As an investor and financial analyst, I’ve come to appreciate the critical role that accurate business valuation plays in making informed investment decisions. Whether you’re a business owner looking to determine the value of your business or an investor evaluating potential opportunities, understanding business valuations is crucial. In this comprehensive guide, we’ll explore the intricacies of using business valuation calculators to simplify the complex process of business appraisal.

Understanding the Foundations of Business Valuation

Before delving into the specifics of business appraisal calculators, it's essential to grasp the fundamentals of business valuation. At its core, business valuation is the process of determining the economic value of a company or business entity. This process is vital for various reasons:

- Evaluating investment opportunities

- Assessing the current value of your holdings

- Facilitating mergers and acquisitions

- Preparing for initial public offerings (IPOs)

- Determining fair compensation for executives

- Estate planning and tax purposes

Business valuation calculators provide a structured approach to this complex process, helping to streamline what can otherwise be a time-consuming and challenging task.

Key Factors Influencing Business Value

When using a business valuation calculator, it's crucial to consider multiple factors that can impact a company's value. Let's break down some of the most significant elements:

1. Financial Performance

A company’s financial health is often the first aspect to examine when assessing its value, as it can significantly impact potential future revenue. Key metrics to consider include:

- Revenue growth: How rapidly is the company increasing its top line?

- Profitability: What are the profit margins, and how have they trended over time?

- Cash flow: Is the company generating strong, consistent cash flows?

2. Market Position and Competitive Landscape

A company’s standing in its industry can significantly impact its value. When using a business appraisal calculator, consider:

- Market share: Is the company a leader in its industry or a small player?

- Competitive advantages: Does the company have unique strengths that set it apart?

- Brand value: How strong is the company’s brand recognition and reputation?

Additionally, conducting a market comparison can help assess a company's value by comparing it to similar businesses within the same market. This method allows business owners to establish a relevant benchmark for valuation by researching comparable sales in their area.

3. Management Quality

The quality of a company's leadership can make or break its success. While challenging to quantify, consider the following:

- Track record: Has the management team consistently delivered on promises?

- Strategic vision: Does the leadership have a clear plan for future growth?

- Corporate governance: Are there strong checks and balances in place?

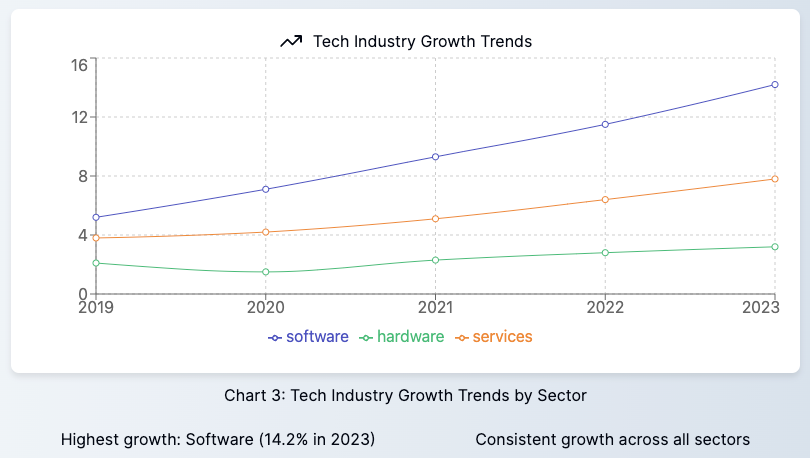

4. Industry Trends and Economic Environment

No company exists in isolation. When using a business valuation calculator, always consider the broader context:

- Industry growth prospects: Is the sector expanding or contracting?

- Regulatory environment: Are there any upcoming regulations that could impact the business?

- Economic cycles: How sensitive is the company to economic ups and downs?

Common Business Valuation Methods

Most business appraisal calculators incorporate one or more of the following valuation methods. Understanding these approaches is crucial for interpreting and adjusting calculator results.

1. Asset-Based Valuation Method

The asset-based approach calculates the value of a business based on its net asset value (NAV). Here's how it works:

- Sum up the fair market value of all the company's assets

- Subtract the total liabilities

- The result is the company's net asset value

This method is particularly useful for companies with significant tangible assets, such as real estate firms or manufacturers. However, it has limitations, especially for businesses with primarily intangible assets.

When using a business valuation calculator that includes an asset-based valuation, consider:

- Are all assets, including intangible ones like patents and brand value, properly accounted for?

- Is the fair market value of assets accurately reflected, or are we just looking at book values?

- For companies with mostly intangible assets, is this method appropriate at all?

