As a long-time Microsoft shareholder, I've watched the company evolve through various tech revolutions. But none has excited me quite like the current AI boom. Recently, I found myself pondering a crucial question: How can we quantify AI's actual value for Microsoft?

Like many of you, I've been inundated with headlines about AI's potential. But as an investor, I needed more than just hype. I wanted to understand the concrete impact AI could have on Microsoft's bottom line and, ultimately, its value as a company.

This quest led me down a rabbit hole of financial models, market projections, and technology forecasts. I've spent countless hours poring over reports, crunching numbers, and analyzing trends. Why? Because I believe that to truly grasp AI's transformative potential for Microsoft, we need to move beyond buzzwords and look at the hard data.

In this post, I'm excited to share my findings with you. We'll dive into the key assumptions that underpin AI's potential to be truly transformational for Microsoft. We'll explore questions like: What growth rates do we need to see in AI adoption? How might AI impact Microsoft's various business segments? What level of investment is required, and what returns can we reasonably expect?

My goal is to provide you, whether you're a fellow shareholder, a potential investor, or simply someone interested in the intersection of AI and business, with a clearer picture of what AI could mean for Microsoft's future.

So, if you've ever found yourself wondering how to separate AI fact from fiction in the context of company valuation, you're in the right place. Let's embark on this analytical journey together and see what the numbers tell us about Microsoft's AI-driven future.

Ready to dive into the data? Let's get started!

Microsoft: Leading the AI Revolution

Microsoft stands on the brink of a significant transformation driven by the rapid evolution of Artificial Intelligence (AI). With a rich history of innovation and a dominant presence in enterprise software and cloud computing markets, the company is well-positioned to capitalize on the next wave of technological advancements.

Microsoft's Legacy and Current Position

Since its founding in 1975, Microsoft has been a driving force in the technology industry. The company has evolved from its roots in operating systems and productivity software to become a diversified giant, with offerings spanning cloud computing, gaming, and now, advanced AI.

Today, Microsoft operates across three main segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Each of these segments is being reimagined and enhanced by the integration of AI.

Microsoft's AI Strategy

Microsoft's approach to AI isn't just about developing cutting-edge technologies, but integrating AI capabilities across its entire product line. From Azure AI to GitHub Copilot, and from Microsoft 365 Copilot to Bing AI, the company is weaving artificial intelligence into the fabric of its offerings.

This strategy leverages Microsoft's strengths across the technology stack. The company's vast cloud infrastructure provides the necessary computing power for AI workloads, while its widely-used productivity tools offer a perfect platform for deploying AI assistants. Meanwhile, Microsoft's developer tools are being enhanced with AI capabilities, potentially revolutionizing the software development process.

Financial Implications of AI Integration

The integration of AI across Microsoft's portfolio is expected to have a transformative effect on the company's financial performance. Our analysis suggests that AI initiatives could add 4-6 percentage points to Microsoft's overall revenue growth rate in the coming years. By fiscal year 2030, AI-related revenues could contribute over $100 billion to Microsoft's top line.

Microsoft's Journey: From Software Giant to AI Pioneer

Microsoft's evolution from a software-centric company to a global technology leader is a testament to its adaptability and vision. Today, with a market capitalization exceeding $2.5 trillion, Microsoft stands as one of the world's most valuable companies, known for its innovative spirit and diverse portfolio of products and services.

The company's journey has been marked by significant milestones. The release of Windows 95 revolutionized personal computing, while the launch of the Xbox in 2001 marked Microsoft's successful entry into the gaming industry. More recently, strategic acquisitions such as LinkedIn in 2016 and GitHub in 2018 have expanded Microsoft's reach in professional networking and developer tools.

Under the leadership of CEO Satya Nadella, who took the helm in 2014, Microsoft has undergone a dramatic transformation. Nadella's "cloud-first, mobile-first" strategy shifted the company's focus towards cloud computing and services, a move that has paid off handsomely. The pending acquisition of Activision Blizzard, announced in 2022, signals Microsoft's continued commitment to expanding its gaming portfolio.

Today, Microsoft's business is organized into three main segments, each playing a crucial role in the company's AI-driven future:

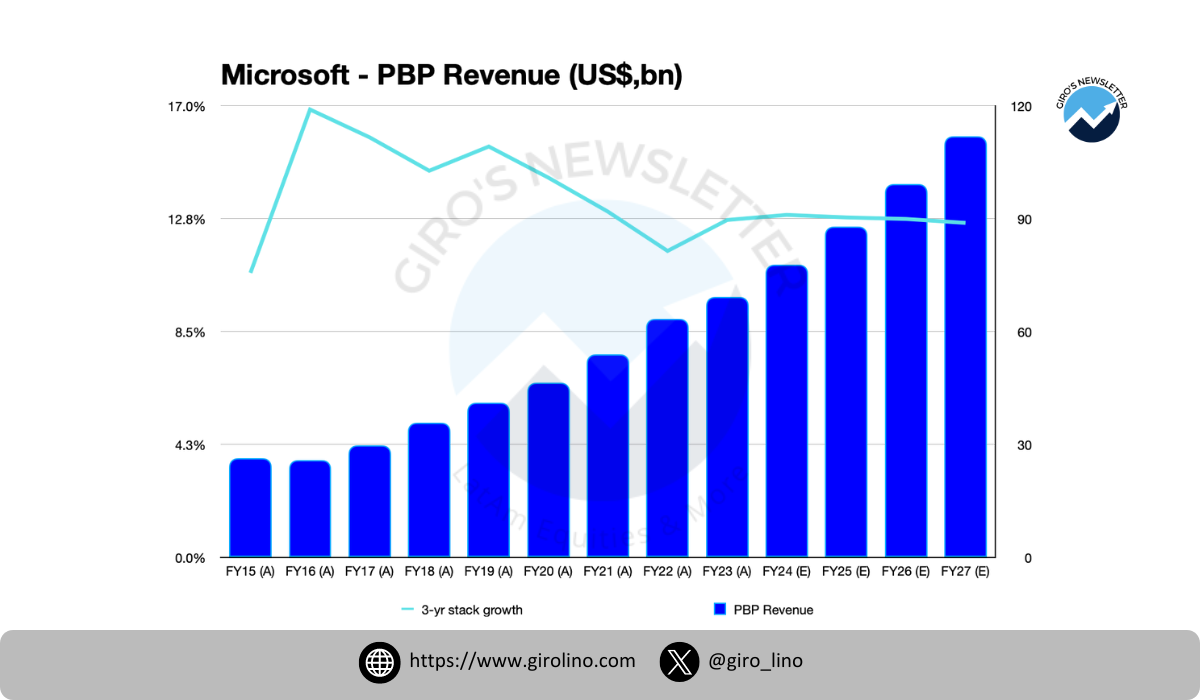

Productivity and Business Processes (PBP) is the backbone of Microsoft's enterprise offerings. This segment includes the Office 365 suite, Dynamics 365, and LinkedIn. In fiscal year 2023, PBP generated $69.3 billion in revenue, accounting for 32.7% of Microsoft's total revenue. Integrating AI into these products, particularly through Microsoft 365 Copilot, promises to revolutionize workplace productivity.

