In the ever-evolving landscape of digital entertainment, the streaming industry has become increasingly competitive, with new players entering the market and established media companies launching their own platforms. Despite this intensifying competition, Netflix, the pioneer of streaming services, continues to demonstrate remarkable resilience and growth. This analysis delves into how Netflix is not just surviving but thriving in this crowded market, backed by recent financial data and strategic insights.

As of 2024, the streaming wars are in full swing. Disney+, Amazon Prime Video, HBO Max, and Apple TV+ have all carved out significant market shares, while traditional media conglomerates continue to launch and expand their own streaming offerings. This proliferation of choices has led many industry observers to question whether Netflix can maintain its leadership position and continue its growth trajectory.

However, Netflix's recent performance tells a compelling story of adaptability, strategic foresight, and continued market dominance. By leveraging its first-mover advantage, investing heavily in original content, expanding globally, and continuously innovating its platform, Netflix has not only weathered the storm of increased competition but has emerged stronger than ever.

In this comprehensive analysis, we will examine Netflix's financial performance, dissect its key strategies, and explore how the company is positioning itself for future growth in an increasingly crowded streaming landscape. Through a data-driven approach, we will demonstrate why Netflix remains a formidable force in the entertainment industry and how it continues to outmaneuver its competitors.

The Competitive Streaming Landscape

The streaming industry in 2024 is characterized by intense competition, with multiple players vying for subscribers' attention and wallets. This section provides an overview of the major competitors and the challenges faced by streaming services in the current market.

Major Competitors

- Disney+: Launched in late 2019, Disney+ has quickly become a formidable competitor, leveraging its vast library of beloved franchises including Marvel, Star Wars, and Pixar. As of Q2 2024, Disney+ reported 152 million subscribers globally.

- Amazon Prime Video: Bundled with Amazon's Prime subscription, Prime Video benefits from Amazon's massive customer base. While exact subscriber numbers are not disclosed, Amazon reported over 200 million Prime members globally in early 2024.

- HBO Max: Rebranded as "Max" in 2023, this platform combines HBO's premium content with a broader offering from Warner Bros. Discovery. It had approximately 95 million subscribers by Q2 2024.

- Apple TV+: While smaller in terms of content library, Apple TV+ has gained traction with high-quality original programming. Apple doesn't disclose subscriber numbers, but analysts estimate it had around 60 million subscribers by 2024.

- Hulu: Primarily focused on the U.S. market, Hulu offers both on-demand and live TV streaming options. It had about 48 million subscribers in the U.S. by Q2 2024.

Challenges Faced by Streaming Services in 2024

- Content Saturation: With the proliferation of streaming services, there's an overwhelming amount of content available to consumers. Standing out in this crowded space requires significant investment in original, high-quality programming.

- Rising Content Costs: The competition for top talent and intellectual property has driven up the costs of content production and acquisition. In 2024, major streaming services collectively spent over $100 billion on content.

- Subscriber Churn: As consumers face multiple subscription options, retaining subscribers has become increasingly challenging. The industry average churn rate in 2024 was approximately 5-7% per month.

- Market Saturation: In mature markets like the U.S., new subscriber growth has slowed, forcing streaming services to look to international markets for expansion.

- Technical Infrastructure: Delivering high-quality streaming experiences to millions of concurrent users requires significant investment in technology infrastructure.

- Regulatory Challenges: Streaming services face varying regulations across different countries, including content quotas, censorship, and data privacy laws.

- Balancing Growth and Profitability: Many streaming services are under pressure to demonstrate a path to profitability while still investing heavily in content and technology.

In this challenging environment, Netflix's ability to maintain its market leadership is a testament to its resilience and strategic acumen. The following sections will delve into Netflix's financial performance and the strategies that have enabled its continued success in this highly competitive landscape.

