Navigating Market Turbulence: Strategies for Investors in Uncertain Times

The past trading week underscored the fragility of the current market environment. Despite muted headline index movements, significant volatility beneath the surface highlighted the complex landscape investors must navigate. Understanding the interplay of economic indicators, Federal Reserve policies, and sector-specific trends is crucial for making informed investment decisions.

Central Theme: Strategic Positioning in a Volatile Market

Economic Indicators: A Mixed Bag

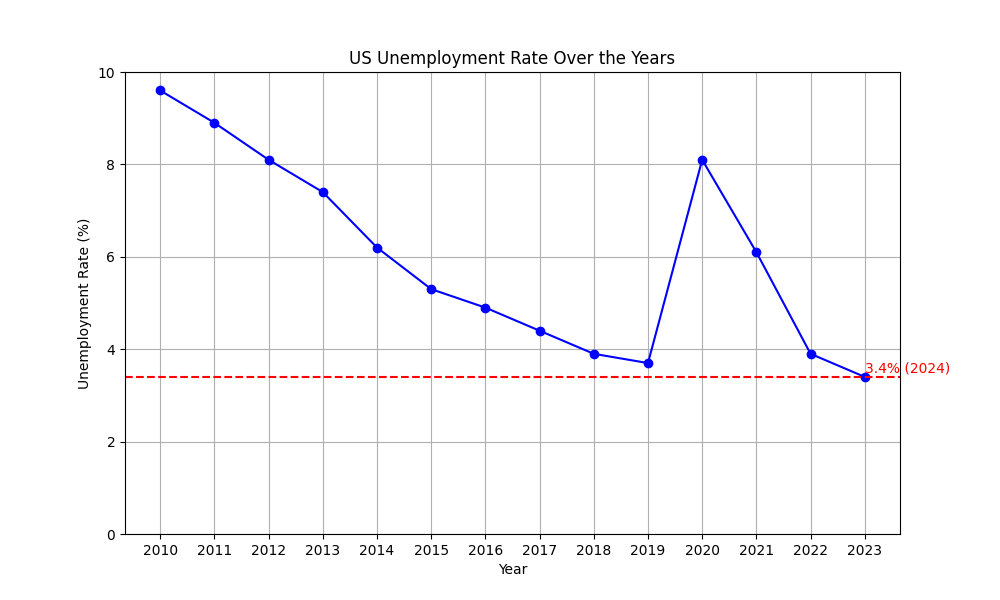

Investors are facing a barrage of mixed signals. On one hand, the labor market shows resilience with historically low unemployment rates at 3.4% (J.P. Morgan | Official Website). On the other hand, new job openings are at their lowest since April 2021, and layoffs have surged to their highest since December 2020 (J.P. Morgan | Official Website). These contradictory signals make it difficult to gauge the true health of the economy.

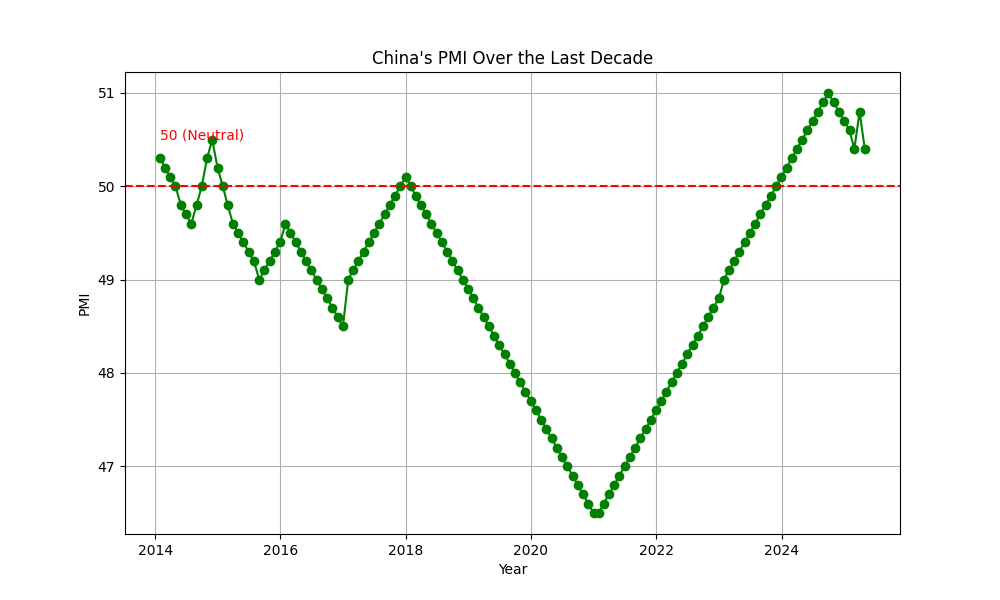

Adding to the complexity, oil prices have experienced their sixth consecutive monthly loss, primarily due to weak Chinese PMI data and broader demand concerns (OECD). This decline impacts various sectors differently, benefiting industries reliant on lower energy costs while hurting oil producers.

