In the ever-evolving landscape of digital entertainment, two behemoths stand tall, locked in an epic battle for supremacy: Netflix Inc. (NFLX) and The Walt Disney Company (DIS). As these streaming giants vie for dominance, their strategies, financial performances, and market positions offer crucial insights for investors considering exposure to the burgeoning streaming industry. This comprehensive analysis delves into the heart of the streaming wars, providing investors with the information needed to evaluate the potential of NFLX and DIS in their portfolios.

Market Position and Subscriber Growth

The streaming industry has become a fiercely contested battleground, with Netflix and Disney emerging as the most prominent competitors. Their subscriber bases and market capitalizations tell a compelling story of rapid growth and shifting market dynamics.

| Company | Global Subscribers (Last Q) | Market Cap |

|---|---|---|

| Netflix Inc. | 277.6 million | $270.45 billion |

| Walt Disney | 229.8 million* | $152.37 billion |

*Walt Disney's figure includes Disney+, Hulu, and ESPN+

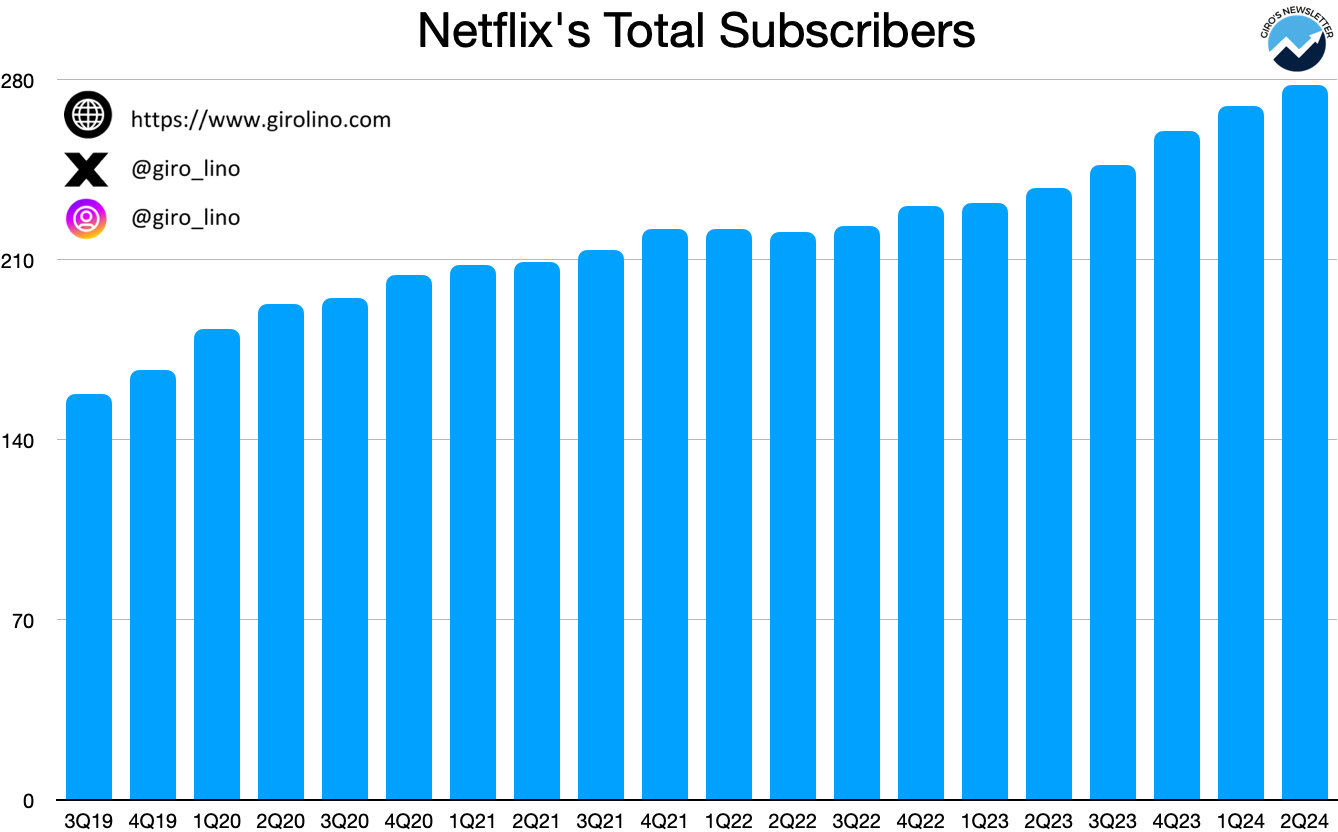

Netflix, headquartered in Los Gatos, California, has maintained its leadership position with an impressive 277.6 million global subscribers. This figure represents a significant milestone for the company, which started its streaming service in 2007. Netflix's first-mover advantage has allowed it to build a substantial lead in subscriber numbers, a key metric for investors assessing the company's market penetration and growth potential.

