Maximizing Returns: Understanding Cumulative Abnormal Returns in the Stock Market

In the fast-paced world of stock market investing, understanding the concept of cumulative abnormal returns is essential for maximizing your investment returns. Cumulative abnormal returns, or CAR, measures the difference between the actual returns of a stock and the expected returns based on market trends, and involves calculating abnormal returns by comparing these values. By analyzing this metric, investors can gain valuable insights into a stock’s performance and identify potential opportunities for profit.

In this article, we will delve into the intricacies of cumulative abnormal returns, explaining how they are calculated and what they indicate about a stock’s performance. We will explore the various factors that can influence CAR, such as company-specific events, market trends, and economic indicators. Additionally, we will discuss the importance of statistical significance when interpreting CAR values.

Whether you are a seasoned investor or just starting out in the stock market, understanding cumulative abnormal returns is crucial for making informed investment decisions. So, join us as we dive into the world of CAR and learn how to maximize your returns in the dynamic world of the stock market.

| Concept | Definition |

|---|---|

| Abnormal Return | The difference between the actual return of a security and its expected return. |

| Cumulative Abnormal Return (CAR) | The sum of all abnormal returns over a specified time period. |

| Expected Return | The anticipated return based on a stock's systematic risk and market performance. |

| Event Window | The time period over which abnormal returns are calculated and cumulated. |

The concept of abnormal returns in the stock market

In the dynamic world of stock investing, the concept of abnormal returns holds immense significance. Abnormal returns refer to the difference between a stock's actual returns and its expected returns based on prevailing market conditions and trends. These deviations from the expected performance can provide valuable insights into a stock's behavior and the factors influencing its performance.

Analyzing abnormal returns is crucial for investors seeking to identify undervalued or overvalued stocks, as well as to understand the impact of specific events or news on a company's stock price. Abnormal returns can be positive or negative, indicating that a stock has outperformed or underperformed the market, respectively. By understanding the reasons behind these deviations, investors can make more informed decisions and potentially capitalize on market inefficiencies.

| Factor Category | Specific Factors | Impact on CARs |

|---|---|---|

| Firm-specific | R&D spending | Mixed effects; potentially positive in long-term |

| Firm-specific | Profitability | Negative relationship observed |

| Firm-specific | Firm size | Negative relationship observed |

| Firm-specific | Leverage | Positive relationship; increased debt can reduce agency costs |

| Firm-specific | Managerial ownership | Negative relationship observed |

| Market-related | Debt financing | Positive effect; average CAR of 2.81% |

| Market-related | Equity issuance | Negative effect; average CAR of -0.96% |

| Macroeconomic | Consumer Price Index (CPI) | Potential influence on equity returns |

| Macroeconomic | Producer Price Index (PPI) | Potential influence on equity returns |

| Macroeconomic | Monetary aggregate (M1) | Potential influence on equity returns |

| Macroeconomic | Investment level in economy | May affect merger activity and related CARs |

| Macroeconomic | Interest rates | May affect merger activity and related CARs |

Abnormal returns can be influenced by a wide range of factors, including company-specific news, industry trends, macroeconomic conditions, and investor sentiment. Identifying the drivers of abnormal returns is essential for understanding a stock's performance and making informed investment decisions. This knowledge can help investors develop more effective investment strategies and potentially maximize their returns in the stock market.

Examples of cumulative abnormal returns (CARs)

Abnormal returns can occur in various scenarios, providing insights into market reactions to specific events or anomalies. Here are some examples of abnormal returns in different contexts:

| Scenario | Description | Abnormal Return |

|---|---|---|

| Earnings Surprise | Company reports earnings 20% above analyst expectations | Positive 5% on announcement day |

| Merger Announcement | Target company in acquisition bid | Positive 25% following announcement |

| Product Recall | Major automotive manufacturer announces widespread recall | Negative 10% over following week |

| Regulatory Change | New legislation impacts pharmaceutical industry | Varied returns across sector stocks |

| Dividend Cut | Company unexpectedly reduces dividend payout | Negative 8% on announcement day |

