In the world of finance and investing, portfolio selection is a critical process that can significantly impact an investor's success. This comprehensive guide will explore the intricacies of portfolio selection, delving into Modern Portfolio Theory (MPT) and its applications in crafting optimal investment strategies.

Understanding Portfolio Selection

Portfolio selection is the process of choosing a combination of assets to create an investment portfolio that aligns with an investor’s financial goals and risk tolerance. It involves carefully balancing risk and return to achieve the best possible outcome for the investor by understanding investment risk.

Modern Portfolio Theory, developed by Harry Markowitz in the 1950s, provides a mathematical framework for portfolio selection. This groundbreaking approach revolutionized the way investors and asset managers approach portfolio construction and risk management. By adjusting the asset allocations and their associated risks or returns, investors can calculate the overall expected return of their portfolio, known as the portfolio's expected return.

Before you dive into our in-depth analysis, we have a quick request:

If you find this content useful, please consider sharing it!

Why? Your shares help us reach a wider audience, allowing us to continue producing high-quality, comprehensive content like this—completely free, with no paywalls or subscriptions.

Thank you for your support!

The Foundations of Modern Portfolio Theory

Modern Portfolio Theory is based on several key principles that form the backbone of contemporary investment strategies:

1. Risk-Return Trade-off

MPT assumes that rational investors are risk-averse, meaning they prefer portfolios with the highest expected return for a given level of risk. This concept is central to understanding how investors make decisions when faced with multiple investment options.

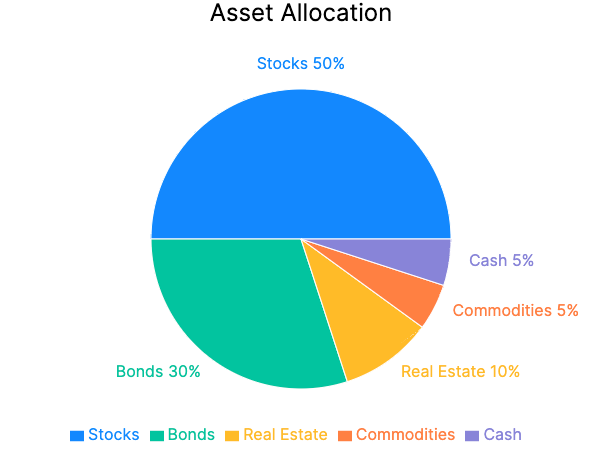

2. Diversification Benefits

One of the most important insights of Modern Portfolio Theory is the power of diversification. By spreading investments across various assets, investors can potentially reduce overall portfolio risk without sacrificing expected returns. Diversification helps in reducing total portfolio risk by combining the individual risk levels of assets based on their percentages in the portfolio.

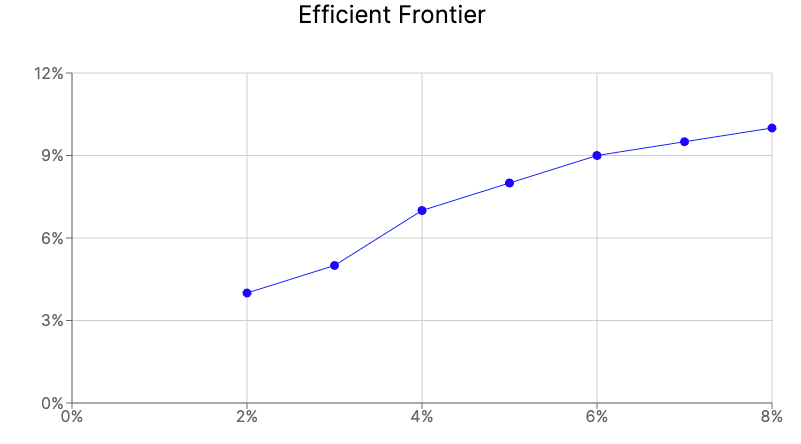

3. Efficient Frontier

The efficient frontier is a key concept in Modern Portfolio Theory. It represents the set of optimal portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. Portfolios lying on the efficient frontier are considered to be the most efficient allocations of assets.

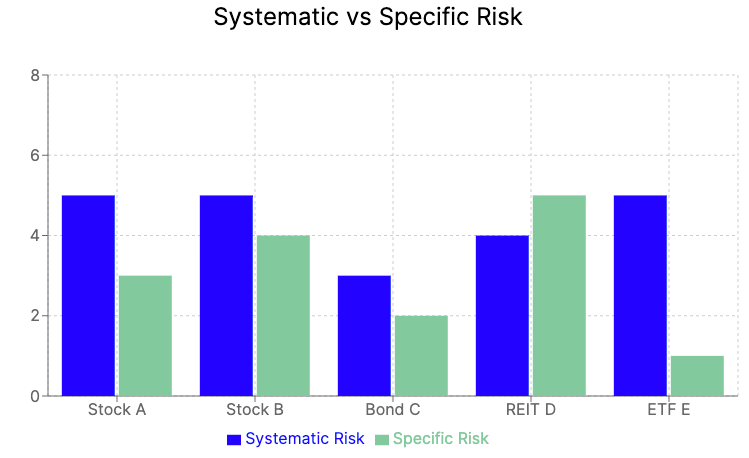

4. Systematic and Specific Risk

Modern Portfolio Theory distinguishes between two types of risk:

- Systematic risk (also known as market risk): This type of risk affects the entire market and cannot be eliminated through diversification.

