Today’s Outline

- Mercado Pago (Introduction)

- Business Breakdown

- Strategy

- Financial Analysis

Mercado Pago

To complement the Marketplace and enhance the user experience for buyers and sellers, MELI developed Mercado Pago, an integrated digital payments solution.

Mercado Pago was initially designed to facilitate transactions on Mercado Libre’s Marketplaces by providing a mechanism that allowed users to securely, quickly, and promptly send and receive payments.

Mercado Pago is a whole ecosystem of financial technology solutions in the digital and physical world, more significant than the Marketplace itself.

The digital payments solution enables any Mercado Libre registered user to securely and efficiently send and receive digital payments and pay for purchases made on any of Mercado Libre’s Marketplaces.

Beyond facilitating Marketplace transactions, MELI has expanded the array of Mercado Pago services to third parties outside Mercado Libre’s Marketplace over the years.

The company began first by satisfying the growing demand for online-based payment solutions by providing merchants with the necessary digital payment infrastructure for e-commerce to flourish in Latin America.

Today, Mercado Pago’s digital payments business not only allows merchants to facilitate checkout and payment processes on their websites through a branded or white label solution or software development kits.

It also enables users to simply transfer money to each other through the Mercado Pago website or the Mercado Pago app.

Through Mercado Pago, MELI brought trust to the merchant customer relationship, allowing online consumers to shop quickly and safely while giving them the confidence to share sensitive personal and financial data.

As MELI deployed their digitally-based payments solutions, they also observed that SME companies in the physical world were being underserved or overlooked by incumbent payment providers.

Mercado Pago is a powerful disruptive provider of end-to-end financial technology solutions that will generate financial inclusion for segments of the population that have been historically underserved and operate in the informal economy today.

- In-store physical payments by selling mobile point of sale (“MPOS”) devices and through quick response (“QR”) payment codes;

- Digital payment solutions for utilities, mobile phone top-up, peer-to-peer payments, and more through the mobile wallet;

- Pre-paid cards and debit cards for users to spend and withdraw their account balances from their Mercado Pago wallet;

- Merchant and consumer credits, both on and off the Mercado Libre Marketplace, and credit cards.

Mercado Credito, the credit solution, leverages the user base, which is not only loyal and engaged but has also been historically underserved or overlooked by financial institutions and suffers from a lack of access to needed credit.

Facilitating credit is a crucial service overlay that enables us to further strengthen the engagement and lock-in rate of Meli’s users while also generating additional touchpoints and incentives to use Mercado Pago as an end-to-end financial solution.

The distribution capabilities and in-depth understanding of merchants’ sales on the Mercado Libre Marketplace have also allowed MELI to develop their own proprietary credit risk models with unique data that differentiate the scoring from traditional financial institutions.

Meli offers credit lines to both online merchants and MPOS device users. Because online merchants’ business flows through Mercado Pago, MELI collects principal and interest payments from their existing sales on the Marketplace, meaningfully reducing the risk on the loans.

Consumers can access credit lines through MELI once they score and approve them through Meli’s proprietary models.

Loans can be used for a purchase on the Marketplace or for a payment on another website where the payment solution is available at checkout.

Since 2019, MELI also has extended personal loans to recurring consumer credit borrowers, allowing them to buy products and services outside the platform.

In 2021, MELI launched the first Mercado Pago credit card in Brazil, which is free, internationally accepted, and digitally managed.

The credit card allows users to pay additional installments for purchases on the Marketplace and accrue extra points to their user loyalty program.

Business Breakdown

On-platform

Payment service provider (PSP): payments processing services provided to Mercado Libre, allowing platform users to securely, efficiently, and promptly send and receive payments online.

The remuneration for such services is not considered fintech revenue because it is bundled in the take rate sellers are charged on their sales of products and services on the platform.

For accounting purposes, the PSP revenue is booked as commerce revenues.

Discount of receivables: users can pay for goods purchased in installments using Mercado Pago. MELI negotiates better discounts than its sellers could get alone from a bank, which allows Pago to earn a spread on the operations.

