As Mercado Libre (MELI) celebrates its 25th anniversary, the company's Q2 2024 earnings report demonstrates why it remains the undisputed leader in Latin American e-commerce and fintech. This analysis dives into the numbers, strategies, and implications of this quarter's results, which have surpassed analyst expectations and reinforced MELI's position as a key player in the region's digital economy. We'll examine Mercado Libre Inc's market data, key financial metrics, and its impact on the NASDAQ.

Financial Highlights: Impressive Growth Across the Board

Mercado Libre reported revenues of $5.1 billion for the quarter, representing a robust 42% year-over-year increase. This growth significantly outpaced analyst predictions, underlining the company's ability to capitalize on the increasing adoption of e-commerce and digital financial services across Latin America. The company's market cap and share price have reflected this positive performance, with investors closely watching MELI stock on the NASDAQ.

CFO Martin de Los Santos emphasized the strength of this performance, stating: 'We are super excited about all of our businesses and in particular, also the new businesses that are growing. Mercado Play, which is something relatively new, showing some positive signs so far. Meli Más, which we launched a year ago, performing very well.

The standout figure in this earnings report is undoubtedly the net income. At $531 million, it represents a remarkable 103% year-over-year growth. Even more impressive is the net income margin of 10.5%, the highest the company has achieved in eight years. This indicates that Mercado Libre is not just growing rapidly but also becoming increasingly efficient in converting revenue into profit.

Key performance metrics further illustrate Mercado Libre's strong quarter:

| Metric | Q2 2024 Value | YoY Growth |

|---|---|---|

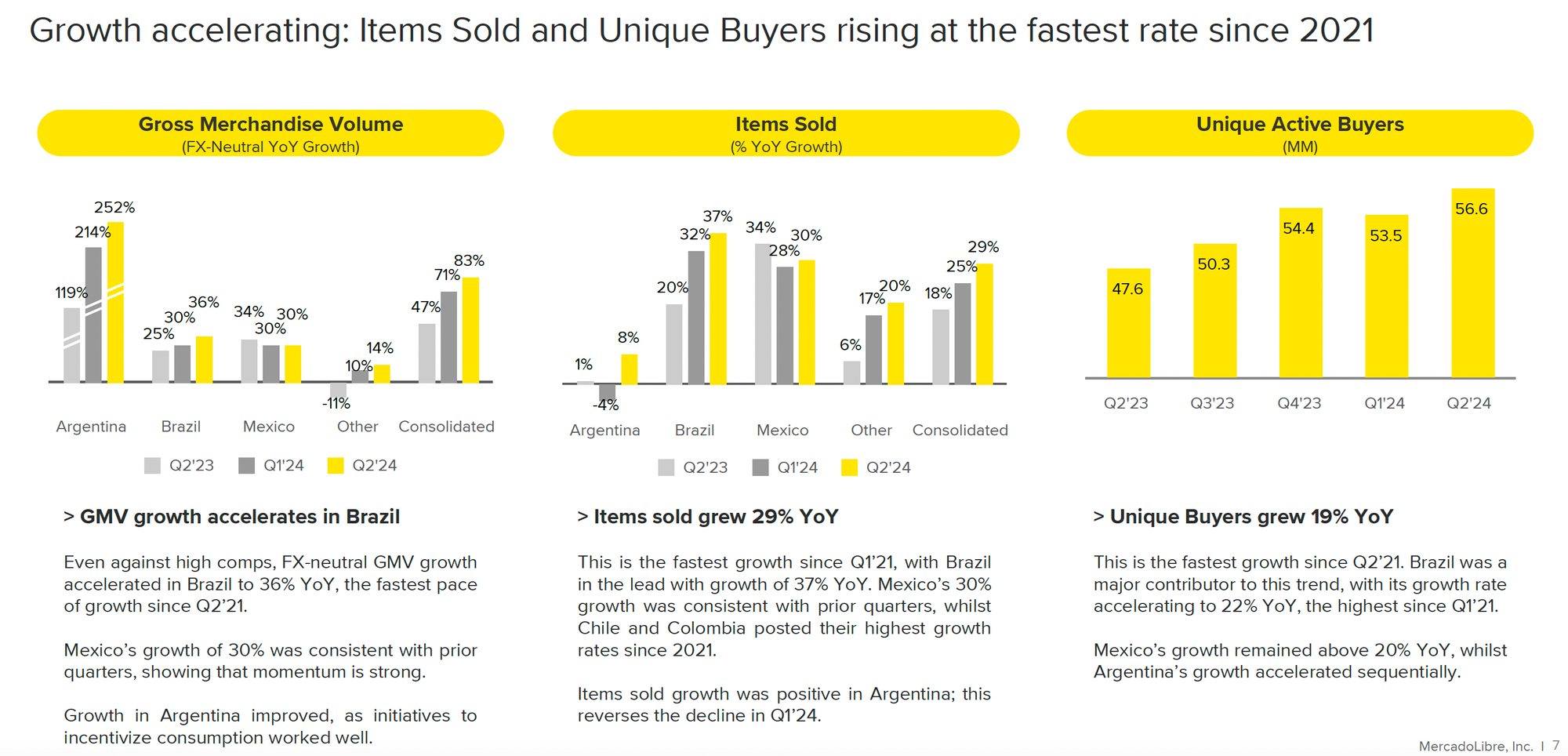

| Gross Merchandise Volume (GMV) | $12.6 billion | 20% (83% FX-neutral) |

| Total Payment Volume (TPV) | $46.3 billion | 36% (86% FX-neutral) |

| Unique Active Buyers | 56.6 million | 19% |

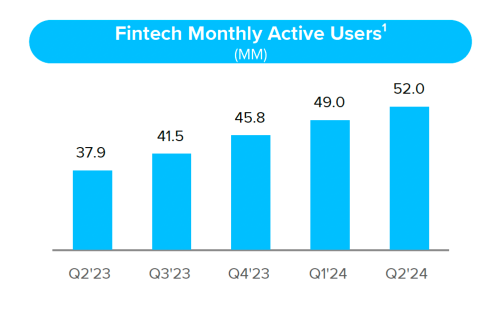

| Fintech Monthly Active Users | 50+ million | 37% |

These figures demonstrate Mercado Libre's success across its various business segments, from its core e-commerce operations to its expanding fintech services. The company's ability to maintain high growth rates in mature markets while also penetrating new ones speaks to the effectiveness of its strategies and the strength of its brand in Latin America. Investors and analysts are particularly interested in MELI's profitability measures and how they compare to industry benchmarks.

E-commerce: Sustained Growth in Core Markets

Mercado Libre's e-commerce platform remains the backbone of its success, demonstrating remarkable strength even in mature markets. The company's NASDAQ-listed stock (MELI) has benefited from this growth, with market data showing a 19% year-over-year increase in unique buyers.

This suggests that Mercado Libre Inc continues to expand its customer base and market share, defying expectations in a market some considered saturated. The company's ability to drive sales and commerce in Latin America has caught the attention of investors looking to buy or sell shares based on this positive performance.

Brazil, Mercado Libre's largest market, saw FX-neutral GMV growth accelerate to 36% year-over-year, the fastest pace since Q2 2021. This acceleration in a mature market is particularly impressive and suggests that Mercado Libre's strategies for growth and market penetration are highly effective. For a deeper dive into Mercado Libre's performance in Brazil, check out our analysis of the Brazilian e-commerce market.

Mexico maintained strong momentum with 30% GMV growth, demonstrating consistency that investors and analysts value. This performance indicates that Mercado Libre has successfully adapted its business model to thrive in different Latin American markets.

Martin de Los Santos highlighted the significance of this growth: 'I think if I had to highlight one is probably the surprise of continuing to gain market share in Brazil for several quarters. For more than a year now, every quarter, we continue to grow at a faster rate than the market at a very large scale.

Even in Argentina, which has faced significant economic challenges, Mercado Libre saw positive growth in items sold, reversing the decline seen in Q1 2024. This turnaround highlights the company's ability to navigate challenging economic conditions and adapt its strategies to local market dynamics.

Fintech: The Rising Star of Mercado Libre's Ecosystem

While e-commerce remains the foundation of Mercado Libre's business, the fintech segment is increasingly becoming a key driver of growth and profitability. The milestone of surpassing 50 million monthly active fintech users represents a digital financial ecosystem that's rapidly becoming an integral part of daily life for millions across Latin America.

The growth in Mercado Libre's fintech segment is reflected in its increasing Total Payment Volume (TPV) and the expansion of its credit portfolio. These services not only generate revenue through fees but also significantly contribute to the company's overall profitability and assets.

Investors tracking MELI stock on the NASDAQ are closely analyzing how these fintech innovations impact the company's financial statements, market valuation, and potential dividend yield. The fintech division's performance has become a key factor in Mercado Libre's equity story, influencing trading decisions and price targets set by market analysts.

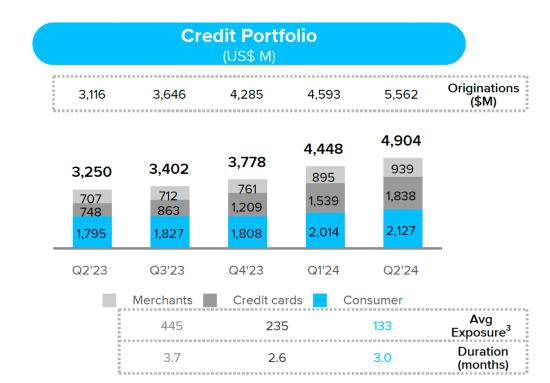

The credit portfolio grew to $4.9 billion, up 51% year-over-year, with the credit card business being a standout performer. This growth isn't just about issuing more credit; it's about deepening Mercado Libre's relationship with its users and increasing their engagement with the platform.

Osvaldo Giménez, Fintech President, commented on the credit card growth: "We are very excited with the evolution of all of our credit portfolios. We are seeing very good results in the earlier cohorts of the credit cards. We continue to see that the improvement in our scoring malls and shortening of the payback period for each cohort, that's why we have been growing the credit card portfolio."