- Specific risk (also called asset-specific risk): This risk is unique to individual assets and can be mitigated through diversification.

Understanding these concepts is crucial for effective portfolio management and risk mitigation strategies.

Applying Modern Portfolio Theory in Practice

To implement Modern Portfolio Theory effectively, investors and asset managers use various tools and techniques:

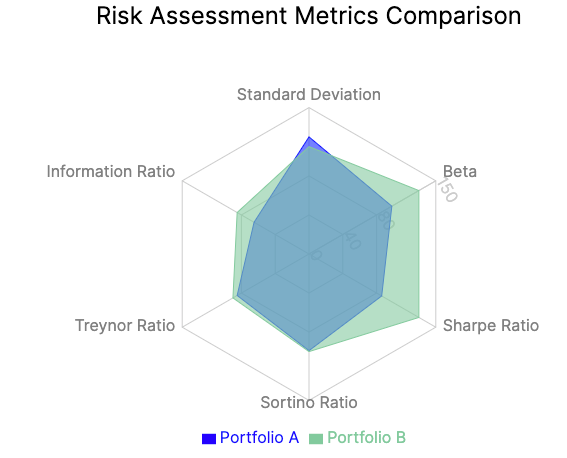

Risk Assessment Tools

- Standard Deviation: Measures the volatility of an investment's returns over time.

- Beta: Compares an asset's volatility to that of the overall market.

- Sharpe Ratio: Evaluates risk-adjusted returns by comparing excess returns to the risk-free rate, divided by standard deviation.

Portfolio Optimization

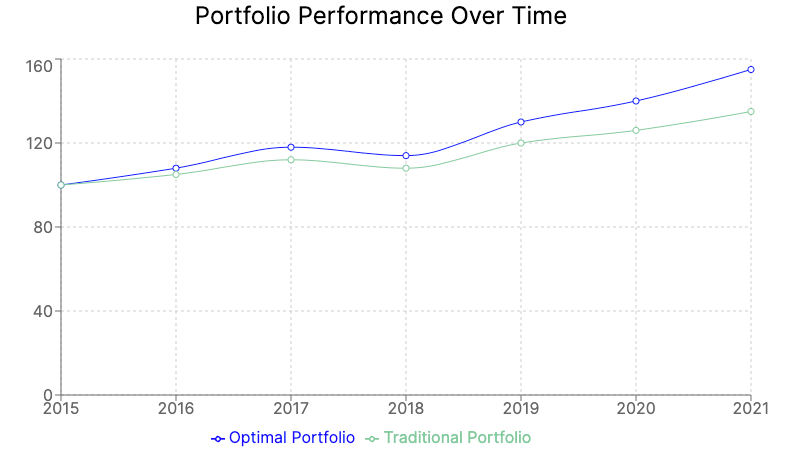

The goal of portfolio optimization is to create an optimal portfolio that maximizes expected returns for a given level of risk. This process often involves:

- Mean-Variance Optimization: Seeks to find the portfolio with the highest expected return for a given level of risk.

- Monte Carlo Simulations: Uses historical data to generate thousands of possible future scenarios to assess portfolio performance.

The Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model is an extension of Modern Portfolio Theory that helps investors determine the expected return of an asset based on its systematic risk. It introduces the concept of a risk-free asset and the market portfolio.

Types of Portfolios

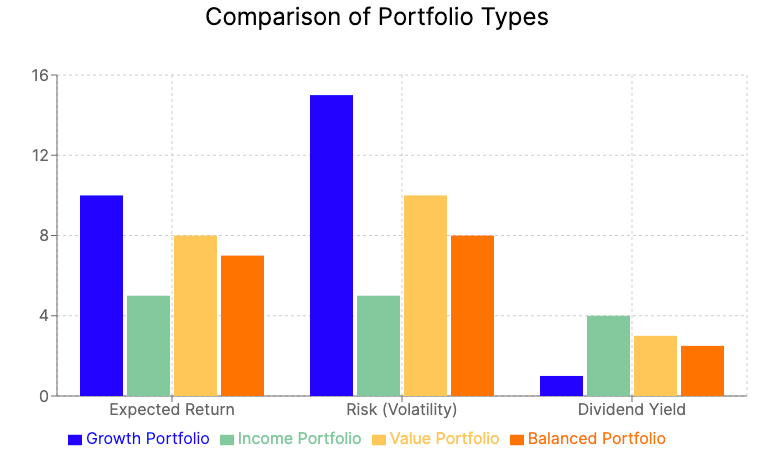

Investors can choose from various portfolio types based on their investment goals and risk tolerance:

- Growth Portfolio: Focuses on capital appreciation with higher risk tolerance.