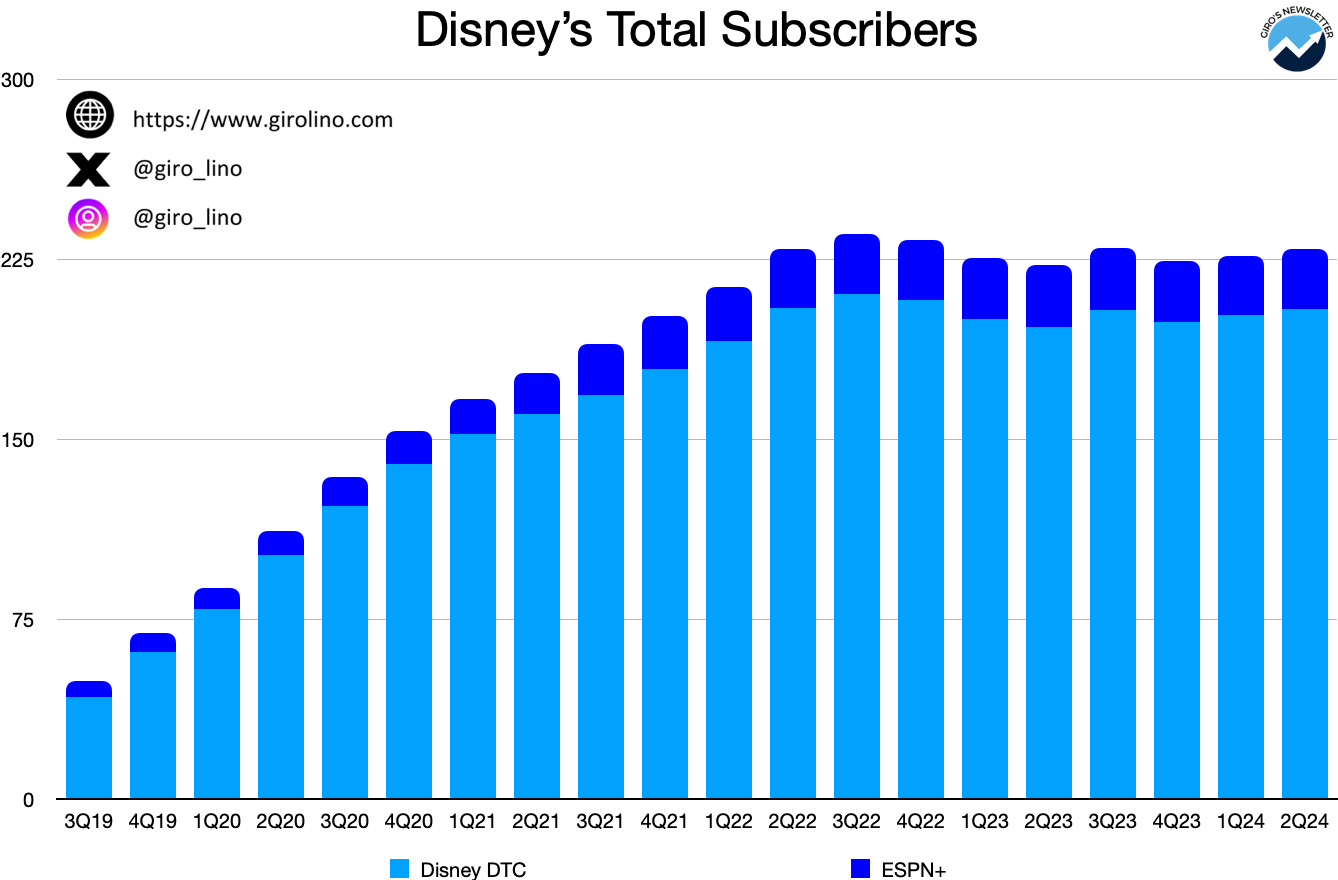

Walt Disney's rapid ascent in the streaming world is equally noteworthy. Launching Disney+ in November 2019, the company has quickly amassed a combined subscriber base of 229.8 million across its streaming services (Disney+, Hulu, and ESPN+) in less than five years. This explosive growth demonstrates the power of Disney's brand and its vast library of beloved content, factors that investors should consider when evaluating the company's long-term potential in the streaming market.

The difference in market capitalization between Netflix and Disney is particularly intriguing. Despite Disney's much broader business portfolio, which includes theme parks, cruise lines, and traditional media networks, Netflix commands a higher market cap. This valuation difference reflects investor optimism about Netflix's future growth potential and its dominant position in the streaming market.

Revenue Streams and Business Models

When it comes to streaming revenue, both companies are generating billions, but their overall financial pictures differ significantly due to their diverse business models.

