Netflix demonstrated remarkable momentum in its third quarter of 2024, delivering strong financial results that exceeded expectations and showcased the company's successful execution of its growth strategy. The streaming leader reported substantial revenue growth, significant margin expansion, and continued progress in its advertising business, while setting ambitious targets for 2025.

Executive Summary: Redefining Growth and Profitability

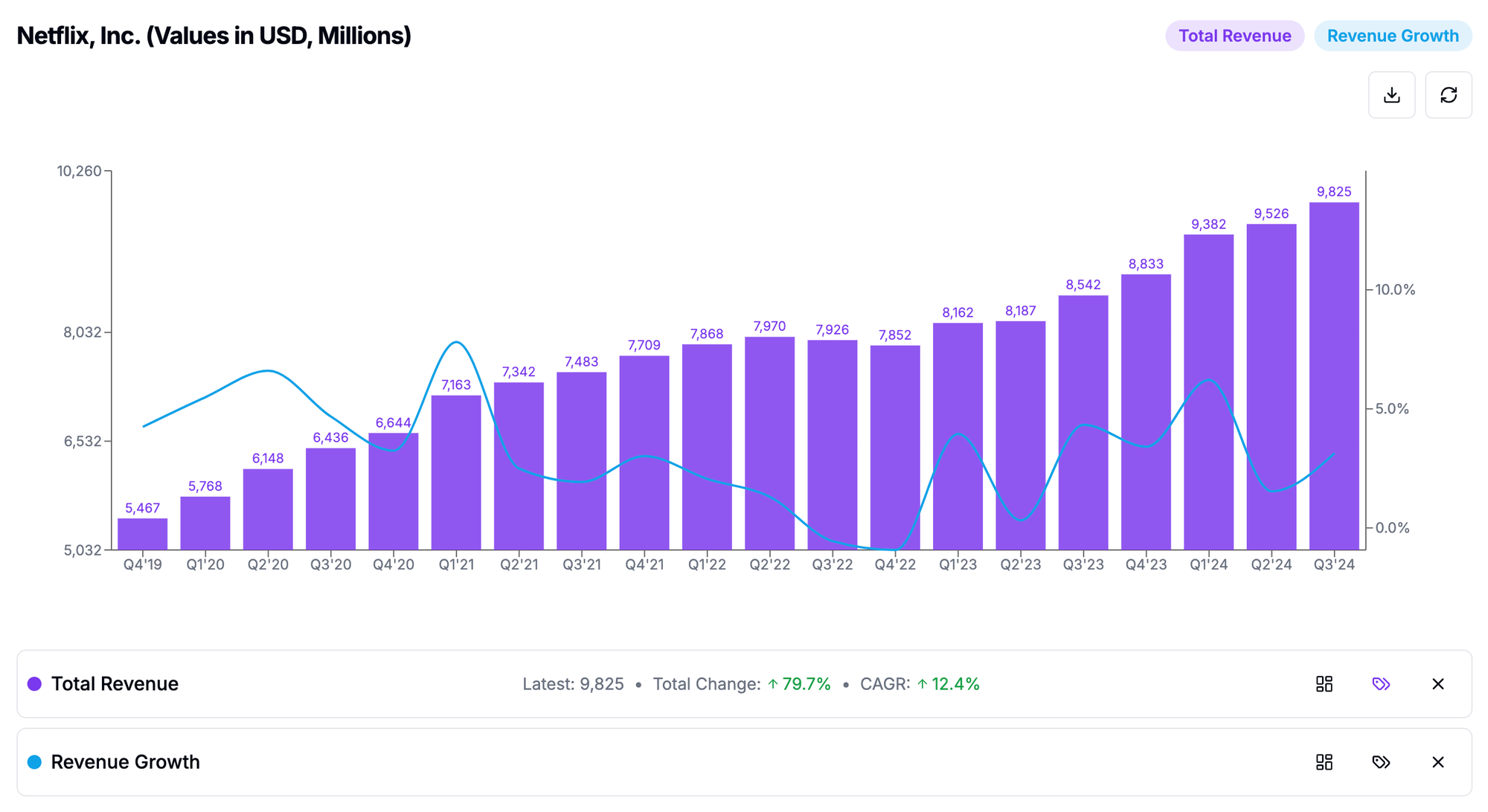

The third quarter marked a significant milestone in Netflix's journey, with revenue growing 15% year over year to reach $9.82 billion. This performance was particularly noteworthy given the complex macroeconomic environment and evolving streaming landscape. The company's operating margin expanded dramatically to 30%, up from 22% in the same quarter last year, demonstrating Netflix's ability to drive both growth and profitability simultaneously.

Co-CEO Ted Sarandos highlighted the company's strategic success: "We had a plan to reaccelerate growth, and we delivered on that plan. You can see that in our 2024 financials. We expect to deliver 15% revenue growth and 6 percentage points of operating margin improvement and engagement, which we view as our best proxy for member happiness."

The strength of Netflix's content offering remained evident through robust engagement metrics, with users averaging approximately two hours of viewing per day per member. The company's commitment to diverse, high-quality content continued to drive success across various markets, with strong performances from titles like "Perfect Couple," "Monsters: The Lyle and Erik Menendez Story," and "Nobody Wants This."

