In today's digital era, Artificial Intelligence (AI) has transcended its role from merely being a frontier of technological innovation to becoming a fundamental force that is reshaping the core of the stock market. Its profound impact, felt across company operations, product innovations, and the overarching market dynamics, has rapidly become a focal point in discussions among investors, strategists, and analysts alike. As we stand on the brink of this transformative wave, it's crucial to understand not just the immediate effects of AI but also its long-term implications on market valuations and investment strategies.

This series of posts is designed to delve deeply into the intricate relationship between AI and the stock market, offering readers a panoramic yet detailed view of this evolving landscape. Our journey begins with an introductory overview that aims to set the stage for a more detailed thematic exploration in the subsequent posts. Each piece in this series will dissect different facets of AI’s impact, from how it's driving operational efficiencies and fostering innovations to its role in redefining company valuations and shaping future market trends.

Our exploration is anchored in a meticulous examination of data, trends, and corporate strategies that underline AI's pervasive influence. By unpacking these elements, we aim to unveil a new paradigm for investors—a market increasingly driven by AI's capabilities and potential. This initial post serves as the cornerstone of our series, inviting readers to embark on a comprehensive journey into the AI-enhanced market landscape.

In the forthcoming posts, we will dive deeper into specific topics, offering granular analyses and insights. These will include case studies on companies that are leading the AI revolution, an in-depth look at AI’s impact on sector-specific valuations, and predictions on how AI might continue to transform market dynamics in the years to come.

Our goal is to provide a holistic guide for navigating the complexities of the AI-driven market, equipping investors with the knowledge and insights needed to make informed decisions in this new era. As we unravel the multifaceted impact of AI on the stock market, we invite our readers to join us in this insightful journey, promising to illuminate the path toward understanding and leveraging the power of AI in investment strategies. Stay tuned for our upcoming posts, where we will delve into the depth of AI's influence on the stock market, one analysis at a time.

The AI Advantage in Earnings and Growth

Operational Efficiency and Revenue Enhancement

Companies integrating AI into their operations are witnessing unparalleled efficiency and revenue growth. An analytical look at operational cost savings and revenue enhancements attributed to AI across sectors provides insight into the financial implications. For instance, NVIDIA, a leader in AI computing, has seen its revenue growth rate significantly exceed industry averages due to its strategic investment in AI technologies. An in-depth analysis of NVIDIA’s financial reports reveals a direct correlation between its AI initiatives and its improved profit margins and earnings growth, underscoring the tangible benefits of AI integration on company valuations.

- Under Operational Efficiency and Revenue Enhancement, Fortive Corp.'s acceleration in software development time due to Generative AI illustrates AI's direct impact on operational productivity.

- Nasdaq Inc. is developing its first proprietary Verafin Generative AI copilot to enhance operational efficiency within financial services.

The Strategic Value of AI-Driven Innovation

Innovation driven by AI is not only creating new revenue streams but also redefining market competitiveness. A case in point is Amazon's use of AI in logistics and customer service, which not only streamlines operations but also enhances the customer experience, leading to increased sales. A comparative analysis of Amazon’s stock performance before and after the implementation of major AI-driven initiatives illustrates the market’s valuation of AI-driven innovation.

- Meta Platforms Inc. uses AI across its ad systems and product suite to demonstrate AI's role in driving strategic innovation in advertising and customer engagement.

- UPS's exploration of generative AI applications is an example of how AI can enhance productivity and customer service in the logistics sector.

Intellectual Property: The New Valuation Frontier

Valuing AI-Related Intellectual Property

The strategic importance of AI-related intellectual property (IP) in the digital economy cannot be overstated. Companies like Alphabet and Amazon, with extensive AI patent portfolios, highlight how intellectual assets contribute to market valuation. An analytical review of patent databases reveals the scale of AI IP holdings among leading tech companies and their correlation with market capitalization, offering a novel perspective on valuation in the AI era.

Data as a Valuable Asset

In the realm of AI, data is a critical asset, with companies possessing unique, large-scale datasets gaining a competitive edge. The valuation of data assets, particularly in training effective AI models, is becoming a focal point for investors. By examining the market performance of companies renowned for their data richness against those with limited data assets, a clear valuation premium on data becomes evident, highlighting data's role as an unseen yet valuable asset in the AI-driven market.