These examples illustrate how abnormal returns can manifest in response to various corporate and market events. Earnings surprises often lead to significant abnormal returns, with positive surprises generally resulting in positive abnormal returns. Merger announcements typically generate substantial positive abnormal returns for target companies, sometimes exceeding 20%. Conversely, negative events like product recalls or unexpected dividend cuts can lead to negative abnormal returns as investors reassess the company's prospects. Regulatory changes can cause varied abnormal returns across an industry as the market evaluates the impact on different companies. It's important to note that the magnitude and direction of abnormal returns can vary based on the specific circumstances and market conditions surrounding each event.

Understanding cumulative abnormal returns (CARs)

Cumulative abnormal returns (CARs) are a powerful tool for analyzing a stock’s performance over a specific time period. CARs measure the total deviation of a stock’s actual returns from its expected returns, providing a comprehensive view of the stock’s performance relative to the market.

The calculation of CARs involves several steps. First, the expected returns of a stock are determined based on a market model, such as the Capital Asset Pricing Model (CAPM) or other asset pricing models like the Fama-French three-factor model. These models consider various factors, including the stock’s beta, the market return, and other relevant variables, to estimate the expected returns.

Next, the actual returns of the stock are calculated for the specified time period. The abnormal returns are then computed by subtracting the expected returns from the actual returns. Finally, the abnormal returns are summed up over the time period to arrive at the cumulative abnormal returns (CARs).

CARs provide valuable insights into a stock’s performance, as they reflect the overall impact of various events, news, and market conditions on the stock’s returns. Positive CARs indicate that the stock has outperformed the market, while negative CARs suggest underperformance. By analyzing CARs, investors can identify stocks with the potential for above-average returns and make more informed investment decisions.

Factors influencing cumulative abnormal returns

Cumulative abnormal returns (CARs) can be influenced by a wide range of factors, both company-specific and market-wide. Understanding these factors is crucial for interpreting the significance of CARs and making informed investment decisions.

One of the primary factors influencing CARs is company-specific news and events. Announcements of earnings, mergers and acquisitions, new product launches, management changes, and other significant corporate events can have a substantial impact on a stock’s performance and, consequently, its CARs. Investors closely monitor these events to assess their potential impact on a company’s future prospects and profitability.

Market conditions and macroeconomic factors also play a crucial role in shaping CARs. Changes in interest rates, inflation, economic growth, and the risk free rate can all influence the expected returns of a stock and, in turn, affect its CARs. Additionally, industry-specific trends and the competitive landscape within a particular sector can contribute to the variations in CARs across different stocks.

| Market Condition | Impact on CARs | Key Considerations |

|---|---|---|

| Bull Market | Generally higher positive CARs | Increased investor optimism may amplify positive reactions |

| Bear Market | More pronounced negative CARs | Heightened risk aversion can exacerbate negative news |

| High Volatility | Larger magnitude of CARs | Increased uncertainty can lead to more extreme reactions |

| Low Volatility | Smaller magnitude of CARs | Stable conditions may result in more muted responses |

| Economic Expansion | Positive bias in CARs | Favorable economic conditions can enhance positive news impact |

| Economic Recession | Negative bias in CARs | Challenging economic environment may dampen positive news effects |

Investor behavior and sentiment can also be a significant factor in determining CARs. Irrational exuberance, herd mentality, and other psychological biases can drive stock prices, leading to temporary deviations from their fundamental value and affecting their CARs. Understanding the role of investor psychology in stock market dynamics is essential for interpreting CARs accurately.

The Unstoppable Bull: A powerful symbol of market optimism and economic growth, charging forward on an upward trajectory

The role of market efficiency and market inefficiencies in cumulative abnormal returns

The concept of market efficiency is closely tied to the interpretation and significance of cumulative abnormal returns (CARs). The efficient market hypothesis (EMH) posits that stock prices in financial markets reflect all available information, and any new information is quickly incorporated into the prices, leaving no opportunities for investors to consistently earn abnormal returns.

