Intuit Q4 2024 Financial Performance: A Mixed Bag of Results

Intuit Inc. (NASDAQ: INTU) has reported its fourth quarter results for fiscal year 2024, presenting a nuanced picture for consideration. While the headline numbers show growth, a closer examination reveals both strengths and potential concerns.

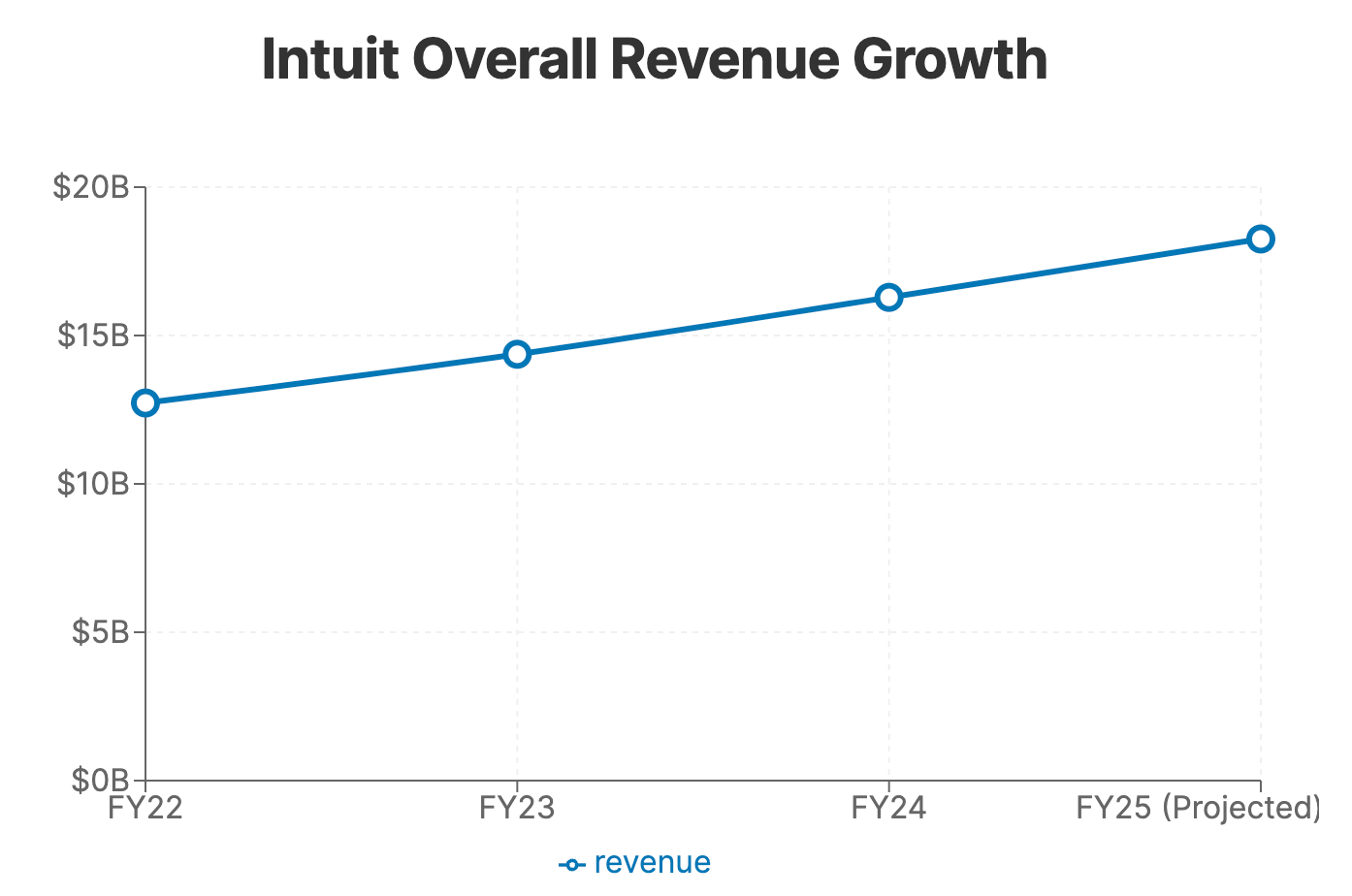

The company's total revenue for Q4 reached $3.2 billion, marking a 17% year-over-year increase. On the surface, this appears impressive. However, it's crucial to contextualize this growth within the broader economic environment and Intuit's historical performance.

