Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money.

(17 minutes read)

Today’s outline

- Latest Posts

- Dystopia

- Doing fine, thanks

- What charts are telling us?

- In case you missed it ($SE, $NU, Oil)

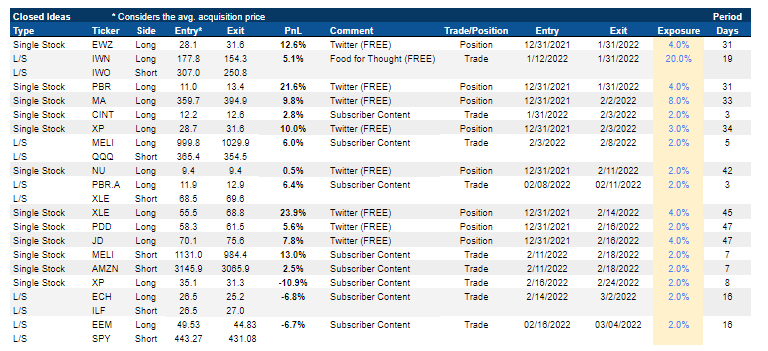

Closed Ideas

Latest Posts

Giro’s NewsletterBrazilian BanksDisclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money. (14 minutes read) Access to Interactive Model…Read more2 months ago · Giro LinoGiro’s NewsletterShopee BrazilDisclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money. Last update on 2022/03/04 Hi. A lot is being said about Shopee in Brazil, especially how Sea will capture a lot of market share throughout the fo…Read more2 months ago · Giro LinoGiro’s Newsletter$SE 4Q21Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money. Going through Sea Limited ("SE")'s earnings, I'd say management is confident with their strategy given the downward trend they showed this quar…Read more2 months ago · Giro Lino

Dystopia

I believe no one can predict the markets. Instead, we can create our thesis based on evidence and our own experiences.

The problem with the human mind is that we suck attributing probabilities or even thinking probabilistically, leading to a series of poor decisions.

In the past couple of weeks, the world witnessed an escalation in threats, raising prospects of a nuclear disaster.

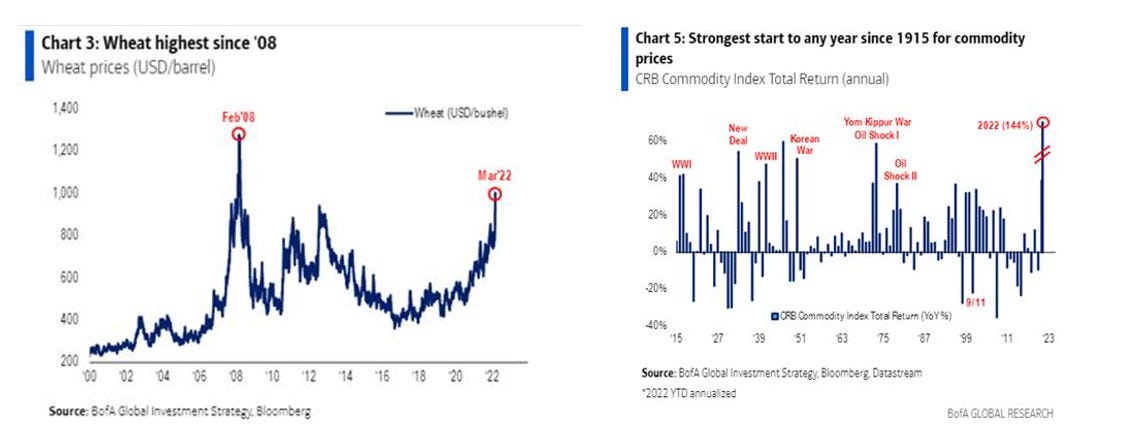

I don’t know much about wars, but we can take a couple of conclusions from history. First, war is Inflationary. We’re living the strongest start to any year since 1915 for commodity prices; all-time high in the price of coal/aluminum, oil/wheat highest since ’08.