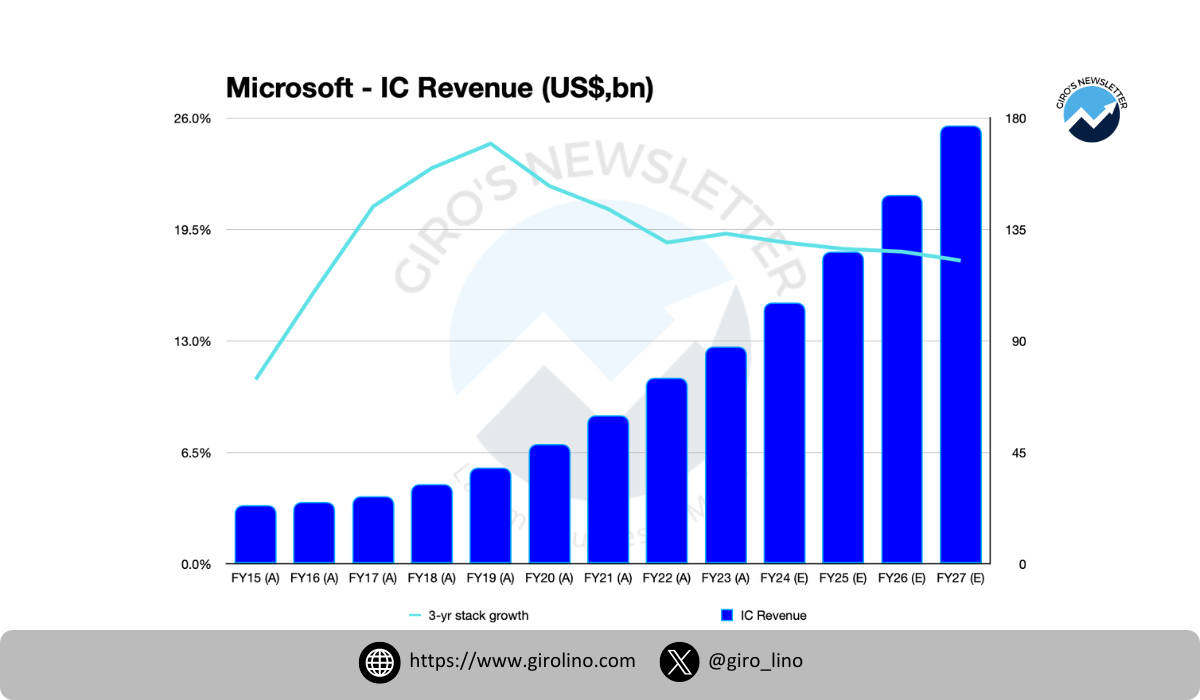

Intelligent Cloud (IC) is Microsoft's fastest-growing segment, driven by the rapid expansion of Azure. This segment, which includes Azure, server products, and enterprise services, brought in $87.9 billion in FY2023, representing 41.5% of total revenue. Azure's AI services are at the forefront of Microsoft's AI strategy, offering a comprehensive suite of tools for businesses to build and deploy AI solutions.

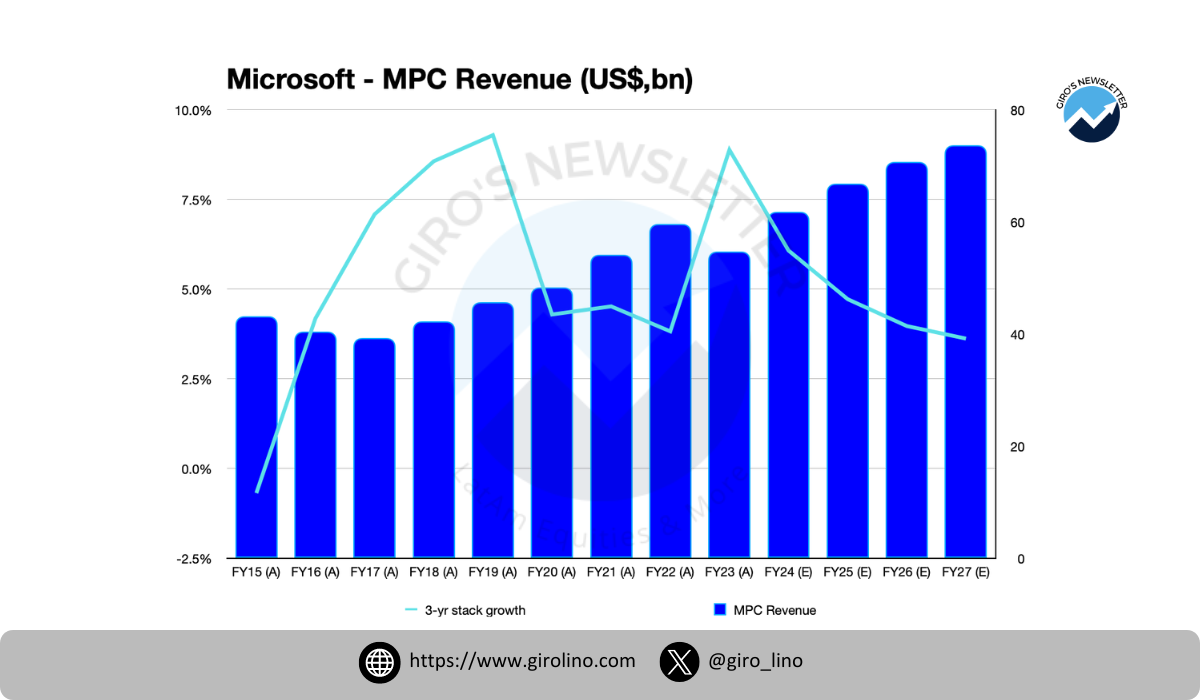

More Personal Computing (MPC) encompasses Windows, devices, gaming, and search advertising. While this segment faces challenges in the PC market, it's being reinvigorated by AI integration. In FY2023, MPC contributed $54.7 billion, or 25.8% of total r,evenue. Incorporating AI into Windows, Bing, and gaming experiences presents new opportunities for growth in this segment.

Microsoft's AI initiatives span across all these segments, creating a synergistic effect that enhances the value proposition of its entire product ecosystem. The company's exclusive partnership with OpenAI, coupled with its own research and development efforts, has positioned Microsoft as a leader in the AI revolution.

As we look to the future, Microsoft's strong financial position, diverse product portfolio, and strategic focus on AI create a compelling narrative for continued growth and innovation. The company's ability to integrate AI across its existing products and services, combined with its strong presence in cloud computing, provides a unique advantage in capitalizing on the AI revolution.

In the following sections, we'll examine Microsoft's financial performance, examine its AI strategy in detail, and explore how these initiatives are likely to shape the company's future. We'll also consider Microsoft's risks and challenges as it navigates this exciting but complex landscape.