When compared to the previous quarter's growth rate of 12%, the 17% increase in Q4 does indicate an acceleration. This could be interpreted as a positive sign of momentum building towards the end of the fiscal year. However, we should be cautious about extrapolating this trend, as seasonal factors often influence Intuit's quarterly performance, particularly in the tax-heavy fourth quarter.

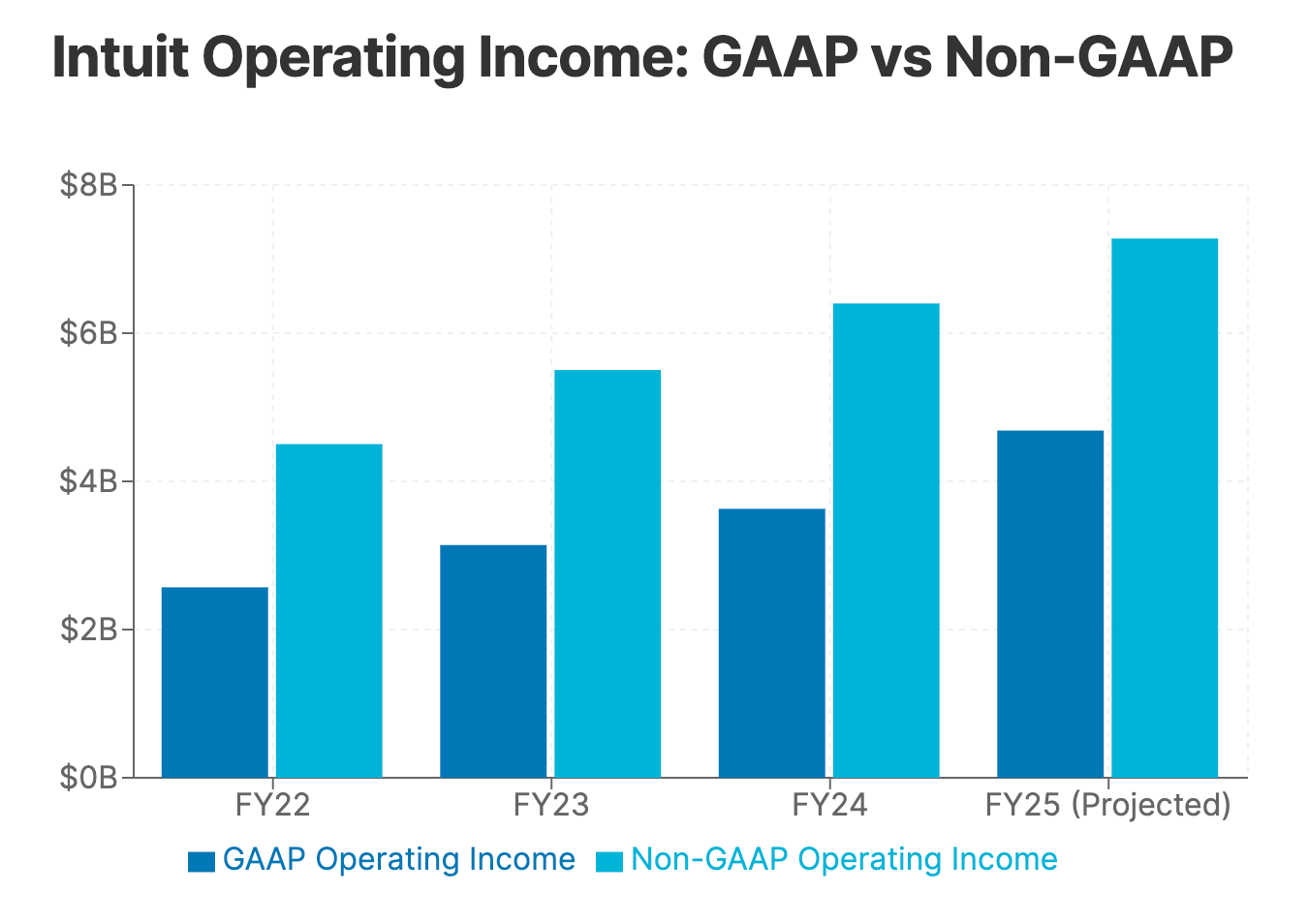

The GAAP operating income for Q4 was $749 million, compared to $433 million in the same quarter last year. This substantial increase in profitability is certainly a positive sign, but it's important to note that it includes a $223 million restructuring charge related to the company's July reorganization. Adjusting for this one-time charge, the operational improvement becomes even more significant.

The company's CEO, Sasan Goodarzi, emphasized the strength of their performance, stating:

"We delivered very strong results for the fourth quarter and full year and made meaningful progress with our AI-driven expert platform strategy and big bets that position the company for durable growth in the future. Our full year revenue grew 13%, and we delivered strong operating margin expansion, demonstrating the strength and momentum of our investments and innovation."

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

Small Business and Self-Employed Group Revenue Growth: A Bright Spot with Caveats

