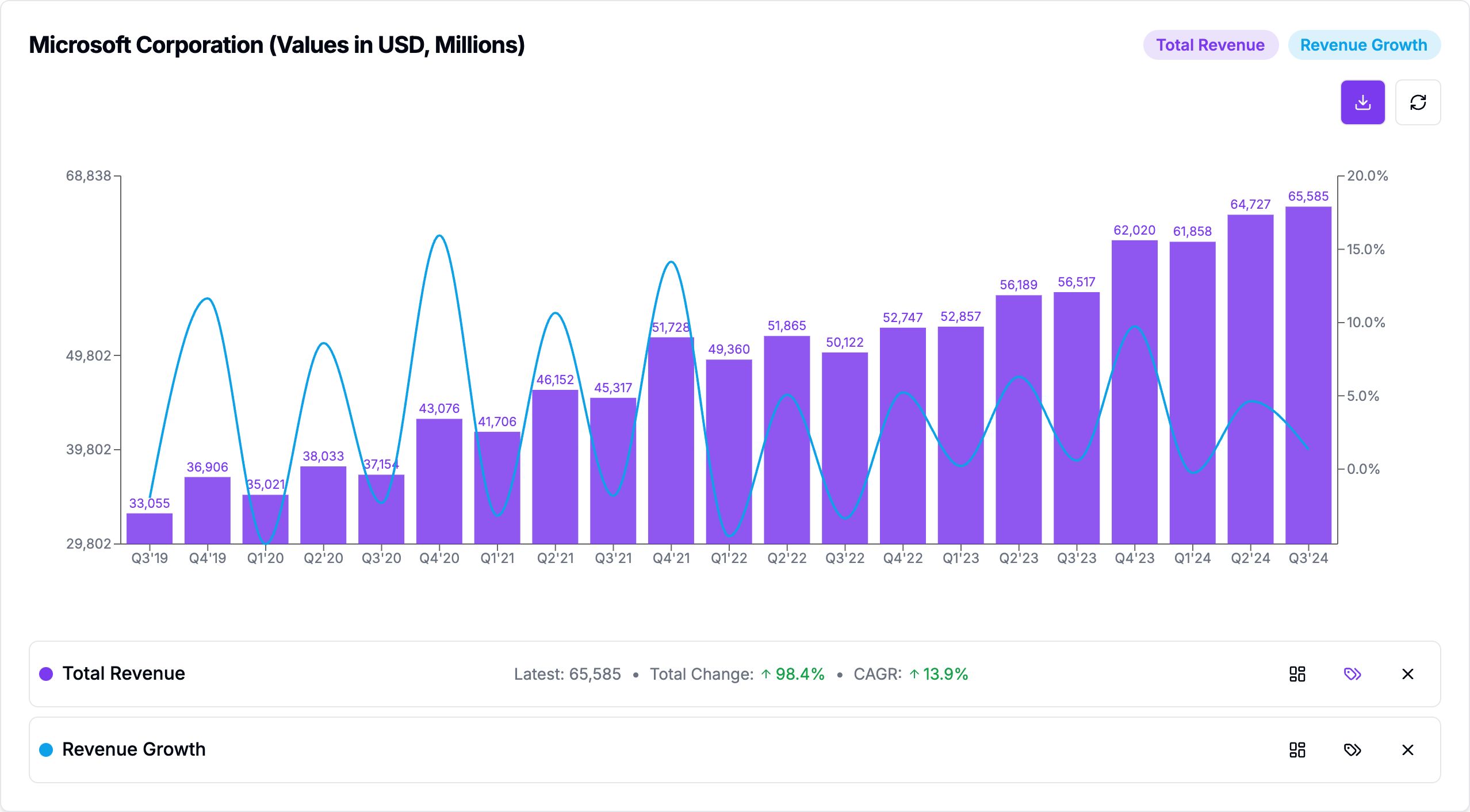

Microsoft delivered strong first-quarter results for fiscal year 2025, demonstrating continued momentum in cloud services and AI integration across its portfolio. Total revenue reached $65.6 billion, increasing 16% year-over-year, while operating income grew 14% to $30.6 billion. The company's performance was marked by robust cloud growth and accelerating AI adoption, with Microsoft Cloud revenue reaching $38.9 billion, up 22% year-over-year.

As CEO Satya Nadella emphasized:

"AI-driven transformation is changing work, work artifacts, and workflow across every role, function, and business process, helping customers drive new growth and operating leverage."