| Company | Streaming Revenue (Q3 2024) | Total Revenue (Q3 2024) |

|---|---|---|

| Netflix Inc. | $9.559 billion | $9.559 billion |

| Walt Disney | $5.143 billion | $23.155 billion |

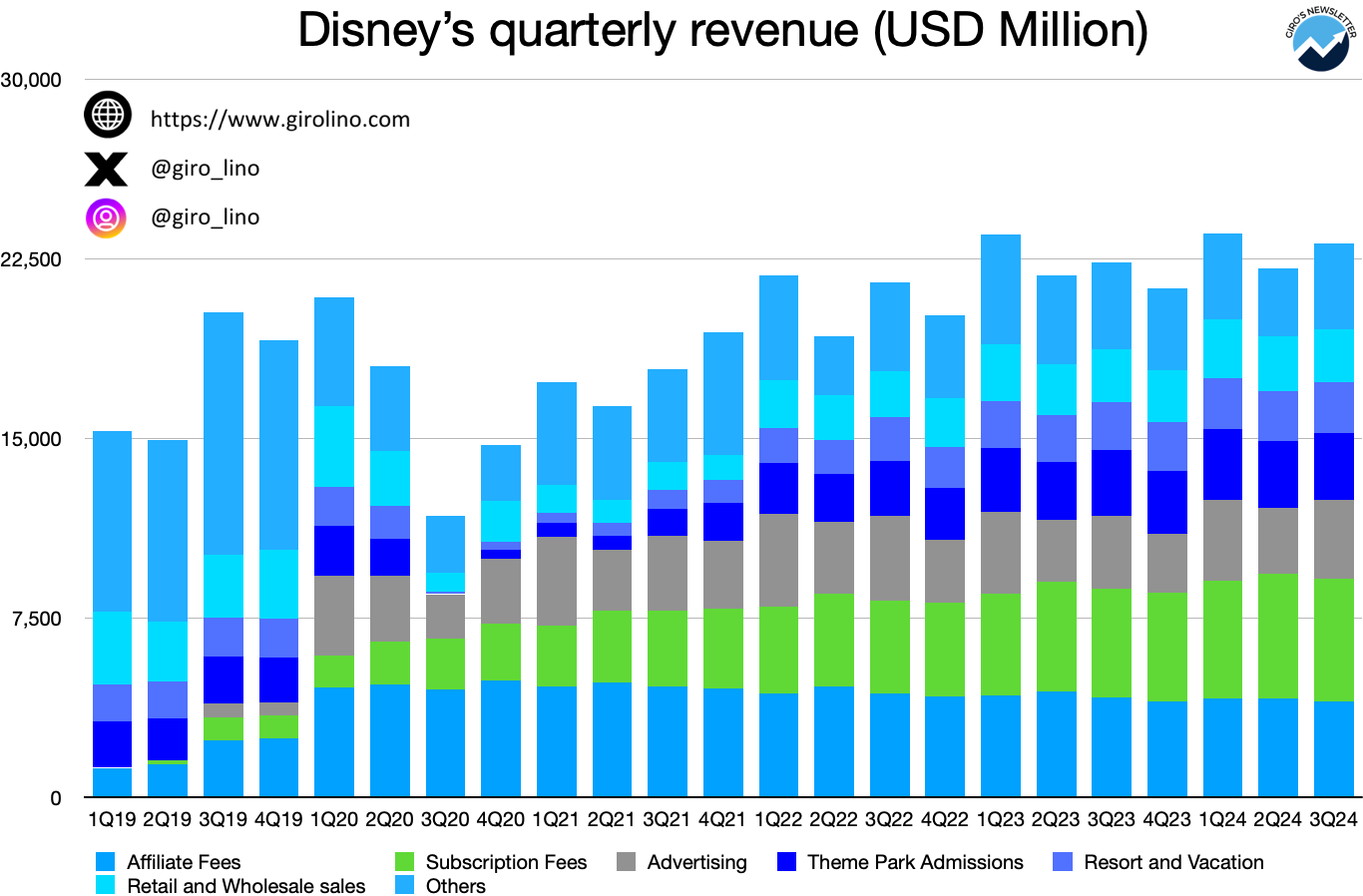

Netflix's revenue figures reflect its pure-play status in the streaming market. The company's entire business is built around its streaming service, allowing for a focused approach to revenue generation and cost management. This singular focus can be attractive to investors looking for pure exposure to the streaming market.

Walt Disney's streaming revenue, while impressive, is just one part of a much larger entertainment empire. The company's total revenue includes income from its theme parks, cruise lines, consumer products, and traditional media networks. This diversification provides Disney with multiple revenue streams and potential synergies across its businesses, which could be appealing to investors looking for a more balanced entertainment industry investment.

For investors, these contrasting business models present distinct opportunities and challenges. Netflix's pure-play strategy offers a clear, focused investment in the streaming market, with revenue growth directly tied to its success in content creation and subscriber acquisition.

This model may appeal to investors seeking high-growth potential and direct exposure to streaming industry trends. Conversely, Disney's diversified approach provides a more balanced investment proposition. While its streaming growth is crucial, investors also benefit from the stability and cash flow of its established entertainment businesses.

The potential for cross-pollination between Disney's various segments – for instance, leveraging IP across streaming, theme parks, and merchandise – offers unique value-creation opportunities. However, it also requires considering a more complex set of factors when evaluating the company's overall performance and growth prospects.

Content Investment Strategies

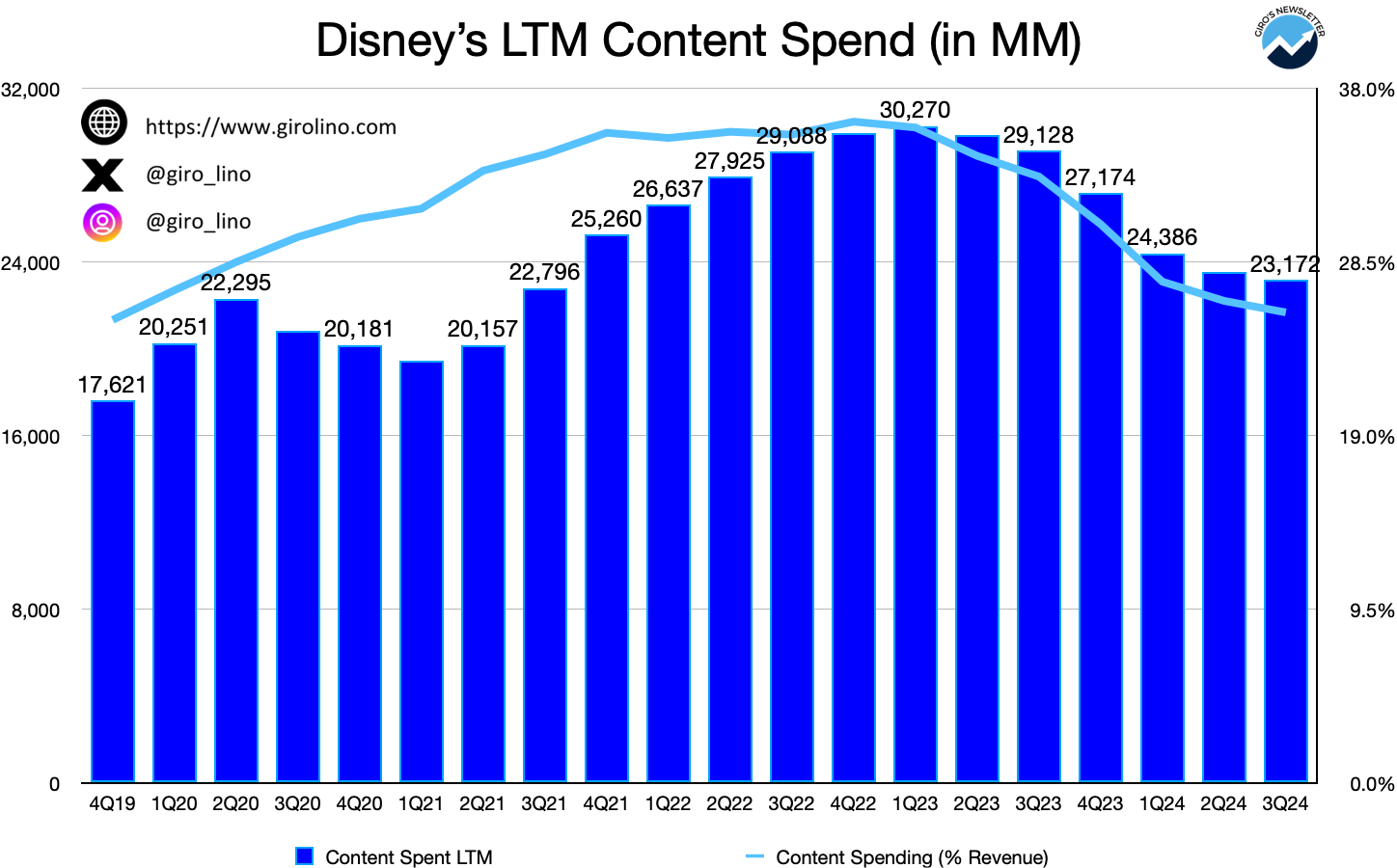

Content is the lifeblood of streaming services, and how effectively Netflix and Disney invest in and monetize their content libraries.