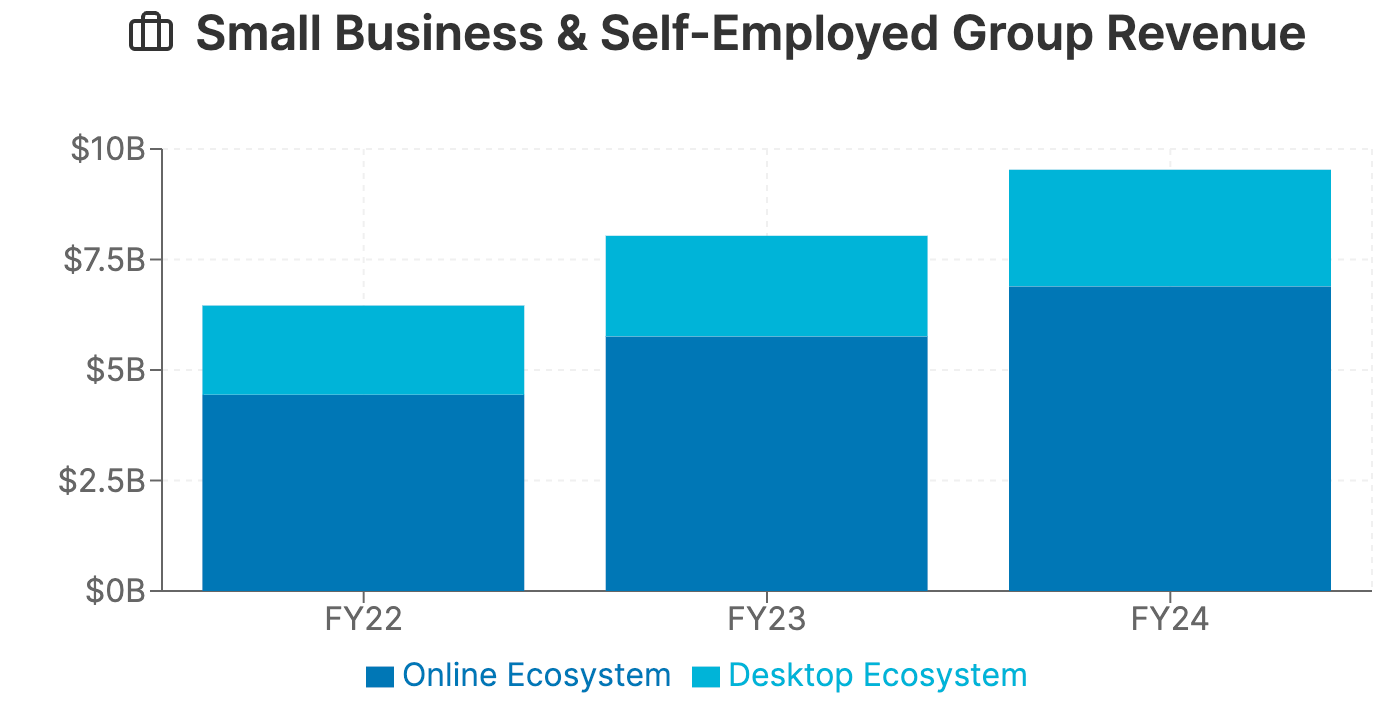

The Small Business and Self-Employed Group emerged as the star performer in Intuit's Q4 results, with revenue surging by 20% to $2.6 billion. This segment's performance is crucial for Intuit's long-term growth prospects, as it represents a significant portion of the company's total revenue.

Within this group, the Online Ecosystem revenue grew by 18%, which is particularly noteworthy. This growth suggests that Intuit's digital transformation efforts and focus on cloud-based solutions are gaining traction. The continued shift towards online services could lead to higher customer lifetime values and improved margins over time.

CFO Sandeep Aujla provided further context for this impressive growth:

"Online ecosystem revenue grew 18% during the quarter and 20% for the full year, driven by a progress serving customers with more complex needs and adoption of our ecosystem of services. As a result, online ecosystem ARPC grew 11% in fiscal 2024." This growth underscores the success of Intuit's strategy to focus on higher-value customers and expand its service offerings.

However, we're always aware, monitoring a few risks:

- Market saturation: As Intuit captures more of the small business market, maintaining high growth rates may become increasingly challenging.

- Economic sensitivity: Small businesses are often the first to feel the impact of economic downturns. Any macroeconomic headwinds could disproportionately affect this segment.

- Competition: The small business financial software market is becoming increasingly crowded, with both established players and startups vying for market share.