Federal Reserve Policies: Navigating Uncertainty

The Federal Reserve's actions continue to be a focal point for investors. The recent 25 basis point hike, without a clear indication of a pause, has added to market uncertainty. The Fed's emphasis on tighter credit conditions potentially weighing on economic activity, hiring, and inflation adds another layer of complexity (J.P. Morgan | Official Website).

Historical comparisons reveal the Fed's recent challenges in accurately predicting market behavior. Initial forecasts of no rate rises until 2024 were overturned by substantial hikes, and inflation, once deemed transitory, has remained persistently high (Deloitte United States). This historical context underscores the difficulty of relying solely on Fed guidance for investment decisions.

Sector Rotation and Market Sentiment

The market's internal dynamics also reflect a cautious sentiment. Investors are shifting towards liquidity, quality, and defensive segments, with financials and oil majors underperforming (J.P. Morgan | Official Website). This rotation suggests a preference for stability amid uncertainty.

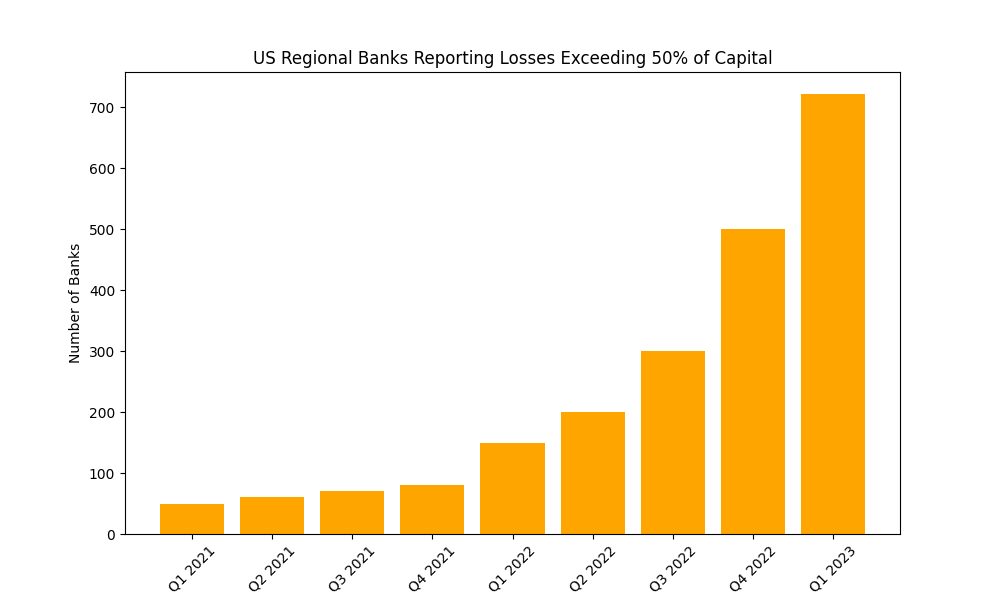

Recent data indicate significant unrealized losses in US regional banks, with 722 banks reporting losses exceeding 50% of capital (Deloitte United States). This highlights the importance of understanding sector-specific risks and adjusting portfolios accordingly.

Strategic Investment Approaches

Given the current landscape, investors should consider several strategic approaches to navigate market turbulence:

- Diversification and Quality Focus: Emphasize high-quality assets and diversify across sectors to mitigate risk. Defensive sectors like healthcare and consumer staples may offer more stability.

- Liquidity Management: Maintain higher cash levels to capitalize on market opportunities and manage downside risks. This approach aligns with the cautious sentiment observed among investors, who are prioritizing capital preservation (Deloitte United States).

- Monitoring Economic Indicators: Stay informed about key economic indicators and their implications. Understanding the nuances of job market data, inflation trends, and sector-specific performance can provide valuable insights for timely adjustments.

- Long-Term Perspective: Focus on long-term growth potential rather than short-term market fluctuations. This includes investing in sectors poised for future growth, such as technology and renewable energy.

Conclusion: Adapting to a Complex Environment

The current market environment demands a nuanced approach to investing. By understanding the interplay of economic indicators, Federal Reserve policies, and sector-specific trends, investors can better navigate the turbulence. Strategic positioning, diversification, and a focus on quality assets are key to managing risks and seizing opportunities in these uncertain times.