| Company | 2023 Content Spend | 2024 Projected Spend |

|---|---|---|

| Walt Disney | $30-32 billion | $25 billion |

| Netflix Inc. | $13 billion | $17 billion |

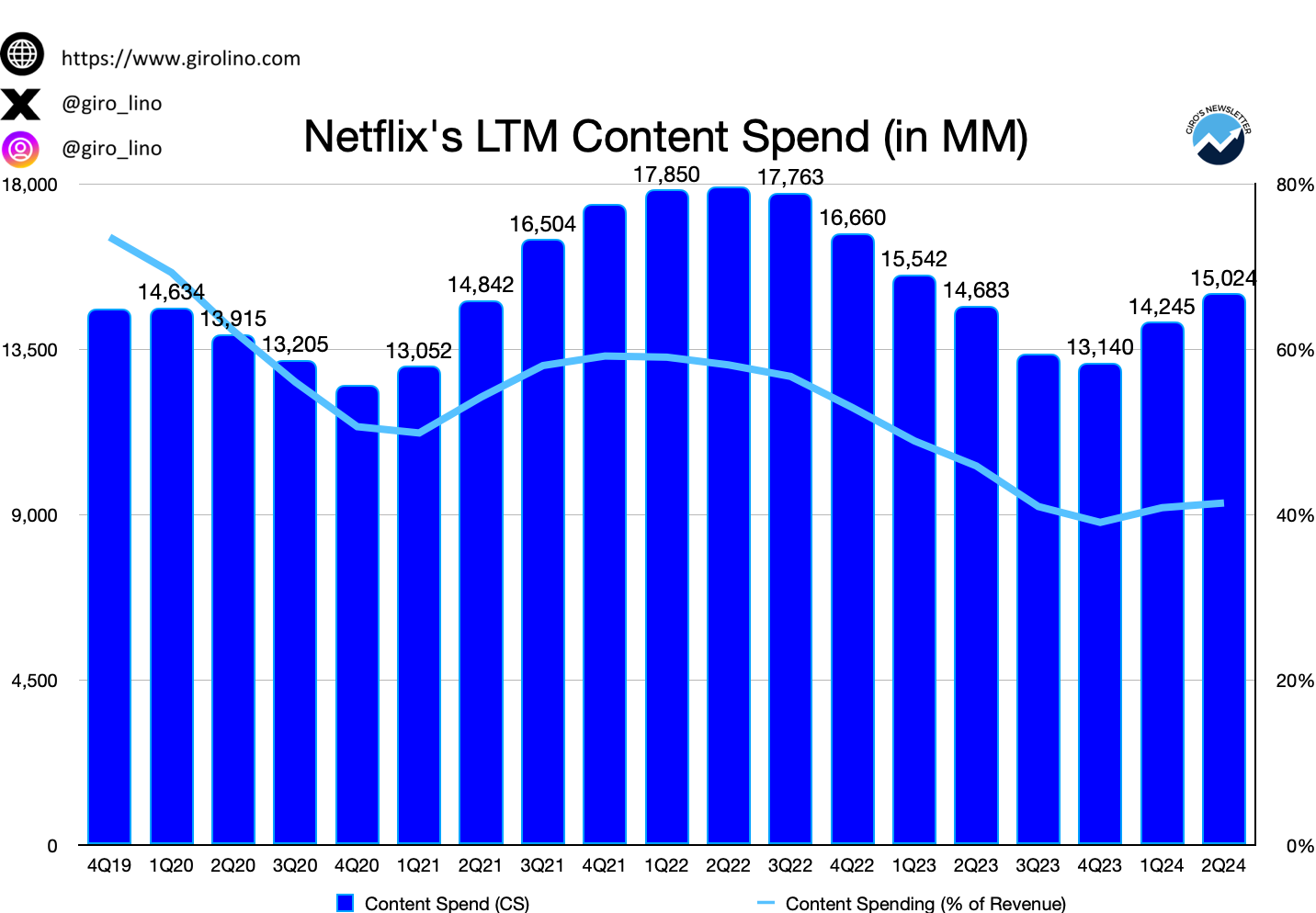

Netflix's consistent $17 billion investment reflects a strategy of creating a steady stream of original content to keep subscribers engaged and drive high demand for its service. The company's focus on producing a wide variety of original programming, spanning multiple genres and languages, has resulted in global hits like "Stranger Things," "The Witcher," and "Bridgerton."

Disney's massive content budget covers a broader spectrum, including theatrical releases, TV productions, and streaming content across its various properties. The company's extensive portfolio of franchises, including Marvel, Star Wars, and Pixar, requires significant investment to maintain and expand. However, Disney is tightening its belt, planning to reduce content spending to $25 billion in 2024, a move aimed at improving profitability in its direct-to-consumer segment.

Netflix's Steady Investment Approach

Unlike Disney's recent budget cuts, Netflix has maintained a relatively stable content investment strategy, consistently allocating around $17 billion annually in recent years. This steady approach reflects Netflix's confidence in its established position within the streaming market, where it continues to prioritize a diverse range of original programming to cater to its global audience.

Netflix's content strategy focuses on producing a high volume of original series, films, and documentaries across various genres and languages, helping to maintain its competitive edge. The company’s emphasis on data-driven content creation allows it to tailor offerings to viewer preferences, resulting in a robust content library that appeals to a broad spectrum of subscribers. While Disney is shifting towards quality over quantity, Netflix remains committed to a high-volume content model, betting on a wide array of content to keep subscribers engaged and attract new ones.

However, even with its consistent spending, Netflix is not immune to industry pressures. The company has become more selective with its investments, focusing on projects with high potential for global appeal and profitability. This selective approach ensures that Netflix can continue to offer a vast content library without overspending, aligning with the broader industry trend towards more sustainable content investment. As streaming services mature, Netflix’s ability to balance content volume with strategic investment will be crucial to its ongoing success in an increasingly competitive market.

Disney's Shift Towards Quality Over Quantity

Disney's content investment strategy has experienced a notable transformation as the company moves from a high-spending, growth-oriented approach to a more selective, quality-focused model. Initially, Disney invested heavily in content to rapidly expand its streaming platforms, particularly Disney+, aiming to build a large subscriber base quickly.