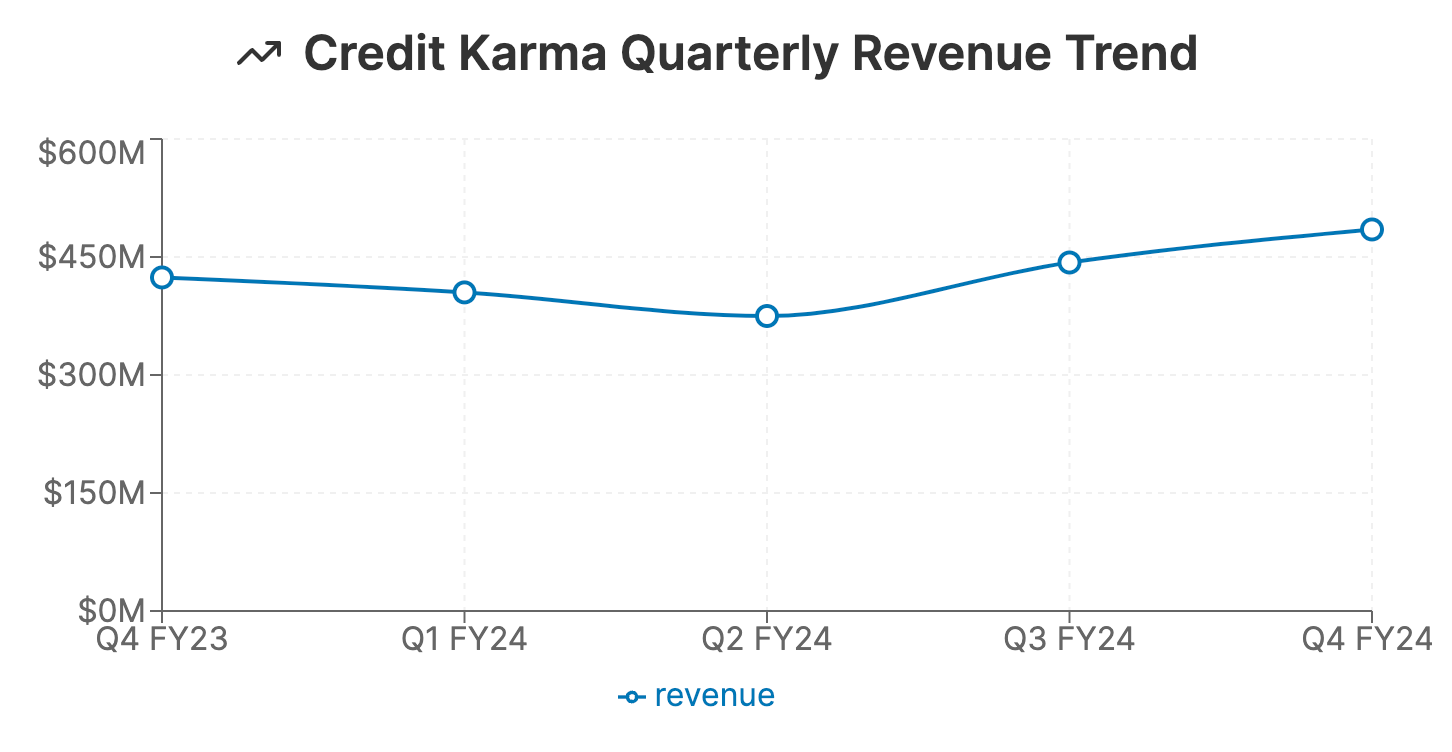

Credit Karma Revenue Trends: Recovery or Temporary Reprieve?

Credit Karma's performance in Q4 showed signs of improvement, with revenue growth of 14% to $485 million. This rebound is encouraging, especially considering the challenges faced by the personal finance sector in recent quarters.

Aujla elaborated on the drivers behind Credit Karma's growth:

"On a product basis in Q4, auto insurance accounted for 6 points of growth, personal loans accounted for 5 points, credit cards accounted for 2 points and Credit Karma money accounted for 1 point."

This diverse growth across multiple product lines demonstrates Credit Karma's resilience and potential for continued expansion.

However, we approach this recovery with not much optimism:

- Comparison base: The 14% growth is coming off a relatively weak performance in the previous year. It's important to analyze longer-term trends to gauge the true health of the Credit Karma business.

- Macroeconomic factors: Credit Karma's performance is closely tied to consumer credit markets. Any tightening in credit conditions could impact future growth, as we've seen in the past.

- Integration progress: The success of Credit Karma within Intuit depends on effective integration and cross-selling opportunities. We should look for concrete evidence of synergies being realized.

