Unveiling Mr. Market: Benjamin Graham's Key to Intelligent Investing

In the ever-changing world of finance, Benjamin Graham's Mr. Market analogy stands as a beacon of wisdom for value investors. Introduced in his 1949 masterpiece "The Intelligent Investor," often referred to as the value investor's bible, this concept continues to guide investors through market turbulence. But who exactly is Mr. Market, and how can Graham's teachings revolutionize your investment strategy?

Who is Mr. Market? Benjamin Graham's Ingenious Analogy

Benjamin Graham, born Benjamin Grossbaum and known as the father of value investing, created Mr. Market to help investors grasp the often irrational behavior of financial markets. This analogy, central to Graham's philosophy in "The Intelligent Investor," personifies the entire stock market as a single entity - Mr. Market - who approaches you daily with offers to buy or sell shares.

| Characteristic | Description |

|---|---|

| Nature | Your hypothetical business partner |

| Behavior | Driven by emotions rather than fundamental analysis |

| Offers | Daily proposals to buy or sell stocks |

| Pricing | Wildly fluctuating based on mood |

| Availability | Always present with new offers |

| Purpose | To serve, not guide, the value investor |

Mr. Market's mood swings between extreme optimism and pessimism, often disconnected from economic realities. Some days, he's willing to pay premium prices for stocks. Other days, he's eager to sell at rock-bottom prices. The key insight? Mr. Market's offers stem from emotions, not rational security analysis of a company's intrinsic value.

The Psychology Behind Mr. Market: Benjamin Graham's Insight

To harness the power of the Mr. Market analogy, we must understand the psychological factors driving market behavior, as Graham elaborates in "The Intelligent Investor":

- Herd mentality in stock markets

- Recency bias affecting stock prices

- Fear and greed in market fluctuations

- Overconfidence in short-term market trends

- Loss aversion leading to irrational selling

These cognitive biases and emotional responses often lead investors astray, causing them to make irrational decisions based on short-term market movements rather than long-term value, as Graham warns in his definitive book on value investing.

Applying Mr. Market to Your Value Investing Strategy

Now, let's explore how to leverage this concept from "The Intelligent Investor" in your value investing approach:

Focus on Intrinsic Value: The Core of Graham's Teaching

The core lesson of Mr. Market is the importance of focusing on a company's intrinsic value rather than its current stock price. By developing your own valuation methods, as Graham teaches in "Security Analysis," co-authored with David Dodd, you can avoid being swayed by Mr. Market's daily mood swings. This approach, rooted in fundamental analysis, is crucial for successful value investing.

Embrace Market Fluctuations: Graham's Opportunity Perspective

Instead of fearing market fluctuations, view them as opportunities. When Mr. Market is overly pessimistic, it may present chances to buy quality stocks at discounted prices. Conversely, periods of irrational exuberance might offer opportunities to sell overvalued assets, as Graham explains in "The Intelligent Investor." This aligns with Graham's famous quote that in the short run, the market is a voting machine, but in the long run, it is a weighing machine.

Develop Emotional Discipline: The Hallmark of a Graham Investor

Perhaps the most valuable lesson from Mr. Market is the importance of emotional discipline. By recognizing that market prices don't always reflect true value, you can resist the urge to follow the herd and instead stick to your well-reasoned investment theses, a key principle in Graham's value investing philosophy. As Graham wrote in the Financial Analysts Journal, the investor's chief problem – and even his worst enemy – is likely to be himself.

Practice Patience: Graham's Long-Term Perspective

Mr. Market teaches us that we don't need to act on every market movement. Sometimes, the best action is no action at all. Wait for Mr. Market to offer favorable prices rather than feeling pressured to trade constantly, adhering to Graham's principle of investing for the long run. This patience allows the market to function as a weighing machine, reflecting the true value of businesses over time.

Mr. Market in Modern Markets: The Enduring Relevance of Graham's Teachings

While Graham introduced Mr. Market over 70 years ago in "The Intelligent Investor," its relevance in today's fast-paced, information-driven markets is stronger than ever. The proliferation of financial news and social media has amplified Mr. Market's mood swings, making this concept even more crucial for modern value investors.

Consider these recent examples of Mr. Market's behavior:

- The 2020 COVID-19 Crash: A prime example of market overreaction

- The GameStop Saga: Illustrating the manic-depressive nature of Mr. Market

- Cryptocurrency Volatility: Demonstrating extreme market fluctuations

These events underscore the enduring value of Graham's teachings in "The Intelligent Investor" and the importance of maintaining a rational, value-focused approach to investing based on fundamental analysis.