This strategy involved substantial spending across its vast portfolio, including theatrical releases, theme park attractions, and multiple streaming services such as Disney+, Hulu, and ESPN+. A significant portion of this budget was dedicated to sports content for ESPN, as well as to blockbuster franchises like Marvel, Star Wars, and Pixar.

However, as the streaming market has matured and competition has intensified, Disney is now adopting a more conservative approach. Under the leadership of CEO Bob Iger, the company is shifting its focus from sheer volume to producing fewer, but higher-quality, projects that have the potential to resonate deeply with audiences and drive long-term subscriber loyalty.

This change is partly driven by the need to improve financial performance amidst broader economic challenges and increased market saturation in the streaming industry. By reducing its content budget—from $30 billion in 2022 to a projected $25 billion in fiscal 2024—Disney aims to create a more sustainable and profitable content pipeline.

The emphasis on quality over quantity reflects a broader industry trend as media companies reassess their strategies in an evolving digital landscape. Disney's success in this new phase will hinge on its ability to leverage its iconic brands and franchises to produce content that stands out in a crowded market, while also managing costs effectively.

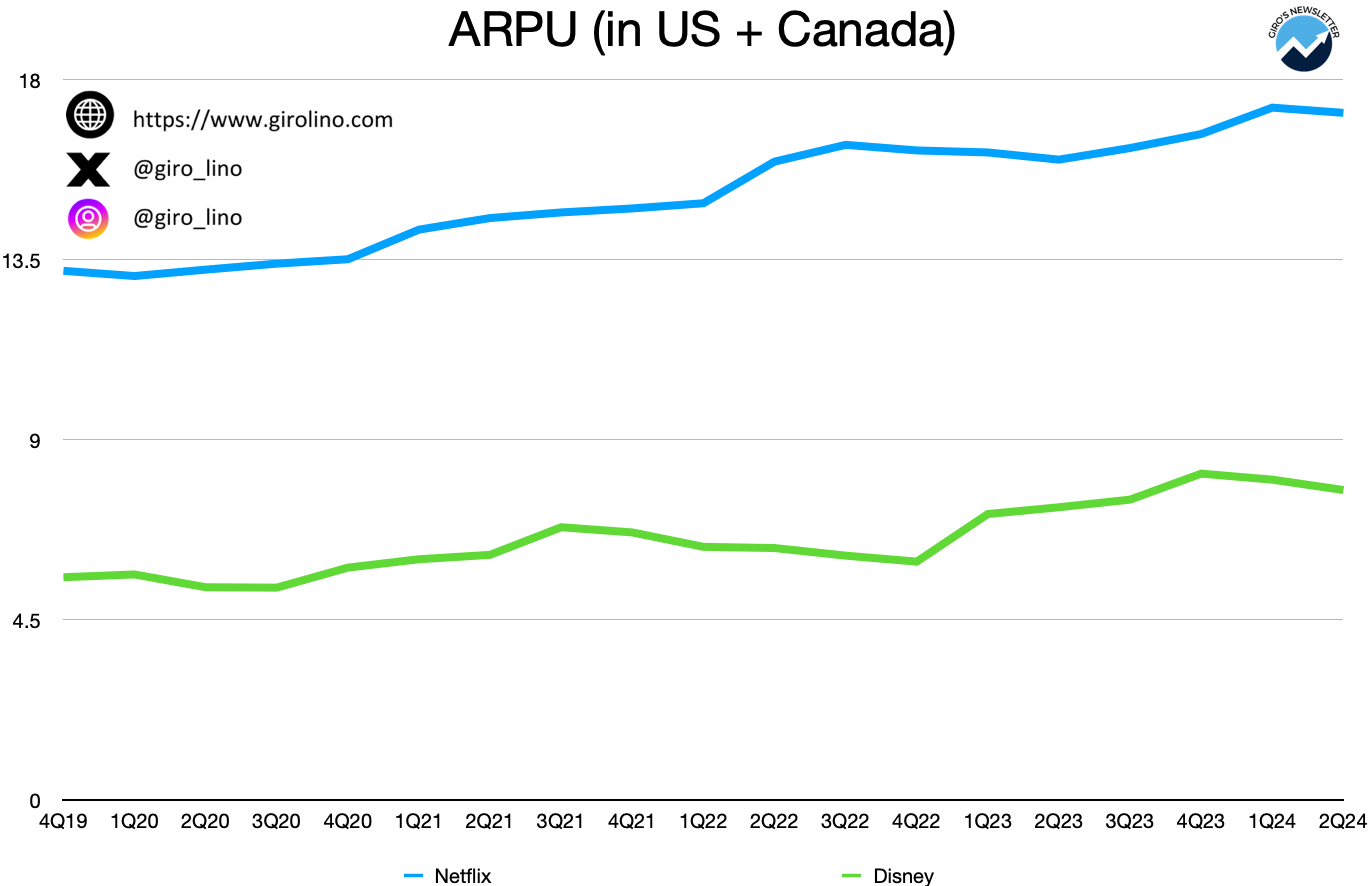

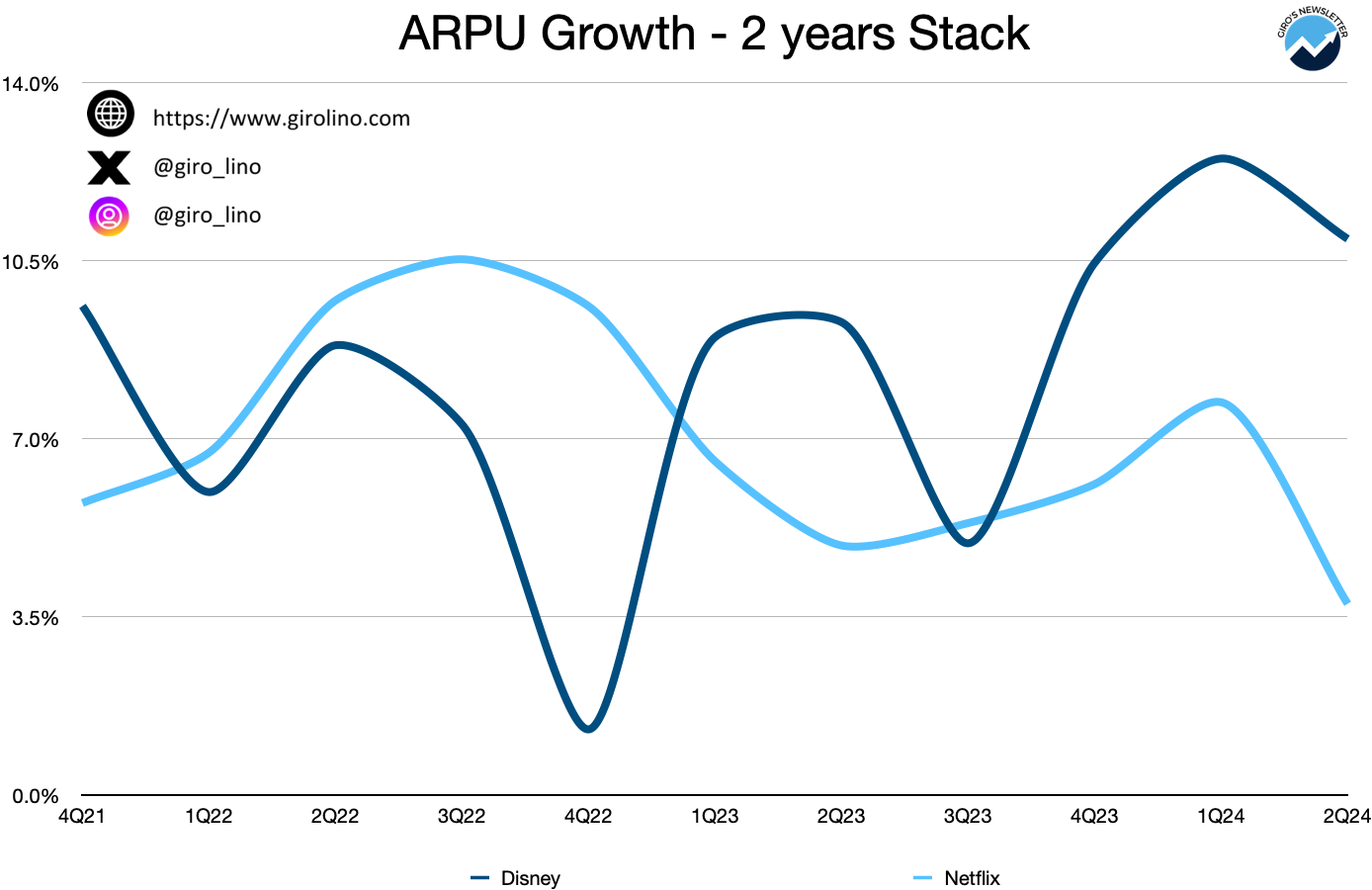

Pricing Power and Revenue Generation

Understanding each company's ability to generate revenue through pricing strategies is crucial for investors evaluating NFLX and DIS. Both Netflix and Disney have demonstrated different approaches to pricing, reflecting their market positions and growth strategies.

Netflix has consistently shown strong pricing power, successfully implementing several price increases over the years without significant subscriber churn. As of August 2024, Netflix's pricing tiers in the U.S. range from $9.99 to $19.99 per month. This pricing structure reflects Netflix's position as a premium content provider and its confidence in the value of its extensive library.