Core Business Financial Analysis: A Foundation for AI-Driven Growth

Microsoft's core business continues to demonstrate robust growth and profitability, providing a solid foundation for its ambitious AI initiatives. To fully appreciate the potential impact of AI on Microsoft's future, we must first understand the company's current financial position and the performance of its key segments.

Productivity and Business Processes: The Backbone of Enterprise Solutions

Microsoft's Productivity and Business Processes (PBP) segment has consistently performed, showcasing the company's strength in enterprise software. PBP is a powerhouse of profitability with a projected compound annual growth rate (CAGR) of 13% from FY2023 to FY2030 and a consolidated gross margin of 80%.

The success of PBP is largely driven by the strong adoption of Microsoft 365, particularly in commercial markets. The shift towards cloud-based productivity solutions has accelerated in recent years, a trend that Microsoft has capitalized on effectively. Additionally, LinkedIn's continued growth in professional networking and hiring solutions has contributed significantly to this segment's performance.

Looking ahead, the integration of AI capabilities into Microsoft 365 through Copilot is expected to drive further growth and cement Microsoft's position in the enterprise productivity market. This AI-enhanced offering has the potential to increase customer retention and create upselling opportunities, potentially accelerating the segment's growth beyond current projections.

Intelligent Cloud: The Engine of Microsoft's Growth

At the heart of the Intelligent Cloud segment lies Azure, Microsoft's cloud computing platform, which has emerged as the primary growth driver and a cornerstone of Microsoft's AI strategy. Azure's performance and projections tell a compelling growth story with significant implications for Microsoft's future.

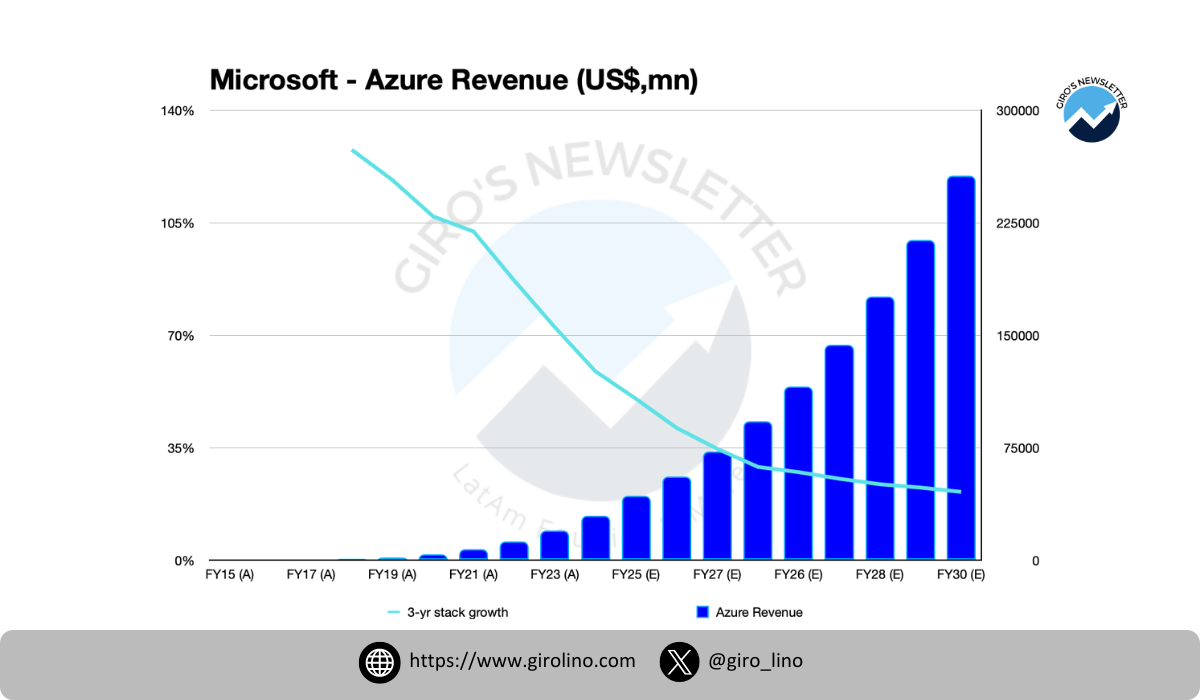

Azure's revenue growth has been nothing short of spectacular, soaring from $898 million in FY2015 to $55,942 million in FY2023, representing a compound annual growth rate (CAGR) of 61.7%. Looking ahead, projections suggest Azure could reach $256,587 million by FY2030, implying a CAGR of 24.3% from FY2023 to FY2030. While the year-over-year growth rate is naturally decelerating as the business scales - from 99% in FY2018 to 29% in FY2023 - the absolute dollar growth remains impressive. Net new revenue increased from $3,566 million in FY2018 to $12,725 million in FY2023, showcasing Azure's ability to maintain strong growth even as it reaches a significant scale.

The three-year stack growth rate, which smooths out short-term fluctuations, has remained robust. It stood at 127.8% in FY2020 and is projected to be 21.3% by FY2030, indicating sustained long-term growth potential. This consistent performance underscores Azure's central role in Microsoft's cloud strategy and its ability to capture a significant share of the expanding cloud market.

