Introduction

Nu Holding, one of Latin America's leading digital banking platforms, has released its Q2 2024 earnings report, showcasing impressive growth in both customer base and profitability. This comprehensive analysis will delve into Nu's financial performance, strategic initiatives, and management insights, providing valuable information for investors and fintech enthusiasts alike.

Financial Highlights

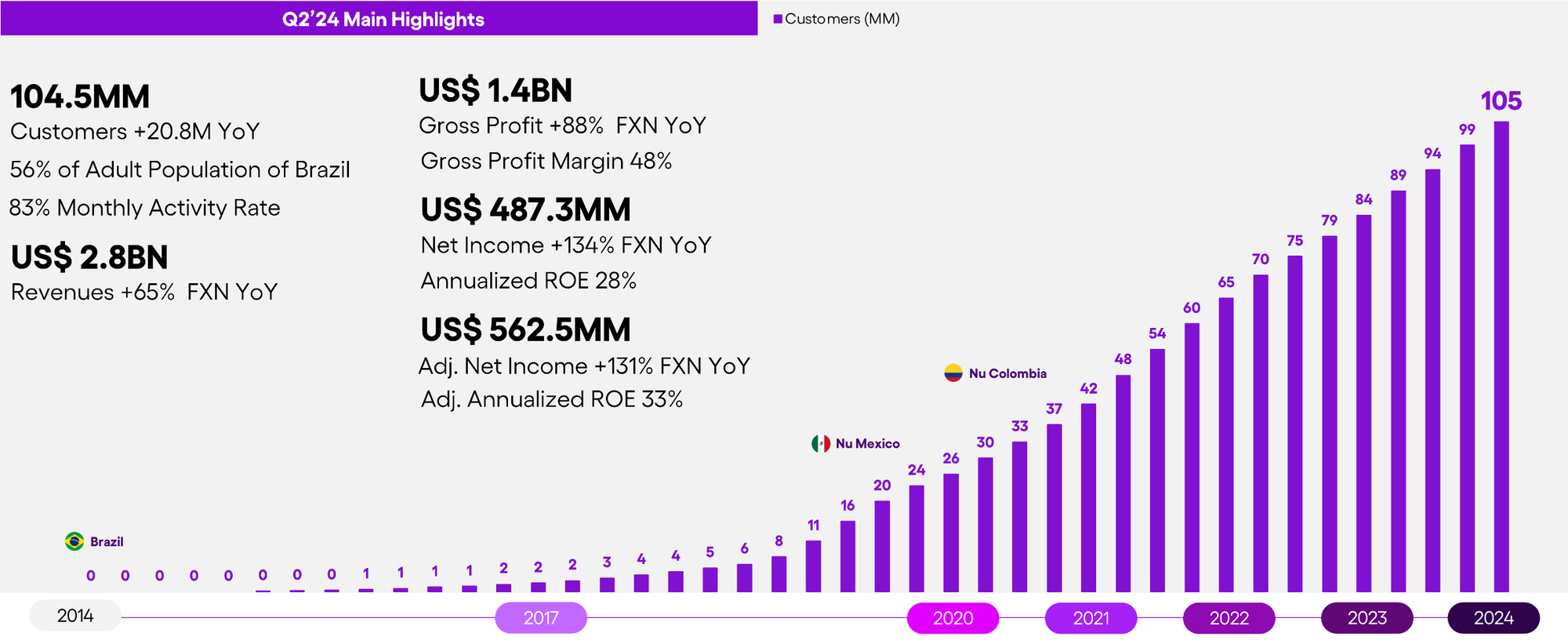

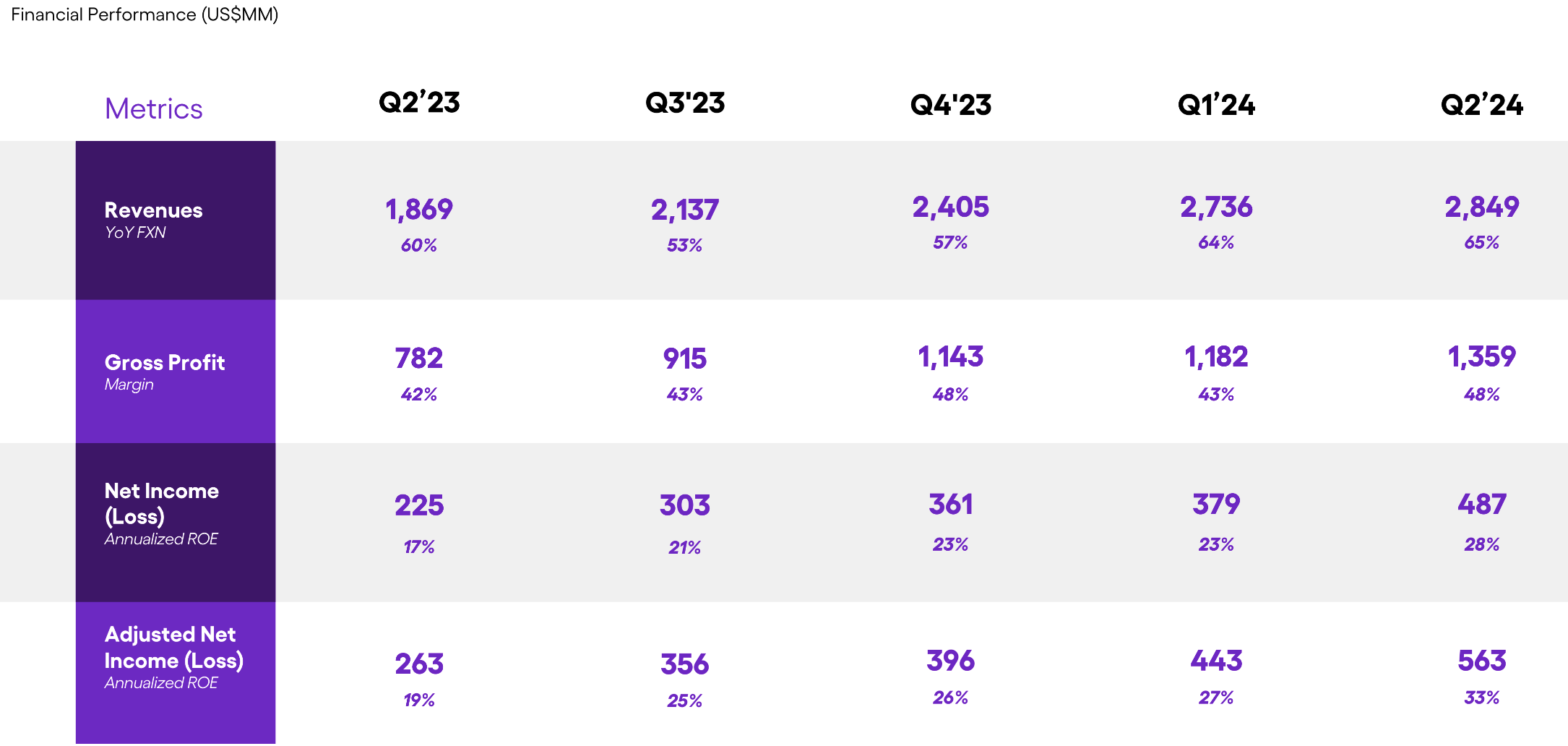

Nu Holding reported stellar financial results for Q2 2024, with significant year-over-year growth across key metrics:

- Revenue: $2.8 billion, up 65% YoY (FX neutral)

- Gross Profit: $1.4 billion, up 88% YoY (FX neutral)