2. Market-Based Valuation Method

The market-based approach values a company by comparing it to similar publicly traded companies or recent transactions in the same industry. This method relies on financial ratios and multiples, such as:

- Price-to-Earnings (P/E) ratio

- Enterprise Value-to-EBITDA (EV/EBITDA) multiple

- Price-to-Sales (P/S) ratio

When using a business appraisal calculator that incorporates market-based valuation, pay attention to:

- The selection of comparable companies: Are they truly similar in terms of size, growth rate, and business model?

- The specific multiples used: Different industries often focus on different metrics

- Recent market conditions: In times of market euphoria or panic, these multiples can become skewed

3. Income-Based Valuation Method

The income-based approach focuses on a company’s ability to generate future cash flows. The most common method within this approach is the Discounted Cash Flow (DCF) analysis. Here’s a simplified version of how it works:

- Project the company’s future cash flows

- Determine an appropriate discount rate (usually the weighted average cost of capital, or WACC)

- Calculate the net present value of these future cash flows

- Add a terminal value to account for cash flows beyond the projection period

When using a business valuation calculator that includes DCF analysis, scrutinize:

- The cash flow projections: Are they realistic and based on sound assumptions?

- The discount rate: Does it accurately reflect the company’s risk profile?

- The terminal growth rate: Is it sustainable in the long term?

Leveraging Business Appraisal Calculators Effectively

Now that we've covered the fundamental valuation methods, let's explore how to make the most of business appraisal calculators.

Choosing the Right Calculator

Not all business valuation calculators are created equal. When selecting a calculator, look for:

- Multiple valuation methods: The best calculators incorporate asset-based, market-based, and income-based approaches.

- Flexibility: Can you adjust assumptions and see how they impact the valuation?

- Industry-specific features: Some calculators are tailored to specific sectors, which can be very helpful.

- Data integration: Does the calculator pull in market data automatically, or do you need to input everything manually?

Gathering Accurate Input Data

A business appraisal calculator is only as good as the data you feed it. Focus on collecting:

- Financial statements: Use the most recent audited financial statements and double-check the numbers.

- Growth projections: Look at both management's guidance and independent analyst forecasts.

- Industry benchmarks: Gather data on comparable companies and recent transactions in the sector.

- Risk factors: Identify company-specific and industry-wide risks that could impact the valuation.

Interpreting and Adjusting Results

Once the calculator provides a valuation, your work isn't done. Take these steps:

- Compare results from different methods: If the asset-based valuation is significantly different from the DCF valuation, investigate why.

- Perform sensitivity analysis: Adjust key assumptions to see how they impact the valuation.

- Consider qualitative factors: Things like management quality or pending litigation might require manual adjustments to the calculated value.

- Sanity check: Does the valuation make sense given what you know about the company and its industry?

Common Pitfalls to Avoid

Even with a sophisticated business valuation calculator, there are several traps to watch out for:

- Overreliance on a Single Method: Use multiple methods and understand why they might differ.

- Ignoring Industry Specifics: Generic valuation methods don't always capture industry-specific factors.

- Failing to Consider the Economic Cycle: Valuations can vary significantly depending on where we are in the economic cycle.

- Overlooking Liquidity and Control Premiums: When valuing private companies or minority stakes, issues of liquidity and control can significantly impact value.

- Neglecting to Update Assumptions: Markets and companies evolve rapidly. Revisit and update your assumptions regularly.

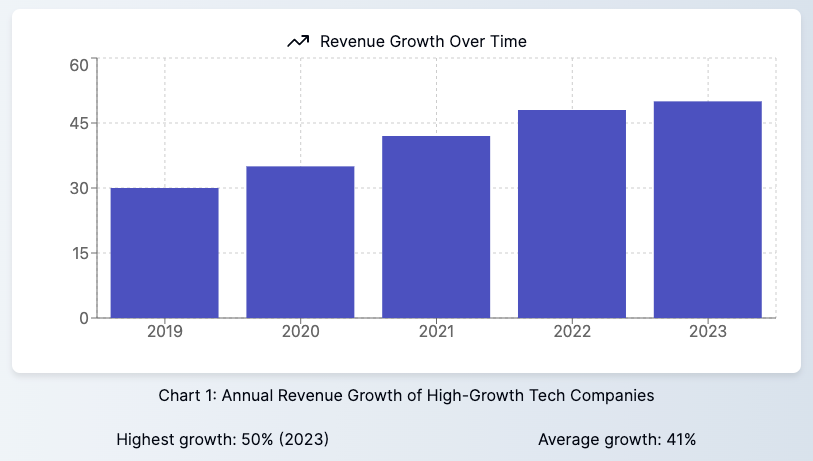

Case Study: Valuing a High-Growth Tech Company

Let's walk through a real-world example of using a business appraisal calculator to value a high-growth tech company. This case study illustrates many of the points we've discussed.