Financial Performance: A Deeper Look at Growth Dynamics

Revenue Growth Across Regions

Netflix's revenue growth story in Q3 2024 was marked by strong performance across all geographical segments. The UCAN (United States and Canada) region, despite being the company's most mature market, delivered impressive 16% year-over-year revenue growth, reaching $4.32 billion. This growth was driven by a combination of 10% growth in average paid memberships and a 5% increase in Average Revenue per Membership (ARM).

The EMEA (Europe, Middle East, and Africa) region matched UCAN's growth rate, posting a 16% year-over-year revenue increase to $3.13 billion. This growth was primarily driven by expanding membership numbers, demonstrating the region's continued potential for market penetration.

APAC (Asia-Pacific) emerged as the standout performer, leading all regions with 19% year-over-year revenue growth to reach $1.13 billion. CFO Spencer Neumann noted the region's success: "We're improving our product/market fit in APAC and had a strong local content slate in Japan, Korea, Thailand and India in Q3. As a result, our revenue growth rate in APAC led all regions."

LATAM (Latin America) showed resilience with 9% year-over-year revenue growth to $1.24 billion, despite experiencing a slight decline in paid memberships during the quarter. Management attributed this temporary setback to recent pricing changes and a softer content slate, while noting that membership growth had already rebounded early in Q4.