- Net Income: $487.3 million, up 134% YoY (FX neutral)

- Adjusted Net Income: $562.5 million, up 131% YoY (FX neutral)

- Annualized ROE: 28%

- Adjusted Annualized ROE: 33%

These results demonstrate Nu's ability to scale its operations profitably while maintaining strong growth momentum.

CEO David Velez commented on the company's performance:

"During Q2 2024, our business model anchored in three fundamental principles: customer expansion, revenue per customer and efficient operating costs demonstrated its formidable strength by accelerating earnings power."

Customer Growth and Engagement

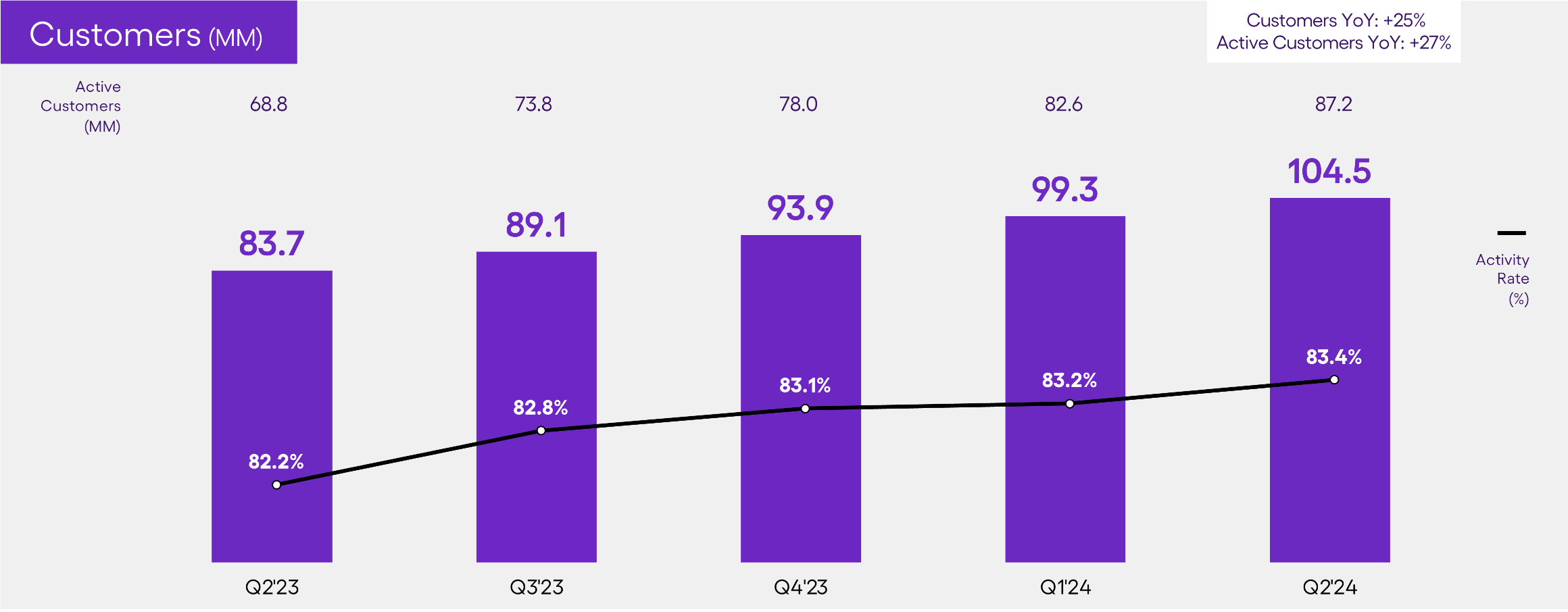

Nu continues to attract new customers at an impressive rate:

- Total customers: 104.5 million, up 25% YoY

- Monthly active customers: 87.2 million, up 27% YoY

- Activity rate: 83.4%, up from 82.2% a year ago

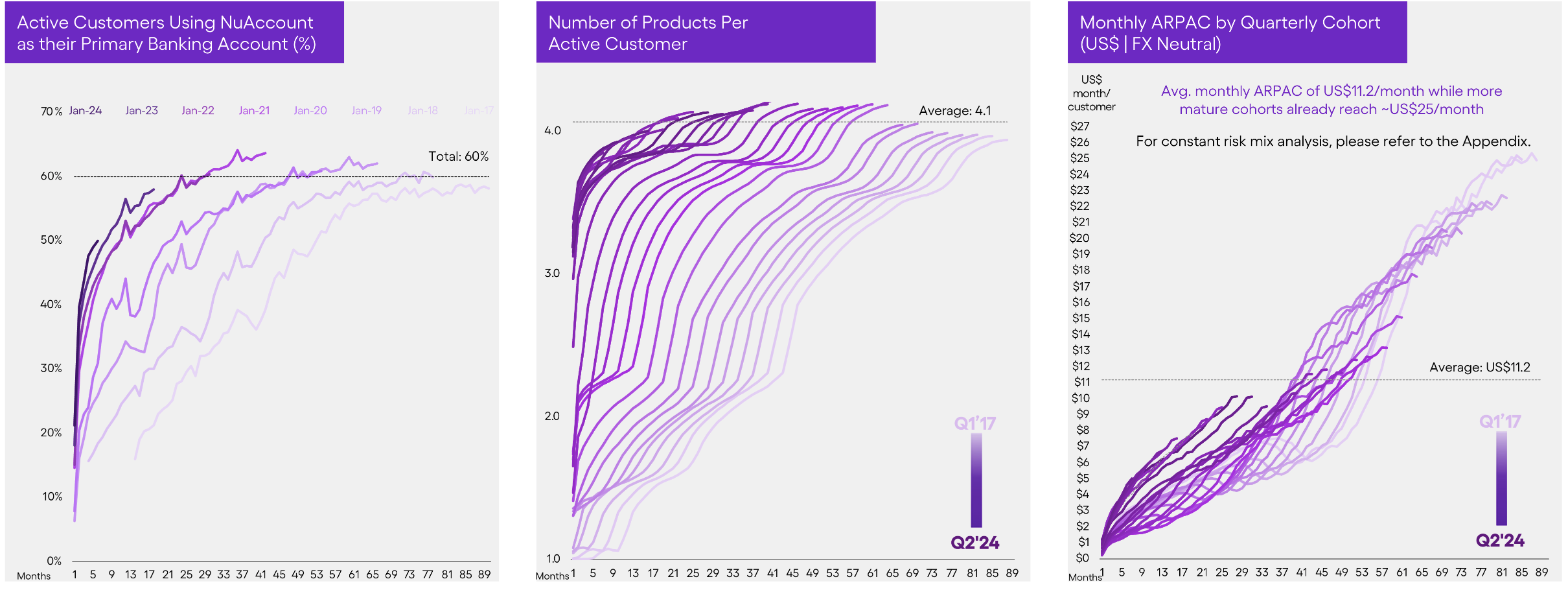

Average Revenue Per Active Customer (ARPAC) Growth

Nu's ARPAC reached $11.2 in Q2 2024, representing a 30% YoY increase on an FX neutral basis. This growth indicates Nu's success in cross-selling products and increasing customer lifetime value.

Key engagement metrics:

- 60% of active customers use Nu as their primary banking relationship

- Average of 4.1 products per active customer

- More mature cohorts are already generating a monthly ARPAC of $25

CEO David Velez commented on the customer acquisition strategy:

"Our customer base grew by an impressive 25% year-over-year, reaching 104.5 million by the end of Q2 2024. This growth reinforces Nu's position as the fourth-largest financial institution in Latin America by number of customers."