Critiques and Limitations of Graham's Mr. Market

While Mr. Market provides valuable insights for value investing, it's important to acknowledge its limitations:

- Efficient Markets Theory: Challenging Graham's view of market irrationality

- Complexity of Market Forces: Beyond the simplification in "The Intelligent Investor"

- Short-Term vs. Long-Term Perspectives: Balancing Graham's long-term focus

- Difficulty in Determining Intrinsic Value: A challenge even for seasoned value investors

Despite these limitations, Mr. Market remains a powerful tool for developing a disciplined, value-oriented investment approach, as advocated by Benjamin Graham in both "The Intelligent Investor" and "Security Analysis."

Integrating Mr. Market into Your Value Investing Process

To truly benefit from Mr. Market, integrate its insights into your overall value investing process, as taught by Graham:

- Develop a Valuation Framework: Based on Graham's teachings in "Security Analysis"

- Set Clear Investment Criteria: Following the defensive investor approach from "The Intelligent Investor"

- Create a Watchlist: Of businesses you understand, as Graham advises

- Implement Dollar-Cost Averaging: A strategy aligned with Graham's philosophy

- Keep a Trading Journal: To track your adherence to value investing principles

- Regularly Review and Rebalance: Ensuring your portfolio aligns with Graham's teachings

- Continuous Education: Study "The Intelligent Investor," "Security Analysis," and Graham's articles in the Financial Analysts Journal

By following these steps, you can harness the wisdom of Mr. Market to make more rational, value-driven investment decisions.

The Lasting Impact of Mr. Market: From Benjamin Graham to Warren Buffett

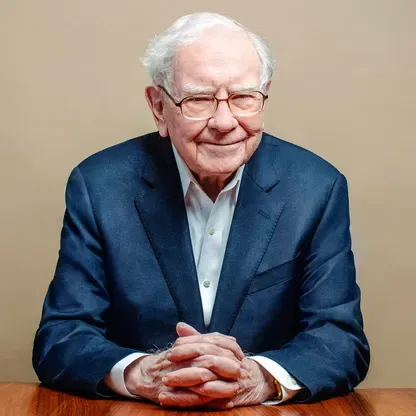

The Mr. Market analogy has profoundly influenced some of the world's most successful value investors. Warren Buffett, Graham's most famous student and the "Oracle of Omaha," has frequently praised this concept, considering it one of the most valuable lessons in "The Intelligent Investor."

Buffett has applied Mr. Market throughout his investing career at Berkshire Hathaway, using it to remain calm during market turbulence and capitalize on mispricing opportunities. His success serves as a testament to the power of Graham's teachings and the enduring relevance of the Mr. Market analogy in value investing.

Explore Warren Buffett's investment philosophy and how it relates to Benjamin Graham's Mr. Market analogy

Conclusion: Embracing Mr. Market's Wisdom in Value Investing

Mr. Market serves as a powerful reminder that successful value investing is as much about managing our own psychology as it is about analyzing financial statements or economic trends. By internalizing its lessons from "The Intelligent Investor," value investors can develop the emotional discipline and long-term perspective necessary to navigate turbulent financial markets.

Remember, as Graham wrote, Mr. Market is there to serve you, not to guide you. By focusing on intrinsic value, embracing market fluctuations as opportunities, and maintaining emotional discipline, you can turn Mr. Market's mood swings to your advantage in value investing. As Graham famously stated, in the short run, the market is a voting machine, but in the long run, it is a weighing machine.

As you continue your value investing journey, let the wisdom of Benjamin Graham and his Mr. Market analogy be your guide. It may not guarantee success, but it will certainly help you avoid many of the pitfalls that ensnare less disciplined investors, as Graham warns in "The Intelligent Investor" and his numerous contributions to the Financial Analysts Journal.

Learn more about value investing strategies to complement your understanding of Benjamin Graham's Mr. Market analogy

FAQ Section

- Q: How often does Mr. Market's mood change according to Benjamin Graham? A: Graham suggests in "The Intelligent Investor" that Mr. Market's mood can change daily or even hourly, reflecting constant fluctuations in stock prices and market sentiment.

- Q: Can Graham's Mr. Market be applied to other asset classes besides stocks? A: Yes, the concept applies to any market where prices are influenced by investor sentiment, including bonds, real estate, and cryptocurrencies, extending Graham's principles beyond just stocks.

- Q: How do I know when Mr. Market is being irrational, according to Graham's teachings? A: Graham advises in "The Intelligent Investor" to look for significant discrepancies between a company's fundamental value and its market price, especially during times of extreme market optimism or pessimism.

- Q: Is it possible to always take advantage of Mr. Market's mood swings in value investing? A: While Graham's analogy provides valuable insights, consistently timing the market is extremely difficult. The key is to use the concept to maintain a disciplined, long-term value investing approach based on fundamental analysis.

- Q: How can I learn more about applying Graham's Mr. Market to my value investments? A: Start by reading Benjamin Graham's "The Intelligent Investor" and "Security Analysis." Then study his articles in the Financial Analysts Journal and the investment philosophies of successful value investors like Warren Buffett who have applied these principles in their careers.