Profitability and Operational Efficiency

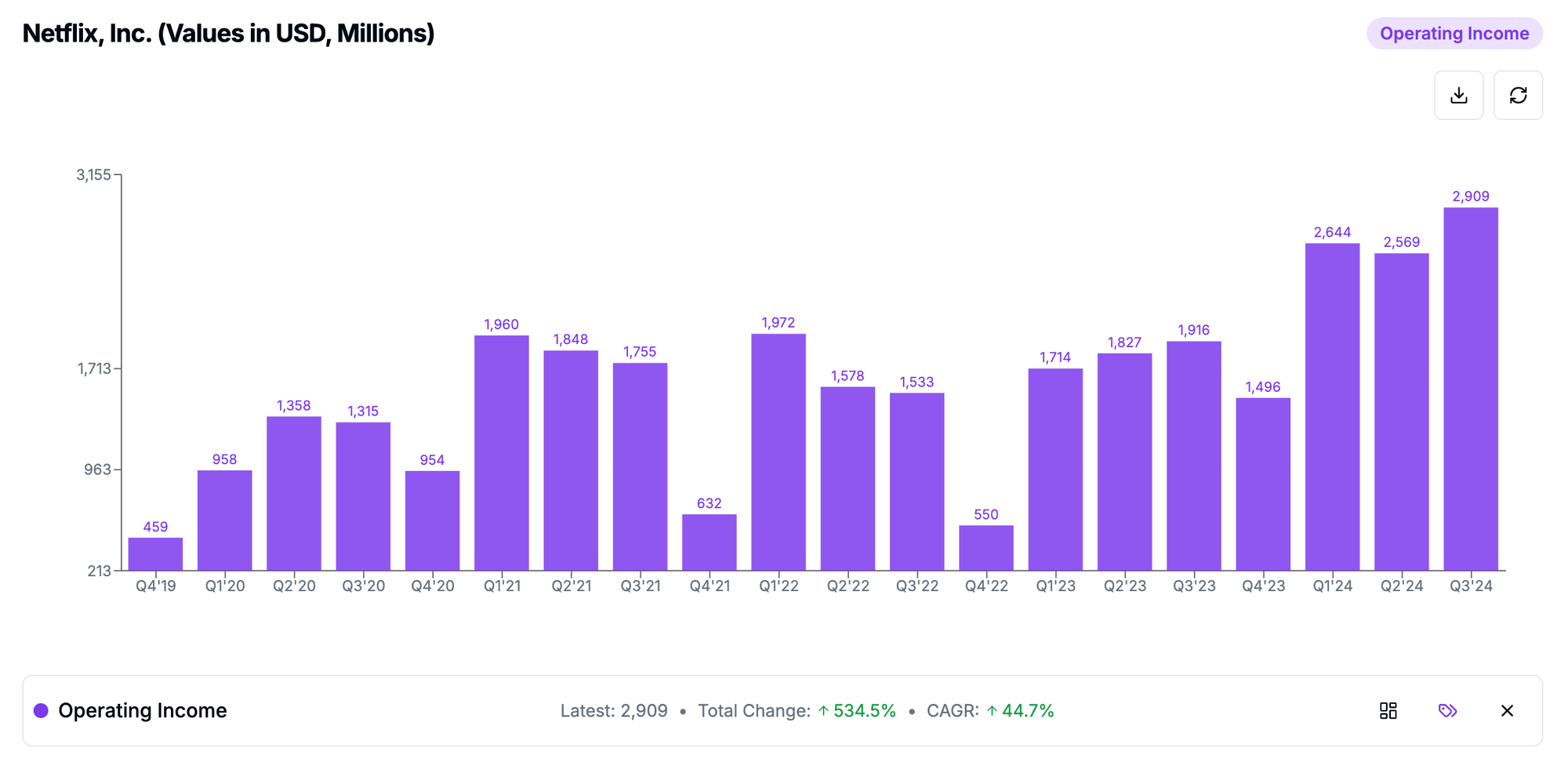

The company's focus on operational efficiency yielded remarkable results in Q3, with operating income surging 52% year over year to $2.9 billion. This translated to an operating margin of 30%, representing a substantial seven percentage point improvement from the previous year. This margin expansion exceeded guidance forecasts, driven by a combination of higher revenue and optimized spending patterns.

Earnings per share (EPS) grew 45% year over year to reach $5.40, despite including a $91 million foreign exchange loss primarily related to Euro-denominated debt remeasurement. This strong bottom-line performance underscores Netflix's ability to convert revenue growth into shareholder value effectively.

Subscriber Metrics and Engagement

The global paid membership base expanded to 282.72 million, with net additions of 5.07 million during the quarter. While this represents a decrease from the 8.76 million net additions in Q3 2023, it reflects the company's strategic shift toward focusing on revenue growth and profitability rather than purely subscriber numbers.

Engagement metrics remained robust, with Netflix maintaining approximately two hours of viewing per day per member, and notably, engagement among owner households (excluding shared accounts) increased year over year through the first three quarters of 2024.