Intuit Fiscal Year 2025 Revenue Projections: Ambitious Goals Amidst Uncertainty

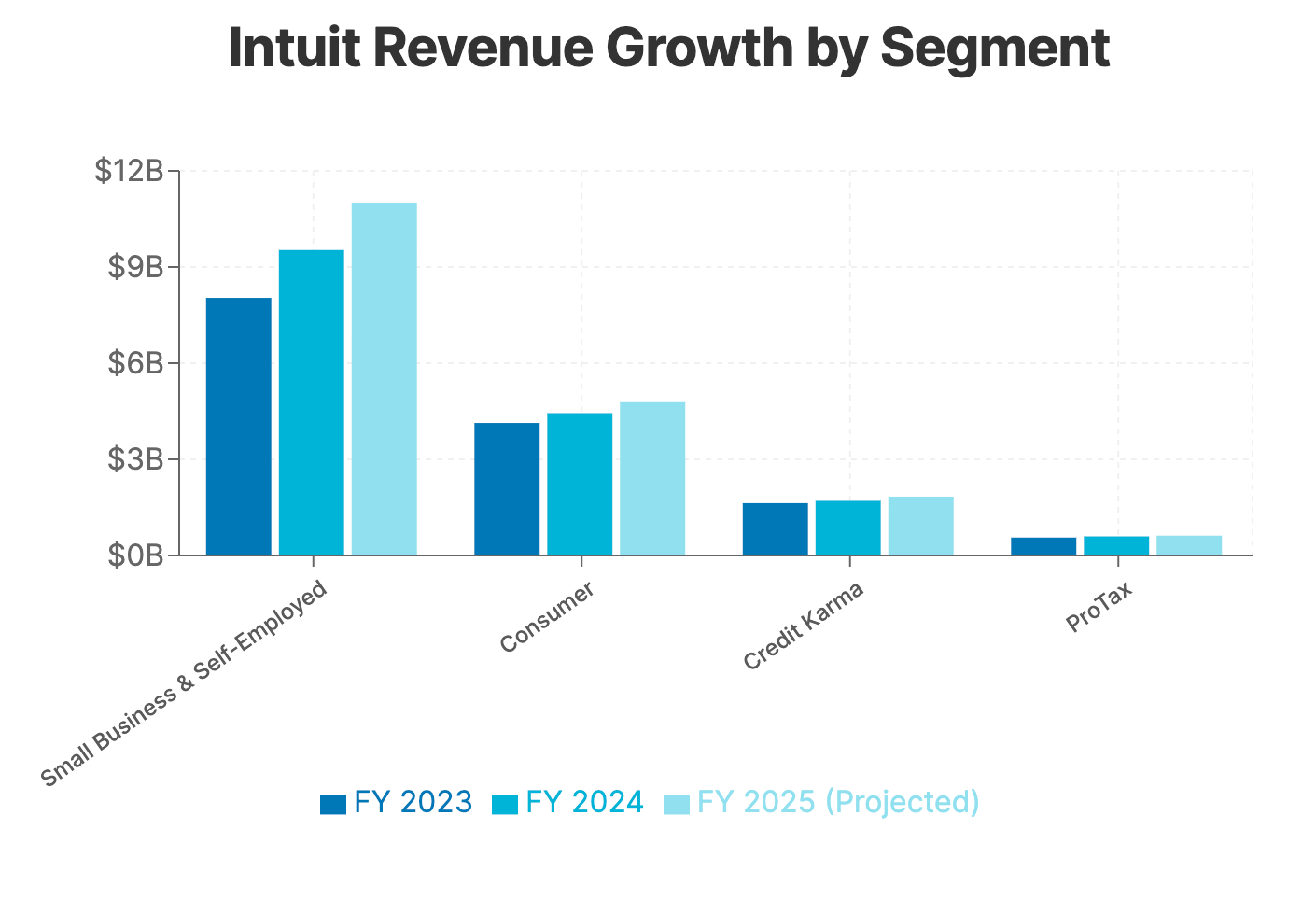

Intuit's outlook for fiscal year 2025 projects total revenue between $18.160 billion and $18.347 billion, representing a growth rate of 12% to 13%. While this forecast demonstrates confidence from management, we should critically evaluate the assumptions underlying these projections.

Segment-Specific Growth Forecasts: A Closer Look

- Small Business and Self-Employed Group: The expected growth of 16% to 17% aligns with recent performance but may be challenging to maintain as the segment scales.

- Consumer Group: Projected growth of 7% to 8% seems conservative, potentially reflecting uncertainties in the tax preparation market or increased competition.

- ProTax Group: The anticipated growth of 3% to 4% suggests limited expansion opportunities in this mature market segment.

