Disclaimer: As of 2024/07/20, I hold NFLX shares in my personal account.

The Evolution of Entertainment Services: Netflix's Q2 2024 Performance

In the ever-evolving landscape of streaming entertainment services, Netflix Inc. (NFLX) has once again asserted its dominance with a remarkable performance in the second quarter of 2024. The company's latest earnings report not only shattered expectations but also provided valuable insights into its strategic direction and future prospects in the entertainment video market. As Netflix navigates the challenges of increased competition and changing consumer behaviors, its Q2 results demonstrate both resilience and adaptability in providing entertainment services.

Netflix Inc. (NFLX), a leader in providing entertainment services, continues to redefine how we watch Netflix and consume digital content. As the entertainment video landscape evolves, Netflix's market capitalization reflects its dominant position in the industry. The company's focus on delivering high-quality entertainment services and expanding into new markets has solidified its status as a top performer on the NASDAQ, attracting attention from investors trading NFLX shares.

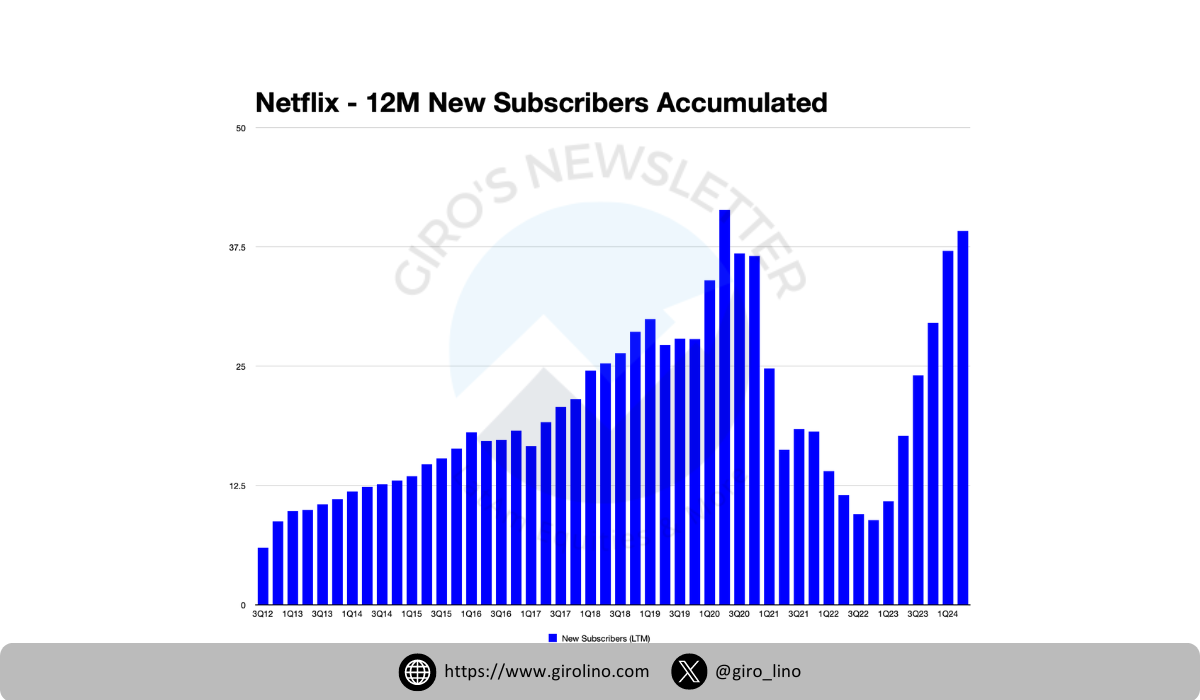

Record-Breaking Subscriber Growth

The headline-grabbing news from the earnings report was Netflix's extraordinary subscriber growth. The company added an impressive 8.05 million new paid members during the quarter, marking its best second quarter performance ever, save for the anomalous growth during the 2020 pandemic lockdowns. This surge brought Netflix Inc.'s global subscriber base to a staggering 277.65 million, significantly exceeding analyst projections of around 4.5 million new additions. This growth reflects the increasing number of people who choose to watch Netflix for their leisure time entertainment.

Diving deeper into the regional breakdown, we see that growth was robust across all markets:

- United States and Canada (UCAN) added 1.45 million subscribers, reaching a total of 84.11 million.

- Europe, Middle East, and Africa (EMEA) gained 2.24 million, bringing its total to 93.96 million.

- Latin America (LATAM) increased by 1.53 million, reaching 49.25 million subscribers.