Loan Portfolio and Deposit Growth

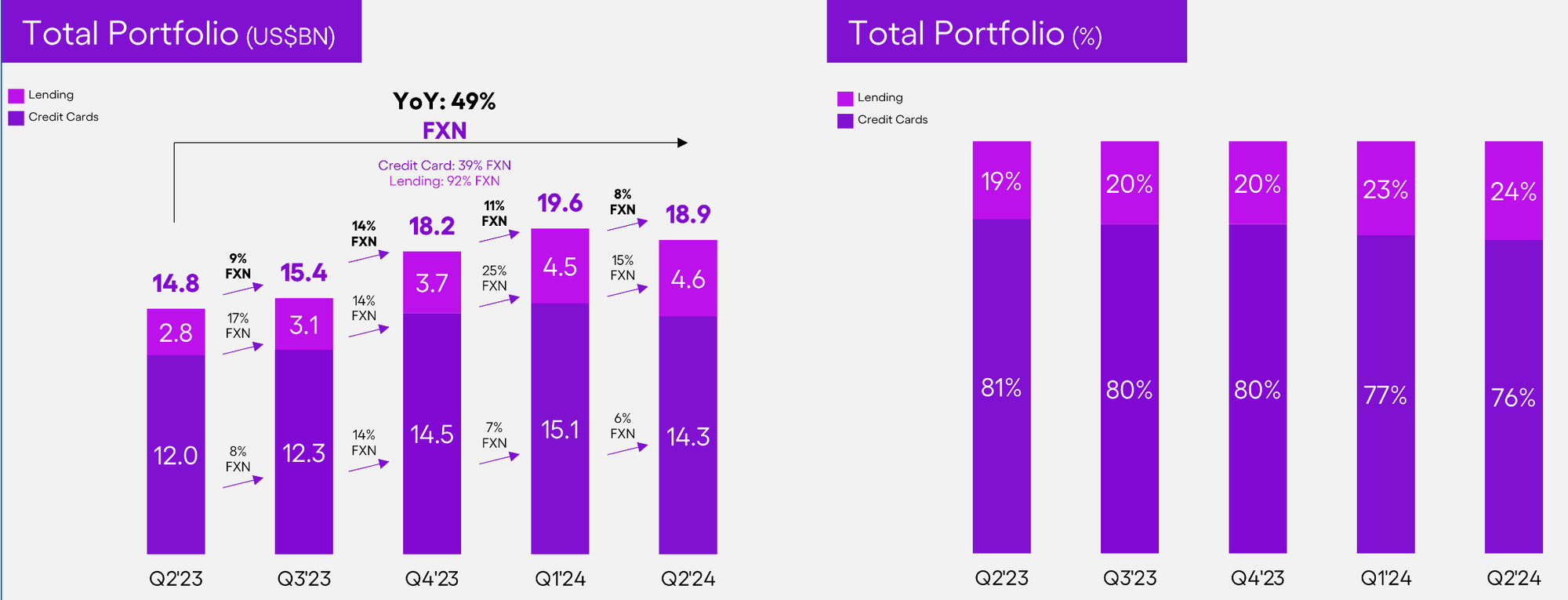

Loan Portfolio Expansion

Nu's total credit portfolio grew to $18.9 billion, a 49% YoY increase on an FX neutral basis:

- Credit card loans: $14.3 billion, up 39% YoY (FX neutral)

- Personal loans: $4.6 billion, up 92% YoY (FX neutral)

Interest-earning installments balance now represents 28% of Nu's total credit card portfolio, up from 26% in the previous quarter.

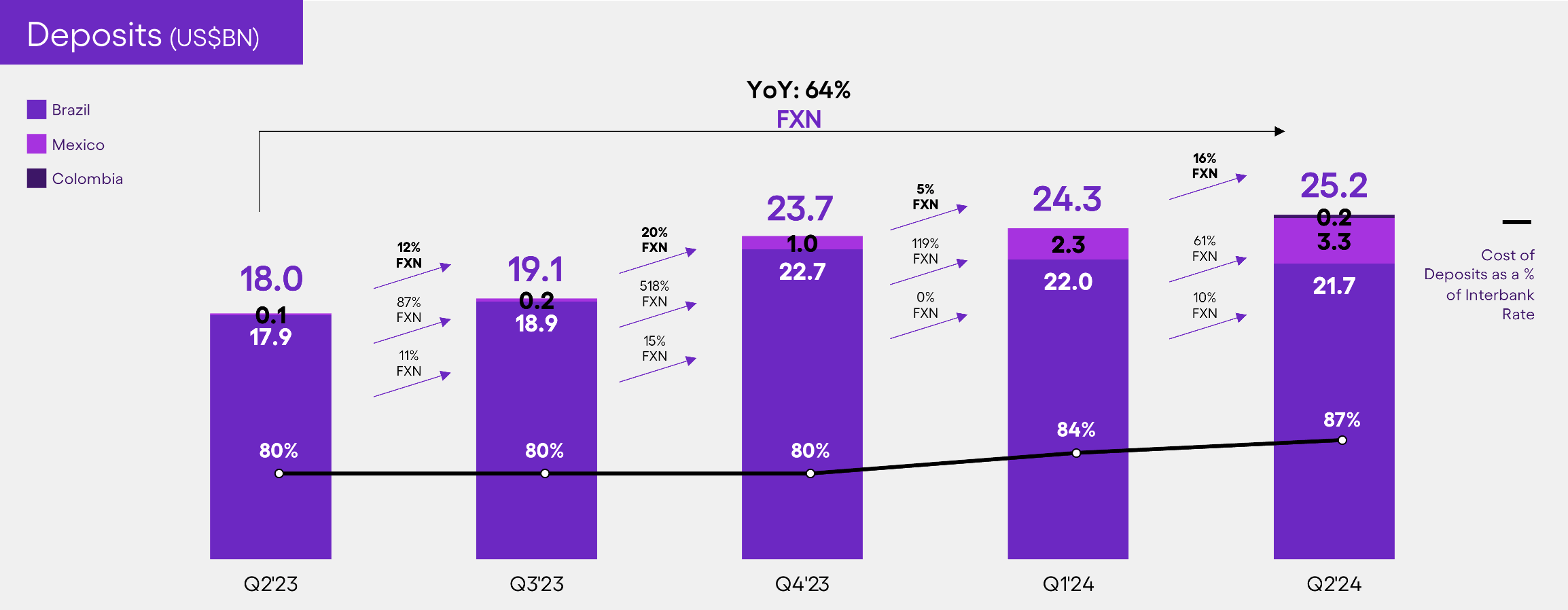

Deposit Growth and Cost of Funding

Total deposits reached $25.2 billion, a 64% YoY increase (FX neutral):

- Brazil: $21.7 billion

- Mexico: $3.3 billion

- Colombia: $0.2 billion

Nu's cost of funding remained competitive at 87% of the blended interbank rates.