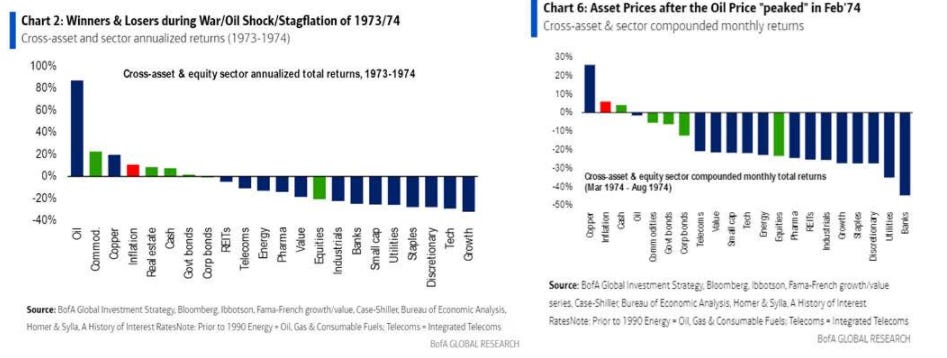

Second, war is Stagflationary. For example, the Yom Kippur War (Fourth Arab-Israeli War) began in October 1973 and ended in April 1974. Though the war itself lasted for six months, its consequences prevailed longer.

The S&P 500 fell 40% from the previous high during the period, and the only two sectors to outperform inflation were Oil&Gas, and Copper.

Also, the Fed tightened the market to control inflation, but oil prices didn’t reverse until 1975. So the crises only ended when the Fed reversed the course, slashing Fund Rater from 14% to 3%.

However, market prices don’t look risk-averse, especially the bond market and equities volatility. For instance, the S&P 500 is going through an 11% drawdown, and the VIX barely crossed 30%, though Macro conditions are deteriorating fast.

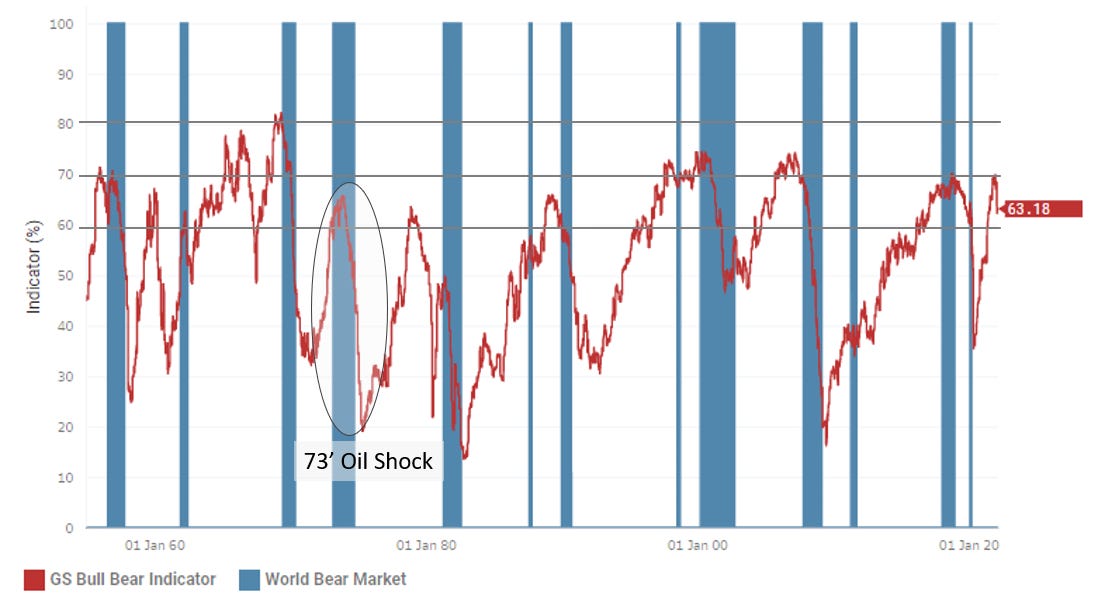

GS Risk Appetite Indicator shows that momentum is performing much better than headlines. In my opinion, the market is injecting an enormous amount of risk premium to the S&P 500.

“The GS uses monthly data on real U.S. per-capita consumption, the real rate on 3-month U.S. Treasury bills, and the inflation-adjusted S&P 500 Index.”

(Bank of Canada)

The S&P 500 technicals are holding much better than I could anticipate. Buybacks should be running, with YTD authorizations for incremental repurchase are already up to $238bn (2022 is expected to be a record year for executions at $995bn).