Netflix's Financial Performance in a Competitive Environment

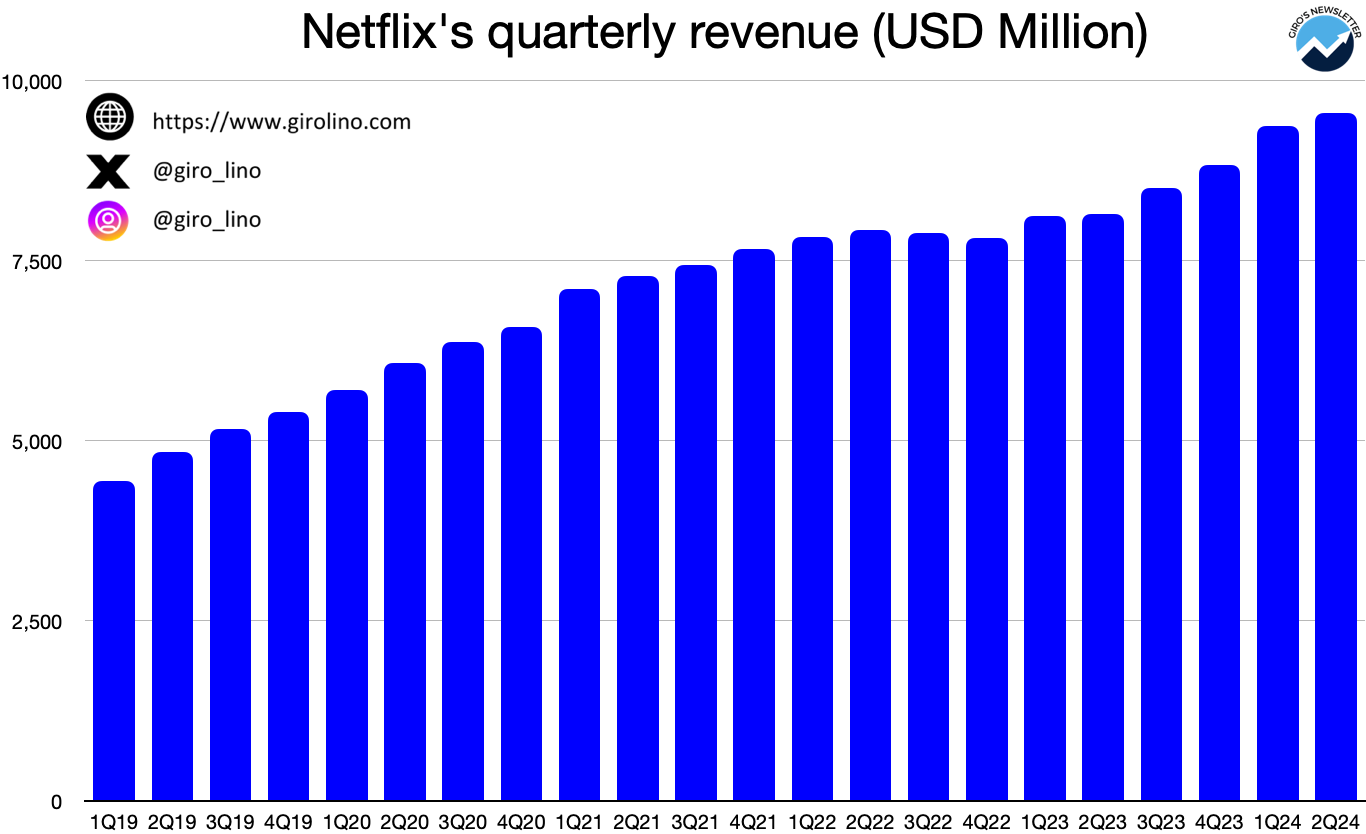

In the face of intensifying competition, Netflix has demonstrated remarkable financial resilience. The streaming giant reported a revenue of $9.559 billion in Q2 2024, showcasing a robust 17.2% year-over-year growth. This impressive increase outpaces the overall streaming market growth of 11%, underlining Netflix's ability to capture market share even in a mature industry.

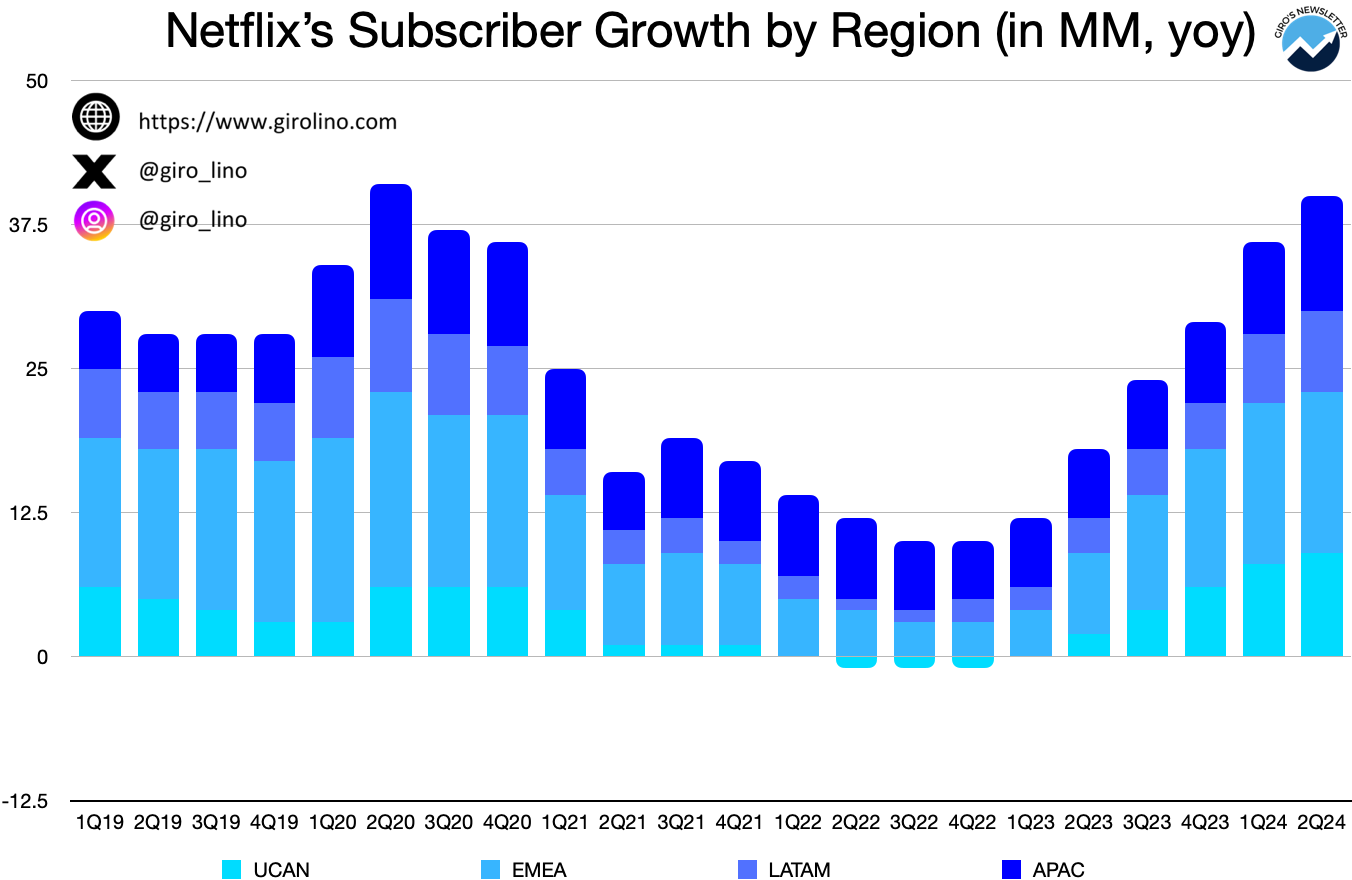

Subscriber growth remains a key indicator of Netflix's market penetration and consumer appeal. By Q2 2024, total paid streaming subscribers reached an impressive 277.6 million, marking a 16.5% increase year-over-year. This growth is particularly noteworthy given the market saturation in key regions and the presence of multiple competitors vying for viewer attention.

