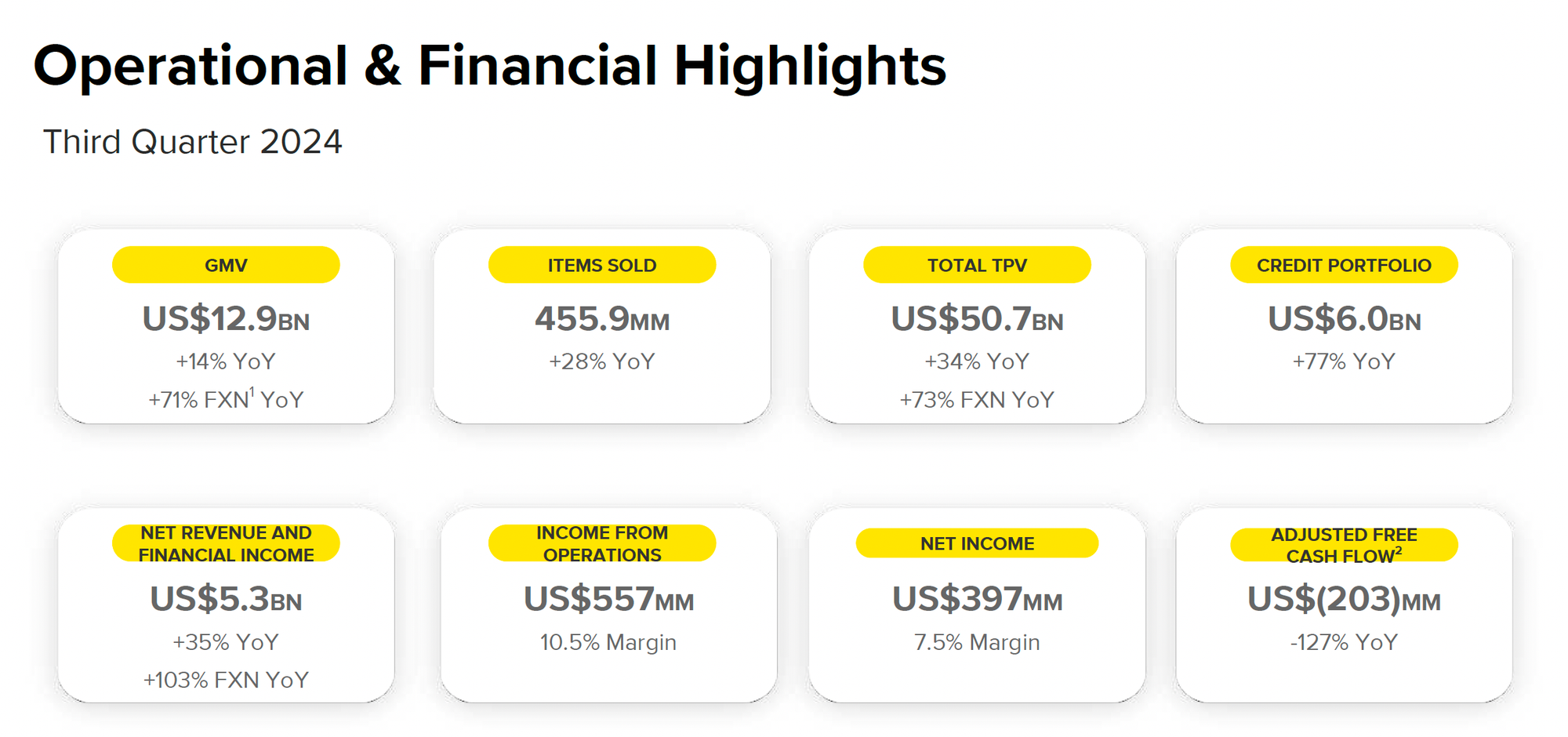

Latin America's leading e-commerce and fintech platform MercadoLibre reported strong third quarter 2024 results, demonstrating the continued shift of commerce and financial services online across the region. Net revenues surged 35% year-over-year to $5.3 billion, while income from operations reached $557 million with a 10.5% margin. The company leveraged its unrivaled ecosystem to drive market share gains and user engagement.