Co-CEO Greg Peters emphasized the significance of these metrics:

"We've always been focused on trying to constantly improve every aspect of our service. It served us quite well for the last 1.5 decades. We hope and expect it will serve us well for decades to come."

Strategic Initiatives and Business Updates

Advertising Business Momentum

Netflix's advertising tier has emerged as a significant growth driver entering its second year of operation. The platform witnessed remarkable adoption metrics in Q3, with the advertising plan accounting for over 50% of new sign-ups in countries where it's available. This strong performance led to a 35% quarter-over-quarter increase in advertising membership, marking four consecutive quarters of substantial growth.

Greg Peters, Co-CEO, provided insight into the company's advertising strategy:

"Our top-level priorities when we think about our ads business are twofold. Priority number one was growing our ad tier membership to sufficient scale to be relevant in each market for advertisers. Priority number two is improving our capabilities and attractiveness to advertisers and therefore the monetization of all that inventory."

The company's advertising technology infrastructure continues to evolve, with its first-party ad server scheduled to launch in Canada during Q4 2024, followed by a broader rollout across all advertising markets in 2025. Partnerships with The Trade Desk and Google are progressing well, demonstrating Netflix's commitment to building a robust advertising ecosystem.

The monetization metrics show promising trends, with CPMs positioning at the high end of the premium CTV advertising market. While advertising won't be a primary revenue driver in 2025, the company expects ad revenue to roughly double year-over-year. This confidence is supported by strong upfront sales, with Netflix securing over 150% increase in advertising sales commitments in the U.S. market.

Content Strategy and Performance

Netflix's content strategy demonstrated resilience despite the impacts of the previous year's Hollywood strikes. The company has begun to normalize its output schedule, with Ted Sarandos, Co-CEO, explaining the strategic approach:

"Our aim here is to always have a very steady drumbeat of great new TV shows and films and games for our members to watch throughout the year. So a drumbeat so steady that when you're watching the last episode of whatever you're watching, you start expecting the next thing to be great, too."

The third quarter showcased several breakthrough hits. "The Perfect Couple" starring Nicole Kidman and Liev Schreiber garnered 65.2 million views, while "Monsters: The Lyle and Erik Menendez Story" from Ryan Murphy achieved 54.6 million views. International content continued to perform strongly, with titles like "Tokyo Swindlers" from Japan and "Desperate Lies" from Brazil demonstrating Netflix's global appeal.

Looking ahead to 2025, Netflix has lined up an impressive slate of content including new seasons of flagship series like "Wednesday," "Squid Game," and "Stranger Things." The company is also expanding its offering with new shows from renowned creators Shonda Rhimes and Ryan Murphy, a new Knives Out film, and Guillermo del Toro's "Frankenstein."

Product and Pricing Strategy Evolution

Netflix continues to refine its monetization strategy through careful adjustments to its pricing and plan structure. The company implemented price increases in several European markets and Japan during Q3, with additional increases planned for Spain and Italy. These adjustments reflect Netflix's balanced approach to growing revenue while maintaining value for subscribers.

The strategic elimination of the Basic plan in key markets like the US and France represents a calculated move to optimize the company's plan structure. Greg Peters elaborated on this approach: "We want to have a range of price points to be able to deliver different features for different consumers while also making sure that we're not adding too much complexity or too much choice tax, which we think is a real thing."

The company's low-price ad-supported tier at $6.99 in the US continues to demonstrate strong value proposition, offering HD streaming, two concurrent streams, and downloads. This positioning has proven effective in both acquiring new subscribers and providing an attractive entry point for price-sensitive consumers.

Expansion into Live Programming

Netflix's venture into live programming marks a significant strategic expansion. The upcoming Mike Tyson and Jake Paul boxing match, alongside two NFL games on Christmas Day, represents the company's ambitious push into live events. Additionally, the acquisition of WWE rights starting in January 2025 signals a long-term commitment to live programming.