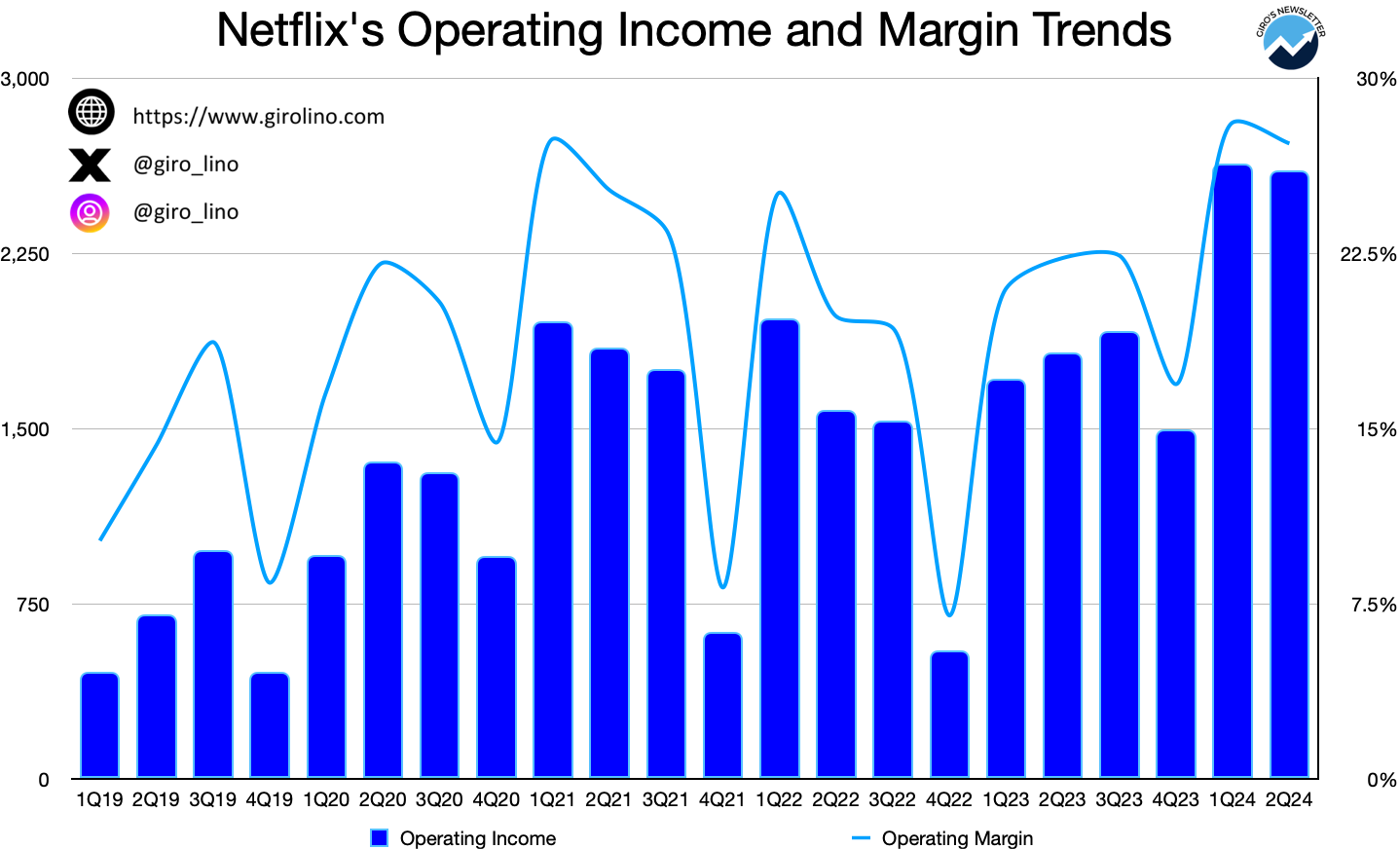

Profitability metrics further underscore Netflix's financial strength. Operating income surged to $2.603 billion, representing a 42.5% year-over-year increase. More impressively, the operating margin expanded to 27.2%, a significant improvement of 491 basis points from the previous year. This demonstrates Netflix's ability to scale efficiently and improve profitability while still investing heavily in content and technology.

The company's financial health is further reinforced by its strong cash generation. Netflix produced $1.213 billion in free cash flow, representing a 12.7% FCF margin. This robust cash flow provides Netflix with the financial flexibility to invest in content, technology, and new growth initiatives, ensuring its continued competitiveness in the market.