Based on commissions from additional fees charged when a buyer elects to pay in installments through the Mercado Pago platform for transactions on the Marketplace, reducing the credit risk.

Mercado Credito: the platform started to originate loans to selected merchants in 2016, given its in-depth understanding of their sales on the Mercado Libre Marketplace. The company earns interest rates over credit originated.

Off-platform

Merchant services: PSP/gateway services to online retailers operating outside Mercado Libre’s Marketplace.

Based on commissions charged to sellers (as a percentage of the processed payment volume) and commissions from additional fees charged when a buyer elects to pay in installments through the Mercado Pago platform in off-marketplace transactions.

Mobile point of sales (mPOS): Mercado Pago sells mPOS devices for SMEs in Brazil, Argentina, and Mexico. The company monetizes from commissions charged to merchants (MDRs) and the prepayment business.

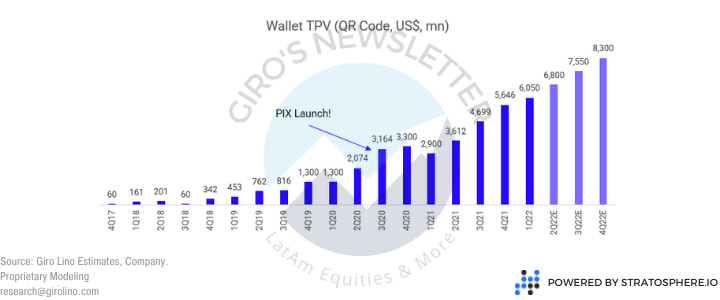

Wallet: cash deposit /investments, money transfers, online and offline payments (with QR codes), pre-paid cards, credit cards, cash withdrawals, bill payments, mobile phone top-ups, insurance, and other features.

Mercado Credito: Pago also offers credit to mPOS merchants and consumers (such as users of Mercado Pago’s digital account). The company earns interest rates over credit originated. It started to gain traction only in 2021.

Strategy

Wallet

In 2018, before PIX, many wallet initiatives were created to replicate Venmo, Square, and traditional wallets. The concept is relatively simple: you can transfer funds to anyone in the system for free and instantly.

By then, PicPay was the dominant player, especially after they came up with the idea of transferring funds using credit cards. So, if you wish to transfer the funds but don’t have cash, you could use your credit card instead.

Mercado Pago was going in the same way. They had this page inside the wallet, which was called Amigos, and you could transfer to your friends, though PicPay’s solution was insanely better for customers.

When PIX was launched, the whole business came down quickly. First, PicPay subsidized the interchange and the network fee for customers, which is very expensive.

Second, there were a record number of fraudulent transactions. For instance, one could pay someone to generate a massive reward at the company's expense.

Third, for transactions out of the system, you had to request a traditional wire transfer, which is expensive and a sub-optimal solution.

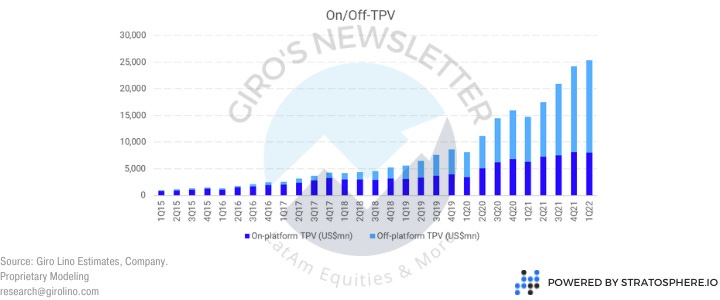

When Pix came out, MELI did what they do best: adapt quickly. They were an early adopter of the Pix solution, including as a payment initiator, and shifted the entire wallet monetization toward P2B transactions.

While PicPay struggled to insist on the same strategy, Mercado Pago offered Pix for free for P2P transactions and ramped the QR Code for P2B, which was a successful strategy.

Merchants / Customers

Mercado Pago’s strategy for merchants is, and always will be the same, facilitating the connection between buyers and sellers. Again, we’ll consider Pix as an example.

Considering the scenario a year before the Pix was launched, the product was terrible for Mercado Pago. Most of the strategy was to boost transactions in-platform.