Ted Sarandos contextualized the live content strategy:

"We have about 200 billion hours every year on Netflix. Very few of them are actually live, but they all promise to be extremely high value. The contributor to growing engagement is going to be across the board on our scripted and unscripted or documentary programming, all the kind of things that people love, including now the addition of some live hours."

2025 Outlook and Strategic Priorities

Netflix enters 2025 with ambitious growth targets and a clear strategic roadmap. The company projects revenue of $43-44 billion for 2025, representing growth of 11-13% from 2024's expected revenue of $38.9 billion. This growth trajectory will be supported by both membership expansion and ARM (Average Revenue per Membership) improvements.

CFO Spencer Neumann detailed the revenue growth components: "The majority of growth next year, we expect to be membership-driven growth. It's from the full year impact of this year's strong net adds plus solid paid net adds expected next year. We still have hundreds of millions of households that aren't members, and we'll grow into that opportunity, thanks to a great '25 slate and our improvements in converting consumer demand."

The company targets an operating margin of 28% for 2025, building upon 2024's expected 27% margin. This measured approach to margin expansion reflects Netflix's strategic balance between profitability and investment in future growth. As Greg Peters emphasized: "We're going to always evaluate and will evolve based on how our business is evolving and, frankly, how the ecosystem is evolving around us."

Market Opportunity and Competitive Position

Netflix's current market position represents just a fraction of its potential opportunity. Greg Peters highlighted this perspective: "If you step back and you think about this opportunity ahead of us, over $600 billion in consumer spend in the areas and countries that we operate, we're only capturing roughly 6% to 7% of that today. That's tremendous upside if we can just stay focused on that continuous improvement."

The company's approach to competition differs notably from other streaming services. While competitors increasingly turn to bundling strategies, Netflix maintains its focus on standalone value creation. Ted Sarandos explained this distinction:

"We're seeing a lot of our competitors use bundles to find growth in their businesses, and I get that. It's a comfortable business model for legacy media companies. But what we're focused on is adding more and more value to this package, amazing series and films and now games at a remarkably low price all in one place."

Investment Priorities and Innovation Focus

Looking ahead, Netflix has identified several key investment areas to drive growth. The company plans to continue enhancing its core film and series offerings while simultaneously developing new revenue streams through gaming, live events, and advertising. The strategy emphasizes both improving existing services and exploring new opportunities for engagement and monetization.

The gaming initiative, in particular, shows promise with upcoming titles based on popular Netflix IPs like Squid Game and Virgin River. The expansion into live programming, including sports events and WWE content, represents another frontier for growth. These investments reflect Netflix's commitment to diversifying its entertainment offering while maintaining its core strength in storytelling.

