Power of AI and Platform Integration

A key theme throughout the Investor Day was Intuit's focus on leveraging AI and integrating its various platforms to create a seamless experience for customers.

Alex Balazs, Intuit's CTO, emphasized the company's AI investments:

We've invested in AI capabilities for several years, and we're operating at an enormous, enormous scale. You can see some of the numbers here. We're going to continue to invest in data and AI. It's a big part of what we do and it's continuing to deliver amazing clean data.

This focus on AI is driving improvements across all of Intuit's products and services. For example, in the tax preparation process, AI is being used to automate data entry and provide personalized guidance to users.

The integration of Intuit's various platforms is also yielding impressive results. Mark Notarainni, EVP & GM of Consumer Group, shared:

When we embed our experiences and we take a customer-backed view, we're actually able to increase Credit Karma members filing with TurboTax by 75% this year. And in fact, those customers, those combined TurboTax and Credit Karma customers are 35% higher ARPC for the overall franchise.

This integration not only improves the customer experience but also drives higher revenue per customer, a key metric for Intuit's growth.

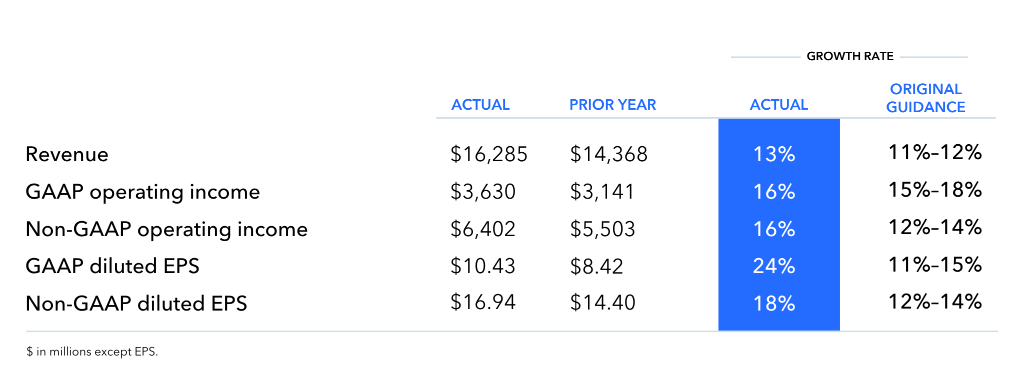

Financial Performance and Outlook

Sandeep Aujla, Intuit's CFO, provided an overview of the company's financial performance and future outlook. Some key highlights include:

- Total revenue growth of 13% in fiscal year 2024

- Platform revenue growth of 14%

- Operating income growth of 16%, outpacing revenue growth

Looking ahead, Aujla shared the company's long-term expectations:

15% to 20% growth in the Global Business Solutions Group, with 5% to 10% growth in customers and 10% to 20% growth in ARPC, as we drive platform adoption and disrupt the mid-market, 6% to 10% growth in the Consumer Group, as we disrupt the Assisted Tax category and have TurboTax Live revenues grow 15% to 20% and 10% to 15% growth in Credit Karma as we continue to scale our core verticals, grow in new verticals, disrupt the Prime segment and deliver a better together experience across the consumer platform.

These ambitious growth targets reflect Intuit's confidence in its strategy and the market opportunities ahead.

Challenges and Competition

While Intuit's presentation painted a rosy picture of its future, it's important to consider the challenges and competitive landscape the company faces.

In the small business segment, Intuit faces competition from both established players like Xero and emerging fintech companies offering specialized services. The company's success will depend on its ability to continue innovating and providing a compelling value proposition to small businesses.

In the consumer tax space, Intuit must navigate changing regulations and potential threats from government-provided free filing options. The company's push into the assisted tax preparation market with TurboTax Live is a strategic move to address these challenges, but it will need to execute flawlessly to succeed.

The mid-market expansion with Intuit Enterprise Suite represents a significant opportunity, but also puts Intuit in competition with more established enterprise software providers. The company will need to leverage its strengths in user experience and AI to differentiate itself in this crowded market.

Conclusion

Intuit's Investor Day 2024 presented a compelling vision of the company's future as an AI-driven platform powering both consumer and business financial ecosystems. The five big bets outlined by management provide a clear roadmap for growth, leveraging Intuit's strengths in AI, data, and user experience.

The integration of Credit Karma and Mailchimp into Intuit's ecosystem is already showing promising results, and the push into the mid-market with Intuit Enterprise Suite opens up new avenues for growth. However, the company will need to navigate a competitive landscape and continue innovating to achieve its ambitious growth targets.

As Sasan Goodarzi concluded:

We wake up every day to find ways to power prosperity for our customers. And it's for the [Jareds], it's for the [Samanthas], it's for the [Marcellas] that you saw. Those are real customers, real challenges, real areas where they need help. And I'm super proud of the big shift that we've made to become a platform company.

Intuit's transformation from a tax and accounting software provider to an AI-driven platform company is well underway. The coming years will reveal whether this ambitious strategy can deliver the growth and customer value that Intuit envisions.