Also, the retail investor has primarily been on the bid has driven record inflows of $156bn to global equity funds, helping to sustain the GS Bull and Bear Index above the 60% percentile, which is still considered a risk-on level.

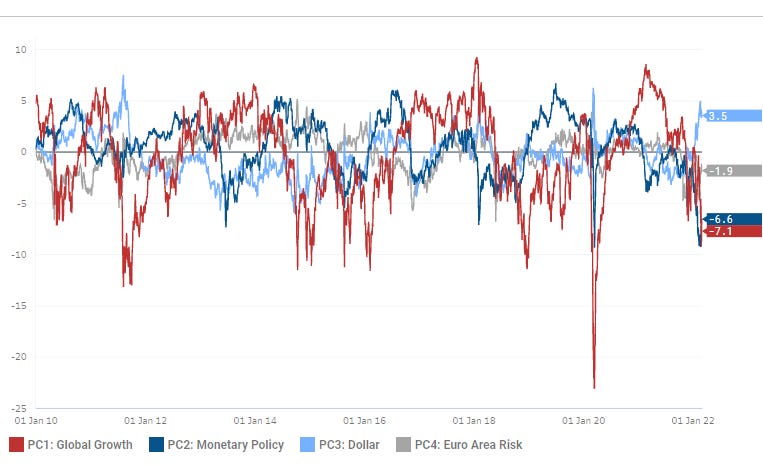

However, we should consider that are multiple interrelated and overlapping cycles affecting markets:

- Structural cycles, long-term condition expectations of trend growth and inflation, and other factors might affect the long-term outlook.

- The global and US business cycles, such as changes in growth and inflation relative to trend, impact returns in the medium term.

- Mini-cycles in risk appetite are often driven by a material change in growth rates or rate shocks caused by geopolitical or political risks or material shifts in monetary policy.

Risk-appetite cycles are shorter and tend to occur more frequently than business cycles and often have more significant swings than growth.

Consequently, if headlines keep performing poorly and have a more dramatic effect on the US business cycle, price direction may change.

Also, rising inflation has been a critical ingredient for US recessions since WW2 as it forces central banks to tighten and deleverage.

But anchored inflation, also due to fewer oil shocks after the shale revolution, has allowed central banks to buffer the business cycle proactively.

In addition, better inventory management, shrinking output share of the most cyclical sectors, and digitalization have reduced the impact of industrial fluctuations.

So fiscal tightening has also become a less significant contributor to US recessions since the 1970s.

Since the 1990s, economists have believed that financial imbalances and asset prices crashes are the source of recession risk, closely linked to risk-appetite cycles.

We should be careful considering that growth and inflation trends might have hit an inflection point. The US business cycles are starting to face these consequences (cost pressure, supply disruption).

Focus on not being caught swimming naked if, eventually, the tide comes down.

Doing fine, thanks

As you may know, I’ve been advocating in favor of oil prices since our first edition in Food for Thought.

Even before I started sharing thoughts in Substack, many friends have heard this pitch throughout the past 12-18 months.

Since my thoughts on Oil prices is a continuation of everything I’ve been writing so far, let’s go back for a moment and recapitulate a few highlights from previous editions:

From Food for Thought #1

“In general, OPEC+ spare capacity is hitting historically low levels, with insufficient buffers relative to demand. Lower production capacity means worse industry’s shock absorber, meaning that any tightness in the market could lead to higher premiums.

Considering that spare capacity is hitting a 25yr low, at 4%, and that OECD’s inventory might hit critical levels in 2022, there are significant odds for oil prices to overshoot in 2022 or 2023.”

From Food for Thought #2

“I think that looking for an exit price for the Oil trade is premature. I don’t believe that Oil Companies will outperform the S&P 500 in the next decade, but every commodity cycle comes with an overshoot in prices. We haven’t seen that in Oil yet.”

From Food for Thought #3

“Oil has just posted a two-month rally that ranks in the top 99.7% of Sharpe ratio in the last twenty years. But, importantly, time spreads still look relatively undervalued vs. expectations of OECD inventories even after the rally.

For almost a decade, selling option tails was a very profitable trade. Perhaps, we might be entering a new decade where buying the right tails will prove to be cheap.”