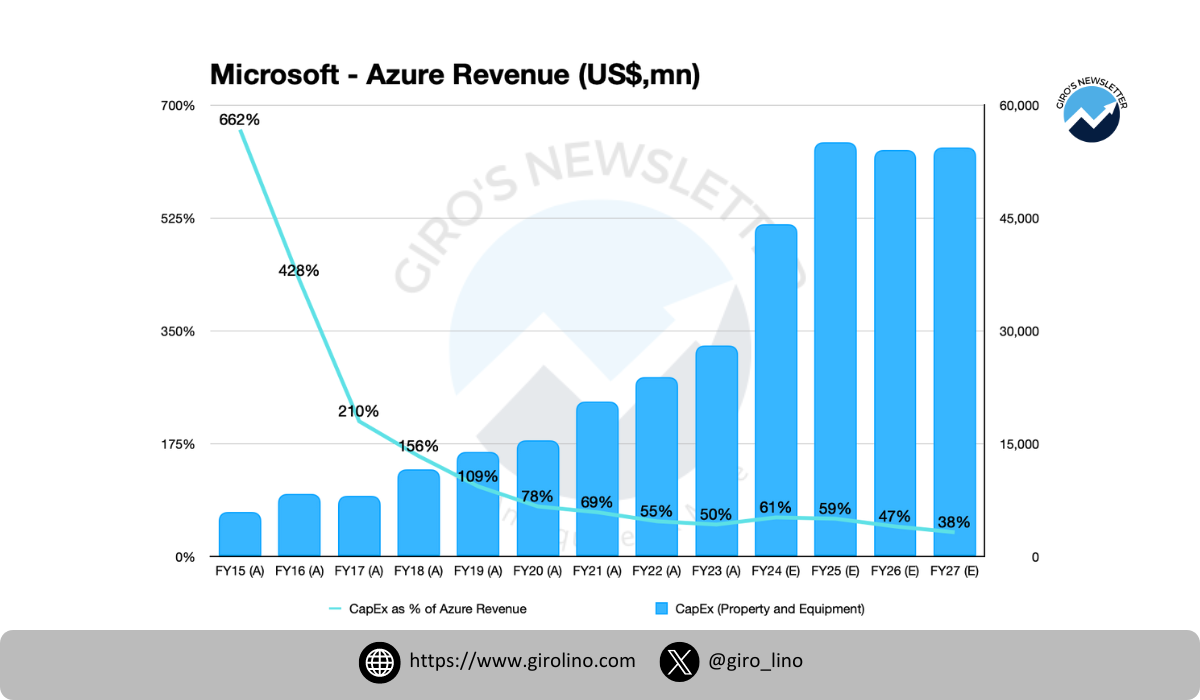

Microsoft's capital expenditure (CapEx) strategy for Azure provides insights into the company's cloud infrastructure investments and efficiency. Total CapEx, including finance leases, has grown from $5,944 million in FY2015 to $31,900 million in FY2023 and is projected to reach $77,352 million by FY2030. CapEx to Azure revenue ratio, a key efficiency metric, has improved dramatically over time. In FY2015, this ratio stood at 662%, indicating heavy upfront investments. By FY2023, it had decreased to 50%, and projections suggest it could reach 30% by FY2030. This trend demonstrates improving capital efficiency as Azure scales, suggesting that Microsoft can generate more revenue per dollar of capital invested - a positive sign for long-term profitability.

Interestingly, there's a projected spike in CapEx as a percentage of Azure revenue in FY2024 and FY2025 (61% and 59%, respectively). This likely represents significant investments in AI-related infrastructure, setting the stage for the next phase of Azure's growth and underlining Microsoft's commitment to leading in the AI-driven cloud market.

Azure's robust growth and improving capital efficiency have far-reaching implications for Microsoft's AI ambitions. The massive investments in Azure provide the computational backbone necessary for advanced AI services, while its proven ability to scale efficiently positions Microsoft to handle the increasing demand for AI-powered cloud services. The improving capital efficiency of Azure allows Microsoft to continue investing heavily in AI research and development without overly straining its financials. Moreover, the combination of Azure's scale and Microsoft's AI capabilities creates a formidable offering in the cloud market, potentially accelerating customer acquisition and retention.

As traditional cloud services mature, AI-powered offerings are poised to become the next major growth driver for Azure. This transition aligns perfectly with Microsoft's broader AI strategy, positioning the company to capture value not just from infrastructure provision, but from the higher-margin, AI-enhanced services built on top of that infrastructure.

Despite the positive outlook, Azure faces challenges. Intense competition from AWS and Google Cloud could impact growth rates or margins. Rapid advancements in cloud and AI technologies may require continued high levels of investment to stay competitive. Additionally, as Azure becomes increasingly central to global digital infrastructure, it may face greater regulatory challenges, particularly around data privacy and AI governance.

In conclusion, Azure's exceptional growth trajectory and improving capital efficiency underscore its central role in Microsoft's future. As the foundation for Microsoft's AI services, Azure is not just a growth driver in its own right, but a strategic asset that positions the company at the forefront of the AI revolution. The projected continuation of strong growth through 2030, coupled with improving capital efficiency, suggests that Azure will remain a key value creator for Microsoft in the coming years, further cementing the Intelligent Cloud segment's position as the engine of Microsoft's growth.

More Personal Computing: Challenges and Opportunities

The More Personal Computing (MPC) segment faces the most challenges among Microsoft's core businesses. MPC is navigating a problematic landscape with minimal projected growth and declining margins, particularly in the traditional PC market.

However, it's not all doom and gloom for MPC. The gaming division, bolstered by Xbox and the pending Activision Blizzard acquisition, presents a significant growth opportunity. Moreover, integrating AI into Windows and Bing search could rejuvenate these products, potentially reversing the segment's fortunes.

Financial Projections and Valuation

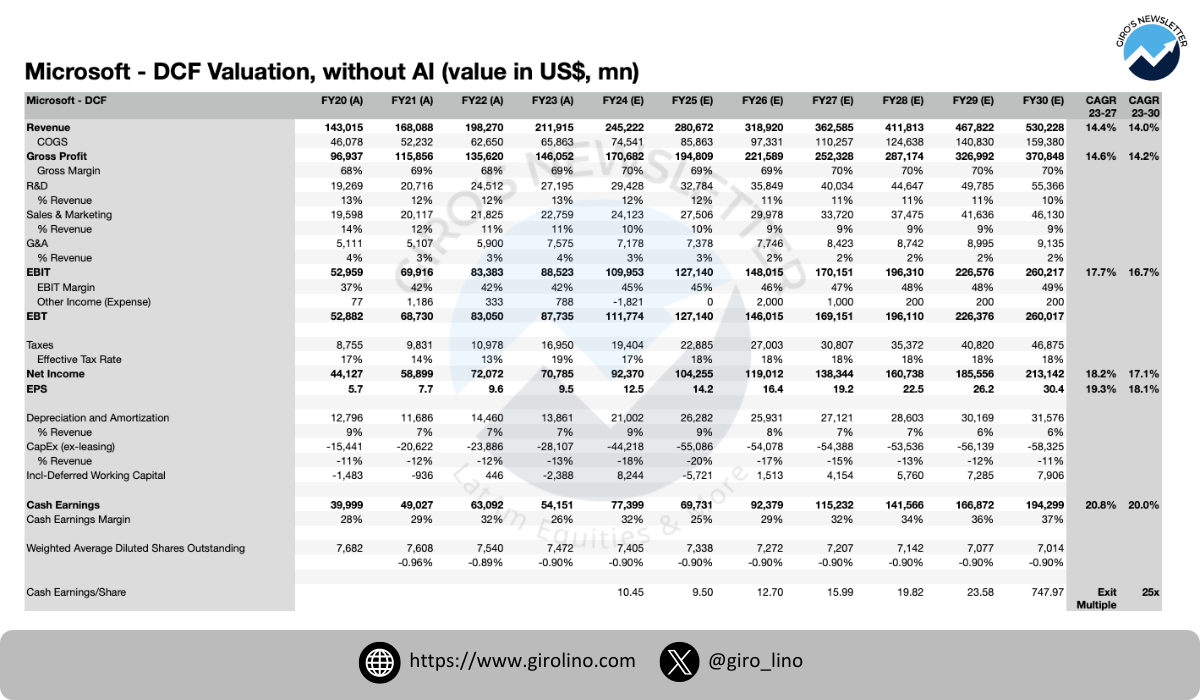

Our DCF model, which excludes the potential impact of AI initiatives, projects strong growth for Microsoft:

- Revenue CAGR (FY2023-FY2030): 14.0%

- EBIT CAGR (FY2023-FY2030): 16.7%

- Free Cash Flow per Share CAGR (FY2023-FY2030): 20.0%

Based on these projections and assuming an exit multiple of 25x cash earnings, our model suggests a valuation of $524.2 per share or a 9% IRR. This represents a modest upside from the current trading price, before considering AI's transformative potential.