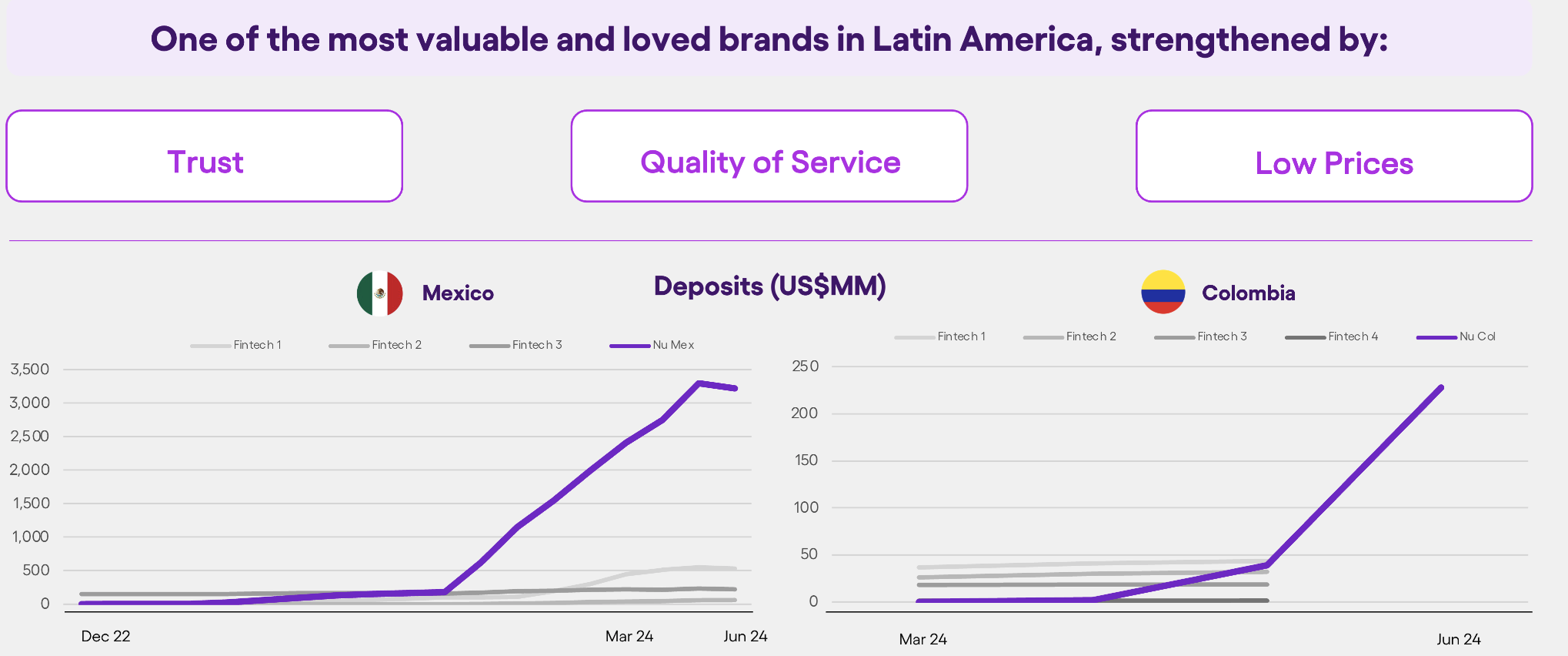

CFO Guilherme Lago commented on the deposit growth:

"The strong growth in Mexico represents a significant milestone in building one of the strongest local currency retail deposit franchises in Latin America. Another noteworthy achievement was the launch of Colombia's checking account product in the second quarter of 2024, which attracted over $220 million in consumer deposits."

Strategic Initiatives and Growth Drivers

Multi-Product Strategy

Nu's multi-product approach has been key to driving engagement and revenue growth. The company reported:

- 41.8 million active credit card customers

- 77.5 million NuAccount users

- 8.7 million personal loan customers

- 18.5 million active investment customers

- 1.9 million active insurance policies

International Expansion

Nu's expansion efforts in Mexico and Colombia have shown promising results:

- Mexico: 7.8 million customers (1.2 million new customers added in Q2)

- Colombia: 1.3 million customers (surpassing the 1 million milestone)