From Food for Thought #5

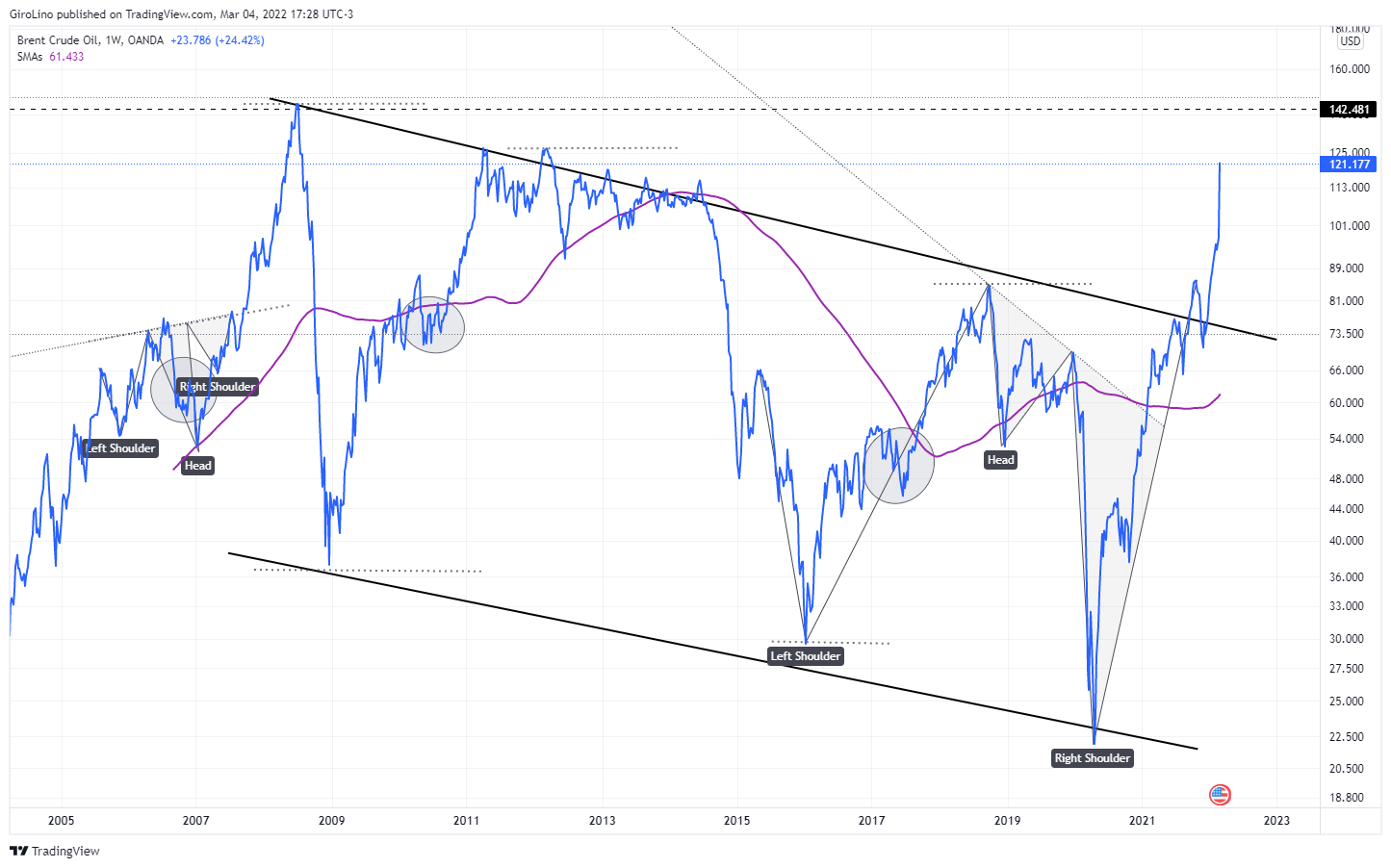

Finally, the last breakout of the week I’m using as evidence to my bull thesis on XME is Brent, who broke a 12-years falling wedge. Also, the bull thesis for Oil continues to play out, as we vastly discussed over the past weeks.

From Food for Thought #6

If broad sanctions are imposed, exposure to Russian material can create legal costs, as physical aluminum traders learned during the 2018 Russian sanctions.