However, Mercado Pago can offer Pix for its Marketplace business. Moreover, since they are certified by the Brazilian Central Bank as a PSP, Mercado Pago could deploy both in and out platform growth strategies.

Pix is a great product, so there is no surprise that Mercado Pago adopted it quickly. The maintenance cost for participants is low for being connected to the Brazilian Central Bank system.

Considering the Mercado Pago checkout, Pix is making it cheaper, so they offer it as an alternative to its clients, making good profits from it.

Even though we do not believe the company will have this profitability for this sort of transaction for good, it’s impossible to recognize their ability to adapt.

Another example is the BNPL using Pix. This time, they assume responsibility for analyzing the credit score of each customer and setting the fee.

Even though many fintechs were calling this transaction category riskless and changing the terminology “credit spread” for “take-rate,” it’s a credit operation.

The difference between allowing a BNPL for a Pix transaction instead of a card is that Mercado Pago will enable customers not included in the financial system to purchase on the Marketplace.

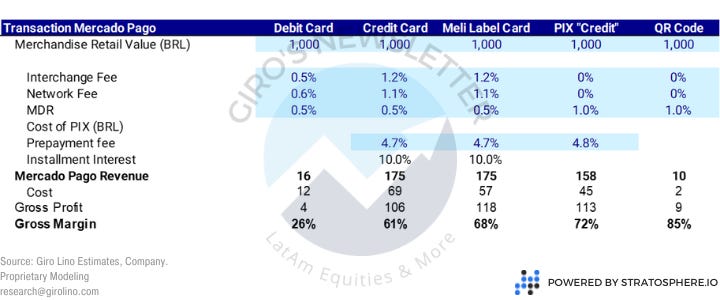

Finally, according to our proprietary analysis, Mercado Pago improves its profitability by creating new means for connecting buyers and sellers with superior margins products.

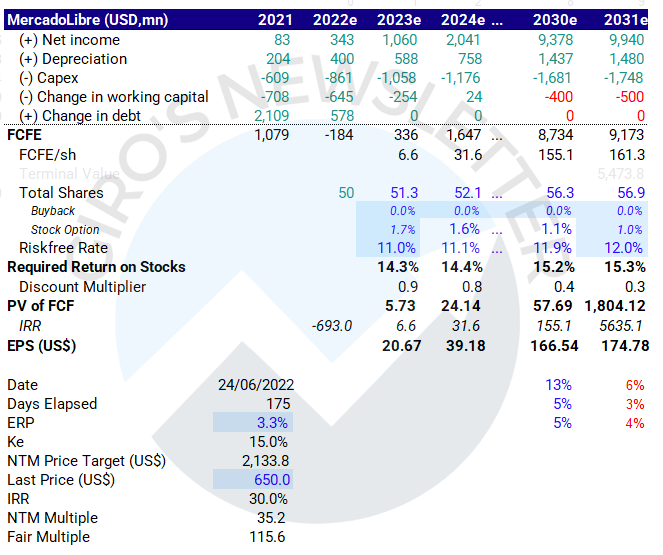

Financial Analysis

Payment

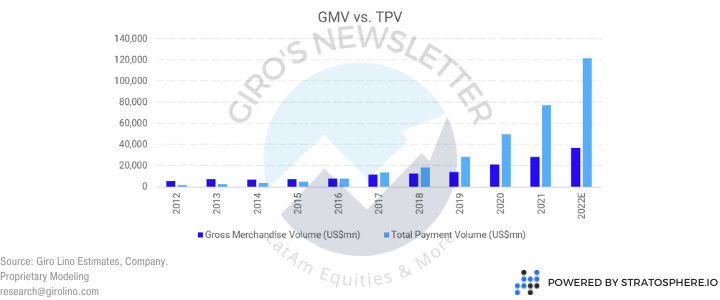

The payment business aggregates the processing business (in/off-platform and wallet) and the prepayment operation.