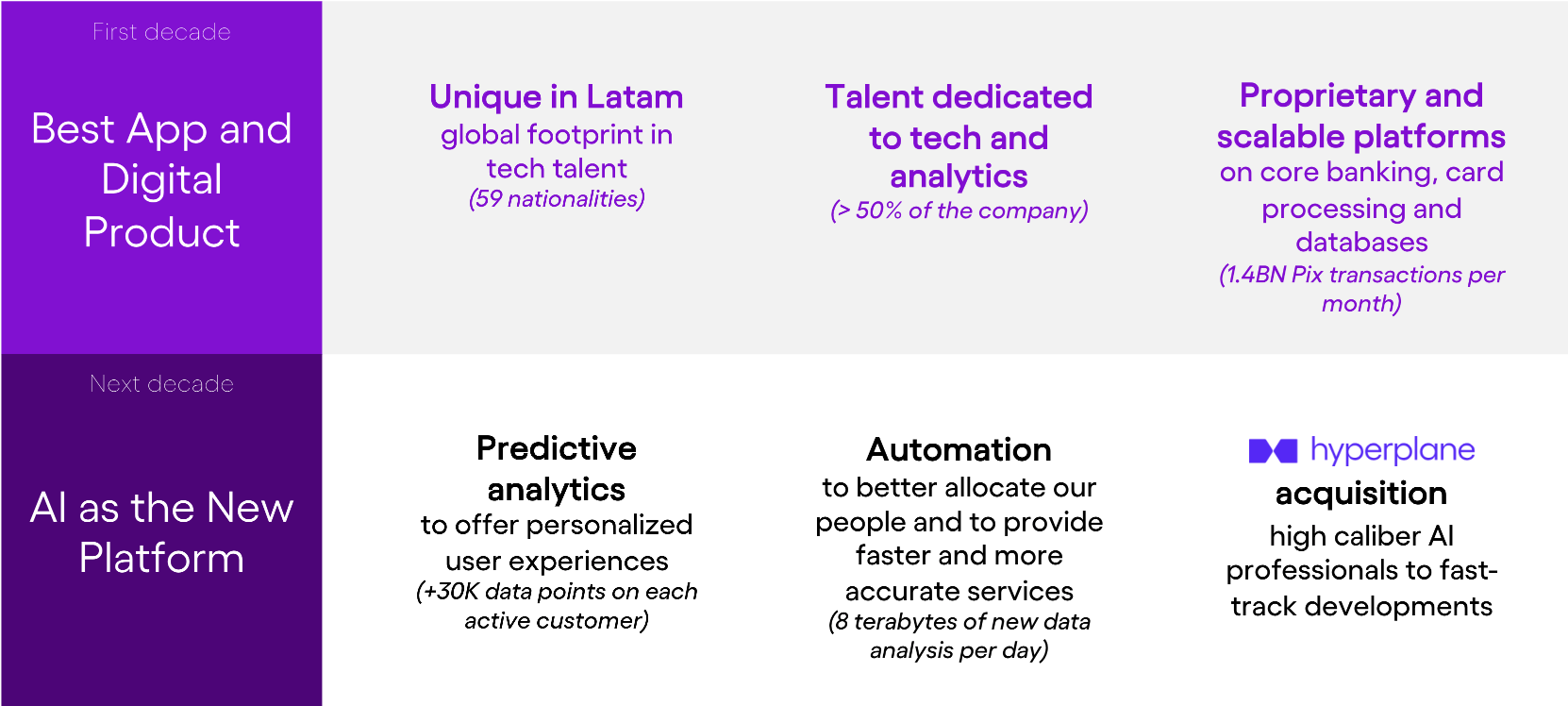

Technology and AI Investment

Nu is leveraging its strong technology and product teams to drive innovation and maintain its competitive edge. The company recently acquired Hyperplane, a Silicon Valley-based leader in AI-powered solutions for financial services.

David Velez emphasized the importance of technology and AI:

"Our talent competitive advantage will be critical to seize the AI opportunity. We have a unique global footprint in tech talent, with 59 nationalities represented and over 50% of our company dedicated to tech and analytics."

Brand Equity and Customer Trust

Nu's strong brand equity across borders has contributed to its success in new markets. The company's focus on quality of service, trust, and competitive pricing has resonated with customers in Brazil, Mexico, and Colombia.