In an efficient market, the presence of persistent and statistically significant CARs would contradict the EMH, as it would suggest the existence of market inefficiencies that allow investors to outperform the market. However, the reality of stock market dynamics is more complex, and the degree of market efficiency can vary across different markets, time periods, and asset classes.

In semi-strong form efficient markets, where stock prices reflect all publicly available information, the presence of short-term CARs may still be observed, as the market may take time to fully incorporate new information. In these cases, the statistical significance and persistence of CARs become crucial in determining whether they represent genuine market inefficiencies or simply temporary market adjustments.

Conversely, in less efficient markets, where information is not fully or quickly reflected in stock prices, the presence of persistent and statistically significant CARs may indicate the potential for investors to identify undervalued or overvalued stocks and capitalize on these market inefficiencies. Understanding the degree of market efficiency is essential for interpreting the significance of CARs and developing effective investment strategies.

| Market Efficiency Level | Description | Impact on CARs |

|---|---|---|

| Weak-form efficiency | Past price information is fully reflected in current prices | CARs should not be predictable based on historical price patterns |

| Semi-strong form efficiency | All publicly available information is reflected in prices | CARs should only occur at the moment of new information release |

| Strong-form efficiency | All information, including private information, is reflected in prices | No significant CARs should be observed |

Analyzing cumulative abnormal returns in different market conditions

Cumulative abnormal returns (CARs) can exhibit different patterns and characteristics depending on the prevailing market conditions. Analyzing CARs in various market environments can provide valuable insights for investors seeking to maximize their returns.

In bullish market conditions, where the overall market is experiencing positive returns, CARs can be influenced by the general optimism and investor sentiment. Stocks with positive CARs may indicate their ability to outperform the broader market, potentially due to company-specific factors or their positioning within the industry. In these environments, investors may focus on identifying stocks with consistently positive CARs to capitalize on the market's upward trajectory.

Conversely, in bearish market conditions, where the overall market is experiencing negative returns, CARs can provide insights into the relative resilience of certain stocks. Stocks with less negative or even positive CARs during market downturns may be considered more defensive or resilient investments, as they have managed to outperform the broader market. Identifying these stocks can be particularly valuable for investors seeking to preserve capital or generate returns in challenging market environments.

In volatile or uncertain market conditions, the analysis of CARs becomes even more crucial. Periods of high market volatility can lead to significant fluctuations in stock prices and, consequently, in CARs. Investors may focus on identifying stocks with consistent or predictable CARs, as they may be better positioned to withstand market turbulence and provide more reliable investment opportunities.

Strategies for maximizing cumulative abnormal returns

Maximizing cumulative abnormal returns (CARs) is a key objective for many investors in the stock market. By understanding the factors that influence CARs and developing effective strategies, investors can potentially enhance their investment performance and achieve excess return.

One strategy for maximizing CARs is to focus on identifying undervalued stocks with the potential for positive CARs. This can involve in-depth fundamental analysis, considering factors such as a company’s financial health, growth prospects, and competitive positioning. By identifying stocks that are trading at a discount to their intrinsic value, investors can potentially capitalize on the market’s inefficiencies and generate excess returns as the stock’s price adjusts to its fair value.

| Strategy | Description | Potential Impact |

|---|---|---|

| Event-driven investing | Capitalizing on price movements around corporate events | May generate significant positive CARs if timed correctly |

| Earnings surprise exploitation | Trading based on unexpected earnings announcements | Can lead to positive CARs due to post-earnings announcement drift |

| Merger arbitrage | Profiting from price discrepancies in M&A situations | Potential for consistent, albeit smaller, positive CARs |

| Insider trading analysis | Monitoring and acting on legal insider trading information | May provide early signals for future price movements and CARs |

| Behavioral bias exploitation | Capitalizing on known market overreactions or underreactions | Can lead to contrarian profits and positive CARs |

| Sector rotation | Shifting investments to outperforming sectors | May enhance overall portfolio CARs through timely allocation |

Another strategy is to closely monitor and respond to company-specific events and news that can impact CARs. By staying informed about developments within a company, such as earnings announcements, product launches, or management changes, investors can anticipate potential CARs and adjust their investment positions accordingly. This can involve taking advantage of short-term price movements or positioning for longer-term positive CARs.