Although the shock looks temporary, it changes a few dynamics, such as any prospective Iran deal, in which higher oil prices give some flexibility to the country.

Also, since there was no physical shock to Russia's supply, the odds for OPEC+ to accelerate ramp-up in the following months sound unlikely, leaving space for a rally in oil prices while sanctions persist.

So, let’s wrap up everything we went through so far and summarize the present situation, commenting on each bullet:

OPEC+ spare capacity is hitting historically low levels, with insufficient buffers relative to demand. Still look relatively undervalued vs. expectations of OECD inventories even after the rally. Any tightness in the market could lead to higher premiums. Overshoot in prices.

Comment: The overshoot is being confirmed. It’s hard to say if it’s over or not, but volatility is inevitable.

Buying the right tails will prove to be cheap.

Comment: The market is structurally short-gamma, on the right tails, meanings that everyone has been selling upside for more than a decade. It’s impossible to predict when this is gonna be over.

Iran deal: higher oil prices give some flexibility to the country.

Comment: Still soon to say, but if the crisis keeps escalating, there could be even more upside risk here. I don’t know.

Physical shock to Russia’s supply, the odds for OPEC+ to accelerate ramp-up in the following months sound unlikely, leaving space for a rally in oil prices while sanctions persist.

Comment: This has been playing out. Yet, we must have higher visibility about the durability of the movement.

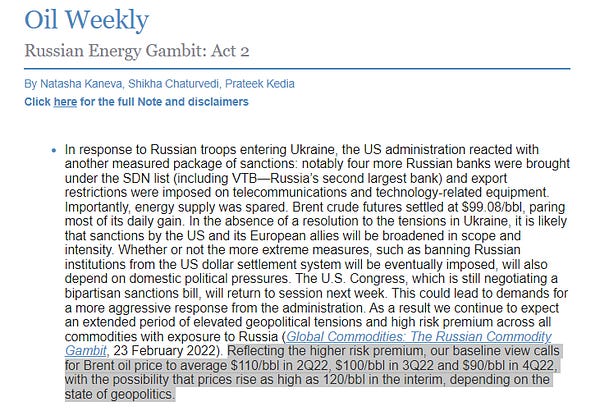

With that said, I have no clue where oil prices will hit, but thinking probabilistically, the market is still skewed to the upside. That doesn’t mean oil prices will keep plunging forever, though Brent should trade with a significant premium over the next 6-12 months.

What charts are telling us?

As discussed, the fundamentals for oil prices have improved consistently throughout the past months.

Prices have confirmed that oil is going through a bull market, with prices overshooting given recent events already discussed previously.

The following week will be decisive for Oil & Gas companies. When oil companies attempted a breakout in the past decade, they failed when the RSI reached overbought levels.