Financial Highlights

MercadoLibre posted robust top-line growth despite currency headwinds in key markets. Total payment volume (TPV) rose 34% to $50.7 billion, while gross merchandise volume (GMV) increased 14% to $12.9 billion, both on an FX-neutral basis. The two-speed growth reflects the company's strategic focus on expanding its higher-margin commerce and fintech offerings.

On a segment basis, Commerce revenues climbed 48% year-over-year, contributing $3.1 billion. Fintech revenues grew at a slower but still healthy 21% pace to $2.2 billion. Advertising revenues jumped 37%, reaching 2% of GMV as more merchants embraced the high ROI platform.

Operating margins contracted by 740 basis points to 10.5% on an adjusted basis, primarily due to deliberate credit portfolio expansion and logistics investments. CFO Martin de los Santos emphasized these are strategic decisions to capture long-term growth opportunities, noting

"we will continue to invest in fulfillment and business as usual as we have done it in the past."

Free cash flow remained solidly positive year-to-date at $635 million, providing ample dry powder. The company's investment grade balance sheet was recently validated by a credit rating upgrade from Fitch.

Commerce: Extending Market Leadership

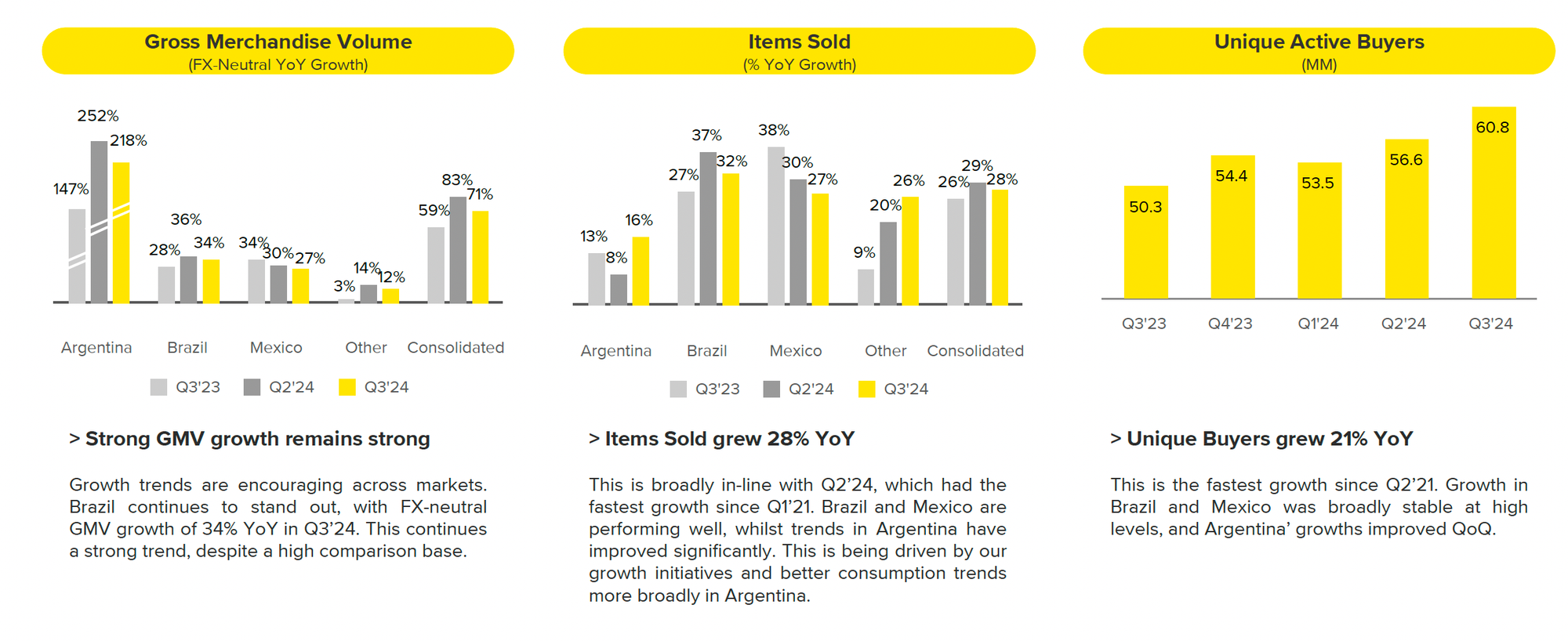

MercadoLibre's commerce business flourished as the company made strategic investments to drive the offline-to-online transition. Unique active buyers reached 60.8 million, jumping 21% year-over-year - the fastest growth since the pandemic. According to CEO Marcos Galperin, this even surpassed peak pandemic new user additions, reinforcing MercadoLibre's strengthening value proposition.