Credit Quality and Risk Management

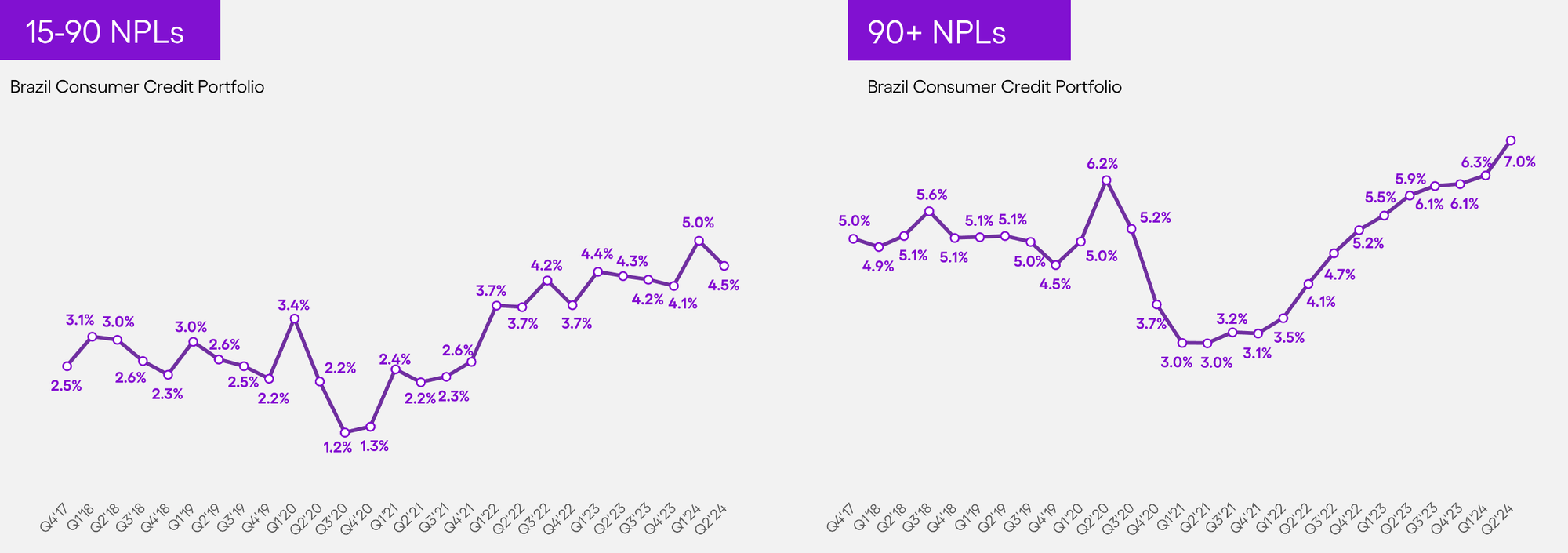

Delinquency Ratios

Nu's 90+ day NPL ratio increased to 7.0% in Q2 2024, up from 6.3% in the previous quarter. The company attributed this increase to seasonal effects and its strategy of expanding credit to a broader customer base.

President and COO Youssef Lahrech commented on the credit quality:

"We are intentionally and strategically growing our lending book and expanding down the credit spectrum, where we see relevant opportunities. In line with our credit philosophy, we prioritized decisions that optimize the long-term net present value of our credit cohorts rather than focusing solely on short-term NPL metrics."

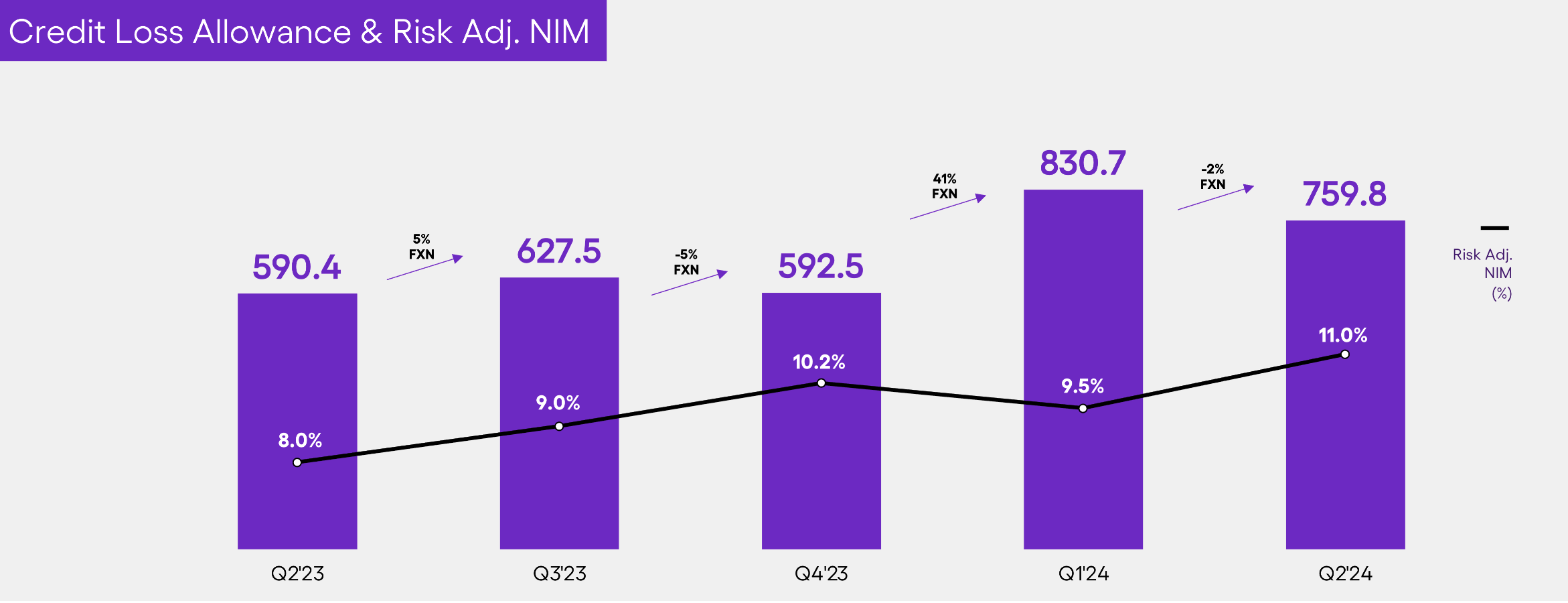

Risk-Adjusted Net Interest Margin (NIM)

Nu's risk-adjusted NIM reached a record high of 11% in Q2 2024, reflecting a 300-basis-point expansion from a year ago. This improvement demonstrates Nu's ability to price risk effectively and generate higher returns on its credit portfolio.