Financial Performance Analysis

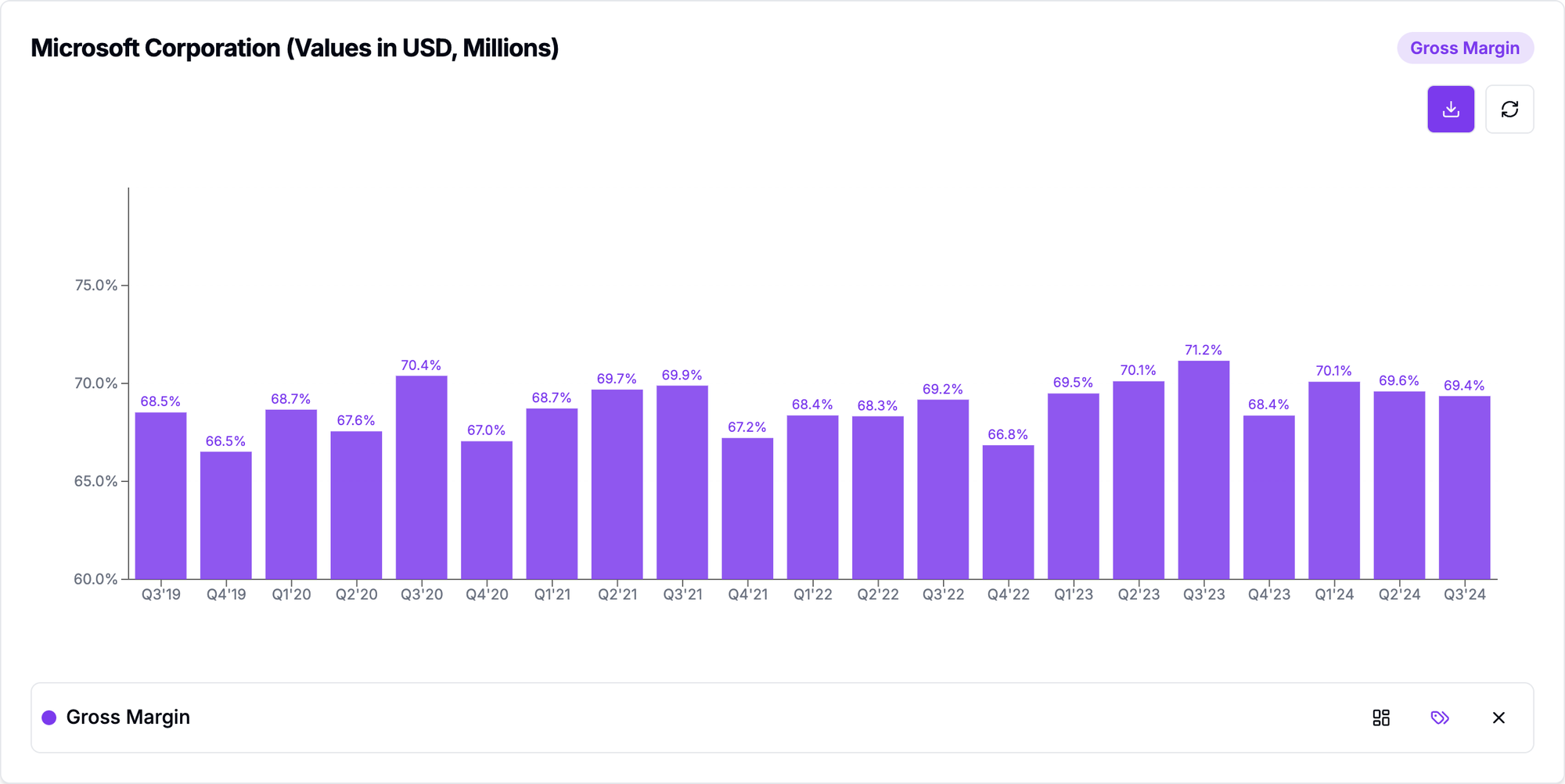

Revenue growth was broad-based across all three major segments. The Intelligent Cloud segment led growth at 20% (21% in constant currency), reaching $24.1 billion. Productivity and Business Processes grew 12% to $28.3 billion, while More Personal Computing increased 17% to $13.2 billion. The company maintained strong profitability with a gross margin of 69%, though this represented a 2-point decrease year-over-year due to AI infrastructure investments.

Commercial bookings showed exceptional strength, as CFO Amy Hood highlighted:

"Strong execution by our sales teams and partners delivered a solid start to our fiscal year with Microsoft Cloud revenue of $38.9 billion, up 22% year-over-year."

Particularly noteworthy was the performance of Azure and other cloud services, which grew 33% (34% in constant currency), including approximately 12 points of growth from AI services. Hood noted during the earnings call that Azure's growth reflected "healthy consumption trends" and emphasized that demand continues to exceed available capacity for AI services.

Detailed Segment Analysis

Intelligent Cloud

The Intelligent Cloud segment, which includes Azure, Windows Server, and other enterprise services, has been a significant driver of Microsoft's growth. Azure's 33% growth is particularly impressive, reflecting the increasing demand for cloud computing and AI capabilities. This growth is fueled by enterprises seeking to leverage AI to enhance their operations, improve decision-making, and drive innovation. The segment's performance underscores Microsoft's strategic focus on cloud and AI as core components of its business model.

Productivity and Business Processes

The Productivity and Business Processes segment, which includes Office 365, LinkedIn, and Dynamics 365, also showed strong growth. Microsoft 365 Commercial products and cloud services revenue grew 13%, driven by seat growth of 8% and increasing adoption of premium offerings. LinkedIn revenue increased 10%, with sessions growing 11% and reaching record engagement levels. Dynamics 365 revenue grew 18%, continuing to gain market share. This segment's performance highlights the ongoing demand for productivity tools and business applications that enable remote work and digital transformation.