The strong projected growth in free cash flow per share (20% CAGR) is particularly noteworthy, highlighting Microsoft's ability to convert revenue growth into shareholder value. This robust cash generation provides Microsoft with the financial flexibility to invest heavily in AI while maintaining a strong balance sheet.

In conclusion, Microsoft's core business demonstrates solid fundamentals, with the Intelligent Cloud segment positioned as the primary growth driver. While the MPC segment faces challenges, the overall business model shows resilience and strong cash generation capabilities. This strong foundation puts Microsoft in an excellent position to leverage its AI initiatives, which we will explore in detail in the following sections.

Microsoft's AI Strategy: Reimagining the Future of Technology

A comprehensive and ambitious artificial intelligence strategy lies at the heart of Microsoft's future. This strategy isn't merely about developing cutting-edge AI technologies but weaving AI into every product and service Microsoft offers. Let's delve into the key components of this strategy and how they position Microsoft at the forefront of the AI revolution.

Azure AI: The Cloud Foundation for AI Innovation

Azure AI forms the bedrock of Microsoft's AI offerings. It provides a comprehensive suite of AI services that enable businesses to build, train, and deploy AI models at scale. What sets Azure AI apart is its seamless integration with existing Azure cloud services, allowing companies to leverage their current cloud investments while stepping into the world of AI.

From machine learning to cognitive services and bot frameworks, Azure AI offers a wide array of tools that cater to various AI needs. This platform approach allows Microsoft to serve businesses at different stages of AI adoption, from those taking their first steps to companies pushing the boundaries of what's possible with AI.

GitHub Copilot: Revolutionizing Software Development

GitHub Copilot represents Microsoft's foray into AI-assisted coding. This tool, which utilizes OpenAI's language models, suggests code snippets and functions as developers work. By potentially boosting developer productivity significantly, Copilot could transform the software development landscape.

The implications of Copilot extend beyond mere efficiency gains. It could democratize coding, making it more accessible to novices while allowing experienced developers to focus on more complex problems. As AI becomes increasingly central to software development, Microsoft's early mover advantage with Copilot could prove crucial.

Microsoft 365 Copilot: AI-Powered Productivity

Microsoft's integration of AI into its productivity suite through Microsoft 365 Copilot is perhaps its most visible AI initiative for end-users. By assisting with writing, data analysis, presentation creation, and email management, Copilot aims to enhance workplace productivity dramatically.

This move is strategically significant. Microsoft 365's vast user base provides an enormous platform for AI adoption. If successful, Copilot could entrench Microsoft's position in enterprise productivity software, creating a powerful moat against competitors.

Bing AI: Challenging the Search Status Quo

With Bing AI, Microsoft is bringing conversational AI to its search engine. This move directly challenges Google's dominance in the search market. By providing more nuanced and contextual search results, Microsoft hopes to capture a larger share of the lucrative search advertising market.

While Bing has historically struggled to compete with Google, the integration of advanced AI could be a game-changer. If Bing AI can provide notably superior search experiences, it could shift user behavior and market dynamics in the search industry.

Strategic Partnerships: Amplifying AI Capabilities

Microsoft's AI strategy is significantly bolstered by its strategic partnerships, most notably with OpenAI. As OpenAI's exclusive cloud provider and a major investor, Microsoft gains access to some of the most advanced AI models in the world. This partnership has already borne fruit in products like GitHub Copilot and is expected to drive innovation across Microsoft's portfolio.

Additionally, Microsoft's collaboration with NVIDIA on AI supercomputing infrastructure ensures that it has the hardware capabilities to match its AI ambitions.

Competitive Positioning and Future Outlook

While Microsoft's comprehensive AI strategy leverages its strengths across the technology stack, from cloud infrastructure to productivity software and developer tools, it's crucial to acknowledge the rapidly evolving nature of the AI landscape.

At this early stage in the AI revolution, it's premature to make definitive projections about the competitive scenario. New players are emerging constantly, and established tech giants are all vying for position in this space. Rather than speculate on Microsoft's competitive advantage, our focus will be on understanding how AI could potentially generate value for the company.

Looking ahead, Microsoft's AI initiatives have the potential to drive growth across all business segments. They could enhance existing products, increase customer retention, create new revenue streams, and potentially strengthen Microsoft's market position. However, realizing this potential will depend on various factors, including the rate of AI adoption, the effectiveness of Microsoft's implementation, and the overall evolution of AI technologies.

The path forward is not without challenges. As AI becomes more pervasive, Microsoft, like all players in this field, must navigate complex ethical and regulatory landscapes. These factors add another layer of uncertainty to any long-term projections.

In the next section, we'll examine the potential financial impact of these AI initiatives. Our goal is to provide a quantitative perspective on how AI could transform Microsoft's business in the years to come, focusing on the key assumptions we need to make to believe in AI's transformational potential for the company. This approach will allow us to assess the potential value creation of AI for Microsoft, independent of the uncertain competitive landscape.

Stand-Alone AI Financial Model: Quantifying the AI Revolution

To fully grasp the transformative potential of Microsoft's AI initiatives, we've developed a stand-alone financial model focused specifically on the company's AI-driven revenue streams. This model provides a granular view of how AI could reshape Microsoft's financial landscape over the next decade.