Sectorial Disparities and Opportunities

Financial Services: Analyzing Efficiency vs. Personalization

The dual impact of AI in the financial sector—improving operational efficiency and enhancing customer personalization—presents diverse investment opportunities. By analyzing stock performance and valuation metrics of traditional banks adopting AI for efficiency against fintech companies using AI for personalization, distinct valuation trajectories emerge. This disparity underscores the market’s valuation of personalization and customer engagement, facilitated by AI, over mere operational efficiency.

Healthcare: AI’s Premium on Innovation

In healthcare, AI’s potential to revolutionize diagnostics and patient care management is translating into a valuation premium for innovators. Companies leveraging AI for breakthrough diagnostics or personalized medicine, such as Tempus, are attracting higher valuation multiples, reflective of AI’s transformative potential in healthcare. An examination of P/E ratios and market performance of AI-driven healthcare companies versus traditional providers underscores the market's valuation of AI innovation in healthcare.

The Broader Market Impact of AI

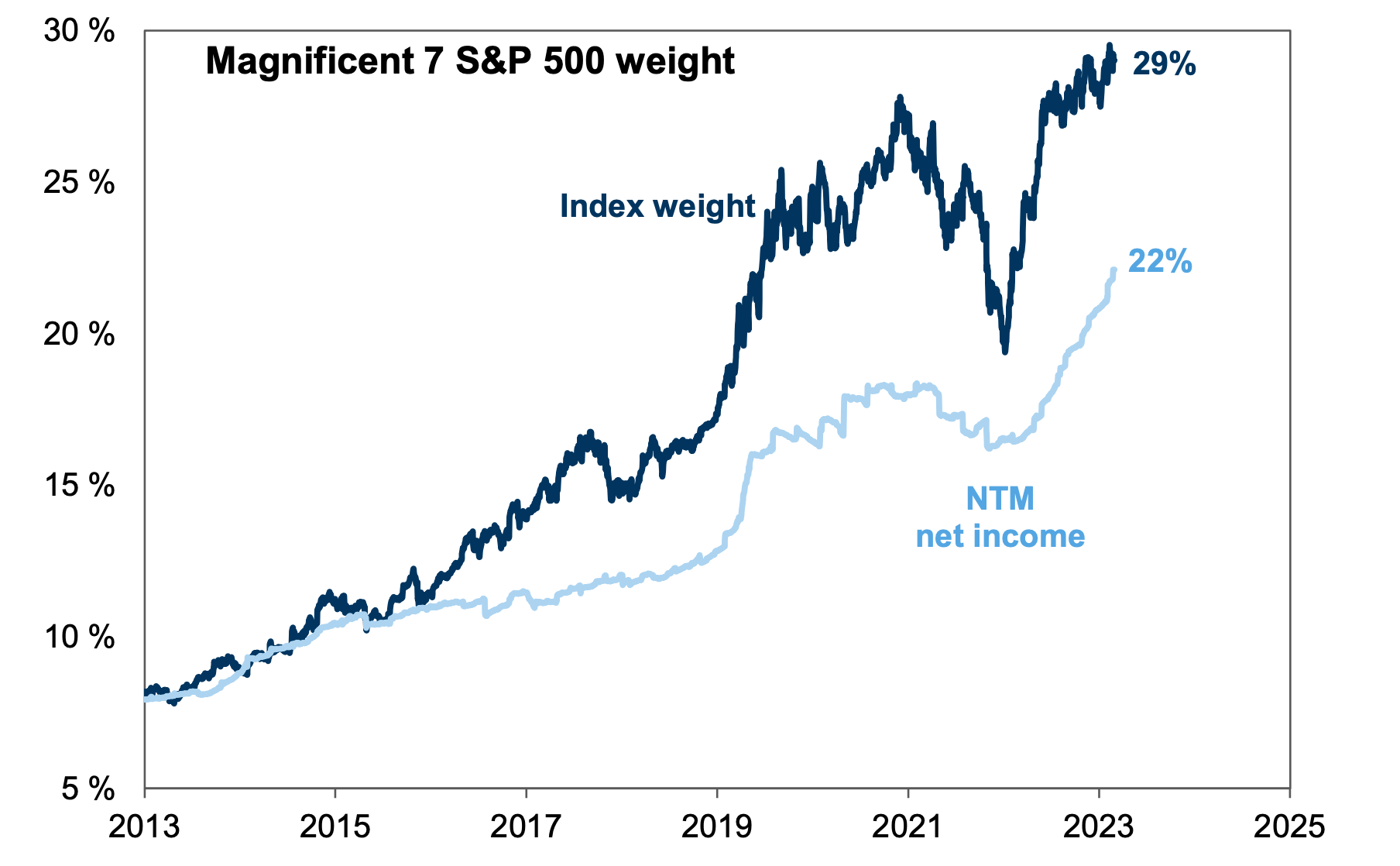

AI and the "Magnificent 7" Performance

The tech giants often dubbed the "Magnificent 7" (Mag 7) — Alphabet, Amazon, Apple, Facebook (Meta), Microsoft, NVIDIA, and Tesla — serve as prime examples of AI's broader market impact. These companies have not only integrated AI into their core operations and product offerings but have also led the charge in AI innovation, setting the stage for the future of technology.