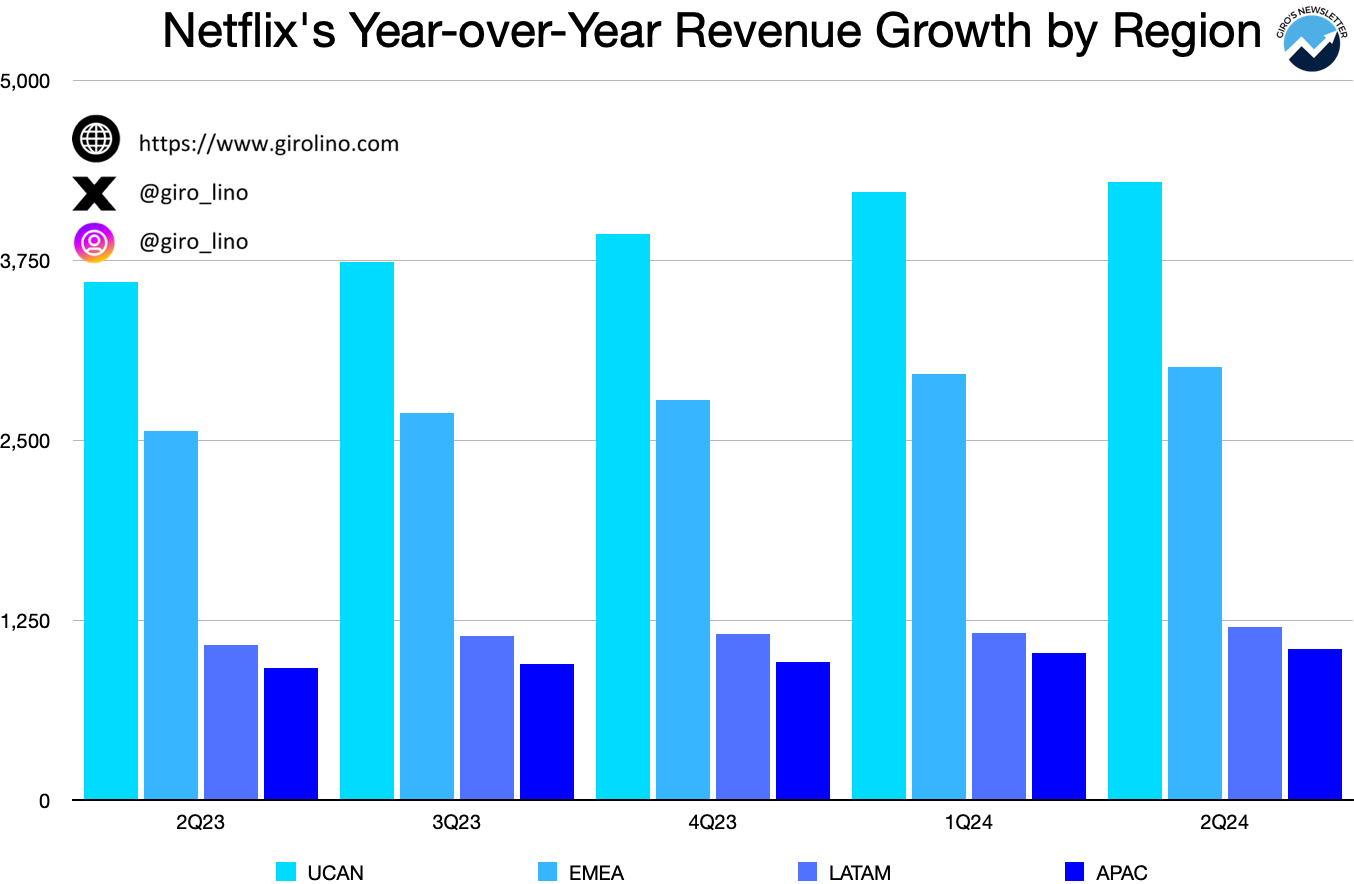

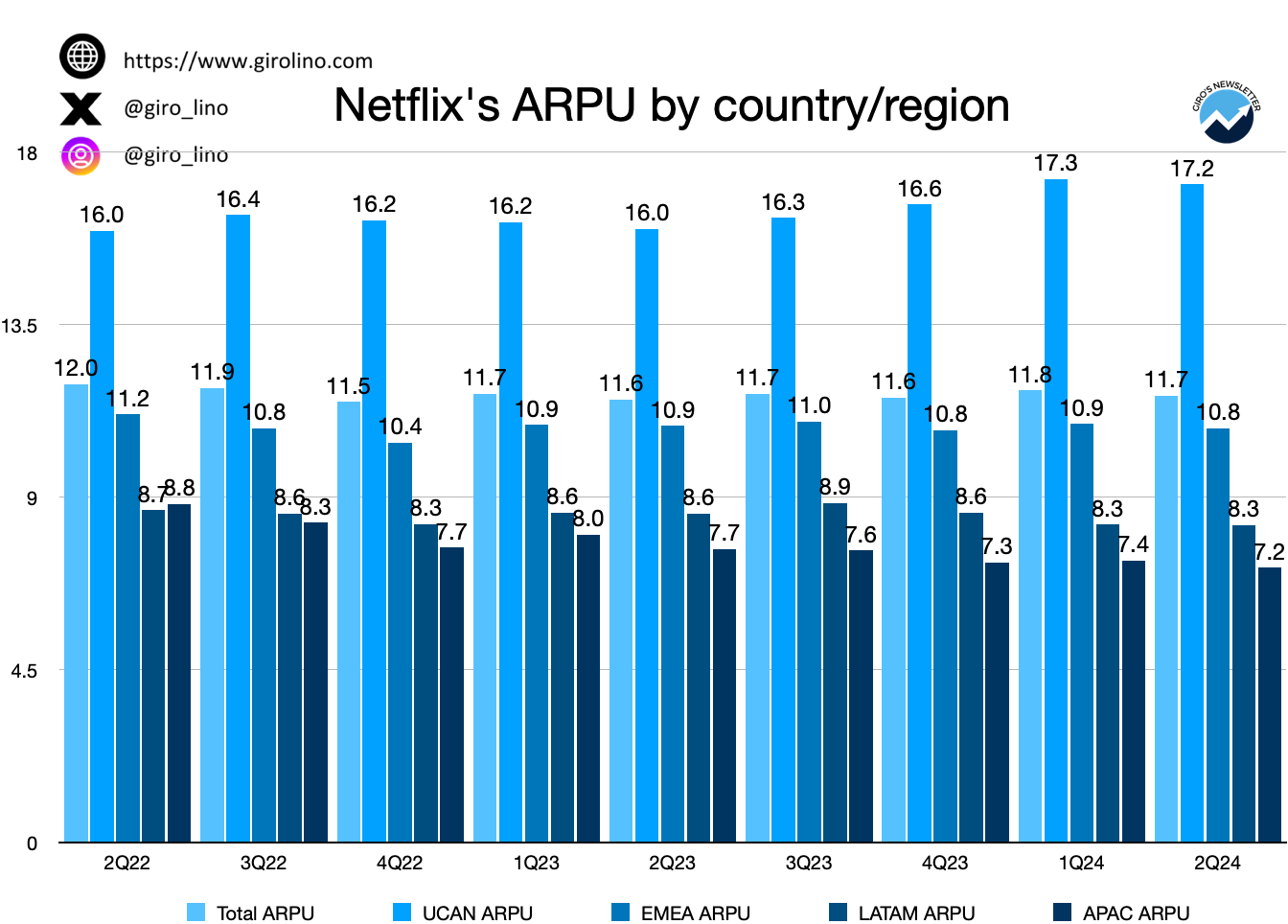

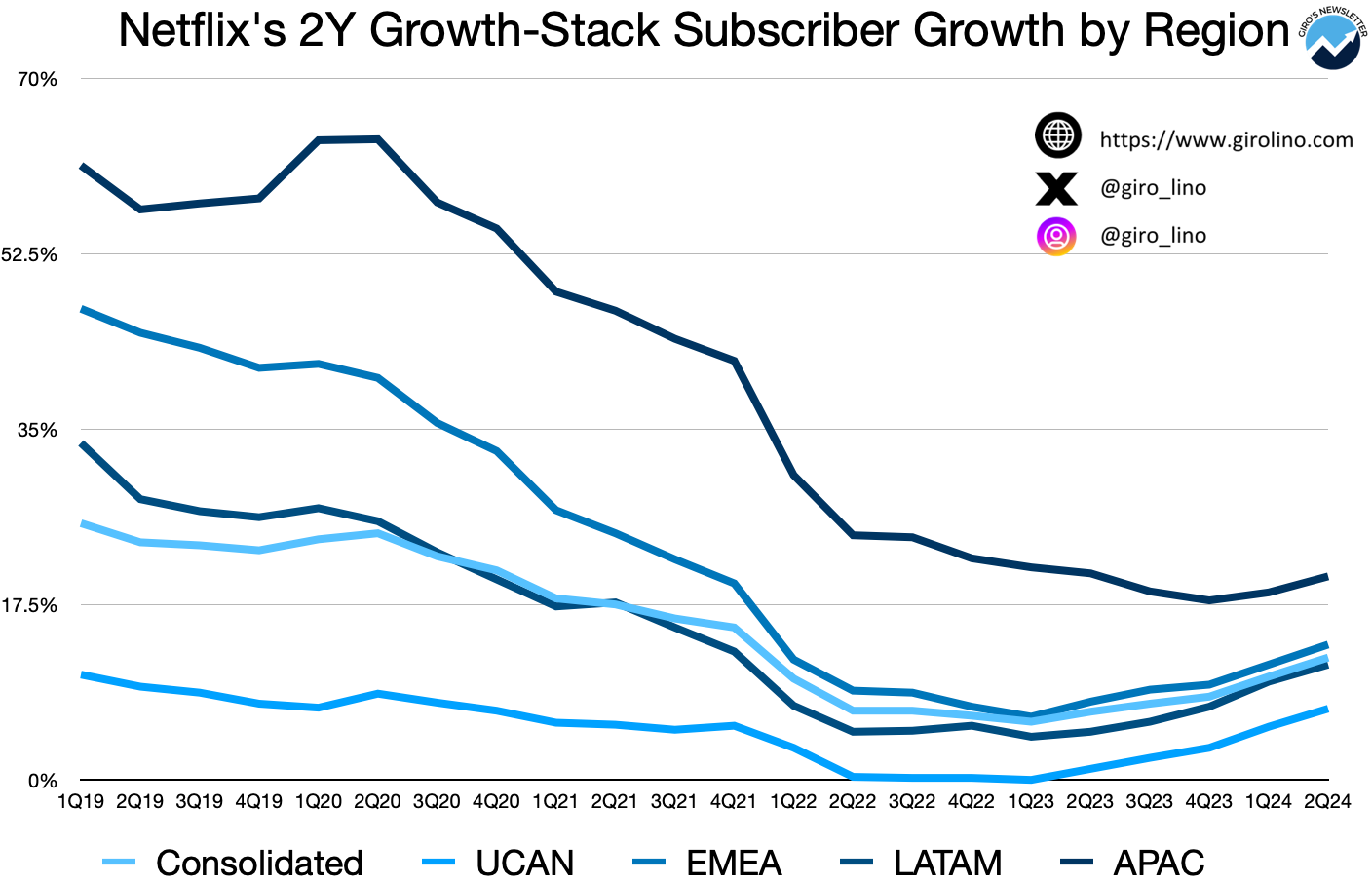

Netflix's success extends across all regions, with strong growth reported globally. The UCAN (US & Canada) region led with $4.296 billion in revenue, a 19.3% year-over-year growth. EMEA followed closely with $3.008 billion (17.4% growth), while LATAM and APAC regions showed impressive gains of 11.8% and 14.4% respectively. These figures highlight Netflix's effective global strategy and its ability to thrive in both mature and emerging markets.