In contrast, Disney+ entered the market with a more aggressive pricing strategy, initially offering lower subscription costs to drive rapid adoption. As of August 2024, Disney+ prices range from $7.99 to $13.99 per month for its bundle with Hulu and ESPN+. This strategy has allowed Disney to quickly amass a large subscriber base, but at the cost of lower Average Revenue Per User (ARPU).

The ARPU figures tell a compelling story:

| Company | ARPU (US & Canada, Last Q) |

|---|---|

| Netflix | $17.17 |

| Disney+ | $7.74 |

Netflix's significantly higher ARPU demonstrates its ability to monetize its subscriber base effectively. For investors, this translates to stronger revenue generation per subscriber and potentially higher profit margins in the long term.

However, Disney's lower ARPU should be considered in the context of its broader strategy. The company's bundled offerings with Hulu and ESPN+ provide opportunities for cross-selling and upselling, potentially increasing the lifetime value of each customer. Additionally, Disney's diverse revenue streams from its other business segments provide financial flexibility as it grows its streaming services.

Understanding the ARPU Gap: Disney+ vs. Netflix

The significant Average Revenue Per User (ARPU) gap between Netflix ($17.17 in US & Canada) and Disney+ ($7.74) reflects their differing market strategies and positions. Key factors influencing this disparity include:

- Pricing Strategy: Netflix maintains premium pricing due to its established market presence, while Disney+ entered with competitive pricing for rapid subscriber growth.

- Market Maturity: Netflix's first-mover advantage allows it to command higher prices, whereas Disney+ prioritized subscriber acquisition over ARPU.

- Content Library: Netflix's diverse, extensive library justifies higher pricing. Disney+'s more niche focus on franchises like Marvel and Star Wars currently limits its pricing power.

- Global Market Presence: Netflix's extensive global reach and regionalized pricing maximize ARPU. Disney+'s global ARPU is diluted by lower-priced offerings like Hotstar in Asia.

- Advertising and Bundling: While both offer ad-supported tiers, Netflix's higher-priced ad-free plans boost its ARPU. Disney's bundling strategy with Hulu and ESPN+ can lower individual service ARPU.

- Content Investment and Monetization: Despite higher overall spending, Disney faces challenges in translating content investments into ARPU growth compared to Netflix's more focused approach.