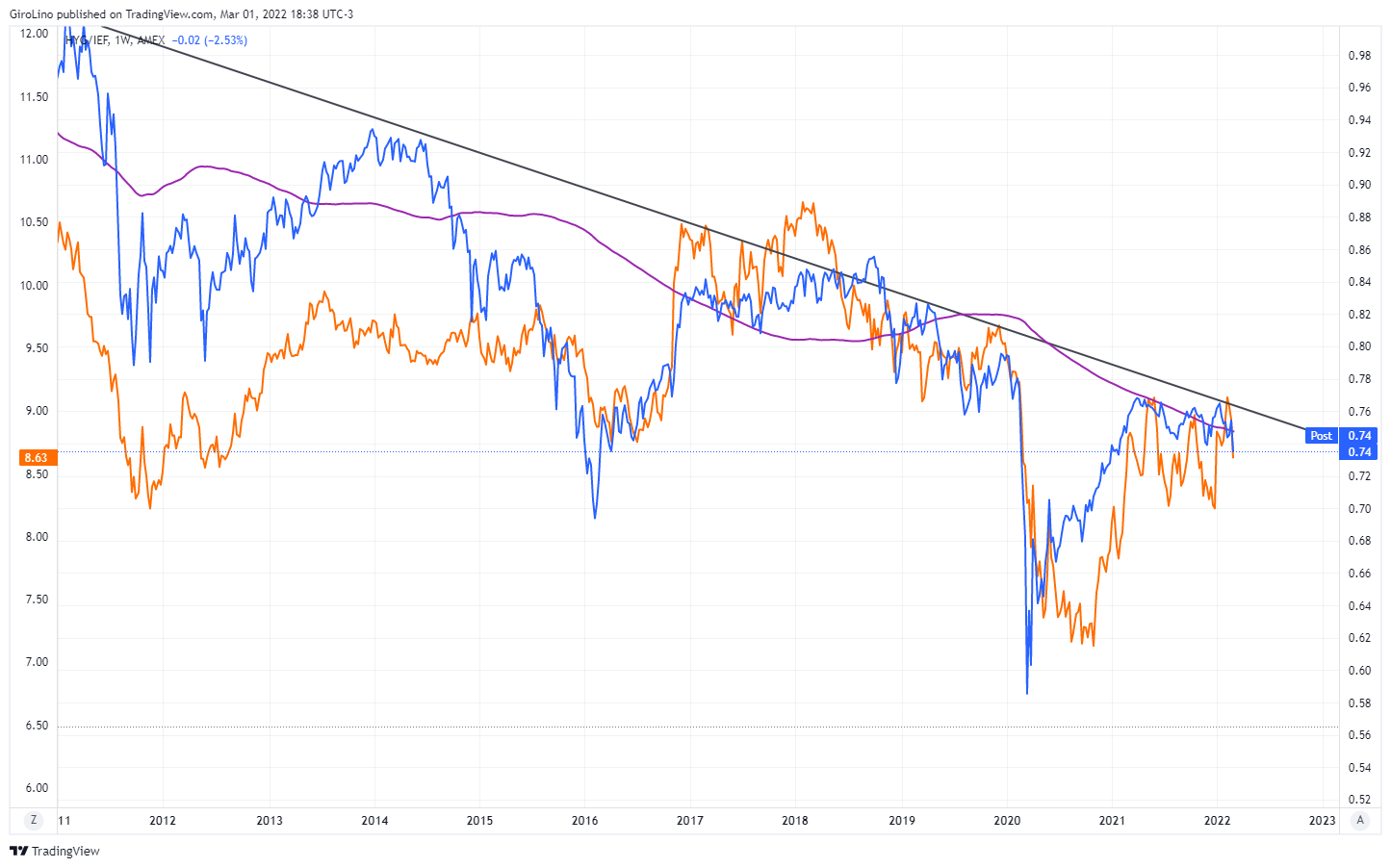

Nevertheless, after a decade of underperforming, $XOP performed a breakout against $XLF. Higher inflation boosts credit portfolio and margins.

However, usually asset quality deteriorates, and inflation is harmless only when there is growth. In a scenario with stagflation, banks will bleed.

Also, $XLF should keep underperforming the $SPY if the credit market conditions keep getting worse.