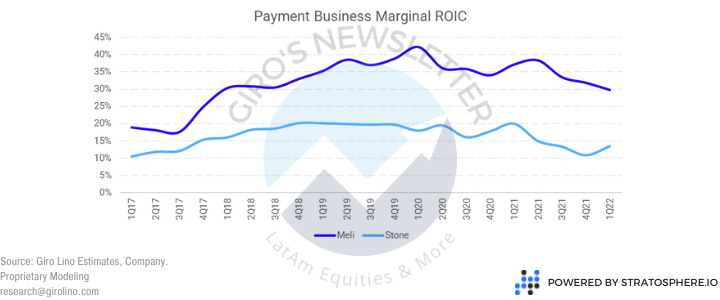

In this case, the closest peers would be the Brazilian acquiring companies, such as Stone, Pagseguro, Cielo, and Getnet.

Initially, the Marketplace's success generated colossal traction for its payment business through in-platform transactions.

For the following years, we believe that most of the growth will come from off-platform volumes, such as QR Code payment and merchant solutions, pushing Pago as one of the dominant players in the market in the following years.

However, unlike traditional acquirers, which are asset-heavy, Mercado Pago is an excellent business, presenting an unparalleled competitive advantage.

A significant portion of the superior profitability comes from the products mentioned in the previous section.

Through the Marketplace, the company leverages its payment business enabling more customers to access online items.

So, Mercado Pago has had an impressively stable take-rate throughout the years, remaining very competitive in traditional acquiring (minimize churn) while yielding juicy profitability in different products.

By maintaining a competitive fee in traditional acquiring, and higher fees in the different products, the company minimizes its churn, reducing friction in higher rate periods and, therefore, the CAC.

We diverge from the consensus when they mention the company charges higher fees for its clients. Instead, we believe that Mercado Pago generates a considerable gain for society, creating means for allowing new customers to join the system.

Also, Mercado Pago has been sharing gains of scale with its customers, offering a similar yield to Stone, for instance.

Even though the cost for the final customer is the same, Mercado Pago manages to keep its take rate above its peers through innovative products.

The take rate is superior, and the company is the lowest cost provider in the industry, distributing the product through the most significant Marketplace business in LatAm.

We believe the company operates with unparalleled competitive advantages, with higher profitability and lower cost to distribute its products, pushing the ROIC.

If you don’t wish to learn about technicalities regarding a credit operation, skip to the next section.

Credit

Until recently, Mercado Credito was a smaller business inside Mercado Pago, with minimal disclosure. It took us a lot of time to uncrack this one.

By the end of 2020, when $MELI received its IF license (Financial Institution), which allowed the company to collect deposits to fund its lending business through RDBs, the business gained traction.

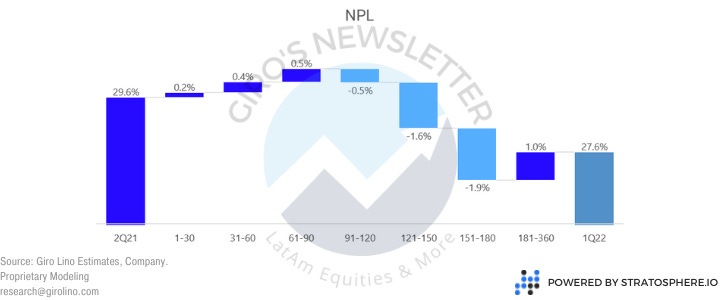

In the past couple of years, the credit portfolio grew from US$180mn to ~US$2.5bn in the 1Q22. So naturally, that raised questions from investors regarding the soaring provisioning.

In our opinion, Mercado Pago is executing its credit portfolio well, and NPLs will improve from 2023 onward. As a result, we believe it’ll be essential growth leverage in the following years.

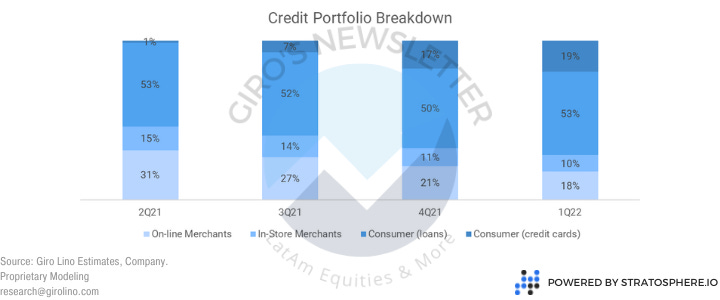

First, we need to consider the product mix is evolving. The company has been slowly introducing new products, such as credit cards and personal loans, and testing them.