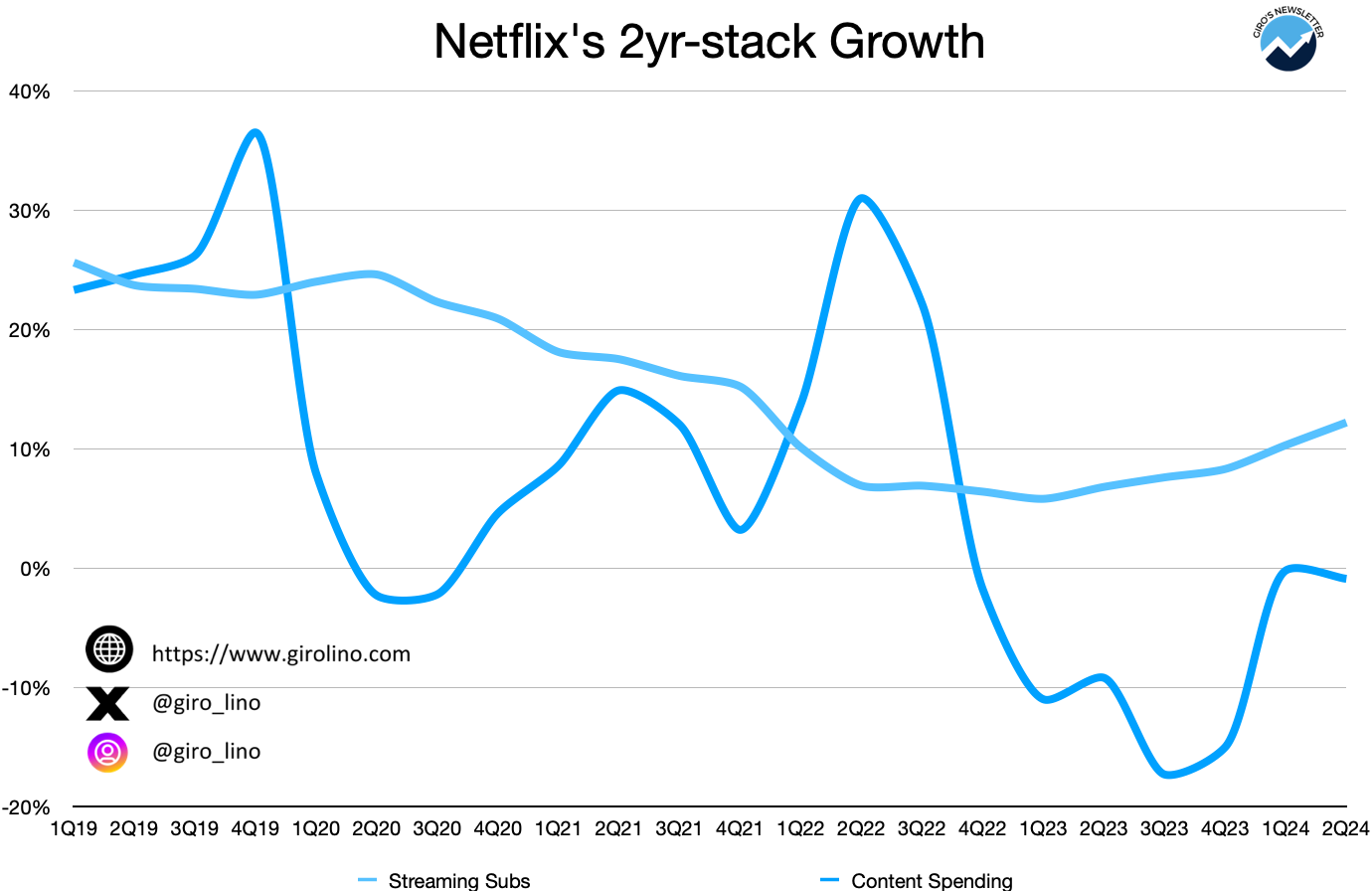

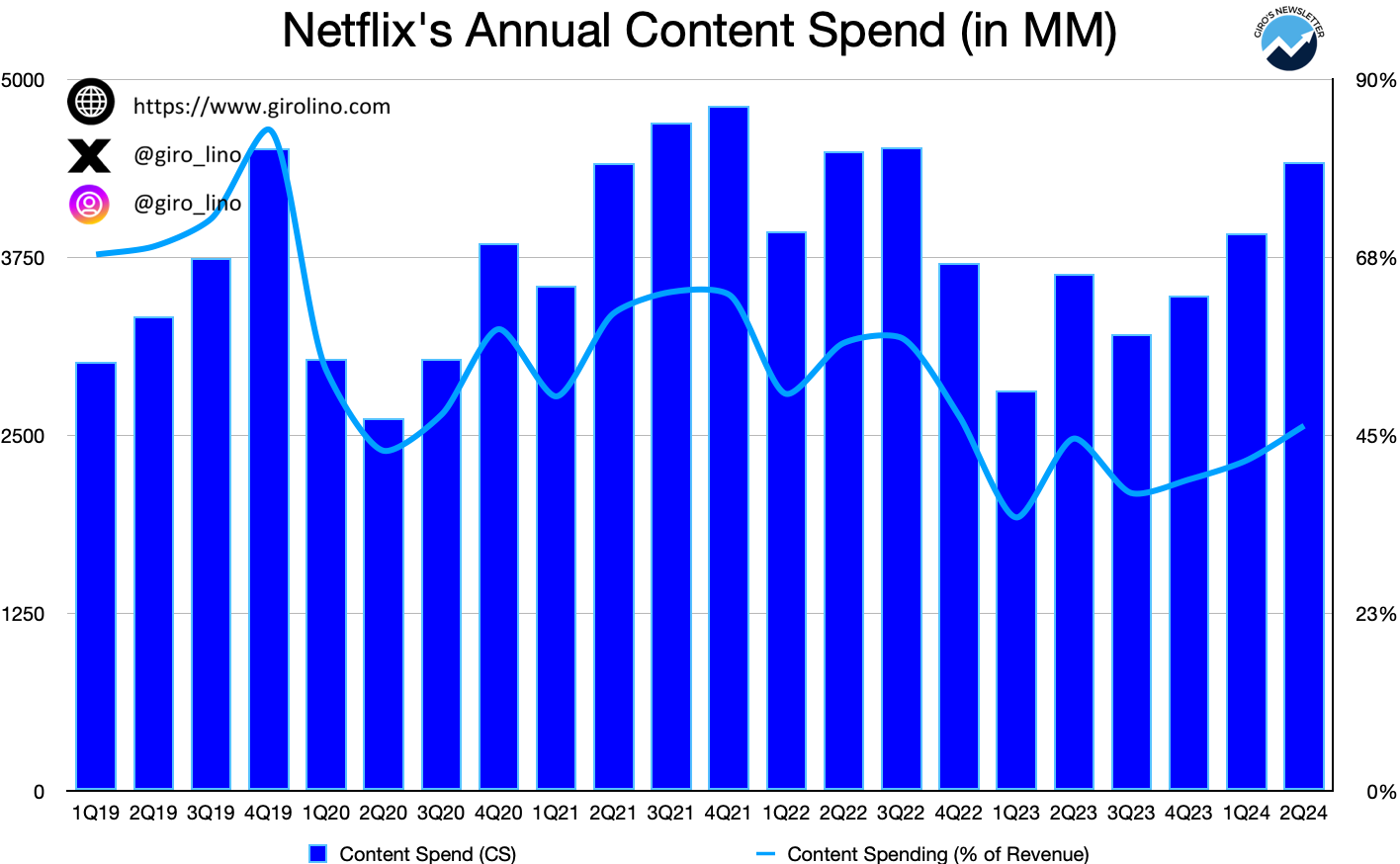

Central to Netflix's strategy is its substantial and consistent investment in content. The company's annualized content spend has remained relatively stable at around $17 billion over the past three years, demonstrating a strategic approach to content investment. In Q2 2024, the company's quarterly cash content spend was $4.415 billion, reflecting this consistent commitment to producing and acquiring high-quality, engaging content for its global audience.

While content spend has plateaued, Netflix has shown impressive efficiency in leveraging this investment to drive subscriber growth and revenue. This approach indicates a maturing strategy that focuses on optimizing return on content investment rather than simply increasing spending.

The company's ability to maintain strong subscriber growth and improve profitability while keeping content spend relatively stable is a testament to Netflix's evolving business model. It demonstrates an increased focus on efficiency and strategic content selection, leveraging data-driven insights to make smarter investments that resonate with audiences globally.

These financial metrics and strategic decisions paint a picture of a company that is not just withstanding competitive pressures but is adapting and thriving in a challenging streaming landscape. Netflix's approach to content investment, coupled with its ability to drive subscriber growth and improve margins, showcases its resilience and strategic acumen in navigating the highly competitive streaming market.

Strategies Driving Netflix's Resilience

Netflix's continued success in a competitive environment can be attributed to several key strategies that have allowed the company to differentiate itself and maintain its market leadership.

Content Investment Strategy

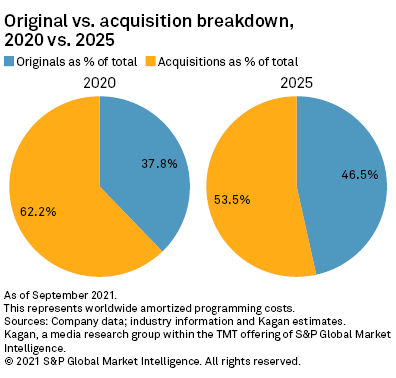

At the heart of Netflix's resilience is its content strategy, which revolves around creating a diverse library of high-quality original content that appeals to a global audience. The company has significantly increased its focus on original productions, with over 50% of its content spend in 2024 dedicated to originals, up from 25% in 2019. This shift towards original content reduces Netflix's reliance on licensed content and creates exclusive draws for subscribers, still representing more than 50% of Netflix's content as a percent of the total.