Brazil and Mexico were standout performers, with FX-neutral GMV soaring 34% and 27% respectively. Items sold spiked 28% to 456 million, near record levels, while Argentina saw improving momentum with 16% growth. To enhance the online shopping experience, MercadoLibre launched features like installation scheduling for auto parts, virtual makeup try-on, and dynamic pricing tools for sellers.

On the logistics front, the company opened 5 fulfillment centers in Brazil and 1 in Mexico during the quarter. While pressuring near-term margins, management views these investments as essential to its market leadership. Commerce President Ariel Szarfsztejn noted "fulfillment leads to higher GMV because of faster delivery promises, higher conversion rates, stronger buyer and seller NPS and from there, higher retention rates."

To further engage its user base, MercadoLibre split its loyalty program into "MELI+ Essencial" and "MELI+ Total" tiers. The lower priced Essencial plan offers free shipping and extra marketplace benefits, democratizing access, while Total includes content streaming perks. This personalized approach aims to drive even greater ecosystem adoption.

Fintech: The Next Frontier

MercadoLibre's fintech business maintained its torrid pace of profitable growth. Total payment volume surged 34% year-over-year to $50.7 billion. Fintech MAUs grew 35% to 56 million, powered by product innovation and strong engagement. The company's "power users," those transacting in at least 9 of the last 12 weeks, are growing at an even faster clip.