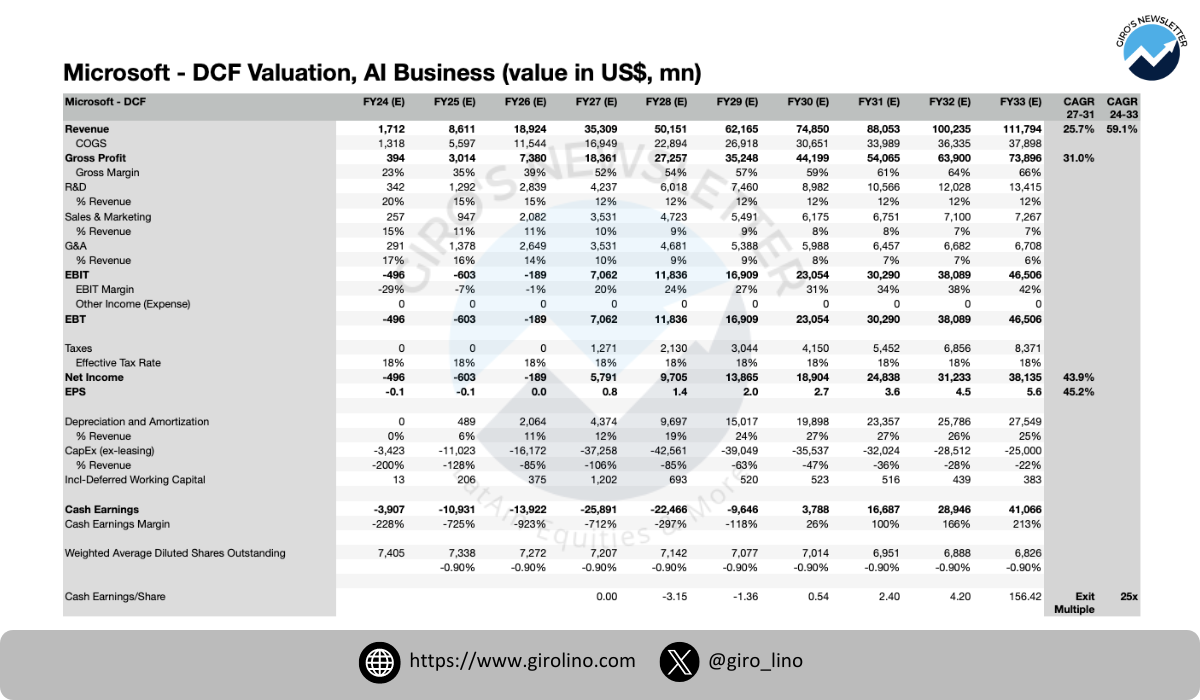

Our model projects explosive growth in AI-related revenues:

This represents a compound annual growth rate (CAGR) of 59.8% over the ten years. The steep growth curve in the early years reflects the rapid adoption of AI technologies across Microsoft's product portfolio, particularly in cloud services and productivity tools.

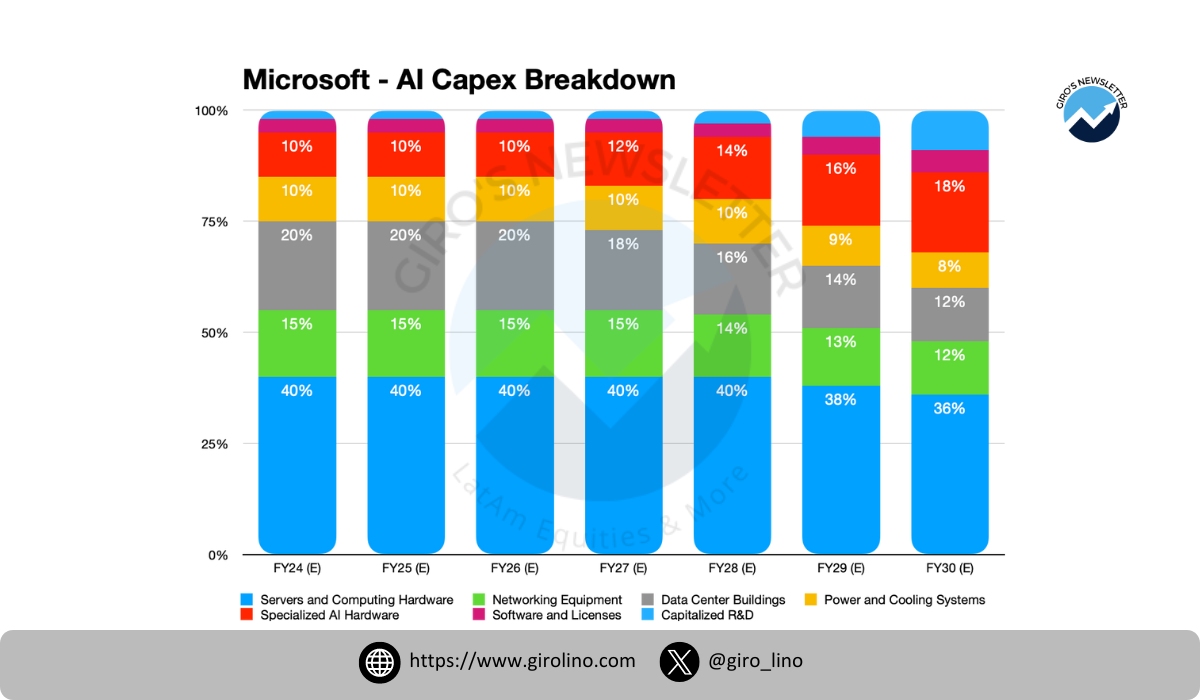

However, it's crucial to note that even with our solid dataset, believing that AI will generate significant shareholder value requires assuming enormous productivity gains in capital expenditure (CapEx). Currently, AI-related infrastructure faces high depreciation rates, which could potentially erode value creation if not managed effectively.

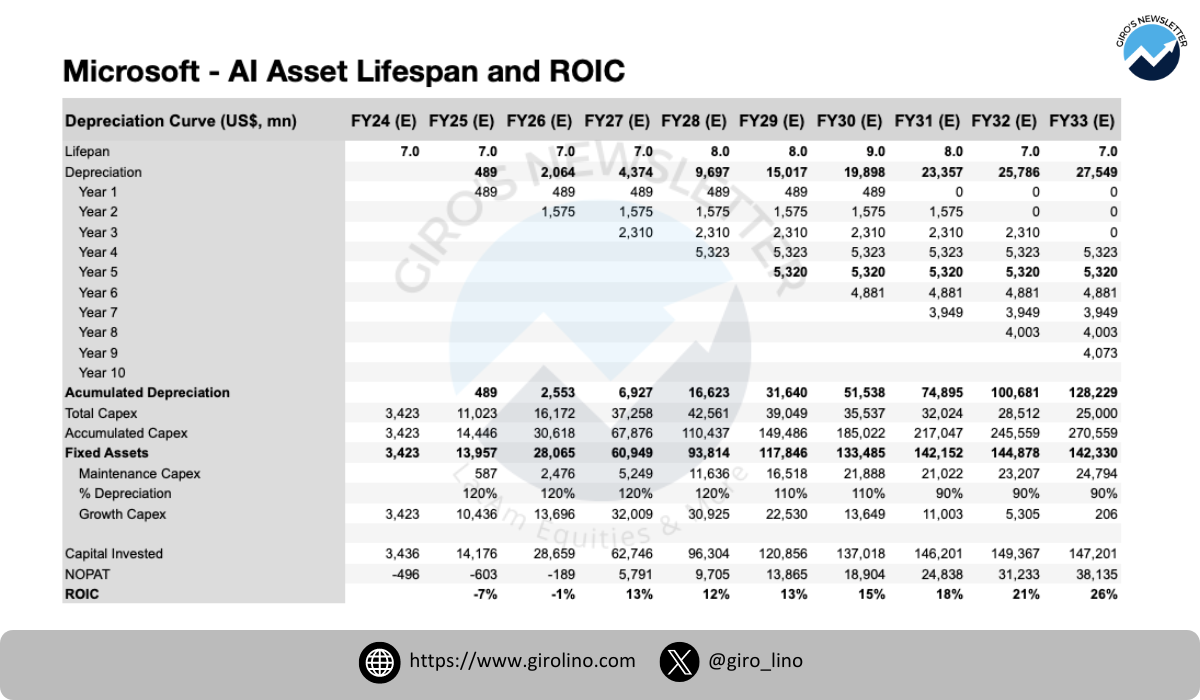

Our model assumes a significant improvement in CapEx efficiency over time. This assumption is based on the historical trajectories of Azure and AWS. In their early stages, these cloud platforms also grappled with scaling issues and product pricing challenges. However, over the years, they demonstrated an incredible potential for value generation as they achieved economies of scale and optimized their operations.