Diversification is also a crucial strategy for maximizing CARs. By investing in a portfolio of stocks with varying characteristics and risk profiles, investors can mitigate the impact of individual stock volatility and potentially enhance their overall CARs. This approach can help investors capture positive CARs from different sectors, industries, and market capitalizations, reducing the reliance on any single stock or sector.

Case studies on successful utilization of cumulative abnormal returns

The effective utilization of cumulative abnormal returns (CARs) has been a key factor in the success of many renowned investors and investment strategies. By analyzing CARs and incorporating them into their decision-making processes, these investors have been able to identify undervalued stocks, capitalize on market inefficiencies, and generate impressive investment returns.

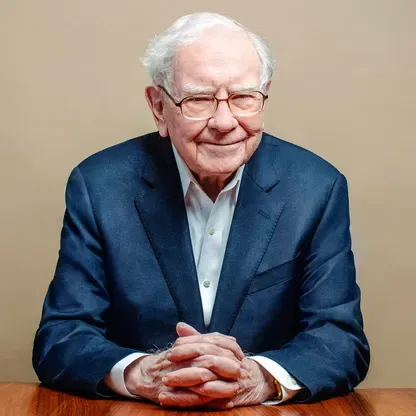

One prominent example is the investment approach of Warren Buffett, the legendary investor and chairman of Berkshire Hathaway. Buffett's value-investing strategy, which focuses on identifying undervalued companies with strong fundamentals, has been closely linked to the analysis of CARs. By carefully studying a company's historical performance, financial statements, and market position, Buffett has been able to identify stocks with the potential for positive CARs, often leading to significant long-term investment gains.

Another case study is the success of activist investors, who leverage CARs to identify underperforming companies and implement strategies to unlock shareholder value. These investors analyze a company's CARs to identify potential areas of improvement, such as operational inefficiencies, poor management, or underutilized assets. By engaging with the company's management and proposing strategic changes, activist investors can drive positive CARs and generate substantial returns for their investors.

| Study | Key Findings | Implications |

|---|---|---|

| Merger Announcements | Positive CARs for target firms, mixed results for acquirers | Potential for profitable trading strategies around M&A events |

| Earnings Surprises | Significant positive CARs following positive earnings surprises | Evidence of market inefficiency and potential for post-earnings announcement drift strategies |

| Stock Splits | Positive CARs around split announcements and ex-dates | Suggests information content in split decisions and potential for short-term gains |

| Dividend Announcements | Positive CARs for dividend increases, negative for decreases | Demonstrates signaling effect of dividend policy changes |

| CEO Turnover | Negative CARs for forced departures, positive for planned successions | Highlights importance of leadership stability and succession planning |

The utilization of CARs has also been a key component of quantitative investment strategies, where algorithms and machine learning models are used to analyze large datasets and identify stocks with the potential for positive CARs. These systematic approaches to investment decision-making have enabled hedge funds and other institutional investors to consistently outperform the broader market by effectively capitalizing on market inefficiencies.

Limitations and challenges in interpreting cumulative abnormal returns

While cumulative abnormal returns (CARs) provide valuable insights into a stock's performance, there are also limitations and challenges in interpreting these metrics that investors should be aware of.

One of the primary challenges is the issue of statistical significance. CARs can be affected by random market fluctuations, and it is essential to determine whether the observed CARs are statistically significant or simply the result of chance. Rigorous statistical analysis, including the use of t-tests and other statistical methods, is necessary to ensure the reliability and validity of CARs.