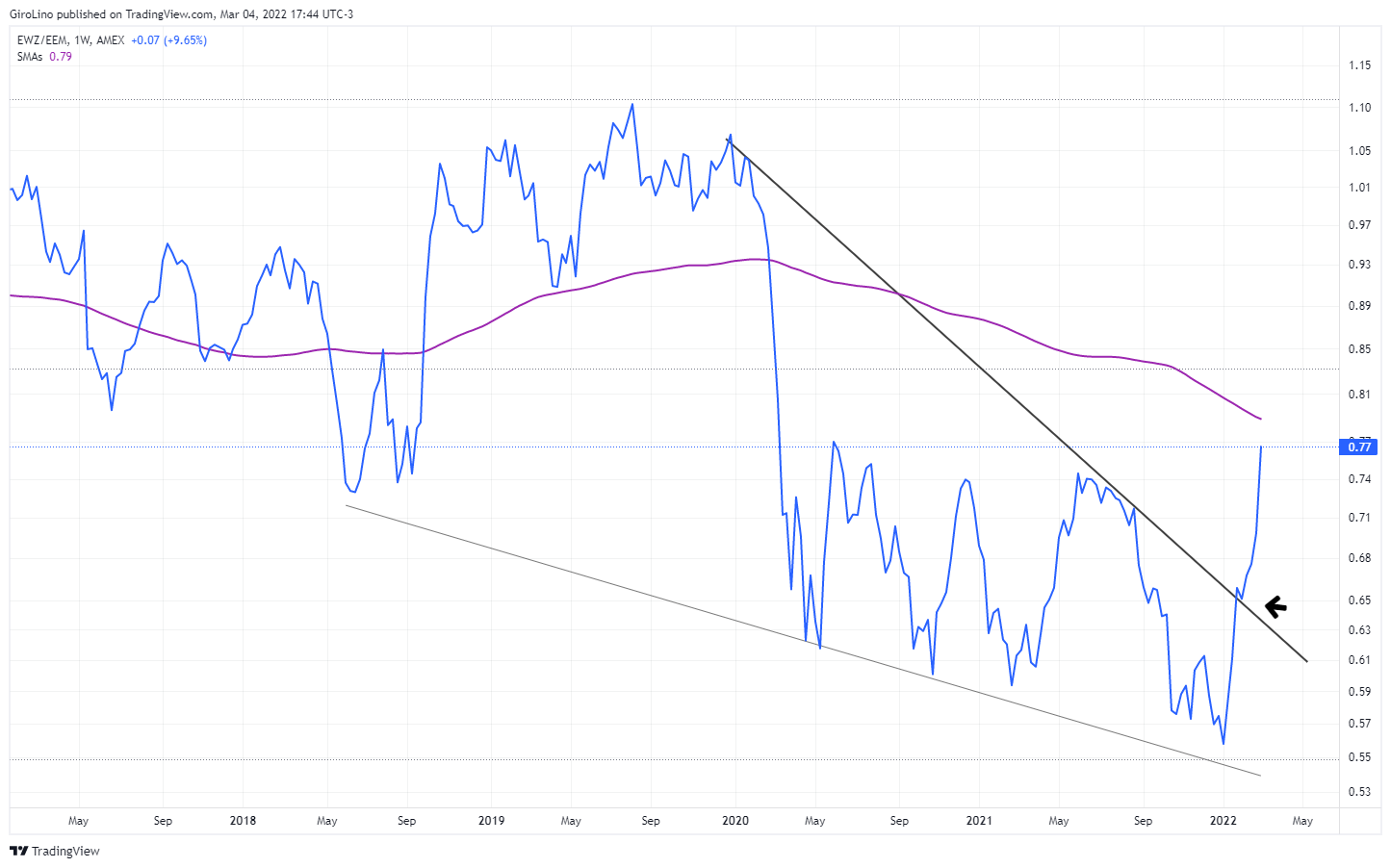

As for the S&P 500, $XOP is attempting a new breakout against the $QQQ. If macro conditions favor oil prices, the breakout should be confirmed next week.

Finally, both trades triggered two weeks ago confirmed the breakout. We discussed both in previous editions, in the PRO section.

In case you missed it ($SE, $NU, Oil)

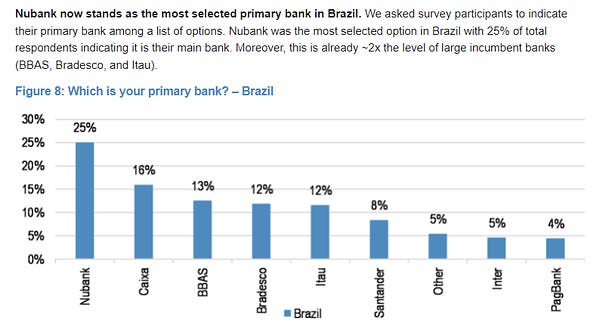

$NU

Giro Lino @giro_lino$NU is the favorite among 18-35yr in ALL income segments. Also, 50% of those use 3/4 banks, then 1-2 banks from 46yr and so on. HUGE tailwind for $NU if they keep those customers' loyalty for this long. Bad for $ITUB, $BBD.

March 4th 202211 Likes

Oil

Giro Lino @giro_lino$JPM on #Oil #BrentOil: "At risk 2.9 mbd of supply = $50/bbl annualized price impact. Russia has always been a reliable supplier of oil, and even at the height of the Cold War, the Soviet Union did not shut off oil exports. Things might be different now."

March 3rd 20222 Retweets13 Likes

Closed Ideas in 2022

If you’re paid subscriber, don’t worry. I created a new section (“Trade Ideas”) to improve our communication. You can expect to receive all PRO content in your mailbox.

Also, all posts/ideas will be saved in this new section, so you can find any topic much more quickly from now on. : )

Click here to access the latest updates in my portfolio.