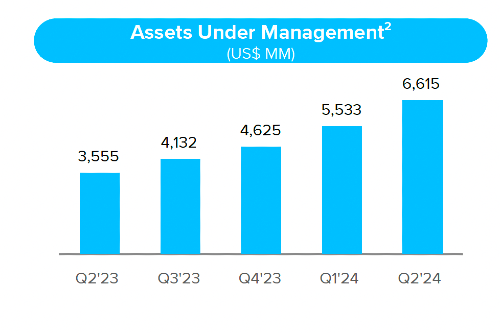

Assets Under Management (AUM) grew by an impressive 86% year-over-year to $6.6 billion. This growth speaks to the trust that users are placing in Mercado Libre as a financial services provider, not just an e-commerce platform. To understand the implications of this growth in AUM, read our analysis of fintech trends in Latin America.

The company's move to apply for a banking license in Mexico is a strategic decision that could open up new avenues for growth and cement Mercado Libre's position as a financial services leader in the region. This move aligns with the company's broader strategy of creating a comprehensive ecosystem of digital services for its users.

Challenges and Future Outlook

Despite the overwhelmingly positive results, it's important to acknowledge the challenges that Mercado Libre faces. The company operates in a region known for economic volatility and regulatory complexities. Currency fluctuations, particularly in Argentina, continue to impact results, though the company has shown remarkable skill in navigating these waters.

As Mercado Libre continues to grow, investors and analysts are meticulously monitoring its market data, key financial metrics, and news. The company's ability to maintain its high growth rate while improving profitability will be crucial for its stock performance on the NASDAQ. Potential investors considering whether to buy, sell, or hold MELI shares should carefully analyze these factors, along with broader market trends in the e-commerce and fintech industries.

Mercado Libre's performance relative to its competitors, its market cap evolution, and its strategy for addressing challenges in the Latin American market are all critical considerations for those interested in the stock.

The increase in provisions for doubtful accounts, rising from 6.2% to 8.9% of net sales year-over-year, is a reminder of the risks inherent in expanding credit offerings. However, management expressed confidence in the robustness of their credit models and the overall health of their loan portfolio. This increase in provisions warrants careful monitoring in future quarters to ensure it doesn't become a drag on profitability.

Management addressed this concern during the earnings call. Martin de Los Santos explained: "We are comfortable with the results we are seeing, that are the spreads we have are very, very healthy. And I think overall, we are comfortable with the credit portfolio."

Looking ahead, Mercado Libre seems well-positioned to continue its growth trajectory. The company's focus on improving logistics, expanding its fintech offerings, and deepening its ecosystem of services bodes well for future performance. The recent introduction of AI-generated answers to product questions and the expansion of its advertising business are examples of how MELI continues to innovate and add value to its platform.

Conclusion: A Latin American Success Story with Global Implications

Mercado Libre's Q2 2024 results are more than just an impressive set of numbers – they're a testament to the company's vision, execution, and the growing digital economy of Latin America. As the company celebrates its 25th anniversary, it's clear that MELI is not resting on its laurels but continuing to push boundaries and explore new frontiers in e-commerce and fintech.

As CEO Marcos Galperin stated: "We are as optimistic as ever about the opportunity that are ahead of us, and we're excited to pursue them with a culture of entrepreneurship, excellence and innovation that has served us well for the last 25 years. This is, therefore, a great moment to reaffirm our belief that the best is yet to come."

For investors, Mercado Libre represents a unique opportunity to tap into the growth potential of Latin America's digital economy. The company's ability to consistently outperform expectations and navigate regional challenges makes it a standout in the e-commerce and fintech sectors.

As we look to the future, one thing seems certain: Mercado Libre will continue to play a pivotal role in shaping the digital landscape of Latin America. Its success story offers valuable insights not just for those interested in Latin American markets but for anyone studying the evolution of e-commerce and fintech globally.

FAQ

Q: How does Mercado Libre's performance compare to other global e-commerce giants?

A: While direct comparisons can be challenging due to market differences, Mercado Libre's growth rates in GMV and user base are impressive even by global standards. Its ability to maintain high growth in mature markets like Brazil is particularly noteworthy.

Q: What are the key risks to Mercado Libre's continued growth?

A: Key risks include economic volatility in Latin America, currency fluctuations, increasing competition in both e-commerce and fintech sectors, and potential regulatory challenges as the company expands its financial services offerings.

Q: How is Mercado Libre addressing the challenge of logistics in Latin America?

A: Mercado Libre has been investing heavily in its logistics network, including fulfillment centers and last-mile delivery. The company's Mercado Envios service has been crucial in improving delivery times and reliability across the region.

Q: What role does Mercado Libre's advertising business play in its overall strategy?

A: Advertising is becoming an increasingly important revenue stream for Mercado Libre. It not only provides additional monetization of the platform's large user base but also helps sellers increase their visibility, thereby enhancing the overall marketplace ecosystem.

Want to stay updated on the latest developments in e-commerce and fintech in Latin America? Sign up for our newsletter to receive regular insights and analysis on companies like Mercado Libre and the evolving digital economy landscape in the region.