Financial Strategy and Capital Allocation

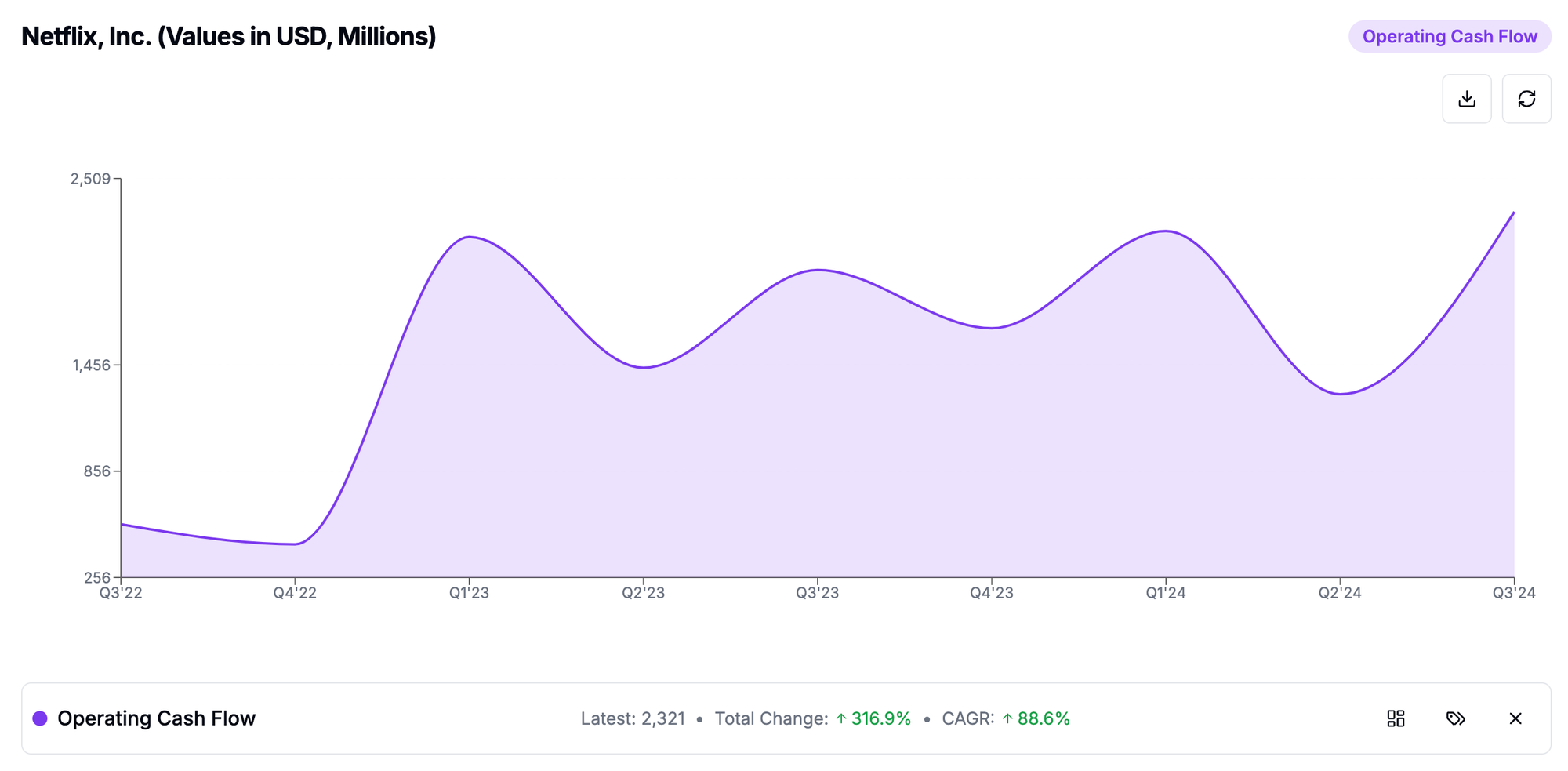

Netflix's approach to capital allocation remains disciplined yet opportunistic. The company generated $2.2 billion in free cash flow during Q3, contributing to a projected full-year free cash flow of $6.0-6.5 billion for 2024. This strong cash generation provides flexibility for both content investment and strategic initiatives.

CFO Spencer Neumann outlined the company's capital allocation priorities:

"We prioritize profitable growth by reinvesting in our business. Maintain ample liquidity, second priority. And then we return excess cash to shareholders beyond several billion dollars of minimum cash that we have on our balance sheet and then any that we use for selective M&A."

Looking Ahead: Challenges and Opportunities

As Netflix moves forward, several key challenges and opportunities will shape its trajectory. The company must continue navigating the evolving content production landscape, managing increased competition for viewer attention, and scaling its advertising business effectively. However, its strong market position, financial resources, and clear strategic vision provide a solid foundation for continued growth.

The company's success in maintaining high engagement levels while expanding into new business areas demonstrates its ability to execute complex strategic initiatives. With approximately two hours of daily viewing per member and growing adoption of its advertising tier, Netflix appears well-positioned to capitalize on the significant market opportunity ahead.