The credit card strategy, in particular, reminds Nubank’s approach, releasing a small credit limit for new customers and increasing it as the customer proves himself as a good payer.

Second, we can’t evaluate Mercado Pago’s credit business without a broader context on how the company reports its provisioning since the company adopts different accountant practices compared to Brazilian banks.

Under accounting practices adopted in Brazil applicable to institutions authorized to operate by the Central Bank, loans are generally carried at cost and report losses under IAS 39.

As of March 31, 2000, loans should be categorized into 9 categories, and the minimum allowance is determined by applying specific percentages to each category.

Loans are classified following management’s judgment of the risk level, considering the economic situation, past experience, and specific risks concerning the transactions, the debtors, and the guarantors.

The regulation requires a systematic analysis of the portfolio and its classification, by risk level, into 9 categories between AA (minimum risk) and H (maximum risk - loss).

The minimum allowance is determined by applying specific percentages to the loans in each category, which vary on the product and customer.

Income from credit operations overdue for more than 60 days, independent from risk level, is only recognized as revenue when effectively received. Operations classified as level H remain in such classification for nine months.

After this time, the loan is charged against the existing allowance and remains controlled in memorandum accounts for five years, no longer appearing on the balance sheet.

Suppose there is objective evidence that an impairment loss on loans and receivables investments has been incurred.

In that case, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate.

The carrying amount of the asset is reduced through an allowance account, and the amount of the loss is recognized in the income statement.

However, Mercado Pago doesn’t report under IAS 39 but through IFRS 9, using ECL (expected credit losses), which is entirely different.

As commented, under IAS 39, impairment allowances were measured according to an ‘incurred’ loss model wherein the recognition of credit loss allowances was triggered by loss events after origination.

Losses ‘incurred but not reported’ were evaluated using diverse provisioning approaches, varying between banks and countries, such as we commented for Brazil.

The IFRS 9 impairment model requires impairment allowances for all exposures from the time a loan is originated, based on the deterioration of credit risk since initial recognition.

If the credit risk has not increased significantly (Stage 1), IFRS 9 requires allowances based on 12-month expected losses.

If the credit risk has increased significantly (Stage 2) and if the loan is “credit impaired” (Stage 3), the standard requires allowances based on lifetime expected losses.

The assessment of whether a loan has experienced a significant increase in credit risk varies by product and risk segment. It requires the use of quantitative criteria and experienced credit risk judgment.

Mercado Pago’s approach is ultimately quantitative since they’ve been gathering and processing data since 2004. It means that the company has an entire credit bureau at its disposal.

Primarily operating in countries such as Argentina and Brazil, Mercado Pago understands how default rate behaves under different economic scenarios, which is an advantage that will take years for many players to replicate.

Finally, as opposed to IAS 39, which required a historically estimate approach, IFRS 9 requires multiple forward-looking macro-economic and workout scenarios to estimate expected credit losses.

As highlighted previously, we believe that Mercado Pago’s short NPLs are impacted by a product mix change. According to our estimates, credit card accounted for 19% of the credit portfolio in the last quarter, from 1% last year.

Nevertheless, we’ve seen a tremendous improvement in long NPLs, which is a great leading indicator for the personal loan business, launched last year.

Still, we believe credit card will increase to ~25%, so we think that short NPLs will be pressured in the following quarters, but with promising expectations for the following cohorts.

Surprisingly, Mercado Credito already presents a very profitable operation, with a ROA close to 6%. We’ll keep to our conservative stance and not consider any profitability gain, even though all evidence suggests otherwise.

For curiosity, our ROE estimates for Nubank’s personal loan and credit card business are 60% and 80%, respectively. For Meli, we don’t see the company managing risk as well as Nu, but our ROE ranges from 30%-40%, which is also great.