An analytical review of their stock performance, especially in relation to their AI developments, offers valuable insights. For instance, analyzing the compound annual growth rate (CAGR) of these companies' stock prices before and after significant AI milestones can reveal the extent to which AI has fueled their market valuation. Such analysis highlights a clear trend: companies that lead in AI innovation tend to outperform the market, showcasing AI’s pivotal role in driving investor confidence and stock performance.

Evolving Valuation Metrics in the AI Age

The advent of AI is also prompting a shift in the metrics used to evaluate company valuations. Traditional metrics such as P/E ratios, while still relevant, are being complemented by AI-specific indicators that account for the strategic value of AI technologies and data assets. Metrics like AI R&D intensity (AI R&D expenditure as a percentage of total sales) and AI patent scores (reflecting the quantity and quality of a company’s AI-related patents) are emerging as critical tools for investors assessing a company’s potential in the AI-driven market.

We can observe a positive correlation by conducting a cross-sectional analysis of S&P 500 companies and correlating these AI-specific metrics with their market performance. Companies with higher AI R&D intensity and stronger AI patent scores generally exhibit superior stock performance, underscoring the market's valuation of AI innovation.

Sector-Specific Analysis: Dissecting AI's Impact

Disrupting Retail with AI

The retail sector provides a fascinating case study on AI's disruptive impact. Companies like Amazon have revolutionized the retail experience with AI-driven recommendations, inventory management, and customer service, setting new standards for operational efficiency and customer satisfaction. An analysis of retail sector stock performance, contrasting AI-adopting firms against traditional retailers, reveals a growing divergence in market valuation, highlighting the competitive edge and investor appeal provided by AI technologies.

AI's Role in Manufacturing Revolution

The manufacturing sector's embrace of AI for predictive maintenance, quality control, and supply chain optimization exemplifies AI's transformative potential. Companies leveraging AI to enhance operational efficiency and reduce downtime are seeing marked improvements in profit margins and market valuation. Analyzing the stock performance of manufacturers with significant AI investments against their less tech-savvy counterparts illustrates the market's recognition of AI's value, with AI-driven firms enjoying higher valuation multiples.

Navigating Risks and Opportunities in the AI-Driven Market

Investing in AI-driven companies requires a balanced approach, recognizing the immense opportunities and inherent risks. The rapid pace of AI innovation, regulatory uncertainties, and ethical considerations present a complex landscape for investors. A detailed risk-benefit analysis, considering market saturation, technological obsolescence, and regulatory compliance, is essential for informed investment decisions in the AI space.

The intersection of AI and stock market valuations marks a pivotal moment in the evolution of investment strategies. As AI continues to redefine operational paradigms and market dynamics, its role in shaping company valuations and investor decisions grows increasingly significant. Armed with analytical insights into AI's impact across sectors and companies, investors are better positioned to navigate the opportunities and challenges presented by this technological revolution.

The future of investing in an AI-driven market demands a proactive, informed approach. Engaging with ongoing developments, leveraging analytical tools to assess AI's impact, and maintaining a diversified investment portfolio are essential strategies for capitalizing on the opportunities presented by AI. As we stand on the brink of a new era in technology and investment, the time to deepen our understanding and embrace the potential of AI is now.

As we navigate the unfolding narrative of AI's transformative impact on the stock market and company valuations, staying informed and agile in your investment strategies has never been more crucial. The intersection of technology and finance is rapidly evolving, and with it, the opportunities for growth and innovation are vast. To ensure you remain at the forefront of these developments, we invite you to sign up for our posts. By joining our community, you'll receive insightful analyses, timely updates, and expert perspectives directly to your inbox, empowering you to make informed decisions in an AI-driven market. Don't miss out on the opportunity to elevate your investment strategy—sign up today and join a community of forward-thinking investors ready to embrace the future.