- Asia-Pacific (APAC) added 2.83 million subscribers, for a total of 50.32 million.

Financial Performance

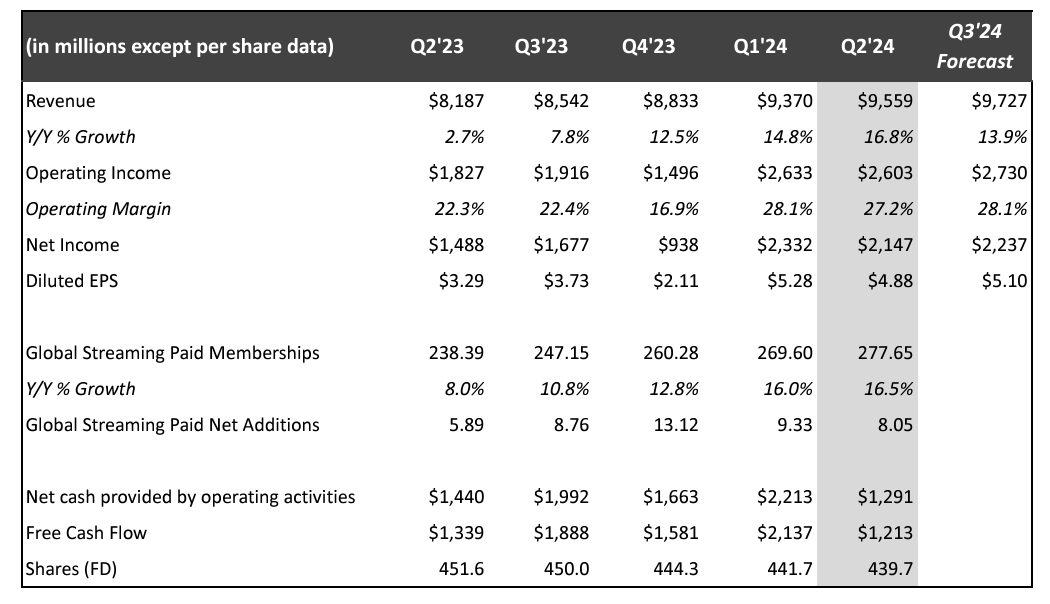

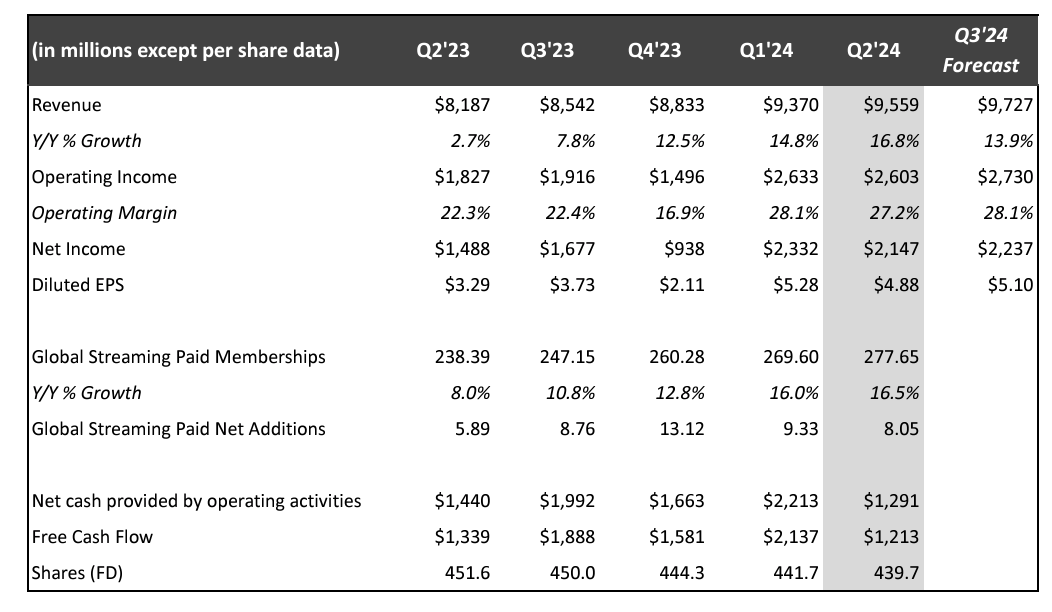

Netflix's financial metrics for Q2 2024 paint a picture of a company firing on all cylinders. Revenue reached $9.56 billion, marking a 17% year-over-year increase and slightly exceeding analyst expectations. This impressive revenue growth outpaced even Netflix's own forecast of 16% from its Q1 report. The strong performance has positively impacted NFLX shares, with the stock price and trading activity on the NASDAQ reflecting investor confidence.