The company in question is a cloud-based software provider with the following characteristics:

- Revenue growth: 50% year-over-year

- Current profitability: Unprofitable

- Strong market position in a rapidly growing industry

- Proprietary technology and high customer retention rates

Here's how we approached the valuation:

- Asset-Based Valuation: This method yielded a low value as the company had few tangible assets. However, it provided a useful "floor" for the valuation.

- Market-Based Valuation: We used the calculator to compare the company to other high-growth software firms. The key metrics we focused on were the Price-to-Sales ratio and the EV/Revenue multiple.

- DCF Analysis: This was challenging due to the negative current cash flows. We had to project when the company would turn profitable and estimate future cash flows. The calculator allowed us to model different scenarios.

- Adjustments: We made manual adjustments to account for the company's strong market position and proprietary technology, which weren't fully captured by the quantitative methods.

The initial results from the calculator showed a wide range of potential values. The market-based approach suggested a very high valuation, while the DCF analysis was more conservative.

To reconcile these differences, we:

- Performed a sensitivity analysis on key assumptions like the growth rate and discount rate

- Considered the company's competitive position and barriers to entry

- Factored in the overall market sentiment towards high-growth tech stocks at the time

Ultimately, we arrived at a valuation range rather than a single number. This range helped inform decisions about whether the stock was attractively priced given our risk tolerance and investment goals.

Frequently Asked Questions

How do you calculate business appraisal?

Calculating a business appraisal involves several steps:

- Choose an appropriate valuation method (or methods) based on the business type and available information.

- Gather relevant financial and operational data.

- Apply the chosen valuation method(s) using a business appraisal calculator or spreadsheet.

- Adjust the results based on qualitative factors and market conditions.

- Compare results from different methods to arrive at a final valuation or range.

How do you appraise the value of a small business?

Appraising the value of a small business often involves:

- Using the asset-based approach to establish a baseline value.

- Applying income-based methods like the Discounted Cash Flow analysis.

- Comparing the business to similar companies that have recently sold (market approach).

- Considering industry-specific multiples (e.g., 2-3 times annual earnings for typically restaurants).

- Adjusting for factors like customer concentration, growth potential, and the owner's role in the business.

What is the average cost of a business appraisal?

The cost of a business appraisal can vary widely depending on the size and complexity of the business, as well as the purpose of the valuation. On average:

- For small businesses, a basic appraisal might cost $2,000 to $5,000.

- For mid-sized companies, costs can range from $5,000 to $20,000.

- Large or complex businesses might require appraisals costing $20,000 or more.

Many business valuation calculators offer a more cost-effective alternative for initial estimates, but they may not provide the level of detail and analysis required for legal or financial reporting purposes.

How much is my business worth based on revenue?

While revenue is an important factor, the value of a business isn't solely based on its top line. However, some general rules of thumb based on revenue include:

- For small businesses, a common multiple is 0.5 to 1.5 times annual sales.

- Some industries use higher multiples, such as 2-3 times annual sales for high-tech companies with strong growth potential.

- These multiples can vary significantly based on profitability, growth rate, and industry trends.

It's important to note that these are very rough estimates. A more accurate valuation would consider factors like profitability, cash flow, assets, liabilities, market position, and growth potential.

The Art and Science of Business Valuation

After years of experience and countless valuations, it's clear that business appraisal is both an art and a science. The science lies in the rigorous financial analysis and the use of tools like business valuation calculators. The art comes in interpreting the results, understanding the limitations of each method, and incorporating qualitative factors that numbers alone can't capture.

Business appraisal calculators are powerful tools that can significantly streamline the valuation process. They provide a structured framework for analysis and can quickly process complex calculations. However, they're not infallible. The key to using them effectively is to understand their underlying assumptions, input accurate data, and interpret the results critically.

Remember, valuation is not about pinpointing an exact number, but rather about developing a well-reasoned estimate of a company's worth. It's about making informed decisions in the face of uncertainty. A good valuation should stand up to scrutiny and provide a solid foundation for investment decisions.

As you embark on your own valuation journey, leverage the power of business valuation calculators while also developing your own judgment and intuition. With practice and experience, these tools will become an invaluable part of your investment toolkit, helping you uncover opportunities and avoid pitfalls in the dynamic world of business and finance.