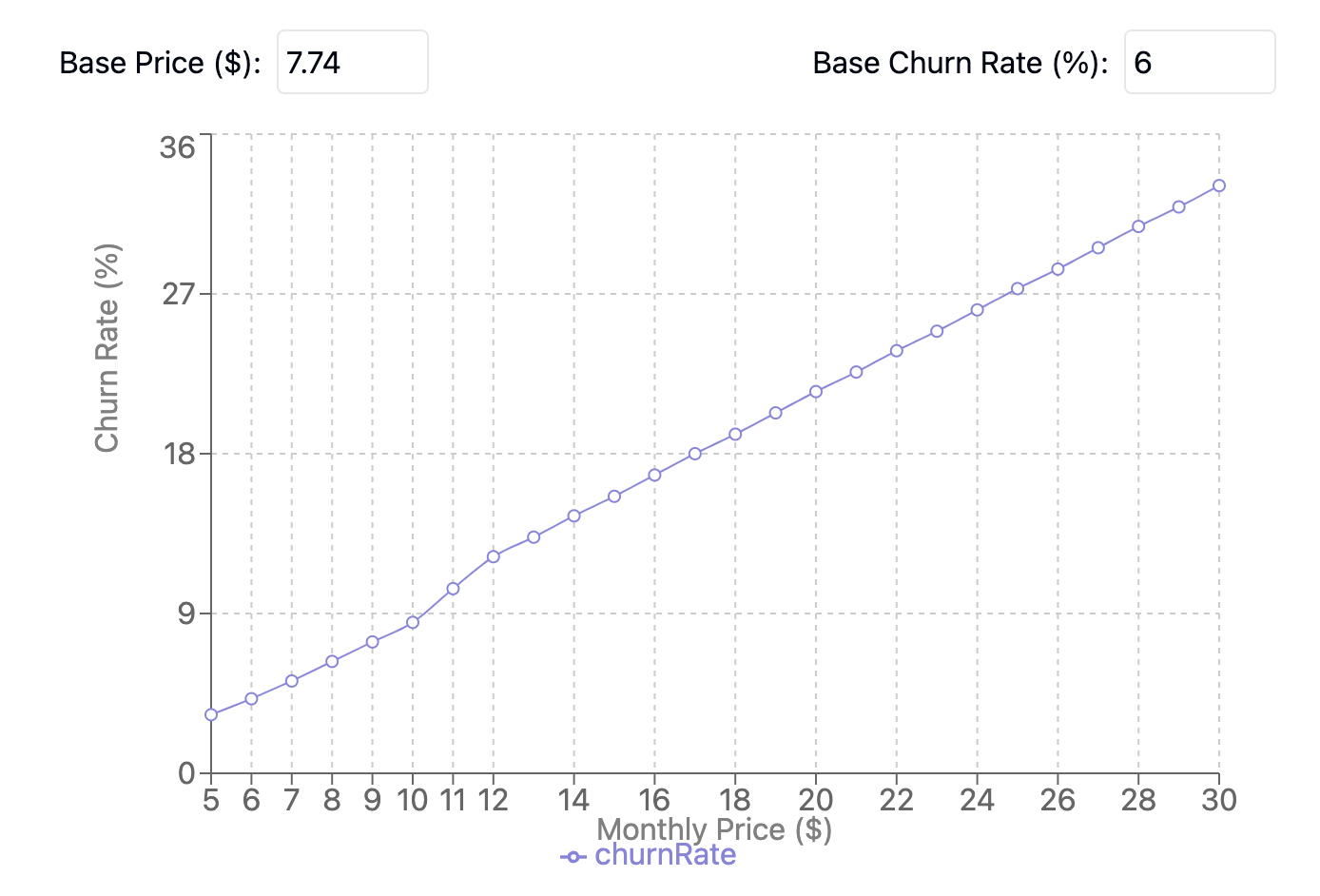

Disney's decision to prioritize rapid subscriber growth through competitive pricing carries significant risks for its long-term position in the streaming market. While this strategy has successfully built a large subscriber base, it presents challenges in transitioning to a more profitable model without triggering substantial churn.

The low initial pricing may have set customer expectations, making it difficult to implement future price increases without losing price-sensitive subscribers. Additionally, the lower ARPU puts pressure on profit margins, potentially limiting Disney's ability to invest in new, high-quality content creation, which is crucial for subscriber retention and acquisition in the long run.

Furthermore, consistently low pricing might lead to a perception of lower value, complicating efforts to position Disney+ as a premium service in the future. This approach could also make the service vulnerable to new market entrants who can undercut on price or offer perceived better value.

The focus on subscriber growth over immediate profitability may create tension with investors expecting financial returns, potentially leading to pressure to change strategy and disrupt Disney's market position. Balancing these risks against the benefits of rapid market penetration will be crucial for Disney's long-term success in the streaming industry.

Addressing the ARPU Challenge: Disney's Strategic Adjustments

To narrow the ARPU gap, Disney has begun implementing strategic changes, including price increases for its streaming services. This shift reflects Disney's growing focus on profitability over pure subscriber growth.

However, the challenge remains in executing these price hikes without triggering significant subscriber churn, particularly in a highly competitive streaming landscape. As the market continues to evolve, both Disney and Netflix will need to adapt their strategies, balancing ARPU optimization with subscriber retention to maintain their positions in the streaming industry.

International Expansion and Market Penetration

Global growth is a critical factor for both Netflix and Disney as domestic markets approach saturation. The companies' abilities to penetrate international markets and adapt to local conditions will significantly impact their long-term growth prospects.

Netflix has been a pioneer in international expansion, available in over 190 countries as of 2024. The company's strategy includes producing local content in various markets, which has led to global hits like "Money Heist" (Spain) and "Squid Game" (South Korea). This approach has allowed Netflix to grow its international subscriber base significantly, with international markets now accounting for the majority of its new subscriber growth.

Disney+ has pursued a more measured international rollout but has leveraged Disney's strong global brand recognition to quickly gain traction in new markets. The company's partnership with Hotstar in India, for example, has been particularly successful, giving Disney+ a strong foothold in one of the world's largest and fastest-growing streaming markets.

Comparative performance in key international markets provides insight into each company's global strategy:

| Market | Netflix Subscribers | Disney+ Subscribers |

|---|---|---|

| India | 6.5 million | 40 million (incl. Disney+ Hotstar) |

| Brazil | 18 million | 12 million |

| UK | 14 million | 7 million |

| Japan | 7 million | 9 million |

Note: Figures are estimates as of Q2 2024

These numbers highlight the varying success of each company's international strategies. Disney's partnership approach has given it an advantage in markets like India, while Netflix's early-mover status and local content production have allowed it to maintain leadership in markets like Brazil and the UK.

Future Outlook and Potential Catalysts

As investors look to the future of the streaming industry, several factors could significantly impact the performance of NFLX and DIS:

- Content Pipeline: Both companies have robust content pipelines, but the success of key titles can drive subscriber growth and engagement. Investors should monitor anticipated releases and their potential impact.