More Personal Computing

The More Personal Computing segment, which includes Windows, Surface, and gaming, saw a 17% increase in revenue. Gaming revenue grew 43%, including 43 points of net impact from the Activision acquisition. Windows OEM and Devices revenue increased 2%, while search and news advertising revenue excluding traffic acquisition costs grew 18%, outpacing the broader search market. The acquisition of Activision Blizzard has bolstered Microsoft's gaming portfolio, positioning it as a leader in the gaming industry.

AI and Strategic Initiatives

Microsoft's AI business is approaching a significant milestone, with Nadella announcing:

"All up, our AI business is on track to surpass an annual revenue run rate of $10 billion next quarter, which will make it the fastest business in our history to reach this milestone."

The company's AI strategy spans across its entire portfolio, with initiatives aimed at driving AI adoption and innovation.

Enterprise AI Adoption

Microsoft 365 Copilot has achieved significant traction, with nearly 70% of Fortune 500 companies now using the service. Management highlighted that adoption rates exceed those of previous Microsoft 365 suite launches. This rapid adoption reflects the growing importance of AI in enhancing productivity and collaboration within enterprises. Microsoft 365 Copilot leverages AI to provide intelligent assistance, automate routine tasks, and deliver insights that help users work more efficiently.

Cloud AI Services

Azure AI continues to gain momentum, with Azure OpenAI Service usage more than doubling over the past six months. Notable enterprise adoptions include GE Aerospace, which deployed a digital assistant for its 52,000 employees, processing over 500,000 internal queries and 200,000 documents in just three months. This example illustrates the transformative potential of AI in streamlining operations and improving employee productivity.

Developer Tools

GitHub Copilot is transforming developer productivity, with enterprise customers increasing 55% quarter-over-quarter. The company introduced new capabilities including GitHub Copilot Workspace and Autofix, enhancing the AI-powered development experience. These tools leverage AI to assist developers in writing code, identifying bugs, and automating repetitive tasks, ultimately accelerating the software development process.

Forward Outlook and Strategic Focus

Looking ahead, Microsoft expects continued strong demand for its AI and cloud services. Hood provided guidance for Q2 FY25, projecting Azure revenue growth of 31-32% in constant currency, with AI services contribution remaining similar to Q1 levels due to capacity constraints.

Regarding future growth, Hood emphasized:

"In H2, we still expect Azure growth to accelerate from H1 as our capital investments create an increase in available AI capacity to serve more of the growing demand."

Microsoft's strategic focus on expanding its AI and cloud capabilities is expected to drive future growth. The company's investments in AI infrastructure and capacity are aimed at meeting the increasing demand for AI services and ensuring that it remains a leader in the AI space.

Market Context and Competitive Position

Microsoft's results reflect strong execution in an evolving competitive landscape. The company's early leadership in AI, particularly through its partnership with OpenAI, has positioned it advantageously as enterprise AI adoption accelerates. Nadella emphasized this advantage:

"The most hit products of this generation, all are in our cloud, right, whether it's ChatGPT, whether it's Copilot, whether it's GitHub Copilot or even DAX Copilot."

Microsoft's strategic partnerships and investments in AI have enabled it to offer a comprehensive suite of AI-powered products and services. This positions the company well to capitalize on the growing demand for AI solutions across various industries.

Risk Factors and Challenges

While Microsoft's quarter showed strong performance, several challenges warrant monitoring:

Supply Constraints

AI infrastructure limitations could restrict near-term growth potential. The significant capital expenditure required for AI infrastructure expansion ($20 billion in Q1) impacts free cash flow, which decreased 7% year-over-year. Managing these constraints will be crucial to sustaining growth and meeting customer demand for AI services.

Acquisition Integration

The company faces the challenge of managing the Activision Blizzard integration while maintaining operational efficiency. The acquisition contributed approximately 3 points to revenue growth but had a 2-point negative impact on operating income growth and a $0.05 negative impact on earnings per share. Successfully integrating Activision Blizzard will be key to realizing the full potential of the acquisition and driving long-term growth in the gaming segment.

Final Assessment

Microsoft's Q1 FY25 results demonstrate successful execution of its AI-first strategy while maintaining strong core business performance. The company's ability to drive both growth and profitability while investing heavily in AI infrastructure positions it well for future opportunities. Management's focus on disciplined expansion of AI capacity while maintaining cost control suggests a balanced approach to capturing the AI opportunity while managing near-term constraints.

The rapid scaling of AI-related revenue and broad-based adoption of AI tools across the product portfolio indicate Microsoft is successfully monetizing its AI investments. With Azure growth expected to accelerate in the second half and AI capacity expanding, the company appears well-positioned for continued strong performance, though managing supply constraints and integration challenges will be key to maintaining momentum.

In conclusion, Microsoft's strategic focus on AI and cloud services, combined with its strong execution and market leadership, positions it well for future growth. The company's ability to navigate challenges and capitalize on opportunities in the AI space will be critical to sustaining its competitive advantage and driving long-term success.