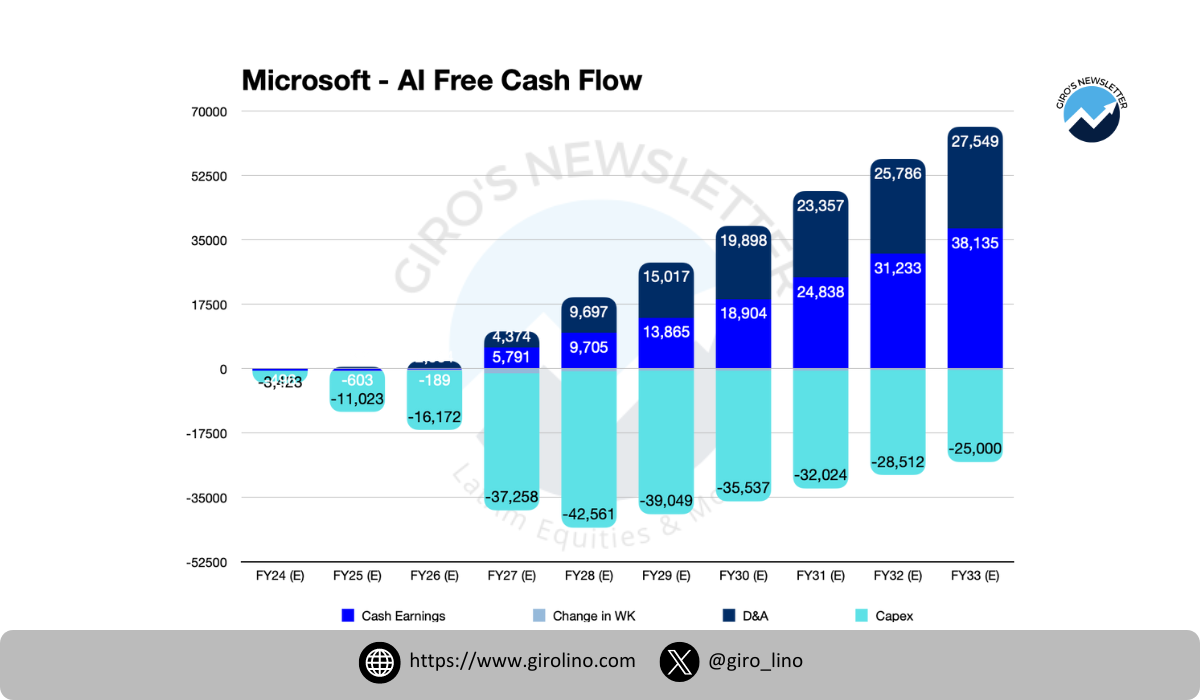

The total CapEx is forecast to grow dramatically from $3,423 million in FY24 to a peak of $42,561 million in FY28, before gradually declining to $25,000 million by FY33. This pattern reflects an initial phase of intense infrastructure buildout followed by a period of optimization and efficiency gains. The accumulated CapEx rises from $3,423 million in FY24 to $270,559 million by FY33, underscoring the massive scale of Microsoft's AI investments.

The significant upfront investments in AI infrastructure are reflected in the projected Free Cash Flow (FCF) for the AI segment:

As the graph illustrates, the AI segment is expected to experience negative FCF in the initial years due to heavy capital investments. This pattern is typical for emerging technologies requiring substantial infrastructure. However, as the technology matures and efficiencies are gained, we project a dramatic turnaround in FCF.

The inflection point, where FCF turns positive, is expected around FY27. From there, we anticipate rapidly increasing positive cash flows, reaching substantial levels by FY33. This trajectory mirrors the historical patterns seen in cloud computing, where initial years of negative cash flow were followed by strong positive cash generation as the technology scaled and matured.

This FCF projection underscores the importance of Microsoft's ability to execute its AI strategy effectively. The company must balance the need for continued investment with the imperative to demonstrate improving cash generation to shareholders.

Crucially, our model projects that these investments will yield improving returns over time:

While the Return on Invested Capital (ROIC) starts negative in the early years (-7% in FY25), it turns positive in FY27 and steadily improves, reaching 26% by FY33. This progression demonstrates that substantial upfront investments are expected to yield significant returns over time, mirroring the historical patterns seen in cloud computing infrastructure.

As I've delved deep into these financial projections, I've been struck by both the immense potential and the significant challenges that lie ahead for Microsoft's AI initiatives. As a long-term investor, I've seen Microsoft navigate major technological shifts before, but the AI revolution presents a unique set of opportunities and risks.

The projected Free Cash Flow and improving ROIC paint an exciting picture of AI's potential value creation. However, as your fellow investor, I want to emphasize that these projections are based on assumptions of significant improvements in CapEx productivity - improvements we've seen Microsoft achieve before with Azure, but which are far from guaranteed in this new AI landscape.

I plan to keep a close eye on several key metrics as Microsoft's AI strategy unfolds:

- The pace of AI adoption across Microsoft's product suite

- Improvements in CapEx efficiency and infrastructure utilization

- The inflection point where AI initiatives turn cash flow positive

- Progress in AI-driven revenue growth across all business segments

As we continue this journey together, I commit to providing regular updates and analysis on these crucial aspects. My goal is to offer you, my fellow investors, the insights you need to make informed decisions about Microsoft's AI-driven future.

Remember, while the potential is exciting, we must approach these projections with a balance of optimism and caution. The AI field is evolving rapidly, and our assumptions may need to be adjusted as new information comes to light.

In the next section, we'll explore how these AI projections could impact Microsoft's overall business valuation. As always, I encourage you to reach out with any questions or insights of your own. Together, we can navigate the complexities of this AI revolution and its impact on our investments.

AI Impact on Microsoft's Overall Business: A Transformative Force

After extensive analysis of Microsoft's financials and AI strategy, it's clear that we're potentially witnessing a pivotal moment in the company's history. The integration of AI across Microsoft's portfolio could significantly reshape its future, and as investors, we need to carefully consider the implications.