- Technological Advancements: Innovations in areas like AI-driven personalization, interactive content, and enhanced streaming quality could provide competitive advantages.

- Regulatory Environment: Increased scrutiny from regulators, particularly regarding data privacy and market competition, could impact growth strategies in various markets.

- Diversification: Disney's diverse business model provides both challenges and opportunities. The performance of its theme parks, cruise lines, and traditional media networks can impact its ability to invest in and grow its streaming services.

- Industry Consolidation: Potential mergers, acquisitions, or strategic partnerships could reshape the competitive landscape.

- Economic Factors: Consumer discretionary spending on entertainment subscriptions may be impacted by broader economic conditions, affecting both companies' growth prospects.

As the streaming wars continue, both Netflix and Disney are well-positioned to shape the future of digital entertainment. Their ongoing competition is likely to drive further innovation and content creation, potentially benefiting both consumers and investors in the long run.

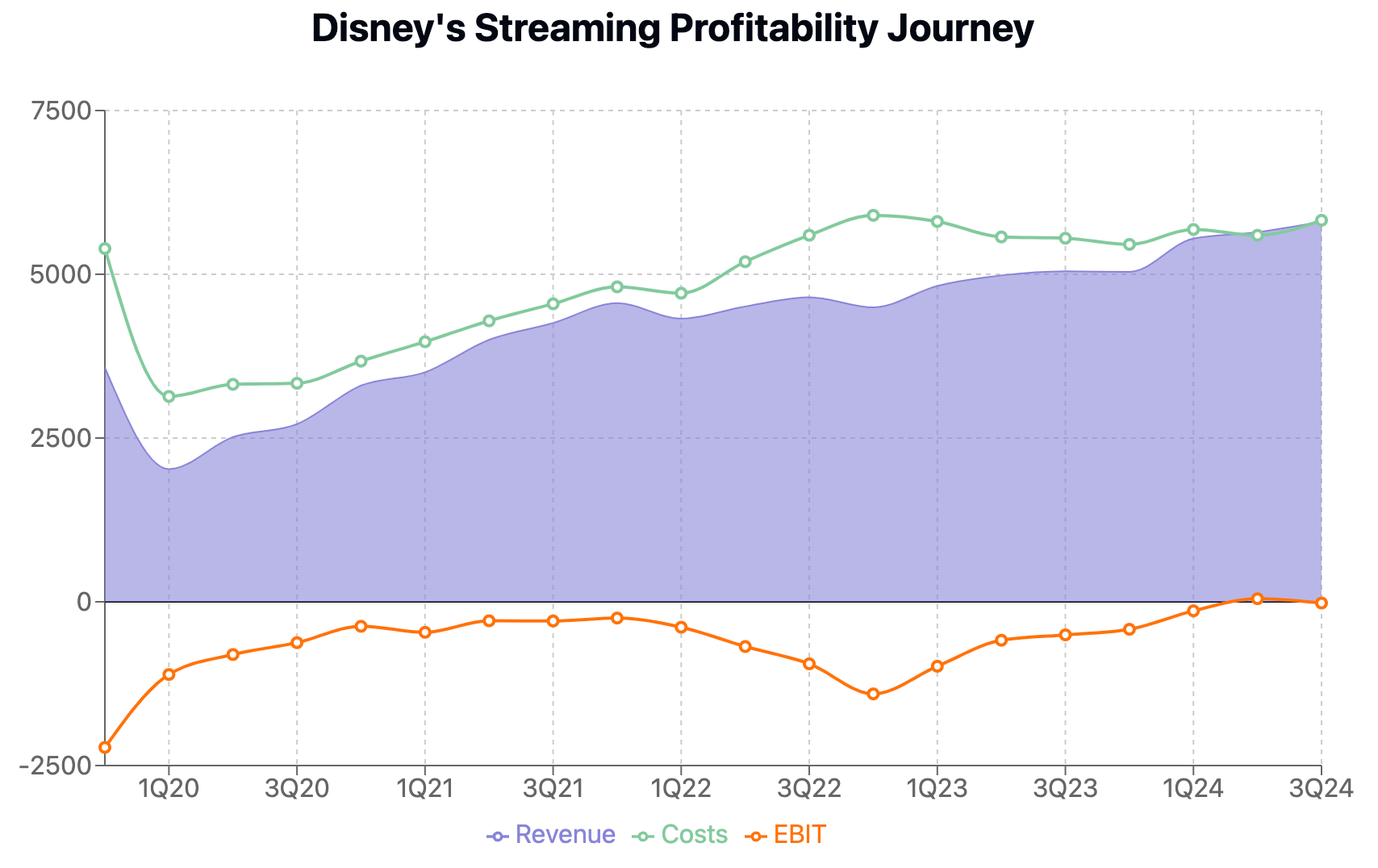

Weighing the Investment Opportunity

Netflix emerges as a compelling pure-play in the streaming industry, with its focused business model providing clear exposure to market trends. With 277.6 million global subscribers and an industry-leading ARPU of $17.17 in the US & Canada, Netflix has demonstrated consistent growth, strong pricing power, and efficient content monetization. Its successful international expansion and data-driven content strategy position it favorably in the evolving digital entertainment landscape.

In contrast, Disney presents a more complex case. Despite rapid subscriber growth to 229.8 million across its services, Disney's streaming segment has only recently approached profitability. The company's low ARPU of $7.74 for Disney+ reflects an aggressive pricing strategy that now poses challenges for future price increases. While Disney's diversified business model provides multiple revenue streams, it also complicates the evaluation of its streaming performance within the broader corporate context.

The stark difference in market capitalization - $270.45 billion for Netflix versus $152.37 billion for Disney - reflects the market's current preference for Netflix's streamlined, streaming-focused approach over Disney's more diversified but complex business model. Netflix's clear financial model offers more straightforward insights into its core business, while Disney's streaming success is just one factor in its overall financial health.

As the streaming wars continue, both companies are poised to drive innovation in content and technology. However, based on current trajectories, Netflix appears better positioned to capitalize directly on the streaming market's growth. Disney, while offering the potential upside of a diversified entertainment giant, faces the significant challenge of increasing streaming profitability while managing the intricate interplay between its various business units.