Another limitation is the potential for confounding events or information. When analyzing CARs, it can be challenging to isolate the impact of a specific event or news on a stock's performance, as multiple factors may be influencing the stock's returns simultaneously. This can make it difficult to attribute the observed CARs to a specific cause, leading to potential misinterpretations.

| Limitation/Challenge | Description | Implications |

|---|---|---|

| Model dependency | CARs rely on accurate estimation of expected returns | Biased results if the underlying model is misspecified |

| Event window selection | Choice of event window can significantly impact results | Potential for over or underestimation of event impact |

| Confounding events | Multiple events occurring within the same period | Difficulty in isolating the effect of a specific event |

| Sample selection bias | Non-random selection of firms for analysis | Results may not be generalizable to the broader market |

| Thin trading | Infrequent trading of some stocks | Can lead to biased estimates of abnormal returns |

| Cross-sectional correlation | Correlation among abnormal returns of different firms | May violate statistical assumptions in hypothesis testing |

| Long-horizon issues | Challenges in accurately measuring long-term abnormal returns | Potential for misinterpretation of long-term event impacts |

Additionally, the choice of the market model used to calculate expected returns can have a significant impact on the resulting CARs. Different models, such as the CAPM or the Fama-French three-factor model, may yield different expected returns and, consequently, different CARs. Investors must carefully consider the appropriateness of the market model used and its underlying assumptions.

FAQ

Q: What are Cumulative Abnormal Returns (CARs)?

A: Cumulative Abnormal Returns (CARs) measure the total deviation of a stock's actual returns from its expected returns over a specific time period. They provide insights into a stock's performance relative to the market.

Q: How are CARs calculated and what is the expected return?

A: CARs are calculated by first determining the expected returns of a stock using a market model, then subtracting these expected returns from the actual returns, and finally summing up these abnormal returns over the specified time period.

Q: Why are CARs important for investors?

A: CARs help investors identify undervalued or overvalued stocks, capitalize on market inefficiencies, and develop more effective investment strategies. They provide a comprehensive view of a stock's performance relative to market expectations.

Q: What factors influence CARs?

A: CARs can be influenced by company-specific news and events, market conditions, macroeconomic factors, and investor behavior and sentiment.

Q: Are there any limitations to using CARs in investment analysis?

A: Yes, there are limitations such as issues with statistical significance, confounding events, and the choice of market models used to calculate expected returns. It's important to consider these limitations when interpreting CARs.

Conclusion and key takeaways

In the dynamic world of stock market investing, understanding the concept of cumulative abnormal returns (CARs) is essential for maximizing investment returns. CARs provide a comprehensive measure of a stock's performance relative to the market, offering valuable insights into the factors influencing a stock's price movements.

By analyzing CARs, investors can identify undervalued or overvalued stocks, capitalize on market inefficiencies, and develop more effective investment strategies. Key factors influencing CARs include company-specific news and events, market conditions, macroeconomic factors, and investor behavior and sentiment.

The role of market efficiency is crucial in interpreting the significance of CARs. In efficient markets, the presence of persistent and statistically significant CARs may indicate market inefficiencies, while in less efficient markets, CARs can provide opportunities for investors to identify undervalued stocks and generate superior returns.

Strategies for maximizing CARs include focusing on undervalued stocks, closely monitoring company-specific events, and diversifying investments to mitigate the impact of individual stock volatility. The successful utilization of CARs has been a key component of the investment approaches of renowned investors and investment strategies.

Intrigued by the potential of Cumulative Abnormal Returns? Discover how value investing strategies can consistently generate these market-beating returns. Unlock the secrets of legendary investors like Warren Buffett and learn to identify undervalued stocks with our comprehensive free newsletter.

Don't leave money on the table. Join thousands of savvy investors and start your journey to consistently beating the market today!