Netflix has also made substantial investments in local-language content across various countries. This strategy not only helps in penetrating new markets but also creates content that can achieve global appeal, as seen with breakout hits like "Squid Game" from South Korea and "Money Heist" from Spain.

The company's content decisions are heavily informed by its vast trove of viewer data. This data-driven approach helps in creating content that resonates with viewers, improving engagement and reducing churn. Additionally, Netflix maintains a diverse library of niche content that caters to specific audience segments, alongside its big-budget productions. This long-tail content strategy helps in retaining subscribers by offering something for everyone.

Global Expansion and Localization

Netflix's global strategy has been a key driver of its growth and resilience. The company employs a nuanced pricing strategy across different markets, balancing affordability with value perception. This approach has enabled Netflix to penetrate price-sensitive markets while maximizing revenue in mature markets.

Beyond content, Netflix has invested heavily in localizing its user experience. As of 2024, the platform supports over 60 languages for its interface and provides subtitles or dubbing in over 40 languages. This commitment to localization extends to strategic partnerships with local telecom operators and pay-TV providers in various countries, bundling its service with other offerings to reach new customers.

Netflix has also shown remarkable flexibility in adapting to different regulatory environments, including content quotas in the EU and censorship requirements in certain markets. This adaptability has been crucial in navigating the complex global media landscape.

Technological Innovation

Netflix's technological edge remains a crucial differentiator in the streaming market. The company has made continuous improvements in video encoding and adaptive streaming technologies, allowing it to deliver high-quality video even in areas with limited bandwidth.

The platform's recommendation system, powered by advanced machine learning algorithms, helps users discover new content, increasing engagement and retention. In 2024, Netflix reported that over 80% of viewer discovery came through its recommendation system, underscoring the importance of this technology in keeping subscribers engaged.