The company's profitability saw a significant boost, with net income soaring to $2.15 billion, a substantial 44% increase from the same period last year. This translated to earnings per share (EPS) of $4.88, surpassing the $4.70 expected by analysts. The operating margin stood at an impressive 27.2%, exceeding the forecasted 26.6% and demonstrating Netflix's ability to scale efficiently.

Free cash flow generation remained robust, with $1.2 billion generated during the quarter. This strong cash flow position, coupled with $6.7 billion in cash and short-term investments, provides Netflix with ample resources to fund its ambitious content creation and technology development plans.

Strategy

Ad-Supported Tier Success

One of the most significant contributors to Netflix's Q2 success has been the rapid adoption and growth of its ad-supported tier. Membership in this tier grew by an impressive 34% quarter-over-quarter, with Netflix reporting that it now accounts for over 45% of all new sign-ups in markets where it's available. By the end of Q2, the ad-supported tier had attracted approximately 46 million monthly active users, a clear indication that this new offering is resonating with price-sensitive consumers.

Content Strategy and Investment

Netflix's commitment to producing high-quality, diverse programming shows no signs of waning. The company, which operates from Los Gatos, California, plans to invest up to $17 billion in content creation for 2024, maintaining a robust pipeline of original programming and licensed content. This investment strategy, initiated by co-founders Reed Hastings and Marc Randolph, continues to pay off. Several hit series and films contributed to Netflix's strong Q2 performance, including "Bridgerton" Season 3, "Baby Reindeer," "Queen of Tears," "Under Paris," and "Atlas." The firm's data-driven approach to content creation has been key to its success in the entertainment market.

Expansion into Live Programming

In a significant strategic shift, Netflix is expanding its content offerings to include more live events. Upcoming live programming includes two NFL games scheduled for Christmas Day 2024, a high-profile boxing match between Jake Paul and Mike Tyson, and WWE's "Raw" program, starting in 2025. This expansion into live sports and events represents a new frontier for Netflix, potentially opening up new revenue streams and attracting a broader audience base.

Global Strategy and Regional Performance

Netflix's global strategy continues to evolve, with a particular focus on high-growth markets. The EMEA and APAC regions have experienced a compound annual growth rate (CAGR) of 12% over the past four years, compared to 9% for UCAN. Notably, EMEA has now overtaken UCAN as the region with the highest number of subscribers, contributing 34% of global paid memberships compared to UCAN's 30%.

Technology and User Experience Enhancements

Netflix continues to invest in improving its platform and user experience. The company has begun testing a "new, simpler and more intuitive" TV homepage, which is expected to significantly enhance the content discovery experience for users. Additionally, Netflix plans to test an in-house ad tech platform in Canada in 2024, with a broader launch expected in 2025.

Looking Ahead: Future Outlook and Challenges

Based on its strong Q2 2024 performance, Netflix has revised its revenue growth forecast for fiscal year 2024 upwards to 14-15%, an increase from the previous guidance of 13-15%. The company has also raised its operating margin forecast for the year to 26% from 25%, citing an improved revenue outlook and ongoing expense discipline.

For Q3 2024, Netflix anticipates revenue growth of 13.9% year-over-year to $9.73 billion, with an operating income of $2.73 billion and an operating margin of 28.1%. The company expects to maintain its strong free cash flow generation, forecasting approximately $6 billion for the full year 2024. These projections have positively influenced NFLX Netflix stock prices and trading volumes on the NASDAQ, as investors consider the company's growth potential and market capitalization.

However, Netflix isn't without its challenges. The company faces potential headwinds from a strengthening U.S. dollar, which could impact international revenue. There are also concerns about the company's stock valuation, with some analysts viewing it as overvalued. Additionally, economic indicators such as slowing consumer spending growth and a slight uptick in U.S. unemployment rates could pose challenges for Netflix's growth trajectory.

Conclusion

Netflix's Q2 2024 results demonstrate the company's ability to innovate and adapt in the evolving streaming landscape. With record-breaking subscriber growth, strong financial performance, and strategic initiatives in advertising and content, Netflix appears well-positioned to maintain its leadership in the global streaming market. However, the company's future success will depend on its ability to navigate industry challenges, capitalize on growth opportunities in international markets, and continue delivering value to both subscribers and shareholders.

Your Opinion Matters!

We're constantly striving to improve our content. Could you spare 2 minutes to let us know what you think? Your feedback is invaluable in helping us deliver the financial insights you need.