If this quarter had a name, it would be MercadoPago. Yeah, I get it. You take Meli as an eCommerce company focused on growing its GMV. That’s simply not true.

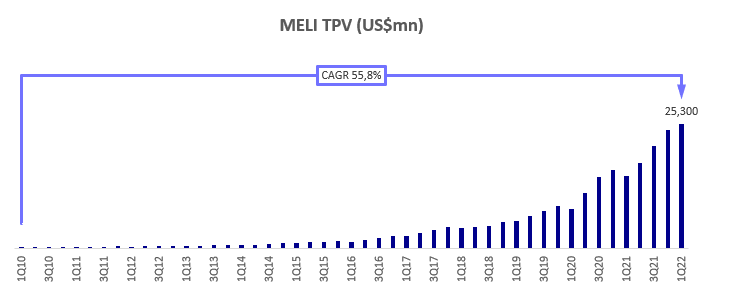

In the past 12 years, Meli’s TPV grew at a 55.8% annualized pace. Specifically, the past four quarters were absolutely unbelievable.

I underestimated TPV growth, fintech take rate, credit portfolio, and delinquency. As a result, MercadoPago beat me every quarter.

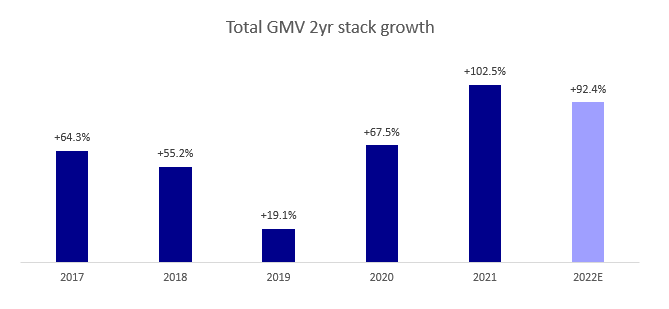

The marketplace growth has remained consistent for yet another quarter. Meli reached almost $7.7bn in GMV, +32% YoY, and maintained a 2-year stack growth above 70%.

Also, we estimate that Meli will end the year with a total GMV 2yr stack growth of 92.4%, versus Amazon’s 49.5% and Shopify’s 88.6%.

With almost 40mn unique buyers in the 1Q22, buyer behavior remains sticky. Total items per buyer continue to grow versus last year's pandemic impacted year.

As we mentioned in our last post about Meli’s marketplace, we're confident that the depth of product and category mix in the marketplace and the quality of Meli’s seller base place them in a unique position to drive continued growth with solid monetization in commerce.

The services attached to the marketplace are also continuing to expand. Specifically, the advertising business has been a consistent highlight in growth and margin structure and has almost doubled in revenue YoY.

Even though we estimate a penetration of 1% for Ads as a percentage of the GMV in 2022, we also believe this is a 70%+ operating margin, with little incremental capital and substantial profitability leverage going forward.

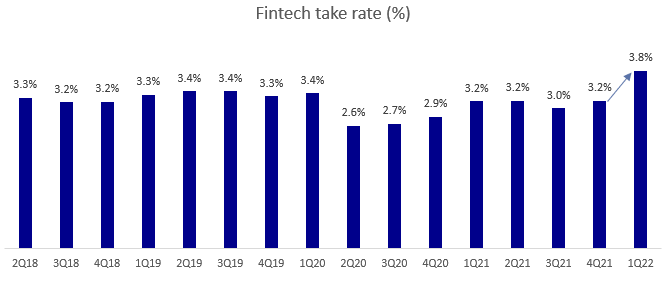

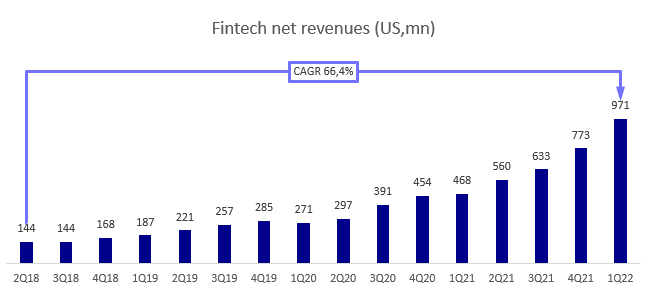

The positive highlight during the quarter was the Fintech business, boosted by the credit business, increasing the take rate by 60bps.