Netflix's Average Streaming Quality

Regular updates to the user interface, including features like autoplay previews and interactive content, keep the platform fresh and engaging. Furthermore, Netflix's Open Connect content delivery network, which places servers directly within internet service providers' networks, ensures fast and reliable streaming while reducing costs.

These strategies, working in concert, have enabled Netflix to maintain its leadership position in the streaming industry despite intense competition. By continuously innovating in content, expanding globally, and leveraging technology, Netflix has built a resilient business model that continues to deliver strong financial results and subscriber growth in an increasingly crowded market.

Challenges and Future Outlook

Despite its impressive performance, Netflix faces several challenges as it navigates the evolving streaming landscape. Understanding these challenges is crucial for assessing the company's future prospects and its ability to maintain its market leadership.

Content Costs and Competition

One of the primary challenges for Netflix is the escalating cost of content production and acquisition. As more players enter the streaming market, the competition for top talent and intellectual property rights has intensified, driving up costs. In 2024, Netflix's content spend reached $17 billion, a significant portion of its revenue. While this investment is crucial for attracting and retaining subscribers, it also puts pressure on the company's margins.

Moreover, competitors like Disney+ and Amazon Prime Video are leveraging their vast content libraries and franchises, creating a more crowded content landscape. Netflix must continue to produce hit shows and movies to stand out, which requires significant investment and carries inherent risk.

Market Saturation and Subscriber Growth

In mature markets like the United States, subscriber growth has begun to slow as the streaming market approaches saturation. This challenge is reflected in Netflix's varying growth rates across regions.

To address this, Netflix is focusing on international expansion, particularly in emerging markets. However, these markets often come with their own challenges, including lower average revenue per user (ARPU), infrastructure limitations, and complex regulatory environments.

Technological and Operational Challenges

As Netflix expands globally, it must continue to invest in its technological infrastructure to ensure high-quality streaming experiences across diverse network conditions. This includes ongoing investment in content delivery networks, video compression technologies, and personalization algorithms.

Additionally, the company faces operational challenges in managing a global content production and distribution network. Balancing local content production with globally appealing shows, while navigating different cultural and regulatory landscapes, requires significant resources and expertise.

Future Growth Strategies

Despite these challenges, Netflix is well-positioned for future growth, with several strategies in place:

- Diversification of Revenue Streams: Netflix is exploring new revenue streams beyond its core subscription model. This includes its entry into the gaming market, with the acquisition of several gaming studios and the launch of mobile games included in its subscription. The company is also experimenting with merchandise and experiential events tied to its popular shows.

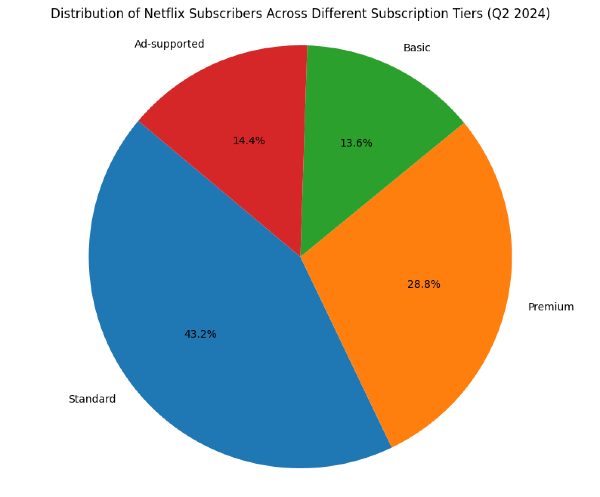

- Ad-Supported Tier: In late 2023, Netflix launched an ad-supported subscription tier in select markets. This move aims to capture more price-sensitive consumers and open up new advertising revenue streams. Early results have been promising, with the ad-supported tier showing strong adoption rates.

- Content Strategy Evolution: Netflix is refining its content strategy to focus on quality over quantity. This includes investing in fewer, higher-impact shows and movies, and leveraging data analytics to make more informed content decisions. The company is also expanding its focus on local-language content, which has proven successful in driving global engagement.

- Technological Innovation: Continued investment in AI and machine learning to improve content recommendations, optimize streaming quality, and enhance the overall user experience remains a priority. Netflix is also exploring technologies like interactive storytelling and virtual reality to create more immersive viewing experiences.

- Strategic Partnerships: Netflix is pursuing partnerships with telecom operators, device manufacturers, and other ecosystem players to expand its reach and improve its service offering. These partnerships could help Netflix overcome infrastructure challenges in emerging markets and provide bundling opportunities to drive subscriber growth.

Conclusion

Netflix's resilience in the face of intense competition is a testament to its innovative spirit, strategic foresight, and ability to execute effectively on a global scale. The company's strong financial performance, growing subscriber base, and improving profitability metrics demonstrate its continued leadership in the streaming industry.

By focusing on original content production, global expansion, technological innovation, and diversification of revenue streams, Netflix has built a robust business model capable of withstanding competitive pressures and evolving consumer preferences. The company's data-driven approach to content creation and user experience optimization provides a significant competitive advantage.

However, Netflix cannot afford to be complacent. The streaming landscape continues to evolve rapidly, with new entrants and changing consumer behaviors presenting ongoing challenges. The company's ability to navigate content cost inflation, market saturation in mature markets, and the complexities of global expansion will be crucial in maintaining its growth trajectory.

Looking ahead, Netflix's future success will depend on its ability to continue innovating in content and technology, effectively monetize its large user base, and adapt to local market conditions while maintaining a coherent global strategy. With its strong brand, vast subscriber base, and culture of innovation, Netflix is well-positioned to continue thriving in the dynamic and competitive world of streaming entertainment.

As the streaming wars continue to unfold, Netflix's journey offers valuable insights into the importance of adaptability, strategic investment, and customer-centric innovation in building a resilient and successful global media business.