- Income Portfolio: Emphasizes generating regular income through dividends and interest payments.

- Value Portfolio: Seeks undervalued assets with potential for long-term growth.

- Balanced Portfolio: Combines growth and income strategies for a moderate risk profile.

Modern Portfolio Theory in Practice: Examples and Applications

To illustrate the practical application of Modern Portfolio Theory, let's consider a few examples:

Example 1: Efficient Frontier and Portfolio Selection

Imagine two portfolios with the same expected return but different levels of risk. According to MPT, a rational investor would choose the portfolio with lower risk. This concept is visually represented by the efficient frontier, where the y-axis shows expected returns and the x-axis represents the level of risk (often measured by standard deviation).

Example 2: Diversification and Risk Reduction

Consider an investor who holds a portfolio consisting solely of technology stocks. By diversifying into other sectors such as healthcare, finance, and consumer goods, the investor can potentially reduce the portfolio’s overall risk while maintaining a similar expected return. This diversification helps in reducing the total portfolio risk by combining the individual risk levels of assets based on their percentages in the portfolio.

Example 3: Risk-Free Asset and the Optimal Risky Portfolio

Modern Portfolio Theory introduces the concept of a risk-free asset, typically represented by government bonds. By combining a risk-free asset with a risky portfolio, investors can create a portfolio that suits their specific risk tolerance while still benefiting from the principles of MPT.

Challenges and Criticisms of Modern Portfolio Theory

While Modern Portfolio Theory has been instrumental in shaping modern finance, it's not without its criticisms:

- Assumptions of normality: MPT assumes that returns are normally distributed, which may not always be the case in real-world markets.

- Use of historical data: The theory relies heavily on historical data, which may not accurately predict future performance.

- Ignoring investor behavior: MPT doesn't account for irrational investor behavior, which can significantly impact market dynamics.

Post-Modern Portfolio Theory (PMPT)

In response to some of the limitations of MPT, Post-Modern Portfolio Theory has emerged. PMPT focuses more on downside risk and uses alternative risk measures that better align with investor preferences.

Practical Tips for Portfolio Selection

For most investors, applying the principles of Modern Portfolio Theory can seem daunting. Here are some practical tips for effective portfolio selection:

- Understand your risk tolerance and investment goals.

- Diversify across different asset classes, sectors, and geographies.

- Regularly rebalance your portfolio to maintain your desired asset allocation.

- Consider using low-cost index funds or ETFs to achieve broad market exposure.

- Stay informed about market trends and economic conditions, but avoid making impulsive decisions based on short-term fluctuations.

The Role of Robo-Advisors and Modern Portfolio Theory

In recent years, robo-advisors have gained popularity by applying the principles of Modern Portfolio Theory to automate the investment process. These platforms use algorithms to create and manage diversified portfolios based on an investor's risk profile and financial goals.

Conclusion

Modern Portfolio Theory has fundamentally changed the landscape of investing and portfolio management. By providing a mathematical framework to build portfolios that balance risk and return, MPT has enabled investors to make more informed decisions about their investments.

While the theory has its limitations, its core principles of diversification, risk management, and the relationship between risk and return continue to be relevant in today's financial markets. As the field of finance evolves, new approaches like Post-Modern Portfolio Theory are emerging to address some of MPT's shortcomings.

For individual investors and asset managers alike, understanding and applying the principles of Modern Portfolio Theory can lead to more effective portfolio selection and potentially better long-term investment outcomes.

Frequently Asked Questions

What is a portfolio selection?

Portfolio selection is the process of choosing a combination of assets to create an investment portfolio that aligns with an investor's financial goals and risk tolerance. It involves carefully balancing risk and return to achieve the best possible outcome for the investor.

What is an example of a portfolio choice?

An example of a portfolio choice could be an investor deciding between two portfolios with the same expected return but different levels of risk. According to Modern Portfolio Theory, a rational investor would choose the portfolio with lower risk, assuming all other factors are equal.

What are the 4 types of portfolio?

The four main types of portfolios are:

- Growth Portfolio: Focuses on capital appreciation with higher risk tolerance.

- Income Portfolio: Emphasizes generating regular income through dividends and interest payments.

- Value Portfolio: Seeks undervalued assets with potential for long-term growth.

- Balanced Portfolio: Combines growth and income strategies for a moderate risk profile.

What is modern financial theory?

Modern financial theory encompasses several key concepts in finance, with Modern Portfolio Theory being a central component. It provides a framework for understanding how markets work, how assets are priced, and how investors can make optimal decisions in the face of risk and uncertainty.

What is the Markowitz theory?

The Markowitz theory, also known as Modern Portfolio Theory, was developed by Harry Markowitz in the 1950s. It provides a mathematical framework for portfolio selection that emphasizes the benefits of diversification and the trade-off between risk and return.

What is meant by Modern Portfolio Theory?

Modern Portfolio Theory is an investment framework that aims to help investors maximize their portfolio's expected return for a given level of risk. It emphasizes the importance of diversification and the relationship between risk and return in investment decision-making.