TPV surpassed $25bn for the first time ever and accelerated acquiring and digital account TPV with significant growth in overall Fintech take rates.

Pago had almost 36 million unique active users, growing across all geographies, boosted by higher engagement in wallet payments and the growth in credit users.

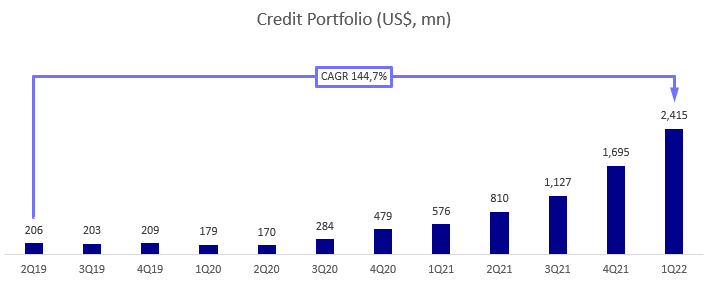

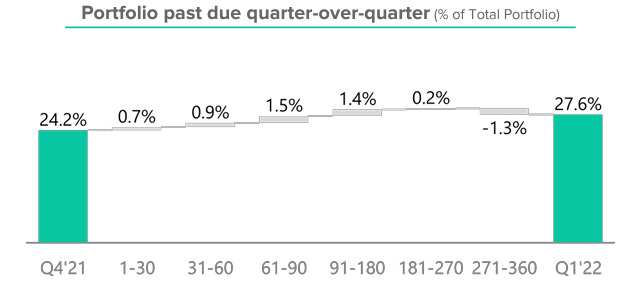

The credit portfolio continues to deliver consistent profitable growth while the credit books improve quarter after quarter.

Regarding the financial results, Meli achieved a new record in terms of total revenues, even higher than the fourth quarter of last year, with improvements in monetization in both commerce and Fintech.

Specifically, the Fintech revenue delivered a sound beat due to an increase in the take rate led by credit revenues. This is explained by US$1.7bn credit origination in the quarter, posting another substantial expansion in the portfolio credit.

Even though the NPL percentage of the portfolio moved from 24.2% to 27.6%, that is not a concern — for now.

Our channel check and management commented that 2/3 of the deterioration is due to product mix, and only 1/3 to a worsening condition. So with that in consideration, Meli has a slower deterioration vs. peers.

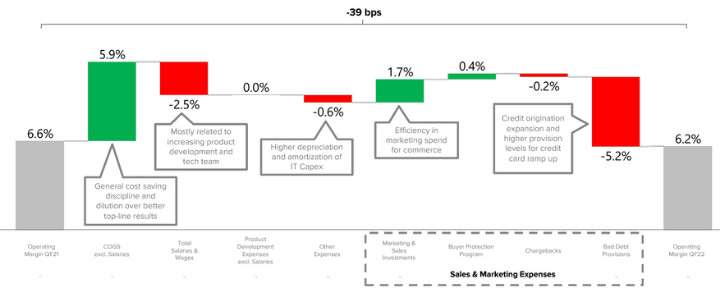

Also, gross margins have improved YoY with better operating leverage over the cost base. As a result, despite tough comps, Meli sustained consolidated EBIT margins at similar levels to 1Q21.

As illustrated below, Meli spent 250bps of its revenue, increasing its product and development team. This is primarily the increase of engineers.

In our view, these are the kind of investments that then unlock all sorts of software development and product improvements that should help Meli sustain growth. This is how tech companies deploy capital.

Instead of investing through Capex, they invest through Opex, compressing operational margins. As evidenced in our last Meli’s post, we estimate an accretive capital allocation from management based on ROIIC.

Finally, please, forget about the price to earnings when analyzing Meli. Its main drivers are not property, land, machinery, and inventory but patents, brands, clients, information technology, and people.

This group is not present on any balance sheet and is treated in accounting as an expense, generating distortion in both the balance sheet and financial statements.

These three factors — intangibles, the proliferation of managerial guidance, and delays in recognizing important corporate events — explain the distortion.

For its business nature, Meli acquires its customer through its marketing expense and, therefore, doesn’t capitalize it on its balance sheet.

We believe Meli is one of the most extraordinary companies in LatAm. None of its precious are on the balance sheet, so focus on cash flow. The value is there.