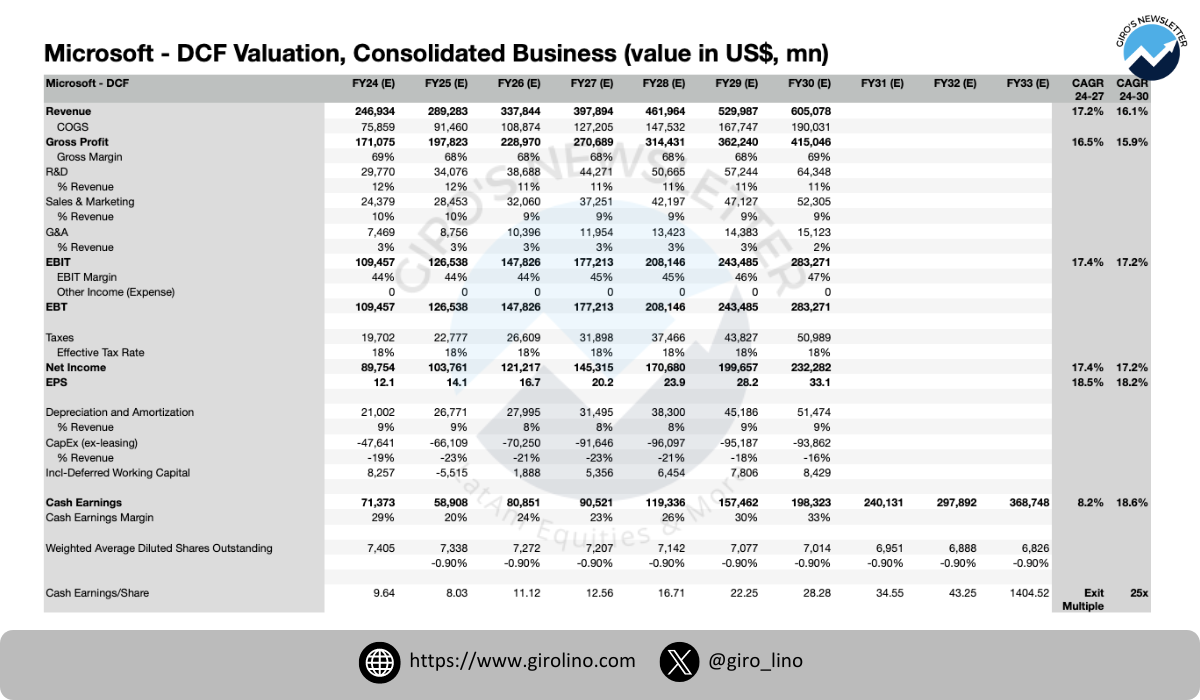

Our consolidated DCF model, which incorporates both Microsoft's core business and its AI initiatives, yields compelling results:

As the model illustrates, we project a target price of $667.7 per share, representing a 43% upside from the current market price of $466. This projection is based on a thorough analysis, factoring in the potential impact of AI across Microsoft's business segments.

Key takeaways from this model include:

- Revenue CAGR of 16.1% from FY24 to FY30, with AI acting as a significant growth catalyst.

- An projected Internal Rate of Return (IRR) of 14%, compared to 9% in the stand-alone Microsoft model without AI considerations.

- Steady expansion of EBIT margins, reaching 47% by FY30, reflecting the potential efficiency gains from AI integration.

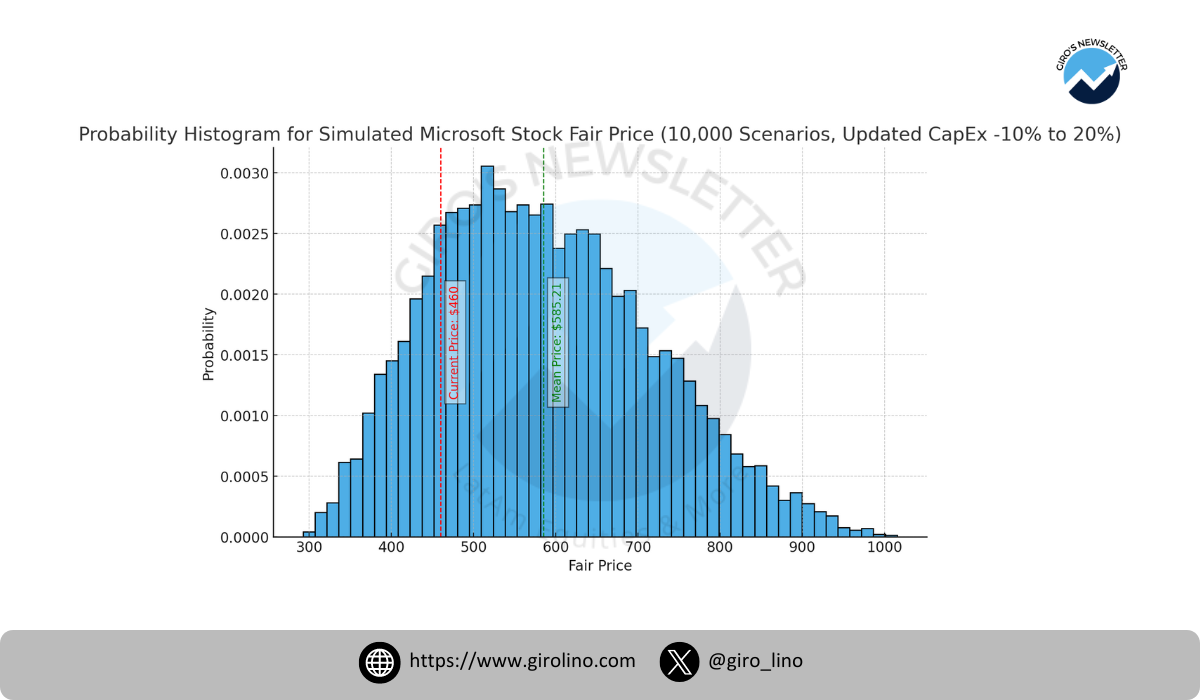

However, it's crucial to acknowledge the uncertainties inherent in these projections. The AI field is evolving rapidly, and the competitive landscape is intensifying. To account for these uncertainties, we've conducted a Monte Carlo simulation:

This simulation helps us understand the range of potential outcomes based on varying key assumptions. As the chart shows, while our base case target price is $667.7, there's a wide distribution of possible outcomes. This underscores the importance of monitoring key metrics and adjusting our analysis as new information becomes available.

Our valuation is particularly sensitive to several key factors:

- Exit Multiple: Varying this from 17x to 30x results in a significant target price range.

- AI Adoption Rate: Faster or slower adoption could substantially impact valuation.

- AI CapEx: The efficiency of Microsoft's AI investments will be crucial.

- AI Gross Margin: The pace of margin expansion in AI-related services could significantly affect overall profitability.

As we continue to monitor Microsoft's AI journey, these are the key metrics I'll be watching closely. The company's ability to balance aggressive AI investment with maintaining its core business will be crucial.

In the coming months, I'll be conducting further analysis on Microsoft's quarterly reports, industry trends, and AI developments. My goal is to provide ongoing, in-depth insights to help us navigate this potentially transformative period for Microsoft.

The AI revolution presents both significant opportunities and challenges for Microsoft. As investors, staying informed and adaptable will be key to understanding the evolving impact on Microsoft's valuation and market position.

I welcome any thoughts or questions you might have. Collaborative discussion can only enhance our understanding of this complex and rapidly evolving situation.