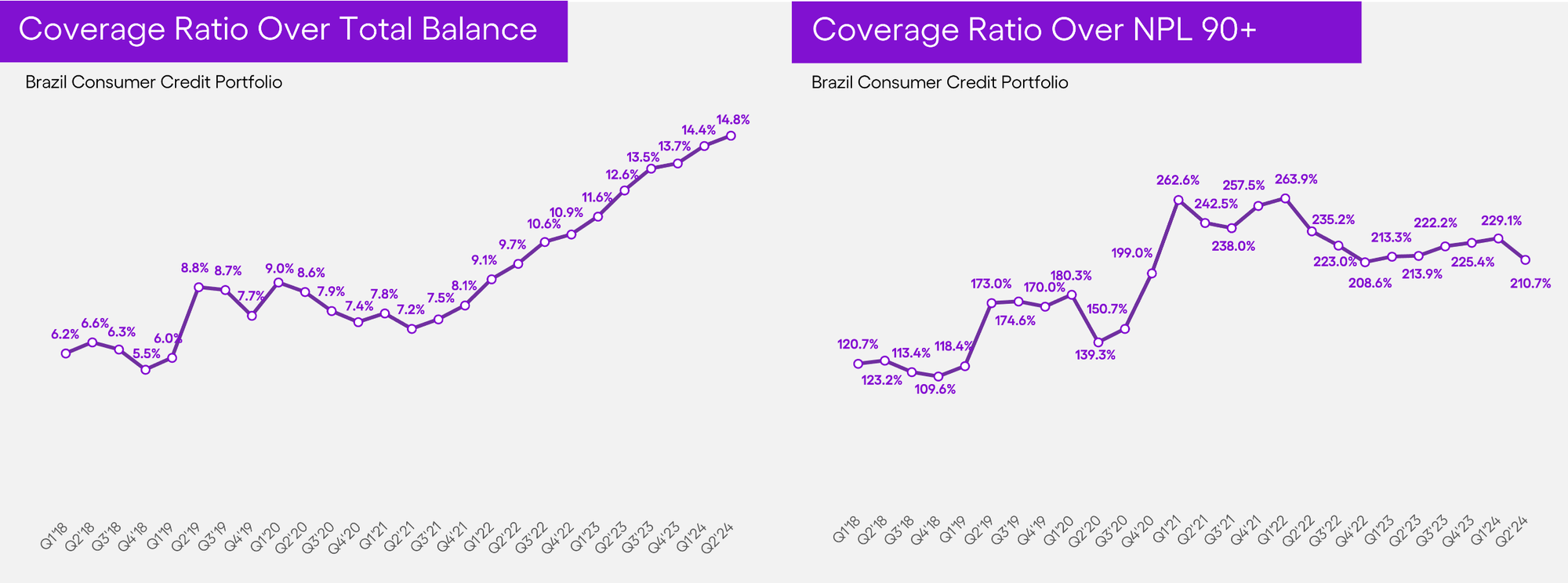

Credit Loss Allowance and Coverage Ratios

Credit Loss Allowance (CLA) expenses declined to $760 million in Q2 2024, a decrease of 2% on an FX-neutral basis. The coverage ratio over total balance increased to 14.8%, while the coverage ratio over NPL 90+ remained stable at 210.7%.

Critical Analysis of Asset Quality

While Nu Holding's Q2 2024 results showed impressive growth in revenue and customer base, a closer examination of asset quality indicators reveals some concerning trends:

- Provision Decrease: Despite a deterioration in most asset quality indicators, provisions fell by 9% QoQ. This unexpected decrease warrants further investigation.

- NPL Trends:

- The 15-day NPL improved by 50 bps QoQ, but it's worth noting that Q2 is typically a better quarter for early NPLs.

- The 90-day NPL saw a significant deterioration of 70 bps QoQ, with indications that it may worsen in coming quarters.

- NPL Formation:

- NPL formation increased by 60 bps QoQ

- Stage 3 formation rose by 50 bps QoQ

- Both metrics are at all-time highs, signaling potential future challenges in credit quality

- Equity Impact: An interesting effect was observed in equity, which increased by only US$120 million QoQ in USD terms, but R$4.6 billion QoQ in BRL terms, primarily due to currency translation effects.

These asset quality trends suggest that while Nu Holding is experiencing rapid growth, it may be facing challenges in managing credit risk effectively. The company's strategy of expanding into higher-risk segments could be contributing to these asset quality pressures.

Key Insights from Earnings Call

The earnings call provided several interesting points that shed light on Nu Holding's strategy and recent performance:

- Personal Credit Origination: In July, personal credit origination reached R$5.2 billion, compared to a monthly average of R$4.3 billion in Q2 2024. This indicates an acceleration in lending activity.

- Loan Renegotiation: The renegotiation rate was around 11% in Q2 2024, providing insight into how Nu is managing its loan portfolio.

- Mexico Funding Cost: Nu reduced its deposit rate in Mexico to 13.5% per annum, which could help improve net interest margins in that market.

These insights suggest that Nu is actively managing its growth strategy, particularly in credit expansion and international operations. However, the increased lending activity, especially in personal credit, should be monitored closely given the asset quality concerns.

Future Outlook and Challenges

Continued Growth Opportunities

Nu sees significant potential for further growth in its core markets:

- Brazil: Nu has 56% market share of the adult population but only 13-14% market share in credit cards and single-digit market share in loans

- Mexico and Colombia: Expanding product offerings and increasing customer engagement

Balancing Growth and Risk Management

As Nu continues to expand its credit portfolio, maintaining strong credit quality while pursuing aggressive growth targets will be crucial. The company's focus on optimizing long-term net present value of credit cohorts will be key to managing this balance.

Regulatory Environment

Nu will need to navigate evolving regulatory landscapes in its operating markets, particularly as it grows its market share and introduces new products. The company's engagement with regulators and compliance efforts will be important factors in its future success.

Competition

Increased competition from traditional banks and other fintech companies may pressure customer acquisition costs and margins. Nu's focus on technology, brand equity, and customer trust will be essential in maintaining its competitive edge.

Conclusion

Nu Holding's Q2 2024 results demonstrate the company's ability to drive significant growth while improving profitability. With its strong technology foundation, multi-product strategy, and expanding international presence, Nu is well-positioned to capitalize on the growing demand for digital financial services in Latin America. However, the company will need to carefully balance growth ambitions with risk management and navigate regulatory challenges to maintain its strong performance in the coming quarters.