- Credit Karma: The forecast of 5% to 8% growth indicates management's cautious outlook for this segment, possibly due to economic uncertainties affecting consumer credit markets.

These projections provide a framework for evaluating Intuit's performance in the coming year, but we should remain vigilant for any signs of deviation from these targets.

Intuit's AI-Driven Expert Platform Strategy: Potential Game-Changer or Overhyped Promise?

Intuit's strategic focus on becoming a global AI-driven expert platform is central to its growth narrative. CEO Sasan Goodarzi has emphasized the transformative potential of AI for the company's products and services.

Goodarzi further detailed the company's AI advantage:

"We have a significant advantage with the scale of our data, investments in AI capabilities such as knowledge engineering, machine learning and GenAI and our large network of AI-powered virtual experts. This is enabling us to disrupt the categories in which we operate." He added, "We are transforming how we serve our customers by delivering done for you experiences where we do the hard work for them, connecting them with AI-powered human expertise to fuel their success."

While the integration of AI into Intuit's offerings could indeed drive significant value, investors should consider the following:

- Implementation challenges: Successfully integrating AI across diverse product lines may prove more complex and time-consuming than anticipated.

- Return on investment: The costs associated with AI development and implementation need to be weighed against the tangible benefits and revenue growth they generate.

- Competitive landscape: Many fintech companies are pursuing AI strategies. Intuit's success will depend on its ability to differentiate its AI offerings and deliver unique value to customers.

- Regulatory considerations: As AI becomes more prevalent in financial services, increased regulatory scrutiny is likely. This could impact the speed and scope of AI implementation.

TurboTax Live Market Share Expansion: Promising Growth, but Challenges Remain

The revelation that TurboTax Live now accounts for approximately 30% of the Consumer Group's revenue in FY2024 is a positive development. This growth suggests that Intuit's strategy of offering live expert assistance is resonating with customers.

Highlighting the success of TurboTax Live, Goodarzi reported:

"In fiscal year 2024, TurboTax Live revenue grew 17% and full service customers doubled while those customers who needed TurboTax tripled."

This growth demonstrates the strong market demand for assisted tax preparation services and Intuit's ability to capture this opportunity.

Factors warrant consideration:

- Margin implications: While TurboTax Live may drive revenue growth, its impact on profitability needs to be closely monitored. The costs associated with providing live expert support could pressure margins.

- Scalability: As TurboTax Live grows, maintaining quality and customer satisfaction with a larger pool of tax experts may become more challenging.

- Competitive response: Success in this area may prompt stronger responses from traditional tax preparation services and other digital competitors.

The $30 billion assisted tax preparation market represents a significant opportunity, but capturing a substantial share of this market will require continued innovation and effective execution.

Conclusion: Intuit's Position in the Evolving FinTech Landscape - Opportunities and Risks

Intuit's Q4 2024 results and FY2025 outlook present a company at a critical juncture. The strong performance in the Small Business and Self-Employed Group, coupled with the recovery in Credit Karma, provides a solid foundation for growth. The company's AI-driven strategy and expansion into live expert services demonstrate a forward-thinking approach to evolving customer needs.

Goodarzi expressed confidence in the company's future, stating:

"We are confident in our long-term growth strategy, including double-digit revenue growth and operating income growing faster than revenue. We have the strategy to win given the green shoots we're observing and with less than 5% penetration of our $300 billion in TAM, we have a massive runway ahead."

As we look ahead to Intuit's investor day on September 26, 2024, key areas to focus on will be:

- Detailed plans for AI integration across product lines

- Strategies for mid-market expansion and international growth

- Updates on the integration and performance of Credit Karma

- Long-term margin expectations, especially as live services grow

Metrics for measuring the success of the AI-driven expert platform

By critically analyzing these factors, investors can better assess Intuit's potential for sustainable growth and its ability to navigate the evolving fintech landscape.