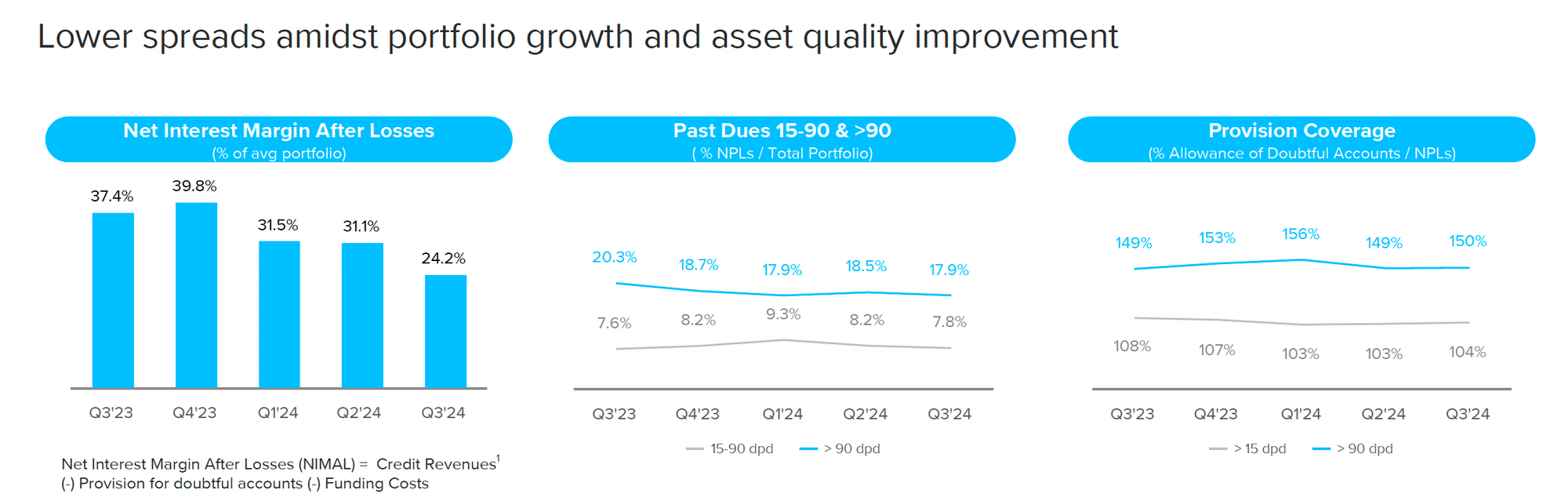

Mercado Pago's credit portfolio reached $6 billion, soaring 77% compared to Q3 2023. Management accelerated originations across consumer, merchant, and credit card books given improving risk models. The credit card portfolio grew a blistering 172% year-over-year to $2.3 billion. Fintech President Osvaldo Gimenez highlighted early credit card cohorts are exhibiting positive unit economics, providing a clear path to profitability as the portfolio matures.

Asset quality remained resilient with 15-90 day NPL ratios stable at 7.8%. The non-performing loan coverage ratio stayed above 100%. Net interest margins after loss (NIMAL) contracted to 24.2% primarily due to the credit mix shift towards lower-yielding cards. Management expressed confidence in the ROI of its credit investments, emphasizing stable delinquencies.

Off-platform total payment volume represented over 60% of Mercado Pago's TPV in both Brazil and Mexico, underscoring its growing popularity as a full-fledged fintech platform. The pace of active fintech user growth reaccelerated to 35% year-over-year, reaching 56.2 million. Assets under management soared 93% to $8 billion, anchored by strong adoption of Mercado Pago's remunerated account as the destination for user balances.

Investing For The Future

MercadoLibre's management struck an optimistic tone on the earnings call, highlighting the massive runway ahead given Latin America's still low e-commerce penetration. "We have a clear vision of the future and are focused on the long-term growth, profitability and cash flow generation our business," remarked Galperin.

Investments in three strategic areas – logistics, credit, and loyalty – will be key to sustaining MercadoLibre's heady growth. The company aims to more than double its Brazilian fulfillment footprint by 2025 to enhance delivery speeds. Meanwhile, Mercado Pago sees a significant greenfield opportunity to expand access to credit responsibly and cement user loyalty. Finally, the enhanced MELI+ program provides differentiated perks to consumers, incentivizing greater platform usage.

As a testament to management's execution, MercadoLibre regained investment grade status from credit rating agency Fitch during the quarter. With $4.4 billion in available liquidity, the company has significant firepower to extend its market leadership.

Bottom Line

In summary, MercadoLibre delivered another quarter of market-leading growth, demonstrating the power of its unrivaled e-commerce and fintech ecosystem in Latin America. The company's strategic investments in logistics capacity, its credit portfolio, and user loyalty programs position it strongly to sustain rapid, profitable expansion for the foreseeable future.

With e-commerce still in the early adoption phase across much of the region, MercadoLibre has a long growth runway ahead as it brings more consumers and businesses into the online economy. Strategic investments in logistics, credit, and user loyalty position the company to extend its market share gains across Latin America. With online penetration still in the early innings, MercadoLibre appears poised to maintain its blistering pace of growth and profitability for years to come.